Unlocking Growth: The Best CRM Systems for Small Accounting Firms

Unlocking Growth: The Best CRM Systems for Small Accounting Firms

In the fast-paced world of accounting, where deadlines loom and client relationships are paramount, efficiency and organization are the cornerstones of success. For small accounting firms, the challenge lies in balancing the demands of financial management with the need to cultivate strong client relationships and streamline operations. This is where a Customer Relationship Management (CRM) system becomes an indispensable tool. But with a plethora of options available, choosing the right CRM can feel like navigating a complex maze. This comprehensive guide delves into the best CRM systems specifically tailored for small accounting firms, exploring their features, benefits, and how they can revolutionize your practice.

Why a CRM is Crucial for Small Accounting Firms

Before we dive into specific CRM solutions, let’s understand why a CRM is so vital for small accounting firms. In essence, a CRM acts as the central nervous system for your client interactions, sales processes, and overall business operations. It helps you:

- Centralize Client Data: Consolidate all client information, including contact details, communication history, financial data, and project status, in one accessible location.

- Improve Client Relationship Management: Foster stronger relationships by personalizing interactions, tracking communication, and proactively addressing client needs.

- Streamline Sales and Marketing: Manage leads, track sales opportunities, and automate marketing campaigns to attract new clients and grow your business.

- Enhance Efficiency and Productivity: Automate repetitive tasks, reduce manual data entry, and improve collaboration among team members.

- Gain Data-Driven Insights: Track key performance indicators (KPIs), analyze client behavior, and make informed business decisions based on data.

Without a CRM, small accounting firms often struggle with scattered data, missed opportunities, and inefficient workflows. This can lead to client dissatisfaction, lost revenue, and hindered growth. A CRM empowers you to overcome these challenges and build a thriving practice.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, prioritize features that are specifically designed to meet your unique needs. Here are some essential features to consider:

1. Contact Management

At the heart of any CRM is effective contact management. Your CRM should allow you to:

- Store and organize client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Segment clients based on various criteria, such as industry, service level, or revenue.

- Track communication history, including emails, calls, meetings, and notes.

- Set reminders and follow-up tasks to ensure timely communication.

2. Lead Management

A robust lead management system is crucial for converting prospects into clients. Look for a CRM that allows you to:

- Capture leads from various sources, such as website forms, email campaigns, and referrals.

- Qualify leads based on their needs and potential.

- Track lead interactions and progress through the sales pipeline.

- Automate lead nurturing workflows to engage prospects and move them closer to conversion.

3. Sales Pipeline Management

A well-defined sales pipeline helps you visualize your sales process and track opportunities. Your CRM should enable you to:

- Create custom sales pipelines that reflect your specific sales stages.

- Track the progress of each opportunity through the pipeline.

- Assign tasks and deadlines to team members.

- Generate sales reports and forecasts to monitor performance.

4. Task and Appointment Management

Efficient task and appointment management is essential for staying organized and meeting deadlines. Your CRM should provide the following features:

- Create and assign tasks to team members.

- Set deadlines and reminders.

- Schedule appointments and meetings.

- Integrate with your calendar to streamline scheduling.

5. Reporting and Analytics

Data-driven insights are crucial for making informed decisions. Your CRM should offer comprehensive reporting and analytics capabilities, including:

- Track key performance indicators (KPIs), such as client acquisition cost, customer lifetime value, and sales conversion rates.

- Generate custom reports based on your specific needs.

- Visualize data through charts and graphs to identify trends and patterns.

- Provide insights into client behavior and engagement.

