Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

In the fast-paced world of accounting, staying organized and connected with clients is paramount. For small accounting firms, juggling multiple clients, deadlines, and financial data can be a daunting task. That’s where a Customer Relationship Management (CRM) system comes in. A well-chosen CRM can be the cornerstone of your firm’s success, streamlining workflows, improving client communication, and ultimately, boosting profitability. This article delves into the best CRM systems specifically tailored for small accounting firms in 2024, exploring their features, benefits, and how they can revolutionize your practice.

Why Your Small Accounting Firm Needs a CRM

Before diving into specific CRM solutions, let’s understand why a CRM is crucial for small accounting firms. Traditional methods of managing client relationships, such as spreadsheets and email chains, are often inefficient and prone to errors. Here’s how a CRM can transform your operations:

- Centralized Client Data: A CRM provides a single, organized repository for all client information, including contact details, communication history, financial records, and project status.

- Improved Communication: CRM systems facilitate seamless communication through email integration, automated reminders, and personalized messaging, ensuring you stay connected with your clients.

- Enhanced Collaboration: Many CRMs offer collaboration features, allowing team members to share information, track progress, and work together on client projects.

- Streamlined Workflows: CRM automation capabilities can automate repetitive tasks, such as sending invoices, scheduling appointments, and following up on leads, freeing up your time to focus on core accounting services.

- Data-Driven Insights: CRM systems provide valuable insights into client behavior, allowing you to identify opportunities for upselling, cross-selling, and improved service delivery.

- Increased Efficiency: By automating tasks and centralizing information, a CRM can significantly improve your firm’s efficiency, allowing you to take on more clients and grow your business.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your small accounting firm, consider these essential features:

1. Client Management

The core function of any CRM is client management. Look for a system that allows you to:

- Store comprehensive client profiles: Capture all relevant client information, including contact details, financial data, tax information, and communication history.

- Segment clients: Categorize clients based on various criteria (e.g., industry, revenue, service level) for targeted marketing and personalized service.

- Manage client interactions: Track all communication with clients, including emails, phone calls, meetings, and notes.

2. Contact Management

Effective contact management is crucial for maintaining strong client relationships. The CRM should:

- Organize contact information: Store and manage contact details for all clients and stakeholders.

- Track communication: Log all interactions with contacts, including emails, calls, and meetings.

- Segment contacts: Group contacts based on various criteria for targeted outreach.

3. Task Management and Automation

Automation is key to efficiency. A good CRM should enable you to:

- Create and assign tasks: Assign tasks to team members and track their progress.

- Automate workflows: Automate repetitive tasks, such as sending invoices, scheduling appointments, and following up on leads.

- Set reminders and notifications: Receive timely reminders for important deadlines and client communications.

