The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Relationships

The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Relationships

Running a small accounting firm is no walk in the park. You’re juggling deadlines, managing client expectations, and keeping up with ever-changing tax regulations. In the midst of this chaos, it’s easy for important details to slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes in. It’s not just for big corporations; a well-chosen CRM can be a game-changer for small accounting businesses, helping you streamline operations, nurture client relationships, and ultimately, grow your practice. This comprehensive guide will delve into the best CRM options tailored specifically for small accountants, exploring their features, benefits, and how to choose the perfect fit for your firm.

Why Your Small Accounting Firm Needs a CRM

You might be thinking, “I’m a small business; do I really need a CRM?” The answer is a resounding yes. While you might be managing client information in spreadsheets or your email inbox currently, a CRM offers a level of organization and efficiency that these methods simply can’t match. Here’s why a CRM is invaluable for small accountants:

- Centralized Client Data: A CRM acts as a single source of truth for all client information. You can store contact details, communication history, financial data, and any other relevant information in one secure location. This eliminates the need to hunt through multiple files and folders, saving you valuable time.

- Improved Client Relationships: A CRM helps you build stronger relationships with your clients. By tracking interactions, understanding their needs, and personalizing your communication, you can foster loyalty and trust. This leads to increased client retention and referrals.

- Streamlined Workflow: Automate repetitive tasks like sending invoices, scheduling appointments, and following up with leads. This frees up your time to focus on higher-value activities, such as providing financial advice and growing your business.

- Enhanced Collaboration: If you have a team, a CRM allows for seamless collaboration. Everyone has access to the same client information, ensuring everyone is on the same page and can provide consistent service.

- Better Lead Management: Track potential clients, manage their journey through the sales pipeline, and convert leads into paying customers. A CRM provides valuable insights into your sales and marketing efforts, helping you optimize your strategies.

- Increased Efficiency: By automating tasks and providing easy access to information, a CRM significantly improves efficiency, allowing you to do more with less. This translates to increased profitability and a better work-life balance.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting firm, it’s essential to select one that meets your specific needs. Here are some key features to look for:

1. Contact Management

This is the core functionality of any CRM. It should allow you to store and organize client contact information, including names, addresses, phone numbers, email addresses, and other relevant details. Look for features like:

- Customizable fields to capture specific client data.

- Segmentation and tagging to categorize clients based on various criteria.

- Easy search and filtering capabilities to quickly find the information you need.

2. Communication Tracking

Keep track of all interactions with your clients, including emails, phone calls, meetings, and notes. This provides a comprehensive view of your client relationships and ensures that nothing falls through the cracks. Key features include:

- Integration with your email and phone systems.

- Ability to log and track all communication.

- Automatic email logging.

3. Workflow Automation

Automate repetitive tasks to save time and improve efficiency. Look for features that allow you to automate processes such as:

- Sending invoices and payment reminders.

- Scheduling appointments.

- Following up with leads.

- Automated email sequences.

