Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

In the fast-paced world of accounting, staying organized and maintaining strong client relationships are absolutely critical. For small accounting firms, this can be a significant challenge. Juggling client data, managing communications, and tracking deadlines can quickly become overwhelming. This is where a Customer Relationship Management (CRM) system comes into play. A well-chosen CRM can be a game-changer, streamlining operations, boosting productivity, and ultimately, helping you grow your business. But with so many options available, choosing the right one can feel daunting. This comprehensive guide will explore the best CRM systems tailored specifically for small accounting firms, helping you navigate the landscape and find the perfect fit.

Why Your Small Accounting Firm Needs a CRM

Before diving into specific CRM recommendations, let’s understand why a CRM is such a valuable asset for small accounting firms. Think of a CRM as the central nervous system of your client interactions. It’s a hub where you store, manage, and analyze all your client-related information. Here’s a breakdown of the key benefits:

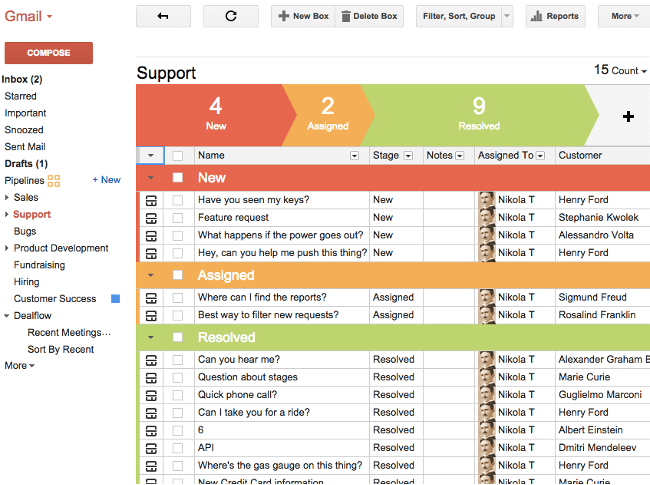

- Centralized Client Data: No more scattered spreadsheets or lost emails! A CRM provides a single, accessible location for all client details, including contact information, financial records, communication history, and project statuses.

- Improved Client Communication: CRM systems enable you to track all interactions with clients, ensuring you never miss a beat. You can easily log calls, emails, and meetings, and even automate follow-up communications.

- Enhanced Organization and Efficiency: By automating tasks like appointment scheduling, reminders, and report generation, a CRM frees up your time to focus on core accounting activities.

- Streamlined Sales and Marketing: CRM tools can help you manage leads, track sales opportunities, and nurture potential clients. This can be particularly beneficial for growing your client base.

- Data-Driven Decision Making: CRM systems provide valuable insights into client behavior, allowing you to identify trends, personalize your services, and make informed business decisions.

- Better Collaboration: Team members can easily access and share client information, ensuring everyone is on the same page and providing consistent service.

- Increased Client Satisfaction: By providing personalized service and staying on top of client needs, a CRM can significantly improve client satisfaction and loyalty.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider these essential features:

- Contact Management: This is the foundation of any CRM. Look for features like detailed contact profiles, segmentation capabilities, and the ability to import and export data.

- Lead Management: If you’re actively seeking new clients, lead management features are crucial. This includes lead capture, lead scoring, and opportunity tracking.

- Task and Project Management: A CRM should help you manage your workload. Look for features like task assignment, deadline tracking, and project progress monitoring.

- Reporting and Analytics: Data is your friend. Choose a CRM that provides robust reporting capabilities, allowing you to track key metrics and gain insights into your business performance.

- Email Integration: Seamless email integration is a must-have. The CRM should integrate with your email provider, allowing you to send and track emails directly from the system.

- Workflow Automation: Automate repetitive tasks to save time. Look for features that allow you to create automated workflows for tasks like sending follow-up emails or generating reports.

- Integration with Accounting Software: This is a critical feature for accountants. The CRM should integrate seamlessly with your existing accounting software, such as QuickBooks or Xero, to streamline data transfer and eliminate manual data entry.

- Customization Options: Your accounting firm is unique. Choose a CRM that allows you to customize fields, workflows, and reports to meet your specific needs.

- Mobile Accessibility: Being able to access your client data on the go is a huge advantage. Look for a CRM with a mobile app or a responsive web interface.

- Security and Compliance: Protecting client data is paramount. Ensure the CRM offers robust security features and complies with relevant data privacy regulations.

Top CRM Systems for Small Accounting Firms: A Detailed Review

Now, let’s explore some of the best CRM systems tailored for small accounting firms. We’ll examine their key features, pricing, and suitability for different needs. Keep in mind that the “best” CRM depends on your specific requirements and budget. Take the time to research these options and consider a free trial before making a decision.

