The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Satisfaction

The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Satisfaction

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking billable hours, sending invoices, and, of course, staying on top of the ever-changing tax regulations. It’s a lot! In this fast-paced environment, efficiency is key. That’s where a Customer Relationship Management (CRM) system comes in. A CRM is more than just a contact list; it’s a powerful tool that can streamline your operations, improve client communication, and ultimately, boost your bottom line. This guide dives deep into the world of CRMs, specifically focusing on the best options for small accounting firms. We’ll explore what a CRM is, why you need one, and, most importantly, which CRM is the perfect fit for your unique needs.

What is a CRM and Why Does Your Accounting Firm Need One?

Let’s start with the basics. CRM stands for Customer Relationship Management. At its core, a CRM system is a software solution designed to manage and analyze your interactions with current and potential clients. Think of it as a centralized hub for all your client-related information.

So, why is a CRM essential for a small accounting firm? Here are a few compelling reasons:

- Improved Client Management: A CRM provides a 360-degree view of each client. You can store contact information, communication history, financial data, project details, and more – all in one place. This makes it easier to personalize interactions and provide better service.

- Increased Efficiency: Automation is a game-changer. CRMs can automate repetitive tasks like sending emails, scheduling appointments, and generating reports, freeing up your time to focus on more strategic activities.

- Enhanced Communication: A CRM helps you stay connected with your clients. You can track all communication, ensuring that nothing falls through the cracks. You can also segment your client base and send targeted messages based on their specific needs.

- Better Lead Management: If you’re actively seeking new clients, a CRM can help you track leads, nurture prospects, and convert them into paying customers.

