Unlocking Efficiency: The Best CRM Solutions for Small Accounting Firms

Unlocking Efficiency: The Best CRM Solutions for Small Accounting Firms

In the fast-paced world of accounting, managing client relationships effectively is crucial for success. A Customer Relationship Management (CRM) system can be a game-changer, helping small accounting firms streamline operations, improve client communication, and boost profitability. But with a plethora of CRM options available, choosing the right one can feel overwhelming. This article dives deep into the best CRM solutions tailored for small accounting practices, exploring their features, benefits, and how they can transform your business.

Why Your Small Accounting Firm Needs a CRM

Before we delve into specific CRM solutions, let’s understand why a CRM is essential for small accounting firms. In the past, many firms relied on spreadsheets, email inboxes, and memory to manage client interactions. This approach is inefficient, prone to errors, and can lead to missed opportunities. A CRM system centralizes client data, providing a 360-degree view of each client. Here are some key benefits:

- Improved Client Communication: CRM systems help you track all interactions with clients, ensuring consistent and personalized communication.

- Enhanced Organization: Centralized data eliminates the need to hunt through multiple sources for client information.

- Increased Efficiency: Automation features streamline tasks like scheduling meetings, sending invoices, and following up with leads.

- Better Client Retention: By providing exceptional service and building stronger relationships, CRM systems contribute to increased client loyalty.

- Data-Driven Decision Making: CRM reports and analytics provide valuable insights into client behavior, marketing campaign performance, and overall business health.

Investing in a CRM is not just about adopting new technology; it’s about investing in your firm’s future. It empowers you to work smarter, not harder, and ultimately, achieve greater success.

Key Features to Look for in a CRM for Accountants

Choosing the right CRM requires careful consideration of your firm’s specific needs. While all CRM systems offer core functionalities, some features are particularly crucial for accounting firms. Here’s what to look for:

- Contact Management: Robust contact management capabilities are essential. The CRM should allow you to store detailed client information, including contact details, financial data, communication history, and notes.

- Lead Management: A CRM should help you capture, nurture, and convert leads into clients. Look for features like lead scoring, automated follow-up sequences, and integration with marketing tools.

- Task Management: Accountants juggle multiple tasks and deadlines. A CRM should allow you to create, assign, and track tasks, ensuring nothing falls through the cracks.

- Calendar and Scheduling: Integration with calendar applications (e.g., Google Calendar, Outlook) is essential for scheduling appointments, meetings, and deadlines.

- Document Management: The ability to securely store and manage client documents, such as tax returns, financial statements, and contracts, is a must-have.

- Reporting and Analytics: Comprehensive reporting capabilities provide insights into key performance indicators (KPIs), such as client acquisition cost, client retention rate, and revenue per client.