1. HubSpot CRM

Overview: HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms due to its user-friendly interface and generous free plan. HubSpot offers a comprehensive suite of tools, including contact management, lead management, email marketing, and sales automation.

Key Features:

- Free CRM: HubSpot offers a robust free CRM that includes unlimited users, contact management, and basic sales and marketing tools. This is a major advantage for startups and small firms on a tight budget.

- Contact Management: Detailed contact profiles, including company information, activity history, and deal stages.

- Email Marketing: Create and send email marketing campaigns to nurture leads and stay in touch with clients.

- Sales Automation: Automate repetitive tasks, such as sending follow-up emails and creating tasks.

- Reporting and Analytics: Track key metrics, such as sales performance and marketing campaign effectiveness.

- Integrations: Integrates with popular accounting software, such as QuickBooks and Xero, as well as other tools like Gmail, Outlook, and Slack.

- User-Friendly Interface: Easy to learn and use, even for those with limited CRM experience.

Pricing: HubSpot offers a free CRM plan with limited features. Paid plans start at around $45 per month and offer more advanced features and functionality.

Pros:

- Free plan is very generous and suitable for small businesses.

- User-friendly interface.

- Excellent integration capabilities.

- Comprehensive suite of tools.

Cons:

- Some advanced features are only available on paid plans.

- Can be overwhelming for users who only need basic CRM functionality.

Best For: Small accounting firms looking for a free or affordable CRM with a comprehensive set of features and excellent integration capabilities.

2. Zoho CRM

Overview: Zoho CRM is another popular option, known for its affordability and extensive customization options. It offers a wide range of features, including contact management, lead management, sales automation, and marketing automation. Zoho CRM is a great choice for accounting firms that need a highly customizable CRM to fit their specific workflows.

Key Features:

- Customization: Highly customizable, allowing you to tailor the CRM to your specific needs.

- Contact Management: Detailed contact profiles, segmentation, and activity tracking.

- Lead Management: Lead capture, scoring, and nurturing capabilities.

- Sales Automation: Automate sales processes, such as follow-up emails and task creation.

- Workflow Automation: Create automated workflows to streamline your business processes.

- Reporting and Analytics: Generate custom reports and dashboards to track key metrics.

- Integrations: Integrates with popular accounting software, email providers, and other business tools.

- Affordable Pricing: Offers a range of pricing plans to suit different budgets.

Pricing: Zoho CRM offers a free plan for up to 3 users with limited features. Paid plans start at around $14 per user per month.

Pros:

- Highly customizable.

- Affordable pricing.

- Wide range of features.

- Excellent integration capabilities.

Cons:

- Can be complex to set up and configure.

- User interface can be overwhelming for some users.

Best For: Small accounting firms that need a highly customizable and affordable CRM to fit their specific workflows and business needs.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that’s known for its ease of use and intuitive interface. It’s designed to help sales teams manage their pipeline and close deals. While not specifically designed for accountants, its simplicity and effectiveness make it a viable option for small firms that want a straightforward CRM to track leads and manage client interactions.

Key Features:

- Visual Pipeline Management: Clear and intuitive pipeline view to track deals and opportunities.

- Contact Management: Centralized contact database with detailed information.

- Deal Management: Track deals through different stages of the sales pipeline.

- Email Integration: Seamless email integration with your email provider.

- Automation: Automate repetitive tasks, such as sending follow-up emails and creating tasks.

- Reporting and Analytics: Track sales performance and gain insights into your sales process.

- User-Friendly Interface: Easy to learn and use, even for users with limited CRM experience.

Pricing: Pipedrive offers a free trial. Paid plans start at around $14.90 per user per month.

Pros:

- User-friendly interface.

- Visual pipeline management.

- Easy to learn and use.

Cons:

- May lack some of the advanced features found in other CRMs.

- Not as focused on accounting-specific features.

Best For: Small accounting firms that prioritize ease of use and want a simple, effective CRM for tracking leads and managing client interactions.

4. Salesforce Sales Cloud

Overview: Salesforce Sales Cloud is a powerful and feature-rich CRM system, but it can be more complex and expensive than other options. It’s a good choice for larger accounting firms or those with complex needs. Salesforce offers a wide range of features, including contact management, lead management, sales automation, and reporting and analytics.

Key Features:

- Comprehensive Features: Offers a wide range of features, including contact management, lead management, sales automation, and reporting and analytics.

- Customization: Highly customizable, allowing you to tailor the CRM to your specific needs.

