Seamlessly Sync Your Finances: Mastering CRM Integration with QuickBooks

Introduction: The Power of Synergy in Business

In today’s fast-paced business environment, efficiency and streamlined operations are no longer luxuries; they’re necessities. Businesses are constantly seeking ways to optimize their workflows, reduce manual data entry, and gain a holistic view of their operations. This is where the powerful combination of Customer Relationship Management (CRM) software and QuickBooks accounting software comes into play. Specifically, integrating your CRM with QuickBooks can be a game-changer, transforming how you manage your customer relationships and financial data.

This comprehensive guide delves into the intricacies of CRM integration with QuickBooks, exploring the benefits, implementation strategies, and best practices to ensure a smooth and successful integration. We’ll cover everything from understanding the core concepts to selecting the right integration tools and troubleshooting common issues. Whether you’re a small business owner, a seasoned entrepreneur, or a finance professional, this guide is designed to equip you with the knowledge and tools you need to leverage the power of CRM and QuickBooks integration.

Understanding CRM and QuickBooks: The Building Blocks

What is CRM?

Customer Relationship Management (CRM) software is a system that helps businesses manage and analyze customer interactions and data throughout the customer lifecycle. It’s essentially a central hub for all things customer-related, from initial contact to post-sale support. Key features of CRM systems often include:

- Contact Management: Storing and organizing customer contact information, including names, addresses, phone numbers, and email addresses.

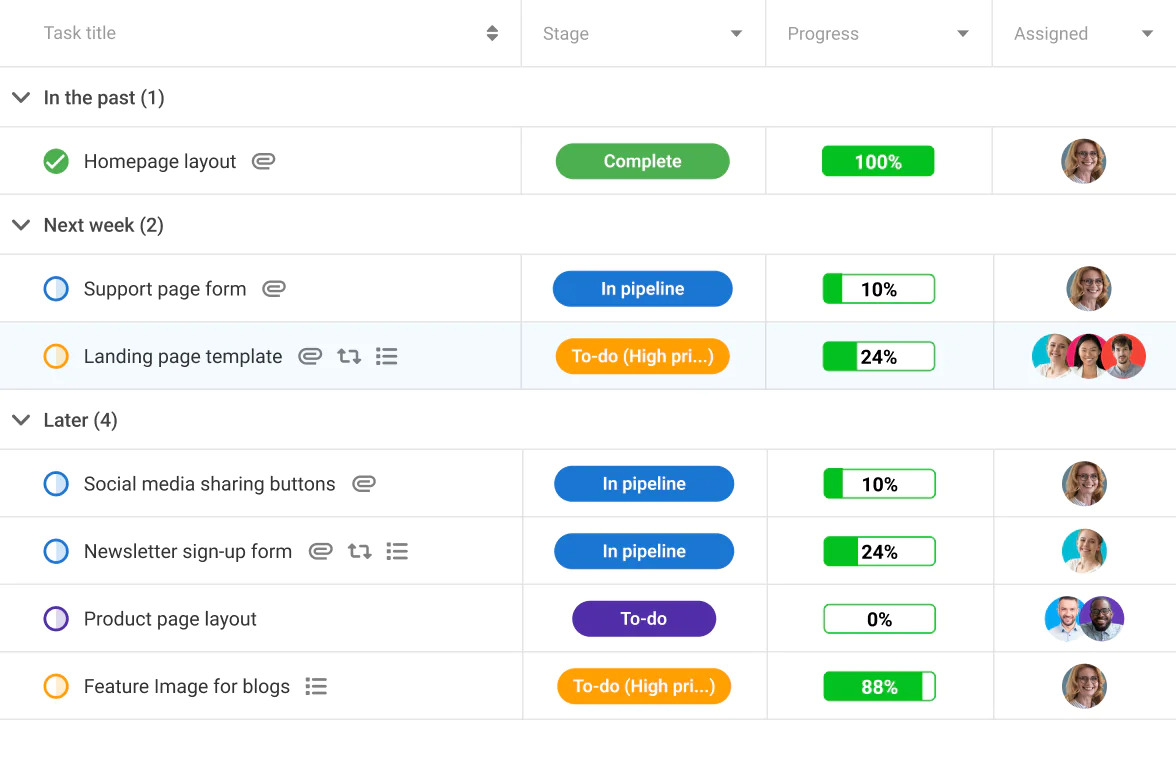

- Lead Management: Tracking and nurturing potential customers (leads) through the sales funnel.

