Unlocking Efficiency: The Ultimate CRM Guide for Small Accounting Firms

The Cornerstone of Accounting Success: Why a CRM is Non-Negotiable

In the fast-paced world of accounting, staying organized and client-focused isn’t just a good idea; it’s absolutely crucial. For small accounting firms, in particular, the ability to manage client relationships effectively can be the difference between thriving and merely surviving. That’s where a Customer Relationship Management (CRM) system steps in. It’s no longer a luxury; it’s a necessity. Think of it as the central hub that keeps all your client information, communications, and tasks neatly organized and easily accessible. This allows you to deliver exceptional service, nurture client relationships, and ultimately, grow your business. But with so many CRM options out there, choosing the right one can feel overwhelming. This guide is designed to demystify the process, helping small accounting firms find the perfect CRM to fit their specific needs and budget.

What Makes a CRM Indispensable for Accountants?

Before we dive into the specifics of the best CRM options, let’s explore why a CRM is such a game-changer for accountants:

- Centralized Client Data: Say goodbye to scattered spreadsheets, email chains, and sticky notes. A CRM provides a single source of truth for all client information, including contact details, financial data, communication history, and more.

- Improved Communication and Collaboration: Easily track all client interactions, ensuring that everyone on your team is on the same page. This leads to more consistent and personalized client experiences.

- Streamlined Workflows: Automate repetitive tasks like appointment scheduling, follow-up emails, and invoice reminders, freeing up your time to focus on more strategic activities.

- Enhanced Client Service: With a complete view of each client’s needs and preferences, you can provide tailored advice and proactively address their concerns, leading to increased client satisfaction and loyalty.

- Better Lead Management: Track potential clients, nurture leads, and convert them into paying customers with targeted marketing campaigns and personalized follow-ups.

- Increased Productivity: By automating tasks and centralizing information, a CRM helps your team work more efficiently, allowing you to take on more clients without increasing your workload exponentially.

- Data-Driven Insights: Gain valuable insights into your client base, sales performance, and marketing effectiveness, enabling you to make informed business decisions and optimize your strategies.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your small accounting firm, consider these essential features:

1. Contact Management

This is the foundation of any CRM. Look for features that allow you to:

- Store detailed client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Segment your clients based on various criteria, such as industry, revenue, or service needs.

- Import and export contact data easily.

- Integrate with your existing contact lists.

2. Lead Management

A good CRM should help you manage potential clients effectively. Look for features like:

- Lead capture forms to collect information from your website or other sources.

- Lead scoring to prioritize the most promising leads.

- Lead nurturing workflows to automate follow-up emails and other interactions.

- Sales pipeline management to track leads through the sales process.

3. Task and Calendar Management

Stay organized and never miss a deadline with these features:

- Task creation and assignment to team members.

- Calendar integration to schedule appointments, meetings, and deadlines.

- Reminders and notifications to keep you on track.

- Ability to track time spent on client tasks.

4. Communication Tracking

Keep a record of all client interactions, including:

- Email integration to track email correspondence.

- Phone call logging and recording (if applicable).

- Notes and comments to document important details.

- Integration with communication tools like Slack or Microsoft Teams.

5. Reporting and Analytics

Gain valuable insights into your business performance with these features:

- Customizable reports to track key metrics like client acquisition cost, revenue, and client satisfaction.

- Dashboards to visualize your data and track progress.

- Data export capabilities for further analysis.

6. Integration Capabilities

Choose a CRM that integrates seamlessly with the other tools you use, such as:

- Accounting software (e.g., QuickBooks, Xero)

- Email marketing platforms (e.g., Mailchimp, Constant Contact)

- Payment processing systems (e.g., Stripe, PayPal)

- Project management tools

7. Security and Compliance

Data security is paramount, especially when dealing with sensitive financial information. Ensure the CRM you choose offers:

- Data encryption to protect client data.

- Compliance with industry regulations such as GDPR and CCPA.

- Secure user access controls.

Top CRM Systems for Small Accounting Firms: A Comparative Analysis

Now, let’s examine some of the best CRM options specifically tailored for small accounting firms. We’ll consider their features, pricing, and ease of use to help you make an informed decision.

1. HubSpot CRM

Overview: HubSpot CRM is a popular and powerful choice, especially for businesses that prioritize marketing and sales. It offers a free version with a robust set of features, making it an excellent starting point for small firms.

Key Features:

- Free forever plan with unlimited users and contacts.

- Contact management, deal tracking, and task management.

- Email marketing and automation tools.

