Unlocking Growth: The Best CRM Systems for Small Accounting Firms

Unlocking Growth: The Best CRM Systems for Small Accounting Firms

In the fast-paced world of accounting, staying organized, nurturing client relationships, and streamlining operations are crucial for success. As a small accounting firm, you’re likely juggling multiple clients, deadlines, and tasks. That’s where a Customer Relationship Management (CRM) system comes in. But with so many options available, choosing the right CRM can feel overwhelming. This guide will delve into the best CRM systems tailored for small accounting firms, helping you make an informed decision that will boost your efficiency and drive growth.

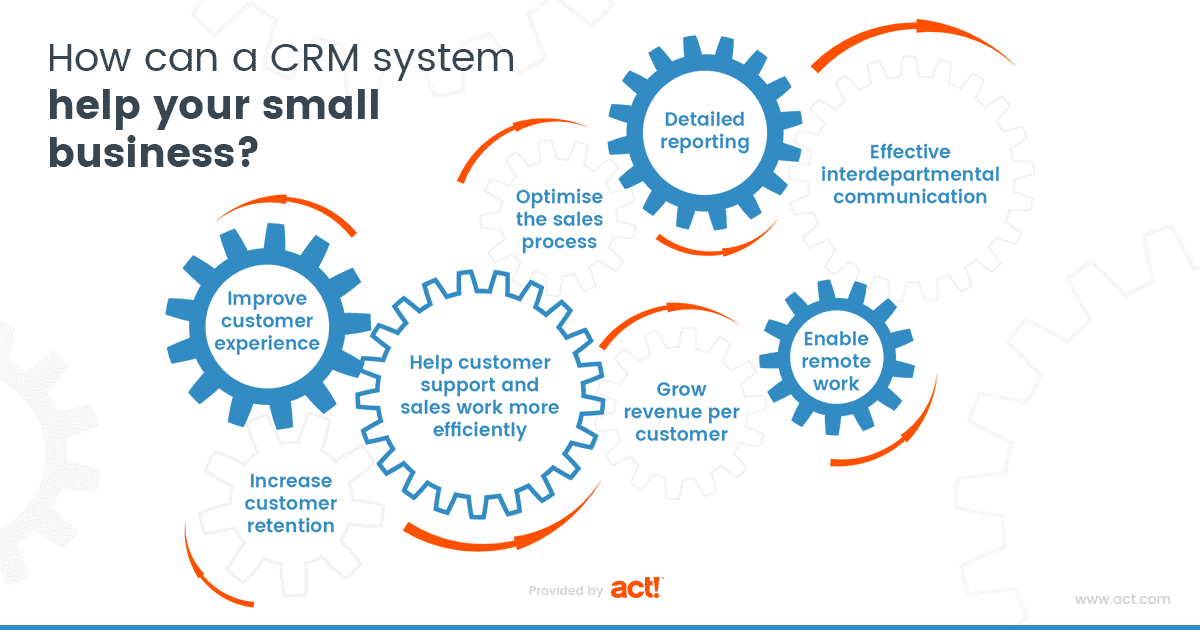

Why Your Small Accounting Firm Needs a CRM

Before we dive into the best CRM systems, let’s explore why a CRM is essential for small accounting firms. A CRM isn’t just a fancy contact list; it’s a central hub for managing all your client interactions, data, and workflows. Here’s how a CRM can benefit your firm:

- Improved Client Relationships: A CRM provides a 360-degree view of your clients, including their contact information, communication history, and financial data. This allows you to personalize your interactions, anticipate their needs, and build stronger relationships.

- Enhanced Organization: Say goodbye to scattered spreadsheets and sticky notes. A CRM centralizes all client information, making it easy to find what you need when you need it. You can track tasks, set reminders, and manage deadlines, ensuring nothing falls through the cracks.

- Increased Efficiency: Automate repetitive tasks, such as sending appointment reminders, following up on leads, and generating reports. This frees up your time to focus on more strategic activities, like providing expert financial advice.

- Better Lead Management: Capture leads from various sources, track their progress through the sales funnel, and nurture them with targeted communication. A CRM helps you convert leads into paying clients more effectively.

- Data-Driven Decision Making: Gain valuable insights into your client base, sales performance, and marketing effectiveness. Use this data to make informed decisions about your business strategy and identify areas for improvement.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider these essential features:

- Contact Management: Store and manage client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Communication Tracking: Track all interactions with clients, including emails, phone calls, meetings, and notes.

- Task and Workflow Automation: Automate repetitive tasks, such as sending invoices, scheduling appointments, and following up on leads.

