Unlocking Efficiency: The Ultimate Guide to the Best CRM for Small Accounting Firms

Introduction: Why a CRM Matters for Your Accounting Practice

In the fast-paced world of accounting, where deadlines loom and client relationships are paramount, having the right tools can make all the difference. For small accounting firms, the pressure to deliver exceptional service while managing a growing client base is constant. This is where a Customer Relationship Management (CRM) system comes into play. A CRM isn’t just a piece of software; it’s a strategic asset that can transform how you operate, helping you streamline processes, boost client satisfaction, and ultimately, grow your business. But with so many options available, choosing the best CRM for small accountants can feel overwhelming. This comprehensive guide will break down everything you need to know, from the core benefits of a CRM to detailed reviews of the top contenders in the market.

Imagine a world where client information is readily accessible, communication is seamless, and no opportunity falls through the cracks. That’s the promise of a well-implemented CRM. It’s about more than just storing contact details; it’s about building stronger relationships, understanding your clients’ needs, and providing proactive, personalized service. For small accounting firms, where every client interaction counts, this is a game-changer.

The Core Benefits of a CRM for Small Accounting Firms

Before diving into specific CRM solutions, let’s explore why a CRM is so crucial for small accounting firms. The benefits are numerous and far-reaching, impacting everything from client management to business development.

1. Improved Client Relationship Management

At the heart of any successful accounting practice is strong client relationships. A CRM provides a centralized hub for all client-related information, including contact details, communication history, service agreements, and financial data. This 360-degree view of each client allows you to:

- Personalize Interactions: Tailor your communication based on a client’s specific needs and history.

- Provide Proactive Service: Anticipate client needs and offer timely advice and support.

- Strengthen Loyalty: Build stronger relationships by demonstrating that you understand and care about your clients’ success.

2. Streamlined Communication and Collaboration

Communication is key in accounting. A CRM facilitates seamless communication by:

- Centralizing Communications: Store all emails, calls, and other interactions in one place, ensuring everyone on your team is on the same page.

- Automating Tasks: Automate repetitive tasks such as sending appointment reminders or follow-up emails.

- Improving Collaboration: Enable team members to easily share information and collaborate on client projects.

3. Enhanced Efficiency and Productivity

Time is money, especially in the accounting world. A CRM helps you work smarter, not harder, by:

- Automating Workflows: Automate repetitive tasks such as data entry and report generation.

- Reducing Manual Errors: Minimize the risk of errors by centralizing data and automating processes.

- Freeing Up Time: Allow your team to focus on higher-value activities such as client consulting and strategic planning.

4. Better Lead Management and Sales Conversion

Even small accounting firms need to attract new clients. A CRM can help you:

- Track Leads: Manage leads effectively, from initial contact to conversion.

- Nurture Leads: Nurture leads through targeted communication and follow-up.

- Improve Conversion Rates: Increase your chances of converting leads into paying clients.

5. Data-Driven Decision Making

A CRM provides valuable insights into your business, allowing you to make data-driven decisions:

- Track Key Metrics: Monitor key performance indicators (KPIs) such as client acquisition cost, client retention rate, and revenue per client.

- Identify Trends: Identify trends in client behavior and service demand.

- Optimize Strategies: Refine your marketing and sales strategies based on data insights.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, consider these essential features:

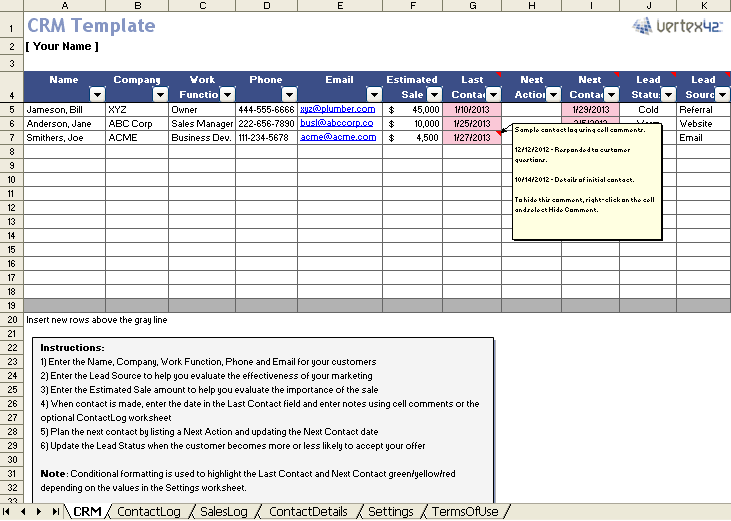

1. Contact Management

This is the foundation of any CRM. Look for features such as:

- Centralized Contact Database: Store all client information in one place.