- Sales pipeline management.

- Integration with popular accounting software like QuickBooks.

- User-friendly interface.

Pros:

- Free plan offers significant value.

- Easy to learn and use.

- Excellent integration capabilities.

- Strong marketing and sales features.

Cons:

- The free plan has limitations on features like advanced reporting and automation.

- Can be overwhelming for firms that primarily need basic CRM functionality.

Pricing: Free plan available. Paid plans start at $45 per month.

Ideal for: Small firms that want a comprehensive CRM with strong marketing and sales capabilities and are willing to invest time in learning the platform.

2. Zoho CRM

Overview: Zoho CRM is a feature-rich and affordable option, particularly well-suited for businesses looking for a customizable and scalable solution. It offers a free plan and several paid plans to accommodate different needs.

Key Features:

- Contact management, lead management, and sales pipeline management.

- Workflow automation and process management.

- Customization options to tailor the CRM to your specific needs.

- Email marketing and integration with other Zoho apps.

- Integration with accounting software like QuickBooks and Xero.

Pros:

- Highly customizable.

- Affordable pricing.

- Wide range of features.

- Strong integration capabilities.

Cons:

- Can have a steeper learning curve compared to some other CRMs.

- The interface can feel a bit cluttered at times.

Pricing: Free plan available. Paid plans start at $14 per user per month.

Ideal for: Small firms that need a customizable and scalable CRM with a wide range of features and are comfortable with a slightly more complex interface.

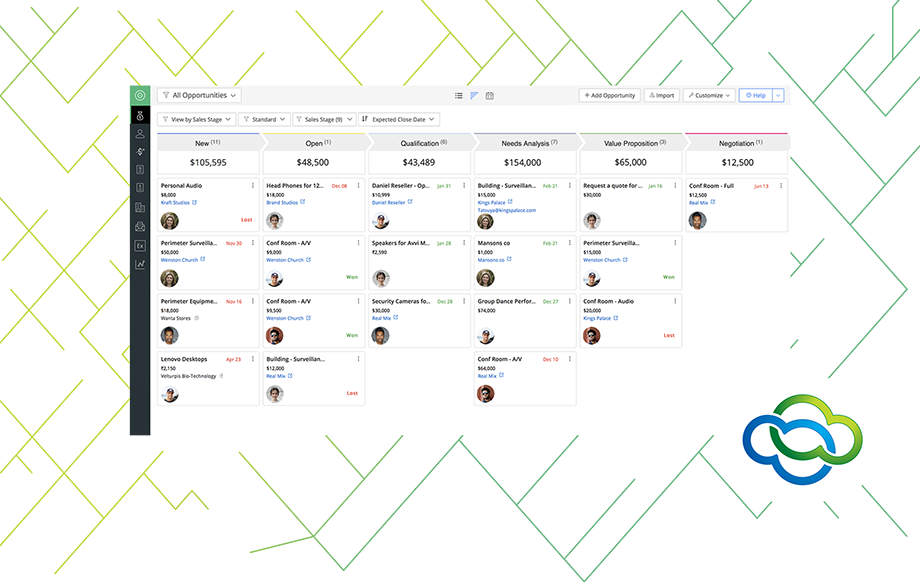

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that’s designed to be intuitive and easy to use. It’s a great option for firms that want a simple and effective tool for managing their sales pipeline.

Key Features:

- Visual sales pipeline management.

- Contact management and lead tracking.

- Email integration and automation.

- Activity scheduling and tracking.

- Reporting and analytics focused on sales performance.

Pros:

- User-friendly interface.

- Focus on sales pipeline management.

- Easy to set up and use.

Cons:

- May lack some of the advanced features of other CRMs.

- Can be less suitable for firms that need extensive marketing automation capabilities.

Pricing: Paid plans start at $12.50 per user per month.

Ideal for: Small firms that want a simple and effective sales-focused CRM with a user-friendly interface.

4. Freshsales (Freshworks CRM)

Overview: Freshsales is a sales CRM designed to help businesses manage their sales processes and build relationships with clients. It offers a user-friendly interface and a range of features, including sales automation, lead scoring, and reporting.

Key Features:

- Contact management and lead management.

- Sales pipeline management and deal tracking.

- Email integration and automation.

- Built-in phone and chat features.

- Reporting and analytics.

Pros:

- User-friendly interface.

- Robust sales automation features.

- Integrated phone and chat features.

Cons:

- Can be less customizable than some other CRMs.

- May not offer as many advanced features as some competitors.

