Unlocking Efficiency: The Ultimate Guide to the Best CRM for Small Accounting Firms

Introduction: Why Your Small Accounting Firm Needs a CRM

Let’s be honest, running a small accounting firm is a juggling act. You’re managing client relationships, deadlines, financial data, and a whole lot more. In the whirlwind of tasks, it’s easy for client communication to fall by the wayside, for opportunities to slip through the cracks, and for your firm to feel less organized than it should be. This is where a Customer Relationship Management (CRM) system comes in. Think of it as your central hub, a place to organize all your client interactions, track progress, and ultimately, boost your bottom line.

For small accounting firms, a CRM isn’t just a nice-to-have; it’s a necessity. It’s the difference between scrambling for information and having everything at your fingertips. It’s the difference between reactive client management and proactive, personalized service. It’s about growing your business strategically, not just working harder, but smarter.

This guide will delve into the best CRM options specifically tailored for small accounting firms. We’ll explore the features that matter most, compare the top contenders, and help you make an informed decision that aligns with your firm’s unique needs and budget. Get ready to transform your client relationships and streamline your operations!

What to Look for in a CRM for Accountants

Choosing the right CRM is crucial. A generic CRM might not cut it for the specific demands of an accounting firm. Here’s what to prioritize:

1. Client Management & Contact Organization

At its core, a CRM is about managing your clients. Look for features that allow you to:

- Centralized Client Data: Store all client information in one place – contact details, financial data (with integrations, see below), communication history, and more.

- Segmentation & Tagging: Easily segment clients based on industry, service level, revenue, or any other criteria that matters to your firm. Tagging helps you quickly identify and target specific client groups.

- Communication Tracking: Track all interactions – emails, calls, meetings – so you have a complete view of your client relationships.

2. Integration with Accounting Software

This is a game-changer. Your CRM should seamlessly integrate with your existing accounting software (e.g., QuickBooks, Xero, Sage). This allows you to:

- Eliminate Data Entry: Automatically sync client and financial data between your CRM and accounting software, saving you valuable time and reducing the risk of errors.

- Gain Real-Time Insights: Access financial data directly within your CRM, providing a holistic view of your client’s financial health and your firm’s performance.

- Automate Workflows: Trigger automated tasks based on financial events (e.g., send a reminder email when a payment is overdue).

