The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

Running a small accounting firm is no walk in the park. You’re juggling client relationships, deadlines, financial data, and a whole host of other responsibilities. In today’s digital age, efficiency and organization are paramount to success. That’s where a Customer Relationship Management (CRM) system comes in. But with so many options available, choosing the best CRM for small accountants can feel overwhelming. Fear not! This comprehensive guide will walk you through everything you need to know to select, implement, and leverage a CRM to transform your accounting practice.

Why Small Accountants Need a CRM

Before diving into specific CRM solutions, let’s explore why a CRM is crucial for small accounting firms. The benefits are numerous and can significantly impact your bottom line. Here are some of the key advantages:

- Improved Client Relationship Management: A CRM centralizes all client data in one place. This includes contact information, communication history, service agreements, and financial records. Having this information readily available allows you to provide personalized service, anticipate client needs, and build stronger relationships.

- Enhanced Organization and Efficiency: A CRM automates many administrative tasks, such as scheduling appointments, sending reminders, and tracking communication. This frees up valuable time for you and your team to focus on core accounting activities.

- Increased Sales and Revenue: A CRM helps you track leads, manage the sales pipeline, and identify opportunities for upselling and cross-selling. This can lead to a significant increase in revenue and profitability.

- Better Data Analysis and Reporting: A CRM provides valuable insights into your client base, sales performance, and overall business health. This data-driven approach allows you to make informed decisions and optimize your operations.

- Improved Collaboration and Communication: A CRM facilitates seamless communication and collaboration among team members. This ensures that everyone is on the same page and working towards common goals.

- Reduced Errors and Improved Compliance: By centralizing data and automating processes, a CRM minimizes the risk of errors and helps you stay compliant with industry regulations.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, consider the following essential features:

- Contact Management: This is the core functionality of any CRM. It should allow you to store and manage detailed client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Lead Management: The ability to track leads, qualify them, and move them through the sales pipeline is crucial for attracting new clients. Look for features such as lead scoring, lead assignment, and pipeline visualization.

- Task and Appointment Management: A CRM should allow you to schedule appointments, set reminders, and track tasks related to client interactions and other business activities.

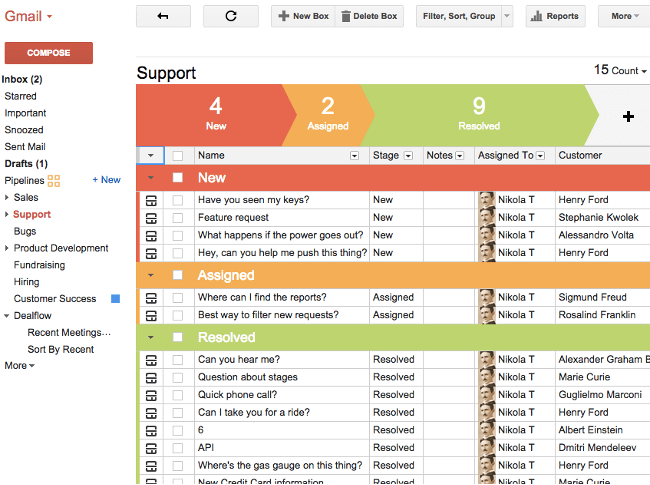

- Email Integration: Seamless integration with your email provider is essential for managing client communication. The CRM should allow you to send and receive emails, track email opens and clicks, and associate emails with specific client records.