Pricing: Free plan available. Paid plans start at $15 per user per month.

Ideal for: Small firms that want a user-friendly CRM with strong sales automation features and integrated communication tools.

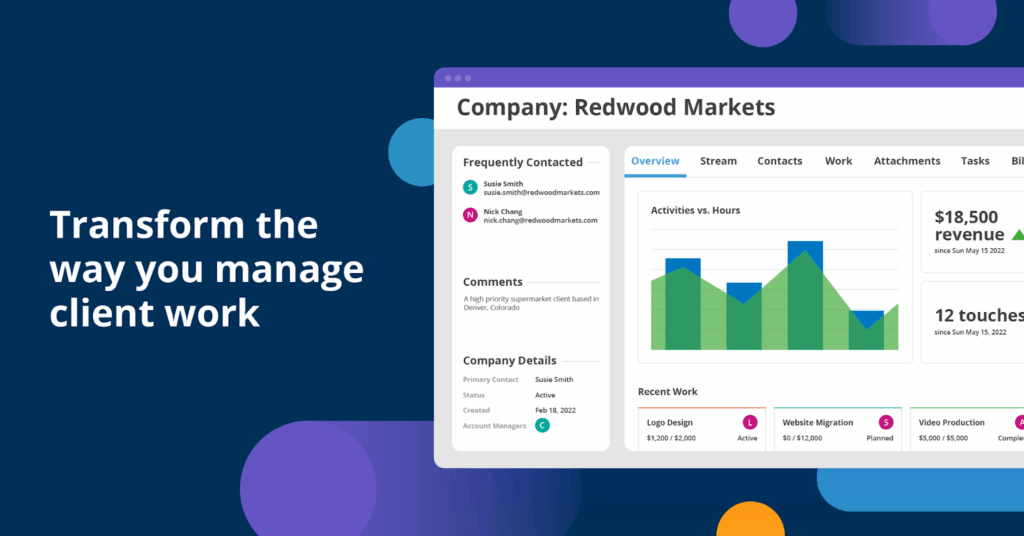

5. Insightly

Overview: Insightly is a CRM designed specifically for small and medium-sized businesses. It offers a comprehensive suite of features, including contact management, project management, and sales pipeline management.

Key Features:

- Contact management and lead management.

- Sales pipeline management and deal tracking.

- Project management features.

- Task management and workflow automation.

- Reporting and analytics.

Pros:

- Comprehensive suite of features.

- Project management capabilities.

- Easy to use.

Cons:

- Can be more expensive than some other CRMs.

- May have a slightly steeper learning curve.

Pricing: Paid plans start at $29 per user per month.

Ideal for: Small firms that need a comprehensive CRM with project management capabilities.

6. Agile CRM

Overview: Agile CRM is a versatile CRM that combines sales, marketing, and customer service functionalities. It’s designed to be user-friendly and affordable, making it a good option for small businesses with limited budgets.

Key Features:

- Contact management, lead management, and sales pipeline management.

- Marketing automation features.

- Helpdesk and customer service tools.

- Integration with a wide range of apps.

- Affordable pricing.

Pros:

- Affordable pricing.

- User-friendly interface.

- Combines sales, marketing, and customer service functionalities.

Cons:

- May lack some of the advanced features of more expensive CRMs.

- The free plan has limitations on features.

Pricing: Free plan available. Paid plans start at $9.99 per user per month.

Ideal for: Small firms that want an affordable CRM with sales, marketing, and customer service features.

Choosing the Right CRM: A Step-by-Step Guide

Here’s a step-by-step process to help you choose the best CRM for your small accounting firm:

1. Assess Your Needs

Before you start comparing CRM systems, take the time to understand your firm’s specific needs and goals. Consider these questions:

- What are your biggest challenges in managing client relationships?

- What are your key priorities for a CRM (e.g., improving communication, streamlining workflows, increasing sales)?

- What features are essential for your firm?

- What is your budget?

- How many users will need access to the CRM?

- What other software do you currently use, and what integrations are necessary?

2. Define Your Budget

CRM pricing varies widely, from free plans to enterprise-level solutions. Determine your budget and stick to it. Consider not only the monthly or annual subscription costs but also any implementation fees, training costs, and potential costs for add-ons or integrations.

3. Research and Compare Options

Based on your needs and budget, research the different CRM options available. Read reviews, compare features, and consider free trials to get a feel for the platform.

4. Prioritize Essential Features

Identify the features that are most critical to your firm’s success. Focus on the must-haves and avoid getting bogged down in features that you may not need.

