Unlocking Growth: The Best CRM Systems for Small Accounting Firms

Running a small accounting firm is a balancing act. You’re juggling client needs, financial data, regulatory compliance, and the constant pressure to grow your business. In this fast-paced environment, efficiency and client satisfaction are paramount. That’s where a Customer Relationship Management (CRM) system comes into play. But with so many options available, choosing the right CRM for your specific needs can feel overwhelming. This comprehensive guide will delve into the best CRM systems tailored for small accounting firms, helping you streamline your operations, enhance client relationships, and ultimately, boost your bottom line.

Why Your Accounting Firm Needs a CRM

Before we jump into the specifics, let’s establish why a CRM is a crucial investment for your accounting practice. It’s not just about fancy features; it’s about fundamental improvements in how you operate and engage with your clients. Think of a CRM as the central nervous system of your client interactions.

- Centralized Client Data: A CRM provides a single, accessible repository for all client information. This includes contact details, communication history, financial data (if integrated), project status, and more. No more scattered spreadsheets, email chains, or lost sticky notes.

- Improved Client Relationship Management: By having a complete view of each client, you can personalize your interactions. You can anticipate their needs, offer tailored services, and proactively address any concerns. This leads to higher client satisfaction and retention.

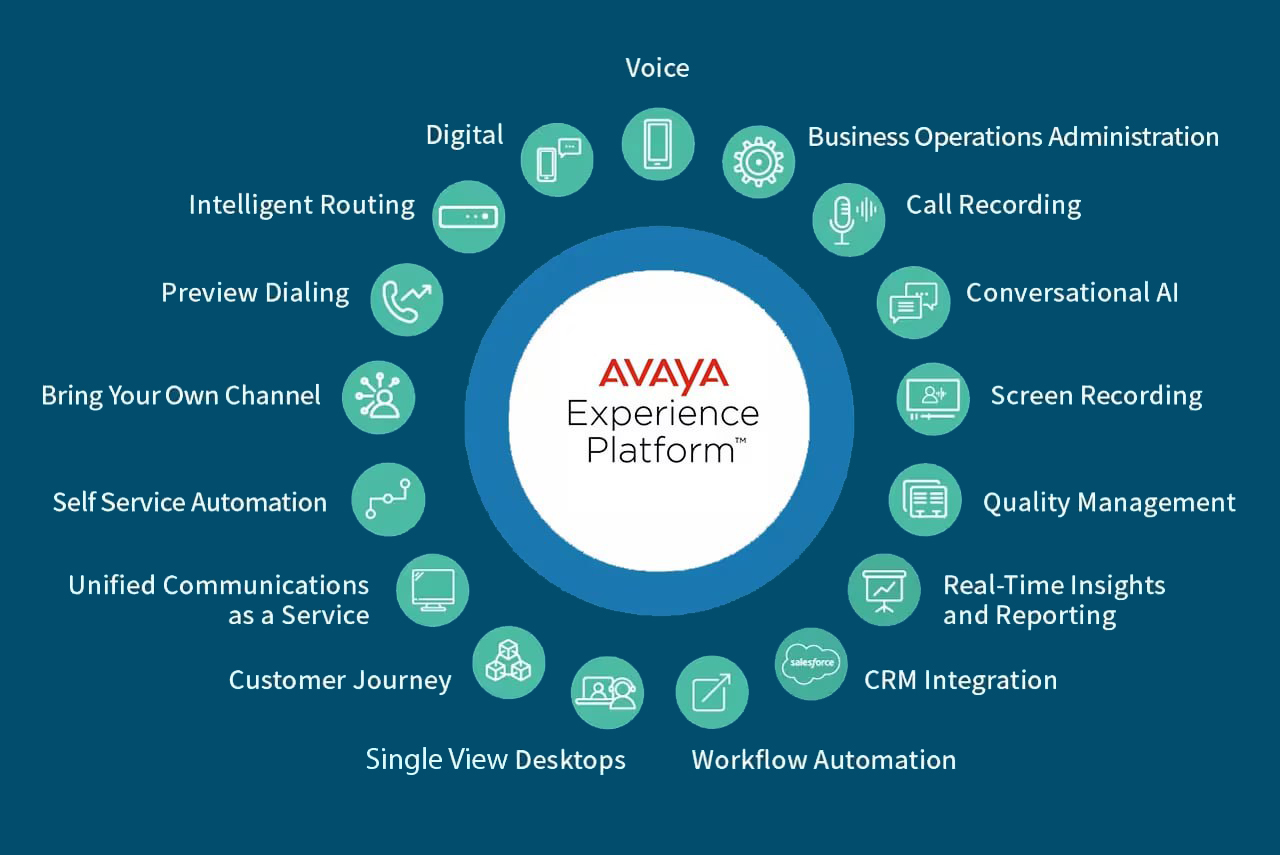

- Enhanced Communication: CRM systems often integrate with email, phone, and other communication channels. This allows you to track all interactions, ensuring nothing falls through the cracks. You can also automate email campaigns, appointment reminders, and other communications to save time.

