Unlocking Efficiency: The Ultimate CRM Guide for Small Accounting Firms

Unlocking Efficiency: The Ultimate CRM Guide for Small Accounting Firms

Running a small accounting firm is like juggling chainsaws while riding a unicycle. You’re constantly balancing client relationships, financial data, deadlines, and the ever-changing landscape of tax regulations. Amidst this whirlwind, the need for streamlined processes and efficient management becomes paramount. That’s where a Customer Relationship Management (CRM) system steps in – your digital sidekick, helping you wrangle clients, organize data, and ultimately, boost your bottom line. But with a plethora of CRM options available, choosing the right one for a small accounting firm can feel like navigating a maze. This comprehensive guide dives deep into the world of CRM, specifically tailored for the unique needs of small accounting businesses, helping you choose the perfect fit to transform your practice.

Why Your Small Accounting Firm Needs a CRM

In the accounting world, relationships are everything. Trust, reliability, and personalized service are the cornerstones of client retention and growth. A CRM system goes beyond just storing contact information; it’s a centralized hub for all client interactions, providing a 360-degree view of your relationships. Here’s why a CRM is indispensable for your small accounting firm:

- Improved Client Management: Keep track of client communications, meeting notes, and important deadlines, ensuring nothing slips through the cracks.

- Enhanced Communication: Send targeted emails, automate follow-ups, and personalize interactions, nurturing client relationships.

- Increased Efficiency: Automate repetitive tasks, such as appointment scheduling and email marketing, freeing up your time for more strategic activities.

- Better Lead Generation: Capture leads from your website, social media, and other marketing channels, and nurture them through the sales pipeline.

- Data-Driven Decision Making: Gain insights into client behavior, track key performance indicators (KPIs), and make informed decisions to improve your business.

- Improved Collaboration: Share client information and collaborate seamlessly with your team, ensuring everyone is on the same page.

- Compliance and Security: Many CRM systems offer robust security features and compliance certifications, crucial for handling sensitive financial data.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. For a small accounting firm, certain features are crucial for maximizing efficiency and effectiveness. Here’s a breakdown of the essential features you should look for:

1. Contact Management

This is the foundation of any CRM. It allows you to store and organize client contact information, including names, addresses, phone numbers, email addresses, and other relevant details. Look for features such as:

- Customizable Fields: The ability to add custom fields to store specific client information, such as tax identification numbers, financial goals, or preferred communication methods.

- Segmentation: The ability to segment your clients based on various criteria, such as industry, service level, or revenue, allowing you to target your marketing efforts more effectively.

- Import and Export: Easy import and export of contact data from spreadsheets and other sources.

2. Task and Calendar Management

Accounting firms are often juggling multiple deadlines and client appointments. A robust task and calendar management system is essential for staying organized and avoiding missed deadlines. Key features include:

- Appointment Scheduling: Integrated calendar functionality for scheduling client meetings and calls.

- Task Reminders: Automated reminders for important tasks, such as tax filing deadlines, invoice payments, and client follow-ups.

- Task Assignment: The ability to assign tasks to team members and track their progress.

- Integration with Email and Calendar: Seamless integration with your existing email and calendar systems, such as Outlook or Google Calendar.

3. Communication Tracking

Maintaining a record of all client interactions is critical for providing excellent service and building strong relationships. Look for features such as:

- Email Integration: The ability to track and store email communications with clients.

- Call Logging: The ability to log phone calls and record call notes.

- Interaction History: A complete history of all interactions with a client, including emails, calls, meetings, and notes.

- Templates: Pre-built email templates for common communications, such as appointment confirmations and follow-up emails.

4. Reporting and Analytics

Data is your friend. A CRM system should provide insights into your business performance. Look for features such as:

- Customizable Reports: The ability to generate custom reports on key metrics, such as client acquisition costs, client retention rates, and revenue per client.

- Dashboard: A dashboard that provides a real-time overview of your business performance.

- Sales Pipeline Tracking: The ability to track leads through the sales pipeline and identify areas for improvement.

- KPI Tracking: Track essential Key Performance Indicators (KPIs) to monitor your firm’s progress.

5. Automation

Automation is your secret weapon. Automate repetitive tasks to save time and improve efficiency. Look for features such as:

- Email Automation: Automated email sequences for lead nurturing, onboarding, and client follow-ups.

