Unlocking Success: The Ultimate Guide to the Best CRM for Small Accounting Firms

Running a small accounting firm is a whirlwind. You’re juggling client deadlines, tax regulations, and the constant need to find new clients. In this chaotic environment, it’s easy for things to slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes in. It’s not just for the big guys; a well-chosen CRM can be a game-changer for small accounting practices, helping you streamline operations, improve client relationships, and boost your bottom line. This comprehensive guide will delve into the best CRM options specifically tailored for your needs, helping you make an informed decision and take your firm to the next level.

Why Your Small Accounting Firm Needs a CRM

You might be thinking, “I’m a small firm; do I really need a CRM?” The answer, in most cases, is a resounding yes. Here’s why:

- Improved Client Relationships: A CRM centralizes all client information, including communication history, preferences, and financial data. This allows you to provide personalized service and build stronger relationships.

- Enhanced Efficiency: Automate repetitive tasks like appointment scheduling, email follow-ups, and invoice reminders, freeing up your time to focus on core accounting activities.

- Better Organization: Say goodbye to scattered spreadsheets and lost emails. A CRM keeps all your client data in one place, making it easy to find what you need, when you need it.

- Increased Sales and Revenue: Track leads, nurture prospects, and close deals more effectively. A CRM helps you identify and capitalize on new business opportunities.

- Data-Driven Decisions: Gain valuable insights into your client base, sales performance, and marketing efforts. Use this data to make informed decisions and improve your business strategies.

Essentially, a CRM acts as your central nervous system, connecting all the different parts of your practice and allowing you to operate more efficiently and effectively. It’s an investment that can pay significant dividends in terms of client satisfaction, operational efficiency, and ultimately, profitability.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, consider these essential features:

1. Contact Management

This is the foundation of any good CRM. Look for features that allow you to:

- Store and manage client contact information (names, addresses, phone numbers, email addresses)

- Track communication history (emails, calls, meetings)

- Segment clients based on demographics, services used, or other criteria

- Create custom fields to capture specific client data relevant to your practice

2. Lead Management

A good CRM should help you manage your leads effectively. Look for features like:

- Lead capture forms to collect information from your website or other sources

- Lead scoring to prioritize the most promising prospects

- Automated lead nurturing campaigns to keep leads engaged

- Sales pipeline management to track leads through the sales process

3. Task and Workflow Automation

Automation is key to efficiency. Your CRM should allow you to:

- Automate routine tasks like sending appointment reminders or follow-up emails

- Create workflows to streamline processes like onboarding new clients or processing invoices

- Set up automated alerts and notifications to keep you on track

4. Reporting and Analytics

Data is your friend. Your CRM should provide you with:

- Pre-built reports on key metrics like client acquisition cost, customer lifetime value, and sales performance

- Customizable dashboards to visualize your data

- The ability to track key performance indicators (KPIs)

5. Integration with Accounting Software

This is crucial for accountants. Your CRM should integrate seamlessly with your existing accounting software (e.g., QuickBooks, Xero). This integration should allow you to:

- Sync client data between your CRM and accounting software

- Automate the creation of invoices and other financial documents

- Track payments and manage accounts receivable

6. Security and Compliance

Data security is paramount, especially when dealing with sensitive financial information. Your CRM should:

- Offer robust security features, such as data encryption and access controls

- Comply with relevant data privacy regulations (e.g., GDPR, CCPA)

- Provide audit trails to track user activity

7. Mobile Accessibility

You’re on the go. Your CRM should be accessible from your mobile devices, allowing you to:

- Access client information and update records from anywhere

- Manage tasks and schedule appointments on the go

- Receive notifications and stay connected with your team

Top CRM Systems for Small Accounting Firms

Now, let’s dive into some of the best CRM options specifically designed for small accounting firms. The “best” choice depends on your specific needs and budget, so consider the pros and cons of each before making a decision.

