The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Satisfaction

The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Satisfaction

As a small accountant, you wear many hats. You’re not just crunching numbers; you’re building relationships, managing client expectations, and navigating the ever-changing landscape of financial regulations. In this fast-paced environment, efficiency is paramount. That’s where a Customer Relationship Management (CRM) system comes in. But not just any CRM will do. You need a solution tailored to the specific needs of your profession. This comprehensive guide will explore the best CRM options for small accountants, helping you streamline your operations, enhance client communication, and ultimately, grow your business.

Why Small Accountants Need a CRM

Before diving into specific CRM solutions, let’s understand why a CRM is essential for small accounting firms. Traditional methods of managing client information – spreadsheets, email chains, and scattered notes – are prone to errors, inefficiencies, and missed opportunities. A CRM centralizes all client data, providing a 360-degree view of each relationship. Here are some key benefits:

- Improved Client Communication: Track all interactions, from emails and phone calls to meetings and invoices. This ensures consistent and personalized communication.

- Enhanced Organization: Organize client data, documents, and deadlines in one centralized location, reducing the risk of errors and missed deadlines.

- Increased Efficiency: Automate repetitive tasks, such as sending invoices, scheduling appointments, and following up with leads, freeing up your time to focus on more strategic activities.

- Better Lead Management: Track potential clients, nurture leads, and convert them into paying customers.

- Data-Driven Decision Making: Gain insights into client behavior, identify trends, and make informed decisions about your business.

- Enhanced Collaboration: Share client information and collaborate with team members seamlessly.

- Improved Client Satisfaction: Provide a better client experience through personalized communication, timely responses, and proactive service.

Key Features to Look for in a CRM for Accountants

Choosing the right CRM is crucial. Here are the essential features to consider when evaluating different options:

1. Contact Management

At the heart of any good CRM is robust contact management. This includes the ability to store and organize client information, such as contact details, financial data, tax returns, and communication history. The CRM should allow you to easily search, filter, and segment your contacts based on various criteria.

2. Task and Calendar Management

Accountants juggle numerous deadlines and responsibilities. A CRM with integrated task and calendar management helps you stay organized and on track. Features to look for include task assignment, deadline reminders, and calendar synchronization with other tools.

3. Document Management

Accountants deal with a lot of documents. A CRM with document management capabilities allows you to securely store, organize, and share client documents. This can include tax returns, financial statements, contracts, and other important files. Look for features like version control and secure sharing options.

4. Email Integration

Seamless email integration is essential for efficient communication. The CRM should integrate with your email provider, allowing you to send and receive emails directly from the CRM, track email interactions, and automatically log emails to client records.

5. Automation

Automation can save you a significant amount of time and effort. Look for CRM features that automate repetitive tasks, such as sending invoices, scheduling appointments, and following up with clients. This can free up your time to focus on more strategic activities.

6. Reporting and Analytics

Data is your friend. A good CRM provides reporting and analytics capabilities, allowing you to track key performance indicators (KPIs), identify trends, and make data-driven decisions. Look for features like customizable dashboards, report generation, and data visualization.

7. Integrations

The CRM should integrate with other tools you use, such as accounting software, email marketing platforms, and project management tools. This will streamline your workflow and eliminate the need to manually transfer data between different systems.

8. Security

Data security is of utmost importance. Choose a CRM that offers robust security features, such as data encryption, access controls, and regular backups. Ensure the CRM complies with relevant data privacy regulations.

9. Mobile Accessibility

In today’s mobile world, you need access to your client data on the go. Choose a CRM with a mobile app or a responsive design that allows you to access your data from your smartphone or tablet.

10. User-Friendliness and Support

The CRM should be easy to use and navigate. Look for a user-friendly interface, clear instructions, and helpful support resources. Consider the level of customer support offered by the vendor, including documentation, tutorials, and customer service.

Top CRM Systems for Small Accountants

Now, let’s explore some of the best CRM options specifically tailored for small accounting firms:

1. HubSpot CRM

Overview: HubSpot CRM is a popular and versatile CRM platform that offers a free version with a wide range of features. It’s known for its user-friendliness, extensive integrations, and powerful marketing tools.

Key Features for Accountants:

- Free CRM with unlimited users.

- Contact management and segmentation.

- Email marketing and automation.

- Sales pipeline management.

- Integration with popular accounting software (e.g., Xero, QuickBooks).

- Reporting and analytics.