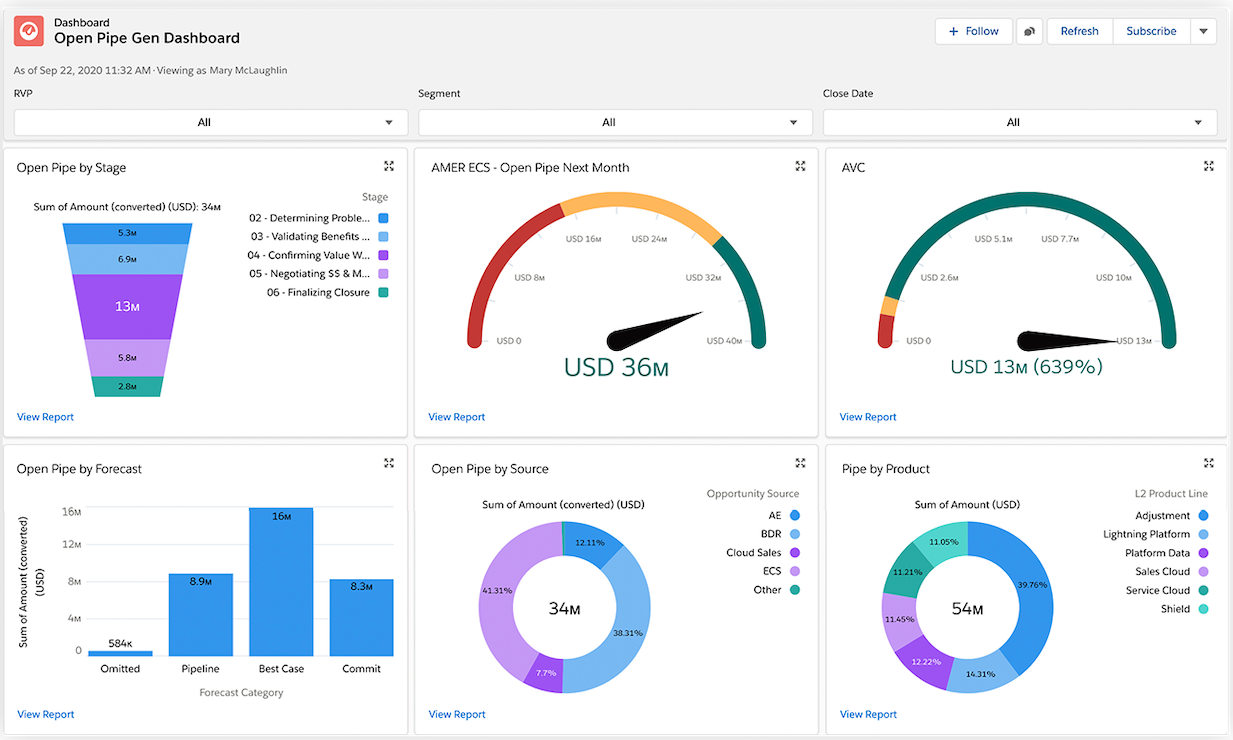

3. Reporting & Analytics

Data is your friend. A good CRM provides robust reporting and analytics capabilities, allowing you to:

- Track Key Metrics: Monitor client acquisition costs, client retention rates, revenue per client, and other vital KPIs.

- Identify Trends: Spot patterns in your client base, service usage, and financial performance to make informed business decisions.

- Generate Custom Reports: Create reports tailored to your specific needs, providing insights you can’t get anywhere else.

4. Automation Capabilities

Automation is your secret weapon for efficiency. Look for a CRM that allows you to automate repetitive tasks, such as:

- Email Marketing: Send automated welcome emails, newsletters, and promotional offers.

- Appointment Scheduling: Allow clients to book appointments directly through your CRM.

- Task Management: Automate reminders for deadlines, follow-ups, and other essential tasks.

5. User-Friendly Interface & Ease of Use

A CRM is only useful if your team actually uses it. Choose a system with a clean, intuitive interface that’s easy to navigate. Consider:

- Onboarding & Training: Look for a CRM provider that offers excellent onboarding and training resources to help your team get up to speed quickly.

- Mobile Accessibility: Ensure the CRM has a mobile app or is mobile-friendly so you can access client information and manage your firm on the go.

- Customization: The ability to customize the CRM to match your firm’s branding and workflows is a huge plus.

6. Security and Compliance

For accounting firms, data security is paramount. Ensure the CRM you choose:

- Meets Industry Standards: Complies with relevant regulations (e.g., GDPR, CCPA).

- Offers Robust Security Features: Includes features like data encryption, access controls, and regular security audits.

- Provides Data Backup: Has a reliable data backup system to protect your client data from loss.

Top CRM Systems for Small Accounting Firms: A Deep Dive

1. HubSpot CRM

HubSpot CRM is a popular choice, and for good reason. It’s free, surprisingly robust, and incredibly user-friendly. While the free version may be sufficient for smaller firms just starting out, HubSpot offers paid plans with advanced features. Here’s a breakdown:

- Key Features: Contact management, deal tracking, email marketing, sales automation, and reporting.

- Integrations: Integrates with a wide range of apps, including popular accounting software like QuickBooks and Xero (though you may need a third-party integration for seamless data sync).

- Pros: Free plan is powerful, easy to use, excellent for sales and marketing, strong automation capabilities, and extensive resources (tutorials, support).

- Cons: The free plan has limitations on features and storage. Advanced features can become expensive. Some accounting integrations might require extra setup.

- Ideal for: Small firms looking for a free or low-cost CRM with strong sales and marketing features. Firms that prioritize ease of use and a wide range of integrations.

