Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

In the fast-paced world of accounting, staying organized and connected with clients is paramount. Small accounting firms, in particular, need every advantage they can get to streamline operations, boost client satisfaction, and ultimately, grow their business. This is where a robust Customer Relationship Management (CRM) system steps in. But with a plethora of options available, choosing the right CRM can feel like navigating a complex maze. Fear not! This comprehensive guide will delve into the best CRM systems tailored specifically for small accounting firms, helping you make an informed decision and transform your practice.

Why Small Accounting Firms Need a CRM

Before we dive into specific CRM recommendations, let’s first understand why a CRM is so crucial for small accounting firms. It’s not just about fancy software; it’s about building stronger client relationships and improving overall efficiency.

- Centralized Client Data: A CRM acts as a central hub, storing all client information in one accessible location. This includes contact details, communication history, financial data, and any relevant notes. No more scattered spreadsheets or lost emails!

- Enhanced Communication: CRM systems often offer features like email integration, task management, and automated workflows. This allows you to communicate with clients more effectively, ensuring timely responses and personalized interactions.

- Improved Client Relationship Management: By tracking client interactions and preferences, you can tailor your services to meet their specific needs. This leads to increased client satisfaction and loyalty.

- Streamlined Sales and Marketing: CRM systems can help you manage leads, track marketing campaigns, and nurture potential clients. This can significantly improve your lead conversion rates.

- Increased Efficiency: Automation features in CRM systems can automate repetitive tasks, freeing up your time to focus on more strategic activities like client consultations and financial analysis.

- Data-Driven Decision Making: CRM systems provide valuable insights into your client base, your sales performance, and your overall business operations. This data can inform your decision-making and help you identify areas for improvement.

Key Features to Look for in a CRM for Accountants

Choosing the right CRM means understanding what features are most important for your specific needs. Here are some essential features to consider when evaluating CRM systems for your accounting firm:

- Contact Management: This is the foundation of any CRM. Look for a system that allows you to easily store, organize, and access client contact information.

- Lead Management: The ability to track and nurture leads is crucial for business growth. The CRM should enable you to capture leads, assign them to team members, and track their progress through the sales funnel.

- Task Management: Accounting involves many tasks, deadlines, and follow-ups. The CRM should include task management features to help you stay organized and on top of your workload.

- Email Integration: Seamless integration with your email provider is essential for efficient communication. The CRM should allow you to send and receive emails directly from the system, and track email interactions.