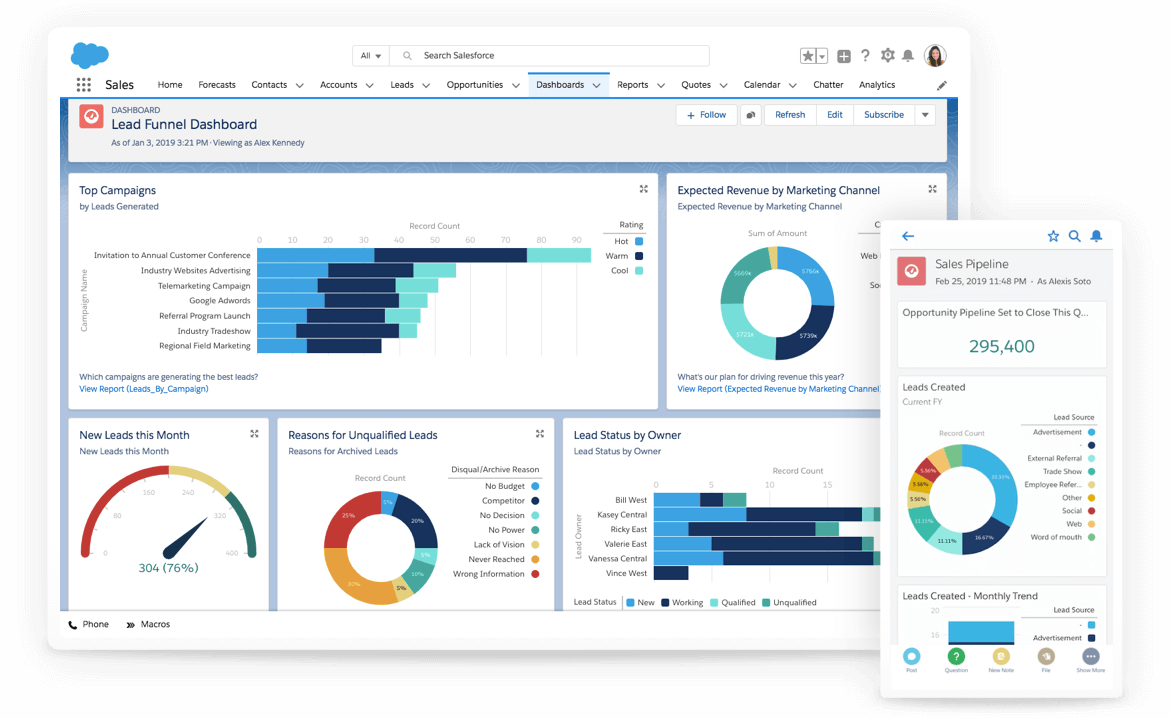

- Reporting and Analytics: The ability to generate reports and analyze data is critical for understanding your business performance and making informed decisions. Look for features such as customizable dashboards, sales reports, and client engagement metrics.

- Workflow Automation: Automate repetitive tasks, such as sending welcome emails, following up on leads, and sending invoices. This saves time and reduces the risk of errors.

- Integration with Accounting Software: This is a crucial feature for accountants. The CRM should integrate with your existing accounting software, such as QuickBooks, Xero, or Sage, to streamline data entry and improve accuracy.

- Customization: The ability to customize the CRM to meet your specific needs is essential. Look for features such as custom fields, custom reports, and the ability to integrate with other business applications.

- Security and Compliance: Ensure the CRM offers robust security features to protect sensitive client data and complies with relevant industry regulations, such as GDPR and CCPA.

- Mobile Accessibility: Choose a CRM that offers a mobile app or a responsive web interface so you can access client information and manage your practice on the go.

Top CRM Solutions for Small Accountants: A Detailed Comparison

Now, let’s delve into some of the best CRM solutions for small accountants, comparing their key features, pricing, and suitability for different needs.

1. HubSpot CRM

Overview: HubSpot CRM is a popular and versatile CRM platform that offers a free version with a robust set of features, making it an excellent option for small businesses. It’s known for its user-friendly interface, comprehensive features, and strong integration capabilities.

Key Features:

- Contact Management: Excellent contact management features with detailed profiles and activity tracking.

- Lead Management: Robust lead generation and management tools, including lead scoring and pipeline visualization.

- Email Marketing: Integrated email marketing tools for sending newsletters and marketing campaigns.

- Sales Automation: Automate tasks such as sending follow-up emails and scheduling appointments.

- Free Plan: A generous free plan that includes a significant number of features.

- Integration: Integrates with a wide range of third-party applications, including accounting software.

Pros:

- User-friendly interface

- Comprehensive features

- Generous free plan

- Excellent integration capabilities

Cons:

- Advanced features require paid plans

- Can be overwhelming for very small businesses

Pricing: HubSpot offers a free plan with basic features. Paid plans start at a reasonable price point and scale based on the features needed.

Suitable for: Small to medium-sized accounting firms looking for a feature-rich, user-friendly CRM with strong marketing and sales capabilities.