- Sales Automation: Automating sales processes, such as quote generation, order processing, and follow-up tasks.

- Marketing Automation: Automating marketing campaigns, such as email marketing, social media posting, and lead nurturing.

- Customer Service: Managing customer support interactions, tracking issues, and providing resolutions.

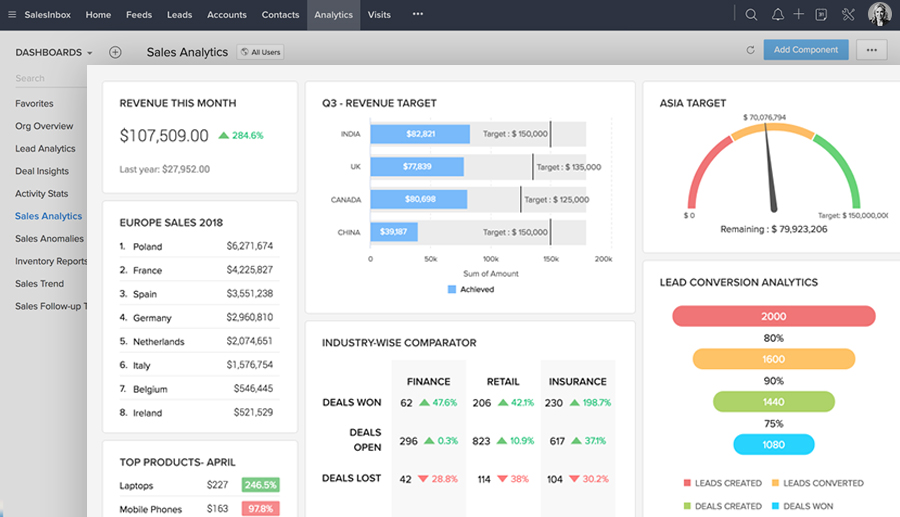

- Reporting and Analytics: Providing insights into customer behavior, sales performance, and marketing effectiveness.

Popular CRM software options include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365, among others. The choice of CRM depends on the specific needs and budget of your business.

What is QuickBooks?

QuickBooks is a widely used accounting software designed for small and medium-sized businesses. It helps businesses manage their finances, including:

- Accounting: Recording financial transactions, such as income, expenses, and payments.

- Invoicing: Creating and sending invoices to customers.

- Expense Tracking: Tracking and categorizing business expenses.

- Bank Reconciliation: Reconciling bank statements with accounting records.

- Reporting: Generating financial reports, such as profit and loss statements, balance sheets, and cash flow statements.

- Payroll: Managing employee payroll and taxes (available in some QuickBooks versions).

QuickBooks offers various versions, including QuickBooks Online (cloud-based) and QuickBooks Desktop (installed software). The choice between the two depends on factors such as budget, features required, and accessibility preferences.

The Benefits of CRM Integration with QuickBooks: A Synergistic Partnership

Integrating your CRM with QuickBooks offers a wealth of benefits that can significantly improve your business operations. It’s more than just connecting two software programs; it’s about creating a seamless workflow that streamlines processes, reduces errors, and provides valuable insights.

