Top CRM Systems for Small Accounting Firms: Streamline Your Business and Boost Profits

Top CRM Systems for Small Accounting Firms: Streamline Your Business and Boost Profits

Running a small accounting firm is no walk in the park. You’re juggling client relationships, financial data, deadlines, and a whole host of other responsibilities. In today’s fast-paced business environment, efficiency is key. That’s where a Customer Relationship Management (CRM) system comes in. It’s like having a super-powered assistant that helps you manage clients, track leads, automate tasks, and ultimately, grow your business. But with so many CRM options out there, choosing the right one can feel overwhelming. This article dives deep into the best CRM for small accountants, helping you find the perfect fit to streamline your operations and boost your bottom line.

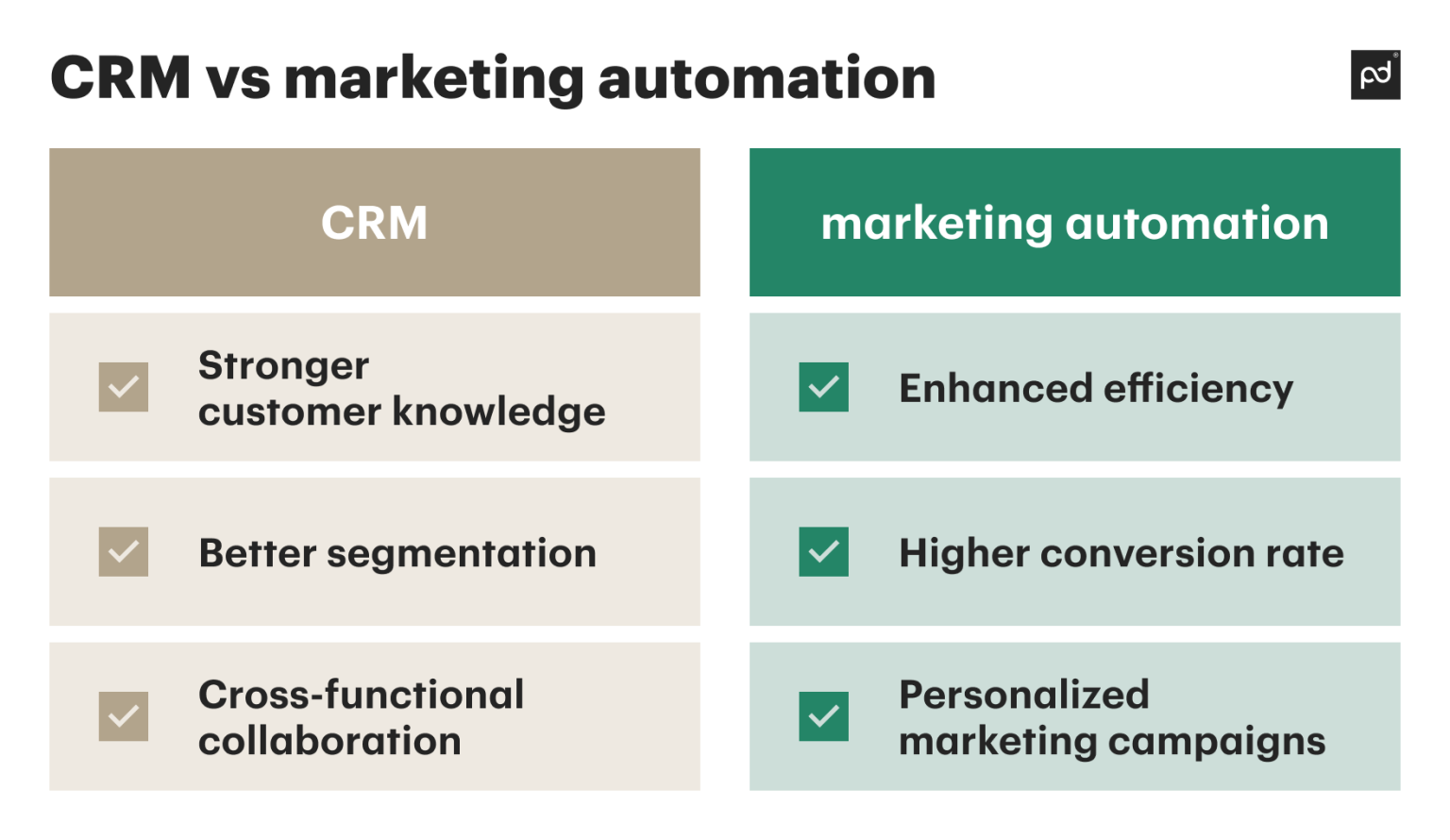

Why Your Small Accounting Firm Needs a CRM

Before we jump into specific CRM recommendations, let’s talk about why a CRM is essential for small accounting firms. You might be thinking, “I’m a small firm, I don’t need a fancy system.” But trust me, a well-implemented CRM can be a game-changer, especially when you’re looking to scale and improve client satisfaction. Here’s why:

- Centralized Client Information: No more scattered spreadsheets, emails, and sticky notes! A CRM provides a single source of truth for all client data. You can easily access contact information, communication history, financial records, and more, all in one place.

- Improved Client Relationships: By understanding your clients better, you can tailor your services to their specific needs. A CRM helps you track interactions, personalize communications, and provide proactive support, leading to stronger, more loyal client relationships.

- Enhanced Lead Management: A CRM helps you track leads, nurture them through the sales pipeline, and convert them into paying clients. You can automate follow-up emails, schedule appointments, and monitor your sales performance, all within the system.

- Increased Efficiency: Automate repetitive tasks like data entry, email marketing, and appointment scheduling. This frees up your time to focus on more important activities, like providing high-quality accounting services.

- Better Collaboration: A CRM allows your team to collaborate more effectively. Everyone has access to the same information, so they can provide consistent and informed support to clients.