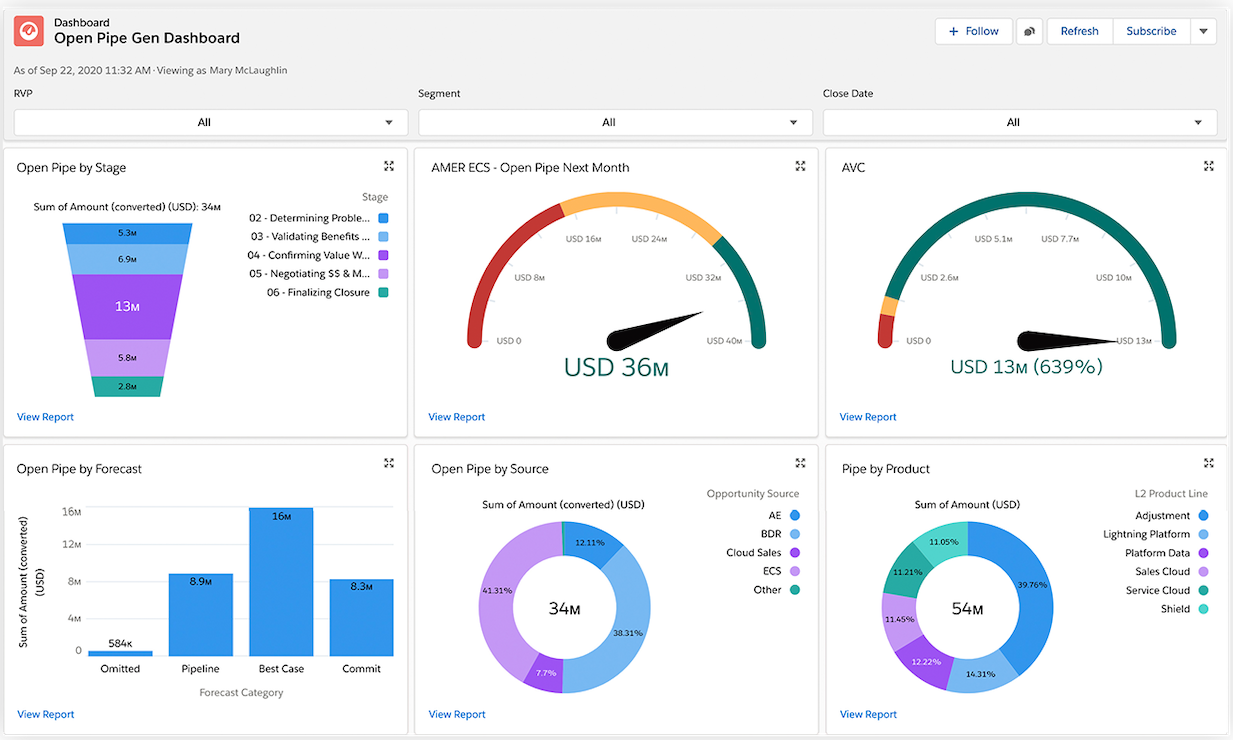

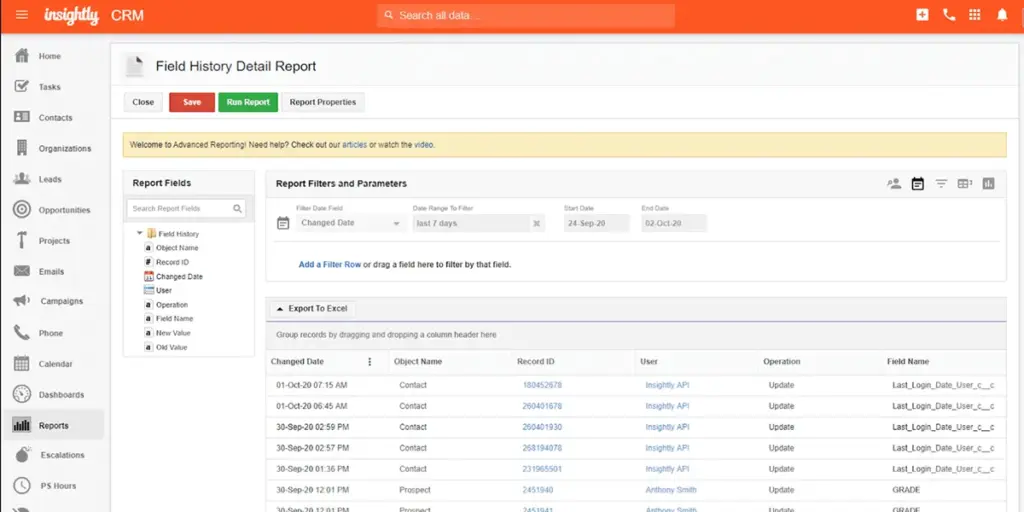

4. Reporting and Analytics

Gain valuable insights into your business performance with robust reporting and analytics features. Look for features that allow you to:

- Track key metrics, such as client retention, sales figures, and marketing ROI.

- Generate custom reports.

- Visualize data through charts and graphs.

