The Ultimate Guide to the Best CRM Systems for Small Accounting Firms: Streamline Your Business and Boost Profits

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking financial data, staying compliant with regulations, and constantly chasing deadlines. It’s a whirlwind, and without the right tools, it can feel overwhelming. One of the most crucial tools for any modern accounting firm is a Customer Relationship Management (CRM) system. But with so many options out there, choosing the best CRM for small accountants can feel like another daunting task.

Fear not! This comprehensive guide will break down everything you need to know about CRM systems, specifically tailored for the needs of small accounting firms. We’ll delve into the benefits, explore the key features to look for, and review some of the top CRM platforms available, helping you make an informed decision that will revolutionize your practice.

Why Your Small Accounting Firm Needs a CRM

You might be thinking, “Do I really need a CRM? I’m a small firm, and I manage my clients just fine.” While that may be true for now, as your firm grows, so does the complexity of managing client interactions, data, and follow-ups. A CRM system isn’t just a fancy address book; it’s a central hub for all your client-related information, enabling you to:

- Improve Client Relationships: CRM systems provide a 360-degree view of each client, including their contact information, communication history, financial data, and service agreements. This allows you to personalize your interactions, anticipate their needs, and build stronger, more trusting relationships.

- Boost Efficiency and Productivity: Automate repetitive tasks like sending appointment reminders, following up on leads, and generating reports. This frees up your time to focus on higher-value activities like providing financial advice and strategic planning.

- Enhance Collaboration: Share client information and collaborate seamlessly with your team. This ensures everyone is on the same page and can access the information they need, when they need it.

- Streamline Sales and Marketing: Manage your leads, track your sales pipeline, and automate marketing campaigns. CRM systems help you identify and nurture potential clients, converting them into loyal customers.

- Increase Profitability: By improving client relationships, boosting efficiency, and streamlining sales, a CRM system can directly contribute to your bottom line. You’ll be able to serve more clients, provide better service, and ultimately, earn more revenue.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your small accounting firm, it’s essential to focus on features that are specifically designed to meet your unique needs. Here are some of the most important features to consider:

1. Contact Management

At its core, a CRM is about managing contacts. Look for a system that allows you to:

- Store comprehensive client information: Name, contact details, address, social media profiles, and any other relevant information.

- Segment your clients: Group clients based on their industry, service needs, or other criteria to personalize your communication and marketing efforts.

- Track communication history: Record all interactions with clients, including emails, phone calls, meetings, and notes.

- Import and export data: Easily import your existing client data and export it if you decide to switch CRM systems in the future.

2. Lead Management

Generating and nurturing leads is crucial for growing your accounting practice. A good CRM should help you:

- Capture leads: Integrate with your website, social media, and other marketing channels to capture leads automatically.

- Track leads: Monitor leads through the sales pipeline, from initial contact to closing.

- Automate follow-ups: Set up automated email sequences and tasks to nurture leads and keep them engaged.

- Score leads: Assign scores to leads based on their engagement and demographics to prioritize your efforts.

