Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

Running a small accounting firm is a juggling act. You’re managing client relationships, crunching numbers, staying compliant with ever-changing regulations, and trying to grow your business – all at the same time. It’s a demanding profession, and anything that can streamline your processes and free up your time is a win. That’s where a Customer Relationship Management (CRM) system comes in.

A CRM isn’t just for big corporations. In fact, the right CRM can be a game-changer for small accounting firms, helping you to:

- Centralize Client Information: Keep all client data in one accessible location.

- Improve Client Communication: Track interactions and personalize your outreach.

- Automate Tasks: Automate repetitive tasks, like follow-ups and appointment scheduling.

- Boost Sales & Marketing: Identify leads and nurture them through the sales funnel.

- Enhance Collaboration: Facilitate teamwork and improve internal communication.

This comprehensive guide will explore the best CRM systems tailored for small accounting firms, helping you find the perfect fit for your specific needs and budget. We’ll delve into the features, pricing, and pros and cons of each system, so you can make an informed decision and take your firm to the next level.

Why Your Accounting Firm Needs a CRM

Before we jump into the best options, let’s clarify why a CRM is essential for modern accounting practices. It’s not just about fancy technology; it’s about building a more efficient, client-focused, and ultimately, more profitable business.

The Challenges Faced by Small Accounting Firms

Small accounting firms face unique challenges, including:

- Time Constraints: Time is money, and accountants are often stretched thin.

- Client Retention: Keeping clients happy and loyal is crucial for long-term success.

- Lead Generation: Finding new clients can be a constant struggle.

- Data Security: Protecting sensitive financial information is paramount.

- Compliance: Staying up-to-date with regulations adds complexity.

A CRM can directly address these challenges by:

- Saving Time: Automating tasks and streamlining workflows.

- Improving Client Relationships: Providing personalized service and proactive communication.

- Generating Leads: Tracking leads and managing the sales process.

- Enhancing Security: Offering secure data storage and access controls.

- Improving Organization: Centralizing client information and providing a clear overview.

Key Benefits of Using a CRM for Accountants

The advantages of implementing a CRM in your accounting firm extend far beyond just organization. Here are some key benefits:

- Improved Client Communication: Easily track client interactions, send personalized emails, and manage communications.

- Increased Efficiency: Automate repetitive tasks, such as appointment scheduling and follow-ups, freeing up time for more important work.

- Enhanced Collaboration: Share client information and collaborate with team members more effectively.

- Better Lead Management: Track leads, manage the sales pipeline, and convert prospects into clients.

- Data Security: Securely store client data and control access to sensitive information.

- Improved Reporting and Analytics: Gain insights into your business performance and make data-driven decisions.

- Increased Revenue: By improving client relationships and lead management, you can increase your revenue and profitability.

Top CRM Systems for Small Accounting Firms

Choosing the right CRM is crucial. It needs to fit your firm’s specific needs, budget, and tech-savviness. Here’s a breakdown of some of the best CRM systems for small accounting firms, along with their key features, pricing, and pros and cons.

1. HubSpot CRM

Overview: HubSpot CRM is a popular choice, particularly for businesses that prioritize inbound marketing and sales. It offers a free version with robust features, making it an attractive option for small firms just starting with CRM.

Key Features:

- Contact Management: Store and organize client information.

- Deals Pipeline: Track leads and manage the sales process.

- Email Marketing: Send targeted email campaigns.

- Marketing Automation: Automate marketing tasks, like email sequences.

- Reporting and Analytics: Track key metrics and gain insights into your performance.

- Free Version: The free version is surprisingly comprehensive.

Pricing: HubSpot offers a free version with limited features. Paid plans start at around $45 per month, offering more advanced features and integrations.

Pros:

- User-friendly interface.

- Excellent for marketing and sales automation.

- Free version is very powerful.

- Extensive integrations with other tools.

Cons:

- Can be overwhelming for beginners due to the breadth of features.

- Advanced features can be costly.