- Data-Driven Decision Making: A CRM provides valuable insights into your business performance. You can track key metrics like client acquisition cost, client retention rate, and revenue per client, helping you make informed decisions about your business strategy.

In essence, a CRM is an investment that can significantly improve the efficiency, client satisfaction, and profitability of your small accounting firm.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, it’s important to look for specific features that cater to your unique needs. Here are some essential features to consider:

- Contact Management: This is the foundation of any CRM. Look for features like contact storage, organization, and segmentation. You should be able to easily store and access client contact information, track interactions, and segment your client base based on various criteria (e.g., industry, service type, revenue).

- Lead Management: The ability to capture, track, and nurture leads is crucial for business growth. The CRM should allow you to capture leads from various sources (e.g., website, social media, referrals), track their progress through the sales pipeline, and automate follow-up communications.

- Task Management: Accounting firms are busy places. A CRM should allow you to create, assign, and track tasks to ensure that deadlines are met and client needs are addressed promptly.

- Appointment Scheduling: Integrated appointment scheduling can save you time and reduce the risk of missed appointments. Clients should be able to book appointments directly through the CRM or a connected calendar, and you should receive automated reminders.

- Email Integration: Seamless integration with your email provider is essential. The CRM should allow you to send and receive emails directly from the system, track email opens and clicks, and automate email marketing campaigns.

- Reporting and Analytics: The ability to track key performance indicators (KPIs) is crucial for understanding your business performance. The CRM should provide customizable reports and dashboards that allow you to monitor client acquisition cost, client retention rate, revenue per client, and other important metrics.

- Integration with Accounting Software: This is a critical feature for accountants. The CRM should integrate seamlessly with your existing accounting software (e.g., QuickBooks, Xero) to streamline data entry and provide a complete view of your clients’ financial data.

- Customization Options: Every accounting firm is unique. The CRM should offer customization options that allow you to tailor the system to your specific needs. This might include custom fields, workflows, and reports.

