Unlocking Growth: The Definitive Guide to the Best CRM for Small Accountants

Unlocking Growth: The Definitive Guide to the Best CRM for Small Accountants

Let’s be honest, running a small accounting firm is a whirlwind. You’re juggling client meetings, tax deadlines, financial reporting, and a mountain of paperwork. Amidst all the chaos, it’s easy for client relationships to fall by the wayside. That’s where a Customer Relationship Management (CRM) system steps in – your secret weapon for streamlined operations and happier clients. But with so many CRMs on the market, choosing the right one can feel overwhelming. Don’t worry, this comprehensive guide will break down everything you need to know about the best CRMs for small accountants, helping you find the perfect fit to fuel your firm’s success.

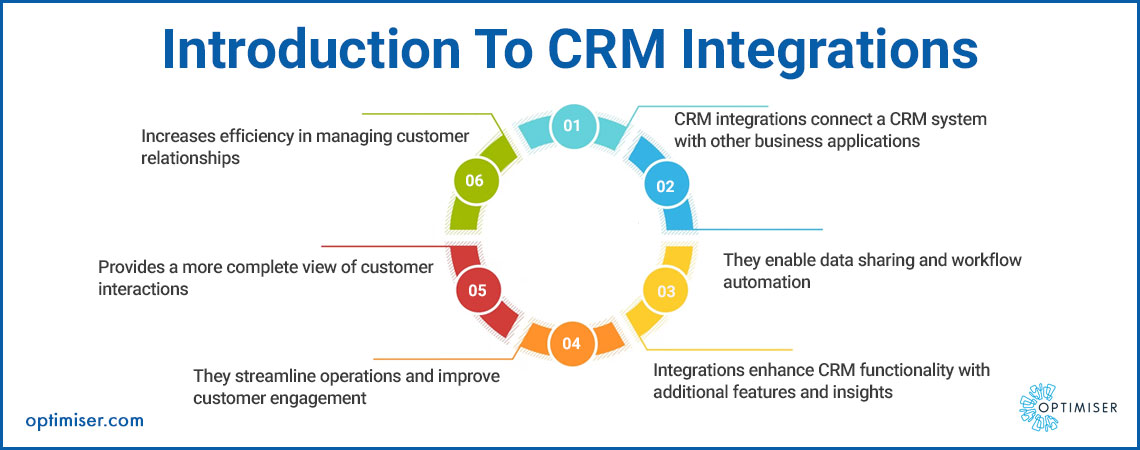

Why Small Accountants Need a CRM

You might be thinking, “I’m a small firm, do I really need a CRM?” The answer is a resounding YES! Here’s why:

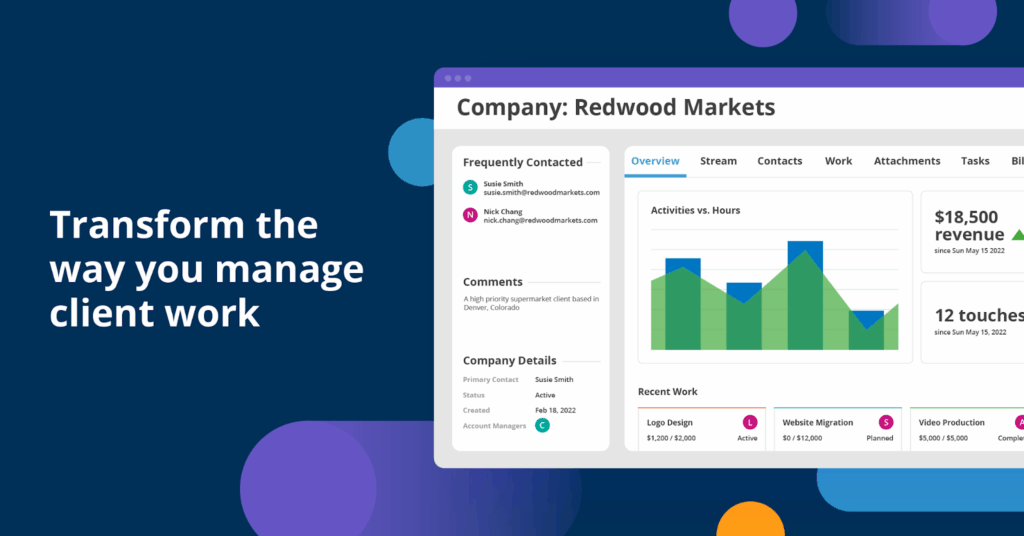

- Improved Client Relationships: A CRM centralizes client information, providing a 360-degree view of each client. You’ll have easy access to communication history, financial data, and preferences, allowing you to personalize interactions and build stronger relationships.

- Increased Efficiency: Automate repetitive tasks like sending invoices, scheduling appointments, and following up on leads. This frees up your time to focus on higher-value activities like providing expert financial advice.

