Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking financial data, staying compliant with regulations, and, of course, trying to grow your business. In this whirlwind of tasks, it’s easy for crucial details to slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes in. It’s more than just a contact list; it’s your central hub for all things client-related, streamlining your operations and helping you build stronger, more profitable relationships.

Choosing the right CRM, however, can feel overwhelming. The market is flooded with options, each promising to be the ultimate solution. But what’s truly the best CRM for a small accounting firm? This guide will cut through the noise, exploring the top CRM systems tailored to the unique needs of accountants, helping you find the perfect fit to boost your firm’s productivity and client satisfaction.

Why Your Accounting Firm Needs a CRM

Before we dive into specific CRM recommendations, let’s clarify why a CRM is a non-negotiable tool for modern accounting practices. It’s not just about fancy features; it’s about building a sustainable and thriving business.

Centralized Client Information

Imagine having all your client information – contact details, communication history, financial records, and project updates – in one easily accessible place. That’s the power of a CRM. No more scrambling through emails, spreadsheets, and sticky notes to find what you need. This centralized approach saves time, reduces errors, and ensures everyone on your team has the same, up-to-date information.

Improved Client Relationships

A CRM helps you build deeper relationships with your clients. By tracking interactions, you can personalize your communication, anticipate their needs, and provide proactive advice. This level of personalized service fosters trust and loyalty, leading to increased client retention and referrals.

Streamlined Workflow and Increased Efficiency

Automation is a key benefit of CRM systems. You can automate repetitive tasks like sending appointment reminders, following up on leads, and generating invoices. This frees up your time to focus on more strategic activities, such as business development and providing high-value services to your clients.

Enhanced Sales and Marketing

CRMs provide valuable insights into your sales and marketing efforts. You can track the performance of your marketing campaigns, identify your most profitable leads, and tailor your sales strategies for maximum impact. Some CRMs also offer built-in tools for email marketing and social media management, further streamlining your marketing efforts.

Better Data Security and Compliance

Many CRM systems offer robust security features, helping you protect sensitive client data. They also often comply with industry regulations, such as GDPR, ensuring you’re meeting your compliance obligations.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When selecting a CRM for your accounting firm, consider these essential features:

Contact Management

This is the foundation of any good CRM. It should allow you to store detailed contact information, including names, addresses, phone numbers, email addresses, and social media profiles. It should also allow you to segment your contacts based on various criteria, such as industry, revenue, or service needs.

Communication Tracking

The ability to track all communications with clients, including emails, phone calls, and meetings, is crucial. This gives you a complete history of your interactions and helps you stay organized. Look for features like email integration and call logging.

Lead Management

A CRM should help you manage potential clients (leads) effectively. This includes the ability to capture lead information, track lead progress through the sales pipeline, and assign leads to team members. Features like lead scoring and automated follow-up are particularly beneficial.

Task and Calendar Management

Integrated task and calendar management helps you stay organized and meet deadlines. You can create tasks, assign them to team members, set reminders, and track progress. Calendar integration allows you to schedule appointments, manage meetings, and avoid conflicts.

Reporting and Analytics

Reporting and analytics provide valuable insights into your business performance. Look for a CRM that offers customizable reports, allowing you to track key metrics such as client acquisition cost, client retention rate, and revenue per client. These insights can help you make data-driven decisions to improve your business.

Integration with Accounting Software

This is a critical feature for accountants. The CRM should integrate seamlessly with your existing accounting software, such as QuickBooks, Xero, or Sage. This integration allows you to automatically sync client data, track financial transactions, and generate reports, eliminating the need for manual data entry and reducing errors.

Customization

Your CRM should be customizable to meet the specific needs of your firm. Look for a system that allows you to add custom fields, create custom reports, and tailor the user interface to your preferences.

Mobile Accessibility

In today’s mobile world, it’s essential to have access to your CRM on the go. Look for a system with a mobile app or a responsive web design that works well on mobile devices.

Security and Compliance

Data security is paramount. Choose a CRM that offers robust security features, such as data encryption, access controls, and regular backups. Ensure the system complies with relevant industry regulations, such as GDPR.