- Mobile Accessibility: In today’s mobile world, you need access to your client data on the go. The CRM should have a mobile app or a responsive web design that allows you to access the system from your smartphone or tablet.

- Security and Compliance: Security is paramount, especially when dealing with sensitive financial data. The CRM should have robust security measures in place to protect your data from unauthorized access. It should also comply with relevant data privacy regulations (e.g., GDPR, CCPA).

By prioritizing these features, you can choose a CRM that effectively supports the specific needs of your accounting firm.

Top CRM Systems for Small Accountants

Now, let’s dive into some of the top CRM systems specifically designed for small accounting firms. We’ll explore their key features, pricing, and suitability for different needs. Remember, the best CRM for you will depend on your specific requirements and budget. I’ll try to give you a few good options.

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and it’s a particularly good option for small accounting firms. It offers a free version with a generous set of features, making it an excellent starting point for those on a tight budget. HubSpot CRM is known for its user-friendly interface and comprehensive suite of tools. It’s a great choice if you’re looking for an all-in-one CRM solution.

- Key Features:

- Free forever plan: This is a major selling point. You get access to core CRM features like contact management, deal tracking, task management, and email marketing tools without paying a dime.

- User-friendly interface: HubSpot is known for its intuitive design, making it easy to learn and use.

- Contact management: Automatically logs interactions with contacts, providing a complete view of your client relationships.

- Deal tracking: Track your sales pipeline and manage your deals with ease.

- Email marketing tools: Create and send professional-looking emails to nurture leads and engage clients.

- Integration with other tools: Integrates with popular accounting software like QuickBooks and Xero through the HubSpot App Marketplace, although the integration capabilities vary based on the plan you choose.

- Reporting and analytics: Track your sales performance and gain insights into your business with customizable reports and dashboards.

- Pricing: HubSpot CRM offers a free plan with basic features. Paid plans start at around $45 per month and increase in price based on the number of users and features.

- Pros:

- Free plan is very generous.

- User-friendly interface.

- Comprehensive suite of tools.

- Strong integration capabilities.

- Cons:

- Free plan has limitations on features and usage.

- Advanced features can be expensive.

- Ideal for: Small accounting firms looking for an all-in-one CRM solution with a user-friendly interface and a generous free plan.

