The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking financial data, staying compliant with regulations, and, of course, trying to grow your business. It’s a lot! That’s where a Customer Relationship Management (CRM) system comes in. Think of it as your central hub for everything client-related. It’s a powerful tool that can transform how you operate, freeing up your time, improving client satisfaction, and ultimately, boosting your bottom line. In this comprehensive guide, we’ll delve deep into the world of CRM for small accountants, helping you find the perfect solution to fit your specific needs. We’ll explore the benefits, key features to look for, and provide a detailed comparison of some of the best CRM options available.

Why Your Small Accounting Firm Needs a CRM

You might be wondering, “Do I really need a CRM?” The short answer is: Absolutely! Even if you’re a solo practitioner or a small team, a CRM can be a game-changer. Here’s why:

- Improved Client Relationships: A CRM provides a 360-degree view of each client, including their contact information, communication history, financial data (if integrated), and any specific notes or preferences. This allows you to personalize your interactions, anticipate their needs, and build stronger, more trusting relationships.

- Enhanced Organization and Efficiency: Say goodbye to scattered spreadsheets, overflowing email inboxes, and lost client information. A CRM centralizes all your client data in one accessible location, making it easy to find what you need, when you need it. This saves you valuable time and reduces the risk of errors.

- Streamlined Communication: CRM systems often include features like email integration, task management, and automated workflows. This makes it easy to communicate with clients, schedule appointments, and follow up on leads, all from a single platform.

- Increased Sales and Revenue: By tracking leads, managing your sales pipeline, and identifying opportunities for upselling or cross-selling, a CRM can help you generate more business and increase your revenue.

- Better Data Analysis and Reporting: Many CRMs offer powerful reporting and analytics tools that allow you to track your key performance indicators (KPIs), measure your success, and make data-driven decisions. This helps you identify areas for improvement and optimize your business strategies.

- Improved Collaboration: If you have a team, a CRM facilitates seamless collaboration by providing a shared platform for accessing and updating client information. This ensures everyone is on the same page and can provide consistent, high-quality service.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, it’s crucial to select one that meets your specific needs. Here are some key features to consider:

- Contact Management: This is the core of any CRM. It should allow you to store and manage client contact information, including names, addresses, phone numbers, email addresses, and any other relevant details.