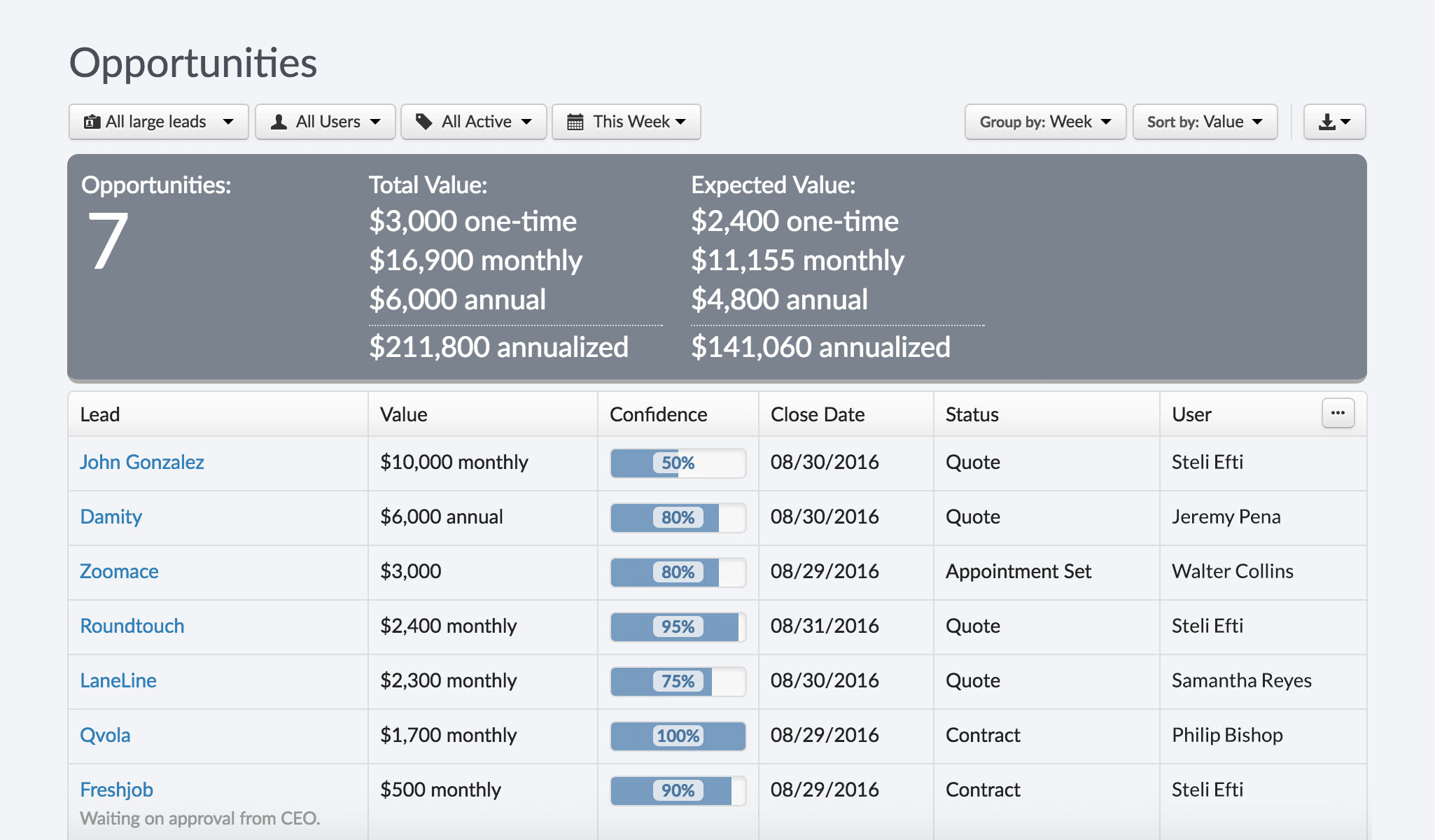

3. Sales Pipeline Management

Even if you don’t consider yourself a “salesperson,” you still need a system to track your potential clients and the services you offer. A CRM can help you:

- Visualize your sales pipeline: See where each lead is in the sales process at a glance.

- Track deals: Monitor the value of potential deals, their expected close dates, and the probability of success.

- Automate sales tasks: Automate tasks like sending proposals, scheduling meetings, and following up on deals.

- Generate reports: Track your sales performance and identify areas for improvement.

4. Task Management and Automation

Accountants are busy people. CRM systems can automate many of the tedious tasks that eat up your time. Look for features like:

- Automated reminders: Set up reminders for appointments, deadlines, and follow-ups.

- Workflow automation: Automate repetitive tasks like sending emails, updating client records, and generating reports.

- Task assignment: Assign tasks to team members and track their progress.

- Calendar integration: Integrate with your calendar to schedule appointments and manage your time effectively.

5. Reporting and Analytics

Data is your friend. A CRM system should provide you with insights into your business performance. Look for features like:

- Customizable dashboards: Create dashboards to track the metrics that matter most to your firm.

- Pre-built reports: Access pre-built reports on sales, marketing, and client activity.

- Custom reports: Create custom reports to analyze specific data and gain deeper insights.

- Data visualization: Visualize your data with charts and graphs to easily understand trends and patterns.

6. Integration with Accounting Software

This is a MUST-HAVE for accountants. The CRM needs to seamlessly integrate with your existing accounting software (e.g., QuickBooks, Xero). This allows you to:

- Sync client data: Automatically sync client information between your CRM and accounting software.

- Track financial data: View client invoices, payments, and other financial data within your CRM.

- Automate invoicing: Generate and send invoices directly from your CRM.

- Improve accuracy: Reduce the risk of data entry errors by automating data transfer.

7. Mobile Accessibility

Accountants are often on the go. Ensure your CRM has a mobile app or is mobile-friendly so you can access your client data and manage your business from anywhere.

8. Security and Compliance

Protecting client data is paramount. Your CRM system should have robust security features and comply with relevant data privacy regulations (e.g., GDPR, CCPA).

Top CRM Systems for Small Accounting Firms: A Detailed Comparison

Now, let’s dive into some of the best CRM systems specifically tailored for small accounting firms. We’ll compare their features, pricing, and ease of use to help you find the perfect fit for your practice.

1. HubSpot CRM

Overview: HubSpot CRM is a powerful and user-friendly platform that offers a comprehensive suite of features, including contact management, lead management, sales pipeline management, and marketing automation. It’s a popular choice for small businesses due to its robust free plan and scalable paid options.