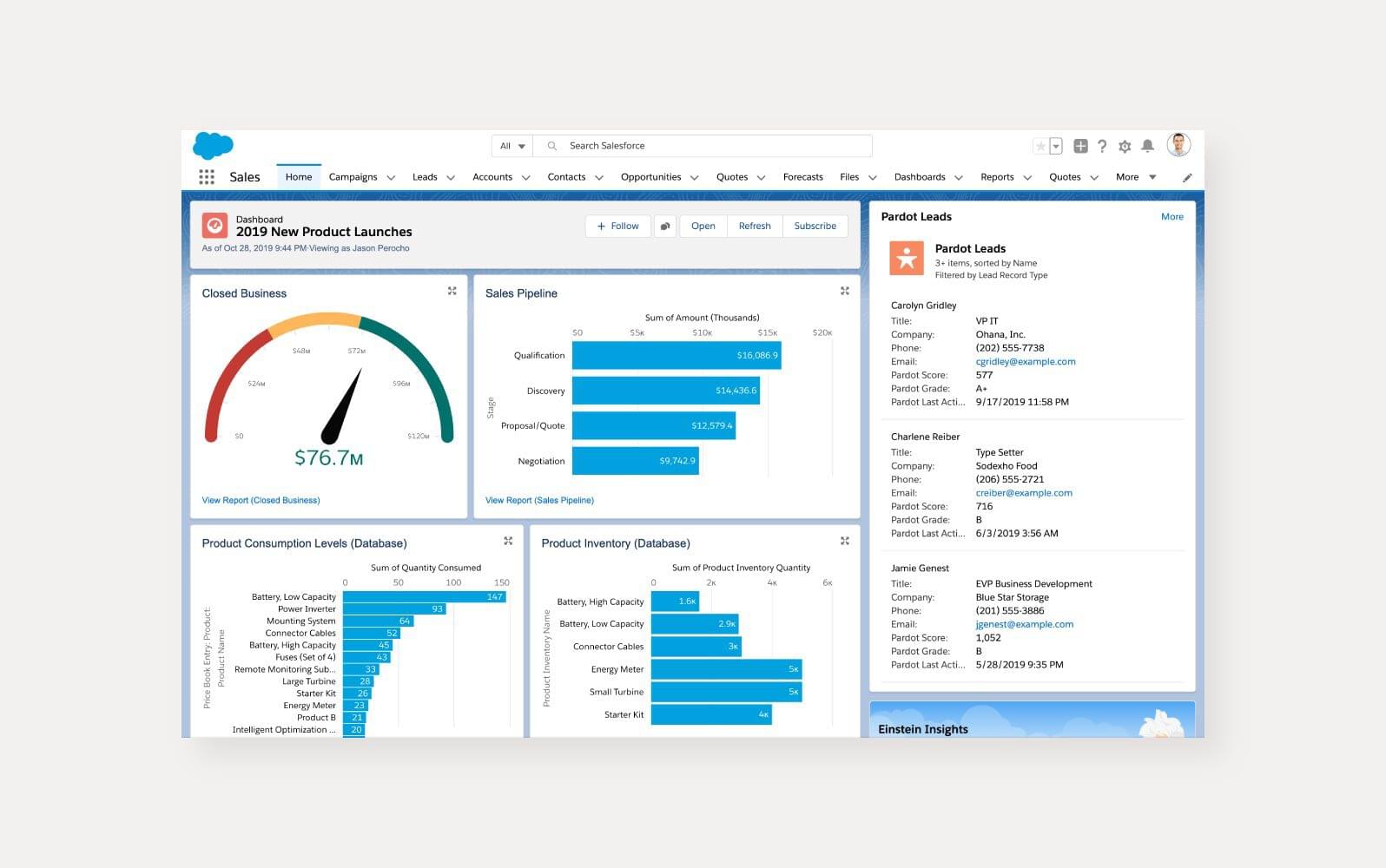

4. Reporting and Analytics

Data-driven insights are essential for making informed decisions. Your CRM should provide:

- Customizable dashboards: View key performance indicators (KPIs) and track progress towards your goals.

- Detailed reports: Generate reports on client interactions, sales performance, and other relevant metrics.

- Data visualization: Visualize data using charts and graphs to gain a clear understanding of your firm’s performance.

5. Integration Capabilities

Seamless integration with other software is crucial for streamlining your workflow. The CRM should integrate with:

- Accounting software: Integrate with popular accounting software like QuickBooks, Xero, and Sage to streamline data entry and reporting.

- Email marketing platforms: Connect with email marketing platforms like Mailchimp and Constant Contact to automate marketing campaigns.

- Calendar and scheduling tools: Integrate with calendar tools like Google Calendar and Outlook to schedule appointments and manage your time efficiently.

6. Security and Compliance

Data security is paramount, especially when dealing with sensitive financial information. The CRM should:

- Offer robust security measures: Implement security measures to protect client data from unauthorized access.

- Comply with industry regulations: Ensure compliance with relevant industry regulations, such as GDPR and CCPA.

Top CRM Systems for Small Accounting Firms in 2024

Now, let’s explore some of the best CRM systems specifically designed for small accounting firms:

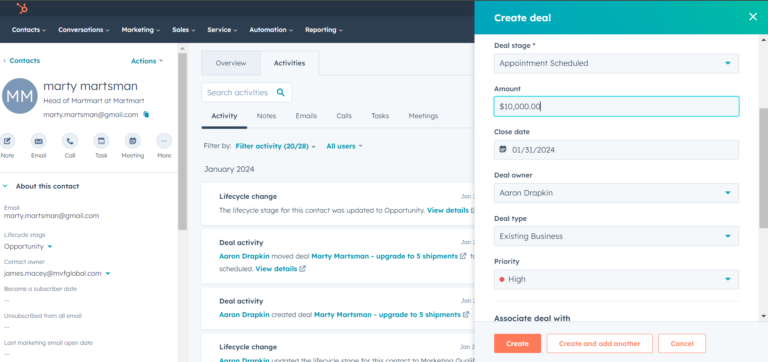

1. HubSpot CRM

HubSpot CRM is a popular choice, known for its user-friendliness and robust features. It offers a free version with a generous set of functionalities, making it an excellent option for small firms just starting with CRM. Key features include:

- Free forever plan: Offers a free plan with unlimited users and essential CRM features.