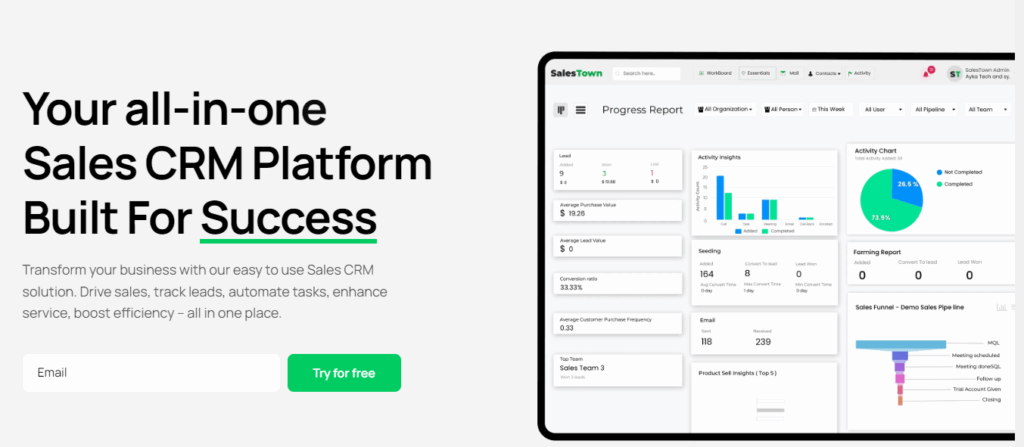

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically tailored to the needs of small accounting firms. We’ll consider their features, pricing, and overall suitability.