Key Features for Accountants:

- Free CRM: HubSpot offers a generous free plan that includes contact management, deal tracking, and basic marketing automation.

- Sales Pipeline Management: Visualize your sales pipeline and track your deals with ease.

- Email Marketing: Send targeted email campaigns and track their performance.

- Integration: Integrates with popular accounting software like QuickBooks and Xero.

- Reporting and Analytics: Generate reports on sales, marketing, and client activity.

- Ease of Use: User-friendly interface with a gentle learning curve.

Pros:

- Free plan is very generous.

- User-friendly interface.

- Excellent marketing automation features.

- Strong integration capabilities.

Cons:

- Advanced features require paid plans.

- Can be overwhelming for very small firms.

Pricing: Free plan available. Paid plans start at $45 per month.

2. Zoho CRM

Overview: Zoho CRM is a versatile and affordable CRM system that offers a wide range of features, including contact management, lead management, sales pipeline management, and automation. It’s a good option for small firms looking for a cost-effective solution.

Key Features for Accountants:

- Affordable Pricing: Offers competitive pricing plans for small businesses.

- Customization: Highly customizable to meet your specific needs.

- Workflow Automation: Automate repetitive tasks to save time.

- Sales Force Automation: Manage your sales pipeline and track deals.

- Integration: Integrates with a variety of third-party apps, including accounting software.

- Mobile App: Access your client data and manage your business from anywhere.

Pros:

- Affordable pricing.

- Highly customizable.

- Strong automation capabilities.

Cons:

- Interface can feel a bit dated.

- Some advanced features require paid plans.

Pricing: Free plan available. Paid plans start at $14 per user per month.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM system that is known for its user-friendly interface and focus on sales pipeline management. It’s a great option for accounting firms that want to streamline their sales process.

Key Features for Accountants:

- Intuitive Interface: Easy to learn and use.

- Sales Pipeline Focused: Designed to help you manage your sales pipeline effectively.

- Deal Tracking: Track deals and their progress through the sales pipeline.

- Automation: Automate repetitive sales tasks.

- Reporting: Generate reports on your sales performance.

- Integration: Integrates with various apps, including accounting software.

Pros:

- User-friendly interface.

- Excellent sales pipeline management features.

- Easy to set up and get started.

Cons:

- Limited features compared to other CRMs.

- Not as strong on marketing automation.

Pricing: Paid plans start at $12.50 per user per month.

4. Salesforce Sales Cloud

Overview: Salesforce Sales Cloud is a robust and feature-rich CRM system that offers a comprehensive suite of tools for managing sales, marketing, and customer service. It’s a more complex and expensive option, but it can be a great choice for growing accounting firms that need a powerful and scalable solution.

Key Features for Accountants:

- Comprehensive Features: Offers a wide range of features for managing sales, marketing, and customer service.

- Customization: Highly customizable to meet your specific needs.

- Automation: Automate a wide variety of tasks.

- Reporting and Analytics: Generate in-depth reports and gain valuable insights.

- Integration: Integrates with a vast array of third-party apps.

- Scalability: Can scale to accommodate the needs of a growing firm.

Pros:

- Extremely powerful and feature-rich.

- Highly customizable.

- Scalable to meet the needs of a growing firm.

Cons:

- Expensive.

- Complex and can have a steep learning curve.

- May be overkill for very small firms.

Pricing: Paid plans start at $25 per user per month.

5. Insightly

Overview: Insightly is a CRM known for its user-friendliness and focus on project management. It’s a good option for accounting firms who need to manage both client relationships and projects.

Key Features for Accountants:

- User-Friendly: Easy to set up and use.

- Project Management: Built-in project management features.

- Contact Management: Robust contact management capabilities.

- Sales Pipeline Management: Manage your sales pipeline effectively.

- Integration: Integrates with popular apps.

Pros:

- User-friendly interface.

- Good for project management.

- Affordable pricing.

Cons:

- Fewer features than some other CRMs.

- Some advanced features require higher-tier plans.

Pricing: Paid plans start at $29 per user per month.

Choosing the Right CRM: A Step-by-Step Approach

Selecting the right CRM is a crucial decision. Here’s a step-by-step approach to guide you through the process:

- Assess Your Needs: What are your current pain points? What tasks are you struggling with? What are your goals for your accounting firm? Identify the specific features you need in a CRM.