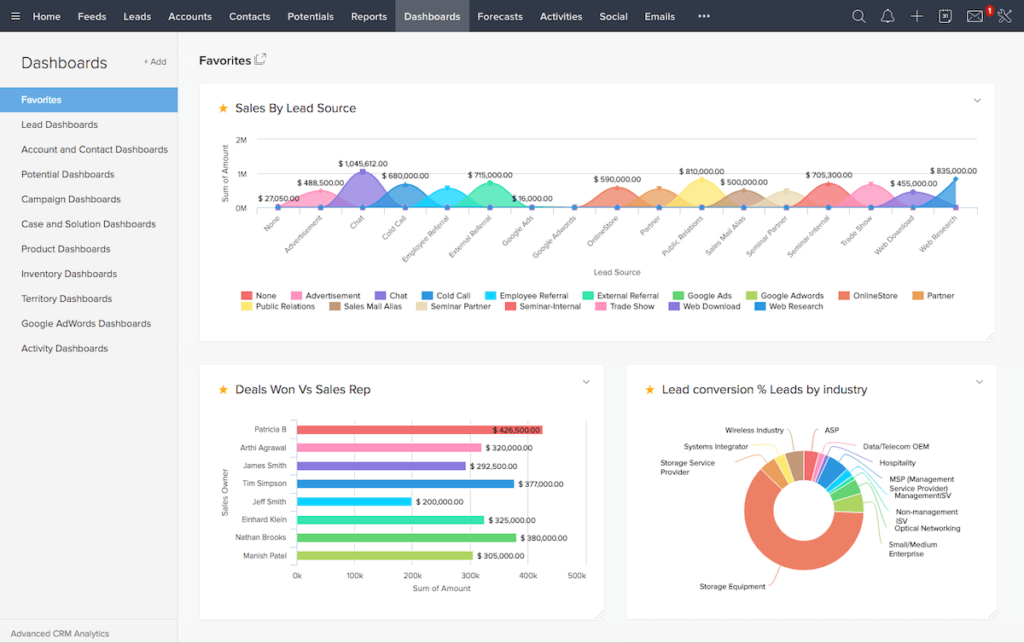

- Reporting and Analytics: Data is king! The CRM should provide robust reporting and analytics capabilities, allowing you to track key performance indicators (KPIs) and gain insights into your business performance.

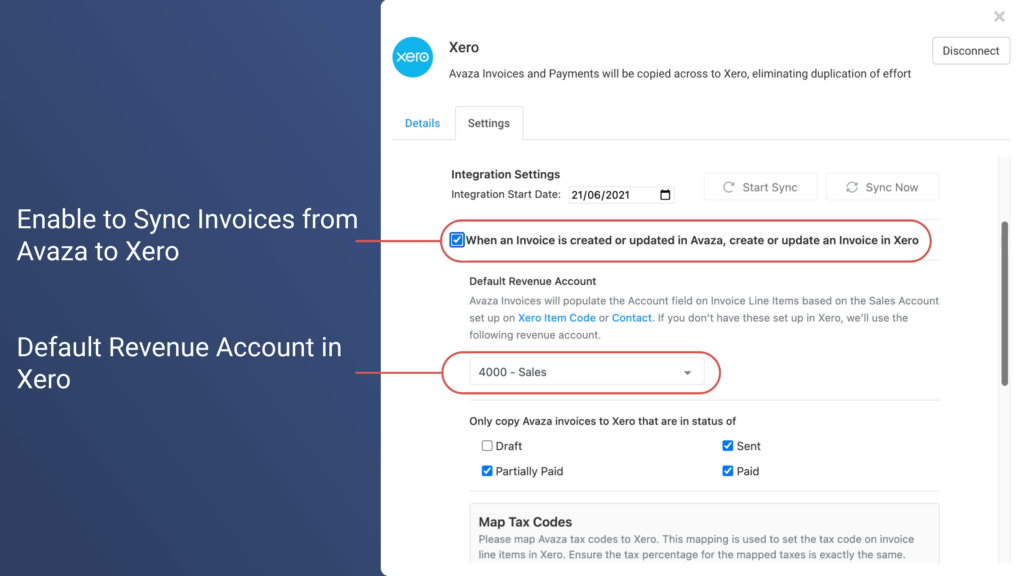

- Integration with Accounting Software: This is a must-have for accounting firms. The CRM should integrate seamlessly with your existing accounting software, such as QuickBooks or Xero, to avoid data silos and streamline data transfer.

- Client Portal: A client portal allows clients to access their financial documents, communicate with you securely, and track the progress of their projects.

- Security Features: Data security is paramount. The CRM should offer robust security features to protect sensitive client information.

- Mobile Accessibility: In today’s mobile world, it’s important to have access to your CRM on the go. Look for a CRM with a mobile app or a responsive web design that works well on mobile devices.

- Automation: Automation features, such as automated email sequences, task assignments, and workflow triggers, can save you time and improve efficiency.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed for small accounting firms. We’ll consider their features, pricing, and ease of use to help you make an informed decision.

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms. It offers a free version with a generous set of features, making it an excellent option for firms on a budget. HubSpot CRM is known for its user-friendly interface and comprehensive features.

Key Features:

- Free CRM with powerful features

- Contact management

- Deal tracking

- Email marketing tools

- Task management

- Reporting and analytics

- Integration with popular accounting software

- User-friendly interface

Pros:

- Free version is very capable

- Easy to use and navigate

- Excellent integration with marketing tools

- Strong customer support

Cons:

- Limited features in the free version

- Advanced features require paid subscriptions

Pricing: Free; Paid plans start from around $45 per month.