- Contact management: Comprehensive contact management features to store and organize client information.

- Email marketing: Integrated email marketing tools to nurture leads and engage clients.

- Sales automation: Automate sales tasks, such as sending emails and scheduling appointments.

- Integration: Integrates with popular accounting software and other business tools.

- Ease of use: User-friendly interface that is easy to learn and navigate.

Pros: User-friendly, free plan, strong marketing automation capabilities, excellent integration options.

Cons: The free plan has limitations on features and storage; advanced features require paid subscriptions.

2. Zoho CRM

Zoho CRM is a feature-rich CRM system that offers a variety of plans to suit different business needs. It is a good option for accounting firms looking for a comprehensive CRM solution with advanced features. Key features include:

- Customization: Highly customizable to meet the specific needs of your firm.

- Workflow automation: Automate complex workflows to streamline your operations.

- Sales force automation: Manage your sales pipeline and track sales performance.

- Reporting and analytics: Generate detailed reports and gain insights into your business.

- Integration: Integrates with a wide range of third-party applications.

- Pricing: Offers a range of pricing plans to fit different budgets.

Pros: Highly customizable, advanced automation features, robust reporting capabilities, affordable pricing.

Cons: Can be complex to set up and configure; the interface may feel overwhelming for some users.

3. Pipedrive

Pipedrive is a sales-focused CRM that is known for its simplicity and ease of use. It is a great option for accounting firms that want a CRM that is focused on managing their sales pipeline and closing deals. Key features include:

- Visual sales pipeline: Visualize your sales pipeline and track deals through each stage.

- Deal management: Manage deals and track their progress towards closure.

- Contact management: Store and organize contact information for clients and prospects.

- Email integration: Integrate with your email provider to track email conversations and schedule follow-ups.

- Automation: Automate repetitive tasks to save time and improve efficiency.

- User-friendly interface: Easy to learn and use, with a clean and intuitive interface.

Pros: Simple and intuitive interface, excellent sales pipeline management, easy to set up and use.

Cons: Limited features compared to other CRM systems; may not be suitable for firms with complex needs.

4. Freshsales

Freshsales is a comprehensive CRM system that offers a range of features for sales, marketing, and customer service. It is a good option for accounting firms that want a CRM that can handle all aspects of their client relationships. Key features include:

- Contact management: Comprehensive contact management features to store and organize client information.

- Sales automation: Automate sales tasks, such as sending emails and scheduling appointments.

- Email marketing: Integrated email marketing tools to nurture leads and engage clients.

- Telephony: Integrated telephony features to make and receive calls directly from the CRM.

- Reporting and analytics: Generate detailed reports and gain insights into your business.

- Customer service: Integrated customer service features to provide excellent client support.

Pros: Comprehensive features, excellent customer service tools, user-friendly interface.

Cons: Can be expensive for small firms; some advanced features require paid subscriptions.

5. Keap (formerly Infusionsoft)

Keap is a CRM and marketing automation platform designed for small businesses. It is a good option for accounting firms that want a CRM that can automate their marketing and sales processes. Key features include:

- Marketing automation: Automate your marketing campaigns, such as sending emails and creating landing pages.

- Sales automation: Automate your sales tasks, such as sending proposals and following up on leads.

- Contact management: Comprehensive contact management features to store and organize client information.

- E-commerce: Integrated e-commerce features to sell your services online.

- Reporting and analytics: Generate detailed reports and gain insights into your business.

- Segmentation: Segment your contacts based on their behavior and preferences.

Pros: Powerful marketing automation features, excellent lead management capabilities, good for e-commerce.

Cons: Can be complex to set up and use; expensive compared to other CRM systems.

6. Insightly

Insightly is a CRM that is focused on project management and sales. It is a good option for accounting firms that want a CRM that can help them manage their projects and track their sales pipeline. Key features include:

- Project management: Manage projects and track their progress.

- Sales pipeline management: Manage your sales pipeline and track deals through each stage.

- Contact management: Store and organize contact information for clients and prospects.

- Workflow automation: Automate repetitive tasks to save time and improve efficiency.

- Reporting and analytics: Generate detailed reports and gain insights into your business.

- Integration: Integrates with a variety of third-party applications.

