Top CRM Systems for Small Accounting Firms: Boost Efficiency and Client Satisfaction

In the dynamic world of accounting, where precision and client relationships are paramount, the right tools can make all the difference. For small accounting firms, juggling multiple clients, deadlines, and financial data can be a daunting task. That’s where a Customer Relationship Management (CRM) system steps in. This article delves into the best CRM systems tailored for small accounting firms, exploring their features, benefits, and how they can transform your business.

Why a CRM is Essential for Small Accounting Firms

Before we jump into the specifics, let’s understand why a CRM is crucial for small accounting firms. It’s not just about managing contacts; it’s about fostering lasting client relationships and streamlining your operations. Here’s why you need one:

- Centralized Client Data: A CRM provides a single source of truth for all client information, including contact details, communication history, financial data, and project status.

- Improved Communication: Stay on top of client interactions, track emails, phone calls, and meetings, ensuring no communication falls through the cracks.

- Enhanced Client Relationship Management: Understand your clients better, anticipate their needs, and provide personalized service, leading to increased client satisfaction and loyalty.

- Streamlined Workflows: Automate repetitive tasks, such as appointment scheduling, follow-ups, and document management, freeing up your time to focus on core accounting tasks.

- Increased Efficiency: By automating tasks and providing easy access to information, a CRM boosts your team’s productivity, allowing you to serve more clients without increasing your workload exponentially.

- Better Lead Management: Track potential clients, nurture leads, and convert them into paying customers, growing your client base and revenue.

- Data-Driven Decision Making: Analyze client data, track key performance indicators (KPIs), and make informed decisions to improve your business performance.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. For accounting firms, certain features are non-negotiable. Here’s what to look for:

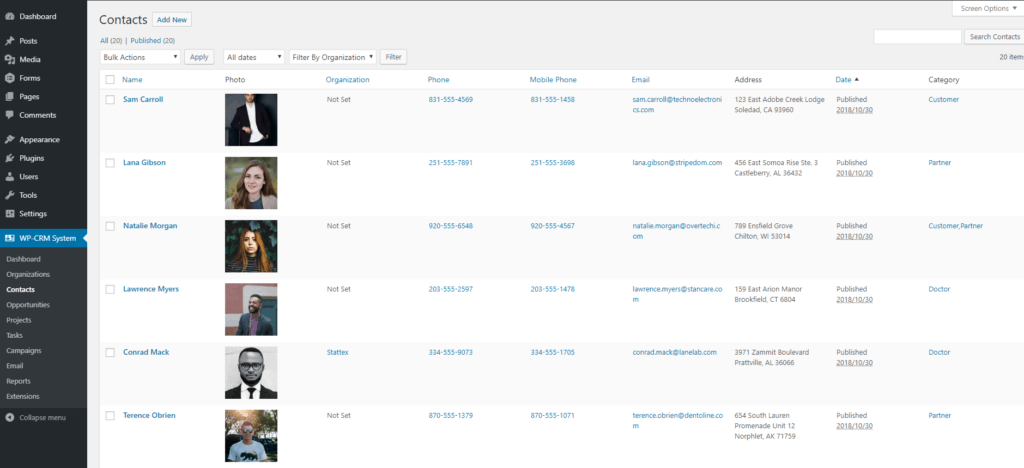

1. Contact Management

This is the foundation of any CRM. It should allow you to:

- Store detailed client information, including contact details, addresses, and financial data.

- Segment clients based on criteria such as industry, revenue, or service type.

- Track communication history, including emails, phone calls, and meetings.

- Set reminders for important dates, such as tax deadlines and client meetings.