- Reporting and Analytics: Generate reports on key performance indicators (KPIs), such as client acquisition cost, customer lifetime value, and sales revenue.

- Integration with Accounting Software: Seamlessly integrate with your existing accounting software, such as QuickBooks, Xero, or Sage, to streamline data entry and eliminate errors.

- Security and Data Privacy: Ensure the CRM system complies with data privacy regulations, such as GDPR and CCPA, and offers robust security features to protect sensitive client information.

- Mobile Accessibility: Access your CRM data and manage your client relationships on the go with a mobile app.

- Customization: Tailor the CRM system to meet the specific needs of your accounting firm, including custom fields, workflows, and reports.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems for small accounting firms. We’ve considered factors like ease of use, features, pricing, and integrations to help you find the perfect fit.

1. HubSpot CRM

HubSpot CRM is a popular choice for small businesses, and for good reason. It’s free to use, user-friendly, and packed with features that can benefit accounting firms. While the free version offers a solid foundation, paid plans unlock advanced features like marketing automation and custom reporting.

- Pros:

- Free to use (with paid options for advanced features)

- User-friendly interface

- Excellent contact management

- Robust automation capabilities

- Integrates with popular accounting software

- Comprehensive reporting and analytics

- Cons:

- Free version has limitations on features

- Can be overwhelming for beginners due to the breadth of features

- Ideal for: Small accounting firms looking for a free, feature-rich CRM with room to grow.

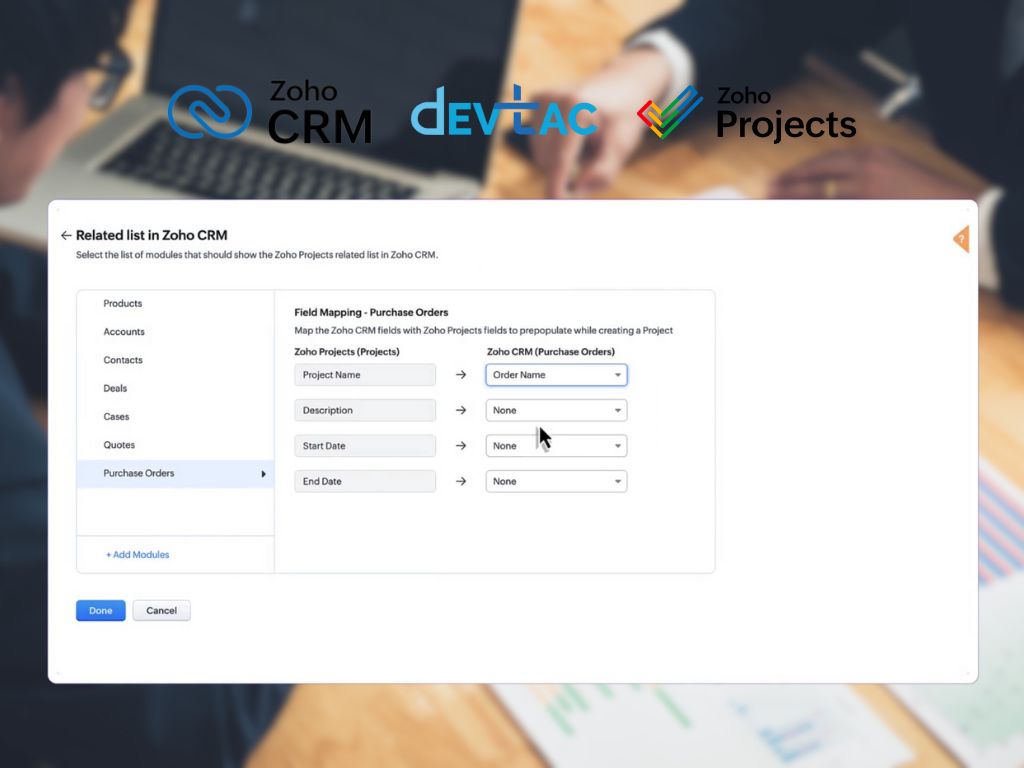

2. Zoho CRM

Zoho CRM is a versatile and affordable CRM system that caters to businesses of all sizes. It offers a wide range of features, including sales automation, marketing automation, and customer support tools. Zoho CRM’s pricing plans are competitive, making it an attractive option for budget-conscious firms.

- Pros:

- Affordable pricing plans

- Extensive feature set

- Sales and marketing automation capabilities

- Excellent integration with other Zoho apps

- Customizable to meet specific needs

- Cons:

- Interface can be slightly complex

- Some advanced features require higher-tier plans

- Ideal for: Small accounting firms seeking a feature-rich, affordable CRM with strong sales and marketing capabilities.

