Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

In the fast-paced world of accounting, staying organized and connected with your clients is paramount. As a small accounting firm, you’re likely juggling multiple clients, deadlines, and financial complexities. This is where a Customer Relationship Management (CRM) system becomes an invaluable asset. A well-chosen CRM can streamline your operations, enhance client relationships, and ultimately, boost your bottom line. But with so many options available, selecting the right CRM for your specific needs can feel overwhelming. This comprehensive guide will delve into the best CRM systems tailored for small accounting firms in 2024, helping you make an informed decision and transform your business.

Why Your Small Accounting Firm Needs a CRM

Before we dive into specific CRM solutions, let’s understand why a CRM is so crucial for your accounting practice. Think of it as the central nervous system of your client interactions. It’s where you store, manage, and analyze all client-related information, from contact details and communication history to financial data and project progress. Here’s a breakdown of the key benefits:

- Improved Client Relationship Management: A CRM provides a 360-degree view of each client, allowing you to personalize your interactions and build stronger relationships. You can track communication, understand their needs, and proactively offer relevant services.

- Enhanced Organization and Efficiency: Say goodbye to scattered spreadsheets and lost emails. A CRM centralizes all client data, making it easy to find what you need, when you need it. This saves time, reduces errors, and improves overall efficiency.

- Streamlined Communication: CRM systems often integrate with email, phone, and other communication channels, allowing you to manage all client interactions from a single platform. This ensures consistent messaging and eliminates the risk of missed communications.

- Better Lead Management: If you’re actively seeking new clients, a CRM can help you track leads, nurture them through the sales funnel, and convert them into paying customers.

- Increased Productivity: Automation features in many CRM systems can automate repetitive tasks, such as sending follow-up emails and scheduling appointments, freeing up your time to focus on more strategic activities.

- Data-Driven Decision Making: CRM systems provide valuable insights into your client base, service performance, and overall business health. This data can inform your decision-making and help you identify areas for improvement.

- Compliance and Security: Many CRM systems offer robust security features and compliance capabilities, helping you protect sensitive client data and meet industry regulations.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider these essential features:

- Contact Management: The core of any CRM, contact management allows you to store and organize client contact information, including names, addresses, phone numbers, email addresses, and other relevant details.

- Communication Tracking: This feature tracks all client interactions, including emails, phone calls, meetings, and notes. It provides a complete history of your communication with each client.

- Task Management: Assign tasks to team members, set deadlines, and track progress. This helps you stay organized and ensure that all client projects are completed on time.

- Calendar and Scheduling: Integrate your CRM with your calendar to schedule appointments, meetings, and deadlines. This helps you avoid scheduling conflicts and manage your time effectively.

- Lead Management: If you’re actively seeking new clients, a lead management feature allows you to track leads, nurture them through the sales funnel, and convert them into paying customers.

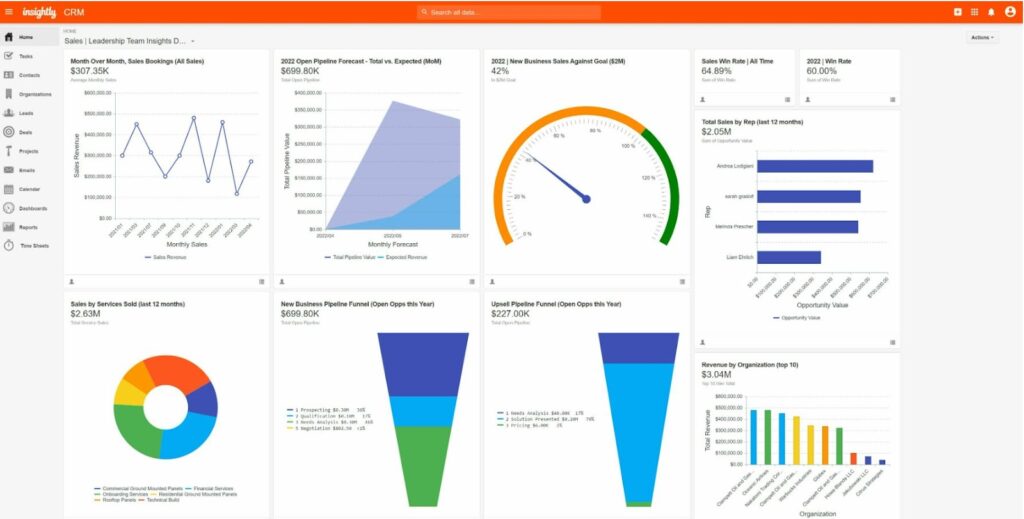

- Reporting and Analytics: Generate reports on key metrics, such as client engagement, service performance, and revenue. This data can help you identify areas for improvement and make data-driven decisions.