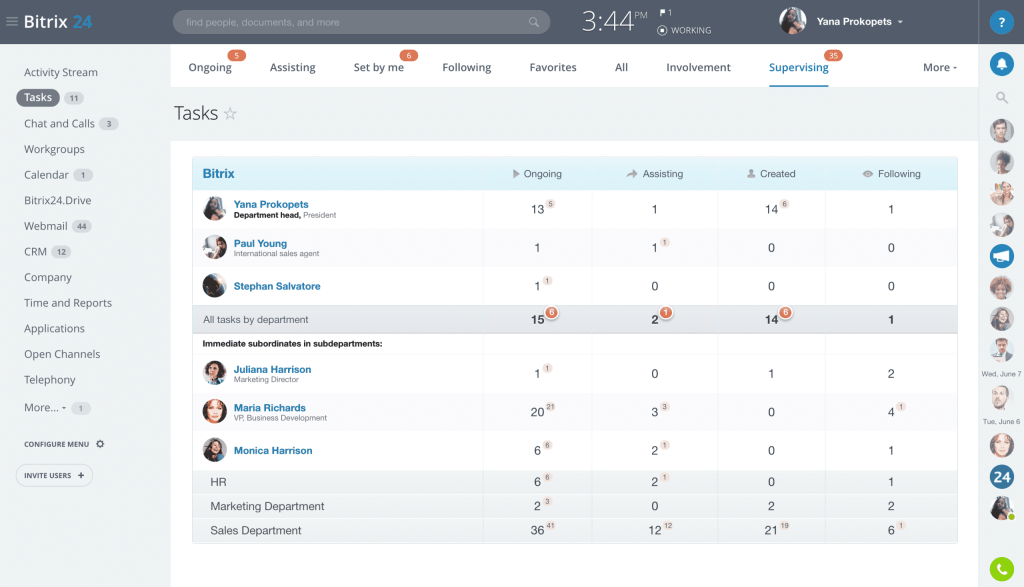

2. Task and Project Management

Accounting firms often juggle multiple projects simultaneously. A good CRM should enable you to:

- Create and assign tasks to team members.

- Set deadlines and track progress.

- Manage projects from start to finish.

- Collaborate with team members on projects.

3. Email Integration

Seamless email integration is crucial for efficient communication. The CRM should:

- Integrate with your existing email provider (e.g., Gmail, Outlook).

- Track email interactions with clients.

- Allow you to send personalized emails directly from the CRM.

- Automate email follow-ups and reminders.

4. Reporting and Analytics

Data-driven insights are essential for making informed decisions. The CRM should provide:

- Customizable reports on key metrics, such as client acquisition cost, client retention rate, and revenue per client.

- Dashboards that visualize your key performance indicators (KPIs).

- The ability to track and analyze client interactions.

5. Integration with Accounting Software

This is a critical feature for accounting firms. The CRM should integrate seamlessly with your existing accounting software (e.g., QuickBooks, Xero, Sage) to:

- Sync client data between the CRM and accounting software.

- Track invoices, payments, and other financial data.

- Automate billing and payment reminders.

6. Security and Compliance

Data security is paramount, especially when dealing with sensitive financial information. The CRM should:

- Comply with industry regulations, such as GDPR and CCPA.

- Offer robust security features, such as data encryption and access controls.

- Provide regular data backups.

7. Mobile Access

In today’s fast-paced world, mobile access is a must-have. The CRM should:

- Offer a mobile app or a mobile-friendly interface.

- Allow you to access client information and manage tasks on the go.

- Provide push notifications for important updates.

Top CRM Systems for Small Accounting Firms

Now, let’s dive into some of the best CRM systems specifically designed for small accounting firms.

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms. Here’s why:

- Free CRM: HubSpot offers a powerful free CRM that includes contact management, deal tracking, email marketing, and basic automation features. This makes it an excellent starting point for small firms on a budget.

- User-Friendly Interface: HubSpot’s intuitive interface makes it easy to learn and use, even for those with limited technical expertise.

- Marketing Automation: HubSpot’s marketing automation tools help you nurture leads, send personalized emails, and track your marketing efforts.

- Sales Automation: Automate repetitive sales tasks, such as follow-ups and appointment scheduling, to save time and improve efficiency.

- Integration Capabilities: HubSpot integrates with a wide range of other software, including accounting software, email providers, and social media platforms.

- Scalability: As your firm grows, you can upgrade to paid HubSpot plans to access more advanced features, such as advanced reporting, custom objects, and more sophisticated automation.

- Customization: HubSpot CRM is highly customizable, allowing you to tailor it to your specific needs and workflows.

Pros: Free version, user-friendly, powerful marketing and sales automation, extensive integrations, scalable, customizable.

Cons: The free version has limitations on the number of contacts and emails. Advanced features require a paid subscription.

2. Zoho CRM

Zoho CRM is another excellent option for small accounting firms, offering a comprehensive suite of features at a competitive price.

- Affordable Pricing: Zoho CRM offers a range of plans to suit businesses of all sizes, with affordable pricing for small firms.