- Enhanced Lead Management: Capture, track, and nurture leads more effectively. A CRM helps you manage your sales pipeline, ensuring no potential client slips through the cracks.

- Better Organization: Say goodbye to spreadsheets and scattered documents. A CRM provides a centralized hub for all your client-related information, making it easy to find what you need, when you need it.

- Data-Driven Decisions: Gain valuable insights into your client base and business performance. CRM reporting features allow you to track key metrics, identify trends, and make informed decisions to drive growth.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, look for these essential features:

- Contact Management: The foundation of any good CRM. This feature should allow you to store and manage client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Lead Management: A robust lead management system is crucial for tracking and nurturing potential clients. Look for features like lead scoring, pipeline management, and automated follow-up sequences.

- Task Management: Stay organized and on top of your to-do list with task management features. You should be able to create tasks, assign them to team members, set deadlines, and track progress.

- Appointment Scheduling: Simplify appointment scheduling with integrated calendar functionality. Clients should be able to book appointments online, and you should be able to sync your CRM with your calendar.

- Email Integration: Seamlessly integrate your CRM with your email provider to track email communications, send mass emails, and automate email marketing campaigns.

- Reporting and Analytics: Gain valuable insights into your business performance with reporting and analytics features. Track key metrics like client acquisition cost, client retention rate, and revenue per client.

- Document Management: Store and manage client documents securely within your CRM. This feature should allow you to upload, organize, and share documents with clients.

- Workflow Automation: Automate repetitive tasks and streamline your workflows with workflow automation features. This can include automating email marketing campaigns, sending invoices, and following up on leads.

- Integration with Accounting Software: This is a MUST! Your CRM should seamlessly integrate with your accounting software (e.g., QuickBooks, Xero) to sync client data, invoices, and payments.

- Mobile Accessibility: Access your CRM data on the go with a mobile app or a mobile-friendly interface. This is essential for staying connected with clients and managing your business from anywhere.

- Security and Compliance: Ensure your CRM offers robust security features to protect sensitive client data. Look for features like data encryption, access controls, and compliance with relevant regulations (e.g., GDPR, CCPA).

Top CRM Systems for Small Accountants

Now, let’s dive into some of the best CRM systems specifically tailored for small accounting firms. We’ll consider factors like ease of use, features, integrations, and pricing.

1. HubSpot CRM

Why it’s great for accountants: HubSpot CRM is a popular choice for its user-friendliness and comprehensive features. The free version is remarkably powerful, making it an excellent starting point for small firms. Its intuitive interface and robust automation capabilities can streamline your client management process significantly.

- Key Features: Contact management, lead tracking, email marketing, sales pipeline management, task management, reporting dashboard, and free CRM tools.

- Integrations: Integrates seamlessly with popular accounting software like QuickBooks, Xero, and many other business tools.

- Pricing: Free plan available. Paid plans offer advanced features like marketing automation and custom reporting.

- Pros: User-friendly interface, powerful free plan, extensive integrations, excellent customer support.

- Cons: Some advanced features require paid upgrades.

2. Zoho CRM

Why it’s great for accountants: Zoho CRM is another strong contender, offering a wide range of features at a competitive price point. It’s highly customizable, allowing you to tailor the system to your specific needs. Its focus on automation can significantly reduce manual tasks.

- Key Features: Contact management, lead management, sales pipeline management, workflow automation, email marketing, reporting and analytics, and document management.

- Integrations: Integrates with a wide array of business tools, including accounting software like QuickBooks and Xero.

- Pricing: Offers a free plan for up to three users. Paid plans are affordable and scale well for growing firms.

- Pros: Highly customizable, affordable pricing, strong automation capabilities, extensive integrations.

- Cons: Can have a steeper learning curve than some other options.

3. Pipedrive

Why it’s great for accountants: Pipedrive is a sales-focused CRM, but its intuitive interface and focus on pipeline management make it a great fit for managing client relationships and tracking leads in an accounting context. It’s designed to be visually appealing and easy to use, making it ideal for firms that prioritize a streamlined workflow.

- Key Features: Sales pipeline management, contact management, deal tracking, email integration, and reporting.

- Integrations: Integrates with popular accounting software and other business tools.

- Pricing: Offers a free trial and affordable paid plans.

- Pros: User-friendly interface, visually appealing, strong pipeline management features.

- Cons: May lack some of the advanced features found in other CRMs.

4. Insightly

Why it’s great for accountants: Insightly is a CRM designed to help businesses of all sizes organize their leads, manage projects, and build stronger client relationships. It’s known for its intuitive design and ease of use, making it a solid choice for accounting firms looking for a straightforward CRM solution.

- Key Features: Contact management, lead tracking, project management, task management, and reporting.

- Integrations: Integrates with popular accounting software and other business tools.

- Pricing: Offers a free plan and affordable paid plans.

- Pros: User-friendly interface, good project management features, affordable pricing.

- Cons: Some advanced features are only available in higher-tier plans.

