Unlocking Efficiency: The Ultimate Guide to the Best CRM for Small Accountants

Introduction: Why a CRM is a Game-Changer for Small Accounting Firms

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking projects, sending invoices, and staying on top of regulatory changes, all while trying to grow your business. In this whirlwind of activity, it’s easy for things to slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes in. A CRM isn’t just for big corporations; it’s a powerful tool that can transform how small accounting firms operate, fostering better client relationships, boosting productivity, and ultimately, driving revenue. This guide will delve into the best CRM options specifically tailored for small accountants, helping you choose the perfect fit to streamline your operations and achieve your business goals.

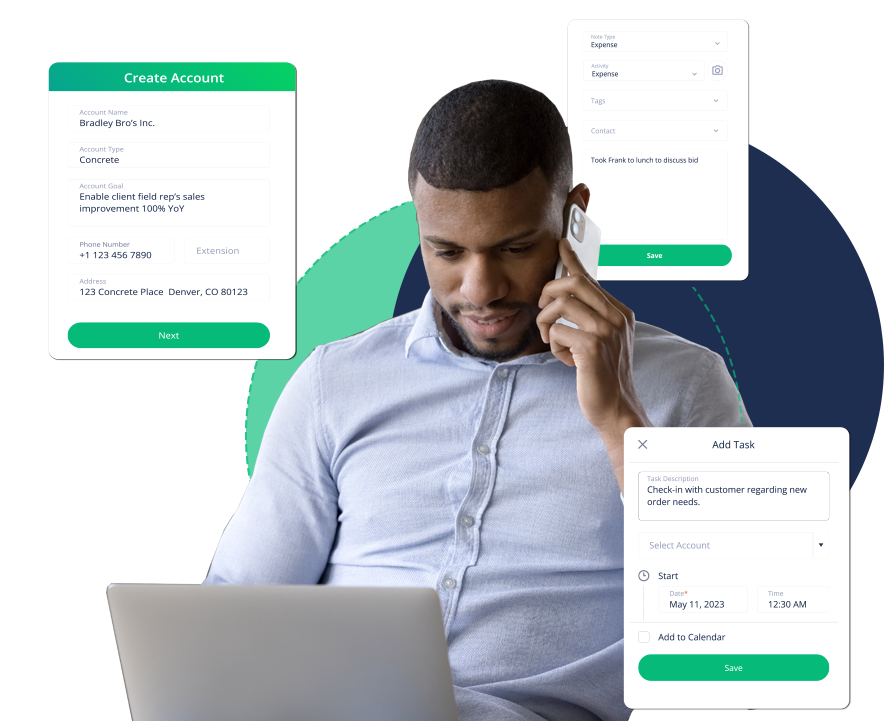

Imagine a world where client information is readily available at your fingertips, where follow-ups are automated, and where you have a clear view of your sales pipeline. That’s the power of a CRM. It centralizes all your client data, allowing you to personalize interactions, anticipate needs, and provide exceptional service. For small accounting firms, this translates to increased client satisfaction, improved retention rates, and more referrals. Choosing the right CRM is a crucial decision. It should integrate seamlessly with your existing tools, be user-friendly, and offer the features you need to manage your client base effectively.

What to Look for in a CRM for Small Accountants

Before diving into specific CRM recommendations, let’s explore the key features and functionalities that are essential for small accounting firms. Selecting a CRM that meets your specific needs ensures you get the most out of your investment. Here’s a breakdown of the critical elements to consider:

1. Contact Management: The Foundation of Client Relationships

At its core, a CRM is about managing contacts. Look for a system that allows you to:

- Store comprehensive client information: This includes contact details, financial data, tax information, communication history, and any other relevant notes.

- Segment your contacts: Categorize clients based on industry, service needs, or any other criteria to tailor your communication and marketing efforts.

- Easily search and filter contacts: Quickly find the information you need, when you need it.

2. Workflow Automation: Streamlining Your Processes

Automation is a game-changer for small accounting firms. A good CRM should automate repetitive tasks, freeing up your time to focus on more strategic activities. Key automation features to look for include:

- Automated email marketing: Send targeted emails to clients based on their interests or stage in the sales cycle.

- Appointment scheduling: Allow clients to book appointments directly through the CRM.

