Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

Running a small accounting firm is a juggling act. You’re not just crunching numbers; you’re building relationships, managing client expectations, and chasing deadlines. In this fast-paced environment, efficiency is paramount. This is where a Customer Relationship Management (CRM) system steps in, becoming your indispensable ally. But with a plethora of options available, choosing the right CRM can feel overwhelming. This article delves into the best CRM systems tailored specifically for small accounting firms, offering a comprehensive guide to help you streamline operations, boost client satisfaction, and ultimately, grow your business.

Why Your Accounting Firm Needs a CRM

Before we dive into specific CRM recommendations, let’s explore why a CRM is a game-changer for your accounting practice. Think of it as your central hub for all client-related information. Instead of scattered spreadsheets, sticky notes, and email threads, a CRM consolidates everything in one accessible location. Here’s how it benefits your firm:

- Improved Client Relationship Management: A CRM allows you to track interactions, understand client needs, and personalize your services. This fosters stronger relationships and increases client loyalty.

- Enhanced Organization and Efficiency: By automating tasks, scheduling appointments, and centralizing data, a CRM frees up your time, allowing you to focus on core accounting activities.

- Better Communication: CRM systems often integrate with email and other communication channels, making it easier to stay in touch with clients and respond promptly to inquiries.

- Increased Sales and Revenue: Many CRMs include features for lead management and sales tracking, helping you identify and nurture potential clients.

- Data-Driven Decision Making: With a CRM, you gain valuable insights into client behavior and business performance, enabling you to make informed decisions.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, consider these essential features:

- Contact Management: This is the cornerstone of any CRM. It should allow you to store detailed client information, including contact details, financial data, tax information, and communication history.

- Lead Management: Track potential clients, manage leads through the sales pipeline, and monitor conversion rates.

- Task and Workflow Automation: Automate repetitive tasks such as sending invoices, scheduling follow-up calls, and generating reports.

- Reporting and Analytics: Gain insights into your business performance with customizable reports and dashboards.

- Integration with Accounting Software: Seamless integration with your existing accounting software (e.g., QuickBooks, Xero) is crucial for data synchronization and efficiency.

- Email Marketing Integration: Send targeted email campaigns to clients and prospects.

- Document Management: Securely store and manage client documents within the CRM.

- Mobile Accessibility: Access your CRM data on the go with a mobile app or responsive design.

- Security and Compliance: Ensure the CRM offers robust security features and complies with data privacy regulations.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed or well-suited for small accounting firms:

1. HubSpot CRM

HubSpot is a popular choice, and for good reason. Its free CRM plan offers a robust set of features, making it an excellent starting point for small businesses. While the free version is powerful, HubSpot also offers paid plans with advanced features. Here’s why it’s a top contender:

- User-Friendly Interface: HubSpot is known for its intuitive and easy-to-navigate interface.

- Free Plan: The free plan includes contact management, deal tracking, task management, and email marketing tools.

- Sales Automation: Automate repetitive sales tasks and streamline your sales process.

- Integration Capabilities: Integrates with a wide range of apps, including popular accounting software.

- Reporting and Analytics: Provides detailed reports to track your progress and identify areas for improvement.

- Scalability: Easily scale up to paid plans as your business grows.

Pros: Free plan, ease of use, extensive integration capabilities, strong marketing automation features.

Cons: Free plan has limitations, more advanced features require paid subscriptions, and some users find the interface a little cluttered.