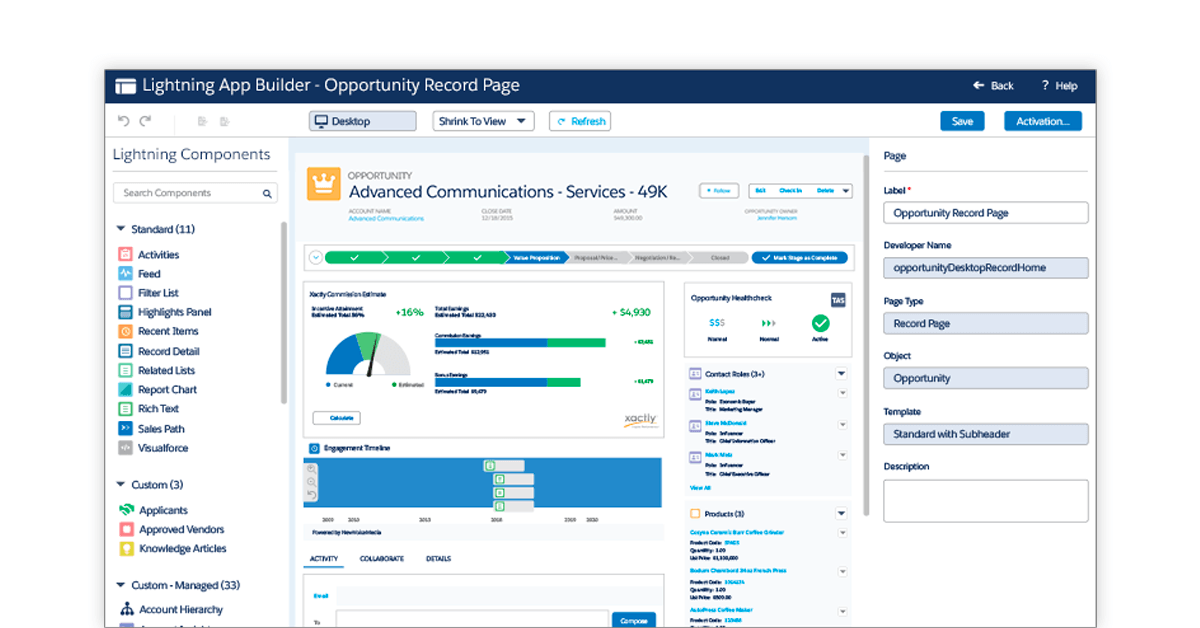

5. Integration with Accounting Software

Seamless integration with your accounting software is crucial for streamlining your workflow. Look for a CRM that integrates with popular accounting platforms like QuickBooks, Xero, and Sage. This allows you to:

- Sync client data between your CRM and accounting software.

- Access financial data directly within your CRM.

- Automate tasks such as invoice creation and payment tracking.

6. Security and Data Protection

Protecting your clients’ sensitive financial data is paramount. Ensure that the CRM you choose offers robust security features, including:

- Data encryption.

- Regular backups.

- Compliance with relevant data privacy regulations (e.g., GDPR, CCPA).

7. Mobile Accessibility

Access your client data and manage your business on the go with a mobile-friendly CRM. Look for features like:

- Mobile apps for iOS and Android devices.

- Responsive design that adapts to different screen sizes.

- Offline access to important data.

Top CRM Systems for Small Accountants

Now, let’s dive into some of the best CRM systems specifically designed for small accountants. We’ll look at their key features, pros, and cons to help you find the perfect fit for your firm.