- Task reminders and notifications: Set up automated reminders for deadlines, follow-ups, and other important tasks.

3. Integration Capabilities: Connecting Your Tools

Your CRM should integrate seamlessly with the other tools you use, such as:

- Accounting software: Integrate with popular accounting platforms like QuickBooks, Xero, or Sage to sync client data and financial information.

- Email marketing platforms: Connect with platforms like Mailchimp or Constant Contact to manage your email campaigns.

- Calendar and scheduling tools: Integrate with Google Calendar, Outlook Calendar, or other scheduling tools.

4. Reporting and Analytics: Gaining Insights into Your Performance

Data is your friend. A good CRM provides reports and analytics to track your performance, identify areas for improvement, and make data-driven decisions. Look for features like:

- Sales pipeline tracking: Visualize your sales process and track the progress of leads.

- Client activity tracking: Monitor client interactions and engagement levels.

- Performance reports: Generate reports on key metrics such as client acquisition cost, customer lifetime value, and conversion rates.

5. User-Friendliness and Accessibility: Ease of Use is Key

A CRM is only useful if your team actually uses it. Choose a system that is:

- Intuitive and easy to navigate: The interface should be clean and user-friendly.

- Mobile-friendly: Access your CRM on the go from your smartphone or tablet.

- Offers adequate training and support: Make sure the vendor provides sufficient training materials and customer support.