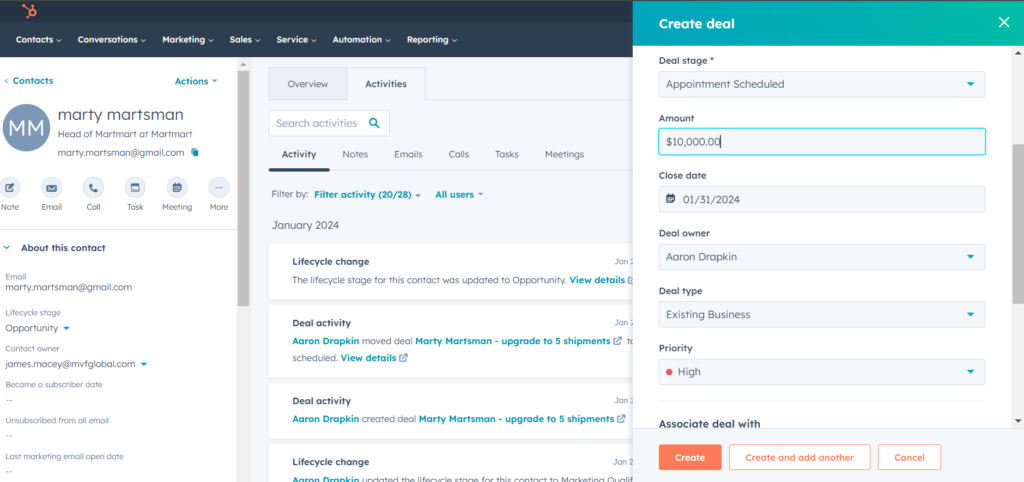

1. HubSpot CRM

Pros:

- Free CRM: HubSpot offers a powerful free CRM that’s ideal for small businesses just getting started.

- User-Friendly Interface: Easy to learn and use, even for those new to CRM systems.

- Comprehensive Features: Offers contact management, lead management, task management, and basic reporting features.

- Integration with Accounting Software: Integrates with popular accounting software like QuickBooks and Xero (through third-party apps).

- Marketing Automation: Includes basic marketing automation features, which can be helpful for lead nurturing.

Cons:

- Limited Features in Free Version: The free version has limitations on the number of contacts, emails, and storage.

- Advanced Features Require Paid Plans: More advanced features like sales automation and custom reporting require paid subscriptions.

- Can Be Overwhelming: HubSpot’s wide range of features can be overwhelming for some users.

Best for: Small firms looking for a free, easy-to-use CRM with basic features and the potential to upgrade as their needs grow.

2. Zoho CRM

Pros:

- Affordable Pricing: Zoho CRM offers a variety of affordable plans to suit different budgets.

- Customization Options: Highly customizable to meet the specific needs of your accounting firm.

- Excellent Integration: Integrates well with other Zoho apps, as well as third-party apps like QuickBooks and Xero.

- Sales Automation: Includes robust sales automation features, such as workflow automation and lead scoring.

- Reporting and Analytics: Provides detailed reporting and analytics to track your performance.

Cons:

- Learning Curve: Can have a steeper learning curve than some other CRMs.

- Interface Can Be Cluttered: The interface can feel a bit cluttered at times.

- Customer Support Can Be Slow: Some users have reported slow response times from customer support.

Best for: Small to medium-sized accounting firms looking for a feature-rich, customizable CRM at an affordable price.

3. Pipedrive

Pros:

- Sales-Focused: Designed specifically for sales teams, making it ideal for firms looking to improve their lead generation and sales process.

- Visual Sales Pipeline: Offers a visual sales pipeline that makes it easy to track leads and manage deals.

- User-Friendly Interface: Easy to learn and use, with a clean and intuitive interface.

- Excellent Integrations: Integrates well with a variety of third-party apps, including accounting software.

- Strong Automation Capabilities: Provides strong automation capabilities to streamline your sales process.

Cons:

- Limited Contact Management Features: Contact management features are less robust compared to other CRMs.

- Focus on Sales: May not be the best choice for firms that prioritize client relationship management over sales.

- Can Be Expensive: Pricing can be higher than some other options.

Best for: Small accounting firms that are heavily focused on sales and lead generation.

4. Salesforce Sales Cloud

Pros:

- Highly Customizable: Extremely customizable to meet the specific needs of your firm.

- Powerful Features: Offers a wide range of features, including sales automation, marketing automation, and reporting.

- Extensive Integrations: Integrates with a vast number of third-party apps, including accounting software.

- Scalable: Can scale with your business as you grow.

Cons:

- Expensive: Salesforce is one of the most expensive CRM options on the market.

- Complex: Can be complex to set up and use, requiring extensive training.

- Steep Learning Curve: Has a steep learning curve, especially for new users.

Best for: Larger accounting firms with complex needs and the budget to invest in a comprehensive CRM solution.