- Integration with Accounting Software: Seamless integration with your existing accounting software, such as QuickBooks or Xero, is crucial. This allows you to sync client data, track invoices, and manage financial information in one place.

- Customization: The ability to customize the CRM to fit your specific needs is essential. Look for a system that allows you to create custom fields, workflows, and reports.

- Mobile Accessibility: Access your CRM data on the go with a mobile app. This allows you to stay connected with your clients and manage your business from anywhere.

- Security and Compliance: Choose a CRM that offers robust security features and complies with industry regulations, such as GDPR and CCPA, to protect sensitive client data.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems tailored for small accounting firms in 2024:

1. HubSpot CRM

HubSpot CRM is a popular and versatile option that offers a free version with robust features. It’s known for its user-friendly interface, ease of use, and comprehensive suite of tools. HubSpot CRM is an excellent choice for small accounting firms looking for a CRM that’s easy to implement and scalable. Its free plan offers a surprising amount of functionality, making it an attractive option for those just starting out or on a tight budget.

Key Features:

- Free Forever Plan: Offers a generous free plan with contact management, deal tracking, and email marketing features.

- User-Friendly Interface: Intuitive and easy to navigate, making it simple for accounting professionals with limited CRM experience to adopt.

- Contact Management: Stores detailed client information, including contact details, communication history, and deal information.

- Deal Tracking: Tracks leads through the sales pipeline, helping you manage potential clients and close deals.

- Email Marketing: Create and send email campaigns to nurture leads and engage with clients.

- Integration with Accounting Software: Integrates with popular accounting software like QuickBooks and Xero through third-party integrations or HubSpot’s own integrations.

- Reporting and Analytics: Provides basic reporting and analytics to track key metrics.

- Scalability: Offers paid plans with advanced features for growing businesses.

Pros:

- Free plan with robust features

- User-friendly interface

- Excellent for lead management

- Scalable to accommodate growth

Cons:

- Limited features in the free plan

- Advanced features require paid plans

- Integration with accounting software may require extra setup

2. Zoho CRM

Zoho CRM is a feature-rich CRM system that offers a variety of plans to suit different business needs. It’s a great option for small accounting firms looking for a comprehensive CRM with advanced features and customization options. Zoho CRM’s flexibility and affordability make it a strong contender for businesses of all sizes.

Key Features:

- Comprehensive Features: Offers a wide range of features, including contact management, sales automation, marketing automation, and more.

- Customization: Highly customizable, allowing you to tailor the CRM to your specific needs.

- Workflow Automation: Automate repetitive tasks, such as sending emails and assigning tasks.

- Reporting and Analytics: Provides detailed reporting and analytics to track key metrics.

- Integration with Accounting Software: Integrates with popular accounting software like QuickBooks and Xero through third-party integrations or Zoho’s own integrations.

- Mobile App: Access your CRM data on the go with a mobile app.

- Scalability: Offers a variety of plans to suit different business needs and budgets.

Pros:

- Feature-rich

- Highly customizable

- Workflow automation

- Affordable pricing plans

Cons:

- Can be overwhelming for beginners

- Steeper learning curve than some other options

- Integration with accounting software may require extra setup

3. Pipedrive

Pipedrive is a sales-focused CRM that’s designed to help businesses manage their sales pipeline and close deals. It’s a good option for small accounting firms that want to focus on lead management and sales conversions. Pipedrive’s visual interface and focus on sales make it a favorite among sales-driven teams.

Key Features:

- Sales Pipeline Management: Visual sales pipeline with drag-and-drop functionality.

- Contact Management: Stores detailed client information, including contact details, communication history, and deal information.

- Deal Tracking: Tracks leads through the sales pipeline, helping you manage potential clients and close deals.

- Email Integration: Integrates with your email to track communication and manage your inbox.

- Reporting and Analytics: Provides reporting and analytics to track key sales metrics.

- Mobile App: Access your CRM data on the go with a mobile app.

- Integrations: Integrates with a variety of third-party apps, including accounting software through integrations.

Pros:

- User-friendly interface

- Excellent for sales pipeline management

- Visual sales pipeline

- Easy to set up and use

Cons:

- Less focused on marketing automation

- Limited features in the basic plan

- May not be as comprehensive as other options

4. Freshsales

Freshsales is a CRM system that offers a balance of features and ease of use. It’s a good option for small accounting firms that want a CRM that’s easy to implement and offers a good range of features. Freshsales is known for its intuitive interface and excellent customer support.

Key Features:

- Contact Management: Stores detailed client information, including contact details, communication history, and deal information.

- Sales Automation: Automate repetitive tasks, such as sending emails and assigning tasks.