Top CRM Systems for Small Accountants: A Comparative Analysis

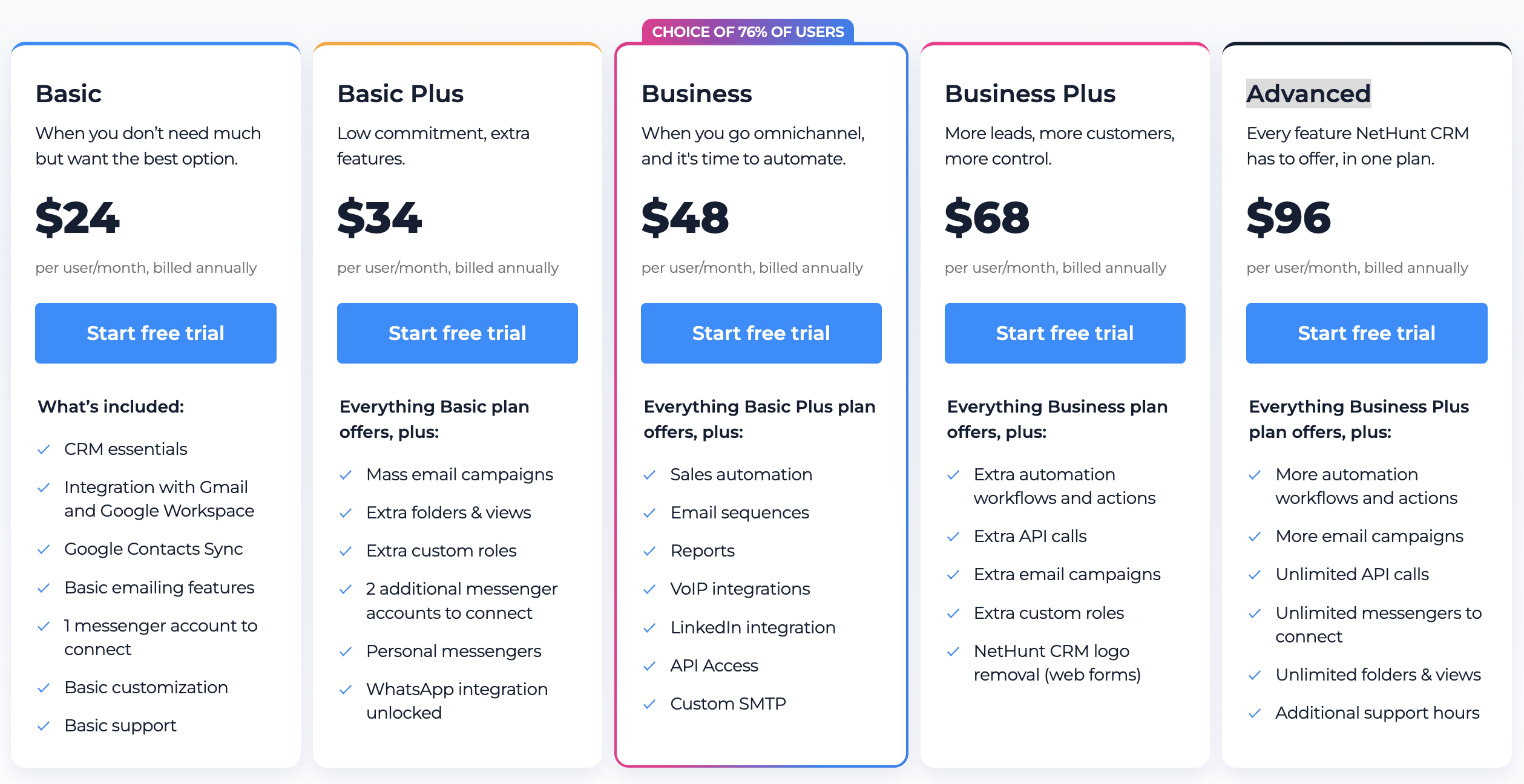

Now that we’ve established the essential features, let’s explore some of the top CRM systems specifically designed to meet the needs of small accounting firms. We’ll analyze their strengths, weaknesses, pricing, and ideal use cases to help you make an informed decision. Remember, the best CRM is the one that aligns with your firm’s unique requirements.

1. HubSpot CRM: The Free Powerhouse

Overview: HubSpot CRM is a popular choice for small businesses due to its generous free plan and comprehensive features. It’s known for its user-friendly interface and ease of use. While the free version is robust, paid plans unlock advanced features such as marketing automation and sales analytics.

Key Features:

- Contact Management: Robust contact management features, including detailed contact profiles and segmentation.

- Sales Pipeline: Visual sales pipeline to track deals and opportunities.

- Email Marketing: Basic email marketing capabilities in the free plan, with advanced features in paid plans.

- Integration: Integrates with popular accounting software, email providers, and other business tools.

- Free Plan: Offers a generous free plan with unlimited users and contacts.

Pros:

- Free plan provides a lot of value.

- User-friendly interface.

- Strong integration capabilities.

- Excellent marketing automation features in paid plans.

Cons:

- The free plan has limitations on advanced features.

- Can become expensive as your business grows and you need more advanced features.

Ideal for: Small accounting firms looking for a free or affordable CRM with strong marketing automation capabilities.

2. Zoho CRM: The Affordable All-rounder

Overview: Zoho CRM is a versatile and affordable CRM system that offers a wide range of features for businesses of all sizes. It’s known for its customizability and its ability to integrate with other Zoho apps and third-party applications.

Key Features:

- Contact Management: Comprehensive contact management features with detailed contact profiles and segmentation.

- Sales Automation: Automate sales processes and track deals.

- Workflow Automation: Automate repetitive tasks with customizable workflows.

- Reporting and Analytics: Generate detailed reports and track key metrics.

- Integration: Integrates with a wide range of third-party applications, including accounting software.

Pros:

- Affordable pricing plans.

- Highly customizable.

- Strong integration capabilities.

- Wide range of features.

Cons:

- The interface can be overwhelming for beginners.

- Customer support can be slow at times.

Ideal for: Small accounting firms looking for a customizable and affordable CRM with a wide range of features.

3. Pipedrive: Focused on Sales and Pipeline Management

Overview: Pipedrive is a sales-focused CRM that’s designed to help businesses manage their sales pipeline and close deals. It’s known for its intuitive interface and its focus on sales performance.

Key Features:

- Sales Pipeline Management: Visual sales pipeline to track deals and opportunities.

- Activity Tracking: Track sales activities and set reminders.

- Email Integration: Integrate with your email provider to track email conversations.

- Reporting and Analytics: Generate reports on sales performance.

- User-Friendly Interface: Easy to use and navigate.

Pros:

- Intuitive and user-friendly interface.

- Strong sales pipeline management features.

- Easy to track sales activities.

Cons:

- May lack some of the more advanced features of other CRMs.

- Can be less customizable than other options.

Ideal for: Small accounting firms that are primarily focused on sales and lead generation.

4. Freshsales: AI-Powered CRM for Enhanced Sales

Overview: Freshsales, by Freshworks, is an AI-powered CRM designed to help businesses streamline their sales processes and improve customer interactions. It offers advanced features like lead scoring and AI-driven insights to help you close more deals.