2. Zoho CRM

Overview: Zoho CRM is another popular CRM platform that offers a wide range of features and customization options. It’s known for its affordability and scalability, making it a good choice for businesses of all sizes.

Key Features:

- Contact Management: Comprehensive contact management features with detailed profiles and activity tracking.

- Lead Management: Robust lead generation and management tools, including lead scoring and pipeline visualization.

- Sales Automation: Automate tasks such as sending follow-up emails and scheduling appointments.

- Workflow Automation: Create custom workflows to automate business processes.

- Reporting and Analytics: Powerful reporting and analytics tools for tracking sales performance and client engagement.

- Customization: Highly customizable to meet specific business needs.

- Integration: Integrates with a wide range of third-party applications, including accounting software.

Pros:

- Affordable pricing

- Highly customizable

- Wide range of features

- Good integration capabilities

Cons:

- Interface can be slightly less intuitive than HubSpot

- Can be complex to set up and configure

Pricing: Zoho CRM offers a free plan with basic features. Paid plans are competitively priced and offer a range of features.

Suitable for: Small to medium-sized accounting firms looking for an affordable, customizable CRM with a wide range of features.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that is known for its simplicity and ease of use. It’s a great choice for accounting firms that prioritize sales pipeline management and lead generation.

Key Features:

- Visual Sales Pipeline: A highly visual and intuitive sales pipeline for tracking leads and deals.

- Lead Management: Robust lead generation and management tools, including lead scoring and pipeline visualization.

- Activity Tracking: Track all sales activities, such as calls, emails, and meetings.

- Automation: Automate repetitive sales tasks.

- Reporting and Analytics: Sales performance reports and insights.

- Integration: Integrates with a range of third-party applications.

Pros:

- User-friendly interface

- Focus on sales pipeline management

- Easy to set up and use

Cons:

- May lack some advanced features compared to other CRMs

- Less focus on marketing automation

Pricing: Pipedrive offers a range of paid plans based on the features needed.

Suitable for: Accounting firms that prioritize sales pipeline management and lead generation, and are looking for a user-friendly CRM.

4. Insightly

Overview: Insightly is a CRM platform designed for small to medium-sized businesses. It’s known for its ease of use, robust features, and integration capabilities.

Key Features:

- Contact Management: Comprehensive contact management features.

- Lead Management: Lead tracking and qualification tools.

- Project Management: Project management features for managing client projects.

- Workflow Automation: Automate business processes.

- Reporting and Analytics: Reporting and analytics tools for tracking business performance.

- Integration: Integrates with a range of third-party applications.

Pros:

- User-friendly interface

- Project management features

- Good integration capabilities

Cons:

- Less focus on marketing automation compared to some other CRMs

- May not be as scalable for very large businesses

Pricing: Insightly offers a free plan with basic features. Paid plans offer a range of features.

Suitable for: Small to medium-sized accounting firms that want a user-friendly CRM with project management capabilities.

5. Freshsales

Overview: Freshsales is a sales-focused CRM that is part of the Freshworks suite of business applications. It’s known for its ease of use, affordability, and strong sales automation features.

Key Features:

- Contact Management: Comprehensive contact management features.

- Lead Management: Lead tracking and qualification tools.

- Sales Automation: Sales automation features, such as automated email sequences and task assignments.

- Workflow Automation: Automate business processes.

- Reporting and Analytics: Reporting and analytics tools for tracking sales performance.

- Integration: Integrates with a range of third-party applications.

- Built-in Phone and Email: Features for direct calling and email communication.

Pros:

- User-friendly interface

- Strong sales automation features

- Affordable pricing

- Built-in phone and email features

Cons:

- May lack some advanced features compared to other CRMs

- Less focus on marketing automation

Pricing: Freshsales offers a free plan with basic features. Paid plans are competitively priced and offer a range of features.

Suitable for: Accounting firms that prioritize sales automation and are looking for an affordable, user-friendly CRM.

How to Choose the Right CRM for Your Accounting Firm

Selecting the right CRM is crucial for maximizing its benefits. Here’s a step-by-step guide to help you choose the best CRM for your accounting firm:

- Assess Your Needs: Before you start evaluating CRM solutions, take the time to assess your firm’s specific needs and goals. What are your biggest challenges? What are your priorities? What features are essential?