- Streamlined Workflows: Many CRM systems offer automation capabilities, allowing you to streamline repetitive tasks. For example, you can automate the sending of invoices, follow-up emails, and appointment scheduling. This frees up your time to focus on more strategic activities.

- Increased Sales & Marketing Effectiveness: A CRM can help you identify and nurture leads, track marketing campaigns, and measure their effectiveness. This allows you to optimize your sales and marketing efforts, leading to increased revenue.

- Better Collaboration: A CRM facilitates collaboration among team members by providing a shared view of client information and project progress. This improves communication and reduces the risk of errors.

- Data-Driven Decision Making: CRM systems provide valuable insights into your client base, sales performance, and marketing effectiveness. This data can be used to make informed decisions about your business strategy.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, you need to focus on features that are relevant to your specific needs. Here are some essential features to consider:

- Contact Management: This is the foundation of any CRM. It should allow you to easily store and manage client contact information, including names, addresses, phone numbers, email addresses, and other relevant details.

- Communication Tracking: The ability to track all client interactions, including emails, phone calls, and meetings, is crucial. This provides a complete history of your relationship with each client.

- Task Management: A good CRM should allow you to create and assign tasks to team members, track their progress, and set deadlines. This helps ensure that all client work is completed on time and to a high standard.

- Workflow Automation: Look for a CRM that allows you to automate repetitive tasks, such as sending invoices, follow-up emails, and appointment reminders. This can save you a significant amount of time and effort.

- Reporting and Analytics: The ability to generate reports and analyze data is essential for making informed decisions. Look for a CRM that provides insights into your client base, sales performance, and marketing effectiveness.

- Integration with Accounting Software: This is a critical feature for accountants. The CRM should integrate seamlessly with your accounting software (e.g., QuickBooks, Xero) to allow you to access client financial data and automate tasks such as invoice creation and payment tracking.

- Security and Data Privacy: Ensure the CRM offers robust security measures to protect your client data. Look for features such as data encryption, user access controls, and compliance with relevant data privacy regulations (e.g., GDPR, CCPA).

- Mobile Accessibility: In today’s mobile world, it’s important to be able to access your CRM from anywhere. Look for a CRM with a mobile app or a responsive web interface.

- Customization Options: Your accounting firm is unique. Choose a CRM that allows you to customize fields, workflows, and reports to meet your specific needs.

- Scalability: As your business grows, you’ll need a CRM that can scale with you. Choose a CRM that can handle increasing numbers of clients and users.

Top CRM Systems for Small Accounting Firms: A Detailed Breakdown

Now, let’s dive into some of the best CRM systems specifically tailored for small accounting firms. We’ll explore their key features, pricing, pros, and cons to help you make an informed decision.

1. HubSpot CRM

Overview: HubSpot CRM is a popular and versatile option, particularly well-suited for businesses that prioritize inbound marketing and sales. It offers a free version with a generous set of features, making it an attractive option for small businesses just starting out. While the free version is powerful, paid plans unlock even more advanced capabilities.

Key Features:

- Free Forever Plan: Includes contact management, deal tracking, email marketing, and meeting scheduling.

- Marketing Automation: Helps you nurture leads and automate marketing campaigns.

- Sales Automation: Automates sales tasks, such as follow-up emails and task creation.

- Integration with Accounting Software (via third-party integrations): Integrates with popular accounting software like QuickBooks and Xero through tools like Zapier or direct integrations offered by some add-ons.

- Reporting and Analytics: Provides insights into sales and marketing performance.

- User-Friendly Interface: HubSpot is known for its intuitive and easy-to-navigate interface.

Pricing:

- Free: Includes core CRM features.

- Starter: Starts at $45 per month (billed annually).

- Professional: Starts at $800 per month (billed annually).

- Enterprise: Starts at $3,600 per month (billed annually).

