Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

In the fast-paced world of accounting, staying organized and connected with clients is crucial for success. As a small accounting firm, you likely juggle multiple clients, deadlines, and financial data. This is where a Customer Relationship Management (CRM) system steps in, offering a centralized platform to manage client interactions, streamline workflows, and ultimately, boost your bottom line. But with a plethora of options available, choosing the right CRM can feel overwhelming. This comprehensive guide dives deep into the best CRM systems tailored specifically for small accounting firms in 2024, helping you make an informed decision and transform your business.

Why Your Small Accounting Firm Needs a CRM

You might be thinking, “Do I really need a CRM?” The answer is a resounding yes! A CRM isn’t just for large corporations; it’s a valuable asset for small accounting firms looking to scale and thrive. Here’s why:

- Improved Client Relationships: A CRM provides a 360-degree view of your clients, storing all interactions, communication history, and relevant information in one place. This allows you to personalize your interactions, understand their needs better, and build stronger, more loyal relationships.

- Enhanced Organization and Efficiency: Say goodbye to scattered spreadsheets and lost emails. A CRM centralizes client data, making it easy to access information, track tasks, and manage deadlines. This streamlined approach saves time and reduces the risk of errors.

- Lead Generation and Management: CRM systems often include features to capture and nurture leads, helping you convert prospects into paying clients. You can track lead sources, automate follow-ups, and monitor the progress of each potential client.

- Increased Productivity: Automate repetitive tasks, such as sending invoices or scheduling appointments, freeing up your time to focus on higher-value activities like providing expert financial advice.

- Data-Driven Decision Making: CRM systems provide valuable insights into your client base, helping you identify trends, understand client behavior, and make data-driven decisions to improve your services and grow your business.

- Better Collaboration: Many CRM platforms offer collaboration features, allowing your team to easily share client information, coordinate tasks, and stay on the same page, regardless of location.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider these essential features:

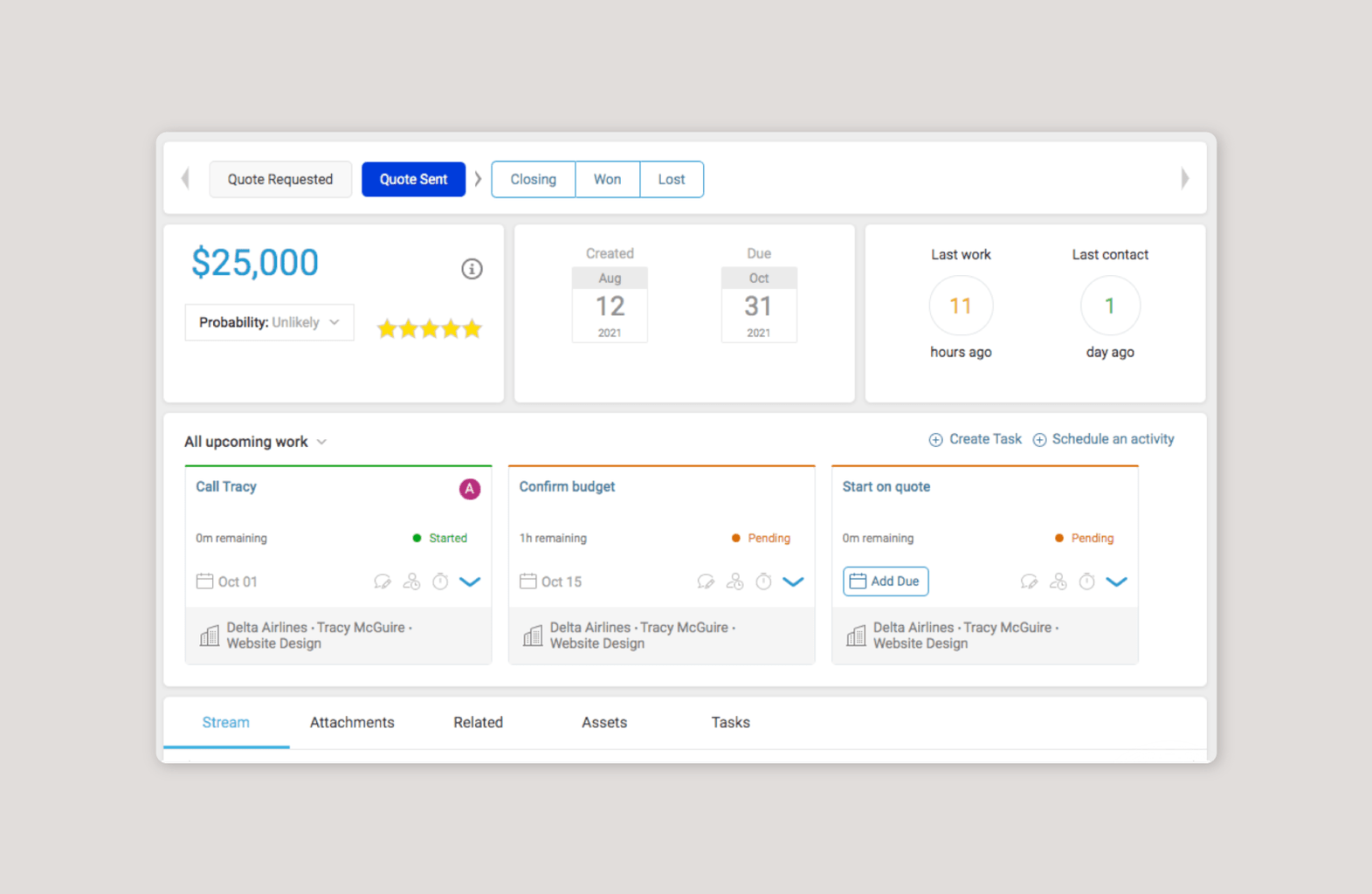

- Client Management: The core function of any CRM. Look for features that allow you to store detailed client information, including contact details, financial data, communication history, and relevant documents.

- Contact Management: Organize and manage all your contacts efficiently. This includes the ability to segment contacts, add notes, and track interactions.

- Lead Management: Features to capture, track, and nurture leads, including lead scoring, automated follow-ups, and sales pipeline management.

- Task Management: Create and assign tasks to team members, set deadlines, and track progress to ensure timely completion of client work.

- Appointment Scheduling: Integrate with your calendar to schedule and manage appointments with clients, reducing the back-and-forth of scheduling.