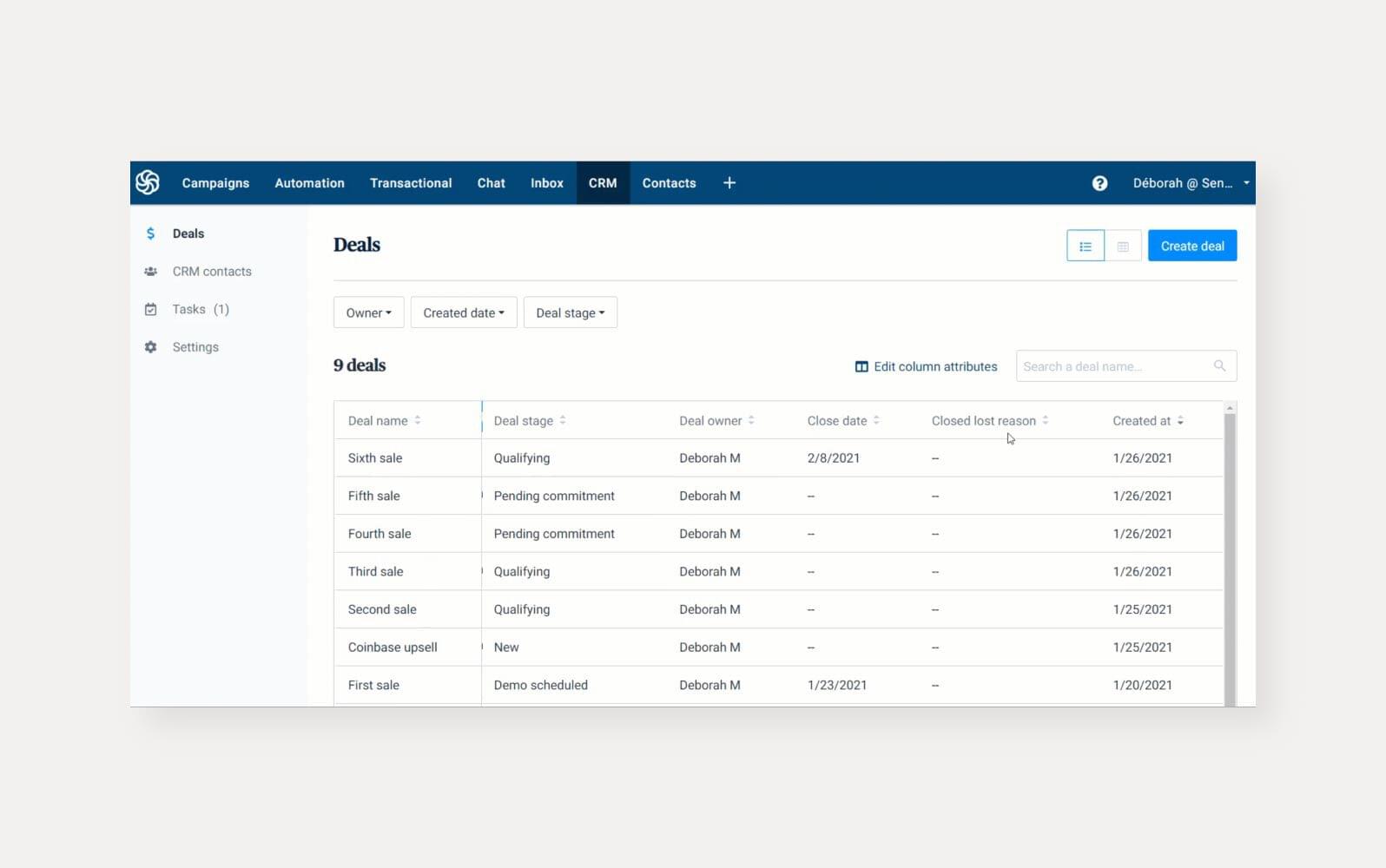

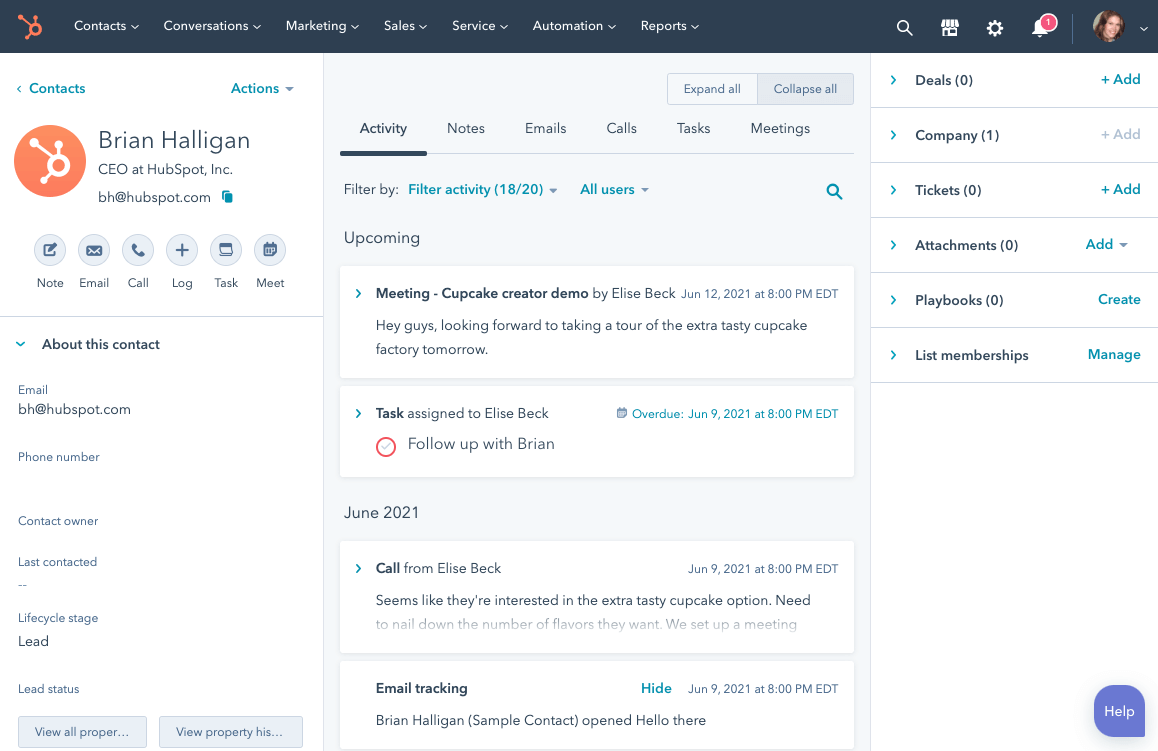

1. HubSpot CRM

HubSpot CRM is a popular choice for small businesses, and for good reason. Its free version offers a robust set of features, including contact management, deal tracking, and basic email marketing capabilities. It’s user-friendly and intuitive, making it easy to get started. HubSpot also offers paid plans with more advanced features, such as marketing automation, sales analytics, and custom reporting. Its integration capabilities are extensive, connecting with popular accounting software and other business tools.

Pros: Free version available with comprehensive features; user-friendly interface; strong integration capabilities; excellent customer support.

Cons: The free version has limitations on the number of contacts and emails; advanced features require paid plans.

Pricing: Free; Paid plans start from $45/month.

2. Zoho CRM

Zoho CRM is a versatile and affordable option, offering a wide range of features for sales, marketing, and customer service. It’s highly customizable, allowing you to tailor the system to your specific needs. Zoho CRM integrates with many popular apps, including accounting software, email marketing platforms, and social media channels. It offers a free plan for up to three users, making it an attractive option for very small firms. Paid plans provide more advanced features, such as workflow automation, sales force automation, and advanced analytics.

Pros: Affordable pricing; highly customizable; strong integration capabilities; free plan available.

Cons: The user interface can be a bit overwhelming for beginners; some advanced features require paid add-ons.

Pricing: Free for up to 3 users; Paid plans start from $14/user/month.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s particularly well-suited for small accounting firms that want to streamline their sales process. It’s designed to be intuitive and easy to use, with a visual pipeline that makes it easy to track deals. Pipedrive integrates with many popular apps, including email marketing platforms and accounting software. It offers a range of pricing plans, making it accessible to firms of all sizes. While its primary focus is on sales, it still provides essential features for managing client relationships.

Pros: Intuitive and user-friendly interface; strong sales focus; visual pipeline for deal tracking; good integration capabilities.