6. Integrations

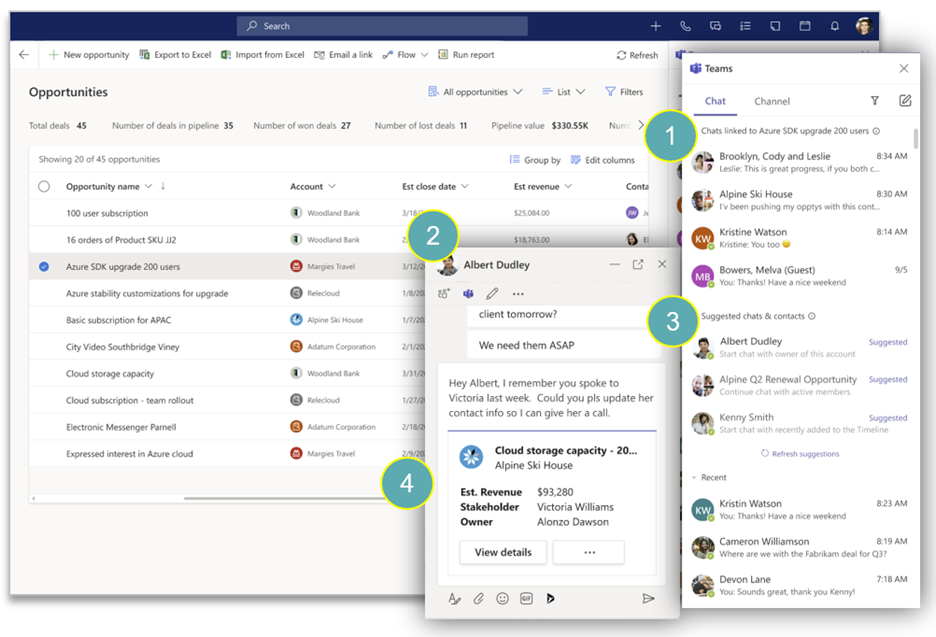

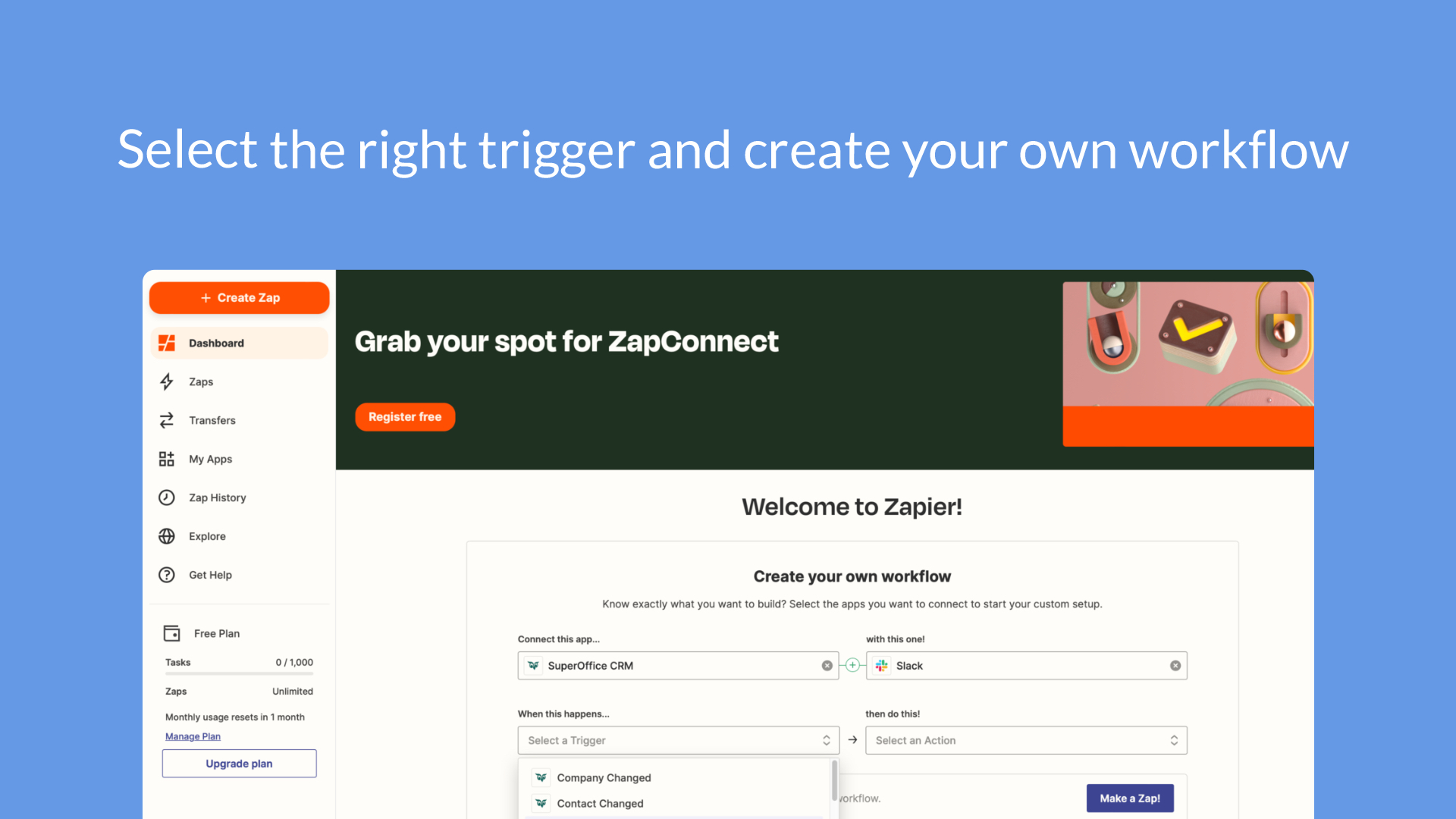

Seamless integration with other business tools is essential for streamlining your workflow. Look for a CRM that integrates with your existing accounting software, email marketing platforms, and other essential applications. Key integrations to consider include:

- Accounting Software: QuickBooks, Xero, Sage Intacct

- Email Marketing Platforms: Mailchimp, Constant Contact, ActiveCampaign

- Communication Tools: Slack, Microsoft Teams

- Calendar Applications: Google Calendar, Outlook Calendar

7. Mobile Access

In today’s mobile world, it’s crucial to have access to your CRM on the go. Choose a CRM that offers a mobile app or a responsive web interface that allows you to access your data and manage your business from anywhere.

8. Security and Compliance

Data security and compliance are paramount, especially in the accounting industry. Ensure that your CRM provider offers robust security measures, such as data encryption, two-factor authentication, and compliance with relevant regulations, such as GDPR and CCPA.

Top CRM Systems for Small Accounting Firms

Now that you understand the key features to look for, let’s explore some of the best CRM systems specifically designed for small accounting firms. These platforms offer a range of features and pricing options to suit different needs and budgets.

1. HubSpot CRM

HubSpot CRM is a popular choice for small businesses due to its user-friendly interface, comprehensive features, and free plan. It offers a wide range of tools for contact management, lead management, sales pipeline management, and marketing automation. HubSpot’s free plan is particularly attractive for startups and small firms looking to get started with CRM without a significant upfront investment. The platform integrates seamlessly with other HubSpot tools, such as marketing, sales, and customer service hubs, allowing you to create a unified customer experience. While the free plan is robust, paid plans offer more advanced features, such as custom reporting, advanced automation, and dedicated support.

Key Features:

- Free CRM with unlimited users and contacts

- Contact management and segmentation

- Lead management and sales pipeline tracking

- Marketing automation and email marketing tools

- Reporting and analytics

- Integrations with popular accounting software and other business tools

Pros:

- User-friendly interface

- Free plan with robust features

- Comprehensive marketing and sales tools

- Strong integrations

Cons:

- Advanced features require paid plans

- Can be overwhelming for users new to CRM

2. Zoho CRM

Zoho CRM is a versatile and affordable CRM system that caters to businesses of all sizes. It offers a wide range of features, including contact management, lead management, sales pipeline management, workflow automation, and reporting. Zoho CRM’s strength lies in its customization options and its ability to integrate with other Zoho applications, such as Zoho Books (accounting software), Zoho Campaigns (email marketing), and Zoho Desk (customer service). This makes it a powerful all-in-one solution for small accounting firms looking to streamline their operations. Zoho offers a free plan for up to three users, as well as several paid plans with increasing features and functionality. The platform is known for its affordability and its extensive customization options.

Key Features:

- Contact management and lead management

- Sales pipeline management and workflow automation

- Reporting and analytics

- Customization options

- Integrations with Zoho applications and third-party tools

Pros:

- Affordable pricing

- Extensive customization options

- Strong integrations with Zoho applications

- User-friendly interface

Cons:

- Can be complex to set up and configure

- Some features may require additional training

3. Pipedrive

Pipedrive is a sales-focused CRM designed to help businesses manage their sales pipelines and close deals. It’s known for its intuitive interface, visual pipeline management, and ease of use. Pipedrive is particularly well-suited for accounting firms that prioritize sales and lead generation. It offers features such as lead tracking, deal management, activity tracking, and reporting. Pipedrive also integrates with various third-party tools, including email marketing platforms, calendar applications, and accounting software. While Pipedrive doesn’t have a free plan, its pricing is competitive, and it offers several plans to cater to different needs and budgets. The platform is designed to be simple and easy to use, making it a great option for small accounting firms that want a CRM that’s quick to implement and easy to learn.

Key Features:

- Visual sales pipeline management

- Lead tracking and deal management

- Activity tracking and reminders

- Reporting and analytics

- Integrations with third-party tools

Pros:

- Intuitive interface

- Visual pipeline management

- Ease of use

- Strong sales focus

Cons:

- Limited features compared to other CRM systems

- No free plan

4. Insightly

Insightly is a CRM and project management platform that offers a comprehensive set of features for small businesses. It combines CRM capabilities with project management tools, making it a good choice for accounting firms that manage projects for their clients. Insightly offers contact management, lead management, sales pipeline management, project management, and reporting features. It also integrates with various third-party tools, including accounting software, email marketing platforms, and communication tools. Insightly offers a free plan for up to two users, as well as several paid plans with increasing features and functionality. The platform is known for its user-friendly interface and its ability to handle both CRM and project management tasks.