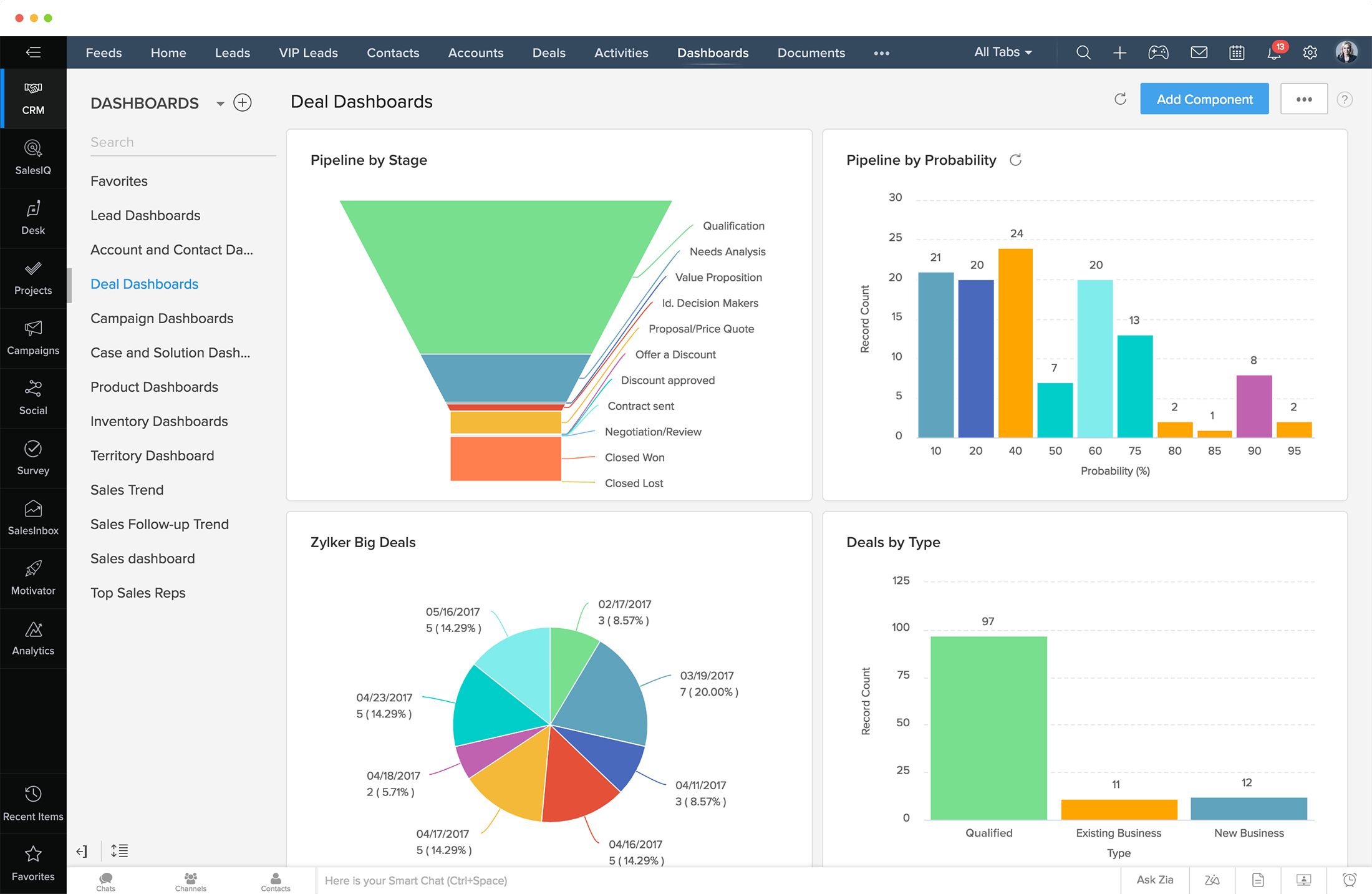

2. Zoho CRM

Zoho CRM is a comprehensive CRM solution that offers a range of features suitable for accounting firms. It’s a strong contender for businesses looking for a customizable and feature-rich platform. Zoho offers a free plan for up to three users, making it a cost-effective option for small firms. Here’s what makes it stand out:

- Customization Options: Highly customizable to fit your specific business needs.

- Automation: Powerful automation features to streamline your workflows.

- Sales Force Automation: Manage your sales pipeline and close more deals.

- Integration Ecosystem: Integrates with a vast array of third-party apps, including accounting software.

- Reporting and Analytics: Offers detailed reporting and analytics to track your performance.

- Pricing: Offers a range of pricing plans to suit different budgets.

Pros: Highly customizable, robust automation features, extensive integration capabilities, affordable pricing.

Cons: Can be overwhelming for beginners due to the number of features, the interface might feel a bit complex, and the free plan has limited functionality.

3. Pipedrive

Pipedrive is a sales-focused CRM designed to help you manage your sales pipeline and close deals. Its visual interface and intuitive design make it a favorite among sales teams. While not specifically designed for accountants, its focus on sales management makes it a valuable tool for attracting and converting new clients. Here’s why it’s worth considering:

- Visual Sales Pipeline: Provides a clear and intuitive view of your sales pipeline.

- Deal Tracking: Easily track deals through each stage of the sales process.

- Automation: Automate repetitive tasks and streamline your sales workflows.

- Email Integration: Integrate with your email provider to track and manage email communications.

- Reporting and Analytics: Offers sales-focused reports to track your performance.

- User-Friendly Interface: Simple and easy to use, with a focus on sales productivity.

Pros: User-friendly interface, visual sales pipeline, strong sales automation features, and a focus on sales productivity.

Cons: Less emphasis on client relationship management features, and may not be as suitable if you need extensive contact management features beyond sales.

4. Insightly

Insightly is a CRM that caters to small businesses, offering a blend of sales, marketing, and project management features. It’s a good option for accounting firms that need a CRM to manage both client relationships and internal projects. Here’s why it’s a solid choice:

- Contact Management: Robust contact management features to store and organize client data.

- Lead Management: Manage leads and track their progress through the sales pipeline.

- Project Management: Manage client projects and track deadlines.

- Email Integration: Integrate with your email provider to track and manage email communications.

- Reporting and Analytics: Offers reporting and analytics to track your performance.

- Integration Capabilities: Integrates with popular apps, including accounting software.

Pros: Combines CRM and project management features, user-friendly interface, and affordable pricing.

Cons: Some users find the interface a bit basic, and the project management features may not be as robust as dedicated project management software.

