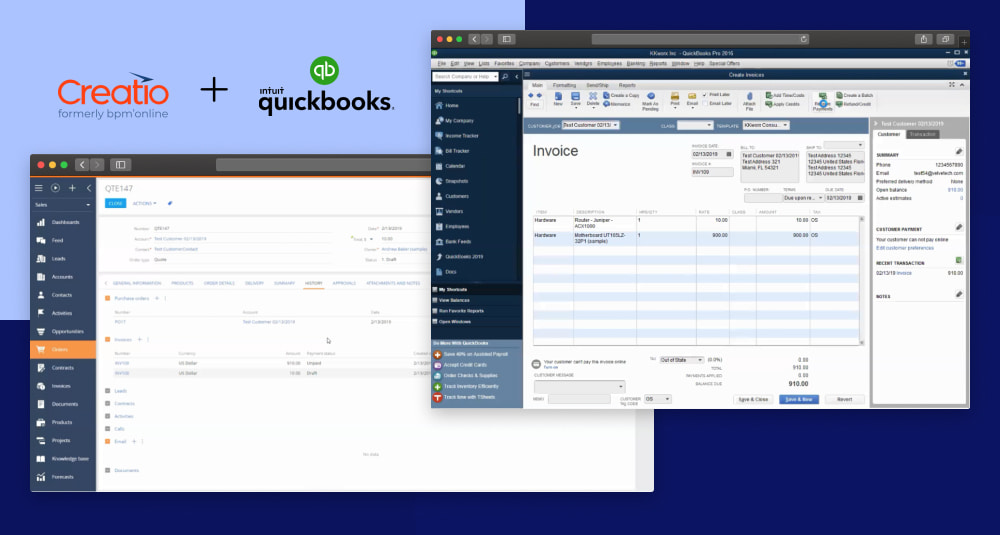

Seamlessly Sync Your Finances: CRM Integration with QuickBooks for Business Growth

Introduction: Bridging the Gap Between Sales and Finance

In the bustling world of business, efficiency is the name of the game. As a business owner, you’re constantly juggling multiple balls – managing sales, tracking finances, and keeping your customers happy. Wouldn’t it be fantastic if these different aspects of your business could work together seamlessly? That’s where CRM (Customer Relationship Management) integration with QuickBooks comes in. This powerful combination can revolutionize how you manage your business, streamline your workflows, and ultimately, boost your bottom line. This article will delve deep into the world of CRM integration with QuickBooks, exploring its benefits, how to set it up, and the best practices to ensure a smooth and successful implementation.

