Seamlessly Sync Your Finances: Mastering CRM Integration with QuickBooks

Introduction: Bridging the Gap Between Sales and Finance

In the fast-paced world of business, efficiency is the name of the game. Every streamlined process, every automated task, and every well-integrated system contributes to a healthier bottom line. One of the most crucial integrations for businesses, particularly small and medium-sized enterprises (SMEs), is the connection between their Customer Relationship Management (CRM) system and their accounting software, most notably QuickBooks. This article dives deep into the world of CRM integration with QuickBooks, exploring the benefits, the how-to’s, and the potential pitfalls to avoid, ensuring you can seamlessly sync your sales and financial data.

Imagine a scenario: a salesperson closes a deal in your CRM. Information about the customer, the products or services sold, and the agreed-upon price is instantly and accurately reflected in QuickBooks, ready for invoicing and revenue recognition. No more manual data entry, no more errors, and no more delays. This is the power of effective CRM and QuickBooks integration.

But the benefits extend far beyond simple time savings. By linking these two critical systems, you unlock a wealth of insights, improve decision-making, and enhance overall operational efficiency. This guide will serve as your comprehensive resource, providing you with the knowledge and tools you need to successfully integrate your CRM with QuickBooks and reap the rewards.

Why Integrate CRM with QuickBooks? The Unfolding Benefits

The advantages of integrating your CRM with QuickBooks are numerous and impactful. Let’s explore some of the key benefits in detail:

1. Eliminating Manual Data Entry and Reducing Errors

One of the most immediate benefits is the elimination of manual data entry. Instead of manually transferring customer information, sales data, and payment details between your CRM and QuickBooks, the integration automates this process. This not only saves valuable time but also significantly reduces the risk of human error. Typos, incorrect data, and missed information can lead to inaccurate financial reports, delayed invoicing, and frustrated customers. Automation ensures data accuracy and consistency across both systems.

2. Improved Data Accuracy and Consistency

Data accuracy is paramount in both sales and finance. An integrated system ensures that the data flowing between your CRM and QuickBooks is consistent and up-to-date. When information is synchronized automatically, you can be confident that the data used for sales forecasting, financial reporting, and customer management is reliable. This leads to better decision-making based on accurate and real-time information.

3. Enhanced Sales Team Productivity

Sales teams can become more productive when they aren’t burdened with administrative tasks. With the integration, they can focus on what they do best: selling. They no longer have to spend time manually entering data into QuickBooks, which frees up their time to engage with prospects, nurture leads, and close deals. This increased efficiency translates to higher sales and revenue.

4. Streamlined Accounting Processes

Accountants and bookkeepers also benefit from the integration. They can automate tasks such as invoice creation, payment tracking, and reconciliation. This streamlined process reduces the workload, minimizes the risk of errors, and allows them to focus on more strategic financial activities, such as financial analysis and planning.

5. Real-Time Visibility into Key Metrics

An integrated system provides real-time visibility into key metrics, such as sales revenue, customer profitability, and outstanding invoices. This information is invaluable for making informed business decisions. You can track sales performance, identify trends, and quickly address any issues that may arise. Having immediate access to this data empowers you to make proactive decisions and optimize your business strategies.

6. Improved Customer Relationship Management

By integrating your CRM with QuickBooks, you gain a more comprehensive view of your customers. You can see their purchase history, payment behavior, and any outstanding balances directly within your CRM. This allows you to provide better customer service, personalize your interactions, and build stronger relationships. Knowing a customer’s financial status can also help you tailor your sales efforts and offer appropriate payment options.

7. Faster Invoice Processing and Payment Collection

Automation speeds up the invoice processing and payment collection cycle. Sales data from your CRM can automatically generate invoices in QuickBooks, which are then sent to customers promptly. This reduces the time it takes to get paid, improving cash flow and reducing the risk of late payments. Reminders can also be automated, further streamlining the process.

8. Better Sales Forecasting and Reporting

The integration provides a more complete picture of your sales pipeline and financial performance. You can track leads, opportunities, and closed deals, along with their associated revenue, within your CRM. This data can be used to generate accurate sales forecasts and create comprehensive reports that provide valuable insights into your business’s performance. Accurate forecasting enables you to make better decisions regarding resource allocation, inventory management, and overall business strategy.

Choosing the Right CRM and QuickBooks Integration Method

There are several ways to integrate your CRM with QuickBooks. The best method for your business will depend on the specific CRM and QuickBooks versions you use, the complexity of your business processes, and your budget. Here are the main integration methods:

1. Native Integrations

Some CRM systems offer native integrations with QuickBooks. These integrations are built directly into the CRM and QuickBooks platforms, making them easy to set up and use. Native integrations often provide a seamless user experience and offer a wide range of features. They are typically the most straightforward option, but they may not be available for all CRM and QuickBooks combinations.

