The Ultimate Guide to the Best CRM Systems for Small Accounting Firms

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking finances, staying on top of regulations, and trying to grow your business, all at the same time. It’s a demanding role, and without the right tools, it can quickly become overwhelming. That’s where a Customer Relationship Management (CRM) system comes in. Think of it as your central hub for everything client-related, helping you streamline operations, boost efficiency, and ultimately, provide better service.

This comprehensive guide will delve into the world of CRM systems tailored specifically for small accounting firms. We’ll explore the benefits, essential features to look for, and, most importantly, the best CRM platforms available to help you thrive. Whether you’re a seasoned accountant or just starting your practice, this guide will equip you with the knowledge to choose the perfect CRM to meet your unique needs.

Why Your Small Accounting Firm Needs a CRM

You might be thinking, “Do I really need a CRM?” The short answer is: Absolutely. While you might be managing clients with spreadsheets and email, a CRM offers significant advantages that can transform your business. Here’s why:

- Improved Client Relationships: A CRM centralizes all client information – contact details, communication history, financial data, and more. This allows you to personalize interactions, anticipate needs, and build stronger, more loyal relationships.

- Enhanced Efficiency: Automate repetitive tasks like appointment scheduling, follow-up emails, and data entry. This frees up your time to focus on higher-value activities like providing financial advice and growing your client base.

- Increased Productivity: With all client information in one place, your team can quickly access what they need, reducing the time spent searching for data and improving overall productivity.

- Better Organization: A CRM helps you organize your client interactions, projects, and tasks, ensuring nothing falls through the cracks. You’ll be able to track deadlines, manage projects effectively, and stay on top of client needs.

- Data-Driven Decisions: Gain valuable insights into your client base and business performance. CRM systems provide reporting and analytics that help you understand your clients better, identify growth opportunities, and make informed decisions.

- Lead Management: A CRM can help you track leads, nurture them through the sales pipeline, and convert them into paying clients. This can significantly improve your lead conversion rates and boost revenue.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, it’s crucial to look for features that specifically cater to your needs. Here are some essential features to consider:

1. Contact Management

This is the foundation of any CRM. It allows you to store and manage client contact information, including names, addresses, phone numbers, email addresses, and other relevant details. Look for features like:

- Contact Segmentation: Ability to categorize clients based on various criteria (e.g., industry, revenue, services used).

- Customizable Fields: Flexibility to add custom fields to capture specific client data relevant to your accounting practice.

- Import and Export: Easy import and export of contact data from spreadsheets and other sources.

2. Client Communication Tracking

Keep track of all interactions with your clients, including emails, phone calls, meetings, and notes. This ensures that everyone on your team has a complete picture of the client relationship. Key features include:

- Email Integration: Seamless integration with your email provider (e.g., Gmail, Outlook) to track emails and manage communication history.

- Call Logging: Ability to log phone calls and record notes about the conversation.

- Meeting Scheduling: Integration with calendar applications for scheduling meetings and sending reminders.

3. Task and Project Management

Manage your client projects and tasks effectively to ensure timely completion and client satisfaction. Look for features like:

- Task Creation and Assignment: Ability to create tasks, assign them to team members, and set due dates.

- Project Tracking: Track the progress of client projects, monitor deadlines, and manage resources.

- Workflow Automation: Automate repetitive tasks, such as sending reminders or generating reports.

4. Reporting and Analytics

Gain insights into your client base and business performance with robust reporting and analytics features. Look for:

- Customizable Reports: Generate reports on various metrics, such as client acquisition, revenue, and client satisfaction.

- Dashboard Visualization: Visualize key performance indicators (KPIs) on a dashboard for easy monitoring.

- Data Analysis: Analyze your data to identify trends, opportunities, and areas for improvement.

5. Integration with Accounting Software

Seamless integration with your existing accounting software (e.g., QuickBooks, Xero) is crucial for streamlining your workflow and avoiding data entry errors. Look for:

- Two-Way Synchronization: Ability to synchronize client data and financial information between your CRM and accounting software.

- Automated Data Transfer: Automate the transfer of data between systems, reducing manual effort.

6. Security and Compliance

Protecting client data is paramount. Ensure your CRM system offers robust security features and complies with relevant regulations, such as GDPR and CCPA. Look for:

- Data Encryption: Encrypt client data to protect it from unauthorized access.

- Access Controls: Control who has access to client data and what they can do with it.

- Compliance Certifications: Ensure the CRM system complies with relevant industry regulations.