Understanding the Players: CRM and QuickBooks

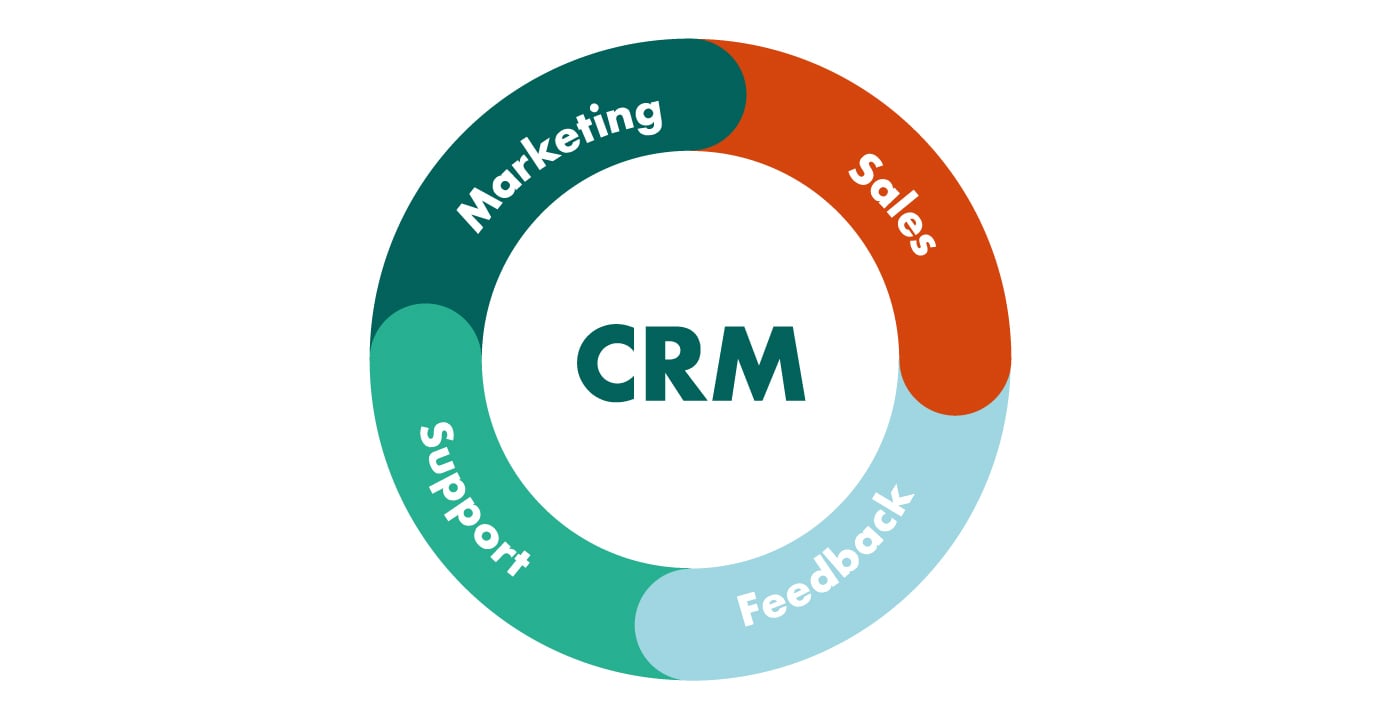

Before we dive into the integration, let’s get acquainted with the key players. CRM software, in its essence, is a system designed to manage and analyze customer interactions and data throughout the customer lifecycle. It helps businesses improve customer relationships, retain customers, and drive sales growth. Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and many more. These systems typically offer features like contact management, sales pipeline tracking, marketing automation, and customer service management.

QuickBooks, on the other hand, is a leading accounting software designed for small and medium-sized businesses. It helps businesses manage their finances, track income and expenses, generate financial reports, and handle tasks like invoicing, bill payments, and payroll. QuickBooks is a cornerstone for financial management for many businesses.

The Power of Integration: Why CRM and QuickBooks Need to Talk

The integration of CRM and QuickBooks is a game-changer because it bridges the gap between sales and finance. Without integration, your teams are likely operating in silos. Sales teams work in their CRM, tracking leads and closing deals, while the finance team toils in QuickBooks, managing invoices and payments. This separation can lead to several inefficiencies and problems:

- Data Silos: Information is scattered across different systems, making it difficult to get a complete view of your business.

- Manual Data Entry: Sales data needs to be manually entered into QuickBooks, and financial data needs to be manually entered into the CRM, leading to errors and wasted time.

- Lack of Visibility: Sales teams may not have real-time access to financial data, and finance teams may not have access to sales data, hindering decision-making.

- Inefficient Workflows: Processes like invoicing and payment tracking can be cumbersome and time-consuming.

Integrating CRM and QuickBooks solves these problems by creating a unified system where data flows seamlessly between the two platforms. This leads to:

- Increased Efficiency: Automate data entry and eliminate manual tasks, saving time and resources.

- Improved Accuracy: Reduce errors by eliminating manual data entry.

- Better Decision-Making: Gain real-time visibility into your sales and financial data.

- Enhanced Collaboration: Foster better communication and collaboration between sales and finance teams.

- Improved Customer Experience: Get a 360-degree view of your customers, enabling you to provide better service.