- Segmentation: Segment your contacts based on various criteria (e.g., industry, service needs).

- Custom Fields: Customize the system to capture the specific data relevant to your practice.

2. Communication Tracking

Keep track of all your interactions with clients:

- Email Integration: Integrate with your email provider to track emails sent and received.

- Call Logging: Log phone calls and record call notes.

- Task Management: Assign tasks and set reminders to ensure timely follow-up.

3. Workflow Automation

Automate repetitive tasks to save time and improve efficiency:

- Automated Email Sequences: Set up automated email sequences for onboarding new clients, sending appointment reminders, and more.

- Task Automation: Automate task assignments and notifications.

- Reporting: Generate reports automatically.

4. Reporting and Analytics

Gain insights into your business performance:

- Customizable Dashboards: Create dashboards to monitor key metrics.

- Reporting Tools: Generate reports on client acquisition, retention, and revenue.

- Data Visualization: Visualize data to identify trends and patterns.

5. Integration with Accounting Software

Seamless integration with your accounting software is crucial:

- Data Synchronization: Automatically sync data between your CRM and accounting software.

- Real-time Data: Access real-time financial data within your CRM.

- Improved Efficiency: Eliminate the need for manual data entry.

6. Security and Compliance

Ensure your CRM offers robust security features:

- Data Encryption: Protect sensitive client data with encryption.

- Access Controls: Control user access to sensitive information.

- Compliance: Ensure the CRM complies with relevant data privacy regulations (e.g., GDPR, CCPA).

7. Mobile Accessibility

Access your CRM on the go:

- Mobile App: Access your CRM via a mobile app.

- Mobile-Friendly Interface: Ensure the CRM is accessible and easy to use on mobile devices.

8. User-Friendliness and Ease of Use

Choose a CRM that’s easy to learn and use:

- Intuitive Interface: Opt for a CRM with a user-friendly interface.

- Training and Support: Ensure the vendor provides adequate training and support.

Top CRM Systems for Small Accounting Firms: A Detailed Review

Now, let’s delve into some of the best CRM systems specifically designed for small accounting firms. We’ll evaluate them based on their features, pricing, ease of use, and overall suitability for accounting professionals.

1. HubSpot CRM

Overview: HubSpot CRM is a popular choice for businesses of all sizes, including accounting firms. It offers a free version with a robust set of features, making it an attractive option for small businesses on a budget. The paid versions offer even more advanced features.

Key Features:

- Free CRM: Offers a comprehensive free version with contact management, email tracking, and basic automation.

- Marketing Automation: Advanced marketing automation tools to nurture leads and engage clients.

- Sales Tools: Sales pipeline management, deal tracking, and sales reporting.

- Integration: Integrates with numerous third-party apps, including popular accounting software.

- Ease of Use: Known for its user-friendly interface and intuitive design.

Pros:

- Free version offers a lot of functionality.

- User-friendly interface.

- Strong marketing automation capabilities.

- Excellent integration options.

Cons:

- The free version has limitations on the number of contacts and features.

- Some advanced features are only available in paid plans.

Pricing: HubSpot offers a free CRM, as well as paid plans that scale based on your needs and usage.

Suitability for Accountants: HubSpot is a great all-around CRM that can be customized to meet the needs of accounting firms. Its strong marketing automation capabilities can be particularly beneficial for attracting and nurturing leads.

2. Zoho CRM

Overview: Zoho CRM is another strong contender, offering a wide range of features and integrations at a competitive price point. It’s a versatile CRM that can be tailored to meet the needs of various industries, including accounting.

Key Features:

- Contact Management: Robust contact management features with detailed profiles.

- Sales Automation: Automate sales processes and workflows.

- Workflow Automation: Automate tasks, notifications, and data entry.

- Reporting and Analytics: Comprehensive reporting and analytics tools.