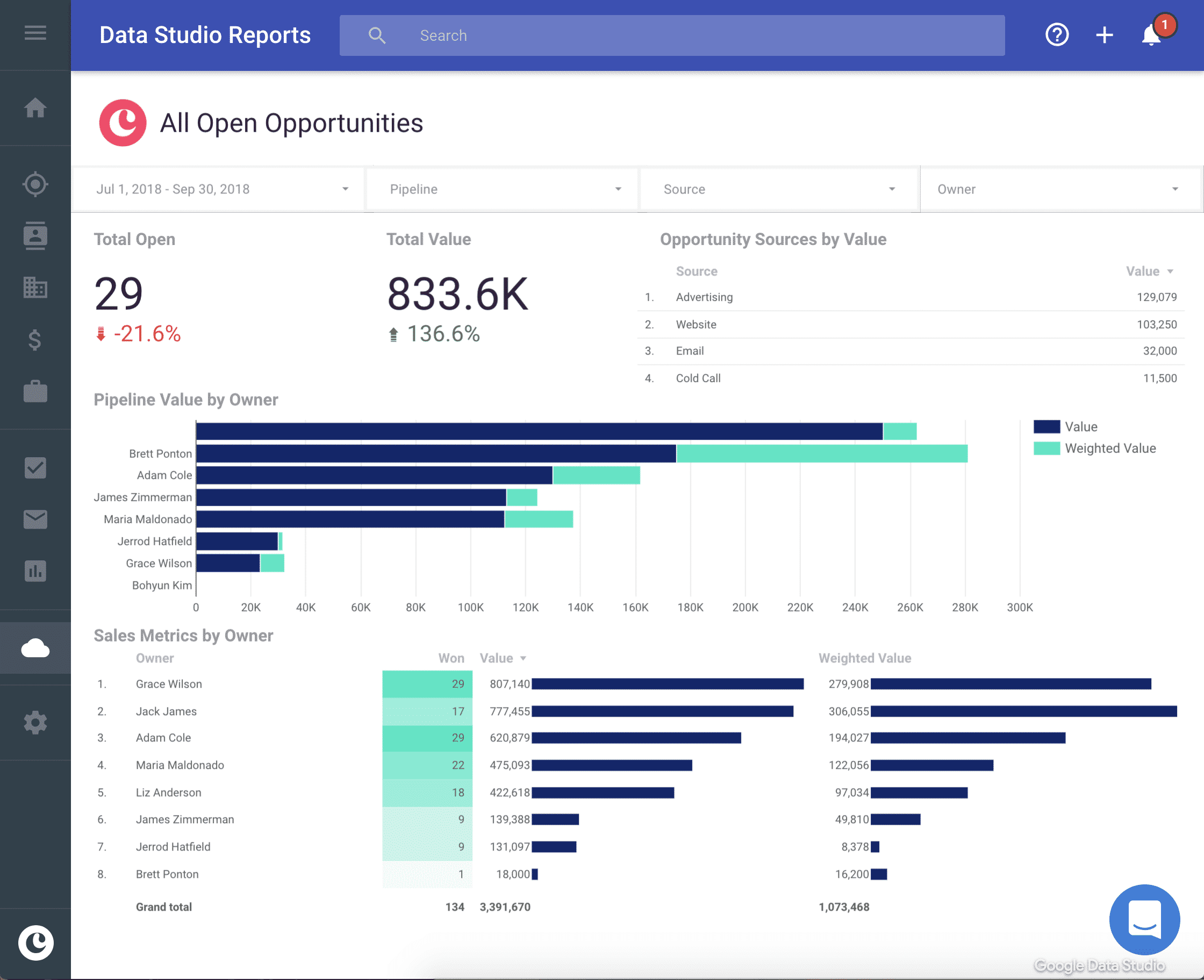

- Reporting and Analytics: Gain valuable insights into your business performance with customizable reports and dashboards that track key metrics such as client acquisition cost, client retention rate, and revenue per client.

- Integration with Accounting Software: Seamless integration with your existing accounting software (e.g., QuickBooks, Xero) is crucial for data synchronization and eliminating manual data entry.

- Email Integration: Integrate with your email provider to track email conversations, send mass emails, and automate email marketing campaigns.

- Security and Data Protection: Ensure the CRM system offers robust security measures to protect sensitive client data, including encryption, access controls, and compliance with relevant regulations (e.g., GDPR, CCPA).

- Mobile Accessibility: Access your CRM data and manage your business on the go with a mobile app or a responsive web design.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed or well-suited for small accounting firms:

1. HubSpot CRM

HubSpot CRM is a popular choice, especially for its free version, which offers a robust set of features. While the free version is excellent for getting started, the paid versions provide even more advanced functionalities that can benefit your accounting firm. HubSpot is known for its user-friendly interface and comprehensive marketing, sales, and customer service tools.

Key Features for Accountants:

- Free CRM: A powerful, free CRM that includes contact management, deal tracking, task management, and email integration.

- Marketing Automation: Automate email marketing campaigns, personalize your communications, and nurture leads.

- Sales Pipeline Management: Track deals, manage your sales pipeline, and close more deals with its visual interface.

- Integration with Accounting Software: Integrates with popular accounting software through third-party apps or custom integrations.

- Reporting and Analytics: Generate insightful reports to track your performance and make data-driven decisions.

Pros: Free version available, user-friendly interface, comprehensive features, strong marketing automation capabilities.

Cons: Limited features in the free version, may require additional integrations for accounting-specific functionalities.