Enhanced Data Accuracy and Reduced Errors

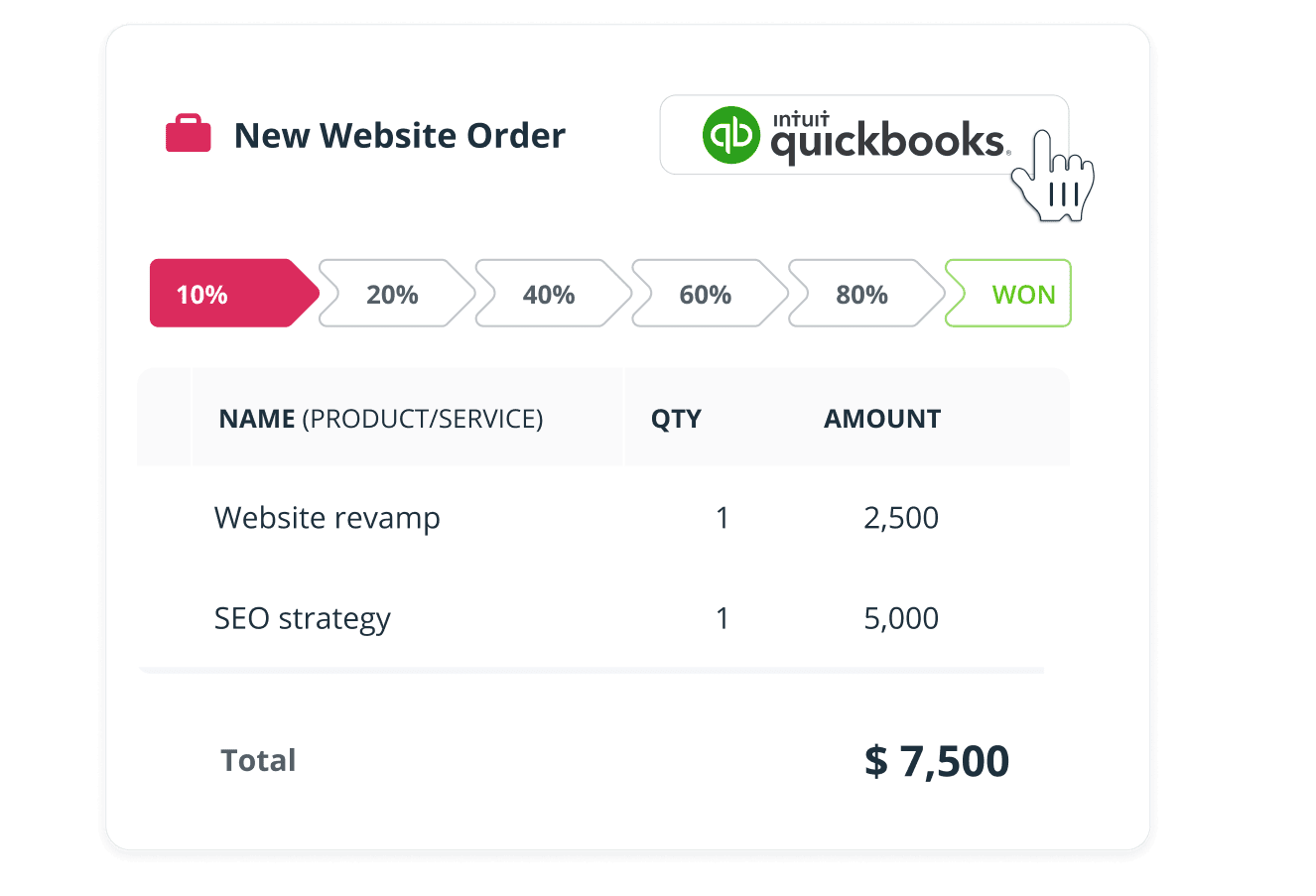

One of the most significant advantages of integration is the elimination of manual data entry. When data flows automatically between your CRM and QuickBooks, you reduce the risk of human error. This is particularly crucial when dealing with financial data, where accuracy is paramount. For example, sales orders created in your CRM can automatically be synced to QuickBooks, generating invoices and updating financial records without the need for manual input. This not only saves time but also minimizes the potential for costly mistakes.