Key Features:

- AI-Powered Features: Lead scoring, deal insights, and sales forecasting.

- Contact Management: Comprehensive contact profiles and segmentation.

- Sales Automation: Automate sales processes and track deals.

- Email Integration: Integrate with your email provider to track email conversations.

- Reporting and Analytics: Generate detailed reports and track key metrics.

Pros:

- AI-powered features provide valuable insights.

- User-friendly interface.

- Strong sales automation capabilities.

Cons:

- Can be more expensive than other options.

- May not be as suitable for firms that are not heavily sales-focused.

Ideal for: Small accounting firms that want to leverage AI to improve their sales performance.

5. Insightly: A CRM for Project Management

Overview: Insightly is a CRM that is well-suited for businesses that need to manage projects alongside their client relationships. It offers strong project management features and integrates seamlessly with other business tools.

Key Features:

- Project Management: Manage projects and track tasks.

- Contact Management: Comprehensive contact profiles and segmentation.

- Sales Pipeline: Visual sales pipeline to track deals and opportunities.

- Reporting and Analytics: Generate detailed reports and track key metrics.

- Integration: Integrates with a wide range of third-party applications.

Pros:

- Strong project management features.

- User-friendly interface.

- Good for businesses that need to manage projects alongside client relationships.

Cons:

- May not be as feature-rich as other CRMs.

- Can be more expensive than some other options.

Ideal for: Small accounting firms that need to manage projects and client relationships in one place.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM can feel overwhelming. Here’s a step-by-step guide to help you navigate the process and make an informed decision:

1. Assess Your Needs: Define Your Requirements

Before you start researching CRMs, take the time to define your specific needs and requirements. Ask yourself the following questions:

- What are your current pain points? What processes are inefficient or time-consuming?

- What are your goals for using a CRM? Do you want to improve client relationships, increase sales, or streamline operations?

- What features are essential for your firm? Make a list of must-have features, such as contact management, automation, and integration capabilities.

- How many users will need access to the CRM? This will affect the pricing and plan you choose.

- What is your budget? Set a realistic budget for your CRM investment.

2. Research Your Options: Explore Different CRM Systems

Once you have a clear understanding of your needs, it’s time to research different CRM systems. Use the information in this guide as a starting point, and also:

- Read reviews and compare features: Compare different CRM systems based on your requirements and read reviews from other small accounting firms.

- Consider your existing tech stack: Make sure the CRM integrates with your existing accounting software, email marketing platforms, and other business tools.

- Look for industry-specific features: Some CRMs offer features specifically designed for accounting firms, such as tax form management or client portals.

3. Request Demos and Free Trials: Test the CRM Systems

Most CRM vendors offer demos and free trials. Take advantage of these opportunities to test the CRM systems and see how they work in practice.

- Request a demo: Ask the vendor to walk you through the features and functionalities of the CRM.

- Sign up for a free trial: Test the CRM with your own data to see how it fits your needs.

- Involve your team: Get feedback from your team members who will be using the CRM.

4. Evaluate and Choose: Make Your Decision

After testing different CRM systems, evaluate them based on the following criteria:

- Features: Does the CRM offer the features you need?

- Ease of use: Is the interface intuitive and user-friendly?

- Integration: Does the CRM integrate with your existing tools?

- Pricing: Is the pricing affordable and aligned with your budget?

- Customer support: Does the vendor offer adequate training and support?

Based on your evaluation, choose the CRM that best meets your needs and budget. Don’t be afraid to start small and scale up as your business grows.

5. Implementation and Training: Get Your Team Onboard

Once you’ve chosen a CRM, it’s time to implement it and train your team. This is a crucial step to ensure a smooth transition and maximize the benefits of your CRM investment.

- Plan your implementation: Create a detailed implementation plan, including data migration, user training, and process adjustments.

- Migrate your data: Transfer your existing client data to the CRM.

- Train your team: Provide comprehensive training to your team members on how to use the CRM.

- Monitor and optimize: Monitor your team’s use of the CRM and make adjustments as needed.

