Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking projects, sending invoices, and staying on top of compliance – all while trying to grow your business. In this fast-paced environment, efficiency is key. That’s where a Customer Relationship Management (CRM) system comes in. Think of it as your central hub for all client-related information, streamlining your processes and freeing up your time to focus on what matters most: serving your clients and building your practice.

Choosing the right CRM can feel overwhelming, especially with so many options available. This comprehensive guide will walk you through the best CRM systems specifically tailored for small accounting firms in 2024. We’ll delve into their features, pricing, pros, cons, and suitability for different needs, helping you make an informed decision that aligns with your firm’s goals and budget. Get ready to transform your client management and boost your bottom line!

Why Your Small Accounting Firm Needs a CRM

You might be thinking, “Do I really need a CRM?” The answer, in most cases, is a resounding yes. Here’s why:

- Improved Client Relationships: A CRM centralizes all your client data – contact information, communication history, project details, and more. This 360-degree view allows you to personalize interactions, anticipate needs, and provide exceptional service, leading to increased client satisfaction and loyalty.

- Enhanced Organization: Say goodbye to scattered spreadsheets and endless email threads. A CRM keeps everything organized in one place, making it easy to find the information you need when you need it. This significantly reduces the time wasted on administrative tasks.

- Increased Efficiency: CRM systems automate many routine tasks, such as sending appointment reminders, tracking follow-ups, and generating reports. This frees up your staff to focus on more strategic activities, such as providing financial advice and building client relationships.

- Better Lead Management: If you’re actively seeking new clients, a CRM can help you manage your leads effectively. You can track leads through the sales pipeline, nurture them with targeted communication, and convert them into paying clients.

- Data-Driven Decision Making: CRM systems provide valuable insights into your business performance, such as client retention rates, project profitability, and marketing campaign effectiveness. This data empowers you to make informed decisions and optimize your strategies.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When selecting a CRM for your accounting firm, prioritize these essential features:

- Contact Management: The ability to store and manage client contact information, including names, addresses, phone numbers, email addresses, and other relevant details.

- Communication Tracking: Logging all interactions with clients, including emails, phone calls, meetings, and notes.

- Task Management: Creating and assigning tasks to team members, setting deadlines, and tracking progress.

- Appointment Scheduling: Integrating with your calendar to schedule appointments and send reminders.

- Reporting and Analytics: Generating reports on key metrics, such as client acquisition costs, revenue per client, and client retention rates.

- Integration with Accounting Software: Seamlessly connecting with your existing accounting software (e.g., QuickBooks, Xero) to sync client data and financial information. This is crucial for avoiding data entry errors and ensuring a unified view of your clients’ financial health.

- Workflow Automation: Automating repetitive tasks, such as sending invoices, following up on leads, and sending welcome emails to new clients.

- Security and Compliance: Ensuring the CRM system meets industry-specific security and compliance requirements, such as GDPR and SOC 2.

- Mobile Accessibility: Accessing client information and managing tasks from your smartphone or tablet, allowing you to stay connected on the go.

- Customization: The ability to customize the CRM to meet the specific needs of your firm, such as creating custom fields and reports.

Top CRM Systems for Small Accounting Firms

Now, let’s dive into the best CRM systems for small accounting firms in 2024. We’ve evaluated these based on their features, pricing, ease of use, and suitability for accounting professionals.

1. HubSpot CRM

Overview: HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms due to its user-friendliness and robust free plan. It offers a comprehensive suite of features, including contact management, email marketing, sales automation, and reporting.

Key Features:

- Free CRM with unlimited users and contacts.

- Contact management with detailed profiles.

- Email marketing tools, including templates and automation.

- Sales pipeline management.

- Reporting and analytics dashboards.

- Integration with popular accounting software via third-party apps.

- Excellent customer support and extensive knowledge base.

Pros:

- Free plan is incredibly generous and suitable for many small firms.

- Easy to learn and use, with a clean and intuitive interface.

- Scalable as your firm grows, with paid plans offering more advanced features.

- Strong integration capabilities.

- Excellent for marketing and sales automation.

Cons:

- Free plan has limitations on features and storage.

- Advanced features, such as custom reporting and workflow automation, require paid plans.

- Integration with accounting software may require third-party apps.

Pricing: HubSpot CRM offers a free plan with basic features. Paid plans start at around $45 per month, offering more advanced features and increased usage limits.

