The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Satisfaction

The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Satisfaction

Running a small accounting firm is a juggling act. You’re managing client relationships, tracking projects, sending invoices, and staying on top of deadlines, all while navigating the ever-changing landscape of tax regulations. In the midst of this whirlwind, it’s easy for crucial details to slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes in. But not just any CRM – you need the best CRM for small accountants, one that’s tailored to your specific needs and budget.

This comprehensive guide will walk you through everything you need to know about choosing and implementing the perfect CRM for your accounting practice. We’ll delve into the benefits, explore the key features to look for, and review some of the top contenders on the market. By the end of this article, you’ll be equipped with the knowledge to select a CRM that streamlines your operations, enhances client relationships, and ultimately, boosts your bottom line.

Why a CRM is Essential for Small Accounting Firms

You might be thinking, “I’m a small business; do I really need a CRM?” The answer is a resounding yes! While it might seem like an unnecessary expense, a CRM is an investment that can pay dividends in the long run. Here’s why:

- Improved Client Relationships: A CRM centralizes all your client information, including contact details, communication history, and project notes. This allows you to provide more personalized service and build stronger relationships.

- Increased Efficiency: Automation is key. A CRM can automate tasks like appointment scheduling, email marketing, and invoice reminders, freeing up your time to focus on more strategic activities.

- Better Organization: Say goodbye to scattered spreadsheets and overflowing inboxes. A CRM keeps all your client data in one place, making it easy to find what you need, when you need it.

- Enhanced Collaboration: If you have a team, a CRM facilitates seamless collaboration. Everyone has access to the same information, ensuring everyone is on the same page.

- Data-Driven Decision Making: A CRM provides valuable insights into your client base, allowing you to identify trends, measure performance, and make informed decisions about your business.

- Lead Management: Track potential clients, nurture leads, and convert them into paying customers with ease.

In short, a CRM isn’t just a nice-to-have; it’s a necessity for any small accounting firm that wants to thrive in today’s competitive market.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting practice, it’s crucial to select one that offers the specific features you need. Here are some essential features to consider:

1. Contact Management

This is the foundation of any CRM. The system should allow you to store and manage all your client contact information, including:

- Contact Details (name, address, phone number, email)

- Company Information

- Client Type (e.g., individual, small business, corporation)

- Notes and Tags (to categorize clients and add specific details)

The CRM should also allow you to easily search and filter your contacts to find the information you need quickly.

2. Client Communication Tracking

Keep a detailed record of all your communications with clients, including emails, phone calls, and meetings. This feature is essential for:

- Providing a clear audit trail of all interactions.

- Ensuring everyone on your team has access to the same information.

- Personalizing your communications and building stronger relationships.

Look for a CRM that integrates with your email provider and allows you to log calls and meetings directly within the system.

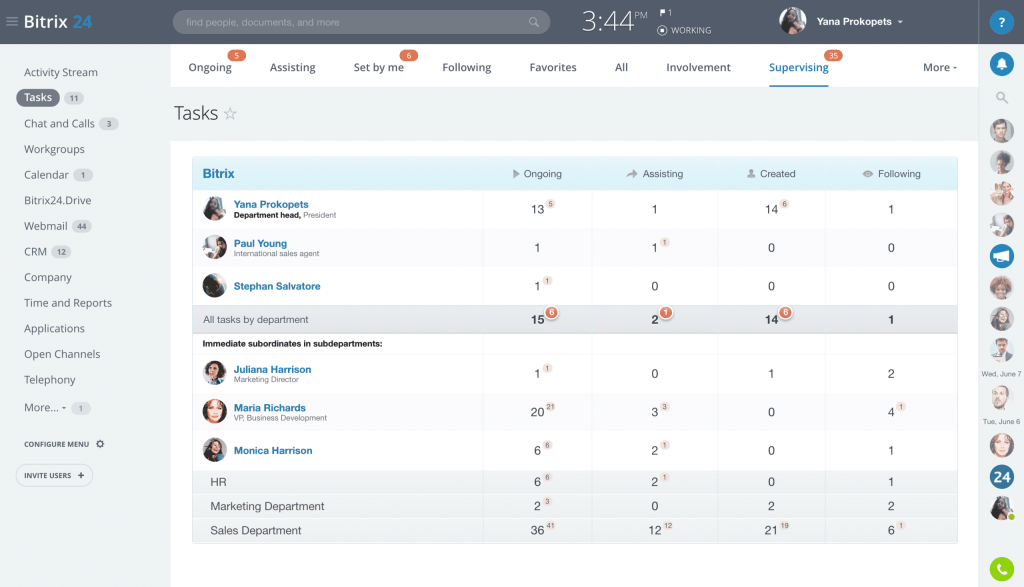

3. Task and Project Management

Accounting firms often juggle multiple projects simultaneously. A good CRM should include task and project management features to help you stay organized and on schedule. This includes:

- Creating and assigning tasks.