Key Features:

- Contact management and lead management

- Sales pipeline management and project management

- Reporting and analytics

- Workflow automation

- Integrations with third-party tools

Pros:

- User-friendly interface

- Project management features

- Comprehensive features

- Good value for money

Cons:

- Can be overwhelming for users new to CRM and project management

- Limited customization options

5. Agile CRM

Agile CRM is an all-in-one CRM platform designed for small businesses. It offers a wide range of features, including contact management, lead management, sales pipeline management, marketing automation, and helpdesk. Agile CRM is known for its affordable pricing and its ease of use. It offers a free plan for up to 10 users, as well as several paid plans with increasing features and functionality. The platform integrates with various third-party tools, including email marketing platforms, social media platforms, and communication tools. Agile CRM is a good option for small accounting firms that are looking for a comprehensive and affordable CRM solution.

Key Features:

- Contact management and lead management

- Sales pipeline management and marketing automation

- Helpdesk and ticketing system

- Reporting and analytics

- Integrations with third-party tools

Pros:

- Affordable pricing

- Ease of use

- Comprehensive features

- Free plan available

Cons:

- Some features may be limited in the free plan

- Interface can feel cluttered

How to Choose the Right CRM for Your Firm

Choosing the right CRM for your small accounting firm requires careful consideration of your specific needs and priorities. Here’s a step-by-step guide to help you make the right decision:

- Assess Your Needs: Identify your firm’s pain points, goals, and requirements. What are you hoping to achieve with a CRM? What features are essential for your practice?

- Define Your Budget: Determine how much you are willing to spend on a CRM. Consider the cost of the software, implementation, training, and ongoing maintenance.

- Research CRM Systems: Explore the various CRM systems available, considering their features, pricing, and reviews.

- Create a Shortlist: Narrow down your options to a few CRM systems that meet your needs and budget.

- Request Demos and Trials: Request demos or free trials of the shortlisted CRM systems to get a hands-on experience.

- Evaluate and Compare: Evaluate each CRM system based on its features, ease of use, integrations, and customer support.

- Consider Scalability: Choose a CRM system that can grow with your business.

- Choose the Right CRM: Select the CRM system that best fits your needs and budget.

- Implement and Train: Implement the CRM system and train your team on how to use it effectively.

Tips for Successful CRM Implementation

Once you’ve chosen a CRM, successful implementation is crucial for realizing its full potential. Here are some tips to help you get the most out of your CRM:

- Plan Your Implementation: Develop a detailed implementation plan that outlines the steps involved, the timeline, and the resources required.

- Clean Your Data: Ensure that your existing client data is accurate and up-to-date before importing it into the CRM.

- Customize Your CRM: Tailor the CRM to your firm’s specific needs by customizing fields, workflows, and reports.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM effectively.

- Encourage Adoption: Encourage your team to use the CRM regularly by highlighting its benefits and providing ongoing support.

- Monitor and Optimize: Monitor your CRM usage and performance, and make adjustments as needed to optimize its effectiveness.

- Seek Ongoing Support: Take advantage of the CRM provider’s support resources, such as documentation, tutorials, and customer support.

The Benefits of Investing in a CRM

The benefits of investing in a CRM for your small accounting firm are numerous and far-reaching. By implementing a CRM, you can:

- Increase Client Satisfaction: Provide better service and build stronger relationships with your clients.

- Improve Efficiency and Productivity: Automate tasks, streamline workflows, and save time.

- Grow Your Revenue: Generate more leads, close more deals, and increase your sales.

- Gain Data-Driven Insights: Make informed decisions based on data and improve your business performance.

- Enhance Collaboration: Improve communication and collaboration among team members.

- Reduce Costs: Streamline operations and reduce manual data entry.

In today’s competitive market, a CRM is no longer a luxury but a necessity for small accounting firms that want to thrive. By choosing the right CRM and implementing it effectively, you can unlock growth, improve client relationships, and build a more successful practice.

Conclusion

Selecting the perfect CRM for your small accounting firm is a pivotal decision that can significantly impact your operational efficiency, client relationships, and ultimately, your bottom line. The CRM systems we’ve explored – HubSpot CRM, Zoho CRM, Pipedrive, Insightly, and Agile CRM – each offer unique strengths and cater to different needs and budgets. By carefully assessing your firm’s specific requirements, considering the key features discussed, and following the implementation tips provided, you can confidently choose a CRM that empowers you to streamline your workflows, nurture client relationships, and drive sustainable growth. Remember, the right CRM is an investment in your firm’s future, enabling you to stay organized, informed, and connected in an ever-evolving landscape. Embrace the power of CRM, and watch your accounting practice flourish.