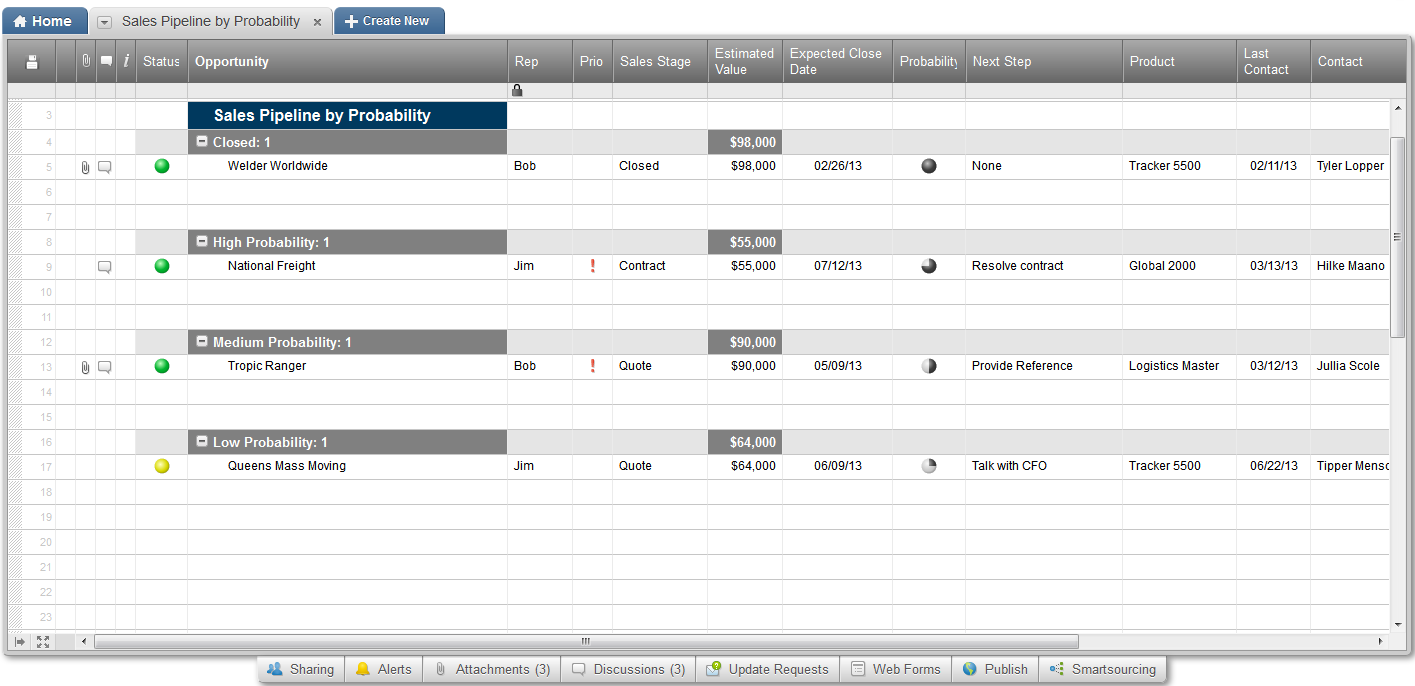

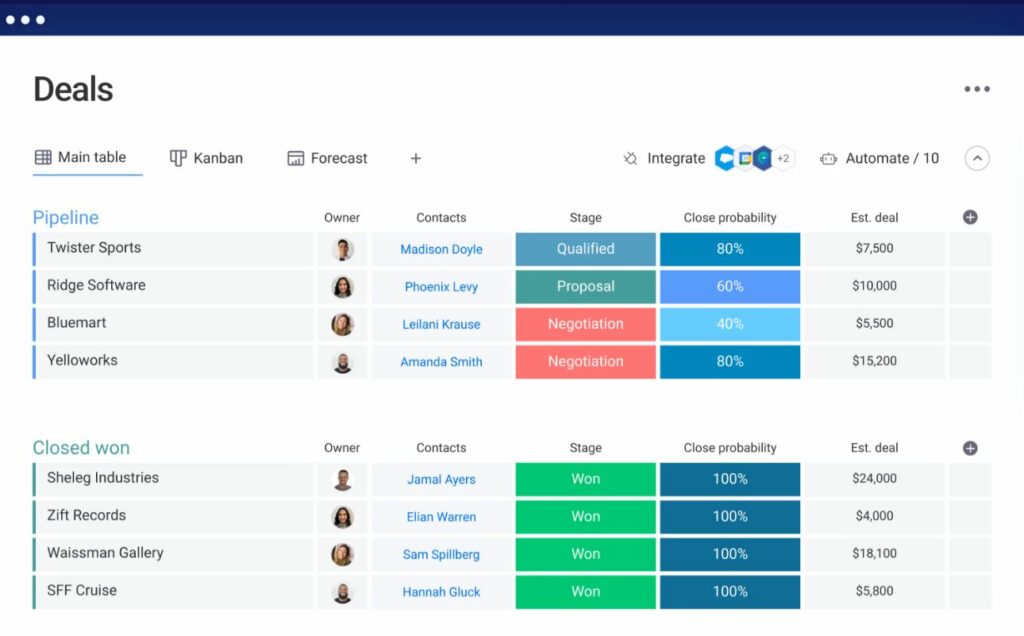

- Lead Management: The ability to track leads, manage your sales pipeline, and nurture potential clients is essential for business growth. Look for features like lead scoring, lead assignment, and sales automation.

- Client Portal: A client portal allows your clients to access their financial documents, communicate with you securely, and submit requests. This improves client satisfaction and reduces your administrative burden.

- Task Management and Reminders: Stay organized and never miss a deadline with task management and reminder features. You can assign tasks to team members, set due dates, and receive notifications to ensure everything gets done on time.

- Email Integration: Seamless integration with your email provider (e.g., Gmail, Outlook) allows you to track email communications, send mass emails, and automate email workflows.

- Reporting and Analytics: Gain valuable insights into your business performance with reporting and analytics tools. Track your KPIs, measure your progress, and identify areas for improvement.

- Integration with Accounting Software: This is a crucial feature for accountants. Integration with your accounting software (e.g., QuickBooks, Xero) allows you to seamlessly share data between your CRM and your accounting system, eliminating the need for manual data entry and reducing the risk of errors.

- Document Management: The ability to store and manage client documents securely is essential for maintaining client confidentiality and complying with regulations.

- Automation: Automate repetitive tasks, such as sending welcome emails, follow-up reminders, and appointment confirmations, to save time and improve efficiency.

- Customization: The CRM should be customizable to fit your specific needs and workflows. Look for features like custom fields, custom reports, and the ability to customize your user interface.

- Mobile Access: Access your client data and manage your business on the go with a mobile-friendly CRM.