2. Pipedrive

Overview: Pipedrive is a sales-focused CRM that excels in managing the sales pipeline. It’s known for its intuitive interface and visual approach to sales management, making it easy for accounting firms to track leads and close deals.

Key Features:

- Visual Sales Pipeline: Track leads through each stage of the sales process.

- Contact Management: Manage client information and interactions.

- Email Integration: Integrate with your email provider for seamless communication.

- Automation: Automate repetitive tasks, like follow-ups.

- Reporting and Analytics: Track sales performance and identify areas for improvement.

Pricing: Pipedrive offers several pricing tiers, starting at around $15 per user per month.

Pros:

- Intuitive and easy-to-use interface.

- Excellent for sales pipeline management.

- Strong automation capabilities.

- Good value for money.

Cons:

- Less focus on marketing automation compared to HubSpot.

- Can be less feature-rich for firms that need advanced marketing tools.

3. Zoho CRM

Overview: Zoho CRM is a comprehensive CRM platform that offers a wide range of features, making it suitable for businesses of all sizes. It’s a strong contender for small accounting firms looking for a feature-rich and customizable CRM.

Key Features:

- Contact Management: Manage client information and interactions.

- Sales Automation: Automate sales tasks and workflows.

- Marketing Automation: Automate marketing campaigns and nurture leads.

- Workflow Automation: Automate repetitive tasks across various departments.

- Reporting and Analytics: Track key metrics and gain insights into your business performance.

- Customization: Highly customizable to fit your specific needs.

Pricing: Zoho CRM offers a free plan for up to three users. Paid plans start at around $14 per user per month.

Pros:

- Feature-rich platform.

- Highly customizable.

- Strong marketing automation capabilities.

- Competitive pricing.

Cons:

- Can be complex to set up and configure.

- Interface can be overwhelming for beginners.

4. Salesforce Sales Cloud

Overview: Salesforce is a leading CRM provider, offering a robust platform with a wide array of features. While it can be more expensive and complex, it can be a good choice for growing accounting firms with more complex needs.

Key Features:

- Contact Management: Manage client information and interactions.

- Sales Automation: Automate sales tasks and workflows.

- Marketing Automation: Automate marketing campaigns and nurture leads.

- Salesforce AppExchange: Access a vast marketplace of apps and integrations.

- Reporting and Analytics: Track key metrics and gain insights into your business performance.

- Customization: Highly customizable to fit your specific needs.

Pricing: Salesforce Sales Cloud has various pricing tiers, and it can be more expensive than other options. Pricing starts at around $25 per user per month.

Pros:

- Extensive features and capabilities.

- Highly customizable.

- Large ecosystem of apps and integrations.

Cons:

- Can be expensive.

- Complex to set up and use.

- May be overkill for small firms with simple needs.

5. Insightly

Overview: Insightly is a CRM platform that focuses on building strong client relationships. It’s known for its user-friendly interface and project management features, making it a good option for accounting firms that handle projects.

Key Features:

- Contact Management: Manage client information and interactions.

- Project Management: Manage projects and tasks.

- Sales Pipeline: Track leads and manage the sales process.

- Email Integration: Integrate with your email provider for seamless communication.

- Reporting and Analytics: Track key metrics and gain insights into your performance.

Pricing: Insightly offers several pricing tiers, starting at around $29 per user per month.

Pros:

- User-friendly interface.

- Project management features.

- Good for client relationship management.

- Relatively affordable.

Cons:

- Can lack the advanced features of some other platforms.

- May not be ideal for firms with complex sales processes.

Choosing the Right CRM: Key Considerations

Selecting the right CRM is a significant decision. To make the best choice for your small accounting firm, consider these factors:

1. Your Specific Needs

What are your primary goals for implementing a CRM? Do you need to improve client communication, streamline sales processes, automate marketing, or manage projects? Identify your most pressing needs and prioritize features that address them.

2. Budget

CRM pricing varies widely. Set a budget and stick to it. Consider the cost per user, the features offered, and any additional expenses for training or integrations.