5. Insightly

Pros:

- User-Friendly Interface: Offers a clean and intuitive interface that’s easy to navigate.

- Project Management Features: Includes project management features, which can be helpful for managing client projects.

- Affordable Pricing: Offers affordable pricing plans for small businesses.

- Good Integration: Integrates with popular apps, including Google Workspace and Mailchimp.

- Contact Management: Strong focus on contact management and client relationship building.

Cons:

- Limited Sales Automation Features: Sales automation features are less robust than some other CRMs.

- Reporting Capabilities Could Be Better: Reporting capabilities are not as advanced as some other options.

- Fewer Integrations Than Some Competitors: The number of integrations is less extensive than some other CRM systems.

Best for: Small to medium-sized accounting firms that prioritize client relationship management and project management features.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM can seem daunting, but by following these steps, you can make an informed decision:

1. Define Your Needs

Before you start evaluating CRM systems, take some time to identify your firm’s specific needs and goals. What are your pain points? What processes do you want to streamline? What features are most important to you? Consider the following questions:

- What are your current challenges in managing client relationships?

- What processes do you want to automate?

- What features are essential for your firm?

- How many users will need access to the CRM?

- What is your budget?

2. Research Your Options

Once you know your needs, research the different CRM systems available. Read reviews, compare features, and consider the pros and cons of each option. Use the information provided in this guide as a starting point.

3. Consider Integration

Make sure the CRM you choose integrates seamlessly with your existing accounting software, email marketing platform, and other tools you use. This will save you time and effort and ensure that your data is synchronized across all your systems.

4. Evaluate Pricing

CRM pricing varies widely. Consider your budget and choose a plan that fits your needs. Be sure to factor in the cost of implementation, training, and ongoing support.

5. Test Drive the System

Most CRM providers offer free trials. Take advantage of these trials to test the system and see if it’s a good fit for your firm. Try out different features, and see how easy it is to use.

6. Get Feedback from Your Team

Involve your team in the decision-making process. Get their feedback on the different CRM options and make sure the system you choose meets their needs.

7. Plan for Implementation and Training

Implementing a CRM takes time and effort. Develop a plan for implementation and training to ensure a smooth transition. Consider providing training to your team to maximize the benefits of the new system.

Tips for Successful CRM Implementation

Once you’ve chosen a CRM, here are some tips to ensure a successful implementation:

- Start Small: Don’t try to implement everything at once. Start with the core features and gradually add more functionality.

- Clean Your Data: Before importing your data into the CRM, clean it up to ensure accuracy.

- Train Your Team: Provide comprehensive training to your team to ensure they know how to use the system effectively.

- Set Clear Expectations: Set clear expectations for how the CRM will be used and what results you expect to achieve.

- Monitor and Evaluate: Regularly monitor your CRM usage and evaluate its effectiveness. Make adjustments as needed.

- Get Ongoing Support: Take advantage of the CRM provider’s support resources.

By following these tips, you can maximize the benefits of your CRM and transform your accounting firm.

The Long-Term Benefits of a CRM for Accountants

Investing in a CRM system is not just about immediate gains; it’s a long-term strategy for sustainable growth and success. Here’s what you can expect:

- Increased Client Retention: By providing personalized service and building stronger relationships, you can increase client loyalty and reduce churn.

- Improved Efficiency and Productivity: Automation and streamlined workflows will free up your time to focus on high-value activities.

- Enhanced Profitability: By improving client relationships, increasing sales, and reducing operational costs, you can boost your bottom line.

- Better Decision-Making: Data-driven insights will allow you to make informed decisions and improve your business strategies.

- Scalability: A CRM can scale with your business as you grow, allowing you to manage more clients and handle more complex operations.

In the competitive world of accounting, a CRM is no longer a luxury; it’s a necessity. It’s the key to unlocking your firm’s full potential. It’s about building lasting relationships, streamlining operations, and ultimately, achieving greater success. Embrace the power of CRM, and watch your accounting firm thrive.

Conclusion: Choosing the Right CRM is an Investment in Your Future

Selecting the right CRM is a crucial decision for any small accounting firm. By carefully evaluating your needs, researching your options, and following the steps outlined in this guide, you can choose a CRM that will help you streamline your operations, improve client relationships, and achieve your business goals. Don’t delay; take the first step towards a more efficient, profitable, and successful accounting practice today. The right CRM is an investment in your future, and the benefits will be felt for years to come.