7. Mobile Accessibility

Access your CRM data on the go with a mobile app or a mobile-friendly interface. This allows you to stay connected with your clients and manage your business from anywhere. Look for:

- Mobile Apps: Dedicated mobile apps for iOS and Android devices.

- Responsive Design: A CRM interface that adapts to different screen sizes.

Top CRM Systems for Small Accounting Firms: A Comparative Overview

Now that you know what to look for, let’s explore some of the best CRM systems for small accounting firms. We’ll compare their features, pricing, and suitability for different needs.

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and it offers a robust free plan that’s perfect for small accounting firms. It’s user-friendly, highly customizable, and integrates seamlessly with other HubSpot tools, such as marketing and sales software.

Key Features:

- Free CRM with unlimited users.

- Contact management, deal tracking, and task management.

- Email integration and tracking.

- Reporting and analytics.

- Integration with popular accounting software (through third-party apps).

- User-friendly interface.

Pros:

- Free plan is generous and powerful.

- Easy to use and set up.

- Excellent customer support.

- Integrates with a wide range of apps.

Cons:

- Free plan has limitations on advanced features.

- Some integrations require paid plans.

Pricing: Free plan available. Paid plans start at $45/month.

Who it’s best for: Small accounting firms looking for a free, easy-to-use CRM with basic features.

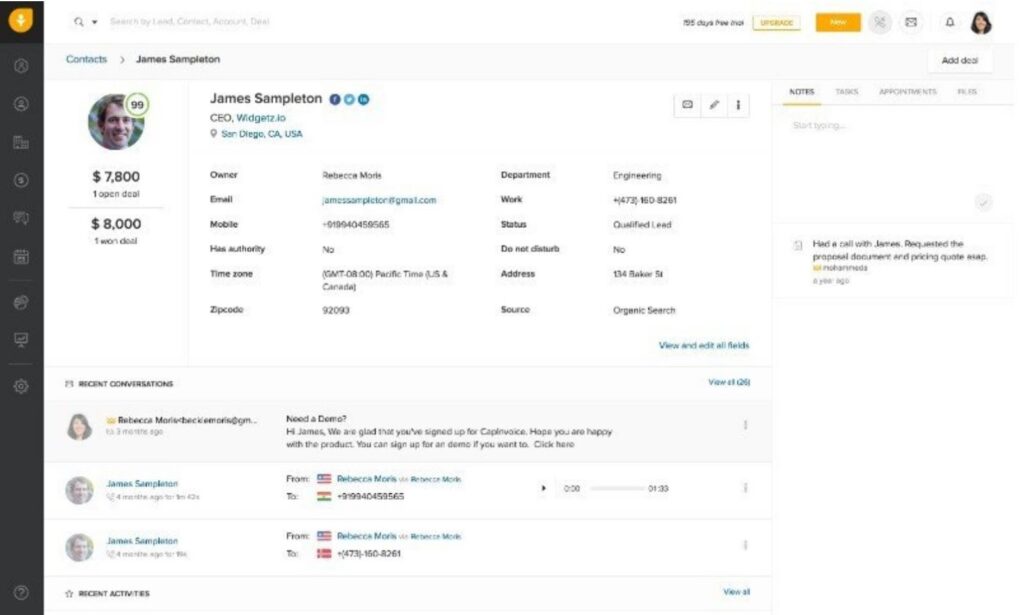

2. Zoho CRM

Zoho CRM is a comprehensive CRM system that offers a wide range of features at a competitive price. It’s a great option for small accounting firms that need a more feature-rich solution than HubSpot’s free plan provides.

Key Features:

- Contact management, lead management, and sales force automation.

- Workflow automation and process management.

- Email marketing and analytics.

- Integration with accounting software (through third-party apps).

- Customization options.

Pros:

- Affordable pricing plans.

- Feature-rich platform.

- Excellent customization options.

- Good customer support.

Cons:

- Interface can be overwhelming for some users.

- Some integrations require paid plans.

Pricing: Free plan available for up to 3 users. Paid plans start at $14/user/month.

Who it’s best for: Small accounting firms looking for a feature-rich, customizable CRM at an affordable price.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its ease of use and visual interface. It’s a good choice for small accounting firms that prioritize sales and lead management.

Key Features:

- Visual sales pipeline management.

- Lead tracking and scoring.

- Email integration and automation.

- Reporting and analytics.

- Integration with accounting software (through third-party apps).

Pros:

- Easy to use and set up.

- Visually appealing interface.

- Strong focus on sales pipeline management.

Cons:

- Less emphasis on customer service features.

- Limited customization options.