3. Ease of Use

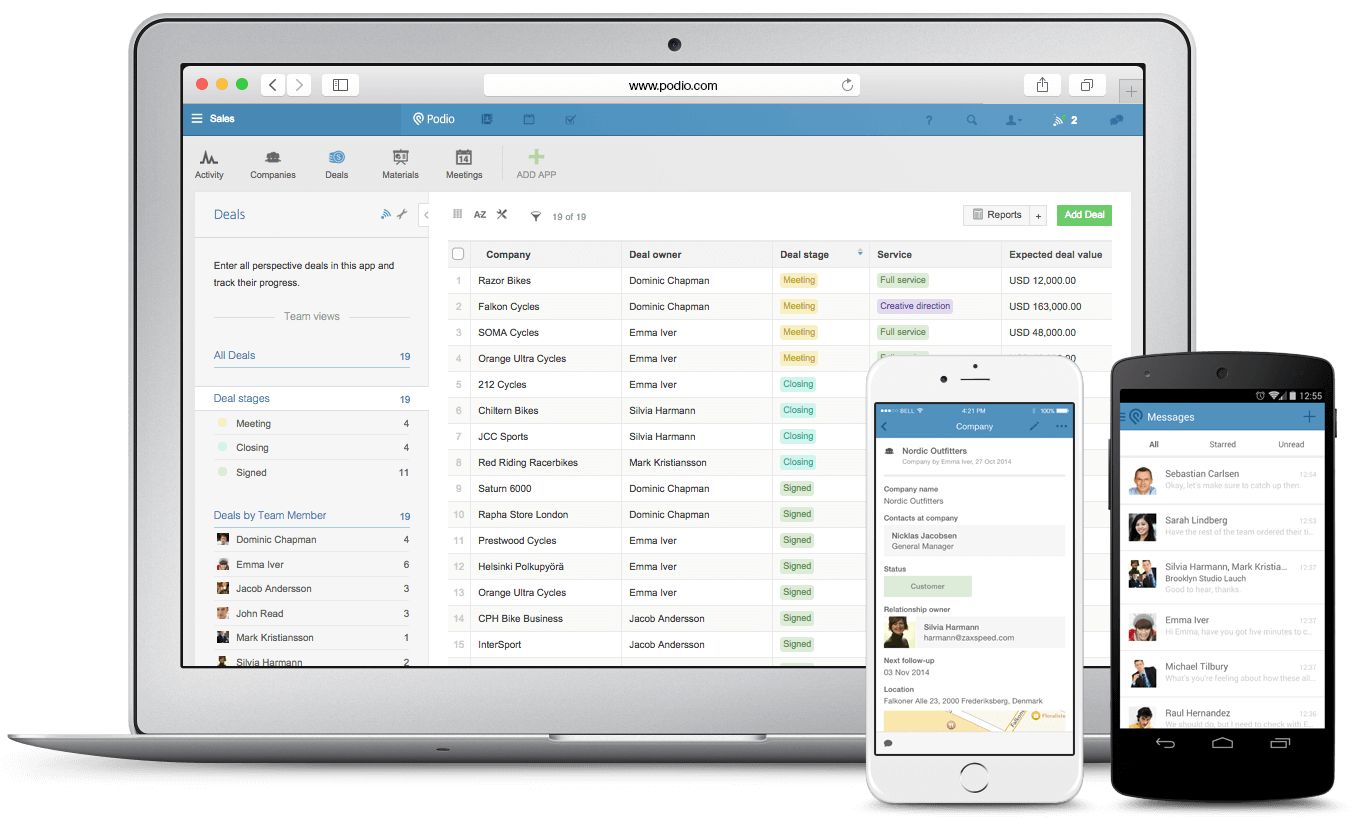

A CRM is only effective if your team actually uses it. Choose a system with an intuitive interface and a user-friendly design. Consider the learning curve and the time it will take to train your team.