3. Pipedrive

Pipedrive is a sales-focused CRM that excels at managing sales pipelines and tracking deals. Its visual interface makes it easy to see where leads are in the sales process and identify opportunities for follow-up. While Pipedrive is primarily designed for sales, it can also be adapted to manage client relationships and track client communications.

- Pros:

- User-friendly interface

- Excellent sales pipeline management

- Visual deal tracking

- Automation features to streamline sales processes

- Easy to integrate with other tools

- Cons:

- Less focus on marketing automation compared to other CRMs

- Can be limited in terms of customization

- Ideal for: Small accounting firms that prioritize sales and need a CRM that helps them close deals efficiently.

4. Freshsales

Freshsales, a product of Freshworks, is a CRM focused on sales and customer engagement. It provides a user-friendly interface, robust sales automation, and advanced analytics. Freshsales stands out with its built-in phone and email capabilities, allowing accountants to communicate directly with clients from within the CRM.

- Pros:

- User-friendly interface

- Integrated phone and email features

- Sales automation capabilities

- Detailed reporting and analytics

- Affordable pricing plans

- Cons:

- May not offer the same level of customization as other CRMs

- Limited integration options compared to some competitors

- Ideal for: Small accounting firms needing an intuitive CRM with integrated communication tools.

5. Salesforce Sales Cloud

Salesforce Sales Cloud is a powerful and comprehensive CRM system that’s suitable for businesses of all sizes. While it can be more complex than other options, it offers a vast array of features, including sales automation, marketing automation, customer service tools, and advanced reporting. Salesforce Sales Cloud is a significant investment, but it can provide a high return for firms that need a robust and scalable CRM solution.

- Pros:

- Extensive feature set

- Highly customizable

- Scalable for growing businesses

- Excellent reporting and analytics

- Large ecosystem of integrations

- Cons:

- Can be expensive, especially for small firms

- Steeper learning curve

- Requires dedicated implementation and management

- Ideal for: Small accounting firms with complex needs and the budget to invest in a comprehensive CRM solution.

6. Agile CRM

Agile CRM is a unified platform that combines sales, marketing, and customer service features. It’s designed to be user-friendly and affordable, making it a good option for small businesses. Agile CRM offers a free plan for up to 10 users, and its paid plans are competitively priced.

- Pros:

- User-friendly interface

- All-in-one platform (sales, marketing, service)

- Affordable pricing plans

- Free plan available

- Automation capabilities

- Cons:

- May not have the same depth of features as more established CRMs

- Limited integration options

- Ideal for: Small accounting firms seeking an all-in-one CRM solution that’s easy to use and affordable.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM for your accounting firm is a crucial decision. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Identify your firm’s specific needs and pain points. What are you hoping to achieve with a CRM? What features are essential?

- Define Your Budget: Determine how much you’re willing to spend on a CRM system. Consider both the initial setup costs and ongoing subscription fees.

- Research CRM Systems: Research the different CRM systems available, considering their features, pricing, and integrations.

- Create a Shortlist: Narrow down your choices to a shortlist of 2-3 CRM systems that best meet your needs.

- Request Demos and Trials: Request demos or free trials of your shortlisted CRM systems. This will allow you to test the systems and see how they work in practice.

- Evaluate Ease of Use: Consider how easy the CRM system is to use. Is the interface intuitive? Is the system easy to learn and navigate?

- Assess Integrations: Check if the CRM system integrates with your existing accounting software and other tools.

- Consider Scalability: Choose a CRM system that can grow with your firm. Can the system handle an increasing number of clients and users?

- Evaluate Customer Support: Assess the quality of customer support offered by the CRM provider. Is support readily available? Is it responsive and helpful?

- Make Your Decision: Based on your research and evaluation, choose the CRM system that best meets your needs and budget.

- Implement and Train: Once you’ve selected a CRM system, implement it and train your team on how to use it effectively.

- Monitor and Optimize: Continuously monitor your CRM system’s performance and make adjustments as needed to optimize its effectiveness.

Tips for Successful CRM Implementation

Implementing a CRM system is a significant undertaking. Here are some tips to ensure a smooth and successful implementation:

- Involve Your Team: Get your team involved in the decision-making process from the start. This will help ensure buy-in and make the transition easier.

- Clean Up Your Data: Before importing your data into the CRM, clean it up. Remove duplicate entries, correct errors, and standardize formatting.

- Customize the System: Tailor the CRM system to meet the specific needs of your firm. Customize fields, workflows, and reports to align with your processes.

- Provide Training: Provide comprehensive training to your team on how to use the CRM system effectively.