- Integration: Integrates with a wide range of apps, including Zoho’s suite of business applications and third-party accounting software.

Pros:

- Affordable pricing.

- Feature-rich platform.

- Strong automation capabilities.

- Excellent integration options.

Cons:

- The interface can feel a bit overwhelming at first.

- Some users report a learning curve.

Pricing: Zoho CRM offers various pricing plans to fit different business needs.

Suitability for Accountants: Zoho CRM is a cost-effective and feature-rich option for small accounting firms. Its automation capabilities can help streamline processes and improve efficiency.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM designed to help businesses manage their sales pipelines and close deals. While it’s not specifically designed for accounting, its user-friendly interface and sales-focused features make it a viable option.

Key Features:

- Sales Pipeline Management: Visual sales pipelines to track deals and opportunities.

- Deal Tracking: Track deals through each stage of the sales process.

- Communication Tracking: Track emails, calls, and other interactions.

- Automation: Automate repetitive tasks and workflows.

- Reporting: Generate sales reports and track key metrics.

Pros:

- User-friendly interface.

- Focus on sales and deal management.

- Easy to set up and use.

Cons:

- Not as feature-rich as some other CRMs.

- May not be ideal for firms that need extensive marketing automation.

Pricing: Pipedrive offers several pricing plans based on features and user count.

Suitability for Accountants: Pipedrive is a good choice for accounting firms that want a simple, sales-focused CRM to manage leads and close deals. It’s particularly well-suited for firms that rely heavily on referrals and new business development.

4. Salesforce Sales Cloud

Overview: Salesforce is a leading CRM provider, offering a comprehensive suite of features for businesses of all sizes. Salesforce Sales Cloud is a powerful CRM that can be customized to meet the specific needs of accounting firms.

Key Features:

- Customization: Highly customizable to fit your specific needs.

- Sales Automation: Automate sales processes and workflows.

- Reporting and Analytics: Advanced reporting and analytics tools.

- Integration: Integrates with a vast ecosystem of apps and services.

- Scalability: Scalable to accommodate growing businesses.

Pros:

- Highly customizable.

- Extensive features and functionality.

- Strong reporting and analytics.

- Large ecosystem of apps and integrations.

Cons:

- Can be expensive, especially for small firms.

- Complex to set up and configure.

- Requires dedicated training and resources.

Pricing: Salesforce offers various pricing plans, with the cost increasing with the number of users and features.

Suitability for Accountants: Salesforce is a good choice for larger accounting firms with complex needs and a dedicated IT team. Its customization options and advanced features can provide significant benefits, but it may be overkill for smaller firms.

5. Insightly

Overview: Insightly is a CRM designed for small and medium-sized businesses. It focuses on building strong client relationships and streamlining sales and project management.

Key Features:

- Contact Management: Centralized contact database with detailed profiles.

- Project Management: Manage projects and tasks.

- Sales Automation: Automate sales processes.

- Reporting: Generate reports on sales and project performance.

- Integration: Integrates with popular apps, including Google Workspace and Mailchimp.

Pros:

- User-friendly interface.

- Project management features.

- Good value for the price.

Cons:

- Not as feature-rich as some other CRMs.

- Project management features may not be as robust as dedicated project management software.

Pricing: Insightly offers various pricing plans based on features and user count.

Suitability for Accountants: Insightly is a good choice for small accounting firms that need a CRM with project management capabilities. It’s user-friendly and provides good value for the price.

6. Freshsales

Overview: Freshsales is a sales-focused CRM offered by Freshworks, designed to help businesses manage their sales pipelines and close deals. It offers a user-friendly interface and a range of features to support sales teams.

Key Features:

- Contact Management: Centralized contact database.

- Sales Pipeline Management: Visual sales pipelines.

- Email Tracking: Track emails and interactions.

- Automation: Automate sales tasks.

- Reporting: Generate sales reports.

Pros:

- User-friendly interface.

- Affordable pricing.

- Good customer support.

Cons:

- Not as feature-rich as some other CRMs.

- May not be ideal for firms that need extensive marketing automation.

Pricing: Freshsales offers different pricing tiers based on features and the number of users.