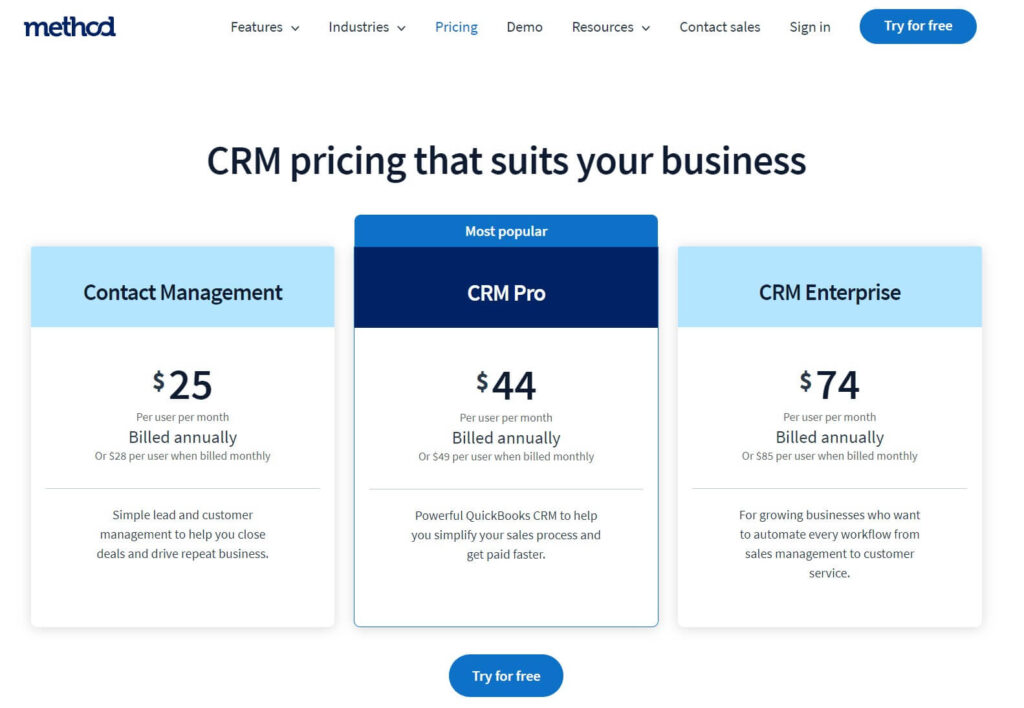

- Define Your Budget: How much are you willing to spend on a CRM system? Consider both the monthly subscription cost and any potential implementation costs.

- Research CRM Options: Explore the different CRM systems available, considering their features, pricing, and reviews. Use the information provided in this guide to get started.

- Create a Shortlist: Narrow down your choices to a few CRM systems that seem to be a good fit for your needs and budget.

- Request Demos and Trials: Contact the vendors of your shortlisted CRM systems and request demos or free trials. This will allow you to test the systems and see how they work in practice.

- Evaluate the Systems: During your demos and trials, evaluate the systems based on the features you need, ease of use, integration capabilities, and pricing.

- Get Feedback from Your Team: If you have a team, involve them in the evaluation process. Ask for their feedback on the different CRM systems.

- Make a Decision: Based on your assessment, choose the CRM system that best meets your needs and budget.

- Implement the CRM: Once you’ve selected a CRM, implement it in your firm. This may involve importing your data, setting up your workflows, and training your team.

- Provide Ongoing Training and Support: Make sure your team receives the necessary training and ongoing support to use the CRM effectively.

Tips for a Smooth CRM Implementation

Implementing a new CRM system can be a significant undertaking. Here are some tips to ensure a smooth transition:

- Plan Ahead: Develop a detailed implementation plan, including a timeline, tasks, and responsibilities.

- Clean Up Your Data: Before importing your data into the CRM, clean it up to ensure accuracy and consistency.

- Involve Your Team: Get your team involved in the implementation process from the start. This will help them feel invested in the new system.

- Provide Training: Provide thorough training to your team on how to use the CRM.

- Start Small: Don’t try to implement all the features of the CRM at once. Start with the core features and gradually add more as your team becomes comfortable with the system.

- Get Support: Don’t hesitate to reach out to the CRM vendor for support if you have any questions or issues.

- Monitor and Evaluate: Monitor the performance of the CRM and evaluate whether it is meeting your needs. Make adjustments as needed.

The Bottom Line: Investing in the Future of Your Accounting Firm

Choosing the right CRM is an investment in the future of your small accounting firm. By streamlining your client management, boosting your efficiency, and enhancing your sales and marketing efforts, a CRM system can help you grow your business and achieve your goals.

Take the time to carefully evaluate your needs, research the available options, and choose the CRM that’s the best fit for your practice. With the right CRM in place, you’ll be well-positioned to thrive in today’s competitive accounting landscape.

Don’t be afraid to embrace technology. The world of accounting is constantly evolving, and staying ahead of the curve is essential for success. A CRM is more than just a software program; it is a strategic asset that can transform your business and empower you to provide exceptional service to your clients.

So, take the plunge, explore the options, and choose the CRM that will help you build stronger client relationships, boost your productivity, and achieve lasting success for your small accounting firm.