- Scalability: Can scale to meet the needs of growing businesses.

- Integrations: Integrates with a wide range of third-party applications.

- Reporting and Analytics: Robust reporting and analytics capabilities.

- AppExchange: Access to a vast library of pre-built applications and integrations through the Salesforce AppExchange.

Pricing: Salesforce Sales Cloud is more expensive than other options. Pricing starts at around $25 per user per month.

Pros:

- Powerful and feature-rich.

- Highly customizable.

- Scalable.

- Extensive integration capabilities.

Cons:

- Can be complex to set up and configure.

- More expensive than other options.

- May be overkill for small accounting firms with simple needs.

Best For: Larger accounting firms or those with complex needs who are willing to invest in a powerful and feature-rich CRM system.

5. Freshsales

Overview: Freshsales is a sales-focused CRM that’s known for its ease of use and affordable pricing. It’s a good option for small accounting firms that want a CRM with a simple interface and a focus on sales automation. Freshsales offers features like contact management, lead management, and sales automation.

Key Features:

- Contact Management: Centralized contact database with detailed information.

- Lead Management: Lead scoring and lead tracking features.

- Sales Automation: Automate sales processes, such as sending follow-up emails and creating tasks.

- Reporting and Analytics: Track sales performance and gain insights into your sales process.

- Email Integration: Seamless email integration with your email provider.

- User-Friendly Interface: Easy to learn and use.

- Affordable Pricing: Offers a range of pricing plans to suit different budgets.

Pricing: Freshsales offers a free plan with limited features. Paid plans start at around $15 per user per month.

Pros:

- User-friendly interface.

- Affordable pricing.

- Good for sales automation.

Cons:

- May lack some of the advanced features found in other CRMs.

- Not as focused on accounting-specific features.

Best For: Small accounting firms that want a simple, affordable, and user-friendly CRM with a focus on sales automation.

How to Choose the Right CRM for Your Firm

Choosing the right CRM is a crucial decision that can significantly impact your firm’s efficiency and growth. Here’s a step-by-step approach to help you make the right choice:

- Assess Your Needs: Before anything else, take the time to understand your firm’s specific needs and requirements. What are your pain points? What processes do you want to improve? Identify the key features that are essential for your business.

- Define Your Budget: Determine how much you’re willing to spend on a CRM system. Consider not only the monthly or annual subscription fees but also the cost of implementation, training, and any potential add-ons.

- Research Available Options: Explore the various CRM systems on the market, considering the options mentioned above and others. Read reviews, compare features, and create a shortlist of potential candidates.

- Request Demos and Free Trials: Most CRM providers offer demos or free trials. Take advantage of these opportunities to see the system in action and evaluate its features and usability.

- Consider Integration Capabilities: Ensure that the CRM integrates seamlessly with your existing accounting software, email provider, and other essential business tools.

- Evaluate Customization Options: Determine whether the CRM can be customized to meet your specific workflows and reporting needs.

- Assess User Experience: The CRM should be user-friendly and easy for your team to learn and use. Consider the interface, navigation, and overall user experience.

- Check for Security and Compliance: Ensure that the CRM offers robust security features and complies with relevant data privacy regulations, such as GDPR.

- Get Feedback from Your Team: Involve your team in the selection process. Their input can be invaluable in assessing the usability and suitability of different CRM systems.

- Make a Decision and Implement: Once you’ve completed your research and evaluation, make a decision and start the implementation process. Provide adequate training to your team and monitor the system’s performance to ensure it’s meeting your needs.