- Comprehensive Features: Zoho CRM includes a wide range of features, including contact management, lead management, sales automation, marketing automation, and reporting.

- Workflow Automation: Automate repetitive tasks and streamline your workflows with Zoho CRM’s powerful workflow automation engine.

- Customization: Zoho CRM is highly customizable, allowing you to tailor it to your specific needs and workflows.

- Integration Capabilities: Zoho CRM integrates with a wide range of other software, including accounting software, email providers, and social media platforms.

- Advanced Analytics: Zoho CRM provides advanced analytics and reporting capabilities, allowing you to track your key performance indicators (KPIs) and make data-driven decisions.

- Mobile App: Zoho CRM offers a mobile app that allows you to access client information and manage tasks on the go.

Pros: Affordable pricing, comprehensive features, powerful workflow automation, highly customizable, extensive integrations.

Cons: The interface can be overwhelming for some users. The learning curve might be slightly steeper compared to HubSpot.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s particularly well-suited for small accounting firms that are focused on lead generation and sales. It’s known for its simplicity and ease of use.

- User-Friendly Interface: Pipedrive’s intuitive interface makes it easy to manage leads, track deals, and close sales.

- Visual Sales Pipeline: Pipedrive’s visual sales pipeline provides a clear overview of your sales process, allowing you to track deals and identify bottlenecks.

- Lead Management: Pipedrive helps you manage leads effectively, track their progress, and convert them into paying customers.

- Sales Automation: Automate repetitive sales tasks, such as follow-ups and email sequences.

- Integration Capabilities: Pipedrive integrates with a variety of other software, including email providers and accounting software.

- Reporting and Analytics: Pipedrive provides reporting and analytics capabilities to track your sales performance and identify areas for improvement.

- Mobile App: Pipedrive offers a mobile app that allows you to access your sales pipeline and manage deals on the go.

Pros: User-friendly, visual sales pipeline, strong sales automation features, easy to learn and use.

Cons: May not be as feature-rich as other CRMs for general business management. Primarily focused on sales.

4. Freshsales

Freshsales is another strong contender, offering a blend of features at a reasonable price point. It’s known for its ease of use and robust features.

- Built-in Phone and Email: Freshsales integrates phone and email directly into the CRM, streamlining communication.

- AI-Powered Features: Offers AI-powered features to help prioritize leads and automate tasks.

- Contact Management: Robust contact management capabilities with detailed client profiles.

- Sales Automation: Automate repetitive tasks such as follow-ups and lead nurturing.

- Reporting and Analytics: Provides detailed sales reports and analytics.

- User-Friendly Interface: Easy to navigate and use, even for those new to CRM systems.

- Customization: Allows for extensive customization to fit specific business needs.

Pros: Integrated phone and email, AI-powered features, user-friendly, strong sales automation.

Cons: Can be more expensive than some other options depending on features needed.

5. Capsule CRM

Capsule CRM is a simple, user-friendly CRM that’s perfect for small businesses looking for an easy-to-use solution.

- User-Friendly Interface: Capsule CRM is known for its simplicity and ease of use, making it a great choice for users who are new to CRM systems.

- Contact Management: Capsule CRM provides robust contact management capabilities, allowing you to store detailed client information and track communication history.

- Deal Tracking: Track deals and manage your sales pipeline with Capsule CRM’s deal tracking features.

- Task Management: Create and assign tasks to team members, and set deadlines to ensure that tasks are completed on time.

- Integration Capabilities: Capsule CRM integrates with a variety of other software, including email providers and accounting software.

- Reporting: Capsule CRM provides basic reporting capabilities to track your sales performance and identify areas for improvement.

- Affordable Pricing: Capsule CRM offers affordable pricing for small businesses.

Pros: User-friendly, simple to use, affordable, good for small teams.

Cons: May lack some of the advanced features of other CRMs. Reporting capabilities are more basic.

6. Agile CRM

Agile CRM is a comprehensive CRM that offers a wide range of features at a competitive price. It’s a good option for small accounting firms that need a feature-rich solution.

- Contact Management: Agile CRM provides robust contact management capabilities, allowing you to store detailed client information and track communication history.

- Sales Automation: Automate repetitive sales tasks, such as follow-ups and email sequences.

- Marketing Automation: Nurture leads and automate your marketing efforts with Agile CRM’s marketing automation tools.