Pricing: Paid plans start at $12.50/user/month.

Who it’s best for: Small accounting firms that prioritize sales and lead management and want a visually appealing and easy-to-use CRM.

4. Salesforce Sales Cloud

Salesforce is a leading CRM platform used by businesses of all sizes. While it can be a significant investment, it offers a vast array of features and customization options that can be beneficial for growing accounting firms.

Key Features:

- Contact management, lead management, and sales force automation.

- Workflow automation and process management.

- Reporting and analytics.

- Extensive customization options.

- AppExchange marketplace with a wide range of integrations.

- Integration with accounting software (through third-party apps).

Pros:

- Feature-rich platform with extensive customization options.

- Large ecosystem of integrations through the AppExchange.

- Scalable to grow with your business.

- Strong reputation and brand recognition.

Cons:

- Can be expensive, especially for small firms.

- Steep learning curve.

- Requires a significant investment of time and resources to implement and customize.

Pricing: Paid plans start at $25/user/month.

Who it’s best for: Growing accounting firms that need a highly customizable, scalable CRM and are willing to invest in training and implementation.

5. Insightly

Insightly is a CRM system that is particularly well-suited for small businesses and offers a good balance of features and affordability. It focuses on project management alongside the usual CRM features, making it a good option for firms that want to manage client projects within the same platform.

Key Features:

- Contact management, lead management, and opportunity tracking.

- Project management and task management.

- Email integration and automation.

- Reporting and analytics.

- Integration with accounting software (through third-party apps).

Pros:

- User-friendly interface.

- Good project management features.

- Affordable pricing.

Cons:

- Limited customization options compared to some other platforms.

- Reporting capabilities could be more robust.

Pricing: Paid plans start at $29/user/month.

Who it’s best for: Small accounting firms that want a user-friendly CRM with project management capabilities at an affordable price.

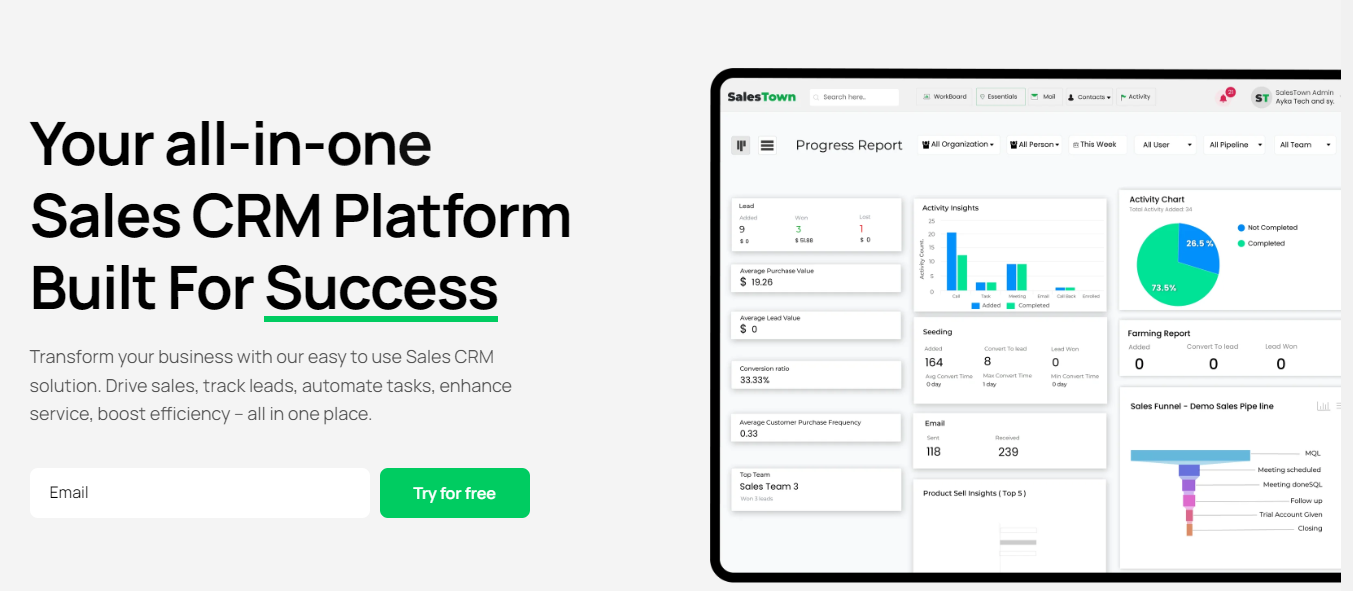

6. Freshsales (by Freshworks)

Freshsales, part of the Freshworks suite, offers a great option for accounting firms looking for a CRM with strong sales and marketing features. It focuses on providing a streamlined experience for sales teams, while also offering automation capabilities that can benefit client management.