- Security: Ensure the CRM has robust security features, including data encryption, access controls, and regular backups, to protect your clients’ sensitive information.

- User-Friendly Interface: The CRM should be easy to use and navigate. A clean, intuitive interface will save you time and reduce the learning curve for your team.

- Customer Support: Choose a CRM provider that offers excellent customer support, including documentation, training resources, and responsive technical support.

Top CRM Solutions for Small Accountants: A Detailed Comparison

Now, let’s dive into some of the best CRM solutions specifically designed for small accounting firms. We’ll compare their key features, pricing, and ease of use to help you make an informed decision.

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms. It offers a free version that includes a wide range of features, making it an excellent option for those just starting out or on a tight budget. HubSpot’s ease of use and intuitive interface make it a breeze to get up and running. Its comprehensive features, including contact management, lead tracking, email integration, and reporting, make it a powerful tool for managing client relationships and growing your business.

- Pros:

- Free version with robust features

- User-friendly interface

- Excellent integration with other HubSpot tools (e.g., marketing, sales)

- Good customer support

- Cons:

- Limited features in the free version (e.g., email sending limits)

- Advanced features require paid plans

- Can be overwhelming for some users due to its extensive feature set

- Pricing: Free, with paid plans starting at $45 per month.

- Best for: Small accounting firms looking for a free or affordable CRM with a user-friendly interface and a wide range of features.

2. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its visual pipeline management. It’s an excellent choice for accountants who want to streamline their sales process and track leads effectively. Pipedrive’s intuitive interface and visual pipeline make it easy to see where your leads are in the sales process and identify potential bottlenecks. It offers features like lead tracking, deal management, email integration, and reporting. While not specifically designed for accounting, its focus on sales makes it a good fit for firms looking to improve their lead generation and sales conversion rates.

- Pros:

- Visual pipeline management

- User-friendly interface

- Excellent for sales and lead tracking

- Good integration with other tools

- Cons:

- Less focus on client management than other CRMs

- Limited features in the basic plans

- May not be the best fit for firms that prioritize client service over sales

- Pricing: Starts at $12.50 per user per month.

- Best for: Small accounting firms that want to streamline their sales process and track leads effectively.

3. Zoho CRM

Zoho CRM is a comprehensive CRM solution that offers a wide range of features and integrations. It’s a good choice for accounting firms that need a robust and customizable CRM system. Zoho CRM offers features like contact management, lead management, sales automation, email integration, reporting, and more. It also integrates with a wide range of other Zoho apps and third-party tools, making it a versatile solution. While the interface can be a bit overwhelming for some users, Zoho CRM provides a lot of power and flexibility.

- Pros:

- Comprehensive feature set

- Highly customizable

- Good integration with other Zoho apps and third-party tools

- Affordable pricing

- Cons:

- Interface can be overwhelming for some users

- Steeper learning curve than some other CRMs

- Customer support can be slow at times

- Pricing: Starts at $14 per user per month.

- Best for: Small accounting firms that need a comprehensive and customizable CRM solution with a wide range of features.

4. Insightly

Insightly is a CRM and project management platform that is a great fit for accounting firms. It is known for its user-friendly interface, its strong focus on project management, and its ability to integrate with other business tools. Insightly’s features include contact management, lead tracking, project management, task management, and reporting. It is particularly useful for accounting firms that need to manage client projects and track progress.

- Pros:

- User-friendly interface

- Strong project management features

- Good integration with other business tools

- Affordable pricing

- Cons:

- Limited customization options

- Fewer integrations than some other CRMs

- Reporting features could be more robust

- Pricing: Starts at $29 per user per month.

- Best for: Small accounting firms that need a CRM with strong project management capabilities.

5. Freshsales

Freshsales is a sales-focused CRM that’s known for its ease of use and affordability. It’s a good choice for accounting firms that are looking for a simple and effective CRM to manage their sales process. Freshsales offers features like contact management, lead tracking, deal management, email integration, and reporting. Its intuitive interface makes it easy to get up and running quickly. While it is primarily focused on sales, it can also be used to manage client relationships.

- Pros:

- User-friendly interface

- Affordable pricing

- Good for sales and lead tracking

- Easy to set up and use

- Cons:

- Fewer features than some other CRMs

- Limited customization options

- Less focus on client management than other CRMs

- Pricing: Starts at $15 per user per month.

- Best for: Small accounting firms that are looking for an affordable and easy-to-use CRM to manage their sales process.