5. Consider Scalability

Choose a CRM that can grow with your business. Consider whether the CRM can accommodate more users, handle a larger client base, and integrate with new tools as your firm expands.

6. Evaluate Ease of Use

The best CRM is one that your team will actually use. Choose a platform with a user-friendly interface and intuitive design. Consider the learning curve and the availability of training and support.

7. Test Drive the CRM

Take advantage of free trials or demos to test drive the CRM. This will give you a hands-on experience and allow you to evaluate its features, ease of use, and overall suitability for your firm.

8. Seek Feedback from Your Team

Involve your team in the decision-making process. Get their feedback on the different CRM options and their preferences. This will increase the likelihood of adoption and ensure that the chosen CRM meets the needs of everyone in the firm.

9. Implement and Train

Once you’ve chosen a CRM, plan for a smooth implementation process. Provide adequate training to your team to ensure that they understand how to use the system effectively. Consider creating a CRM implementation plan to guide the process.

10. Monitor and Optimize

After implementing the CRM, continuously monitor its performance and make adjustments as needed. Track key metrics, gather feedback from your team, and optimize your processes to maximize the benefits of your CRM investment.

Beyond the Basics: Advanced CRM Strategies for Accountants

Once you’ve implemented a CRM, you can take your client relationship management to the next level with these advanced strategies:

- Personalized Client Journeys: Map out the client journey from initial contact to ongoing service. Use the CRM to personalize communications, automate follow-ups, and provide tailored advice at each stage.

- Client Segmentation: Segment your client base based on various criteria, such as industry, revenue, or service needs. This allows you to tailor your marketing messages, service offerings, and communication strategies to each segment.

- Proactive Client Engagement: Use your CRM to proactively engage with clients, such as sending out newsletters, sharing industry updates, or offering personalized financial advice.

- Cross-selling and Upselling: Identify opportunities to cross-sell additional services or upsell clients to higher-value offerings. Use the CRM to track client needs and preferences and make targeted recommendations.

- Client Feedback and Surveys: Gather client feedback through surveys and other methods to understand their needs and preferences. Use this information to improve your services and build stronger relationships.

- Integration with Client Portals: Integrate your CRM with a client portal to provide clients with secure access to their financial data, documents, and other important information.

- Leverage Automation: Automate as many tasks as possible, such as appointment scheduling, invoice reminders, and follow-up emails. This will free up your time to focus on more strategic activities.

- Regular Data Analysis: Regularly analyze the data in your CRM to track key metrics, identify trends, and make data-driven decisions.

Overcoming Common CRM Challenges

While CRM systems offer significant benefits, they can also present challenges. Here are some common hurdles and how to overcome them:

- Lack of User Adoption: The biggest challenge to CRM success is often a lack of user adoption. Ensure that your team understands the value of the CRM and provides adequate training and support.

- Data Migration Issues: Transferring data from existing systems to a new CRM can be complex. Plan for data migration and ensure that your data is clean and accurate.

- Integration Problems: Integrating your CRM with other software can sometimes be challenging. Choose a CRM that integrates seamlessly with the tools you use and seek support from the vendor if needed.

- Complexity and Overwhelm: Some CRM systems can be complex and overwhelming. Choose a CRM that is user-friendly and offers the features you need without unnecessary complexity.

- Maintenance and Updates: CRM systems require ongoing maintenance and updates. Stay up-to-date with the latest features and security updates.

The Future of CRM in Accounting

The role of CRM in accounting is continuously evolving. Here are some trends to watch:

- Artificial Intelligence (AI): AI is being integrated into CRM systems to automate tasks, provide insights, and personalize client interactions.

- Mobile Accessibility: Mobile CRM apps are becoming increasingly important, allowing accountants to access client information and manage their business on the go.

- Data Privacy and Security: Data privacy and security are becoming increasingly important. CRM vendors are investing in robust security measures to protect client data.

- Integration with Emerging Technologies: CRM systems are integrating with emerging technologies, such as blockchain and cloud computing, to enhance their capabilities.

Conclusion: Embracing the Power of CRM for Accounting Firm Success

In conclusion, implementing a CRM system is a strategic investment that can transform your small accounting firm. By centralizing client data, streamlining workflows, and enhancing client service, a CRM empowers you to build stronger relationships, increase efficiency, and ultimately, grow your business. By following the guidelines and recommendations in this guide, you can choose the right CRM for your firm, implement it effectively, and unlock its full potential. Don’t delay. Embrace the power of CRM and take your accounting firm to the next level.