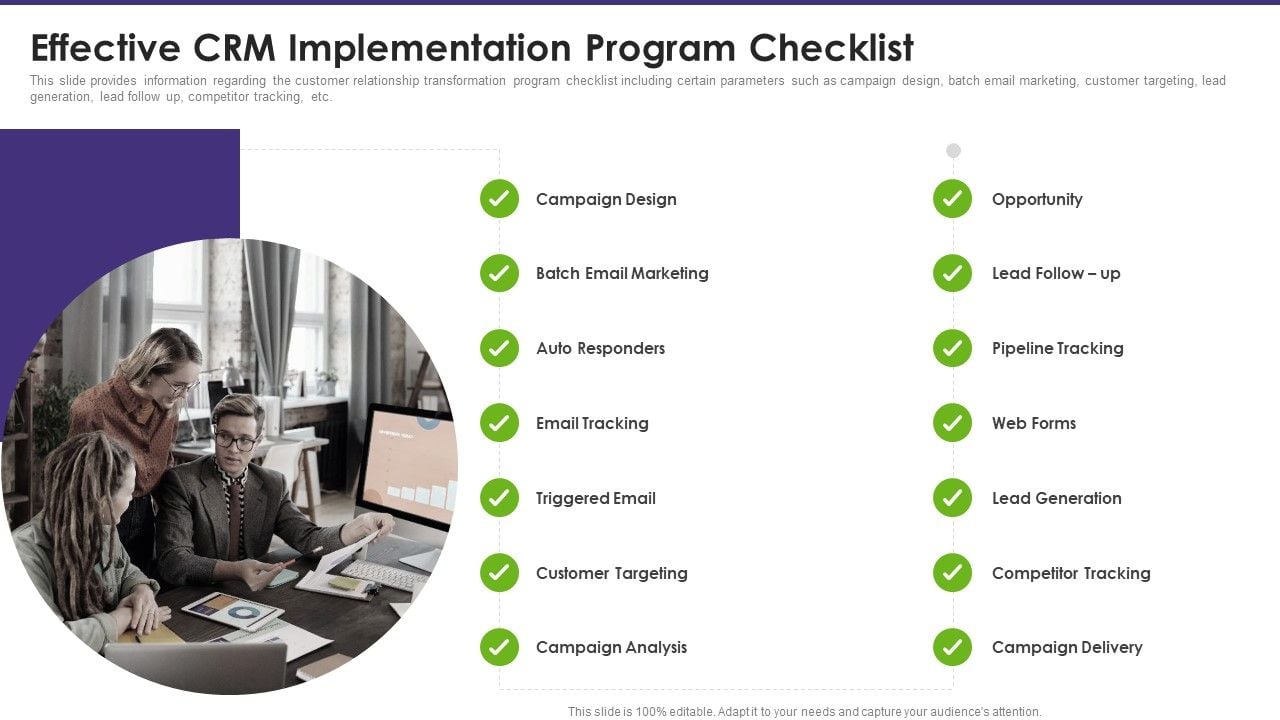

Tips for Successful CRM Implementation

Once you’ve chosen a CRM system, successful implementation is key to realizing its full potential. Here are some tips to ensure a smooth transition:

- Plan Your Implementation: Develop a detailed implementation plan that outlines the steps involved, the timeline, and the resources required.

- Data Migration: Carefully plan the migration of your existing client data to the new CRM system. Ensure that the data is accurate and complete.

- Provide Training: Offer comprehensive training to your team on how to use the CRM system. This will help them adopt the new system quickly and effectively.

- Customize the System: Customize the CRM to meet your specific workflows and reporting needs. This will ensure that it’s tailored to your firm’s requirements.

- Monitor and Evaluate: Regularly monitor the CRM’s performance and evaluate its effectiveness. Make adjustments as needed to optimize its use and maximize its benefits.

- Seek Ongoing Support: Take advantage of the CRM provider’s support resources, such as online documentation, tutorials, and customer support.

- Encourage User Adoption: Encourage your team to use the CRM system consistently and provide ongoing support and encouragement.

- Stay Updated: Keep the CRM system updated with the latest features and security patches.

The Future of CRM in Accounting

The role of CRM in accounting is constantly evolving. As technology advances, we can expect to see even more sophisticated CRM systems that offer:

- Artificial Intelligence (AI): AI-powered CRM systems can automate tasks, provide insights, and predict client behavior.

- Enhanced Automation: More advanced automation capabilities will streamline workflows and reduce manual tasks.

- Improved Data Analytics: CRM systems will provide even more in-depth data analytics to help accountants make informed decisions.

- Increased Integration: CRM systems will integrate with a wider range of accounting software and other business tools.

- Mobile-First Design: CRM systems will become even more mobile-friendly, allowing accountants to access client data and manage their businesses from anywhere.

By embracing CRM technology, small accounting firms can stay ahead of the curve, improve client relationships, and achieve sustainable growth. The right CRM system is an investment that can pay dividends for years to come.

Conclusion: Choosing the Right CRM for Your Accounting Firm

Selecting the right CRM is a pivotal step in modernizing and optimizing your accounting firm. With the wide array of options available, from the feature-rich HubSpot to the customizable Zoho CRM and the sales-focused Pipedrive, there’s a solution tailored to every practice’s unique needs and budget. Remember to prioritize features like contact management, email integration, and integration with your existing accounting software. Take the time to assess your specific requirements, conduct thorough research, and leverage free trials and demos to make an informed decision. Successful implementation, training, and ongoing support are key to maximizing your CRM’s benefits. By making the right choice, your accounting firm can cultivate stronger client relationships, streamline operations, and achieve sustainable growth in today’s competitive landscape.