Improved Efficiency and Time Savings

Manual data entry is time-consuming and can be a major bottleneck in your business processes. Integration automates data transfer, freeing up your employees to focus on more strategic tasks. Sales teams can spend more time selling, and accounting teams can focus on analyzing financial data rather than entering it. This increased efficiency can lead to significant time savings, ultimately boosting productivity and profitability.

Better Customer Relationship Management

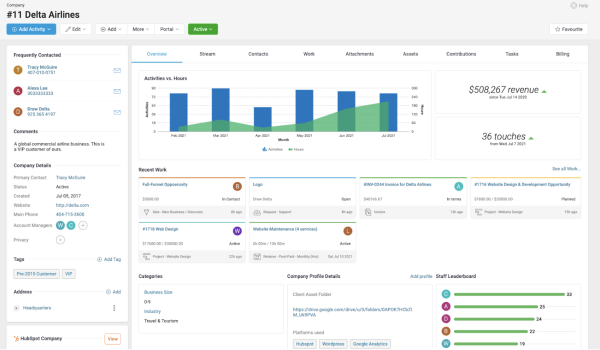

Integration allows you to gain a 360-degree view of your customers. By syncing customer data between your CRM and QuickBooks, you can see a complete history of their interactions, purchases, and financial transactions. This comprehensive view enables you to provide better customer service, personalize your marketing efforts, and identify opportunities for upselling and cross-selling. For instance, a sales representative can quickly access a customer’s invoice history in QuickBooks directly from their CRM, allowing them to answer questions and address concerns more effectively.

Streamlined Sales Processes

Integrating your CRM with QuickBooks streamlines the entire sales cycle. From lead generation to invoice generation, the process becomes more efficient. Sales teams can easily create quotes, track orders, and generate invoices directly from their CRM, eliminating the need to switch between multiple systems. This streamlined process reduces delays, improves the customer experience, and accelerates the sales cycle.

Enhanced Financial Visibility and Reporting

Integration provides a more holistic view of your business’s financial performance. You can track sales, expenses, and profitability in real-time, providing valuable insights into your business’s health. You can also generate more comprehensive reports, such as sales reports by customer, product, or region, allowing you to make data-driven decisions and identify areas for improvement. This enhanced financial visibility is crucial for making informed decisions and driving business growth.

Improved Collaboration Between Sales and Accounting Teams

Integration fosters better collaboration between sales and accounting teams. Both teams have access to the same data, allowing them to work more effectively together. Sales teams can easily see the status of invoices and payments, while accounting teams can see the progress of sales orders. This improved collaboration reduces communication barriers and improves overall teamwork.

How CRM Integration with QuickBooks Works: The Technical Aspects

The technical aspects of CRM integration with QuickBooks can vary depending on the specific CRM and QuickBooks versions you use and the integration method you choose. However, the general process involves establishing a connection between the two systems to allow data to flow seamlessly.

Integration Methods

There are several methods for integrating your CRM with QuickBooks:

- Native Integrations: Some CRM and QuickBooks versions offer native integrations, which are pre-built connections that require minimal setup. These integrations are often the easiest to implement and offer a high degree of functionality.

- Third-Party Integration Platforms: Several third-party platforms specialize in integrating CRM and QuickBooks. These platforms often offer a wide range of features and customizations, allowing you to tailor the integration to your specific needs. Popular platforms include Zapier, PieSync (now part of HubSpot), and Celigo.

- Custom Integrations: If you have specific requirements that are not met by native integrations or third-party platforms, you can develop a custom integration using APIs (Application Programming Interfaces). This approach requires technical expertise but offers the greatest flexibility.

Data Synchronization

Once the integration is set up, data synchronization is the core function. This involves the automatic transfer of data between your CRM and QuickBooks. Common data that is typically synchronized includes:

- Customers: Customer contact information, such as names, addresses, phone numbers, and email addresses.

- Products/Services: Product and service information, including descriptions, prices, and inventory levels.