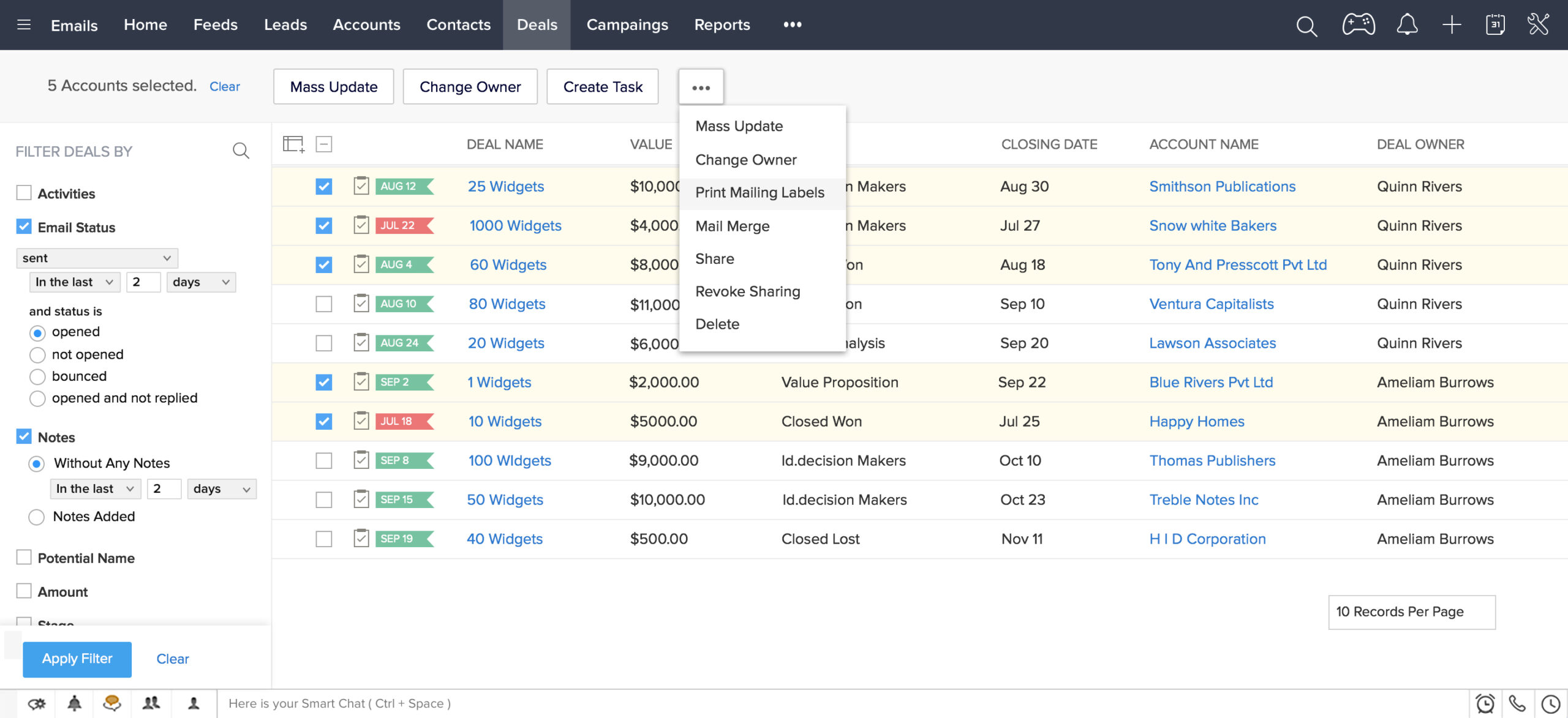

2. Zoho CRM

Zoho CRM is another popular choice for small businesses, known for its affordability and customization options. It’s a robust CRM system with a wide range of features, making it suitable for firms with more complex needs. Zoho CRM offers a free plan, but it’s more limited than HubSpot’s free plan. However, the paid plans are relatively affordable, making it a good value for the money.

- Key Features:

- Customization options: Highly customizable to fit your specific business needs.

- Workflow automation: Automate repetitive tasks and streamline your business processes.

- Sales force automation: Manage your sales pipeline and track your sales performance.

- Marketing automation: Automate your marketing campaigns and nurture leads.

- Integration with other tools: Integrates with a wide range of third-party applications, including accounting software, through the Zoho Marketplace.

- Reporting and analytics: Generate detailed reports and gain insights into your business performance.

- Pricing: Zoho CRM offers a free plan with limited features. Paid plans start at around $14 per user per month, billed annually.

- Pros:

- Affordable pricing.

- Highly customizable.

- Wide range of features.

- Strong integration capabilities.

- Cons:

- Free plan is limited.

- Interface can be overwhelming for new users.

- Ideal for: Small accounting firms looking for a feature-rich, customizable CRM at an affordable price.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its simplicity and ease of use. It’s a great choice for small accounting firms that are primarily focused on lead generation and sales. Pipedrive is designed to help you manage your sales pipeline and close deals more efficiently. It has a clear and intuitive interface, making it easy to track your leads and monitor your sales performance.

- Key Features:

- Sales pipeline management: Visualize your sales pipeline and track your deals.

- Lead management: Capture, track, and nurture leads.

- Workflow automation: Automate repetitive tasks and streamline your sales processes.

- Email integration: Integrate with your email provider to send and receive emails directly from the system.

- Reporting and analytics: Track your sales performance and gain insights into your business.

- Pricing: Pipedrive offers a free trial and paid plans starting at around $14.90 per user per month, billed annually.