Cons: Primarily focused on sales, so some features may be less relevant for accountants; more expensive than some other options.

Pricing: Starts from $14.90/user/month.

4. Insightly

Insightly is a CRM that combines contact management, project management, and sales automation features. It’s a good option for accounting firms that want a CRM that can handle both client relationships and project workflows. Insightly offers a user-friendly interface and a range of integration options. It’s particularly well-suited for small businesses that need a CRM that can handle both sales and project management. It has a free plan with limited features and more extensive paid plans.

Pros: Combines CRM and project management features; user-friendly interface; good for client and project tracking.

Cons: Limited features in the free plan; can be less focused on sales than some other options.

Pricing: Free for up to 2 users; Paid plans start from $29/user/month.

5. Freshsales (by Freshworks)

Freshsales is a sales CRM known for its ease of use and its focus on providing a great user experience. It offers features such as built-in phone and email, and a visual sales pipeline. It is also known for its excellent customer support. Freshsales integrates with various apps, including accounting software. It offers a free plan with limited features and paid plans that offer more advanced functionality.

Pros: User-friendly interface; excellent customer support; built-in phone and email features.

Cons: Can be pricier than some other options; may not have as many features as some of the more established players.

Pricing: Free for up to 3 users; Paid plans start from $15/user/month.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the best CRM for your accounting firm is a significant decision. Here’s a step-by-step guide to help you make the right choice:

1. Assess Your Needs

Before you start comparing CRM systems, take the time to understand your firm’s specific needs. Consider the following:

- What are your primary goals? Are you looking to improve client relationships, streamline your sales process, or automate your marketing efforts?

- What are your pain points? What are the biggest challenges you face in managing client data, communicating with clients, or tracking your leads?

- What features are essential? Make a list of the features you absolutely need in a CRM, such as contact management, communication tracking, and integration with your accounting software.