- Set Clear Expectations: Establish clear expectations for how the CRM system will be used and what results you expect to see.

- Monitor and Measure: Monitor the performance of your CRM system and measure its impact on your business. Track key performance indicators (KPIs) to assess its effectiveness.

- Seek Ongoing Support: Don’t hesitate to seek help from the CRM provider or a consultant if you need assistance.

- Iterate and Improve: Regularly review your CRM system and make adjustments as needed to optimize its performance.

Integrating Your CRM with Accounting Software

One of the most significant advantages of using a CRM for your accounting firm is its ability to integrate with your existing accounting software. This integration streamlines data entry, reduces errors, and provides a more comprehensive view of your clients’ financial data. Here’s why integration is so important and how it works:

- Benefits of Integration:

- Eliminates Manual Data Entry: Automatically sync client data between your CRM and accounting software, saving you time and reducing the risk of errors.

- Improved Data Accuracy: Ensures that client information is consistent across all systems, reducing the potential for discrepancies.

- Enhanced Client Insights: Provides a holistic view of your clients’ financial data, allowing you to make better-informed decisions and provide more personalized service.

- Streamlined Billing and Invoicing: Automates the creation and sending of invoices, reducing the time spent on administrative tasks.

- Better Reporting and Analytics: Enables you to generate more comprehensive reports on your clients’ financial performance and your firm’s overall profitability.

- How Integration Works:

- APIs and Connectors: Most CRM systems offer Application Programming Interfaces (APIs) or pre-built connectors that allow you to integrate with popular accounting software, such as QuickBooks, Xero, and Sage.

- Data Synchronization: Once integrated, the CRM and accounting software automatically synchronize data, such as client contact information, invoices, payments, and financial reports.

- Two-Way Synchronization: Some integrations offer two-way synchronization, meaning that data changes in either system are automatically reflected in the other.

- Choosing the Right Integration:

- Compatibility: Ensure that the CRM system is compatible with your accounting software.

- Features: Look for integrations that offer the features you need, such as automatic data synchronization, invoice generation, and reporting.

- Ease of Use: Choose an integration that is easy to set up and use.

- Support: Ensure that the CRM provider offers adequate support for the integration.

Maximizing ROI from Your CRM Investment

Investing in a CRM system is a significant step towards improving your firm’s efficiency and client relationships. To maximize your return on investment (ROI), consider these strategies:

- Define Clear Goals: Before implementing a CRM, define clear goals and objectives for what you want to achieve. This will help you measure the success of your CRM implementation.

- Train Your Team: Ensure that your team is properly trained on how to use the CRM system. This will help them use it effectively and maximize its benefits.

- Use the CRM Consistently: Encourage your team to use the CRM system consistently. Make it a part of their daily workflow.

- Automate Tasks: Take advantage of the CRM’s automation features to streamline your processes and free up your time.

- Analyze Data: Regularly analyze the data in your CRM system to gain insights into your client base, sales performance, and marketing effectiveness.

- Measure Results: Track key performance indicators (KPIs) to measure the success of your CRM implementation. This will help you identify areas for improvement.

- Stay Updated: Keep up-to-date with the latest features and updates of your CRM system. This will help you maximize its benefits.

- Seek Expert Advice: If needed, seek help from a CRM consultant or expert to help you get the most out of your CRM system.

The Future of CRM for Accountants

The world of CRM is constantly evolving, and the future holds exciting possibilities for accounting firms. Here are some trends to watch:

- Artificial Intelligence (AI): AI-powered CRM systems can automate tasks, provide insights, and personalize client interactions.

- Mobile CRM: The ability to access CRM data and manage client relationships on the go will become increasingly important.

- Integration with Emerging Technologies: CRM systems will continue to integrate with new technologies, such as blockchain and cloud computing.

- Focus on Client Experience: CRM systems will focus increasingly on providing a seamless and personalized client experience.

- Data Privacy and Security: Data privacy and security will remain top priorities, and CRM systems will need to comply with evolving regulations.

Conclusion: Investing in the Right CRM for Your Firm

Choosing the right CRM system is a significant investment for small accounting firms. By understanding your needs, researching your options, and following the steps outlined in this guide, you can select a CRM that will help you build stronger client relationships, streamline your operations, and drive growth. Whether you choose HubSpot CRM, Zoho CRM, Pipedrive, Freshsales, Salesforce Sales Cloud, or Agile CRM, the right system will empower you to manage your client interactions more effectively and free up your time to focus on providing expert financial advice. By embracing a CRM system, you’re not just investing in software; you’re investing in the future of your accounting firm.