- Project Management: Manage projects from start to finish with Agile CRM’s project management features.

- Integration Capabilities: Agile CRM integrates with a wide range of other software, including accounting software, email providers, and social media platforms.

- Reporting and Analytics: Agile CRM provides comprehensive reporting and analytics capabilities to track your key performance indicators (KPIs) and make data-driven decisions.

- Mobile App: Agile CRM offers a mobile app that allows you to access client information and manage tasks on the go.

Pros: Comprehensive features, strong sales and marketing automation, affordable pricing.

Cons: The interface can be a bit overwhelming for some users. The learning curve might be slightly steeper compared to some other CRMs.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision. Here’s a step-by-step guide to help you make the right choice:

1. Define Your Needs

Before you start evaluating CRM systems, take some time to assess your firm’s specific needs. Consider the following:

- What are your goals? What do you want to achieve with a CRM? (e.g., increase client satisfaction, improve efficiency, grow your client base)

- What are your pain points? What challenges are you facing in your current workflow? (e.g., difficulty managing client data, inefficient communication)

- What features are essential? What features do you absolutely need in a CRM? (e.g., contact management, email integration, accounting software integration)

- What is your budget? How much are you willing to spend on a CRM?

- Who will be using the CRM? Consider the technical skills of your team members.

2. Research CRM Options

Once you have a clear understanding of your needs, start researching different CRM options. Use the information in this article as a starting point, and explore other options as well. Consider the following:

- Read online reviews. See what other accounting firms are saying about different CRM systems.

- Compare features. Compare the features of different CRMs to see which ones meet your needs.

- Consider pricing. Compare the pricing of different CRMs to see which ones fit your budget.

- Check for integrations. Ensure that the CRM integrates with your existing accounting software and other tools.

- Look for security and compliance. Ensure that the CRM complies with industry regulations and offers robust security features.

3. Request Demos and Trials

Once you’ve narrowed down your choices, request demos and free trials of the CRM systems you’re interested in. This will allow you to:

- See the CRM in action. Get a firsthand look at how the CRM works.

- Test the interface. See if the interface is user-friendly and easy to navigate.

- Evaluate the features. Test out the features that are important to you.

- Ask questions. Ask the vendor any questions you have about the CRM.

4. Involve Your Team

Involve your team in the decision-making process. Ask for their feedback on the different CRM options you’re considering. This will help you choose a CRM that meets the needs of your entire team.

5. Make a Decision and Implement

Once you’ve evaluated the different CRM options, make a decision and choose the one that best meets your needs. Then, implement the CRM and train your team on how to use it. Be sure to:

- Migrate your data. Transfer your existing client data into the CRM.

- Customize the CRM. Customize the CRM to fit your specific workflows.

- Provide training. Train your team on how to use the CRM.

- Monitor and optimize. Monitor your CRM usage and make adjustments as needed.

Benefits of Implementing a CRM

The benefits of using a CRM system for a small accounting firm are numerous and can significantly impact your bottom line and client relationships. Let’s delve into some key advantages:

1. Enhanced Client Relationships

At the heart of a successful accounting firm are strong client relationships. A CRM system empowers you to cultivate these relationships by:

- Personalized Service: By storing detailed information about each client, you can tailor your services and communication to their specific needs and preferences.

- Proactive Communication: A CRM helps you stay in touch with clients, reminding them of important dates, sending them relevant updates, and proactively addressing their needs.

- Improved Responsiveness: With all client information readily available, you can respond to inquiries and requests quickly and efficiently.

- Increased Client Loyalty: By providing exceptional service and building strong relationships, you can increase client loyalty and retention.

2. Increased Efficiency and Productivity

Time is money, and a CRM can help you save both by streamlining your workflows and automating repetitive tasks:

- Automated Tasks: Automate tasks such as appointment scheduling, follow-up reminders, and email marketing campaigns, freeing up your team’s time.

- Centralized Data: Access all client information from a single location, eliminating the need to search through multiple spreadsheets and documents.

- Simplified Workflows: Create standardized workflows for common tasks, such as onboarding new clients and preparing tax returns.

- Reduced Errors: By automating tasks and centralizing data, you can reduce the risk of errors and improve accuracy.

3. Improved Lead Management and Sales

For firms looking to grow their client base, a CRM can be a powerful tool for lead management and sales:

- Lead Tracking: Track leads from initial contact to conversion, allowing you to identify the most promising prospects.