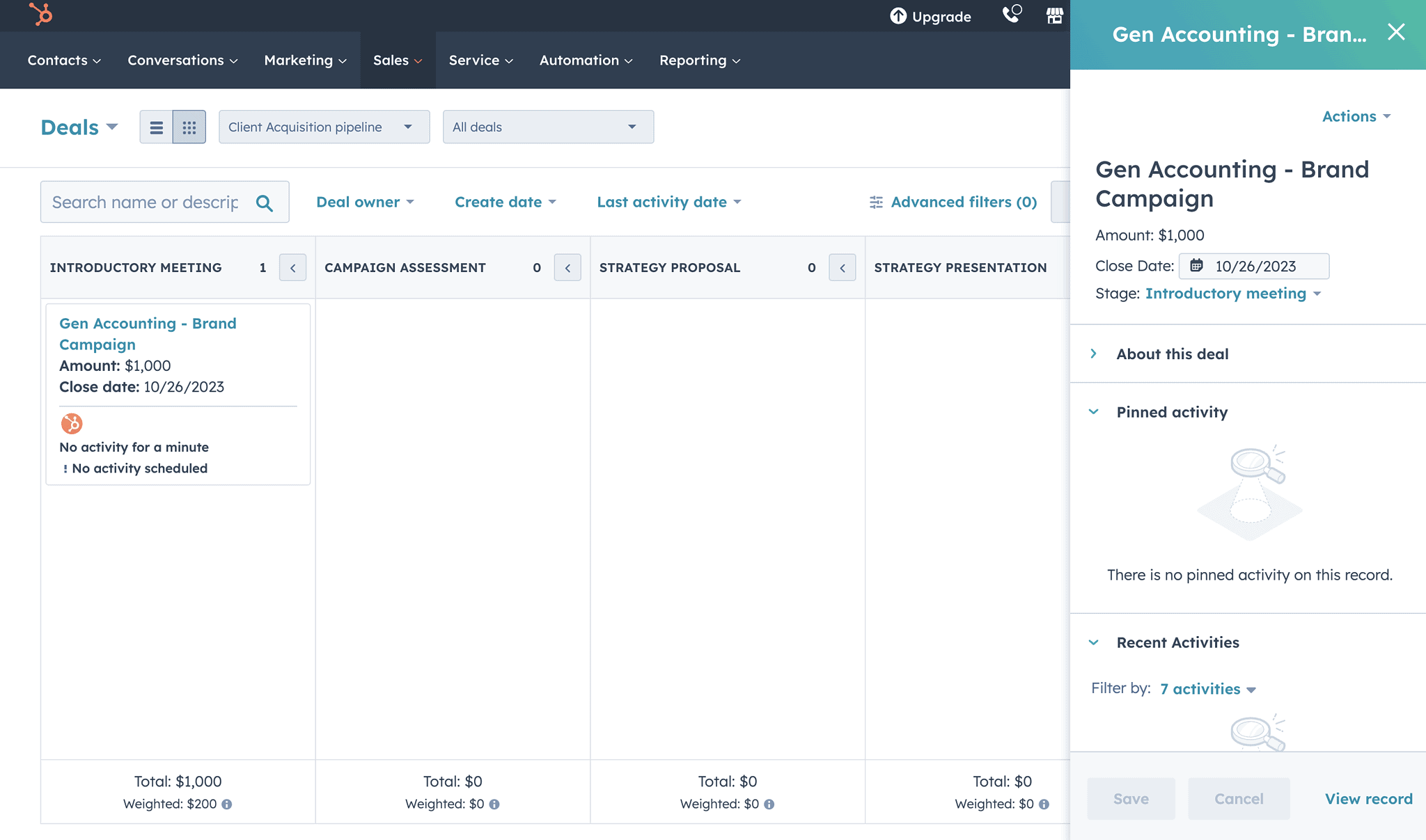

1. HubSpot CRM

Overview: HubSpot CRM is a popular and versatile CRM platform that offers a free version with a robust set of features, making it an excellent option for small businesses. It’s known for its user-friendly interface and comprehensive marketing and sales tools. While the free version is powerful, paid plans unlock more advanced features.

Key Features:

- Free CRM with unlimited users and data storage.

- Contact management, deal tracking, and task management.

- Email marketing tools.

- Sales automation features.

- Integration with popular accounting software (via third-party apps).

- Reporting and analytics.

Pros:

- Free version offers a significant amount of functionality.

- User-friendly interface.

- Excellent marketing and sales tools.

- Scalable to grow with your business.

Cons:

- Integration with accounting software may require third-party apps.

- Advanced features require paid plans.