- Setting deadlines and reminders.

- Tracking project progress.

- Collaborating with team members on projects.

This feature is particularly useful for managing tax returns, audits, and other accounting projects.

4. Reporting and Analytics

Data is your friend. A CRM should provide robust reporting and analytics capabilities to help you track key performance indicators (KPIs), such as:

- Client acquisition costs.

- Client retention rates.

- Project profitability.

- Revenue per client.

These insights will help you identify areas for improvement and make data-driven decisions to grow your business.

5. Integration with Accounting Software

This is a critical feature for any accounting firm. Your CRM should integrate seamlessly with your existing accounting software, such as QuickBooks, Xero, or Sage. This integration will allow you to:

- Automatically sync client data between your CRM and accounting software.

- Generate invoices and track payments.

- Gain a holistic view of your clients’ financial information.

This integration will save you time and reduce the risk of errors.

6. Automation Capabilities

Automation is your secret weapon for increasing efficiency. Look for a CRM that offers automation features, such as:

- Automated email marketing campaigns.

- Automated appointment scheduling.

- Automated task reminders.

Automation will free up your time to focus on more strategic activities.

7. Mobile Accessibility

In today’s mobile world, it’s essential to have access to your CRM on the go. Look for a CRM that offers a mobile app or a responsive web design that works well on mobile devices. This will allow you to access client information, track projects, and communicate with clients from anywhere.

8. Security and Compliance

Data security is paramount, especially when dealing with sensitive financial information. Ensure the CRM you choose has robust security measures in place, including:

- Data encryption.

- Regular security audits.

- Compliance with relevant regulations, such as GDPR and CCPA.

Choose a CRM that prioritizes the security of your client data.

Top CRM Systems for Small Accountants: A Detailed Review

Now that you know what to look for, let’s explore some of the top CRM systems specifically designed for small accountants. We’ll examine their features, pricing, and ease of use to help you find the perfect fit for your firm.

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms. It offers a generous free plan that includes contact management, deal tracking, task management, and email marketing tools. The paid plans offer more advanced features, such as marketing automation, reporting, and customer service tools.

Key Features:

- Free plan with core CRM features.

- Robust contact management.

- Email tracking and automation.

- Deal tracking and pipeline management.

- Integration with popular accounting software (via third-party integrations).

- Excellent reporting and analytics.

- User-friendly interface.

Pricing:

- Free plan available.

- Paid plans start at $45 per month.

Pros:

- Free plan is generous and offers a lot of value.

- User-friendly interface makes it easy to get started.

- Excellent reporting and analytics.

- Wide range of integrations.

Cons:

- The free plan has limitations on the number of contacts and emails.

- Some advanced features are only available on the paid plans.

- Integration with accounting software might require third-party tools.

Ideal for: Small accounting firms looking for a free or affordable CRM with a wide range of features and excellent reporting capabilities.