- Lead Nurturing: Nurture leads with targeted email campaigns and personalized follow-ups, moving them closer to becoming clients.

- Sales Pipeline Management: Manage your sales pipeline, track the progress of deals, and identify bottlenecks.

- Increased Conversions: By effectively managing leads and nurturing them, you can increase your conversion rates and grow your client base.

4. Better Data Analysis and Reporting

A CRM provides valuable insights into your business performance, allowing you to make data-driven decisions:

- Key Performance Indicators (KPIs): Track key metrics such as client acquisition cost, client retention rate, and revenue per client.

- Customizable Reports: Generate custom reports to analyze your business performance and identify areas for improvement.

- Data-Driven Decisions: Use data to make informed decisions about your business strategy, marketing efforts, and sales processes.

- Improved Forecasting: Forecast your revenue and client growth based on historical data and current trends.

5. Enhanced Collaboration and Communication

A CRM facilitates collaboration and communication among team members, leading to improved efficiency and client service:

- Shared Information: Share client information, communication history, and project updates with your team members.

- Improved Communication: Facilitate communication through email integration, task assignments, and shared calendars.

- Increased Transparency: Provide visibility into your team’s activities and progress on projects.

- Better Teamwork: Foster teamwork and collaboration, leading to improved client service and overall business performance.

Overcoming Challenges in CRM Implementation

While the benefits of a CRM are undeniable, implementing a new system can present challenges. Here’s how to navigate them:

1. Data Migration

Migrating your existing data to a new CRM can be time-consuming and complex. To mitigate this challenge:

- Plan Ahead: Develop a detailed plan for data migration, including data cleansing, mapping, and importing.

- Clean Your Data: Clean your data before migrating it to ensure accuracy and consistency.

- Test Your Migration: Test your data migration process before migrating all of your data.

- Seek Help: Consider hiring a data migration specialist to assist with the process.

2. User Adoption

Getting your team to adopt a new CRM can be challenging. To encourage user adoption:

- Provide Training: Provide comprehensive training to your team on how to use the CRM.

- Make it Easy to Use: Choose a CRM that is user-friendly and easy to navigate.

- Demonstrate the Benefits: Show your team how the CRM will improve their efficiency and make their jobs easier.

- Get Feedback: Encourage your team to provide feedback and make adjustments to the CRM as needed.

- Lead by Example: Management should actively use the CRM and champion its use.

3. Customization

Customizing a CRM to fit your specific needs can be complex. To simplify this:

- Start Simple: Start with a basic setup and gradually add customizations as needed.

- Choose a Customizable CRM: Choose a CRM that offers a wide range of customization options.

- Seek Help: Consider hiring a CRM consultant to assist with customization.

- Prioritize: Focus on the most critical customizations first.

4. Integration

Integrating your CRM with other software can be challenging. To ensure seamless integration:

- Choose a CRM with Integrations: Choose a CRM that integrates with your existing accounting software and other tools.

- Test Your Integrations: Test your integrations thoroughly before going live.

- Seek Help: Consider hiring an IT professional to assist with integration.

The Future of CRM in Accounting

The role of CRM in accounting is constantly evolving. Here’s what the future holds:

- AI-Powered CRM: Artificial intelligence will play an increasingly important role in CRM, automating tasks, providing insights, and personalizing client interactions.

- Increased Automation: CRM systems will become even more automated, streamlining workflows and freeing up accountants’ time.

- Enhanced Integration: CRM systems will integrate with a wider range of software, providing a seamless experience.

- Focus on Client Experience: CRM systems will focus on enhancing the client experience, providing personalized service and building stronger relationships.

- Mobile-First Approach: CRM systems will become increasingly mobile-friendly, allowing accountants to access client information and manage tasks on the go.

Conclusion: Embracing CRM for Accounting Firm Success

In conclusion, implementing the right CRM system is a strategic investment for small accounting firms. It’s not just about managing contacts; it’s about building stronger client relationships, streamlining your operations, and driving business growth. By carefully evaluating your needs, researching the available options, and implementing the system effectively, you can transform your firm and thrive in the competitive accounting landscape. The tools and technologies are available; the key is to embrace them and leverage them to their full potential. Start your journey towards a more efficient, client-focused, and successful accounting practice today.