2. Third-Party Integration Platforms

Third-party integration platforms, such as Zapier, Make (formerly Integromat), and Automate.io, provide a more flexible and versatile integration solution. These platforms act as a bridge between your CRM and QuickBooks, allowing you to connect them even if they don’t have native integrations. They offer a wide range of pre-built integrations and customization options, enabling you to tailor the integration to your specific needs. However, these platforms often require some technical expertise to set up and configure.

3. Custom Integrations

For businesses with complex integration requirements, custom integrations may be the best option. This involves hiring a developer to build a custom integration that meets your specific needs. Custom integrations offer the greatest flexibility but require significant investment and ongoing maintenance. This option is usually reserved for larger businesses with complex workflows.

4. QuickBooks Marketplace Apps

QuickBooks Online has a marketplace with various apps designed to integrate with different CRM systems. These apps are typically pre-built integrations that can be installed and configured with relative ease. They offer a user-friendly experience and may provide specific features tailored to your CRM. However, the functionality can be limited compared to other options.

Step-by-Step Guide to Integrating CRM with QuickBooks

The exact steps for integrating your CRM with QuickBooks will vary depending on the integration method you choose. However, here is a general overview of the process:

1. Assess Your Needs

Before you begin, take the time to assess your needs. Identify the specific data you want to sync between your CRM and QuickBooks, the workflows you want to automate, and the features you require. This will help you choose the right integration method and configure the integration effectively.

2. Choose an Integration Method

Based on your needs and budget, choose the integration method that best suits your business. Consider factors such as ease of use, features, and cost.

3. Prepare Your Systems

Ensure that your CRM and QuickBooks systems are set up correctly. This includes creating user accounts, configuring security settings, and ensuring that both systems are up-to-date. You may also need to clean up your data and ensure that your customer and product information is consistent across both systems.

4. Connect Your Systems

Follow the instructions provided by your chosen integration method to connect your CRM and QuickBooks. This may involve entering API keys, authorizing access, and configuring the data mapping.

5. Configure Data Mapping

Data mapping is the process of matching the fields in your CRM with the corresponding fields in QuickBooks. This ensures that the data is transferred accurately between the two systems. Carefully review the data mapping options and customize them to meet your specific needs. For example, you might want to map the “Customer Name” field in your CRM to the “Customer Name” field in QuickBooks.

6. Test the Integration

Before you go live, test the integration thoroughly. Create a test record in your CRM and verify that the data is accurately transferred to QuickBooks. Check the integration for any errors or inconsistencies. Test different scenarios, such as creating invoices, processing payments, and updating customer information.

7. Go Live and Monitor

Once you are satisfied with the testing results, you can go live with the integration. Monitor the integration closely for any issues or errors. Regularly review the data to ensure that it is accurate and consistent. Make adjustments to the integration as needed.

8. Training and Support

Provide training to your employees on how to use the integrated system. Offer ongoing support to address any questions or issues that may arise. This will ensure that your team can effectively use the integration and maximize its benefits.

Key Considerations for a Successful Integration

While the benefits of CRM and QuickBooks integration are clear, successful implementation requires careful planning and attention to detail. Here are some key considerations to keep in mind:

1. Data Synchronization Direction

Decide which direction data should flow. Do you want to synchronize data from your CRM to QuickBooks, from QuickBooks to your CRM, or both ways? This will depend on your specific business needs and the features of your chosen integration method. Consider which system will be the “source of truth” for certain data, such as customer information.

2. Data Mapping

Carefully plan your data mapping. Incorrect data mapping can lead to errors and inconsistencies. Ensure that you map the correct fields in your CRM with the corresponding fields in QuickBooks. Consider the data types, formats, and any special requirements. Review and adjust your data mapping as your business evolves.

3. Security and Data Privacy

Prioritize security and data privacy. Choose an integration method that uses secure protocols and protects your data from unauthorized access. Review the privacy policies of your CRM and QuickBooks providers. Implement appropriate security measures, such as encryption and access controls, to protect sensitive data.

4. Ongoing Maintenance and Support

Integration is not a one-time task. It requires ongoing maintenance and support. Regularly monitor the integration for any issues or errors. Keep both your CRM and QuickBooks systems up-to-date. Provide ongoing training and support to your employees. Have a plan in place to address any issues that may arise.

5. Scalability

Consider the scalability of your integration. As your business grows, your data volume and integration requirements will increase. Choose an integration method that can handle your current and future needs. Ensure that the integration can be easily adapted to accommodate changes in your business processes.

6. User Training and Adoption

Invest in user training and adoption. Ensure that your employees understand how to use the integrated system and its benefits. Provide clear documentation and ongoing support. Encourage user feedback and address any concerns promptly. Successful user adoption is critical for maximizing the value of the integration.