2. Zoho CRM

Zoho CRM offers a comprehensive suite of features at a competitive price point. It’s a solid choice for accounting firms that want a powerful CRM without breaking the bank.

- Key Features: Contact management, lead management, sales force automation, workflow automation, and extensive reporting.

- Integrations: Integrates well with Zoho’s own suite of apps (e.g., Zoho Books, Zoho Analytics) and has integrations with third-party accounting software (QuickBooks, Xero).

- Pros: Affordable pricing, comprehensive features, strong automation capabilities, excellent customization options, good customer support.

- Cons: Interface can feel a bit overwhelming initially due to the sheer number of features. Some integrations might require more setup.

- Ideal for: Small to mid-sized firms seeking a feature-rich, customizable CRM with a budget-friendly price tag. Firms that want a CRM that integrates seamlessly with other business applications.

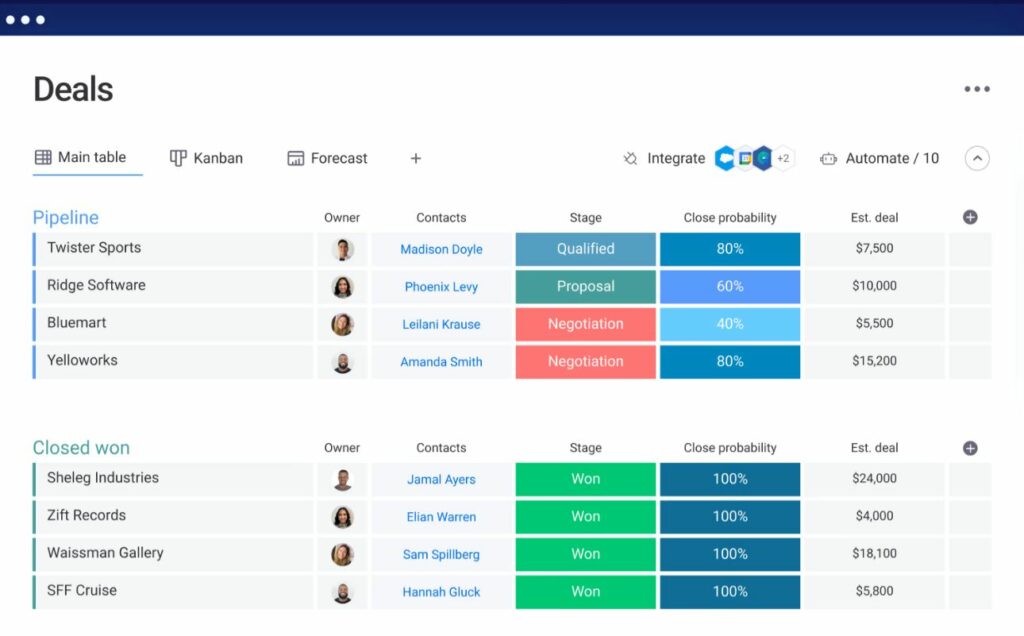

3. Pipedrive

Pipedrive is a sales-focused CRM known for its simplicity and visual pipeline management. While it’s not specifically designed for accounting, it can be a good fit if you prioritize sales and client relationship management.

- Key Features: Visual sales pipeline, deal tracking, contact management, email integration, and activity tracking.

- Integrations: Integrates with popular apps, including QuickBooks and Xero (though the integration might not be as deep as with some other CRMs).

- Pros: Easy to use, visually appealing pipeline management, strong sales focus, good for tracking leads and opportunities.

- Cons: Limited features for accounting-specific tasks. Reporting capabilities aren’t as robust as some other options. May not be the best fit if your primary focus is client service rather than sales.

- Ideal for: Accounting firms that prioritize sales and lead generation. Firms that want a simple, visually appealing CRM for managing their sales pipeline.

4. Salesforce Sales Cloud Essentials

Salesforce is a powerhouse in the CRM world, and Sales Cloud Essentials is its offering for small businesses. It’s a more advanced option than HubSpot or Zoho, but it comes with a higher price tag. However, it provides unparalleled customization and scalability.

