Unlocking Efficiency: The Ultimate Guide to the Best CRM Systems for Small Accounting Firms

Introduction: Revolutionizing Accounting with CRM

In the ever-evolving landscape of the accounting industry, staying ahead requires more than just crunching numbers. It demands building strong client relationships, streamlining operations, and maximizing efficiency. This is where a Customer Relationship Management (CRM) system steps in as a game-changer. For small accounting firms, the right CRM is not just a luxury; it’s a necessity. It empowers them to manage client interactions, automate tasks, and ultimately, drive growth.

This comprehensive guide delves into the best CRM systems specifically tailored for small accounting firms. We’ll explore the key features to look for, the benefits they offer, and the top contenders in the market. Whether you’re a seasoned accountant or just starting your practice, this article will equip you with the knowledge to choose the perfect CRM solution to elevate your business.

Why Small Accounting Firms Need a CRM

You might be thinking, “Do I really need a CRM?” The answer, in most cases, is a resounding yes. While spreadsheets and basic email management can suffice in the early stages, they quickly become limiting as your client base grows. A CRM offers a centralized hub for all client-related information, fostering better organization and communication. Here’s why a CRM is crucial for small accounting firms:

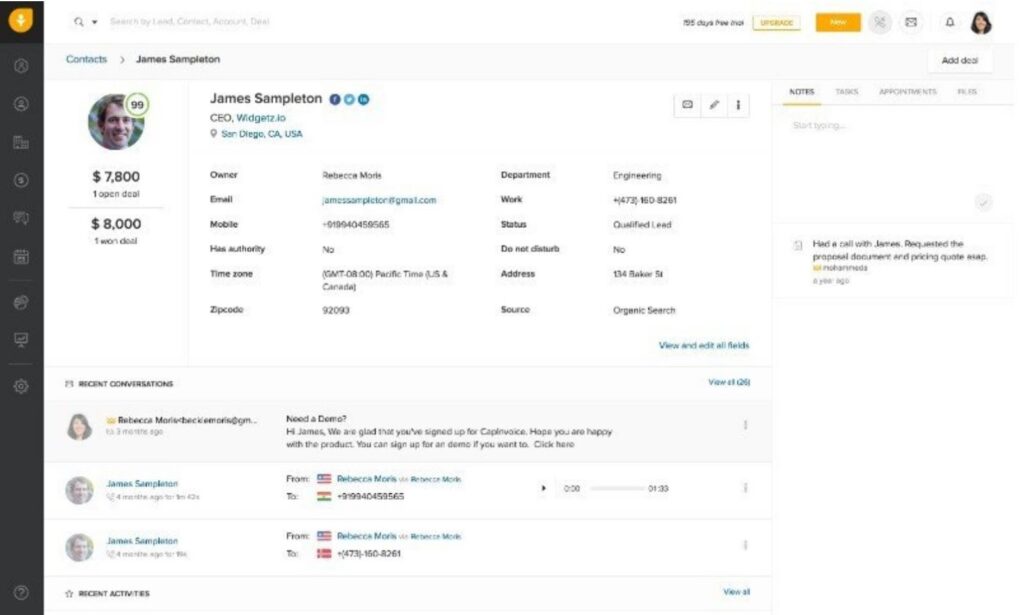

- Improved Client Relationships: A CRM provides a 360-degree view of each client, including their contact details, communication history, service history, and financial data. This allows accountants to personalize interactions, anticipate needs, and build stronger, more loyal relationships.

- Enhanced Efficiency: Automate repetitive tasks like sending invoices, scheduling appointments, and sending follow-up emails. This frees up valuable time that can be dedicated to more strategic activities, such as client consultations and business development.

- Streamlined Communication: Keep all client communications in one place, ensuring that everyone on your team has access to the same information. This eliminates confusion, reduces errors, and ensures consistent service delivery.