Suitability: HubSpot CRM is an excellent choice for small accounting firms looking for a user-friendly and affordable CRM solution. The free plan is a great starting point, and the paid plans offer advanced features for growing firms. It’s particularly well-suited for firms that want to use marketing automation and sales tools.

2. Zoho CRM

Overview: Zoho CRM is a versatile and feature-rich CRM system that caters to businesses of all sizes. It offers a wide range of features, including sales automation, marketing automation, and customer support tools. Zoho CRM’s affordability and customization options make it a strong contender for small accounting firms.

Key Features:

- Contact management with detailed profiles.

- Sales pipeline management with customizable stages.

- Workflow automation for repetitive tasks.

- Email marketing and campaign management.

- Reporting and analytics with customizable dashboards.

- Integration with popular accounting software.

- Mobile app for accessing client information on the go.

Pros:

- Affordable pricing plans.

- Highly customizable to meet your firm’s specific needs.

- Strong workflow automation capabilities.

- Excellent integration with other Zoho apps, such as Zoho Books (accounting software).

- Good customer support.

Cons:

- User interface can be overwhelming for beginners.

- Some advanced features require higher-tier plans.

- Integration with some accounting software may require additional setup.

Pricing: Zoho CRM offers a free plan for up to 3 users with limited features. Paid plans start at around $14 per user per month, offering more features and usage limits.

Suitability: Zoho CRM is a great option for small accounting firms looking for a powerful and customizable CRM solution at an affordable price. It’s particularly well-suited for firms that want robust workflow automation and integration with other Zoho apps. The free plan is a good option for very small firms starting out.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that is known for its simplicity and ease of use. It’s designed to help sales teams manage their leads and close deals more effectively. While it may not have all the bells and whistles of some other CRMs, its intuitive interface and focus on sales make it a strong choice for accounting firms that prioritize lead management.

Key Features:

- Visual sales pipeline management with drag-and-drop functionality.

- Contact management with detailed profiles.

- Deal tracking and management.

- Email integration and tracking.

- Reporting and analytics on sales performance.

- Integration with popular accounting software via third-party apps.

- Mobile app for accessing client information on the go.

Pros:

- User-friendly and easy to learn.

- Focus on sales and lead management.

- Visual sales pipeline makes it easy to track deals.

- Good integration capabilities.

- Affordable pricing.

Cons:

- Less feature-rich than some other CRMs.

- May not be suitable for firms that need extensive marketing automation.

- Limited customer support options.

Pricing: Pipedrive offers a free trial. Paid plans start at around $14.90 per user per month, offering more features and usage limits.

Suitability: Pipedrive is an excellent choice for small accounting firms that are focused on lead generation and sales. Its simple and intuitive interface makes it easy to manage leads and track deals. It’s particularly well-suited for firms that want a CRM that is easy to learn and use.

4. Freshsales (by Freshworks)

Overview: Freshsales, part of the Freshworks suite, is a CRM that emphasizes sales and customer relationship management. It is designed to be user-friendly and offers a good balance of features and affordability, making it a viable option for small accounting firms looking to streamline their client interactions and sales processes.

Key Features:

- Contact and Account Management: Allows for the detailed storage and management of client information.

- Sales Pipeline Management: Helps in visualizing and managing the sales pipeline.

- Email Integration: Integrates with email providers for direct communication.

- Reporting and Analytics: Offers sales and performance reports.

- Workflow Automation: Automates tasks for efficiency.

- Integration Capabilities: Integrates with third-party applications.

Pros:

- User-Friendly Interface: Easy to navigate and use.

- Affordable Pricing: Offers cost-effective plans for small businesses.

- Customer Support: Provides reliable customer support.

- Integration Capabilities: Integrates with various third-party apps.

Cons:

- Limited Free Plan: The free plan has feature restrictions.

- Customization: Customization options might be less extensive compared to some competitors.

Pricing:

Freshsales offers a free plan with basic features. Paid plans start around $15 per user per month, with more advanced features in higher tiers.

Suitability:

Freshsales is suitable for small accounting firms seeking a user-friendly and cost-effective CRM solution. Its features support client management and sales processes, making it a good choice for firms that want to improve their client relationships and sales efforts.