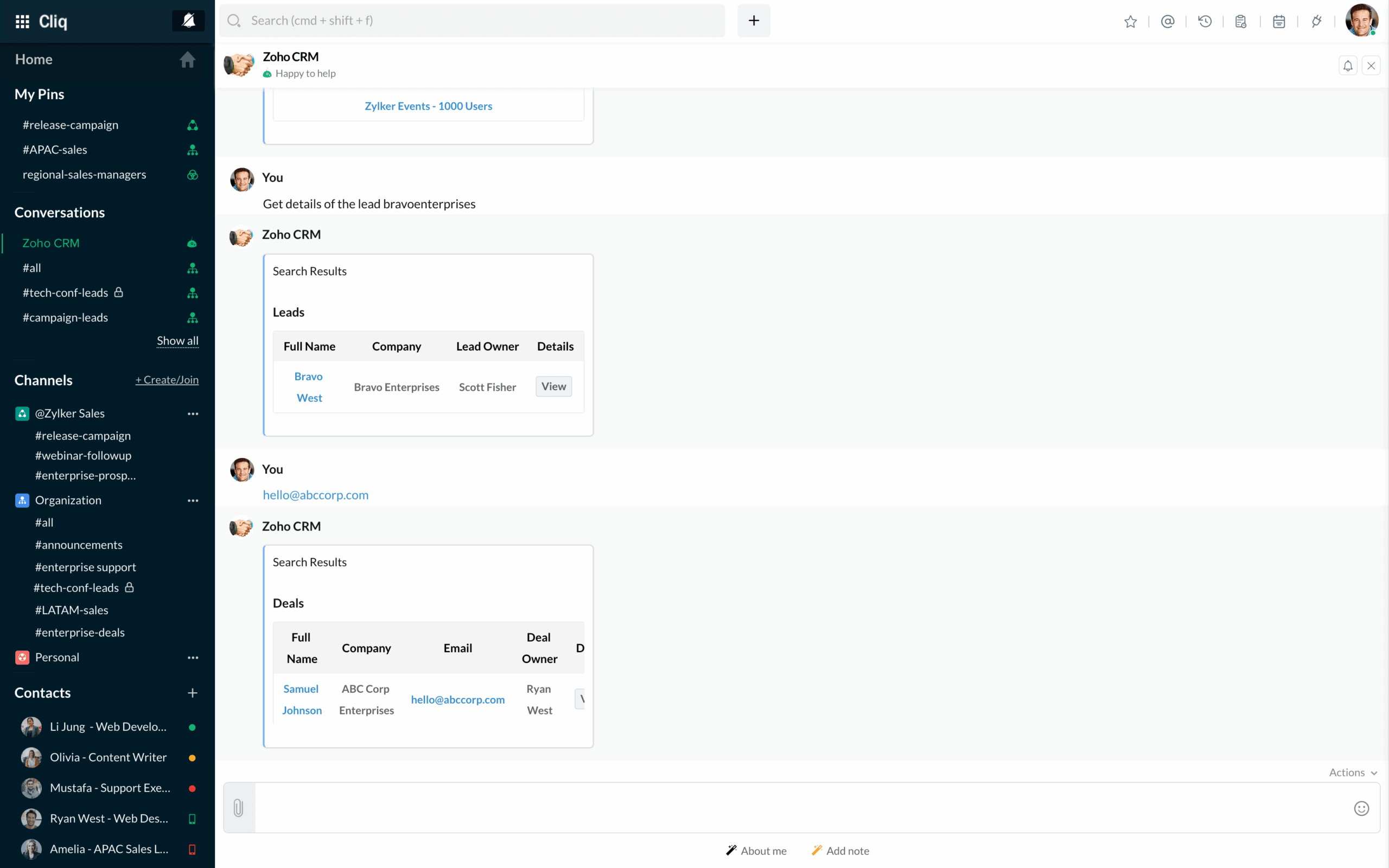

2. Zoho CRM

Zoho CRM is another strong contender, known for its affordability and customization options. It offers a comprehensive suite of features, including contact management, sales automation, marketing automation, and customer support tools. Zoho CRM integrates with a wide range of third-party apps, including accounting software like QuickBooks and Xero.

Key Features:

- Affordable pricing plans.

- Highly customizable.

- Sales automation tools.

- Marketing automation capabilities.

- Customer support features.

- Integration with popular accounting software.

- Mobile apps for iOS and Android.

Pricing:

- Free plan available for up to 3 users.

- Paid plans start at $14 per user per month.

Pros:

- Affordable pricing.

- Highly customizable to fit your specific needs.

- Wide range of features.

- Good integration capabilities.

Cons:

- The interface can be a bit overwhelming for beginners.

- The free plan has limited features.

Ideal for: Small accounting firms looking for an affordable, customizable CRM with a comprehensive feature set.