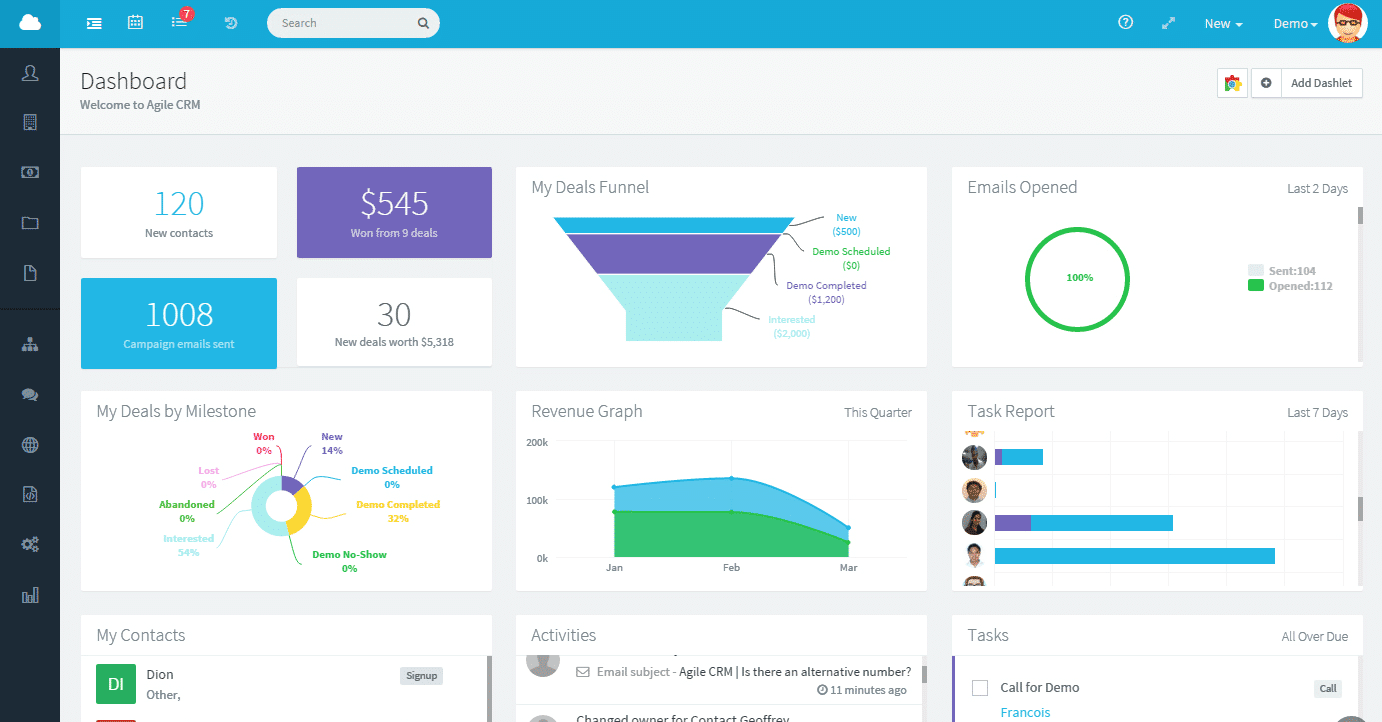

- Data-Driven Decision Making: CRMs provide valuable insights into your business performance. You can track key metrics like client acquisition cost, customer lifetime value, and revenue, allowing you to make data-driven decisions.

- Improved Collaboration: In a small firm, everyone needs to be on the same page. A CRM facilitates collaboration by providing a shared platform for accessing client information and tracking progress.

In essence, a CRM system acts as the central nervous system of your accounting practice, connecting all the critical components and enabling you to provide exceptional client service while optimizing your operations.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, it’s essential to consider the specific features that will benefit your business. Here are some key features to look for:

- Contact Management: This is the foundation of any CRM. It should allow you to store and organize client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Client Segmentation: The ability to segment your client base based on various criteria (e.g., industry, revenue, service type) is crucial for targeted marketing and personalized communication.

- Communication Tracking: A good CRM will track all communication with clients, including emails, phone calls, and meetings. This helps you stay organized and ensures that nothing is missed.

- Task Management: This feature allows you to assign tasks to team members, set deadlines, and track progress. It helps ensure that projects are completed on time and that clients are kept informed.

- Appointment Scheduling: Integrate with your calendar to schedule appointments with clients seamlessly.