- Pros:

- Simple and easy to use.

- Sales-focused features.

- Clear and intuitive interface.

- Cons:

- Less emphasis on contact management compared to other CRMs.

- Limited features for marketing automation.

- Ideal for: Small accounting firms that are primarily focused on lead generation and sales, and want a simple, user-friendly CRM.

4. Insightly

Insightly is a CRM designed to help businesses manage relationships, sales, and projects all in one place. It’s a great option for accounting firms that want a CRM that can handle both client management and project management. Insightly offers a user-friendly interface and a comprehensive set of features, making it a good choice for firms of all sizes.

- Key Features:

- Contact management: Manage your contacts and track your interactions.

- Lead management: Capture, track, and nurture leads.

- Project management: Manage your projects and track your progress.

- Workflow automation: Automate repetitive tasks and streamline your business processes.

- Reporting and analytics: Track your performance and gain insights into your business.

- Pricing: Insightly offers a free plan with limited features. Paid plans start at around $29 per user per month, billed annually.

- Pros:

- Comprehensive set of features.

- Project management capabilities.

- User-friendly interface.

- Cons:

- Free plan is limited.

- Can be more expensive than other options.

- Ideal for: Small accounting firms that want a CRM that can handle both client management and project management.

5. Freshsales

Freshsales, formerly Freshworks CRM, is another solid option for small accounting firms, particularly those looking for robust sales automation features. It’s known for its intuitive interface and focus on helping sales teams close deals faster. The platform offers a range of features designed to streamline the sales process, from lead generation to deal closure. Freshsales also integrates well with other Freshworks products, creating a cohesive ecosystem for businesses.

- Key Features:

- Built-in phone and email: Make calls and send emails directly from the CRM.

- Lead scoring: Prioritize leads based on their engagement and behavior.

- Workflow automation: Automate repetitive tasks and streamline your sales processes.

- Reporting and analytics: Track your sales performance and gain insights into your business.

- Pricing: Freshsales has a free plan and paid plans. The paid plans start at around $15 per user per month, billed annually.

- Pros:

- Intuitive interface.

- Strong sales automation features.

- Built-in phone and email.

- Cons:

- Can be more expensive than some other options.

- Focus primarily on sales.

- Ideal for: Small accounting firms that are heavily focused on sales and want robust sales automation features.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision, and it’s important to take the time to assess your needs and evaluate your options carefully. Here’s a step-by-step guide to help you choose the best CRM for your small accounting firm:

- Assess Your Needs: Before you start looking at CRM systems, take some time to understand your current processes and identify your pain points. What are your biggest challenges in managing clients, leads, and tasks? What features are most important to you?

- Define Your Goals: What do you hope to achieve with a CRM? Do you want to improve client relationships, increase sales, or streamline your operations? Defining your goals will help you prioritize features and choose the right CRM.

- Research CRM Options: Once you have a clear understanding of your needs and goals, start researching different CRM systems. Read reviews, compare features, and consider pricing.

- Prioritize Essential Features: Identify the essential features that you need in a CRM, such as contact management, lead management, task management, and integration with accounting software.

- Consider Integrations: Make sure the CRM integrates with your existing tools, such as your accounting software, email provider, and calendar.

- Evaluate Pricing: Consider your budget and choose a CRM that offers a pricing plan that fits your needs. Remember to factor in the cost of training and implementation.

- Try Free Trials: Most CRM systems offer free trials. Take advantage of these trials to test the system and see if it’s a good fit for your firm.

- Get Feedback from Your Team: Involve your team in the decision-making process. Get their feedback on the different CRM options and choose the system that best meets their needs.

- Plan for Implementation: Once you’ve chosen a CRM, develop a plan for implementation. This should include data migration, training, and ongoing support.

- Provide Training and Support: Make sure your team is properly trained on how to use the CRM. Provide ongoing support to help them troubleshoot issues and get the most out of the system.