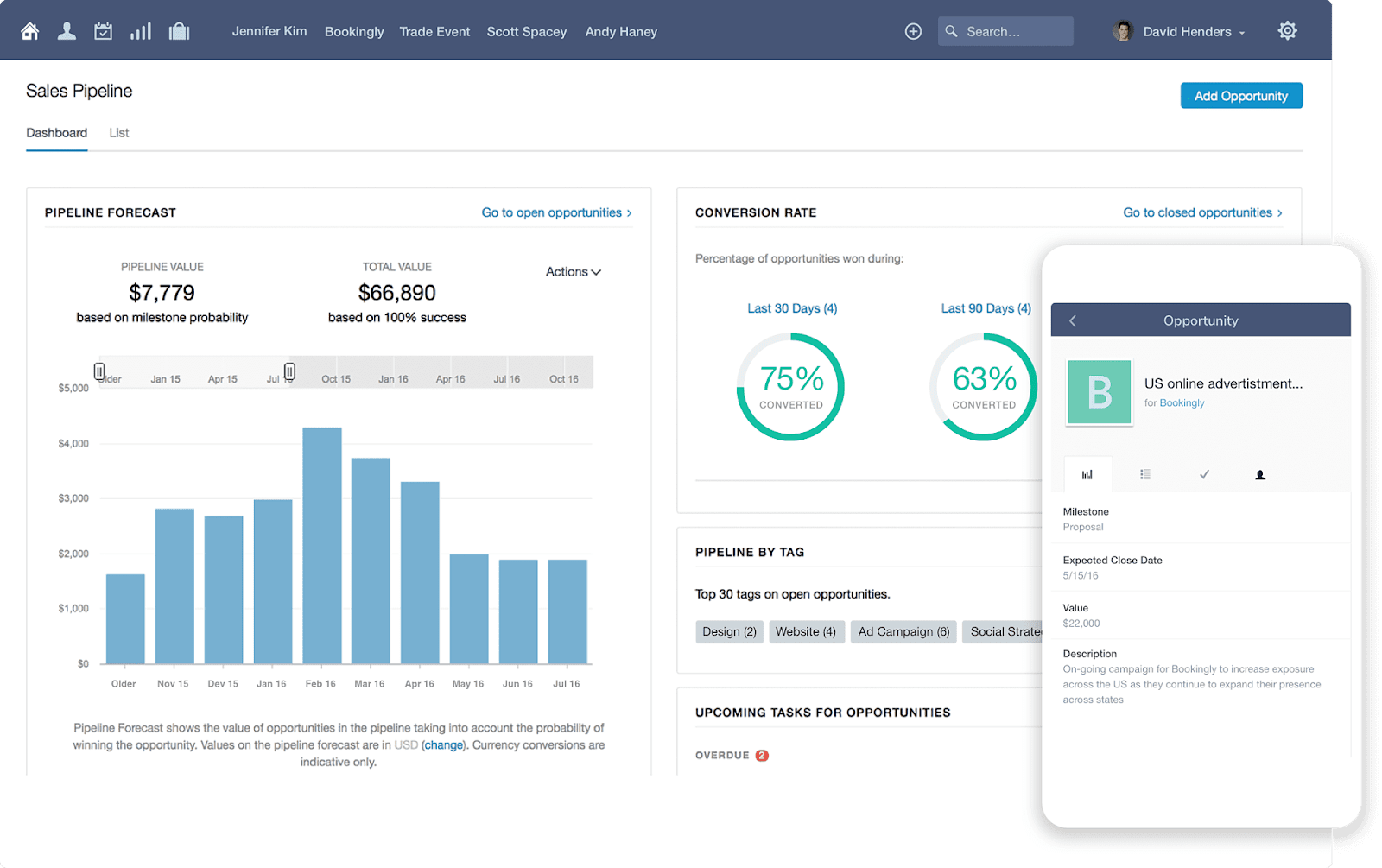

3. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its simplicity and ease of use. It’s a great option for small accounting firms that want a CRM that’s focused on lead management and sales pipeline management. Pipedrive offers a clean and intuitive interface, making it easy to track leads, manage deals, and automate sales tasks.

Key Features:

- User-friendly interface.

- Sales pipeline management tools.

- Lead management features.

- Email integration and tracking.

- Automation capabilities.

- Mobile apps for iOS and Android.

- Integration with some accounting software (via third-party integrations).

Pricing:

- Paid plans start at $14.90 per user per month.

Pros:

- Easy to use and navigate.

- Focuses on sales and lead management.

- Automation features streamline tasks.

- Clean and intuitive interface.

Cons:

- May not have all the features of more comprehensive CRMs.

- Limited reporting capabilities compared to some competitors.

- Integration with accounting software might require third-party tools.

Ideal for: Small accounting firms that want a simple, sales-focused CRM to manage leads and track deals.

4. Insightly

Insightly is a powerful CRM that’s known for its project management capabilities. It’s a good option for small accounting firms that need a CRM to manage projects, track client communications, and automate tasks. Insightly offers a user-friendly interface and a wide range of features, including contact management, lead management, sales automation, and project management tools.

Key Features:

- Project management capabilities.

- Contact management.

- Lead management.

- Sales automation.

- Reporting and analytics.

- Integration with popular apps.

- Good for managing projects.

Pricing:

- Free plan available for up to 2 users.

- Paid plans start at $29 per user per month.

Pros:

- Strong project management features.

- User-friendly interface.

- Good for managing client projects.

- Integration with popular apps.

Cons:

- The free plan has limited features.

- Some advanced features are only available on the paid plans.

Ideal for: Small accounting firms that need a CRM with strong project management capabilities.

5. Freshsales (Freshworks CRM)

Freshsales, now part of the Freshworks CRM suite, is another strong contender, particularly for its focus on sales and customer engagement. It offers a user-friendly interface and a range of features designed to help accounting firms manage leads, close deals, and nurture client relationships.