Suitability for Accountants: Freshsales is a viable option for accounting firms that need a simple, user-friendly CRM to manage leads and sales. Its focus on sales makes it a good fit for firms that are actively pursuing new clients.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision. Here’s a step-by-step guide to help you make the best choice for your small accounting firm:

1. Define Your Needs and Goals

Before you start evaluating CRMs, take the time to understand your specific needs and goals. Consider the following questions:

- What are your current challenges? What processes are inefficient? What areas need improvement?

- What are your goals for a CRM? Do you want to improve client communication, streamline workflows, or increase sales?

- What features are essential? Make a list of the must-have features, such as contact management, communication tracking, and reporting.

- What is your budget? Determine how much you’re willing to spend on a CRM, including the cost of the software, implementation, and ongoing support.

2. Research and Evaluate CRM Options

Once you have a clear understanding of your needs and goals, start researching and evaluating CRM options. Consider the following steps:

- Read Reviews: Read online reviews from other accounting firms to get insights into the strengths and weaknesses of each CRM.

- Compare Features: Compare the features of different CRMs to see which ones align with your needs.

- Consider Integrations: Ensure the CRM integrates with your existing accounting software and other tools.

- Evaluate Pricing: Compare the pricing plans of different CRMs to find one that fits your budget.

3. Request Demos and Trials

Request demos and free trials of the CRMs you’re considering. This will allow you to:

- Test the Interface: Get a feel for the user interface and see how easy it is to use.

- Explore Features: Explore the features and see how they work in practice.

- Evaluate Support: Assess the level of support provided by the vendor.

4. Consider Implementation and Training

Implementation and training are crucial for the success of a CRM. Consider the following:

- Implementation Support: Does the vendor offer implementation support?

- Training Resources: Does the vendor provide training resources, such as tutorials and documentation?

- User Adoption: How will you ensure that your team adopts the CRM and uses it effectively?

5. Make a Decision and Implement

Once you’ve evaluated all the options, make a decision and implement your chosen CRM. Follow these steps:

- Plan Your Implementation: Create a detailed implementation plan.

- Migrate Data: Migrate your existing data to the new CRM.

- Train Your Team: Train your team on how to use the CRM.

- Monitor and Optimize: Monitor the CRM’s performance and make adjustments as needed.

Implementing Your New CRM: Best Practices

Once you’ve chosen your CRM, successful implementation is key. Here are some best practices to ensure a smooth transition and maximize the benefits of your new system:

1. Data Migration

Proper data migration is crucial. Ensure you:

- Clean Your Data: Remove duplicates and inaccurate information.

- Map Fields: Map your existing data fields to the appropriate fields in the new CRM.

- Test the Migration: Test the data migration process before migrating all your data.

2. User Training

Effective training is essential for user adoption. Consider:

- Provide Comprehensive Training: Train your team on all aspects of the CRM, from basic navigation to advanced features.

- Offer Ongoing Support: Provide ongoing support and answer questions.

- Create Training Materials: Develop training materials, such as user guides and videos.

3. Customization and Configuration

Tailor the CRM to your specific needs. This includes:

- Customize Fields: Add custom fields to capture the data that’s most important to your firm.

- Configure Workflows: Configure workflows to automate tasks and streamline processes.

- Set Up Integrations: Integrate the CRM with your accounting software and other tools.

4. Data Security and Privacy

Protect your client data by:

- Implement Access Controls: Restrict access to sensitive data based on user roles.

- Encrypt Data: Encrypt sensitive data to protect it from unauthorized access.

- Comply with Regulations: Ensure your CRM complies with relevant data privacy regulations.

5. Ongoing Monitoring and Optimization

Continuously monitor and optimize your CRM usage:

- Track Key Metrics: Track key metrics to measure the effectiveness of your CRM.

- Gather Feedback: Gather feedback from your team to identify areas for improvement.

- Make Adjustments: Make adjustments to the CRM as needed to optimize its performance.

Conclusion: Making the Right Choice for Your Firm

Choosing the best CRM for your small accounting firm is an investment in your future. By carefully evaluating your needs, researching the available options, and implementing your chosen CRM effectively, you can transform your practice, improve client relationships, and drive sustainable growth. Remember to prioritize user-friendliness, integration with your existing tools, and the ability to scale as your firm grows. The right CRM will empower you to work smarter, serve your clients more effectively, and achieve your business goals. Take the time to do your research, and choose the CRM that best fits your unique needs. Your clients, and your bottom line, will thank you for it.