- Invoices: Invoice details, including invoice numbers, dates, amounts, and payment status.

- Payments: Payment information, including payment dates, amounts, and methods.

- Sales Orders: Sales order details, including order numbers, items ordered, and quantities.

- Accounts: Chart of accounts information, including account names, numbers, and balances.

The specific data that is synchronized and the direction of the data flow (e.g., CRM to QuickBooks, QuickBooks to CRM, or both) depend on the integration method and your specific needs.

Real-Time vs. Scheduled Synchronization

Data synchronization can occur in real-time or on a scheduled basis:

- Real-time synchronization: Data is synchronized immediately as changes are made in either system. This provides the most up-to-date information but can be more resource-intensive.

- Scheduled synchronization: Data is synchronized at regular intervals, such as hourly or daily. This is less resource-intensive but may result in a slight delay in data updates.

The choice between real-time and scheduled synchronization depends on your business needs and the capabilities of your integration platform.

Step-by-Step Guide to Implementing CRM Integration with QuickBooks

Implementing CRM integration with QuickBooks can seem daunting, but with a structured approach, you can ensure a smooth and successful implementation. Here’s a step-by-step guide to help you through the process:

Step 1: Assess Your Needs and Goals

Before you begin, take the time to define your specific needs and goals. What do you hope to achieve with the integration? What data do you need to synchronize? What are your priorities?

- Identify key processes: Determine which processes you want to streamline, such as lead management, sales order processing, or invoice generation.

- Define data requirements: Identify the specific data fields you need to synchronize between your CRM and QuickBooks.

- Set clear objectives: Establish measurable goals for the integration, such as reducing data entry errors or improving sales cycle time.

Step 2: Choose the Right Integration Method

Based on your needs and goals, choose the integration method that best suits your business. Consider the following factors:

- Native integrations: If available, native integrations are often the easiest and most cost-effective option.

- Third-party platforms: Research and compare different integration platforms, considering their features, pricing, and ease of use.

- Custom integrations: If you have unique requirements, custom integrations may be necessary, but they require technical expertise and can be more expensive.

Step 3: Select the Right Tools

Choose the specific CRM and QuickBooks versions and the integration platform or tools that meet your needs. Consider factors such as:

- Compatibility: Ensure that the CRM and QuickBooks versions you choose are compatible with the integration platform.

- Features: Evaluate the features offered by the integration platform, such as data mapping, automation rules, and reporting capabilities.

- Pricing: Compare the pricing models of different integration platforms and choose the one that fits your budget.

- Support: Consider the level of support offered by the integration platform, including documentation, tutorials, and customer support.

Step 4: Plan Your Data Mapping

Data mapping is the process of matching data fields between your CRM and QuickBooks. This is a crucial step to ensure that data is synchronized correctly. Carefully plan which data fields will be mapped and how the data will flow between the two systems. Consider:

- Data field correspondence: Identify which fields in your CRM correspond to which fields in QuickBooks.

- Data transformation rules: Define any rules for transforming data during the synchronization process, such as formatting or converting data types.

- Data validation: Implement data validation rules to ensure data accuracy and prevent errors.

Step 5: Set Up the Integration

Follow the instructions provided by your chosen integration platform to set up the integration. This typically involves:

- Connecting your CRM and QuickBooks accounts: Provide the necessary credentials to connect your accounts.

- Configuring data mapping: Map the data fields between your CRM and QuickBooks.

- Setting up automation rules: Configure any automation rules, such as triggering invoice generation when a sales order is created.

- Testing the integration: Test the integration to ensure that data is synchronizing correctly.

Step 6: Test and Validate the Integration

Thoroughly test the integration to ensure that data is synchronizing correctly. Create test records in both your CRM and QuickBooks and verify that the data is flowing as expected. Check for any errors or inconsistencies and make adjustments as needed. Consider:

- Testing different scenarios: Test various scenarios, such as creating new customers, generating invoices, and processing payments.