Key Features:

- Contact management, lead scoring, and sales pipeline management.

- Email tracking and automation.

- Built-in phone system.

- Reporting and analytics.

- Integration with other Freshworks products.

- Integration with accounting software (through third-party apps).

Pros:

- User-friendly and easy to set up.

- Strong sales and marketing features.

- Built-in phone system is a convenient feature.

- Good value for the price.

Cons:

- Less focus on customer service features compared to some other platforms.

- Some integrations require paid plans.

Pricing: Free plan available. Paid plans start at $15/user/month.

Who it’s best for: Small accounting firms that want a CRM with strong sales and marketing capabilities and a focus on ease of use.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM can feel daunting, but breaking it down into manageable steps can simplify the process. Here’s a step-by-step guide to help you choose the best CRM for your small accounting firm:

1. Define Your Needs and Goals

Before you start evaluating CRM systems, take some time to define your needs and goals. Ask yourself:

- What are your current pain points in managing clients and your business?

- What tasks do you want to automate?

- What are your key performance indicators (KPIs)?

- What are your budget constraints?

- What are your future growth plans?

Answering these questions will help you identify the essential features you need in a CRM.

2. Research and Evaluate CRM Systems

Once you have a clear understanding of your needs, start researching different CRM systems. Consider the options we’ve discussed above, as well as other popular platforms. Evaluate each system based on the following criteria:

- Features: Does it offer the features you need, such as contact management, communication tracking, task management, and reporting?

- Ease of Use: Is it user-friendly and easy to learn?

- Integrations: Does it integrate with your existing accounting software and other tools?

- Pricing: Is it affordable and within your budget?

- Customer Support: Does it offer good customer support?

- Reviews: Read reviews from other accounting firms to get insights into their experiences.

3. Create a Shortlist

Narrow down your options to a shortlist of 2-3 CRM systems that best meet your needs and budget.

4. Request Demos and Free Trials

Most CRM systems offer demos or free trials. Request demos from your shortlisted vendors to see the platform in action and get a feel for its user interface. Take advantage of free trials to test the system with your own data and evaluate its features firsthand.

5. Consider Implementation and Training

Think about the implementation process and the training required for your team. Some CRM systems are easier to implement than others. Consider the level of support offered by the vendor and the availability of training resources.

6. Make a Decision and Implement

Based on your research, demos, and trials, make a final decision and choose the CRM system that best fits your needs. Plan your implementation carefully, and provide adequate training to your team to ensure a smooth transition. This may involve data migration, customization, and integration with other tools. Make sure to celebrate the launch of your new CRM!

Tips for a Successful CRM Implementation

Implementing a CRM system is a significant undertaking. Here are some tips to ensure a successful implementation:

- Involve Your Team: Get your team involved in the selection process and implementation to ensure buy-in and address any concerns.

- Clean Your Data: Before importing your data into the CRM, clean it up to ensure accuracy and consistency.

- Customize the System: Customize the CRM to fit your specific needs and workflows.

- Provide Training: Provide adequate training to your team on how to use the CRM.

- Monitor and Evaluate: Monitor your CRM usage and evaluate its effectiveness regularly.

- Seek Expert Help: If needed, consider hiring a consultant to help with the implementation and customization process.

The Future of CRM for Accountants

The world of CRM is constantly evolving, and the future holds exciting possibilities for accounting firms. Here are some trends to watch out for:

- AI-Powered CRM: Artificial intelligence (AI) is being integrated into CRM systems to automate tasks, provide insights, and personalize client interactions.

- Mobile-First Approach: CRM systems are becoming increasingly mobile-friendly, allowing accountants to access data and manage their businesses from anywhere.

- Enhanced Integrations: CRM systems will continue to integrate with other tools and platforms, such as accounting software, project management tools, and marketing automation platforms.

- Focus on Data Security: With increasing concerns about data privacy, CRM systems will prioritize data security and compliance with relevant regulations.

Conclusion: Embrace the Power of CRM

Choosing the right CRM system is a crucial step towards streamlining your accounting firm, improving client relationships, and boosting your bottom line. By following the steps outlined in this guide and selecting a CRM that meets your specific needs, you can transform your business and thrive in today’s competitive market. Take the time to research your options, evaluate the features, and implement the system effectively. The investment in a good CRM is an investment in the future success of your practice.