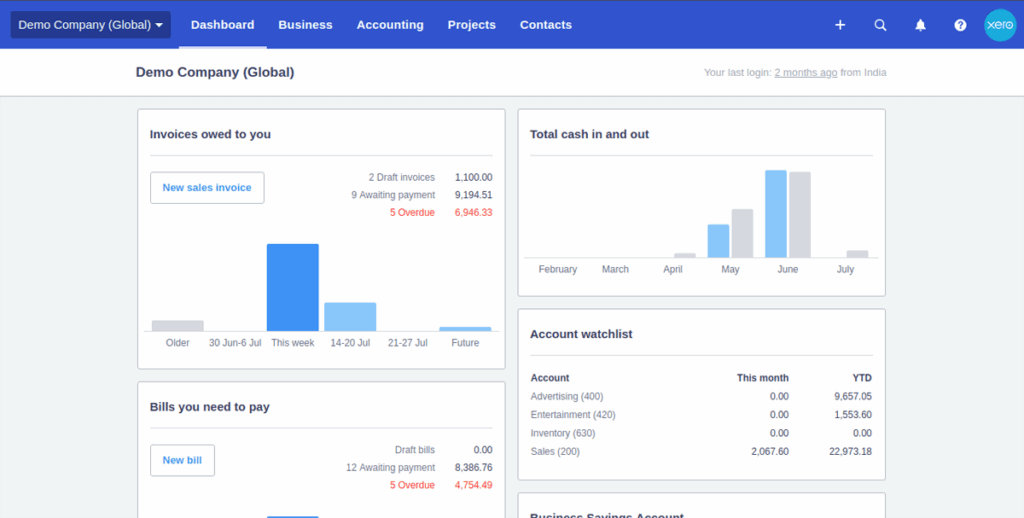

- Integration with Accounting Software: Seamless integration with popular accounting software like QuickBooks, Xero, and Sage is crucial for data synchronization and efficiency.

- Security and Compliance: Given the sensitive nature of financial data, the CRM must have robust security features, including data encryption, access controls, and compliance with industry regulations (e.g., GDPR, CCPA).

- Mobile Accessibility: The ability to access your CRM on the go is essential for staying connected with clients and managing your business from anywhere.

Prioritizing these features will help you find a CRM that perfectly aligns with your firm’s needs and helps you achieve your business goals.

Top CRM Solutions for Small Accounting Firms

Now, let’s explore some of the best CRM solutions available for small accounting firms. We’ll consider their strengths, weaknesses, pricing, and suitability for different types of practices.

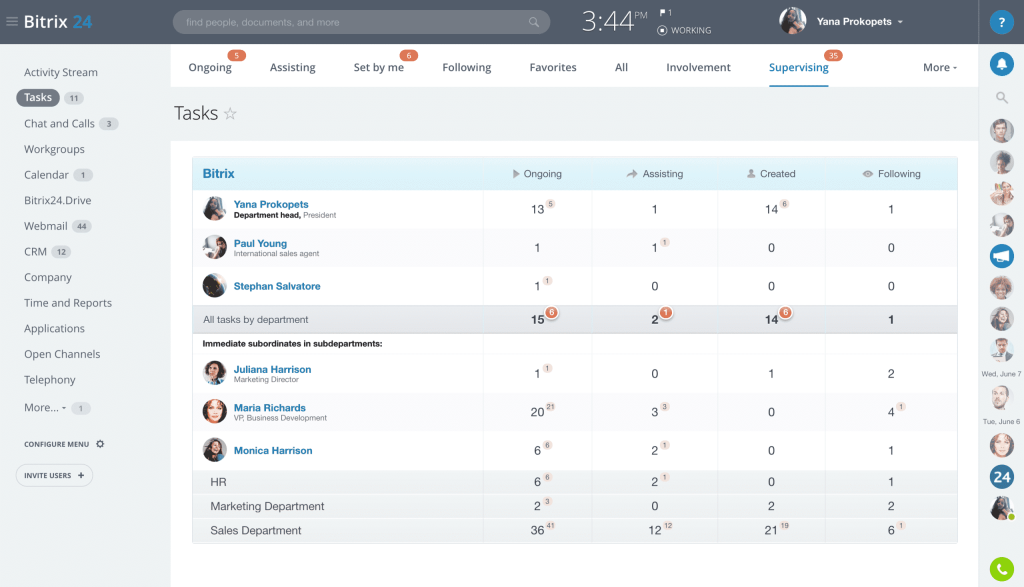

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, including accounting firms. Its free version offers a wide range of features, making it an excellent starting point for small firms.

- Pros:

- Free CRM with robust features.

- User-friendly interface.

- Excellent integration with marketing and sales tools.

- Comprehensive reporting and analytics.

- Cons:

- The free version has limitations on storage and features.

- Advanced features require paid subscriptions.

- Pricing: Free plan available; paid plans start from $45 per month.

- Suitability: Ideal for small firms looking for a cost-effective and feature-rich CRM.

2. Zoho CRM

Zoho CRM is a versatile and affordable CRM solution that caters to a wide range of industries. Its customization options and integrations make it a strong contender for accounting firms.