Benefits of CRM Integration with QuickBooks

The benefits of integrating your CRM with QuickBooks are vast and can significantly impact your business’s success. Here are some key advantages:

1. Streamlined Sales-to-Finance Workflow

Imagine this: a salesperson closes a deal in the CRM. With integration, the relevant data, such as customer information, product details, and pricing, automatically syncs to QuickBooks. This automatically creates an invoice, eliminating the need for manual data entry and saving your finance team valuable time.

2. Automated Invoicing and Payment Tracking

Integration allows you to automate the invoicing process. Once a deal is closed in the CRM, an invoice is automatically generated in QuickBooks and sent to the customer. You can also track payment status in both systems, ensuring you always know where you stand with your accounts receivable. This helps to reduce late payments and improve cash flow.

3. Real-time Financial Visibility for Sales Teams

Sales teams can gain access to financial data directly within their CRM. This includes information such as customer payment history, outstanding balances, and revenue generated from each deal. This visibility empowers sales teams to make better decisions, understand customer needs, and provide better customer service.

4. Accurate Reporting and Analytics

Integration enables you to generate more accurate and comprehensive reports. You can track key metrics like sales revenue, customer profitability, and sales cycle length, all in one place. This data helps you identify trends, make informed decisions, and measure the effectiveness of your sales and marketing efforts.

5. Improved Customer Relationship Management

By integrating CRM and QuickBooks, you get a 360-degree view of your customers. You can see their sales history, payment history, and any other relevant interactions. This holistic view empowers you to provide better customer service, personalize your interactions, and build stronger customer relationships.

6. Reduced Errors and Improved Accuracy

Manual data entry is prone to errors. Integration eliminates manual data entry, reducing the risk of errors and ensuring that your data is accurate and reliable.

7. Time and Cost Savings

Automation saves time and reduces the need for manual tasks. This, in turn, reduces labor costs and allows your team to focus on more strategic initiatives.

How to Integrate CRM with QuickBooks

There are several ways to integrate your CRM with QuickBooks. The best approach will depend on your specific CRM platform, your QuickBooks version, and your business needs. Here are the common methods:

1. Native Integrations

Some CRM platforms, like HubSpot and Zoho CRM, offer native integrations with QuickBooks. This means that the integration is built directly into the platform and is usually easy to set up. You’ll typically find the integration options within your CRM’s settings or app marketplace. This is often the easiest and most reliable way to integrate.

2. Third-Party Integration Apps

If your CRM doesn’t have a native integration with QuickBooks, you can use third-party integration apps. These apps act as a bridge between your CRM and QuickBooks, syncing data between the two platforms. Popular integration apps include Zapier, PieSync (now part of HubSpot), and Workato. These apps often offer a wide range of features and customization options.

3. Custom Integrations

For more complex integrations or specific business needs, you may need to develop a custom integration. This involves hiring a developer to build an integration tailored to your requirements. This option can be more costly and time-consuming but offers the greatest flexibility.

Step-by-Step Guide to Setting Up CRM Integration with QuickBooks (Using a Third-Party App – Example: Zapier)

Let’s walk through a general example of how to set up integration using a popular third-party app like Zapier. Keep in mind that the specific steps may vary depending on the CRM and QuickBooks versions you are using.

1. Choose Your Integration App

Select an integration app that supports both your CRM and QuickBooks. Research the available options and choose one that meets your needs and budget. Zapier is a good starting point as it supports a wide variety of apps.

2. Create an Account and Connect Your Apps

Sign up for an account with the integration app (e.g., Zapier). Then, connect your CRM and QuickBooks accounts to the app. You’ll typically need to provide your login credentials for both platforms and grant the app permission to access your data.

3. Define Your Triggers and Actions

In the integration app, you’ll define “triggers” and “actions.” A trigger is an event that starts the integration process. For example, a trigger could be “a new deal is created in the CRM.” An action is what happens in QuickBooks when the trigger occurs. For example, an action could be “create a new invoice in QuickBooks.”