6. Keap (formerly Infusionsoft)

Keap is a CRM and marketing automation platform that’s designed for small businesses. It’s an excellent choice for accounting firms that want to automate their marketing and sales processes. Keap offers features like contact management, lead tracking, sales automation, email marketing, and reporting. Its powerful automation features can help you streamline your marketing and sales efforts. While it can be more expensive than some other CRMs, its automation capabilities can save you a significant amount of time and effort.

- Pros:

- Powerful marketing automation features

- Good for lead generation and nurturing

- Good for email marketing

- Good integration with other tools

- Cons:

- Can be expensive

- Steeper learning curve than some other CRMs

- Interface can be overwhelming for some users

- Pricing: Starts at $169 per month.

- Best for: Small accounting firms that want to automate their marketing and sales processes.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Start by identifying your firm’s specific needs and goals. What are your biggest challenges? What do you want to achieve with a CRM? Consider factors like the size of your team, your budget, and the specific features you need.

- Define Your Budget: Determine how much you’re willing to spend on a CRM. Consider the cost of the software, implementation, training, and ongoing maintenance.

- Research CRM Options: Research different CRM solutions and compare their features, pricing, and reviews. Read online reviews, watch product demos, and compare the features that each CRM offers.

- Prioritize Key Features: Identify the features that are most important to your firm. Make a list of must-have features and nice-to-have features.

- Consider Integration: Check whether the CRM integrates with your existing accounting software, email provider, and other business tools. Seamless integration will save you time and reduce the risk of errors.

- Try a Free Trial or Demo: Most CRM providers offer free trials or demos. Take advantage of these opportunities to test the software and see if it’s a good fit for your firm.

- Evaluate Ease of Use: The CRM should be easy to use and navigate. A clean, intuitive interface will save you time and reduce the learning curve for your team.

- Consider Customer Support: Choose a CRM provider that offers excellent customer support, including documentation, training resources, and responsive technical support.

- Read Reviews: Read online reviews from other accounting firms to get an idea of their experiences with different CRM solutions.

- Make a Decision and Implement: Once you’ve evaluated your options, make a decision and implement the CRM. Be sure to train your team on how to use the software and integrate it into your workflows.

Tips for Successful CRM Implementation

Once you’ve selected a CRM, successful implementation is key to realizing its full potential. Here are some tips to ensure a smooth transition:

- Plan Ahead: Develop a detailed implementation plan, including timelines, tasks, and responsibilities.

- Clean Up Your Data: Before importing your data into the CRM, clean up your existing data to ensure accuracy and consistency.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM.

- Customize the CRM: Customize the CRM to fit your specific needs and workflows.

- Integrate with Other Tools: Integrate the CRM with your existing accounting software, email provider, and other business tools.

- Monitor and Evaluate: Monitor your CRM usage and evaluate its performance. Make adjustments as needed to optimize your workflows and improve your results.

- Get Buy-In from Your Team: Ensure your team understands the benefits of the CRM and is committed to using it.

- Start Small: Don’t try to implement everything at once. Start with a few key features and gradually add more features as you become more comfortable with the system.

- Seek Support: Don’t hesitate to reach out to the CRM provider’s customer support team if you have any questions or need assistance.

- Stay Consistent: Make sure your team consistently updates the CRM with the latest client information. This will ensure the data is accurate and up-to-date.

The Benefits of CRM for Accountants: A Recap

Let’s revisit the key advantages of using a CRM system for your accounting practice:

- Stronger Client Relationships: Personalized interactions and a deep understanding of client needs.

- Enhanced Efficiency: Centralized data, streamlined communication, and automated tasks.

- Increased Revenue: Improved lead management, sales pipeline visibility, and upselling opportunities.

- Better Data Analysis: Insightful reporting and data-driven decision-making.

- Improved Collaboration: Seamless teamwork and consistent client service.

By implementing a CRM, you’re not just investing in software; you’re investing in the future of your accounting firm. It’s a strategic move that can help you build stronger client relationships, streamline your operations, and drive sustainable growth.

Conclusion: Embrace the Power of CRM

In today’s competitive landscape, a CRM is no longer a luxury; it’s a necessity. For small accounting firms, a well-chosen CRM can be the difference between struggling and thriving. By taking the time to research your options, assess your needs, and choose the right solution, you can unlock the full potential of your business and achieve lasting success. Don’t wait – start exploring the world of CRM today and experience the transformative power it can bring to your accounting practice. It is time to take control of your client relationships, boost your efficiency, and drive growth. The right CRM is waiting to help you achieve your business goals. Make the smart choice, and watch your firm flourish!