- How many users will need access? This will help you determine the appropriate pricing plan.

2. Research and Compare Options

Once you have a clear understanding of your needs, start researching different CRM systems. Read reviews, compare features, and consider the pros and cons of each option. Pay close attention to the following:

- Ease of use: Choose a system that’s intuitive and easy to learn, so your team can quickly adopt it.

- Integration capabilities: Ensure the CRM integrates seamlessly with your existing accounting software and other business tools.

- Customization options: Make sure the CRM can be customized to meet your specific needs.

- Pricing and scalability: Choose a system that fits your budget and can scale as your firm grows.

- Customer support: Look for a CRM provider that offers excellent customer support.

3. Request Demos and Free Trials

Most CRM providers offer demos and free trials. Take advantage of these opportunities to test the systems and see how they work in practice. This will give you a better understanding of the user interface, the features, and the overall usability.

4. Involve Your Team

Involve your team in the decision-making process. Get their feedback on the different CRM systems you’re considering. After all, they’ll be the ones using the system on a daily basis. Make sure everyone feels comfortable with the chosen solution.

5. Implement and Train

Once you’ve selected a CRM, it’s time to implement it. This involves importing your client data, configuring the system, and training your team. Provide comprehensive training to ensure everyone knows how to use the CRM effectively. Many CRM providers offer onboarding assistance and training resources.

6. Monitor and Optimize

After implementation, monitor your CRM usage and track your results. Identify any areas where you can improve your processes or optimize your CRM setup. Regularly review your CRM settings and features to ensure they still meet your firm’s needs. Consider seeking support from the CRM provider or a CRM consultant to help you optimize the system for maximum efficiency.

Maximizing Your CRM Investment

Simply implementing a CRM isn’t enough. To truly reap the benefits, you need to optimize your CRM usage and integrate it into your firm’s daily operations. Here are some tips for maximizing your CRM investment:

Data Migration and Cleansing

Ensure your client data is accurate, complete, and up-to-date. Before importing your data into the CRM, cleanse it by removing duplicates, correcting errors, and standardizing the formatting. This will ensure your CRM provides reliable information.

User Training and Adoption

Provide comprehensive training to your team on how to use the CRM effectively. Encourage user adoption by emphasizing the benefits of the system and showcasing how it will improve their daily tasks. Make the CRM a central part of your workflow.

Automation and Workflow Optimization

Take advantage of the CRM’s automation capabilities to streamline your processes. Automate repetitive tasks, such as sending appointment reminders and following up on leads. Optimize your workflows to ensure maximum efficiency.

Regular Data Analysis and Reporting

Regularly analyze your CRM data to gain valuable insights into your business performance. Use the CRM’s reporting features to track key metrics, such as client acquisition cost, client retention rate, and revenue per client. Use these insights to make data-driven decisions to improve your business.

Integration with Other Tools

Integrate your CRM with other tools, such as your accounting software, email marketing platforms, and social media channels. This will ensure seamless data flow and eliminate the need for manual data entry.

Ongoing Review and Optimization

Regularly review your CRM usage and identify any areas where you can improve your processes or optimize your CRM setup. Stay up-to-date with the latest CRM features and updates. Continuously strive to maximize the value of your CRM investment.

Final Thoughts: Embracing the Future of Accounting

In the dynamic landscape of accounting, embracing technology is no longer optional; it’s essential for success. A well-chosen CRM system is a powerful tool that can transform your small accounting firm. By centralizing client information, streamlining workflows, and improving client relationships, a CRM empowers you to work smarter, not harder. The right CRM will help you attract new clients, retain existing ones, and grow your practice. Take the time to research and select the best CRM for your firm’s specific needs. Your future self will thank you. The investment in a CRM is an investment in your firm’s long-term success.

By following the steps outlined in this guide, you can find the perfect CRM to elevate your accounting firm to new heights. Remember to prioritize your needs, research your options, and involve your team in the decision-making process. With the right CRM, you can unlock efficiency, build stronger client relationships, and achieve your business goals.