- Key Features: Contact management, lead management, sales force automation, reporting, and extensive customization options.

- Integrations: Integrates with a vast ecosystem of apps, including accounting software through the Salesforce AppExchange.

- Pros: Highly customizable, scalable, powerful reporting, excellent for managing complex sales processes, and a well-established brand with a strong reputation.

- Cons: Can be expensive, the interface can be complex, and requires a learning curve. Setup and customization can be time-consuming.

- Ideal for: Growing accounting firms that need a highly customizable and scalable CRM. Firms that are willing to invest in a more complex system.

5. Insightly

Insightly is a CRM focused on helping businesses build stronger customer relationships and streamline their sales processes. It’s a good option for accounting firms seeking a balance of features and ease of use.

- Key Features: Contact management, lead tracking, project management, task management, and reporting.

- Integrations: Integrates with popular apps, including Google Workspace, Mailchimp, and various accounting software.

- Pros: User-friendly interface, good project management features, strong contact management capabilities, and affordable pricing.

- Cons: The feature set may not be as comprehensive as some other options. Limited customization options compared to Salesforce.

- Ideal for: Small to mid-sized accounting firms that need a CRM with strong contact management and project management features. Firms looking for a user-friendly system.

6. Freshsales

Freshsales is a CRM designed with sales teams in mind, offering a user-friendly interface and a focus on sales automation. It can be a viable option for accounting firms, especially those looking to improve their sales processes.

- Key Features: Contact management, lead scoring, sales automation, email tracking, and phone integration.

- Integrations: Integrates with various apps, including popular accounting software like QuickBooks and Xero.

- Pros: User-friendly interface, strong sales automation features, good email tracking capabilities, and affordable pricing.

- Cons: The feature set may not be as comprehensive as other options. Limited customization options compared to Salesforce.

- Ideal for: Small to mid-sized accounting firms that prioritize sales automation and want a CRM with a user-friendly interface.

Comparing CRM Systems: A Quick Guide

To help you make a quicker decision, here’s a comparison table summarizing the key aspects of each CRM discussed:

| CRM | Ease of Use | Price | Key Features | Accounting Integrations | Best For |

|---|---|---|---|---|---|

| HubSpot CRM | Very Easy | Free (with paid options) | Contact Management, Sales Automation, Email Marketing | Limited, requires setup | Firms needing a free or low-cost CRM with strong sales/marketing features. |

| Zoho CRM | Moderate | Affordable | Contact Management, Lead Management, Automation, Reporting | Good | Firms seeking a feature-rich, customizable CRM on a budget. |

| Pipedrive | Easy | Mid-range | Visual Pipeline, Deal Tracking, Contact Management | Moderate | Firms prioritizing sales and lead generation. |

| Salesforce Sales Cloud Essentials | Complex | Expensive | Highly Customizable, Reporting, Automation | Extensive | Growing firms needing a highly customizable and scalable CRM. |

| Insightly | Easy | Affordable | Contact Management, Project Management, Task Management | Moderate | Firms needing a CRM with strong contact and project management. |

| Freshsales | Easy | Affordable | Contact Management, Sales Automation, Email Tracking | Moderate | Firms prioritizing sales automation and user-friendliness. |

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a significant decision. Here’s a step-by-step approach to help you make the best choice:

1. Define Your Needs and Goals

Before you start shopping, take some time to clarify what you need. Ask yourself:

- What are your biggest pain points? What tasks take up the most time? Where are you losing track of opportunities?

- What are your goals? Do you want to increase client retention, improve sales, streamline your workflows, or all of the above?

- What are your must-have features? Do you need robust reporting, deep accounting integrations, or advanced automation capabilities?

2. Assess Your Budget

CRM pricing varies widely. Determine how much you’re willing to spend on a monthly or annual basis. Consider:

- Subscription Fees: Factor in the cost per user and the features you need.

- Implementation Costs: Some CRMs require professional setup or customization, which can add to the overall cost.

- Training Costs: Budget for training your team to use the new CRM effectively.