Pros:

- Free plan offers a lot of value.

- User-friendly interface.

- Strong marketing automation capabilities.

- Excellent reporting and analytics.

- Large ecosystem of integrations.

Cons:

- Some accounting-specific integrations require third-party tools.

- Can be expensive for advanced features.

Best For: Small accounting firms that want a comprehensive CRM with strong marketing and sales capabilities and are comfortable using third-party integrations for accounting software connectivity.

2. Zoho CRM

Overview: Zoho CRM is another popular and affordable option, known for its comprehensive features and robust customization options. It offers a free plan for a limited number of users and a range of paid plans to suit businesses of all sizes. Zoho CRM is a strong contender for businesses looking for a versatile and customizable CRM solution.

Key Features:

- Contact Management: Comprehensive contact management features.

- Sales Automation: Automates sales processes, including lead management, deal tracking, and workflow automation.

- Marketing Automation: Email marketing, social media integration, and lead nurturing.

- Integration with Accounting Software: Integrates with popular accounting software like QuickBooks and Xero (through native integrations or third-party apps).

- Customization: Highly customizable to meet your specific business needs.

- Reporting and Analytics: Provides detailed reports and analytics on sales, marketing, and other business metrics.

- Mobile App: Accessible on mobile devices for on-the-go access.

Pricing:

- Free: For up to 3 users.

- Standard: $14 per user per month (billed annually).

- Professional: $23 per user per month (billed annually).

- Enterprise: $40 per user per month (billed annually).

- Ultimate: $52 per user per month (billed annually).

Pros:

- Affordable pricing.

- Highly customizable.

- Comprehensive feature set.

- Good integration options.

- Strong mobile app.

Cons:

- The user interface can be slightly overwhelming at first due to the extensive features.

- Some advanced features are only available in higher-tier plans.

Best For: Small accounting firms looking for an affordable, feature-rich, and highly customizable CRM solution with good integration capabilities.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that excels at helping businesses manage their sales pipelines and close deals. While it may not have the same breadth of features as some other CRMs, it’s incredibly user-friendly and effective for managing sales processes. It’s a great option for accounting firms that want to streamline their sales efforts.

Key Features:

- Visual Sales Pipeline: Provides a clear and intuitive visual representation of your sales pipeline.

- Deal Tracking: Allows you to track deals through each stage of the sales process.

- Contact Management: Manages contact information and communication history.

- Email Integration: Integrates with email providers to track email communications.

- Workflow Automation: Automates repetitive sales tasks.

- Reporting and Analytics: Provides insights into sales performance.

- Integrations: Integrates with various tools, including accounting software (via integrations).

Pricing:

- Essential: $14.90 per user per month (billed annually).

- Advanced: $29.90 per user per month (billed annually).

- Professional: $59.90 per user per month (billed annually).

- Enterprise: $99.00 per user per month (billed annually).

Pros:

- User-friendly interface.

- Excellent sales pipeline management.

- Easy to set up and use.

- Strong reporting and analytics.

Cons:

- May lack some of the broader marketing and automation features of other CRMs.

- Accounting software integrations may require third-party tools.

Best For: Small accounting firms that want a simple, intuitive, and effective CRM for managing their sales pipeline and closing deals.

4. Keap (formerly Infusionsoft)

Overview: Keap is a CRM and marketing automation platform designed for small businesses. It combines CRM functionality with powerful marketing automation features, making it a good choice for accounting firms that want to nurture leads and automate their marketing efforts. However, it can be more complex to set up and use than some other CRMs.

Key Features:

- Contact Management: Manages client contacts and information.

- Sales Automation: Automates sales processes, including lead management and deal tracking.

- Marketing Automation: Powerful marketing automation features, including email marketing, lead nurturing, and campaign management.

- E-commerce: Offers e-commerce features for selling services online.

- Integration with Accounting Software: Integrates with some accounting software (check for specific compatibility).

- Reporting and Analytics: Provides insights into sales, marketing, and business performance.

Pricing:

- Lite: Starts at $79 per month (billed annually).

- Pro: Starts at $149 per month (billed annually).

- Max: Starts at $199 per month (billed annually).

Pros:

- Powerful marketing automation features.

- Good for lead nurturing and campaign management.

- E-commerce capabilities.

Cons:

- Can be more complex to set up and use.

- Pricing can be higher than some other CRMs.

- Accounting software integrations may be limited.

