The Ultimate Guide to the Best CRM for Small Accounting Firms: Boost Efficiency and Client Satisfaction

Introduction: Why Your Accounting Firm Needs a CRM

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking financial data, generating reports, and staying on top of compliance – all while trying to grow your business. In this hectic environment, it’s easy for things to slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes in. It’s not just for sales teams; a CRM is a powerful tool that can revolutionize how you manage your accounting practice, improve client relationships, and boost overall efficiency.

This comprehensive guide will delve into the best CRM solutions specifically tailored for small accounting firms. We’ll explore the key features to look for, the benefits you can expect, and a detailed comparison of top contenders. Whether you’re a solo practitioner or a small team, finding the right CRM can be a game-changer.

What is a CRM and Why Does Your Accounting Firm Need One?

At its core, a CRM is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. It helps you streamline processes, automate tasks, and gain valuable insights into your clients. For accounting firms, this translates to:

- Centralized Client Data: Store all client information – contact details, communication history, financial records, and more – in one accessible location.

- Improved Communication: Track all interactions, ensuring you never miss a follow-up or lose track of important conversations.

- Enhanced Client Relationships: Personalize interactions and provide proactive service based on client needs.

- Increased Efficiency: Automate repetitive tasks, freeing up your time to focus on more strategic activities.

- Better Decision-Making: Gain insights into client behavior, identify growth opportunities, and improve your overall business strategy.

Without a CRM, your client data might be scattered across spreadsheets, emails, and sticky notes. This fragmented approach leads to inefficiencies, errors, and missed opportunities. A CRM brings everything together, creating a unified view of your clients and empowering you to provide exceptional service.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, consider these essential features:

1. Contact Management

This is the foundation of any CRM. Look for a system that allows you to easily store, organize, and access client contact information, including names, addresses, phone numbers, email addresses, and other relevant details. The ability to segment your contacts based on various criteria (e.g., industry, service type, revenue) is also crucial.

2. Client Communication Tracking

Keep a detailed record of all interactions with your clients, including emails, phone calls, meetings, and even text messages. This allows you to quickly understand the history of your relationship with each client and ensures that all team members are on the same page.

3. Task and Appointment Management

Schedule appointments, set reminders, and assign tasks to team members. This feature helps you stay organized and ensures that important deadlines are never missed. Integration with your calendar system (e.g., Google Calendar, Outlook) is a must-have.

4. Workflow Automation

Automate repetitive tasks, such as sending follow-up emails, generating invoices, and updating client records. This saves you time and reduces the risk of errors. Look for a CRM that offers customizable workflow automation options.

5. Reporting and Analytics

Gain insights into your client base, track key performance indicators (KPIs), and generate reports to measure your firm’s performance. This data-driven approach allows you to make informed decisions and optimize your business strategies.

6. Document Management

Securely store and manage client documents, such as tax returns, financial statements, and contracts. This feature ensures that all important documents are easily accessible and organized.

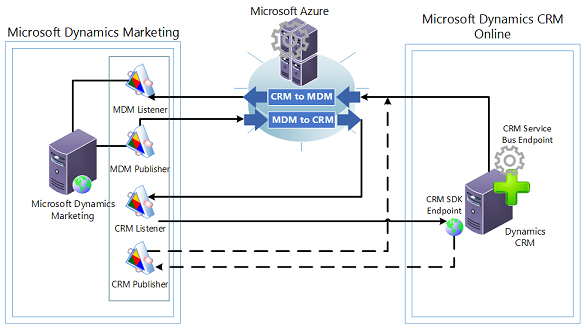

7. Integration with Accounting Software

Seamless integration with your existing accounting software (e.g., QuickBooks, Xero, Sage) is essential. This allows you to automatically sync client data, track financial information, and streamline your workflows.

8. Security and Compliance

Ensure that the CRM you choose offers robust security features to protect sensitive client data. Compliance with industry regulations, such as GDPR and CCPA, is also crucial.

9. Mobile Accessibility

Access your CRM data on the go with a mobile app or a responsive web interface. This allows you to stay connected with your clients and manage your business from anywhere.

10. Customization and Scalability

Choose a CRM that can be customized to meet the specific needs of your firm. As your business grows, the CRM should be able to scale to accommodate your increasing client base and evolving requirements.

Top CRM Systems for Small Accounting Firms: A Detailed Comparison

Now that we’ve explored the key features, let’s dive into some of the best CRM systems available for small accounting firms. We’ll compare their strengths, weaknesses, pricing, and suitability for different needs.

1. HubSpot CRM

Overview: HubSpot CRM is a popular choice for businesses of all sizes, including accounting firms. It offers a free version with a robust set of features, making it an attractive option for those just starting out.