4. Integrations

Does the CRM integrate with the other tools you use, such as your accounting software, email provider, and marketing platforms? Seamless integrations can save you time and improve efficiency.

5. Scalability

Choose a CRM that can grow with your business. Consider whether the system can accommodate your future needs and handle an increasing number of clients and users.

6. Data Security

Data security is crucial, especially for accounting firms. Ensure the CRM provider has robust security measures in place to protect client data.

7. Customer Support

What level of customer support does the CRM provider offer? Look for a provider that offers responsive support, including documentation, tutorials, and live chat or phone support.

Implementation Tips for Accounting Firms

Once you’ve chosen a CRM, successful implementation is key. Here are some tips to help you get started:

1. Define Your Goals

Clearly define your goals for using the CRM. What do you want to achieve? This will help you track your progress and measure the success of your implementation.

2. Clean Your Data

Before importing your data into the CRM, clean it up. Remove duplicates, correct errors, and ensure your data is accurate and up-to-date.

3. Train Your Team

Provide thorough training to your team on how to use the CRM. Make sure everyone understands the features and how to use them effectively. Create training materials and provide ongoing support.

4. Customize the CRM

Customize the CRM to fit your specific needs and workflows. Configure the system to track the information that’s most important to your business.

5. Integrate with Other Tools

Integrate the CRM with your other tools, such as your accounting software, email provider, and marketing platforms. This will streamline your workflows and improve efficiency.

6. Monitor and Evaluate

Regularly monitor your CRM usage and evaluate its effectiveness. Track key metrics and identify areas for improvement. Make adjustments as needed to optimize your use of the system.

7. Get Buy-In from Your Team

Involve your team in the decision-making process and get their buy-in. Explain the benefits of the CRM and how it will improve their work. Encourage them to use the system and provide feedback.

Beyond the Basics: Advanced CRM Strategies for Accountants

Once you’ve mastered the basics of CRM, you can explore more advanced strategies to maximize its potential:

1. Segment Your Clients

Segment your clients based on various criteria, such as industry, revenue, or service needs. This allows you to personalize your communications and offer tailored services.

2. Implement Lead Scoring

Use lead scoring to prioritize leads based on their engagement and likelihood of conversion. This helps you focus your efforts on the most promising prospects.

3. Automate Workflows

Automate more complex workflows, such as onboarding new clients, sending invoices, and following up on outstanding payments.

4. Track ROI

Track the return on investment (ROI) of your CRM. Measure how the system is improving your client relationships, generating leads, and increasing revenue.

5. Integrate with Accounting Software

Integrate your CRM with your accounting software to streamline your workflows and gain a comprehensive view of your client data. This will help you to personalize your service.

6. Use AI-Powered Features

Explore AI-powered features offered by some CRM systems, such as chatbots, predictive analytics, and automated data entry. These features can further streamline your workflows and improve efficiency.

The Future of CRM in Accounting

The world of CRM is constantly evolving, and the future holds exciting possibilities for accounting firms. Here are some trends to watch:

- Artificial Intelligence (AI): AI will play an increasingly important role in CRM, automating tasks, providing insights, and personalizing interactions.

- Mobile CRM: Mobile CRM solutions will become more sophisticated, allowing accountants to access and manage client data on the go.

- Integration with Emerging Technologies: CRM systems will integrate with emerging technologies, such as blockchain and the metaverse.

- Focus on Data Privacy and Security: CRM providers will continue to prioritize data privacy and security to protect client information.

Conclusion: Embracing CRM for Accounting Firm Success

In today’s competitive landscape, a CRM is no longer a luxury for small accounting firms; it’s a necessity. By choosing the right CRM and implementing it effectively, you can streamline your operations, improve client relationships, and drive business growth.

Take the time to research the options, consider your specific needs, and choose a system that fits your budget and goals. With the right CRM in place, you’ll be well-equipped to navigate the challenges of the accounting world and build a thriving practice.

Don’t wait. Embrace the power of CRM and transform your accounting firm today.