2. Zoho CRM

Zoho CRM is another powerful and versatile CRM system that’s a great fit for small accounting firms. It offers a range of features and customization options, making it adaptable to different business needs. Zoho CRM also provides a free plan for up to three users.

Key Features:

- Contact management

- Lead management

- Sales automation

- Workflow automation

- Email integration

- Reporting and analytics

- Integration with accounting software (e.g., QuickBooks)

- Customization options

Pros:

- Free plan available

- Highly customizable

- Wide range of features

- Good value for money

Cons:

- Can be complex to set up and configure

- Interface can feel a bit cluttered

Pricing: Free for up to 3 users; Paid plans start from around $14 per user per month.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its simplicity and ease of use. It’s a great option for small accounting firms that want a CRM that’s focused on managing leads and closing deals. While it may not have all the features of some of the other CRM systems on this list, it excels in its core functionality.

Key Features:

- Visual sales pipeline

- Lead management

- Deal tracking

- Email integration

- Task management

- Reporting and analytics

- Integration with other tools

Pros:

- Easy to use and navigate

- Visual sales pipeline makes it easy to track deals

- Focus on sales and lead management

- Good customer support

Cons:

- Fewer features than some other CRM systems

- May not be suitable for firms with complex needs

Pricing: Paid plans start from around $12.50 per user per month.

4. Salesforce Sales Cloud

Salesforce is a leading CRM provider with a comprehensive suite of features. While it can be more expensive and complex than other options, it’s a powerful choice for small accounting firms that need a highly customizable and scalable CRM solution. Salesforce offers a wide range of features and integrations.

Key Features:

- Contact management

- Lead management

- Sales automation

- Workflow automation

- Email integration

- Reporting and analytics

- Integration with accounting software

- Customization options

- AppExchange (marketplace for add-ons)

Pros:

- Highly customizable and scalable

- Wide range of features and integrations

- Large user community and support resources

Cons:

- Can be expensive

- Steep learning curve

- Can be overwhelming for small firms

Pricing: Paid plans start from around $25 per user per month.

5. Freshsales

Freshsales is a sales-focused CRM that’s designed to be easy to use and affordable. It’s a good option for small accounting firms that are looking for a CRM that’s focused on lead management and sales automation. Freshsales offers a clean interface and a variety of features.

Key Features:

- Contact management

- Lead management

- Sales automation

- Email integration

- Reporting and analytics

- Built-in phone and email

Pros:

- Easy to use

- Affordable

- Good for sales and lead management

- Built-in phone and email features

Cons:

- Fewer features than some other CRM systems

- Limited customization options

Pricing: Free plan available; Paid plans start from around $15 per user per month.

6. Agile CRM

Agile CRM is an all-in-one CRM solution that offers a wide range of features for sales, marketing, and customer service. It’s a good option for small accounting firms that want a comprehensive CRM solution that integrates all aspects of their business. Agile CRM is known for its affordability and ease of use.

Key Features:

- Contact management

- Lead scoring

- Email marketing

- Task management

- Reporting and analytics

- Integration with other tools

Pros:

- Affordable

- All-in-one solution

- Easy to use

- Good customer support

Cons:

- Some features may be less robust than those of specialized CRM systems

- Interface can feel dated

Pricing: Free plan available; Paid plans start from around $8.99 per user per month.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision. To make the best choice for your firm, consider these steps:

- Assess Your Needs: Before you start comparing CRM systems, take the time to assess your firm’s specific needs. What are your pain points? What are your goals? What features are most important to you?

- Define Your Budget: Determine how much you’re willing to spend on a CRM system. Consider not only the monthly or annual subscription costs but also any implementation costs, training costs, and the cost of add-ons.

- Research Different CRM Systems: Explore the different CRM systems available, considering their features, pricing, and reviews. Read case studies and testimonials from other accounting firms.