7. Cost Analysis

Evaluate the total cost of the integration, including software licenses, implementation costs, and ongoing maintenance fees. Compare the costs of different integration methods and choose the one that provides the best value for your business. Consider the return on investment (ROI) of the integration, taking into account the time savings, increased efficiency, and improved decision-making.

Popular CRM Systems and Their QuickBooks Integration Capabilities

Several popular CRM systems offer seamless integration with QuickBooks. Here’s a look at some of the leading options:

1. Salesforce

Salesforce, a leading CRM platform, integrates with QuickBooks through various third-party apps available on the Salesforce AppExchange. These apps enable you to sync customer data, sales orders, invoices, and payments. The level of integration varies depending on the app, but generally, you can expect robust data synchronization and automation capabilities.

2. HubSpot

HubSpot, known for its marketing and sales automation features, offers a native integration with QuickBooks. This integration allows you to sync contact information, deals, and invoices. You can track revenue generated from your HubSpot contacts and gain valuable insights into your sales performance. The integration is generally easy to set up and use, making it a popular choice for businesses using HubSpot.

3. Zoho CRM

Zoho CRM offers a native integration with QuickBooks, which allows you to sync customer data, invoices, and payments. You can track sales performance and gain visibility into your financial data. The integration offers a user-friendly interface and various customization options. Zoho CRM’s integration is a cost-effective option for businesses looking for a comprehensive CRM and accounting solution.