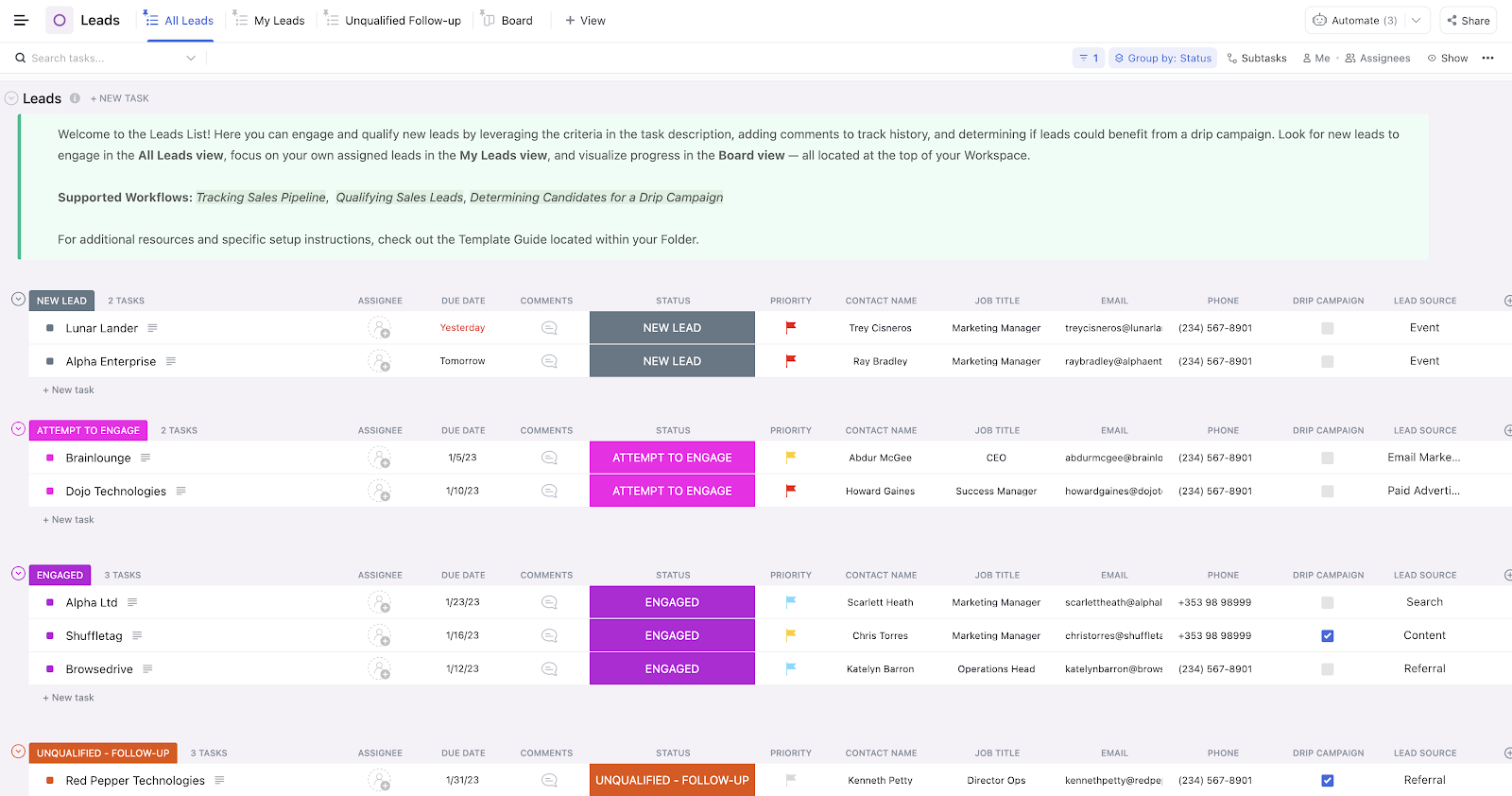

- Lead Management: If you’re actively generating leads, the CRM should have features for capturing, nurturing, and converting leads into clients.

- Reporting and Analytics: The ability to generate reports and analyze key metrics is essential for making data-driven decisions. Look for features like revenue tracking, client acquisition cost analysis, and customer lifetime value calculations.

- Integration with Accounting Software: This is a must-have. Your CRM should integrate with your accounting software (e.g., QuickBooks, Xero) to streamline data entry and avoid duplicate effort.

- Document Management: Securely store and manage client documents within the CRM.

- Automation Capabilities: Look for a CRM that allows you to automate repetitive tasks, such as sending emails, scheduling appointments, and generating reports.

- Mobile Access: Being able to access your CRM on the go is essential, especially if you meet with clients offsite.

- Security Features: Ensure the CRM has robust security features to protect your client’s sensitive financial data.

- Customization Options: The ability to customize the CRM to fit your specific needs is essential.

- User-Friendly Interface: The CRM should be easy to use and navigate.

By focusing on these key features, you can choose a CRM that will truly transform your accounting practice.

Top CRM Systems for Small Accountants: A Detailed Comparison

Now, let’s dive into some of the best CRM systems specifically designed for small accounting firms. We’ll compare their key features, pricing, and integrations to help you make an informed decision.

1. HubSpot CRM

HubSpot CRM is a popular choice, especially for its user-friendliness and generous free plan. It’s a comprehensive platform offering a wide range of features, including contact management, sales pipelines, email marketing, and more.

Key Features:

- Free CRM: HubSpot offers a robust free CRM plan, making it an excellent option for small businesses on a budget.