- Better Lead Management: Track potential clients, nurture leads, and convert them into paying customers. A CRM helps you manage your sales pipeline, identify opportunities, and close deals more effectively.

- Data-Driven Insights: Gain valuable insights into your client base, service performance, and overall business health. CRM systems provide reporting and analytics tools that help you make informed decisions and optimize your operations.

- Increased Profitability: By improving client relationships, streamlining operations, and driving sales, a CRM can significantly boost your firm’s profitability.

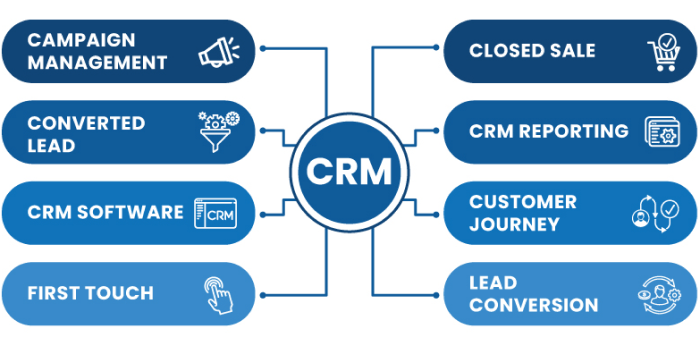

Key Features to Look for in a CRM for Accountants

Choosing the right CRM is crucial. Not all CRM systems are created equal, and some are better suited for accounting firms than others. Here are the essential features to consider when selecting a CRM:

- Contact Management: This is the foundation of any CRM. It should allow you to store and manage client contact information, including names, addresses, phone numbers, email addresses, and other relevant details.

- Client Segmentation: The ability to segment your clients based on various criteria, such as industry, revenue, service type, or location. This allows you to tailor your communication and marketing efforts.

- Communication Tracking: Track all client interactions, including emails, phone calls, meetings, and notes. This provides a comprehensive view of your client relationships and helps you stay organized.

- Task Management: Assign tasks to team members, set deadlines, and track progress. This helps you stay on top of your workload and ensure that deadlines are met.

- Appointment Scheduling: Integrate with your calendar to schedule appointments and send automated reminders. This streamlines the scheduling process and reduces no-shows.

- Document Management: Store and manage client documents, such as tax returns, financial statements, and contracts. This ensures that all important documents are readily accessible.

- Workflow Automation: Automate repetitive tasks, such as sending invoices, following up on leads, and sending welcome emails. This saves time and improves efficiency.

- Reporting and Analytics: Generate reports and analyze data to gain insights into your client base, service performance, and overall business health.

- Integration with Accounting Software: Seamless integration with your existing accounting software, such as QuickBooks or Xero, is critical. This allows you to synchronize data and avoid manual data entry.

- Security and Compliance: Ensure that the CRM system complies with data privacy regulations, such as GDPR and CCPA, and offers robust security features to protect sensitive client data.

- Mobile Accessibility: Access your CRM data from anywhere, anytime, using a mobile app or web browser. This allows you to stay connected with your clients and manage your business on the go.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the leading CRM systems that are particularly well-suited for small accounting firms:

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and for good reason. It offers a user-friendly interface, a wide range of features, and a generous free plan. While the free version is limited, it provides a solid foundation for managing contacts, tracking deals, and automating marketing tasks. HubSpot also excels in its integrations, connecting seamlessly with popular accounting software and other business tools.

Key Features:

- Free CRM with robust features

- Contact management and segmentation

- Deal tracking and pipeline management

- Email marketing and automation

- Integration with accounting software and other tools

- User-friendly interface

Pros:

- Free plan is very generous

- Easy to use

- Excellent integration capabilities

- Strong marketing automation features

Cons:

- Limited features in the free plan

- Can be overwhelming for beginners due to the number of features

2. Zoho CRM

Zoho CRM is another strong contender, offering a comprehensive suite of features at a competitive price point. It’s particularly well-suited for small businesses looking for a cost-effective CRM solution. Zoho CRM provides a wide range of customization options, allowing you to tailor the system to your specific needs. It also offers excellent integration capabilities with other Zoho apps, such as Zoho Books (accounting software) and Zoho Campaigns (email marketing).