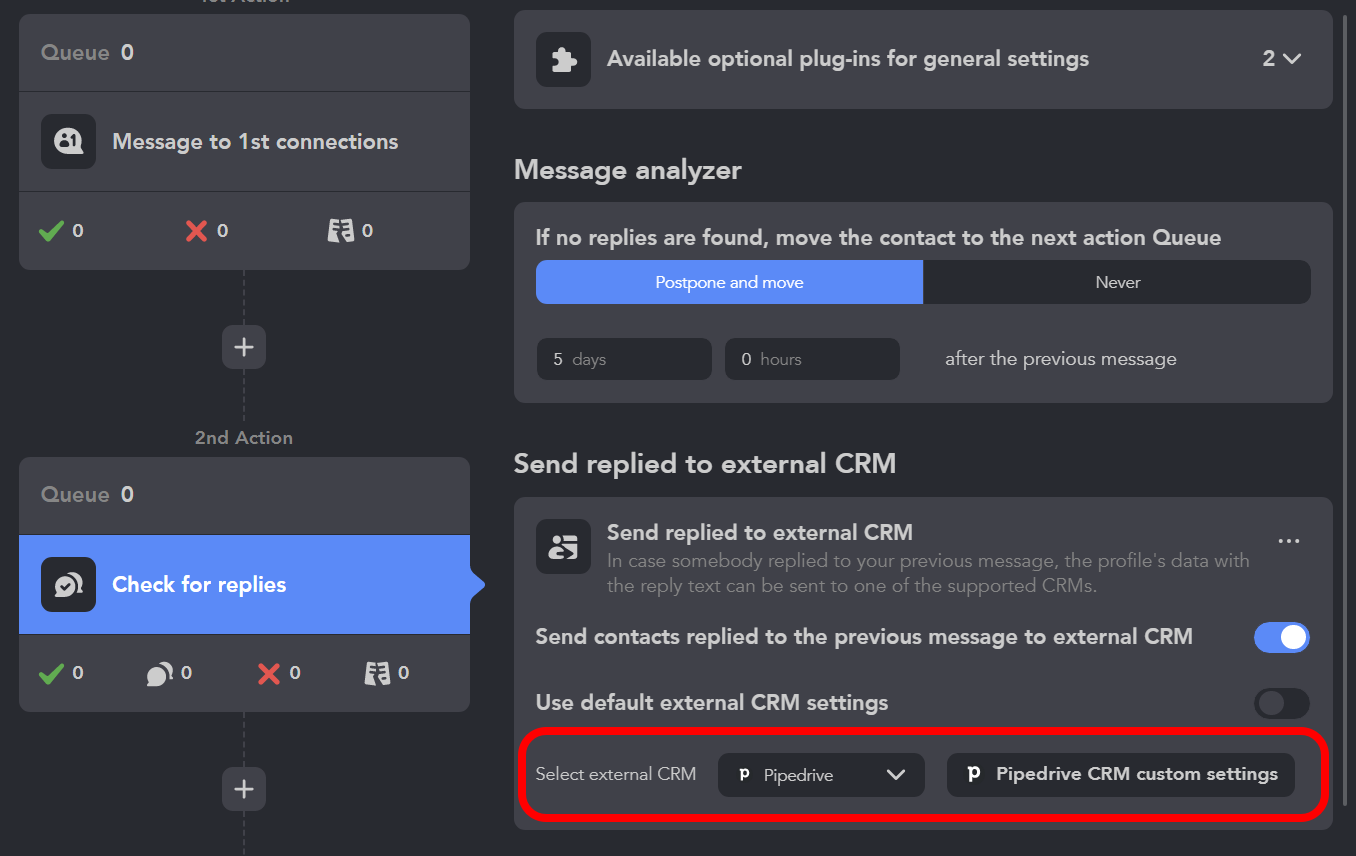

4. Pipedrive

Pipedrive, a sales-focused CRM, integrates with QuickBooks through third-party applications like Zapier. You can synchronize customer data, deals, and invoices. While the integration may require some configuration, it provides a flexible solution for connecting Pipedrive with QuickBooks. Pipedrive’s integration enables you to track sales performance and gain insights into your financial data.

5. Freshsales

Freshsales, an AI-powered CRM, offers integration with QuickBooks through third-party applications like Zapier. It allows you to sync customer data, deals, and invoices. The integration enables you to track sales performance and gain visibility into your financial data. Freshsales’ integration provides a cost-effective option for businesses looking for a comprehensive CRM and accounting solution.

Troubleshooting Common Integration Issues

Even with the best planning, you may encounter issues during the integration process. Here are some common problems and how to resolve them:

1. Data Synchronization Errors

Data synchronization errors can occur due to incorrect data mapping, data format issues, or connectivity problems. To resolve these issues, carefully review your data mapping configuration, ensure that your data formats are compatible, and check your internet connection. Consult the documentation for your integration method for specific troubleshooting steps.

2. Duplicate Data

Duplicate data can occur if your CRM and QuickBooks systems contain duplicate records. To prevent this, ensure that your CRM and QuickBooks systems are clean and up-to-date before you begin the integration. Implement a process for merging duplicate records. Use data deduplication features available in your integration platform or CRM system.

3. Missing Data

Missing data can occur if the data fields are not properly mapped or if the data is not available in one of the systems. To resolve this, carefully review your data mapping configuration and ensure that all the necessary fields are mapped. Verify that the data is available in both your CRM and QuickBooks systems. Consult the documentation for your integration method for specific troubleshooting steps.

4. Connectivity Issues

Connectivity issues can occur due to network problems, server outages, or API limitations. To resolve these issues, check your internet connection, verify that your CRM and QuickBooks systems are operational, and review the API documentation for any limitations. Contact your integration provider for assistance if necessary.

5. Performance Issues

Performance issues can occur if the integration is slow or if it consumes excessive system resources. To improve performance, optimize your data mapping configuration, limit the amount of data that is synchronized, and monitor the system resources. Contact your integration provider for assistance if necessary.

The Future of CRM and QuickBooks Integration

The integration of CRM and QuickBooks is constantly evolving, with new features and capabilities being added regularly. Here are some trends to watch:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are being used to automate tasks, improve data accuracy, and provide more insightful reporting. AI-powered integrations can automatically identify and correct data errors, predict customer behavior, and generate personalized recommendations. This will lead to more efficient and effective CRM and accounting processes.

2. Enhanced Automation

Automation is becoming more sophisticated, with the ability to automate complex workflows and tasks. Integrations will be able to automatically generate invoices, send payment reminders, and update customer information. This will free up even more time for sales and accounting teams.

3. Deeper Integration with Other Business Systems

CRM and QuickBooks integrations will become more integrated with other business systems, such as e-commerce platforms, marketing automation tools, and project management software. This will create a more seamless and connected business ecosystem, allowing businesses to streamline their operations and improve their overall efficiency.

4. Increased Focus on Data Security and Privacy

Data security and privacy will become even more important. Integrations will be designed with security in mind, with features such as encryption, access controls, and data masking. Businesses will need to ensure that their integrations comply with all relevant data privacy regulations.

5. Mobile Accessibility

Mobile access to CRM and QuickBooks data will become more prevalent. Integrations will be designed to work seamlessly on mobile devices, allowing users to access their data and perform tasks from anywhere. This will enable businesses to be more responsive and efficient.

Conclusion: Embracing the Power of Integration

CRM and QuickBooks integration is no longer a luxury; it’s a necessity for businesses that want to thrive in today’s competitive market. By seamlessly connecting your sales and financial data, you can eliminate manual processes, reduce errors, improve decision-making, and enhance your overall business performance. This guide has provided you with the knowledge and tools you need to successfully integrate your CRM with QuickBooks, empowering you to unlock the full potential of your business data. Embrace the power of integration and watch your business flourish.

Remember to assess your needs, choose the right integration method, plan carefully, and provide ongoing maintenance and support. By following these steps, you can create a powerful and efficient business ecosystem that drives growth and success.