Key Features for Accountants:

- Contact management

- Deal tracking

- Email marketing

- Workflow automation

- Reporting and analytics

- Integration with popular accounting software

Pros:

- Free version with generous features

- User-friendly interface

- Excellent marketing automation capabilities

- Strong integration with other HubSpot tools

Cons:

- Limited customization in the free version

- Advanced features require paid plans

- Can be overwhelming for some users due to its extensive feature set

Pricing: Free plan available. Paid plans start at around $45 per month.

Suitability: Ideal for small accounting firms looking for a free, feature-rich CRM with strong marketing capabilities. Great for firms that want to nurture leads and automate client communication.

2. Zoho CRM

Overview: Zoho CRM is a versatile and affordable CRM solution that caters to businesses of all sizes. It offers a wide range of features and a highly customizable platform.

Key Features for Accountants:

- Contact management

- Lead management

- Sales automation

- Workflow automation

- Reporting and analytics

- Integration with various third-party apps, including accounting software

Pros:

- Affordable pricing plans

- Highly customizable platform

- Strong automation capabilities

- Excellent integration options

Cons:

- Interface can be slightly less intuitive than some competitors

- Customer support can be slow at times

Pricing: Free plan available for up to 3 users. Paid plans start at around $14 per user per month.

Suitability: A great choice for small accounting firms looking for a customizable and affordable CRM with robust automation capabilities. Suitable for firms that want to tailor the CRM to their specific needs.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM designed to help businesses manage their sales pipeline and close deals. It’s known for its user-friendly interface and visual approach to sales management.

Key Features for Accountants (with adaptations):

- Contact management

- Deal tracking (can be adapted to track client projects or services)

- Pipeline management

- Workflow automation

- Reporting and analytics

- Integration with accounting software and other tools

Pros:

- User-friendly interface

- Visually appealing sales pipeline

- Easy to set up and use

- Strong focus on sales performance

Cons:

- May not be as feature-rich as other CRMs for general accounting tasks

- Less emphasis on marketing automation compared to HubSpot

Pricing: Paid plans start at around $14.90 per user per month.

Suitability: Best suited for accounting firms that want a simple, user-friendly CRM to manage client interactions and track projects or services. Firms that prioritize sales and business development will find Pipedrive particularly useful.

4. Salesforce Sales Cloud

Overview: Salesforce is a leading CRM provider with a comprehensive suite of features. While it can be a powerful solution for large enterprises, it can also be adapted for small accounting firms.

Key Features for Accountants (with customization):

- Contact management

- Lead management

- Sales automation

- Workflow automation

- Reporting and analytics

- AppExchange marketplace for integrations

Pros:

- Extensive feature set

- Highly customizable platform

- Large app ecosystem

- Scalability for growth

Cons:

- Can be expensive, especially for small firms

- Steep learning curve

- Requires significant setup and configuration

Pricing: Paid plans start at around $25 per user per month. However, the cost can increase significantly depending on the features and add-ons you choose.

Suitability: Suitable for small accounting firms that have the budget and resources to invest in a comprehensive CRM solution. Best for firms that anticipate significant growth and require advanced customization options.

5. Monday.com

Overview: Monday.com is a work operating system that offers CRM functionalities as part of its broader project management capabilities. It is known for its visual interface and collaborative features.

Key Features for Accountants (using CRM templates):

- Contact management

- Project management (tracking client projects and deadlines)

- Workflow automation

- Collaboration features

- Reporting and dashboards

- Integration with other tools

Pros:

- Visually appealing and intuitive interface

- Strong collaboration features

- Easy to set up and use

- Flexible and customizable

Cons:

- CRM features may be less robust than dedicated CRM systems

- Can be more expensive than some competitors

Pricing: Paid plans start at around $9 per seat per month.

Suitability: Ideal for small accounting firms that want a CRM integrated with project management tools. It’s great for firms that prioritize collaboration and visual organization.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision that can significantly impact your firm’s success. Here’s a step-by-step guide to help you make the right choice:

1. Define Your Needs and Goals

Before you start evaluating CRM systems, take the time to identify your specific needs and goals. What are you hoping to achieve with a CRM? Do you want to improve client communication, streamline workflows, or gain better insights into your client base? Make a list of your must-have features and desired outcomes.

2. Assess Your Current Processes

Analyze your existing processes to identify areas for improvement. What tasks are time-consuming or inefficient? Where are you losing track of client information? Understanding your current workflows will help you choose a CRM that can address your pain points.

3. Evaluate CRM Options

Research the CRM systems mentioned in this guide and other options that might be a good fit for your firm. Compare their features, pricing, and user reviews. Consider the following factors:

- Features: Does the CRM offer all the features you need?

- Ease of Use: Is the interface intuitive and easy to navigate?

- Integrations: Does the CRM integrate with your existing accounting software and other tools?

- Pricing: Does the pricing fit your budget?

- Customer Support: Does the vendor offer reliable customer support?

4. Request Demos and Trials

Most CRM providers offer free demos or trial periods. Take advantage of these opportunities to test the software and see how it works in practice. This will give you a better understanding of the user interface, features, and overall functionality.