By following these steps, you can choose a CRM that will help your small accounting firm streamline its operations, improve client relationships, and boost its bottom line.

Implementation and Training: Setting Your Team Up for Success

Choosing the right CRM is only the first step. Successful implementation and proper training are crucial for maximizing the benefits of your new system. Here’s a look at what you need to consider:

- Data Migration: This is often the most time-consuming part of the implementation process. You’ll need to migrate your existing client data from spreadsheets, legacy systems, or other sources into your new CRM. Ensure data accuracy and completeness during this process. Consider cleaning up your data to remove duplicates and outdated information.

- Customization: Tailor the CRM to fit your specific needs. This might involve creating custom fields, workflows, and reports. The level of customization will depend on the CRM’s capabilities and your specific requirements.

- User Training: Provide comprehensive training to your team. This should include both general CRM training and specific training on how to use the system for your accounting firm’s processes. Consider offering different levels of training based on user roles.

- Documentation: Create documentation, such as user manuals and FAQs, to help your team use the CRM effectively.

- Ongoing Support: Provide ongoing support to your team. This might include answering questions, troubleshooting issues, and providing additional training as needed.

- Integration with Existing Tools: Ensure seamless integration with your accounting software, email provider, calendar, and other tools. Test the integrations thoroughly to ensure they are working correctly.

- Set Realistic Expectations: It takes time for your team to get used to a new system. Be patient and provide ongoing support.

- Seek External Help if Needed: Consider hiring a CRM consultant to help with the implementation process, especially if you have a complex setup or limited internal resources.

By investing in proper implementation and training, you can ensure that your team is equipped to use the CRM effectively and that your accounting firm reaps the full benefits of the system.

The Long-Term Benefits of a CRM for Accountants

Investing in a CRM system for your small accounting firm is an investment in the future. The benefits extend far beyond immediate efficiency gains. Here’s a look at the long-term advantages:

- Increased Client Retention: By providing personalized service and proactively addressing client needs, you can build stronger relationships and increase client loyalty.

- Improved Client Satisfaction: A CRM helps you deliver consistent and high-quality service, leading to higher client satisfaction.

- Enhanced Revenue Growth: A CRM helps you identify and capitalize on opportunities for upselling and cross-selling services.

- Scalability: A CRM allows you to scale your business more efficiently as you grow. You can easily manage a larger client base without adding significant administrative overhead.

- Competitive Advantage: By leveraging the power of a CRM, you can gain a competitive advantage over firms that are still relying on manual processes.

- Data-Driven Decision Making: A CRM provides valuable insights into your business performance, helping you make informed decisions about your strategy and operations.

- Better Team Collaboration: A CRM fosters better communication and collaboration among your team members, leading to improved efficiency and productivity.

- Time Savings: Automating repetitive tasks frees up your time to focus on more strategic activities, such as business development and client relationship management.

- Improved Compliance: A CRM can help you track client data and manage compliance requirements more effectively.

In summary, a CRM is a long-term investment that can help your small accounting firm achieve sustainable growth, improve client satisfaction, and gain a competitive edge in the marketplace. It’s a tool that can empower you to work smarter, not harder, and achieve your business goals.

Final Thoughts: Making the Right Choice

Choosing the best CRM for small accountants is a pivotal decision that can significantly impact your firm’s success. By carefully evaluating your needs, researching different options, and implementing the chosen system effectively, you can equip your firm with a powerful tool to streamline operations, nurture client relationships, and drive growth. Remember to prioritize features that cater to the specific needs of accounting firms, such as contact management, lead tracking, task management, and integration with accounting software. Take advantage of free trials to test different systems and involve your team in the decision-making process. With the right CRM in place, your small accounting firm can thrive in today’s competitive landscape.

Don’t be afraid to experiment and find the system that works best for you. The right CRM is an investment that pays dividends in the long run, contributing to a more efficient, client-focused, and profitable accounting practice. Good luck!