2. Zoho CRM

Zoho CRM is a versatile and affordable CRM system that caters to businesses of all sizes. It offers a wide range of features, including sales automation, marketing automation, and customer service tools, making it a great option for small accounting firms looking for a comprehensive solution.

Key Features for Accountants:

- Customization: Highly customizable to tailor the CRM to your specific needs and workflows.

- Sales Automation: Automate sales processes, such as lead assignment, follow-ups, and deal stages.

- Workflow Automation: Automate repetitive tasks, such as sending invoices and scheduling appointments.

- Integration with Accounting Software: Integrates with popular accounting software through third-party apps or custom integrations.

- Advanced Reporting and Analytics: Generate in-depth reports and dashboards to track your performance.

Pros: Affordable, highly customizable, comprehensive features, strong automation capabilities.

Cons: Interface may feel overwhelming for some users, requires some setup and configuration.

3. Pipedrive

Pipedrive is a sales-focused CRM system that excels at helping you manage your sales pipeline and close more deals. Its intuitive interface and visual pipeline make it easy to track leads and opportunities. While it’s not specifically designed for accounting firms, its core features can be adapted to manage client relationships and track client work.

Key Features for Accountants:

- Visual Pipeline: Track leads and opportunities through a visual pipeline, making it easy to manage your sales process.

- Deal Tracking: Track deals and their progress, with customizable deal stages and sales activities.

- Contact Management: Store detailed client information, including contact details, communication history, and relevant documents.

- Automation: Automate repetitive tasks, such as sending emails and scheduling follow-ups.

- Reporting and Analytics: Generate reports to track your sales performance and identify areas for improvement.

Pros: User-friendly interface, visual pipeline, strong sales automation capabilities.

Cons: Less focused on accounting-specific features, may require additional integrations for accounting functionalities.

4. Freshsales

Freshsales, part of the Freshworks suite, is a CRM that combines sales and marketing features. It’s known for its ease of use and affordability, making it a suitable option for small accounting firms. Its integrated features help in managing leads and nurturing them through the sales cycle.

Key Features for Accountants:

- Built-in Phone and Email: Make calls and send emails directly from the CRM.

- Lead Scoring: Prioritize leads based on their activity and engagement.

- Workflow Automation: Automate tasks such as lead assignment, follow-ups, and deal updates.

- Reporting: Generate reports on sales performance and track key metrics.

- Integration: Integrates with other Freshworks products and third-party apps.

Pros: Easy to use, affordable, integrated sales and marketing features.

Cons: May lack some advanced features compared to other CRM systems.

5. Capsule CRM

Capsule CRM is a user-friendly CRM that focuses on simplicity and ease of use. It’s designed for small businesses and offers a straightforward interface for managing contacts, deals, and tasks. It’s an excellent choice for firms that prioritize ease of implementation and a clean design.

Key Features for Accountants:

- Contact Management: Centralized contact information with detailed notes and history.

- Deal Tracking: Manage deals and track progress through different stages.

- Task Management: Assign tasks and set reminders for follow-ups.

- Reporting: Generate basic reports on sales and client activity.

- Integrations: Integrates with various third-party apps including accounting software.

Pros: Simple and easy to use, affordable, user-friendly interface.

Cons: Lacks some advanced features compared to other CRM systems, limited customization options.

6. Insightly

Insightly is a CRM solution that focuses on project management and sales automation. It provides robust features suitable for managing client projects and tracking client interactions. It’s a great choice for accounting firms that want to streamline their client project workflows.

Key Features for Accountants:

- Project Management: Manage client projects, set tasks, and track progress.

- Sales Automation: Automate sales processes such as lead nurturing and follow-ups.

- Contact Management: Store detailed client information and track interactions.

- Reporting: Generate reports on sales, projects, and client activity.

- Integrations: Integrates with various third-party apps including accounting software.

Pros: Strong project management features, sales automation capabilities.