Pros: Free plan, user-friendly interface, robust features, strong integrations, excellent for marketing automation.

Cons: Limited features in the free plan, some advanced features require paid upgrades.

2. Zoho CRM

Overview: Zoho CRM is a feature-rich CRM platform that offers a free plan and affordable paid plans. It’s known for its customization options and strong sales automation capabilities.

Key Features for Accountants:

- Contact management and lead tracking.

- Sales pipeline management and automation.

- Workflow automation.

- Email integration.

- Reporting and analytics.

- Integration with Zoho Books (accounting software).

Pros: Affordable pricing, extensive customization options, strong sales automation, good integrations.

Cons: The interface can be overwhelming for some users, the free plan has limitations.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that’s designed to help businesses manage their sales pipeline and close deals. It’s known for its intuitive interface and focus on sales activities.

Key Features for Accountants:

- Visual sales pipeline management.

- Contact management and lead tracking.

- Email integration and automation.

- Activity tracking and scheduling.

- Reporting and analytics.

- Integrations with other tools.

Pros: User-friendly interface, excellent for sales pipeline management, strong sales focus.

Cons: Less focus on marketing automation compared to other CRMs, may not be ideal if your primary goal is marketing.

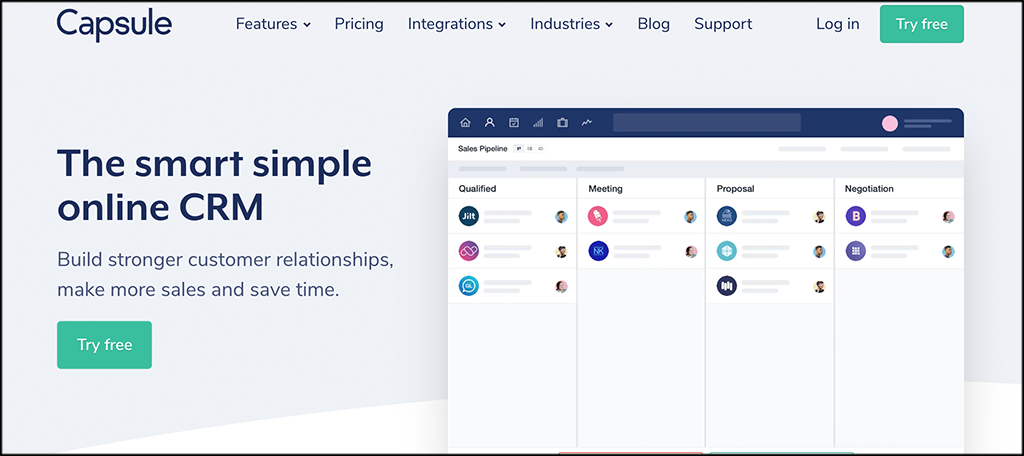

4. Capsule CRM

Overview: Capsule CRM is a simple and user-friendly CRM that’s designed for small businesses. It’s known for its ease of use and affordability.

Key Features for Accountants:

- Contact management and organization.

- Task and calendar management.

- Email integration.

- Sales pipeline management.

- Reporting and analytics.

- Integration with other tools.

Pros: Easy to use, affordable pricing, good for small teams.

Cons: Fewer features compared to other CRMs, limited customization options.

5. Insightly

Overview: Insightly is a CRM platform that’s designed to help businesses manage their sales, marketing, and project management activities. It offers a range of features for small businesses.

Key Features for Accountants:

- Contact management and lead tracking.

- Sales pipeline management and automation.

- Project management features.

- Email integration.

- Reporting and analytics.

- Integration with other tools.

Pros: Strong project management features, good for businesses that need to manage projects, user-friendly interface.

Cons: Pricing can be higher than other CRMs, some features are only available in higher-tier plans.

6. Freshsales

Overview: Freshsales is a sales-focused CRM designed to help businesses streamline their sales processes. It is a product of Freshworks, a company known for its customer service and sales software. It offers a variety of features for managing leads, deals, and customer interactions.

Key Features for Accountants:

- Contact Management: Organize and manage client information, including contact details, communication history, and other relevant data.

- Lead Management: Track leads, qualify them, and move them through the sales pipeline.

- Sales Automation: Automate tasks such as sending emails, scheduling follow-ups, and creating tasks.

- Email Integration: Integrate with your email provider to send and receive emails directly from the CRM.

- Reporting and Analytics: Track key sales metrics and generate reports to gain insights into your sales performance.