- Pros:

- Highly customizable.

- Excellent integration with Zoho’s suite of business applications.

- Affordable pricing plans.

- Automated workflows and sales processes.

- Cons:

- The interface can be overwhelming for some users.

- Some integrations require additional subscriptions.

- Pricing: Free plan available; paid plans start from $14 per user per month.

- Suitability: Well-suited for firms looking for a customizable and affordable CRM with strong integration capabilities.

3. Pipedrive

Pipedrive is a sales-focused CRM that excels at managing sales pipelines and tracking deals. While not specifically designed for accounting, its intuitive interface and deal-driven approach can be beneficial.

- Pros:

- Intuitive and user-friendly interface.

- Strong focus on sales pipeline management.

- Visual deal tracking.

- Excellent reporting and analytics.

- Cons:

- Less emphasis on client relationship management features.

- Limited features in the lower-priced plans.

- Pricing: Paid plans start from $12.50 per user per month.

- Suitability: Best for firms that prioritize sales and lead management.

4. Salesforce Sales Cloud

Salesforce Sales Cloud is a powerful and feature-rich CRM solution suitable for larger accounting firms with complex needs. It offers a wide array of customization options and integrations.

- Pros:

- Highly customizable and scalable.

- Extensive features and integrations.

- Robust reporting and analytics.

- Large ecosystem of apps and add-ons.

- Cons:

- Expensive.

- Complex interface and steep learning curve.

- May be overkill for small firms.

- Pricing: Paid plans start from $25 per user per month.

- Suitability: Best for larger firms with complex needs and a dedicated IT team.