- Workflow Automation: Automate repetitive tasks, such as data entry and task assignment.

- Trigger-Based Automation: Set up automated actions based on specific triggers, such as a new lead being added to the system.

6. Integrations

A CRM system should integrate seamlessly with your existing tools and software. Consider these integrations:

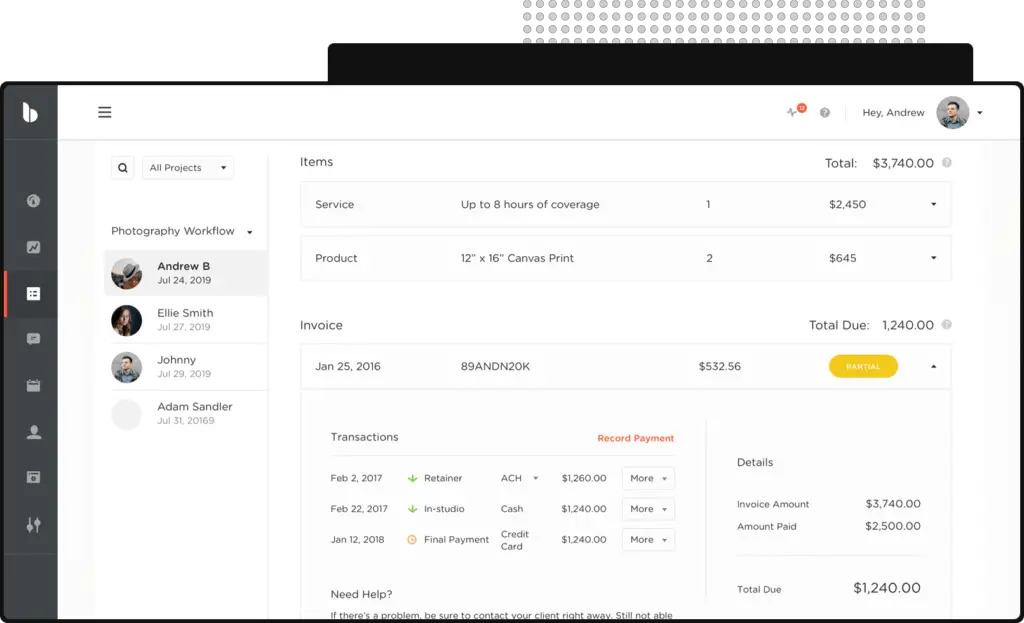

- Accounting Software: Integration with popular accounting software, such as QuickBooks, Xero, or Sage, to streamline data transfer.

- Email Marketing Platforms: Integration with email marketing platforms, such as Mailchimp or Constant Contact, to manage your email campaigns.

- Project Management Tools: Integration with project management tools, such as Asana or Trello, to manage client projects.

- Payment Gateways: Integration with payment gateways, such as Stripe or PayPal, to process client payments.

7. Security and Compliance

Data security is paramount, especially when handling sensitive financial information. Ensure your CRM system offers robust security features and complies with relevant regulations.

- Data Encryption: Protect client data with encryption both in transit and at rest.

- Access Controls: Control user access to sensitive data with role-based permissions.

- Compliance Certifications: Ensure the CRM system complies with relevant regulations, such as GDPR and CCPA.

- Regular Backups: Implement regular data backups to prevent data loss.

Top CRM Systems for Small Accounting Firms

Now that you know what to look for, let’s explore some of the best CRM systems tailored for small accounting firms. The ‘best’ CRM is subjective and depends on your specific needs and budget. Consider these options:

1. HubSpot CRM

HubSpot is a popular choice, especially for firms new to CRM. It offers a free version with a wide range of features, making it an excellent starting point. HubSpot’s user-friendly interface and extensive integrations make it a good choice for businesses of all sizes. HubSpot CRM offers tools for contact management, deal tracking, email marketing, and sales automation. Its free version offers robust features for small businesses. Key benefits include:

- Free Plan: The free plan is surprisingly powerful and offers a lot of functionality.

- User-Friendly Interface: Easy to learn and use, even for those with no prior CRM experience.

- Excellent Integrations: Integrates seamlessly with popular accounting software and other business tools.