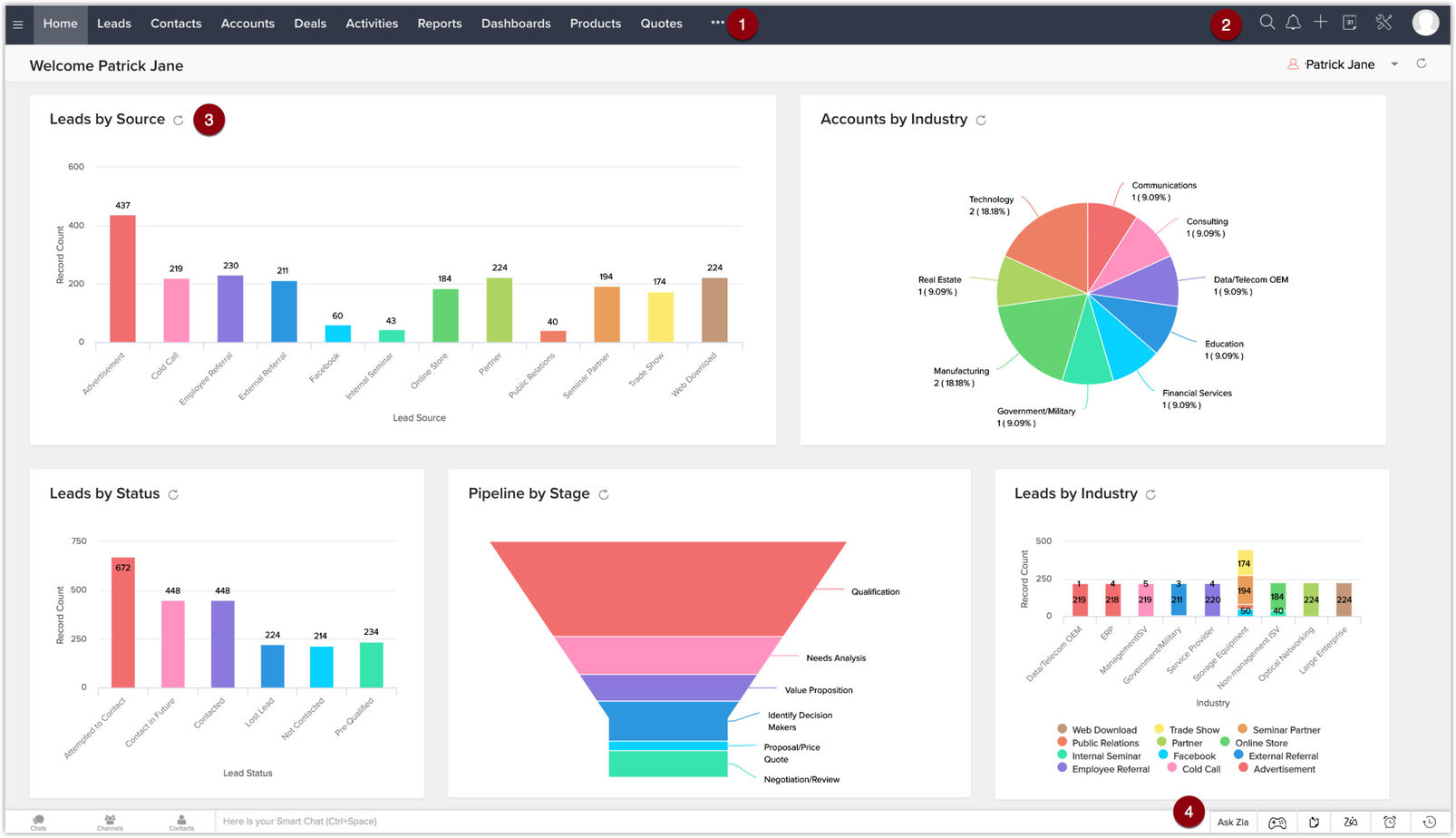

2. Zoho CRM

Overview: Zoho CRM is another strong contender, offering a comprehensive suite of features at a competitive price. It caters to businesses of all sizes and offers a wide range of customization options. Zoho CRM provides a free plan for a limited number of users and a range of paid plans with increasing functionality.

Key Features:

- Contact management, lead management, and deal tracking.

- Workflow automation and email marketing.

- Sales force automation.

- Integration with Zoho’s suite of business apps.

- Integration with accounting software (e.g., QuickBooks, Xero).

- Reporting and analytics.

Pros:

- Highly customizable.

- Competitive pricing.

- Good integration with accounting software.

- Comprehensive features.

Cons:

- Can be overwhelming for new users due to the extensive features.