Key Features:

- Affordable pricing

- Contact management and segmentation

- Sales force automation

- Marketing automation

- Customization options

- Excellent integration capabilities with other Zoho apps

Pros:

- Cost-effective

- Highly customizable

- Strong integration with other Zoho apps

- Good for sales and marketing automation

Cons:

- Interface can be overwhelming for some users

- Steeper learning curve compared to HubSpot

3. Pipedrive

Pipedrive is a sales-focused CRM that’s designed to help businesses close deals faster. It’s known for its intuitive interface and visual pipeline management. While it might not have all the bells and whistles of some other CRMs, it excels at helping sales teams stay organized and track their progress. Pipedrive is a great choice for accounting firms that want a simple, effective CRM to manage their sales pipeline and nurture leads.

Key Features:

- User-friendly interface

- Visual pipeline management

- Sales automation

- Lead management

- Reporting and analytics

Pros:

- Intuitive and easy to use

- Excellent for pipeline management

- Focus on sales performance

Cons:

- May lack some features compared to other CRMs

- Less focus on marketing automation

4. Salesforce Sales Cloud

Salesforce Sales Cloud is a powerful and highly customizable CRM system that’s suitable for businesses of all sizes. While it can be a bit complex for small accounting firms, its extensive features and scalability make it a good choice for those with ambitious growth plans. Salesforce offers a wide range of integrations, automation capabilities, and reporting tools. However, it’s also one of the more expensive options on the market.

Key Features:

- Highly customizable

- Sales force automation

- Marketing automation

- Extensive reporting and analytics

- Scalable for growing businesses

Pros:

- Powerful and feature-rich

- Highly scalable

- Extensive integration capabilities

Cons:

- Can be expensive

- Steeper learning curve

- Can be overwhelming for small firms

5. Freshsales (by Freshworks)

Freshsales is a sales-focused CRM that’s known for its ease of use and affordability. It offers a range of features, including contact management, deal tracking, and email marketing. Freshsales is a good option for small accounting firms that want a simple, effective CRM without breaking the bank. It also integrates well with other Freshworks products.

Key Features:

- User-friendly interface

- Contact management and deal tracking

- Email marketing

- Sales automation

- Affordable pricing

Pros:

- Easy to use

- Affordable

- Good for sales teams

Cons:

- Limited features compared to some other CRMs

- May not be as suitable for complex accounting firms

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM for your accounting firm is a crucial decision. Here’s a step-by-step guide to help you make an informed choice:

- Assess Your Needs: Before you start evaluating CRM systems, take the time to understand your firm’s specific needs and goals. What are your biggest challenges? What features are most important to you? What are your budget and technical capabilities?

- Define Your Requirements: Based on your needs assessment, create a list of essential and desirable features. This will serve as your checklist when evaluating different CRM systems. Consider factors like contact management, client segmentation, communication tracking, task management, and integration with your accounting software.

- Research Potential CRM Systems: Research the CRM systems that align with your requirements. Read reviews, compare features, and consider the pricing plans. The CRM systems mentioned above (HubSpot, Zoho CRM, Pipedrive, Salesforce Sales Cloud, and Freshsales) are excellent starting points.

- Evaluate Pricing and Plans: CRM systems offer various pricing plans, often based on the number of users and the features included. Consider your budget and choose a plan that provides the features you need without overspending. Many CRM systems offer free trials or free plans, which can be a great way to test the system before committing to a paid subscription.

- Consider Integration Capabilities: Ensure that the CRM system integrates seamlessly with your existing accounting software, email marketing platform, and other business tools. This will streamline your workflow and avoid manual data entry.

- Test the System: If possible, take advantage of free trials or demos to test the CRM system before making a decision. This will allow you to assess its usability, features, and overall suitability for your firm.