5. Involve Your Team

Get input from your team members who will be using the CRM. Ask them about their needs and preferences. Their feedback can help you choose a CRM that everyone will be comfortable using.

6. Consider Your Budget

Set a realistic budget for your CRM implementation. Factor in the cost of the software, implementation services, training, and ongoing support. Remember that the cheapest option may not always be the best. Consider the long-term value and return on investment (ROI) of each CRM.

7. Plan for Implementation

Once you’ve chosen a CRM, develop a detailed implementation plan. This should include data migration, user training, and workflow setup. Consider whether you need to hire a consultant to assist with the implementation process.

8. Provide Training and Support

Ensure that your team receives adequate training on how to use the CRM. Provide ongoing support to address any questions or issues that may arise. This will help ensure that your team adopts the CRM and uses it effectively.

9. Review and Optimize

Regularly review your CRM usage and make adjustments as needed. Identify areas where you can further streamline your workflows and improve your efficiency. Continuously optimize your CRM to maximize its benefits.

Benefits of Using a CRM for Your Accounting Firm

Implementing a CRM can bring a wealth of benefits to your accounting firm:

- Improved Client Satisfaction: By centralizing client data and tracking interactions, you can provide more personalized service and build stronger relationships.

- Increased Efficiency: Automating tasks and streamlining workflows frees up your time to focus on more strategic activities.

- Enhanced Collaboration: A CRM provides a centralized platform for team members to access and share client information, improving communication and collaboration.

- Better Data Analysis: Gain valuable insights into your client base and identify growth opportunities through reporting and analytics.

- Reduced Errors: Automating tasks and centralizing data reduces the risk of errors and improves accuracy.

- Increased Revenue: By improving client relationships and identifying new opportunities, a CRM can help you increase revenue.

- Improved Compliance: Securely storing and managing client documents helps you stay compliant with industry regulations.

- Competitive Advantage: Using a CRM can give you a competitive edge by allowing you to provide superior service and build stronger client relationships.

Common Challenges and How to Overcome Them

While a CRM can be a valuable asset, implementing one can come with its own set of challenges. Here are some common obstacles and how to overcome them:

1. Data Migration

Migrating your client data from spreadsheets, emails, and other sources to a new CRM can be a time-consuming and complex process. To overcome this challenge:

- Plan Ahead: Create a detailed data migration plan, including cleaning and organizing your data before you start.

- Choose the Right Tools: Use data migration tools or consult with a data migration specialist.

- Test Your Data: Verify the accuracy of your data after migration.

2. User Adoption

Getting your team to adopt a new CRM can be challenging. Some team members may resist change or be hesitant to learn a new system. To address this:

- Provide Training: Offer comprehensive training on how to use the CRM.

- Communicate the Benefits: Explain how the CRM will benefit them and their work.

- Lead by Example: Have key team members champion the CRM and encourage others to use it.

- Provide Ongoing Support: Offer ongoing support and address any questions or issues that may arise.

3. Customization and Setup

Setting up and customizing a CRM can be time-consuming, especially if you choose a highly customizable platform. To simplify this:

- Start Simple: Begin with the core features and gradually add more customization as needed.

- Use Templates: Leverage pre-built templates to save time.

- Seek Professional Help: Consider hiring a consultant to assist with the setup and customization process.

4. Integration Issues

Integrating your CRM with other software systems, such as your accounting software and email marketing platform, can sometimes present challenges. To mitigate this:

- Choose a CRM with Strong Integrations: Select a CRM that offers seamless integrations with your existing tools.

- Test Integrations: Test the integrations thoroughly before you launch the CRM.

- Seek Technical Support: Contact the CRM vendor or integration provider for assistance with any issues.

5. Cost

The cost of a CRM, including software, implementation, and training, can be a barrier for some small accounting firms. To manage costs:

- Choose an Affordable Option: Select a CRM that fits your budget.

- Start with a Free or Trial Version: Test the software before committing to a paid plan.

- Negotiate Pricing: Negotiate pricing with the vendor, especially if you’re a small firm.

Conclusion: Embrace CRM to Propel Your Accounting Firm Forward

In today’s competitive landscape, a CRM is no longer a luxury but a necessity for small accounting firms. By implementing the right CRM, you can streamline your operations, improve client relationships, and drive business growth. Take the time to evaluate your needs, research the available options, and choose a CRM that fits your firm’s unique requirements.

The journey to CRM implementation might seem daunting, but the rewards are well worth the effort. Embrace the power of CRM and watch your accounting firm thrive. Remember that the best CRM is the one that you actually use. By choosing the right system, providing adequate training, and fostering a culture of adoption, you can unlock the full potential of CRM and take your accounting practice to the next level.

Don’t let your firm fall behind. Start exploring CRM options today and embark on the path to a more efficient, client-focused, and successful accounting practice.