5. Agile CRM

Why it’s great for accountants: Agile CRM is a versatile CRM that offers a blend of sales, marketing, and service features. It’s a good option for accounting firms that want a comprehensive solution to manage all aspects of their client relationships. Its marketing automation features can be particularly useful for nurturing leads and keeping clients engaged.

- Key Features: Contact management, lead scoring, sales automation, email marketing, helpdesk, and reporting.

- Integrations: Integrates with a variety of business tools, including accounting software.

- Pricing: Offers a free plan for up to 10 users. Paid plans are competitively priced.

- Pros: Comprehensive features, affordable pricing, good marketing automation capabilities.

- Cons: The interface can feel a bit cluttered compared to some other options.

Choosing the Right CRM: A Step-by-Step Guide

Finding the perfect CRM is like finding the perfect client: it takes a little bit of work upfront, but the payoff is well worth it. Here’s a step-by-step guide to help you choose the right CRM for your small accounting firm:

- Identify Your Needs: Before you start evaluating CRM systems, take some time to assess your firm’s needs. What are your biggest pain points? What tasks do you want to automate? What features are most important to you? Make a list of your must-haves and nice-to-haves.

- Set a Budget: CRM pricing varies widely. Determine how much you’re willing to spend on a CRM system, including both initial setup costs and ongoing subscription fees.

- Research Different CRM Systems: Once you know your needs and budget, start researching different CRM systems. Read reviews, compare features, and check out pricing plans. The systems listed above are a great starting point.

- Consider Integrations: Make sure the CRM you choose integrates seamlessly with your existing software, particularly your accounting software. This will save you time and effort by eliminating the need to manually transfer data.

- Evaluate Ease of Use: Choose a CRM that’s easy to learn and use. A complex system will require more training and may not be adopted by your team. Look for an intuitive interface and helpful resources like tutorials and customer support.

- Sign Up for Free Trials: Most CRM systems offer free trials. Take advantage of these trials to test out different systems and see which one best fits your needs. Spend some time playing around with the features, adding data, and exploring the interface.

- Get Input from Your Team: Involve your team in the decision-making process. Ask them for their input on the different CRM systems you’re considering. They’ll be the ones using the system on a daily basis, so their feedback is valuable.

- Make a Decision and Implement: Once you’ve evaluated your options and gathered feedback from your team, make a decision and implement the CRM system. Be sure to provide adequate training to your team and encourage them to use the system consistently.

Tips for Successful CRM Implementation

Choosing the right CRM is only half the battle. To ensure a successful implementation, follow these tips:

- Plan Your Implementation: Before you start, create a detailed implementation plan. This should include a timeline, a list of tasks, and a designated team member responsible for overseeing the implementation.

- Import Your Data: Import your existing client data into the CRM system. This will save you time and effort and ensure that you have all your client information in one place.

- Customize the System: Tailor the CRM system to your specific needs. Customize fields, create custom reports, and configure workflows to automate your processes.

- Provide Training: Train your team on how to use the CRM system. Provide them with clear instructions, helpful resources, and ongoing support.

- Encourage Adoption: Encourage your team to use the CRM system consistently. Highlight the benefits of using the system and make it a part of your firm’s daily workflow.

- Monitor and Evaluate: Regularly monitor your CRM usage and evaluate its effectiveness. Identify any areas where you can improve your processes and make adjustments as needed.

- Stay Up-to-Date: CRM systems are constantly evolving. Stay up-to-date on the latest features and updates to ensure you’re getting the most out of your system.

The Future of CRM in Accounting

The world of accounting is constantly changing, and CRM technology is evolving along with it. Here are some trends to watch for:

- Artificial Intelligence (AI): AI-powered CRM systems are becoming increasingly common. These systems can automate tasks, provide insights, and personalize client interactions.

- Mobile CRM: Mobile CRM apps are becoming more sophisticated, allowing accountants to access their client data and manage their businesses from anywhere.

- Integration with Cloud Technology: CRM systems are increasingly integrating with cloud-based accounting software and other business tools.

- Focus on Data Privacy: With growing concerns about data privacy, CRM systems are focusing on security and compliance.

- Personalized Client Experiences: CRMs are enabling accountants to deliver more personalized client experiences, which is crucial for building strong relationships.

Conclusion: Embrace the Power of CRM

In today’s competitive landscape, a CRM is no longer a luxury but a necessity for small accounting firms. By choosing the right CRM and implementing it effectively, you can streamline your operations, improve client relationships, and drive sustainable growth. Take the time to evaluate your needs, research your options, and choose the CRM that’s the perfect fit for your firm. Your clients – and your bottom line – will thank you.

Embrace the power of CRM, and unlock the full potential of your accounting firm. This is not just about managing clients; it’s about building lasting relationships, fostering efficiency, and driving your business to new heights. Take the first step today, and see the positive impact a well-chosen CRM can have on your practice. The journey to a more successful and client-centric accounting firm starts now!