- Interface may not be as intuitive as some other CRMs.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that’s particularly well-suited for small businesses. It’s designed to be intuitive and easy to use, with a focus on helping sales teams manage their pipelines and close deals. It offers a free trial and a range of paid plans.

Key Features:

- Visual sales pipeline.

- Deal tracking and lead management.

- Workflow automation.

- Email integration and tracking.

- Reporting and analytics focused on sales performance.

- Integration with accounting software (through third-party integrations).

Pros:

- User-friendly interface.

- Strong focus on sales pipeline management.

- Easy to set up and use.

Cons:

- May lack some features found in more comprehensive CRMs.

- Integration with accounting software relies on third-party apps.

4. Agile CRM

Overview: Agile CRM is a versatile CRM that offers a free plan for a limited number of users and a range of paid plans. It’s designed to be a one-stop shop for sales, marketing, and customer service. It’s known for its ease of use and affordability.

Key Features:

- Contact management and lead scoring.

- Email marketing and automation.

- Sales automation and deal tracking.

- Helpdesk and customer service features.

- Integration with various third-party apps, including accounting software.

- Reporting and analytics.

Pros:

- Affordable pricing.

- User-friendly interface.

- Comprehensive features for sales, marketing, and customer service.

Cons:

- Free plan has limited features.

- May not be as robust as some other CRMs for large businesses.

5. Freshsales

Overview: Freshsales, by Freshworks, is a CRM designed with sales teams in mind. It’s known for its intuitive interface and a focus on sales automation. It offers a free trial and several paid plans.

Key Features:

- Contact management and lead scoring.

- Sales pipeline management.

- Workflow automation.

- Email tracking and integration.

- Built-in phone and video conferencing.

- Reporting and analytics.

- Integration with accounting software through third-party integrations.

Pros:

- User-friendly interface.

- Strong sales automation features.

- Built-in phone and video conferencing.

Cons:

- May lack some features found in more comprehensive CRMs.

- Integration with accounting software relies on third-party apps.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision. It’s not just about picking the most popular option; it’s about finding the one that best aligns with your specific needs and goals. Here’s a step-by-step guide to help you make the right choice:

1. Assess Your Needs

Before you start researching CRM systems, take some time to assess your firm’s needs. Consider the following questions:

- What are your current pain points? Are you struggling with disorganized client data, inefficient communication, or a lack of visibility into your sales pipeline?

- What are your goals? Do you want to improve client relationships, streamline your workflow, or grow your business?

- What features are essential? Do you need contact management, communication tracking, workflow automation, or integration with your accounting software?

- How many users will need access to the CRM? This will impact the pricing and features you need.

- What is your budget? CRM systems range in price, so it’s important to set a budget before you start shopping.

2. Research CRM Options

Once you have a clear understanding of your needs, start researching CRM options. Read reviews, compare features, and consider the pros and cons of each system. The CRM systems listed above are a great place to start, but don’t limit yourself to just these options. Explore other possibilities and see which ones fit your firm the best.

3. Evaluate Integrations

Integration with your existing tools is critical. Make sure the CRM you choose integrates seamlessly with your accounting software, email marketing platform, and other tools you use regularly. Check for native integrations or integrations through third-party apps.

4. Consider User Experience

The user experience is crucial for adoption. Choose a CRM with a user-friendly interface that is easy to learn and navigate. Consider factors such as the ease of data entry, the clarity of the dashboards, and the availability of tutorials and support resources.

5. Prioritize Security and Data Protection

Your clients’ financial data is sensitive, so security is paramount. Ensure that the CRM you choose offers robust security features, including data encryption, regular backups, and compliance with relevant data privacy regulations. Verify that the CRM provider has a strong reputation for data security.

6. Start with a Free Trial or Demo

Most CRM providers offer free trials or demos. Take advantage of these opportunities to test the system and see how it works in practice. This will give you a better understanding of the features, the user interface, and the overall experience. This hands-on experience will help you determine if the CRM is a good fit for your firm.

7. Get Feedback from Your Team

If you have a team, involve them in the decision-making process. Ask them for their feedback on the different CRM options you are considering. Their input can be invaluable in ensuring that the chosen CRM meets the needs of the entire team. This also increases the likelihood of successful adoption.