- Define Your Requirements: Based on your needs assessment, create a list of essential features and functionalities. This will help you narrow down your options and compare different CRM solutions.

- Research CRM Solutions: Research the different CRM solutions available, such as HubSpot, Zoho CRM, Pipedrive, Insightly, and Freshsales. Read reviews, compare features, and check pricing.

- Consider Integration: Ensure the CRM integrates with your existing accounting software, email provider, and other business applications. This will streamline data entry and improve efficiency.

- Evaluate User Experience: The CRM should be user-friendly and easy to navigate. Consider the user interface, ease of use, and the learning curve.

- Evaluate Pricing: Determine your budget and compare the pricing plans of different CRM solutions. Consider the features offered in each plan and choose the one that best fits your needs and budget.

- Request Demos and Trials: Request demos or free trials of the CRM solutions you are considering. This will allow you to test the features, evaluate the user experience, and see if the CRM is a good fit for your firm.

- Consider Scalability: Choose a CRM that can scale with your business. As your firm grows, your CRM needs may change.

- Prioritize Security: Ensure the CRM offers robust security features to protect sensitive client data and complies with relevant industry regulations.

- Make a Decision: Based on your research, evaluation, and testing, choose the CRM that best meets your needs and goals.

Implementing Your New CRM: A Step-by-Step Guide

Once you’ve chosen your CRM, the next step is implementation. Here’s a step-by-step guide to help you implement your new CRM successfully:

- Plan Your Implementation: Create a detailed implementation plan, including timelines, tasks, and responsibilities.

- Data Migration: Migrate your existing client data from your old system to the new CRM. Ensure the data is accurate and complete.

- Customize the CRM: Customize the CRM to meet your specific needs, such as adding custom fields, creating custom reports, and configuring workflows.

- Train Your Team: Provide training to your team on how to use the CRM. This will ensure that everyone is comfortable using the system and can take full advantage of its features.

- Test the CRM: Test the CRM to ensure that it’s working properly and that all features are functioning as expected.

- Go Live: Once you’ve tested the CRM, you can go live and start using it to manage your client relationships, sales, and other business activities.

- Monitor and Optimize: Monitor the CRM’s performance and make adjustments as needed. Regularly review your processes and workflows to identify areas for improvement.

Tips for Maximizing Your CRM’s Potential

To get the most out of your CRM, consider these tips:

- Clean Your Data: Regularly clean your client data to ensure it’s accurate and up-to-date.

- Use Automation: Automate repetitive tasks to save time and improve efficiency.

- Track Key Metrics: Track key metrics to measure your CRM’s performance and identify areas for improvement.

- Integrate with Other Applications: Integrate your CRM with other business applications, such as your accounting software, email provider, and marketing tools.

- Provide Regular Training: Provide regular training to your team to ensure they are up-to-date on the latest features and best practices.

- Get Feedback from Your Team: Encourage your team to provide feedback on the CRM and make adjustments as needed.

- Stay Up-to-Date: CRM technology is constantly evolving. Stay up-to-date on the latest features and best practices to maximize your CRM’s potential.

The Future of CRM for Accountants

The future of CRM for accountants is bright, with new technologies and trends emerging. Here are some of the key trends to watch:

- Artificial Intelligence (AI): AI is being used to automate tasks, provide insights, and personalize client interactions.

- Mobile CRM: Mobile CRM apps are becoming increasingly important, allowing accountants to access client information and manage their practice on the go.

- Integration with Cloud-Based Applications: Cloud-based CRM solutions are becoming more popular, offering greater flexibility and scalability.

- Focus on Customer Experience: CRM solutions are increasingly focused on providing a seamless and personalized customer experience.

- Data Privacy and Security: With increasing concerns about data privacy, CRM solutions are prioritizing security and compliance.

By embracing these trends, accounting firms can stay ahead of the curve and leverage CRM to drive growth and success.

Conclusion: CRM – A Game Changer for Small Accounting Firms

In conclusion, a CRM is an invaluable tool for small accounting firms. By centralizing client data, automating tasks, and providing valuable insights, a CRM can help you improve client relationships, increase efficiency, and boost your bottom line. By following the steps outlined in this guide, you can choose the right CRM for your firm, implement it successfully, and maximize its potential to achieve your business goals. Don’t delay – invest in a CRM today and take your accounting practice to the next level!