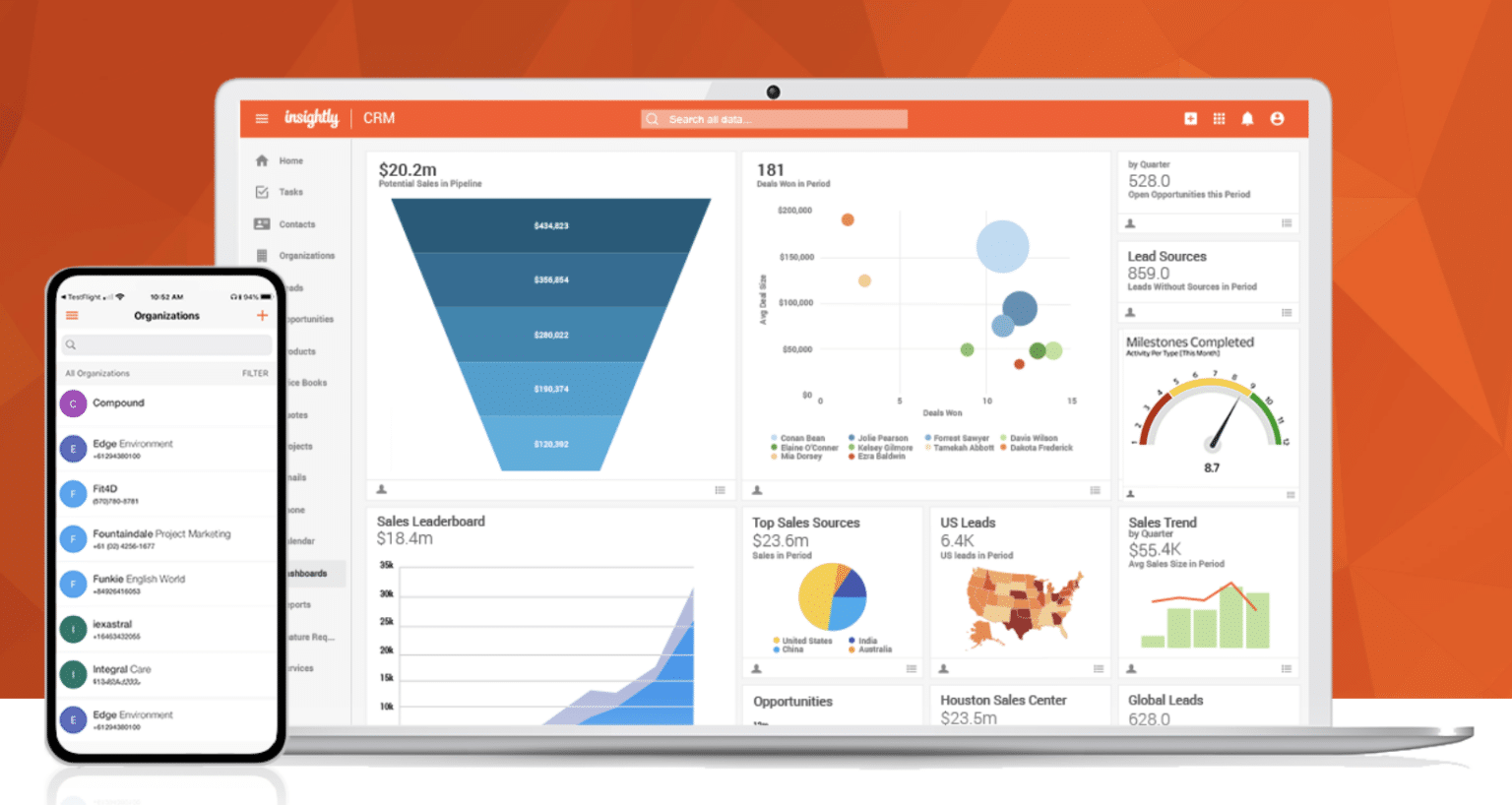

5. Insightly

Overview: Insightly is a CRM system that focuses on sales and project management, making it a good option for accounting firms that handle projects for their clients. It offers a user-friendly interface and a range of features to help manage client relationships and projects effectively.

Key Features:

- Contact and Lead Management: Manages contact information and tracks leads.

- Project Management: Offers features to manage projects and tasks.

- Sales Pipeline: Helps in visualizing and managing the sales pipeline.

- Workflow Automation: Automates tasks for efficiency.

- Reporting and Analytics: Offers sales and performance reports.

- Integration Capabilities: Integrates with various third-party apps.