- Prioritize User-Friendliness: Choose a CRM system that’s easy to use and navigate. A user-friendly interface will ensure that your team can quickly adopt the system and start using it effectively.

- Consider Scalability: Choose a CRM system that can scale with your business. As your client base grows, you’ll need a CRM system that can handle the increased workload and provide the features you need to support your growth.

- Read Reviews and Seek Recommendations: Read online reviews and seek recommendations from other accounting firms. This will give you valuable insights into the experiences of other users and help you make an informed decision.

- Implement and Train Your Team: Once you’ve chosen a CRM system, implement it and train your team on how to use it effectively. Provide ongoing support and training to ensure that everyone is comfortable using the system and maximizing its benefits.

Best Practices for CRM Implementation in Accounting Firms

Implementing a CRM system is just the first step. To maximize its benefits, you need to follow best practices. Here are some tips for successful CRM implementation:

- Clean and Organize Your Data: Before importing your data into the CRM, clean and organize it. This will ensure that your data is accurate and up-to-date.

- Customize the System: Tailor the CRM to your firm’s specific needs. Customize the fields, workflows, and reports to align with your business processes.

- Integrate with Other Systems: Integrate the CRM with your accounting software, email marketing platform, and other business tools to streamline your workflow.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM effectively. Make sure everyone understands how to enter data, manage clients, and use the features that are most relevant to their roles.

- Establish Clear Processes: Define clear processes for using the CRM, such as how to enter new leads, update client information, and track communication.

- Monitor and Evaluate: Regularly monitor and evaluate the performance of the CRM. Track key metrics, such as lead conversion rates, client retention rates, and customer satisfaction.

- Provide Ongoing Support: Provide ongoing support to your team to ensure that they are comfortable using the CRM and can get help when they need it.

- Regularly Update and Maintain: Keep the CRM system up-to-date with the latest features and security updates. Regularly review your data and make sure it’s accurate and relevant.

- Use CRM for Reporting and Analysis: Leverage the reporting and analytics features of the CRM to gain insights into your business performance and make data-driven decisions.

- Prioritize Data Security: Implement robust security measures to protect sensitive client data. Comply with data privacy regulations, such as GDPR and CCPA.

The Long-Term Impact of a CRM on Accounting Firms

The implementation of a well-chosen and properly utilized CRM system can have a profound and lasting impact on a small accounting firm. It’s not just about managing contacts; it’s about fundamentally changing how you do business. Here’s what you can expect:

- Increased Client Retention: By providing personalized service and proactively addressing client needs, a CRM helps you build stronger relationships and reduce client churn.

- Improved Client Satisfaction: A CRM enables you to deliver consistent, high-quality service, leading to happier clients and positive word-of-mouth referrals.

- Enhanced Productivity: Automation and streamlined workflows free up your team’s time, allowing them to focus on more valuable tasks, such as client consultations and strategic planning.

- Higher Revenue: By improving client relationships, streamlining operations, and driving sales, a CRM can contribute to significant revenue growth.

- Better Decision-Making: Data-driven insights from the CRM empower you to make informed decisions about your business, such as identifying profitable clients, optimizing service offerings, and targeting marketing efforts.

- Competitive Advantage: In a competitive market, a CRM can give your firm a significant edge by enabling you to provide superior service and build stronger client relationships.

- Scalability and Growth: A CRM helps you manage your growing client base and scale your operations efficiently.

Conclusion: Embrace the Power of CRM

In conclusion, a CRM system is an indispensable tool for small accounting firms looking to thrive in today’s dynamic business environment. By choosing the right CRM and implementing it effectively, you can transform your business, build stronger client relationships, streamline operations, and drive sustainable growth. Take the time to assess your needs, research the options, and make an informed decision. The investment in a CRM system is an investment in your firm’s future. Embrace the power of CRM and unlock the full potential of your accounting practice.