8. Plan for Implementation and Training

Once you’ve chosen a CRM, plan for implementation and training. Consider the following steps:

- Data migration: Plan how you will migrate your existing client data to the new CRM.

- Customization: Customize the CRM to meet your specific needs.

- Training: Train your team on how to use the CRM.

- Ongoing support: Ensure that you have access to ongoing support from the CRM provider.

The Benefits of Implementing a CRM for Accountants

Implementing a CRM system can bring about significant improvements for your accounting firm. The benefits extend beyond mere organization; they can transform your business operations and client relationships. Let’s explore some of the key advantages:

1. Enhanced Client Relationship Management

A CRM allows you to build stronger, more personal relationships with your clients. By centralizing all client interactions and data, you gain a comprehensive view of their needs and preferences. You can personalize your communications, proactively offer relevant services, and anticipate their needs. This leads to increased client satisfaction, loyalty, and ultimately, referrals. Understanding your clients better allows you to offer tailored advice and solutions, strengthening your position as a trusted advisor.

2. Improved Efficiency and Productivity

CRM systems automate many time-consuming tasks, such as sending invoices, scheduling appointments, and managing follow-ups. This automation frees up valuable time for you and your team to focus on higher-value activities, such as providing financial advice, analyzing data, and growing your business. By streamlining workflows, a CRM reduces the risk of errors, improves accuracy, and allows you to handle a larger client base without increasing your workload significantly.

3. Increased Sales and Revenue

A CRM can significantly improve your sales process. It helps you track leads, manage your sales pipeline, and identify opportunities to cross-sell and up-sell services. By analyzing your sales data, you can identify your most successful strategies and refine your approach. This leads to increased conversion rates, higher revenue, and a more profitable business. The ability to track the progress of leads and deals ensures that you stay on top of your sales efforts and don’t miss out on any potential opportunities.

4. Better Data Management and Organization

A CRM provides a centralized repository for all client data, eliminating the need to search through multiple spreadsheets, emails, and filing cabinets. This organized approach improves data accuracy, reduces the risk of errors, and ensures that everyone on your team has access to the same information. This streamlined access to client information enables faster decision-making, improved collaboration, and a more efficient workflow.

5. Enhanced Collaboration and Communication

If you have a team, a CRM facilitates seamless collaboration. All team members have access to the same client information, ensuring that everyone is on the same page and can provide consistent service. The CRM also allows for easy communication, with features such as internal messaging and email integration. This enhanced collaboration improves teamwork, reduces misunderstandings, and fosters a more productive work environment. By improving communication, you can also improve client satisfaction.

6. Data-Driven Decision Making

CRM systems offer robust reporting and analytics features that provide valuable insights into your business performance. You can track key metrics, such as client retention, sales figures, and marketing ROI. This data-driven approach enables you to make informed decisions, optimize your strategies, and drive business growth. The ability to analyze your data provides a clear understanding of what is working and what is not, allowing you to make necessary adjustments and improve your overall performance.

7. Compliance and Security

CRMs offer robust security features to protect your clients’ sensitive financial data. They often include data encryption, regular backups, and compliance with relevant data privacy regulations, such as GDPR and CCPA. This ensures that your clients’ data is protected and that you are meeting your legal obligations. By choosing a CRM with strong security features, you can avoid potential data breaches, protect your clients’ privacy, and maintain their trust. This is especially important in the accounting industry, where data security is paramount.

Conclusion: Choosing the Right CRM for Your Success

Choosing the right CRM for your small accounting firm is a strategic investment that can yield significant returns. By carefully assessing your needs, researching the available options, and considering the factors outlined in this guide, you can select a CRM that will streamline your operations, improve client relationships, and drive business growth. Remember to prioritize features like contact management, communication tracking, workflow automation, and integration with your accounting software. Start with a free trial or demo to experience the system firsthand and get feedback from your team. With the right CRM in place, you can transform your accounting practice into a more efficient, client-focused, and profitable business.

Don’t be afraid to experiment and find the CRM that fits your specific needs. The perfect solution is out there, waiting to help you elevate your accounting firm to new heights.