- Contact Management: Easily store and manage client information.

- Sales Pipeline: Track leads and deals through your sales process.

- Email Marketing: Create and send email campaigns.

- Reporting: Basic reporting features to track key metrics.

- Integrations: Integrates with various popular apps, including accounting software (though the integration might require a paid version).

- User-Friendly Interface: HubSpot is known for its intuitive and easy-to-use interface.

Pricing: HubSpot offers a free plan with limited features. Paid plans start at a reasonable price and scale up based on the features you need.

Pros: Free plan, user-friendly interface, comprehensive features, good for marketing automation.

Cons: The free plan has limitations, advanced features require a paid subscription, and some integrations may require paid add-ons.

2. Zoho CRM

Zoho CRM is a powerful and versatile CRM system that offers a wide range of features at an affordable price. It’s particularly well-suited for businesses that need a highly customizable solution.

Key Features:

- Contact Management: Manage client information efficiently.

- Sales Automation: Automate sales processes and workflows.

- Lead Management: Capture, nurture, and convert leads.

- Workflow Automation: Automate repetitive tasks.

- Customization: Highly customizable to fit your specific needs.

- Reporting and Analytics: Generate detailed reports and track key metrics.

- Integrations: Integrates with a wide range of apps, including accounting software.

- Mobile App: Access your CRM on the go.

Pricing: Zoho CRM offers several pricing plans, starting with a free plan for a limited number of users. Paid plans offer more features and scalability.

Pros: Affordable, highly customizable, comprehensive features, good for businesses of all sizes.

Cons: The interface can be a bit overwhelming for new users, the learning curve may be slightly steeper.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its simplicity and ease of use. It’s an excellent choice for small accounting firms that prioritize sales and lead management.

Key Features:

- Sales Pipeline Management: Visualize your sales process and track deals.

- Contact Management: Store and manage client information.

- Deal Tracking: Track the progress of deals through the pipeline.

- Email Integration: Integrate with your email provider.

- Reporting: Track sales performance and key metrics.

- Integrations: Integrates with various apps, including accounting software.

- User-Friendly Interface: Simple and intuitive interface.

Pricing: Pipedrive offers several pricing plans, based on the number of users and features.

Pros: User-friendly, great for sales teams, intuitive interface.

Cons: Less feature-rich than some other options, might not be suitable for firms with complex needs, can be expensive for larger teams.

4. Salesforce Sales Cloud

Salesforce is a market leader in the CRM space, offering a highly customizable and feature-rich platform. It’s a great option for businesses that need a scalable solution and are willing to invest in training and implementation.

Key Features:

- Contact Management: Comprehensive contact management features.

- Sales Automation: Powerful sales automation capabilities.

- Lead Management: Advanced lead management features.

- Reporting and Analytics: In-depth reporting and analytics.

- Customization: Highly customizable to fit your specific needs.

- Integrations: Integrates with a vast array of apps.

- Scalability: Designed for businesses of all sizes.

Pricing: Salesforce offers a variety of pricing plans, which can be expensive for small businesses. It’s a more complex and robust solution.

Pros: Feature-rich, highly customizable, scalable, market leader.

Cons: Expensive, complex to implement and manage, requires training.

5. Insightly

Insightly is a CRM that aims to be simple and easy to use. It’s suitable for accounting firms looking for a CRM that is easy to set up and use.

Key Features:

- Contact Management: Manage client contacts effectively.

- Project Management: Includes project management features.

- Lead Management: Basic lead management capabilities.

- Reporting: Basic reporting features.

- Integrations: Integrates with popular apps.

- User-Friendly Interface: Easy to use.

Pricing: Reasonably priced, with different plans based on features and users.

Pros: Easy to use, includes project management features, affordable.

Cons: Fewer advanced features compared to other options, basic reporting.