- Verifying data accuracy: Compare the data in your CRM and QuickBooks to ensure that it is accurate and consistent.

- Troubleshooting any issues: Address any errors or inconsistencies that you encounter during testing.

Step 7: Train Your Team

Once the integration is set up and tested, train your team on how to use the integrated systems. Provide clear instructions and documentation on how to perform common tasks, such as creating new customers, generating invoices, and tracking payments. Ensure that your team understands the benefits of the integration and how it will improve their workflows. Consider:

- Providing training materials: Create training materials, such as user manuals, video tutorials, and FAQs.

- Conducting training sessions: Conduct training sessions to walk your team through the integrated systems.

- Offering ongoing support: Provide ongoing support to help your team with any questions or issues they may encounter.

Step 8: Monitor and Maintain the Integration

After the integration is live, continuously monitor its performance and maintain it to ensure that it continues to function smoothly. Regularly check for any errors or issues and address them promptly. Keep the integration up-to-date with the latest software versions and security patches. Consider:

- Monitoring data synchronization: Regularly check the data synchronization logs for any errors or issues.

- Reviewing data accuracy: Periodically review the data in your CRM and QuickBooks to ensure that it is accurate and consistent.

- Updating the integration: Stay up-to-date with the latest software versions and security patches.

Choosing the Right Integration Platform: Key Considerations

Selecting the right integration platform is crucial for the success of your CRM and QuickBooks integration. Here are some key considerations to keep in mind:

Ease of Use

Choose a platform that is easy to set up and use. The platform should have a user-friendly interface, clear documentation, and helpful support resources. A platform that is easy to use will save you time and reduce the learning curve for your team.

Features and Functionality

Consider the features and functionality offered by the platform. Does it support the specific data fields and processes you need to synchronize? Does it offer automation rules, data mapping capabilities, and reporting features? Choose a platform that meets your specific needs.

Data Mapping Capabilities

Ensure that the platform offers robust data mapping capabilities. You should be able to easily map data fields between your CRM and QuickBooks and define any data transformation rules that are needed. The platform should also allow you to validate data to ensure accuracy.

Scalability

Choose a platform that can scale with your business. As your business grows, you may need to synchronize more data and handle more transactions. The platform should be able to accommodate your future growth.

Pricing and Cost

Compare the pricing models of different platforms and choose the one that fits your budget. Consider the features offered, the number of users, and the transaction volume. Be sure to factor in any hidden costs, such as setup fees or support charges.

Customer Support

Choose a platform that offers excellent customer support. Look for a platform that provides responsive and helpful support, including documentation, tutorials, and customer service. Good customer support can be invaluable if you encounter any issues with the integration.

Security

Prioritize security when selecting an integration platform. Ensure that the platform uses secure protocols to protect your data and comply with relevant data privacy regulations. Look for features such as data encryption and access controls.

Popular Integration Platforms: A Quick Overview

Several integration platforms are popular choices for connecting CRM and QuickBooks. Here’s a brief overview of some of the leading options:

- Zapier: A versatile integration platform that connects thousands of apps, including CRM and QuickBooks. Zapier offers a wide range of pre-built integrations and automation options.

- PieSync (HubSpot): A popular platform specifically designed for two-way contact synchronization. It focuses on keeping contact data consistent across various apps.

- Celigo: A comprehensive integration platform that offers advanced features and customizations. Celigo is well-suited for businesses with complex integration needs.

- Native Integrations: Some CRM and QuickBooks versions offer native integrations, which are pre-built connections that require minimal setup.

Each platform has its strengths and weaknesses. The best choice for your business depends on your specific needs, budget, and technical expertise.

Troubleshooting Common CRM and QuickBooks Integration Issues

Even with the best planning and implementation, you may encounter some issues with your CRM and QuickBooks integration. Here are some common problems and how to troubleshoot them:

Data Synchronization Errors

Data synchronization errors are common and can be caused by various factors, such as incorrect data mapping, conflicting data, or connectivity issues. To troubleshoot these errors:

- Check the integration logs: The integration platform should provide logs that track data synchronization events. Review these logs to identify any errors and the reasons behind them.