- Marketing Automation: Powerful marketing automation features to nurture leads and engage clients.

- Scalability: Grows with your business, with paid plans offering more advanced features.

However, the free version has limitations on the number of contacts and emails. Advanced features require paid plans.

2. Zoho CRM

Zoho CRM is a versatile and affordable option, offering a comprehensive suite of features for small businesses. It is known for its customization options, allowing you to tailor the system to your specific needs. Zoho CRM provides contact management, sales automation, lead management, and reporting features. Key benefits include:

- Affordable Pricing: Competitive pricing plans, making it budget-friendly for small firms.

- Highly Customizable: Extensive customization options to tailor the system to your specific workflows.

- Workflow Automation: Powerful workflow automation features to streamline your processes.

- Integration with Zoho Suite: Seamless integration with other Zoho apps, such as Zoho Books (accounting software) and Zoho Campaigns (email marketing).

- Mobile App: Access your CRM data on the go with the Zoho CRM mobile app.

The interface can be overwhelming due to the sheer number of features. Some users may find the initial setup process complex.

3. Pipedrive

Pipedrive is a sales-focused CRM, ideal for firms that prioritize lead generation and sales pipeline management. Its visual pipeline view makes it easy to track deals and manage your sales process. Key benefits include:

- User-Friendly Interface: Intuitive and easy-to-understand interface, focusing on sales.

- Visual Sales Pipeline: Clear and visual representation of your sales pipeline, making it easy to track deals.

- Sales Automation: Automation features to streamline your sales processes.

- Email Integration: Seamless integration with your email provider.

- Reporting and Analytics: Powerful reporting and analytics to track your sales performance.

It may lack some of the more advanced features found in other CRMs, such as extensive marketing automation capabilities. It is primarily sales-focused, which might not be ideal for firms that prioritize client management over sales.

4. Insightly

Insightly is a CRM that combines sales and project management features, making it a good choice for firms that manage projects for their clients. Insightly provides robust contact management, project management, and sales pipeline features. Key benefits include:

- Project Management: Built-in project management features to manage client projects.

- Contact Management: Powerful contact management features to organize client data.

- Sales Pipeline Management: Clear and visual sales pipeline management.

- Reporting and Analytics: Customizable reports and dashboards to track your performance.

- Integration with Popular Tools: Integrates with popular business tools, such as Google Workspace and Mailchimp.

Some users may find the interface less intuitive than other CRMs. Project management features may not be as comprehensive as dedicated project management software.

5. Capsule CRM

Capsule CRM is a user-friendly and affordable CRM that is well-suited for small businesses. It focuses on contact management and sales pipeline management. Key benefits include:

- Ease of Use: Simple and intuitive interface, making it easy to learn and use.

- Affordable Pricing: Competitive pricing plans for small businesses.

- Contact Management: Powerful contact management features to organize client data.

- Sales Pipeline Management: Clear and visual sales pipeline management.

- Integration with Popular Tools: Integrates with popular business tools, such as Google Workspace and Mailchimp.

It may lack some of the advanced features found in other CRMs, such as extensive marketing automation capabilities. Limited customization options compared to some other CRMs.

Implementing Your CRM: A Step-by-Step Guide

Choosing the right CRM is just the first step. Successful implementation requires careful planning and execution. Here’s a step-by-step guide to help you get started:

1. Define Your Goals and Requirements

Before you start, define your goals for implementing a CRM. What do you want to achieve? Improve client relationships? Increase efficiency? Generate more leads? Identifying your goals will help you choose the right CRM and ensure you implement it effectively. Consider your specific needs, such as the number of users, the types of services you offer, and the integrations you need.

2. Choose the Right CRM

Based on your goals and requirements, research and compare different CRM systems. Consider the features, pricing, integrations, and user reviews. Take advantage of free trials to test out different CRM systems and see which one best fits your needs.

3. Plan Your Implementation

Develop a detailed implementation plan. This should include a timeline, a budget, and a list of tasks. Identify the team members who will be involved in the implementation process and assign roles and responsibilities. Consider who will be responsible for data migration, training, and ongoing maintenance.

4. Migrate Your Data

Transfer your existing client data from spreadsheets, databases, and other sources to your new CRM system. Ensure your data is accurate and up-to-date. Many CRM systems offer data import tools, and you may need to clean and organize your data before importing it.