Cons: Can be more complex to set up and manage, may not be as intuitive as other CRM systems.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision. Here’s a step-by-step guide to help you select the best CRM for your small accounting firm:

- Assess Your Needs: Before you start evaluating CRM systems, take the time to assess your firm’s specific needs and goals. What are your pain points? What processes need improvement? What features are essential for your business?

- Define Your Requirements: Based on your needs assessment, create a list of must-have features and desired functionalities. This will help you narrow down your options and compare different CRM systems effectively.

- Consider Your Budget: CRM systems come in a variety of price points. Determine your budget and look for systems that offer the features you need at a price you can afford. Consider both the initial setup cost and the ongoing monthly fees.

- Research and Compare Options: Research different CRM systems and compare their features, pricing, and reviews. Read user testimonials and case studies to get a better understanding of how each system works in practice.

- Prioritize Integration: Ensure the CRM system integrates seamlessly with your existing accounting software, email provider, and other tools you use. This will save you time and reduce the risk of data errors.

- Evaluate User-Friendliness: Choose a CRM system that is easy to use and navigate. A user-friendly interface will make it easier for your team to adopt the system and get the most out of its features.

- Test Before You Commit: Many CRM systems offer free trials or demos. Take advantage of these opportunities to test the system and see if it meets your needs. This will give you a hands-on experience before you commit to a paid subscription.

- Consider Scalability: Choose a CRM system that can grow with your business. As your firm expands, you’ll want a system that can handle more clients, data, and users.

- Prioritize Security: Ensure the CRM system offers robust security measures to protect your clients’ sensitive data. Look for features like encryption, access controls, and compliance with relevant regulations.

- Seek Training and Support: Choose a CRM system that offers training and support to help you and your team get up to speed quickly. This can include online tutorials, user guides, and dedicated customer support.

Implementing Your New CRM: A Smooth Transition

Once you’ve chosen your CRM, successful implementation is key to maximizing its benefits. Here’s how to ensure a smooth transition:

- Plan Your Implementation: Develop a detailed implementation plan that outlines the steps involved, the timeline, and the resources required.

- Data Migration: Migrate your existing client data from your current system to the new CRM. Ensure the data is accurate, complete, and properly formatted.

- Customize the CRM: Customize the CRM to meet your specific needs and workflows. This may involve configuring fields, creating custom reports, and setting up automation rules.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM system. This should include hands-on training, user guides, and ongoing support.

- Pilot Testing: Before rolling out the CRM to your entire firm, conduct a pilot test with a small group of users. This will help you identify any issues and make necessary adjustments.

- Monitor and Optimize: After implementation, monitor the performance of the CRM and make adjustments as needed. This may involve optimizing workflows, refining reports, and providing ongoing training to your team.

Maximizing Your CRM: Tips for Success

Here are some additional tips to help you get the most out of your CRM:

- Keep Your Data Clean: Regularly clean and update your client data to ensure accuracy and completeness.

- Utilize Automation: Take advantage of automation features to streamline your workflows and save time.

- Track Key Metrics: Monitor key metrics, such as client acquisition cost, client retention rate, and revenue per client, to track your performance and identify areas for improvement.

- Integrate with Other Tools: Integrate your CRM with other tools you use, such as your accounting software, email provider, and calendar.

- Provide Ongoing Training: Provide ongoing training to your team to ensure they are up-to-date on the latest features and best practices.

- Seek Feedback: Regularly seek feedback from your team to identify areas for improvement and make adjustments to the CRM system.

- Stay Updated: CRM systems are constantly evolving. Stay updated on the latest features and best practices to maximize the value of your CRM.

Conclusion: Embracing CRM for Accounting Firm Growth

Choosing the right CRM is a significant investment for any small accounting firm. By selecting a CRM system tailored to your specific needs and following the implementation and optimization tips outlined in this guide, you can unlock significant benefits, including improved client relationships, enhanced organization, increased productivity, and data-driven decision-making. In the competitive landscape of accounting, a well-implemented CRM is no longer a luxury—it’s a necessity for sustainable growth and success. Take the time to evaluate your options, choose the right CRM, and watch your firm thrive.