Choosing the Right CRM: A Step-by-Step Guide

Choosing the right CRM is a critical decision. It’s not a one-size-fits-all solution. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs:

- What are your current pain points?

- What are your goals for implementing a CRM?

- What features are essential for your business?

- How many users will need access to the CRM?

- What is your budget?

- Research CRM Options:

- Explore the CRM systems mentioned above and other options.

- Read reviews and compare features.

- Consider the integrations offered by each CRM.

- Create a Shortlist:

- Narrow down your options to 2-3 CRM systems that best fit your needs.

- Request Demos and Free Trials:

- Request demos from the vendors on your shortlist.

- Sign up for free trials to test the CRM systems.

- Evaluate the User Experience:

- Is the interface user-friendly and intuitive?

- Is it easy to navigate and find the information you need?

- Assess Integration Capabilities:

- Does the CRM integrate with your existing accounting software and other essential tools?

- Consider Pricing and Support:

- What is the pricing structure?

- What support options are available?

- Are there any hidden costs?

- Make a Decision and Implement:

- Choose the CRM that best meets your needs and budget.

- Develop a plan for implementation, including data migration and user training.

- Provide training to your team and ensure they understand how to use the CRM.

By following these steps, you can select the perfect CRM for your small accounting firm.

Maximizing Your CRM Investment: Best Practices

Implementing a CRM is just the first step. To truly reap the benefits, you need to adopt best practices and ensure that your team is using the system effectively. Here are some tips:

- Data Migration: Carefully migrate your existing client data into the CRM. Ensure that the data is accurate and up-to-date. Clean up the data to avoid redundancies.

- Data Entry: Establish a consistent data entry process. Encourage your team to enter all client information into the CRM.

- Training: Provide thorough training to your team on how to use the CRM. Offer ongoing training and support.

- Customization: Customize the CRM to fit your specific needs and workflows.

- Automation: Leverage automation features to streamline your processes and save time.

- Regular Review: Regularly review your CRM usage and make adjustments as needed.

- Integrations: Fully utilize the integrations with your accounting software and other tools.

- Reporting and Analysis: Regularly analyze your CRM data to gain insights into your business performance.

- Security: Implement security best practices to protect your client’s sensitive data.

- Adaptability: Stay informed about new features and updates. Be prepared to adapt your processes as the CRM evolves.

By following these best practices, you can maximize your return on investment and transform your accounting practice.

The Benefits of Using a CRM in Your Accounting Firm: A Recap

Let’s recap the key benefits of implementing a CRM for your small accounting firm:

- Improved Client Relationships: Build stronger relationships with your clients by providing personalized service and staying connected.

- Increased Efficiency: Automate repetitive tasks and streamline your workflows, freeing up your time to focus on more important activities.

- Enhanced Communication: Improve communication with your clients and ensure that nothing falls through the cracks.

- Better Lead Management: Capture, nurture, and convert leads into paying customers.

- Data-Driven Decision Making: Make informed decisions based on data and insights from your CRM.

- Improved Collaboration: Facilitate collaboration among your team members.

- Increased Revenue: Boost your bottom line by improving client satisfaction and increasing efficiency.

- Reduced Costs: Save money by automating tasks and reducing errors.

In today’s competitive accounting landscape, a CRM is no longer a luxury; it’s a necessity. By choosing the right CRM and implementing it effectively, you can significantly improve your firm’s efficiency, client satisfaction, and profitability.

Conclusion: Embrace the Power of CRM

Choosing the right CRM system is an investment in the future of your small accounting firm. It’s about more than just software; it’s about transforming the way you manage your clients, streamline your operations, and grow your business. By understanding the features, comparing the options, and following best practices, you can select a CRM that empowers you to achieve your goals. Don’t let another day go by without exploring the potential of a CRM. Take the first step today and embrace the power of customer relationship management to propel your accounting firm to new heights. The right CRM will not only improve your practice, but it will also give you the edge in a competitive market.