- Lead Scoring: Score leads based on their behavior and engagement.

- Reporting and Analytics: Provides reporting and analytics to track key sales metrics.

- Email Integration: Integrates with your email to track communication and manage your inbox.

- Mobile App: Access your CRM data on the go with a mobile app.

- Integrations: Integrates with a variety of third-party apps, including accounting software through integrations.

Pros:

- User-friendly interface

- Good range of features

- Excellent customer support

- Affordable pricing plans

Cons:

- Some advanced features require paid plans

- May not be as customizable as other options

5. Capsule CRM

Capsule CRM is a simple and straightforward CRM that’s designed for small businesses. It’s a good option for small accounting firms that want a CRM that’s easy to use and doesn’t require a lot of training. Capsule CRM focuses on simplicity and ease of use, making it ideal for teams that prioritize a streamlined experience.

Key Features:

- Contact Management: Stores detailed client information, including contact details, communication history, and deal information.

- Task Management: Assign tasks to team members and track progress.

- Deal Tracking: Tracks leads through the sales pipeline, helping you manage potential clients and close deals.

- Reporting and Analytics: Provides basic reporting and analytics.

- Email Integration: Integrates with your email to track communication and manage your inbox.

- Integrations: Integrates with a variety of third-party apps, including accounting software through integrations.

Pros:

- Easy to use

- Simple and straightforward

- Affordable pricing plans

Cons:

- Limited features

- May not be suitable for complex businesses

- Less customization options

Choosing the Right CRM for Your Accounting Firm

Selecting the perfect CRM isn’t a one-size-fits-all process. The best CRM for your firm will depend on your specific needs, budget, and technical expertise. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Determine your firm’s specific needs and goals. What problems are you trying to solve with a CRM? What features are essential?

- Define Your Budget: Set a budget for your CRM system, including the cost of the software, implementation, and ongoing maintenance.

- Research Options: Research different CRM systems and compare their features, pricing, and reviews.

- Request Demos: Request demos from your top choices to get a better understanding of their functionality and user interface.

- Consider Integrations: Ensure that the CRM integrates with your existing accounting software and other tools.

- Evaluate User Experience: Consider the user experience and ease of use of each CRM.

- Read Reviews: Read reviews from other accounting firms to get insights into their experiences.

- Start a Free Trial: Take advantage of free trials to test out the CRM and see if it’s a good fit for your firm.

- Implement and Train: Once you’ve chosen a CRM, implement it and train your team on how to use it effectively.

- Ongoing Evaluation: Regularly evaluate your CRM and make adjustments as needed to ensure that it’s meeting your needs.

Implementation and Best Practices

Once you’ve chosen a CRM, successful implementation is key to maximizing its benefits. Here are some best practices to follow:

- Data Migration: Migrate your existing client data into the CRM system accurately and efficiently.

- Training: Provide thorough training to your team on how to use the CRM and its features.

- Customization: Customize the CRM to fit your firm’s specific needs and workflows.

- Integration: Integrate the CRM with your existing accounting software and other tools.

- Data Entry Standards: Establish clear data entry standards to ensure data accuracy and consistency.

- Regular Use: Encourage your team to use the CRM consistently to track client interactions, manage tasks, and generate reports.

- Ongoing Support: Provide ongoing support and training to your team to ensure that they’re using the CRM effectively.

- Regular Reviews: Regularly review your CRM usage and make adjustments as needed to optimize its performance.

- Security Measures: Implement strong security measures to protect client data.

The Future of CRM in Accounting

The accounting landscape is constantly evolving, and CRM systems are adapting to meet the changing needs of accounting firms. Here are some trends to watch for:

- Artificial Intelligence (AI): AI-powered features, such as automated data entry and predictive analytics, are becoming increasingly common in CRM systems.

- Automation: Automation features will continue to evolve, allowing accounting firms to automate more tasks and streamline their workflows.

- Integration: CRM systems will continue to integrate with a wider range of tools and platforms, providing a more seamless user experience.

- Mobile Accessibility: Mobile apps will become even more sophisticated, allowing accounting professionals to access their CRM data and manage their businesses from anywhere.

- Data Privacy and Security: Data privacy and security will remain a top priority, with CRM systems offering more robust security features and compliance capabilities.

Conclusion: Embrace the Power of CRM

In today’s competitive accounting landscape, a CRM system is no longer a luxury but a necessity. By choosing the right CRM and implementing it effectively, your small accounting firm can unlock significant benefits, including improved client relationships, enhanced efficiency, and increased profitability. Take the time to research your options, assess your needs, and choose a CRM that will empower your firm to thrive in the years to come. The right CRM is an investment in your firm’s future, and a crucial step towards continued success.