- Get Free Trials: Many CRM systems offer free trials. Take advantage of these trials to test out the systems and see if they meet your needs.

- Consider Integration: Make sure the CRM system integrates with your existing accounting software, email provider, and other tools you use.

- Prioritize Ease of Use: Choose a CRM system that’s easy for your team to learn and use. A complicated CRM system will be difficult to implement and will likely be underutilized.

- Evaluate Customer Support: Check the level of customer support provided by the CRM vendor. Is there documentation, tutorials, and responsive support channels?

- Plan for Implementation: Once you’ve chosen a CRM system, plan for its implementation. This includes data migration, training, and customization.

- Train Your Team: Ensure your team is properly trained on how to use the CRM system. Provide ongoing support and training as needed.

- Regularly Review and Optimize: Regularly review your CRM usage and make adjustments as needed. Optimize your workflows and processes to maximize the benefits of the CRM system.

Tips for Successful CRM Implementation in Your Accounting Firm

Implementing a CRM system is a significant undertaking. Here are some tips to ensure a smooth and successful implementation:

- Get Buy-in from Your Team: Involve your team in the decision-making process and get their buy-in. This will help ensure that they’re invested in using the CRM system.

- Start Small: Don’t try to implement all the features of the CRM system at once. Start with the core features and gradually add more features as you become more comfortable.

- Clean Up Your Data: Before you migrate your data to the CRM system, take the time to clean it up. Remove duplicate records, correct errors, and ensure that your data is accurate and up-to-date.

- Customize the CRM to Your Needs: Tailor the CRM system to your specific needs. Customize the fields, workflows, and reports to reflect your business processes.

- Provide Ongoing Training and Support: Provide ongoing training and support to your team. Offer regular training sessions and make sure that your team knows how to get help when they need it.

- Monitor Your Progress: Track your progress and measure the results of your CRM implementation. This will help you identify areas for improvement.

- Integrate, Integrate, Integrate: Ensure your CRM is talking to all your other vital software – accounting, email, marketing, etc. This avoids data silos and maximizes efficiency.

- Don’t Be Afraid to Adapt: The business world is constantly evolving. Your CRM strategy should adapt too. Be open to making changes and improvements as your firm grows and your needs change.

The Benefits of a Well-Implemented CRM for Small Accounting Firms

The benefits of a well-implemented CRM system for small accounting firms are numerous and can have a profound impact on your business. Here’s a summary:

- Increased Efficiency: By automating tasks, centralizing data, and streamlining communication, a CRM system can significantly increase the efficiency of your firm.

- Improved Client Relationships: A CRM system enables you to build stronger client relationships by providing personalized service and timely communication.

- Enhanced Sales and Marketing: A CRM system can help you manage leads, track marketing campaigns, and nurture potential clients, leading to increased sales.

- Better Data Management: A CRM system provides a centralized location for all client data, making it easy to access and manage your information.

- Improved Reporting and Analytics: A CRM system provides valuable insights into your business performance, allowing you to make data-driven decisions.

- Increased Revenue: By increasing efficiency, improving client relationships, and enhancing sales and marketing efforts, a CRM system can help you increase your revenue.

- Reduced Costs: Automation features within a CRM can help reduce manual labor and associated costs.

- Scalability: As your firm grows, a CRM can scale with you, adapting to your changing needs.

Conclusion: Embracing CRM for Accounting Firm Success

In conclusion, a CRM system is no longer a luxury but a necessity for small accounting firms looking to thrive in today’s competitive market. By selecting the right CRM and implementing it effectively, you can unlock significant benefits, including increased efficiency, improved client relationships, and enhanced business growth. Consider the options outlined in this guide, assess your firm’s specific needs, and choose the CRM that best suits your requirements. With the right CRM in place, your accounting firm will be well-positioned to provide exceptional service, build strong client relationships, and achieve lasting success. Don’t delay; start exploring the world of CRM today and transform your accounting practice into a well-oiled, client-focused machine!