- Customization: Customize the CRM to fit your specific business needs.

Pros: User-friendly interface, strong sales automation features, good value for the price.

Cons: Limited features in the free plan, may not be ideal for businesses that need extensive marketing automation.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision. Here’s a step-by-step guide to help you make the right choice:

1. Assess Your Needs

Before you start evaluating different CRM options, take the time to assess your specific needs. Consider the following questions:

- What are your current pain points? What tasks are time-consuming or inefficient?

- What are your goals? What do you hope to achieve with a CRM? (e.g., increase sales, improve client satisfaction, streamline operations)

- What features do you need? Make a list of essential features based on your needs.

- How many users will need access to the CRM? This will impact your pricing options.

- What integrations do you need? Consider the tools you already use and ensure the CRM integrates with them.

2. Research and Compare Options

Once you have a clear understanding of your needs, research different CRM options. Read reviews, compare features, and check pricing. Consider the following factors:

- Ease of use: Choose a CRM that’s easy to use and navigate.

- Features: Ensure the CRM offers the features you need.

- Integrations: Check if the CRM integrates with your existing tools.

- Pricing: Consider the pricing plans and choose the one that fits your budget.

- Customer support: Check the level of customer support offered by the vendor.

3. Sign Up for Free Trials and Demos

Most CRM vendors offer free trials or demos. Take advantage of these opportunities to test out different CRM options and see which one best fits your needs. This will allow you to experience the interface, test the features, and evaluate the overall user experience.

4. Consider the Implementation Process

Implementing a new CRM can be a significant undertaking. Consider the implementation process and how much time and effort it will require. Some CRM vendors offer implementation assistance, while others require you to handle the implementation yourself.

5. Train Your Team

Once you’ve chosen a CRM, train your team on how to use it. Provide clear instructions, documentation, and training materials. Ensure your team understands how to use the CRM to its full potential.

6. Ongoing Evaluation and Optimization

After implementing the CRM, continuously evaluate its performance and make adjustments as needed. Monitor your KPIs, track your progress, and identify areas for improvement. Regularly update your CRM to ensure you are utilizing the latest features and functionalities.

Tips for Successful CRM Implementation

Implementing a CRM is a significant step towards streamlining your accounting firm’s operations. To ensure a successful implementation, consider these tips:

- Define clear goals: Before implementing the CRM, define clear goals and objectives. What do you hope to achieve with the CRM?

- Involve your team: Involve your team in the selection and implementation process. Get their input and feedback to ensure they are on board.

- Clean up your data: Before migrating your data to the CRM, clean up your existing data. Remove any duplicates, correct errors, and ensure your data is accurate and up-to-date.

- Customize the CRM: Customize the CRM to fit your specific needs. Configure the features and functionalities to align with your workflows and processes.

- Provide training: Provide comprehensive training to your team. Ensure they understand how to use the CRM and its features.

- Start small: Don’t try to implement everything at once. Start with a few key features and gradually add more features over time.

- Monitor and evaluate: Monitor the performance of the CRM and evaluate its effectiveness. Make adjustments as needed to optimize its performance.

- Seek support: Don’t hesitate to seek support from the CRM vendor or a consultant if you need help.

The Future of CRM for Accountants

The CRM landscape is constantly evolving, and the future of CRM for accountants is bright. Here are some trends to watch:

- Artificial Intelligence (AI): AI-powered CRM systems will become more prevalent, offering features like automated data entry, predictive analytics, and personalized recommendations.

- Integration with Blockchain Technology: Blockchain technology could enhance data security and transparency, allowing accountants to securely share client data.

- Increased Mobile Accessibility: CRM systems will continue to become more mobile-friendly, allowing accountants to access client data and manage their business on the go.

- Focus on Data Privacy: CRM vendors will prioritize data privacy and security, ensuring compliance with data privacy regulations.

- Integration with Advanced Technologies: CRM systems will increasingly integrate with other technologies, such as cloud computing and the Internet of Things (IoT).

Conclusion

Choosing the right CRM is a critical decision for small accountants. By carefully evaluating your needs, researching different options, and following the tips outlined in this guide, you can select a CRM that streamlines your operations, enhances client communication, and helps you grow your business. Remember to prioritize features that streamline your workflow, improve client relationships, and ultimately, help you achieve your business goals. The right CRM is an investment that will pay dividends in the long run, helping you to become a more efficient, organized, and successful accounting professional.