Beyond the Basics: Advanced CRM Strategies for Accounting Firms

Once you’ve implemented your CRM, you can explore advanced strategies to maximize its impact on your business. Here are some ideas:

1. Personalized Client Communication

Use your CRM to personalize your client communication. Segment your clients based on their needs and preferences, and tailor your messaging accordingly. This includes sending personalized birthday emails, providing customized financial reports, and offering proactive advice.

2. Automated Workflow Optimization

Leverage the automation features of your CRM to streamline your workflows. Automate tasks such as appointment scheduling, invoice reminders, and follow-up emails. This will free up your time and reduce the risk of errors.

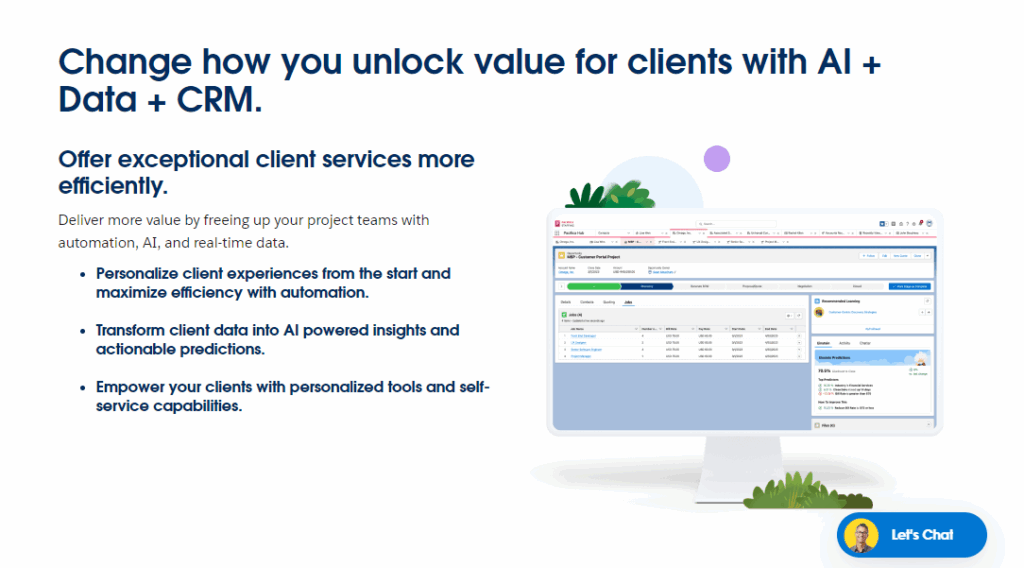

3. Client Portal Integration

Consider integrating a client portal with your CRM. This allows clients to access their financial documents, communicate with you securely, and track the progress of their projects. This enhances client satisfaction and improves communication efficiency.

4. Lead Nurturing

Use your CRM to nurture leads and convert them into clients. Create targeted email campaigns to educate leads about your services and build relationships. Track your lead’s interactions and tailor your messaging based on their interests and needs.

5. Data-Driven Decision Making

Use the reporting and analytics features of your CRM to track your performance and make data-driven decisions. Analyze your client acquisition cost, customer lifetime value, and conversion rates. Identify areas for improvement and adjust your strategies accordingly.

Conclusion: Embrace the Power of CRM to Elevate Your Accounting Firm

In the competitive landscape of accounting, a CRM system is no longer a luxury; it’s a necessity. By choosing the right CRM and implementing it effectively, small accounting firms can significantly improve their client relationships, streamline their operations, and boost their bottom line.

From centralizing client data to automating repetitive tasks and providing valuable insights, a CRM empowers you to work smarter, not harder. It allows you to provide exceptional service, build stronger client relationships, and ultimately, achieve greater success.

Don’t let your firm fall behind. Invest in a CRM today and unlock the potential to transform your business. Take the time to assess your needs, research your options, and choose the CRM that aligns with your goals. Your clients, and your business, will thank you for it.

The journey to a more efficient and client-focused accounting firm starts with the right CRM. Take the first step today and embrace the power of customer relationship management.

The best CRM for you will depend on your specific needs and budget. However, by following the steps outlined in this guide, you can make an informed decision and choose the CRM that will help you achieve your business goals.

Remember to prioritize user-friendliness, integration capabilities, and the ability to scale as your business grows. With the right CRM in place, you’ll be well-equipped to navigate the challenges of the accounting industry and thrive in the years to come.