3. Research and Shortlist Potential CRMs

Based on your needs and budget, create a shortlist of potential CRMs. Use the information in this guide and other online resources to narrow down your options.

4. Request Demos and Free Trials

Most CRM providers offer free trials or demos. Take advantage of these to:

- Get Hands-on Experience: Explore the interface, test the features, and see how easy it is to use.

- Evaluate Integrations: Test the integrations with your accounting software and other essential apps.

- Ask Questions: Ask the sales representatives about any specific questions or concerns you have.

5. Involve Your Team

Your team will be the primary users of the CRM, so involve them in the selection process. Get their feedback on the different options and address any concerns they have. Consider:

- User Experience: Does the CRM have a user-friendly interface?

- Workflow Compatibility: Does the CRM fit into your existing workflows?

- Training Needs: How much training will your team need to get up to speed?

6. Make a Decision and Implement

Once you’ve evaluated all the options and gathered feedback from your team, make a final decision. Then, create a detailed implementation plan:

- Data Migration: Decide how you’ll transfer your existing data to the new CRM.

- Customization: Customize the CRM to match your firm’s branding and workflows.

- Training: Provide your team with thorough training on how to use the CRM.

- Ongoing Support: Establish a plan for ongoing support and maintenance.

Maximizing the Value of Your CRM: Best Practices

Once you’ve chosen and implemented your CRM, it’s essential to use it effectively to maximize its value. Here are some best practices:

1. Data Entry and Accuracy

- Enter Complete and Accurate Data: The more accurate your data, the more valuable the insights you’ll gain.

- Establish Data Entry Standards: Create consistent data entry protocols to ensure data quality.

- Regularly Review and Update Data: Keep your data up-to-date by regularly reviewing and updating client information.

2. Embrace Automation

- Automate Repetitive Tasks: Use automation to streamline your workflows and free up your team’s time.

- Set Up Automated Reminders: Automate reminders for deadlines, follow-ups, and other important tasks.

- Use Email Marketing Automation: Automate your email marketing campaigns to nurture leads and engage with clients.

3. Leverage Reporting and Analytics

- Regularly Review Key Metrics: Track your key performance indicators (KPIs) to monitor your progress and identify areas for improvement.

- Generate Custom Reports: Create custom reports to gain deeper insights into your client base and your firm’s performance.

- Use Data to Make Informed Decisions: Use the data and insights from your CRM to make data-driven business decisions.

4. Train Your Team

- Provide Comprehensive Training: Ensure your team is properly trained on how to use the CRM effectively.

- Offer Ongoing Support: Provide ongoing support and training to help your team stay up-to-date on the latest features and best practices.

- Encourage Adoption: Encourage your team to use the CRM regularly and provide feedback on how it can be improved.

5. Integrate with Other Tools

- Integrate with Your Accounting Software: Seamlessly sync client and financial data between your CRM and accounting software.

- Integrate with Other Business Tools: Integrate your CRM with other business tools, such as email marketing platforms and project management software.

- Streamline Your Workflows: Integrate your tools to create a more streamlined and efficient workflow.

Conclusion: Empowering Your Accounting Firm with the Right CRM

Choosing the right CRM is a pivotal step in transforming your small accounting firm. By selecting a system that aligns with your specific needs, integrating it effectively, and embracing best practices, you can:

- Improve Client Relationships: Provide personalized service and build stronger client relationships.

- Increase Efficiency: Automate repetitive tasks and streamline your workflows.

- Boost Productivity: Empower your team to work more efficiently and effectively.

- Drive Business Growth: Gain valuable insights into your client base and make data-driven decisions to grow your firm.

Don’t let client management and operational inefficiencies hold your firm back. Take the time to research your options, choose the best CRM for your needs, and unlock the power of client relationship management. Your firm’s future success depends on it!

By following the steps outlined in this guide, you’ll be well on your way to selecting the perfect CRM and transforming your accounting firm into a more efficient, client-focused, and ultimately, more profitable business. The right CRM is an investment in your future, giving you the tools you need to not just survive, but thrive in the competitive world of accounting.