- Verify data mapping: Double-check the data mapping configuration to ensure that the data fields are correctly mapped between your CRM and QuickBooks.

- Resolve data conflicts: Identify and resolve any data conflicts, such as duplicate customer records or inconsistent data.

- Check connectivity: Ensure that your CRM and QuickBooks accounts are connected to the internet and that there are no network issues.

- Contact support: If you are unable to resolve the issue yourself, contact the support team of your integration platform.

Data Mismatch Issues

Data mismatch issues occur when the data in your CRM and QuickBooks does not match. This can be caused by incorrect data mapping, data transformation errors, or manual data entry. To troubleshoot these issues:

- Review data mapping: Carefully review the data mapping configuration to ensure that the data fields are correctly mapped between your CRM and QuickBooks.

- Verify data transformation rules: Check the data transformation rules to ensure that they are correctly transforming the data.

- Identify manual data entry: Identify any instances of manual data entry and eliminate them.

- Reconcile data: Reconcile the data in your CRM and QuickBooks to identify any discrepancies.

Performance Issues

Performance issues can occur if the integration is slow or if it consumes a lot of system resources. To troubleshoot these issues:

- Optimize data synchronization: Configure the data synchronization settings to optimize performance, such as scheduling synchronization during off-peak hours.

- Reduce data volume: Reduce the volume of data that is being synchronized, if possible.

- Upgrade system resources: If necessary, upgrade your system resources, such as your server or network.

- Contact support: If you are unable to resolve the issue yourself, contact the support team of your integration platform.

Security Concerns

Security concerns can arise if your data is not properly protected. To address these concerns:

- Use secure protocols: Ensure that the integration platform uses secure protocols to protect your data.

- Implement access controls: Implement access controls to restrict access to sensitive data.

- Monitor data security: Regularly monitor your data security to identify and address any vulnerabilities.

- Comply with regulations: Comply with all relevant data privacy regulations, such as GDPR and CCPA.

Best Practices for a Successful CRM and QuickBooks Integration

Following these best practices will help you ensure a successful CRM and QuickBooks integration:

- Plan thoroughly: Take the time to plan your integration carefully, defining your needs, goals, and data requirements.

- Choose the right tools: Select the CRM, QuickBooks, and integration platform that best suit your business needs.

- Map your data accurately: Carefully map your data fields between your CRM and QuickBooks to ensure data accuracy.

- Test thoroughly: Test the integration thoroughly to ensure that data is synchronizing correctly.

- Train your team: Train your team on how to use the integrated systems.

- Monitor and maintain the integration: Continuously monitor the integration’s performance and maintain it to ensure that it continues to function smoothly.

- Stay up-to-date: Stay up-to-date with the latest software versions and security patches.

- Seek expert advice: If you are unsure about any aspect of the integration, seek expert advice from a consultant or integration specialist.

- Start small and scale up: Begin with a limited scope and gradually expand the integration as you gain experience and confidence.

- Prioritize data security: Implement security measures to protect your data and comply with relevant data privacy regulations.

Conclusion: Embracing the Future of Business with Integrated Solutions

Integrating CRM with QuickBooks is a strategic move that can significantly enhance your business operations. By streamlining workflows, improving data accuracy, and gaining a holistic view of your customer relationships and finances, you can drive efficiency, productivity, and profitability. The key is to understand your needs, choose the right tools, plan carefully, and follow best practices throughout the implementation process.

As technology continues to evolve, integrated solutions like CRM and QuickBooks will become even more essential for businesses of all sizes. Embracing these technologies can help you stay competitive, make data-driven decisions, and build stronger relationships with your customers. So, take the leap, explore the possibilities, and unlock the full potential of your business with CRM and QuickBooks integration.