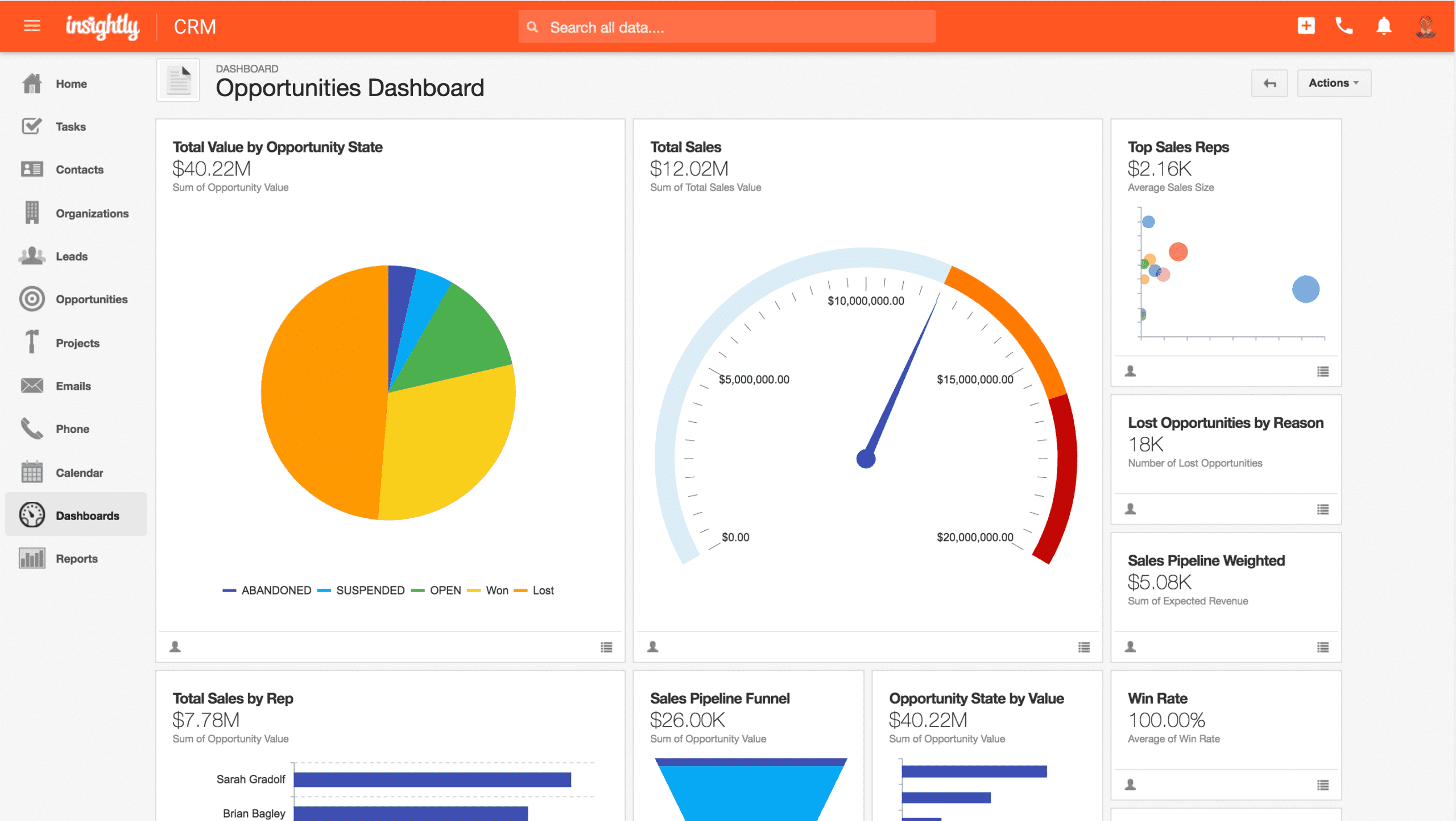

5. Insightly

Insightly is a CRM designed to help small businesses manage their sales, marketing, and project management processes. It’s a good option for accounting firms looking for a CRM that can handle multiple aspects of their business.

- Pros:

- User-friendly interface.

- Project management features.

- Good for managing sales and client relationships.

- Affordable pricing.

- Cons:

- Limited customization options.

- Fewer integrations compared to other CRMs.

- Pricing: Paid plans start from $29 per user per month.

- Suitability: Great for small accounting firms that want a combined CRM and project management tool.

6. Freshsales

Freshsales is a sales-focused CRM with a focus on ease of use. It’s a good option for accounting firms looking to streamline their sales processes.

- Pros:

- Easy to set up and use.

- Built-in phone and email integration.

- AI-powered features.

- Affordable pricing.

- Cons:

- Fewer customization options.

- Not as robust as some other CRMs.

- Pricing: Free plan available; paid plans start from $15 per user per month.

- Suitability: A good choice for accounting firms looking for a simple, sales-oriented CRM.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the ideal CRM for your small accounting firm requires a systematic approach. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Before you begin evaluating CRM solutions, take the time to understand your firm’s specific requirements. Identify your pain points, such as inefficient client communication, disorganized data, or difficulty tracking leads. Determine the features that are most important to you, such as contact management, lead management, task management, and integration with your accounting software.

- Define Your Budget: CRM solutions vary widely in price. Set a realistic budget that aligns with your firm’s financial resources. Consider both the initial setup costs and the ongoing subscription fees. Remember to factor in the cost of training and any additional add-ons or integrations you may need.

- Research CRM Options: Once you have a clear understanding of your needs and budget, begin researching CRM solutions. Explore the options discussed above, as well as other CRM providers. Read reviews, compare features, and visit their websites to learn more.

- Evaluate Key Features: Prioritize the features that are most critical to your firm’s success. Ensure the CRM offers robust contact management, lead management, task management, calendar integration, document management, reporting and analytics, and integration with your accounting software. Consider the security and compliance features, as well as mobile accessibility.

- Consider Integration Capabilities: Assess the CRM’s integration capabilities with your existing tools and applications. Seamless integration with your accounting software, email marketing platform, and other business applications is essential for data synchronization and efficiency.