Key Features:

- Built-in phone and email.

- Lead scoring.

- Workflow automation.

- Detailed sales reports.

- Integration with other Freshworks products (e.g., Freshdesk for support).

- Mobile apps.

Pricing:

- Free plan available.

- Paid plans start at $15 per user per month.

Pros:

- User-friendly interface.

- Built-in phone and email features.

- Strong sales focus.

- Good value for money.

Cons:

- May not have as many features as some of the more comprehensive CRMs.

- Integration with accounting software might require third-party tools.

Ideal for: Small accounting firms looking for a sales-focused CRM with built-in communication tools.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a significant decision. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Before you start comparing CRM systems, take the time to identify your firm’s specific needs and requirements. What are your pain points? What tasks do you want to automate? What features are essential?

- Define Your Budget: Determine how much you’re willing to spend on a CRM. Consider the monthly or annual subscription costs, as well as any implementation or training fees.

- Research Your Options: Explore the different CRM systems available and compare their features, pricing, and reviews. Consider the top contenders mentioned above, and see if they fit your needs.

- Read Reviews and Case Studies: See what other accounting firms are saying about the different CRM systems. Read online reviews and case studies to get a better understanding of each system’s strengths and weaknesses.

- Request Demos and Free Trials: Most CRM vendors offer demos and free trials. Take advantage of these opportunities to test out the software and see if it’s a good fit for your firm.

- Consider Integration: Ensure the CRM integrates with your existing accounting software and other tools. This is crucial for streamlining your workflow and avoiding data silos.

- Think About Scalability: Choose a CRM that can grow with your business. As your firm expands, you’ll want a CRM that can accommodate your increasing needs.

- Prioritize User Experience: Choose a CRM with a user-friendly interface that your team will enjoy using. A clunky or complicated CRM will be a waste of time and money.

- Plan for Implementation and Training: Implement the CRM and make sure your team is properly trained on how to use it.

- Provide Ongoing Support: The CRM vendor should offer ongoing support and resources to help you resolve any issues and get the most out of the system.

Implementing Your New CRM: A Smooth Transition

Once you’ve chosen your CRM, the next step is implementation. Here’s a checklist to ensure a smooth transition:

- Plan Your Implementation: Create a detailed implementation plan that outlines the steps you need to take to set up your CRM. This should include data migration, user training, and system customization.

- Clean and Organize Your Data: Before importing your data into the CRM, make sure it’s clean and organized. This will ensure your data is accurate and easy to use.

- Import Your Data: Import your existing client data, including contact information, communication history, and project details.

- Customize Your CRM: Configure the CRM to meet your specific needs. This includes setting up custom fields, creating workflows, and integrating with other apps.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM. Make sure everyone understands how to use the system and its key features.

- Test Your System: Before going live, test your system to make sure everything is working correctly. This includes testing data imports, workflows, and integrations.

- Go Live: Once you’re confident that your system is working correctly, go live.

- Monitor and Evaluate: Monitor your CRM usage and make adjustments as needed. Evaluate the system’s performance and identify areas for improvement.

Maximizing Your CRM Investment: Tips for Success

Once your CRM is up and running, there are several things you can do to maximize your investment and get the most out of the system:

- Use Your CRM Regularly: Encourage your team to use the CRM on a daily basis. The more they use it, the more valuable it will become.

- Keep Your Data Up-to-Date: Make sure your data is always accurate and up-to-date. Regularly review your client information and update it as needed.

- Automate Your Tasks: Take advantage of the automation features to streamline your tasks and free up your time.

- Use Reporting and Analytics: Use the reporting and analytics features to track your performance, identify trends, and make data-driven decisions.

- Provide Ongoing Training: Offer ongoing training to your team to ensure they’re using the CRM effectively.

- Seek Feedback: Ask your team for feedback on the CRM and make adjustments as needed.

- Stay Up-to-Date: Keep up with the latest updates and features of your CRM.

- Integrate with Other Tools: Integrate your CRM with other tools, such as your email marketing platform and project management software, to streamline your workflow.

Conclusion: Choosing the Best CRM for Your Accounting Firm

Choosing the best CRM for your small accounting firm is an important decision that can have a significant impact on your business. By following the steps outlined in this guide, you can choose a CRM that streamlines your operations, enhances client relationships, and ultimately, boosts your bottom line. Remember to assess your needs, research your options, and choose a CRM that fits your specific requirements and budget. With the right CRM in place, you’ll be well-equipped to take your accounting firm to the next level.

Don’t be afraid to start small, and scale up as your business grows. The key is to find a CRM that works for you and your team, and that you’ll actually use. Good luck!