Pros: Project management features, good for sales pipeline management, user-friendly interface.

Cons: Limited marketing automation features; may not be suitable for firms with complex needs.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM is a critical decision. Here’s a step-by-step guide to help you choose the best CRM for your small accounting firm:

- Assess Your Needs: Before you start evaluating CRM systems, take the time to assess your firm’s specific needs and requirements. Consider your current processes, pain points, and goals. What are you hoping to achieve with a CRM? What features are essential?

- Define Your Budget: Determine how much you’re willing to spend on a CRM system. Pricing varies significantly between different providers, with options ranging from free to thousands of dollars per month. Consider not only the monthly subscription cost but also any potential implementation costs, training expenses, and the cost of integrations.

- Research CRM Systems: Research different CRM systems and compare their features, pricing, and reviews. Look for systems that are specifically designed for small businesses and offer the features you need. Read online reviews and testimonials to get insights into other users’ experiences.

- Create a Shortlist: Narrow down your options to a shortlist of 2-3 CRM systems that best meet your needs and budget.

- Request Demos and Trials: Request demos or free trials of the shortlisted CRM systems. This will give you the opportunity to test the systems and see how they work in practice.

- Evaluate User Experience: Pay close attention to the user experience. Is the system easy to use and navigate? Does it offer a clean and intuitive interface? Consider how easy it will be for your team to learn and adopt the new system.

- Assess Integration Capabilities: Ensure that the CRM system integrates with the other software and tools you use, such as accounting software, email marketing platforms, and calendar tools.

- Consider Scalability: Choose a CRM system that can scale with your business. As your firm grows, you’ll need a CRM that can accommodate your increasing number of clients and users.

- Factor in Support and Training: Consider the level of support and training offered by the CRM provider. Do they offer comprehensive documentation, tutorials, and customer support? Will they provide training to help your team get up to speed quickly?

- Make Your Decision: Based on your research, testing, and evaluation, make a decision on which CRM system is the best fit for your small accounting firm.

Implementation and Training: Setting Your Firm Up for Success

Once you’ve chosen your CRM, successful implementation and training are crucial for maximizing its benefits. Here’s how to set your firm up for success:

- Plan Your Implementation: Develop a detailed implementation plan, including timelines, responsibilities, and milestones.

- Import Your Data: Import your existing client data into the CRM system. Ensure that the data is accurate and complete.

- Customize the System: Customize the CRM system to meet your firm’s specific needs. Configure the system to reflect your workflows, processes, and branding.

- Provide Training: Provide comprehensive training to your team. Ensure that everyone understands how to use the system and its features.

- Encourage Adoption: Encourage your team to use the CRM system consistently. Emphasize the benefits of using the system and provide ongoing support.

- Monitor Performance: Monitor the performance of the CRM system. Track key metrics and make adjustments as needed.

- Seek Ongoing Support: Seek ongoing support from the CRM provider. Take advantage of their resources, such as documentation, tutorials, and customer support.

The Long-Term Benefits of CRM for Accountants

Investing in the right CRM system is an investment in the long-term success of your small accounting firm. The benefits extend far beyond just organizing client data; they include:

- Increased Client Satisfaction: By providing personalized service and timely communication, a CRM can significantly increase client satisfaction and loyalty.

- Improved Efficiency: Automating tasks and streamlining workflows frees up your team’s time to focus on higher-value activities.

- Enhanced Profitability: By improving efficiency, increasing client satisfaction, and identifying opportunities for upselling and cross-selling, a CRM can boost your firm’s profitability.

- Better Decision-Making: Data-driven insights from your CRM empower you to make informed decisions and improve your firm’s performance.

- Scalability: A CRM system can scale with your business, allowing you to manage an increasing number of clients and grow your firm.

- Competitive Advantage: By leveraging the power of a CRM, you can gain a competitive advantage and stay ahead of the curve in the accounting industry.

Conclusion: Embracing the Future of Accounting with CRM

In conclusion, a CRM system is no longer a luxury but a necessity for small accounting firms striving for success in today’s competitive landscape. By centralizing client data, streamlining workflows, improving communication, and providing data-driven insights, a CRM can transform your practice, driving efficiency, boosting profitability, and enhancing client relationships. By carefully evaluating your firm’s needs, researching different CRM systems, and implementing the system effectively, you can unlock the full potential of CRM and propel your small accounting firm towards a future of growth and prosperity. Embrace the power of CRM and take your accounting practice to the next level!