- Read Reviews and Case Studies: Research customer reviews and case studies to gain insights into the experiences of other accounting firms using the CRM. Learn about their successes, challenges, and overall satisfaction.

- Request Demos and Trials: Most CRM providers offer free demos or trial periods. Take advantage of these opportunities to test the software and evaluate its functionality. Get hands-on experience with the interface, explore the features, and determine if it meets your needs.

- Consider User Friendliness: Choose a CRM with an intuitive and user-friendly interface. The easier the system is to use, the more likely your team will adopt it and leverage its benefits.

- Plan for Implementation and Training: Successful CRM implementation requires careful planning and preparation. Develop a detailed implementation plan that includes data migration, user training, and ongoing support. Provide your team with adequate training and resources to ensure they can effectively use the system.

- Provide ongoing support and review: After implementation, provide ongoing support to your team to help them get the most out of the CRM. Regularly review your CRM usage and make adjustments as needed to optimize its effectiveness. Consider scheduling regular check-ins with your team to gather feedback and identify areas for improvement.

By following these steps, you can confidently choose a CRM that empowers your small accounting firm to thrive.

Maximizing Your CRM Investment

Once you’ve implemented a CRM, the work doesn’t stop there. To truly maximize your investment, consider these tips:

- Train Your Team: Comprehensive training is essential to ensure your team can effectively use the CRM. Provide ongoing support and resources to address any questions or challenges.

- Customize Your CRM: Tailor the CRM to your firm’s specific needs. Customize the fields, workflows, and reports to align with your processes and goals.

- Integrate with Other Tools: Integrate your CRM with other business applications, such as your accounting software, email marketing platform, and project management tools, to streamline your workflow and automate tasks.

- Regularly Clean and Update Data: Keep your client data accurate and up-to-date. Regularly clean and update your database to ensure you have the most current information.

- Track Key Metrics: Monitor key performance indicators (KPIs), such as client acquisition cost, client retention rate, and revenue per client, to measure the effectiveness of your CRM and identify areas for improvement.

- Analyze and Adapt: Regularly analyze your CRM data to identify trends, insights, and opportunities. Adapt your strategies and processes as needed to optimize your CRM’s performance.

- Embrace Automation: Leverage automation features to streamline tasks, such as scheduling appointments, sending invoices, and following up with leads.

By following these tips, you can ensure that your CRM becomes an indispensable tool for driving growth and success.

The Future of CRM in Accounting

The future of CRM in accounting is bright, with ongoing advancements in technology and an increasing focus on client-centricity. Here are some trends to watch:

- Artificial Intelligence (AI): AI-powered CRM systems are becoming more prevalent, offering features like predictive analytics, automated data entry, and personalized client interactions.

- Integration with Cloud Technologies: Cloud-based CRM solutions are becoming increasingly popular, providing greater flexibility, scalability, and accessibility.

- Enhanced Data Security: With the increasing threat of cyberattacks, data security is becoming a top priority. CRM providers are investing in robust security features, such as data encryption, access controls, and compliance with industry regulations.

- Mobile CRM: The ability to access your CRM on the go is becoming increasingly important. Mobile CRM solutions provide accountants with the flexibility to manage their business from anywhere.

- Focus on Client Experience: CRM systems are evolving to provide a more personalized and client-centric experience. Features like client portals, self-service options, and proactive communication are becoming increasingly important.

By staying informed about these trends, you can ensure that your firm is well-positioned to leverage the latest CRM advancements and provide exceptional client service.

Conclusion

Choosing the right CRM is a critical decision for any small accounting firm. By understanding your firm’s needs, evaluating the available options, and implementing the system effectively, you can unlock significant benefits. A well-chosen CRM will improve client communication, enhance organization, boost efficiency, and ultimately, contribute to your firm’s success. Embrace the power of CRM and transform your accounting practice into a thriving, client-focused business.