Pros:

- User-Friendly: Easy to learn and use.

- Project Management: Strong project management features.

- Affordable: Offers cost-effective plans.

- Integration: Integrates with various third-party apps.

Cons:

- Limited Free Plan: The free plan has feature restrictions.

- Advanced Features: Some advanced features may require higher-tier plans.

Pricing:

Insightly offers a free plan with basic features. Paid plans start around $29 per user per month, with more advanced features in higher tiers.

Suitability:

Insightly is suitable for small accounting firms that need strong project management capabilities. Its user-friendly interface and project management features make it a good choice for firms that manage projects for their clients and want to streamline their client relationships.

How to Choose the Right CRM for Your Accounting Firm

Selecting the right CRM is a critical decision that can significantly impact your firm’s efficiency and client relationships. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Before you start evaluating CRM systems, take the time to identify your firm’s specific needs and goals. Consider what you want to achieve with a CRM, such as improving client communication, streamlining processes, or generating more leads.

- Define Your Must-Have Features: Based on your needs assessment, create a list of must-have features. This will help you narrow down your options and ensure that the CRM you choose meets your essential requirements. Consider features like contact management, communication tracking, appointment scheduling, and integration with accounting software.

- Set Your Budget: Determine how much you’re willing to spend on a CRM system. Consider the initial setup costs, monthly subscription fees, and any additional costs for training or customization.

- Research Different CRM Systems: Once you have a clear understanding of your needs, budget, and desired features, start researching different CRM systems. Read reviews, compare features, and look for systems that are specifically designed for accounting firms or offer strong integration with accounting software.

- Sign Up for Free Trials: Most CRM systems offer free trials. Take advantage of these trials to test the system and see how it works for your firm. Explore the features, test the user interface, and evaluate whether the system meets your needs.

- Consider Integration with Existing Software: Ensure that the CRM system integrates seamlessly with your existing accounting software and other tools. This will save you time and effort by avoiding data entry errors and ensuring a unified view of your client data.

- Evaluate Customer Support: Check the CRM system’s customer support options. Ensure that the vendor offers adequate support, such as email, phone, or live chat, to help you resolve any issues that may arise.

- Consider Scalability: Choose a CRM system that can grow with your firm. As your firm expands, you’ll need a system that can handle more clients, users, and data.

- Prioritize Data Security: Make sure the CRM system offers robust security features to protect your client data. Look for systems that comply with industry-specific security and compliance requirements.

- Get Feedback from Your Team: Involve your team in the decision-making process. Ask them for their feedback on the CRM systems you’re considering. Their input can help you make a more informed decision.

Making the Most of Your CRM

Once you’ve selected and implemented a CRM system, it’s crucial to make the most of its capabilities. Here are some tips to maximize your CRM’s effectiveness:

- Train Your Team: Provide thorough training to your team on how to use the CRM system. This will ensure that everyone understands how to use the system and can take advantage of its features.

- Enter Data Consistently: Make sure that all client data is entered consistently and accurately. This will ensure that your data is reliable and useful.

- Automate Tasks: Take advantage of the CRM’s automation features to streamline your processes. This will save you time and effort and reduce the risk of errors.

- Use the CRM for Communication: Use the CRM to manage all client communication. This will ensure that you have a complete record of all interactions with your clients.

- Analyze Your Data: Regularly analyze your CRM data to gain insights into your business performance. This will help you identify areas for improvement and make data-driven decisions.

- Regularly Update Your CRM: Keep your CRM system up-to-date with the latest features and updates. This will ensure that you’re getting the most out of the system and that it’s meeting your evolving needs.

- Customize Your CRM: Tailor your CRM to meet the specific needs of your accounting firm. Customize fields, reports, and workflows to streamline your processes and improve your efficiency.

Conclusion

Choosing the right CRM for your small accounting firm is a strategic investment that can significantly improve your client relationships, boost your efficiency, and drive business growth. By carefully evaluating your needs, researching different options, and following the tips outlined in this guide, you can select a CRM system that empowers your firm to thrive in today’s competitive landscape. Remember to prioritize features that align with your core needs, such as seamless integration with your accounting software, robust contact management, and efficient task automation. The right CRM will not only streamline your daily operations but also provide valuable insights to help you make informed decisions and build lasting client relationships. Embrace the power of CRM and watch your accounting firm reach new heights of success!