Best For: Small accounting firms that want a CRM with strong marketing automation capabilities and are willing to invest the time to learn the platform.

5. Monday.com

Overview: While not exclusively a CRM, Monday.com is a highly versatile work management platform that can be customized to function as a CRM. It’s known for its visual interface and ease of use. It’s a good option for accounting firms that want a flexible and adaptable CRM solution.

Key Features:

- Customizable Workflows: Allows you to create custom workflows for managing client interactions, tasks, and projects.

- Visual Interface: Provides a clear and intuitive visual representation of your data.

- Contact Management: Manages client contact information.

- Task Management: Allows you to create and assign tasks to team members.

- Collaboration Features: Facilitates collaboration among team members.

- Integrations: Integrates with various tools, including accounting software (via integrations).

- Reporting and Analytics: Provides insights into your data.

Pricing:

- Free: For up to 2 seats.

- Basic: Starts at $9 per seat per month (billed annually).

- Standard: Starts at $12 per seat per month (billed annually).

- Pro: Starts at $19 per seat per month (billed annually).

- Enterprise: Contact for pricing.

Pros:

- Highly customizable.

- Visual and easy-to-use interface.

- Good for project management and collaboration.

- Integrates with many other tools.

Cons:

- Not a dedicated CRM, so some features may be less robust.

- Accounting software integrations may require third-party tools.

Best For: Small accounting firms that want a highly customizable and visual CRM solution that can also be used for project management and collaboration.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM is a crucial decision. Here’s a step-by-step guide to help you through the process:

- Assess Your Needs:

- Identify your specific goals for using a CRM. What do you want to achieve? (e.g., improved client relationships, increased sales, streamlined workflows)

- Analyze your current processes. What are your pain points? Where are you losing time or efficiency?

- Determine your must-have features. What features are essential for your business? (e.g., contact management, accounting software integration)

- Consider your budget. How much are you willing to spend on a CRM?

- Research CRM Options:

- Explore the CRM systems mentioned above and other options.

- Read reviews and compare features.

- Consider the integration capabilities of each CRM.

- Look for industry-specific reviews and recommendations.

- Create a Shortlist:

- Narrow down your choices to a few top contenders.

- Request Demos and Trials:

- Request demos from your shortlisted CRM providers.

- Sign up for free trials to test the CRM systems.

- Involve your team in the evaluation process.

- Evaluate and Compare:

- Compare the features, pricing, and ease of use of each CRM.

- Assess the integration capabilities.

- Consider the scalability of each CRM.

- Evaluate the customer support provided by each vendor.

- Make a Decision and Implement:

- Choose the CRM that best meets your needs and budget.

- Develop an implementation plan.

- Train your team on how to use the CRM.

- Migrate your data to the new CRM.

- Monitor your progress and make adjustments as needed.

Tips for Successful CRM Implementation

Once you’ve chosen a CRM, successful implementation is key. Here are some tips to ensure a smooth transition:

- Get Buy-In from Your Team: Involve your team in the decision-making process and training to ensure they are invested in using the CRM.

- Clean Up Your Data: Before migrating your data, clean it up to ensure accuracy and consistency.

- Customize the CRM to Your Needs: Configure the CRM to meet the specific needs of your accounting firm.

- Provide Thorough Training: Provide your team with adequate training on how to use the CRM.

- Establish Clear Processes: Define clear processes for using the CRM, such as how to enter data, track client interactions, and generate reports.

- Monitor and Evaluate: Monitor your progress and evaluate the effectiveness of the CRM. Make adjustments as needed.

- Integrate with Other Tools: Integrate your CRM with other tools, such as your accounting software, email marketing platform, and project management software, to streamline your workflows.

- Leverage Customer Support: Don’t hesitate to contact the CRM vendor’s customer support team for assistance.

The Bottom Line: Investing in the Future of Your Accounting Firm

Choosing the right CRM for your small accounting firm is a significant investment in your future success. By streamlining your operations, enhancing client relationships, and improving your sales and marketing efforts, a CRM can help you grow your business and achieve your goals. Take the time to assess your needs, research your options, and choose the CRM that’s right for you. With the right CRM in place, you’ll be well-equipped to thrive in today’s competitive accounting landscape.

By implementing a CRM, you’re not just adopting a new software; you’re cultivating a client-centric approach that will set your firm apart. You’ll be empowered to provide exceptional service, build lasting relationships, and ultimately, achieve sustainable growth. Embrace the power of CRM and watch your accounting firm flourish.