5. Agile CRM

Agile CRM is a versatile CRM that offers a wide range of features at a competitive price. It’s particularly well-suited for businesses that need a CRM with sales, marketing, and customer service capabilities. It offers a free plan and affordable paid plans. Here’s what you need to know:

- Contact Management: Comprehensive contact management features to store and organize client data.

- Sales Automation: Automate repetitive sales tasks and streamline your sales process.

- Marketing Automation: Offers marketing automation features to nurture leads and engage clients.

- Helpdesk: Includes helpdesk features to manage client support requests.

- Integration Capabilities: Integrates with a wide range of apps, including accounting software.

- Pricing: Offers a free plan and affordable paid plans.

Pros: All-in-one platform with sales, marketing, and customer service features, affordable pricing, and a free plan.

Cons: The interface might feel a bit cluttered, and the marketing automation features may not be as advanced as dedicated marketing automation tools.

Implementing Your CRM: A Step-by-Step Guide

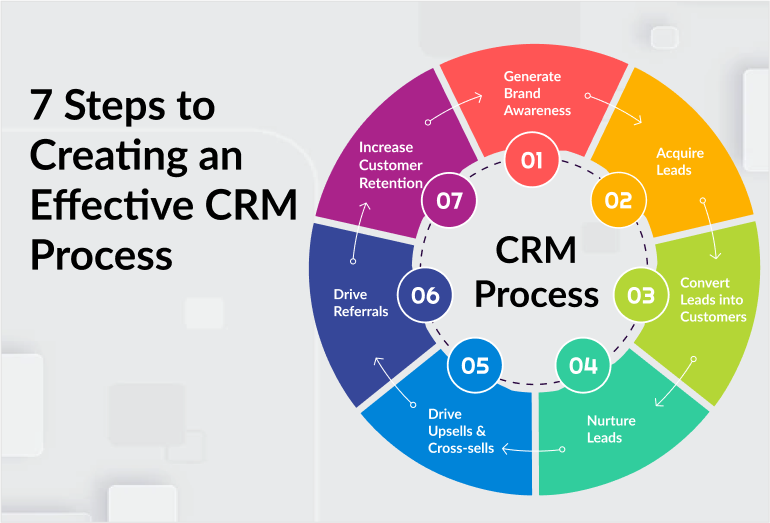

Choosing the right CRM is only the first step. Successfully implementing a CRM requires careful planning and execution. Here’s a step-by-step guide to help you get started:

- Define Your Goals: Before you implement a CRM, identify your specific goals. What do you want to achieve with the CRM? Improve client relationships? Increase sales? Streamline workflows?

- Choose the Right CRM: Based on your goals and needs, select the CRM that best fits your firm. Consider the features, pricing, and integration capabilities.

- Data Migration: Migrate your existing client data from spreadsheets, databases, or other systems into the CRM.

- Customize Your CRM: Customize the CRM to fit your specific business needs. Configure fields, create workflows, and set up automation rules.

- Train Your Team: Provide training to your team on how to use the CRM. Ensure everyone understands how to enter data, manage clients, and use the features.

- Integrate with Other Systems: Integrate your CRM with your accounting software, email provider, and other relevant systems.

- Test and Refine: Test the CRM to ensure it’s working correctly. Refine your workflows and settings as needed.

- Monitor and Evaluate: Regularly monitor your CRM usage and evaluate its effectiveness. Make adjustments as needed to optimize your results.

Tips for CRM Success in Your Accounting Firm

To maximize the benefits of your CRM, consider these additional tips:

- Embrace Automation: Automate as many tasks as possible to save time and improve efficiency.

- Keep Data Accurate: Ensure your client data is accurate and up-to-date.

- Use the CRM Consistently: Encourage your team to use the CRM consistently for all client-related activities.

- Personalize Your Communications: Use the CRM to personalize your communications with clients.

- Analyze Your Data: Regularly analyze your CRM data to gain insights into your business performance.

- Seek Feedback: Ask your team and clients for feedback on the CRM and make adjustments as needed.

- Stay Updated: Keep up-to-date with the latest CRM features and updates.

The Future of CRM in Accounting

The accounting landscape is constantly evolving, and CRM technology is keeping pace. Here’s what you can expect to see in the future:

- AI-Powered Features: Expect to see more AI-powered features, such as predictive analytics and automated data entry.

- Enhanced Integrations: CRM systems will continue to integrate with a wider range of apps and platforms.

- Greater Focus on Mobile: Mobile CRM features will become even more sophisticated.

- Increased Personalization: CRM systems will enable even greater personalization of client interactions.

Conclusion: Embracing the Power of CRM

In the competitive world of accounting, a CRM is no longer a luxury; it’s a necessity. By choosing the right CRM and implementing it effectively, you can streamline your operations, strengthen client relationships, and drive growth for your firm. The systems mentioned above, like HubSpot, Zoho, Pipedrive, Insightly, and Agile CRM, each offer unique advantages for small accounting firms. Evaluate your specific needs, explore these options, and take the first step towards a more efficient and successful future for your practice. Investing in a CRM is investing in your firm’s future.