5. Customize Your CRM

Configure your CRM to meet your specific needs. Customize fields, workflows, and reports to match your business processes. Set up user roles and permissions to control access to data. Customize the system to reflect your brand and business processes.

6. Train Your Team

Provide comprehensive training to your team on how to use the new CRM system. Offer training sessions, create user guides, and provide ongoing support. Ensure your team understands how to use the CRM to manage client relationships, track tasks, and generate reports. Training is essential for user adoption and maximizing the benefits of your CRM.

7. Integrate with Other Tools

Integrate your CRM with other tools and software, such as your accounting software, email marketing platform, and project management tools. This will streamline your workflows and eliminate the need for manual data entry.

8. Monitor and Optimize

Regularly monitor your CRM usage and performance. Track key metrics, such as client acquisition costs, client retention rates, and revenue per client. Identify areas for improvement and make adjustments to your CRM configuration and workflows. Continually evaluate your CRM and make adjustments as your business grows and evolves.

Best Practices for CRM Success in Accounting

Implementing a CRM is a journey, not a destination. Here are some best practices to ensure your CRM implementation is successful:

- Get Buy-In from Your Team: Involve your team in the selection and implementation process. Ensure everyone understands the benefits of the CRM and is committed to using it.

- Start Small and Scale Up: Don’t try to implement everything at once. Start with the core features and gradually add more functionality as your team becomes more comfortable.

- Keep Your Data Clean: Regularly clean and update your data to ensure accuracy. Inaccurate data can lead to wasted time and effort.

- Use Automation Wisely: Automate repetitive tasks to save time and improve efficiency, but don’t over-automate. Ensure your automated processes are effective and provide value to your clients.

- Provide Ongoing Training and Support: Offer ongoing training and support to your team to ensure they are using the CRM effectively. Stay up-to-date with the latest features and updates.

- Review and Refine Your Processes: Regularly review your CRM processes and workflows. Identify areas for improvement and make adjustments as needed.

- Focus on Client Relationships: Remember that the primary goal of a CRM is to improve client relationships. Use your CRM to personalize interactions, provide excellent service, and build strong relationships with your clients.

Beyond the Basics: Advanced CRM Strategies for Accountants

Once you’ve mastered the basics, consider these advanced strategies to take your CRM to the next level:

- Client Segmentation: Segment your clients based on various criteria, such as industry, service level, or revenue, to tailor your marketing efforts and personalize your service.

- Lead Scoring: Implement lead scoring to prioritize and nurture leads based on their engagement and potential.

- Marketing Automation: Use marketing automation to nurture leads, send targeted emails, and automate follow-ups.

- Client Portals: Provide clients with access to a secure portal where they can view their financial data, upload documents, and communicate with your team.

- Integration with Client Onboarding: Integrate your CRM with your client onboarding process to streamline the onboarding experience.

- Feedback Collection: Use your CRM to collect client feedback and identify areas for improvement.

The Future of CRM in Accounting

The accounting industry is constantly evolving, and so is the technology that supports it. Here are some trends to watch for:

- AI-Powered CRM: Artificial intelligence (AI) is being integrated into CRM systems to automate tasks, provide insights, and personalize interactions.

- Mobile CRM: Mobile CRM is becoming increasingly important, allowing accountants to access client data and manage their business on the go.

- Data Analytics: CRM systems are providing more advanced data analytics capabilities, allowing accountants to gain deeper insights into their business performance.

- Integration with Cloud Technology: CRM systems are increasingly integrating with cloud-based accounting software and other business tools.

- Focus on Cybersecurity: As data breaches become more common, CRM systems are investing in robust security features to protect client data.

Conclusion: Embrace the Power of CRM

In the competitive landscape of small accounting firms, embracing the power of a CRM is no longer optional; it’s essential. By choosing the right CRM, implementing it effectively, and leveraging its features, you can streamline your operations, improve client relationships, and drive business growth. Don’t let another day go by without exploring the transformative potential of a CRM. Take the first step today and unlock the efficiency and success your firm deserves. The right CRM can be the key to unlocking new levels of productivity, client satisfaction, and, ultimately, profitability.