4. Map Your Fields

Map the fields between your CRM and QuickBooks. This tells the integration app which data fields to sync between the two platforms. For example, you’ll map the “Customer Name” field in your CRM to the “Customer Name” field in QuickBooks.

5. Test Your Integration

Before you launch your integration, test it to ensure it’s working correctly. Create a test deal in your CRM and verify that the corresponding invoice is created in QuickBooks. Check the data fields to ensure they are syncing accurately.

6. Activate Your Integration

Once you’re satisfied with the test results, activate your integration. The integration app will then automatically sync data between your CRM and QuickBooks based on the triggers and actions you defined.

Best Practices for Successful CRM and QuickBooks Integration

Setting up the integration is only the first step. To ensure a smooth and successful integration, follow these best practices:

1. Plan Your Integration

Before you start, take the time to plan your integration. Identify your goals, determine which data you want to sync, and map out your workflows. This will help you choose the right integration method and avoid problems down the road.

2. Clean Up Your Data

Before you integrate, clean up your data in both your CRM and QuickBooks. This includes removing duplicate records, correcting errors, and standardizing your data formats. Clean data ensures that the integration works accurately and efficiently.

3. Choose the Right Integration Method

Consider your specific needs and choose the integration method that’s right for you. Native integrations are often the easiest to set up, while third-party apps offer more flexibility. Custom integrations are best for complex requirements.

4. Map Your Fields Carefully

Pay close attention to field mapping. Ensure that the data fields in your CRM and QuickBooks are mapped correctly. This will ensure that your data syncs accurately between the two platforms.

5. Test Thoroughly

Test your integration thoroughly before you launch it. Create test deals, invoices, and transactions to verify that the data is syncing correctly. Identify and fix any issues before they impact your live data.

6. Monitor Your Integration

Once your integration is live, monitor it regularly to ensure it’s working correctly. Check for errors, and make sure that data is syncing accurately. If you encounter any problems, troubleshoot them quickly.

7. Train Your Team

Train your team on how to use the integrated system. Make sure they understand how to enter data, track deals, and manage invoices. Proper training will help them use the system effectively and avoid errors.

8. Document Your Integration

Document your integration process, including the steps you took to set it up, the triggers and actions you defined, and the field mappings you used. This documentation will be helpful if you need to troubleshoot any issues or make changes to the integration in the future.

9. Stay Updated

Both CRM and QuickBooks are constantly evolving. Stay up-to-date with the latest features and updates. This will ensure that your integration continues to function correctly and take advantage of the latest improvements.

10. Seek Professional Help If Needed

If you’re struggling with the integration process, don’t hesitate to seek professional help. There are many consultants and integration specialists who can help you set up and manage your integration.

Choosing the Right CRM for QuickBooks Integration

While QuickBooks integration is a key consideration, the choice of CRM should be based on your overall business needs. Here are some factors to consider when choosing a CRM that integrates well with QuickBooks:

- Native Integration Availability: Does the CRM offer a native integration with QuickBooks? This usually simplifies the setup process.

- Features and Functionality: Does the CRM have the features you need to manage your sales, marketing, and customer service processes?

- Scalability: Can the CRM scale with your business as it grows?

- Ease of Use: Is the CRM easy to use and navigate?

- Pricing: Does the CRM fit your budget?

- Reviews and Reputation: What are other users saying about the CRM?

Some CRM platforms known for their QuickBooks integrations include:

- HubSpot: Offers a robust native integration with QuickBooks.

- Zoho CRM: Provides a strong integration with QuickBooks through its marketplace.

- Salesforce: Integration options are available through third-party apps.

- Pipedrive: Offers integration options, often through third-party apps like Zapier.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some issues during or after the integration process. Here are some common problems and how to troubleshoot them:

1. Data Sync Errors

If data is not syncing correctly, check the following:

- Field Mapping: Ensure that your fields are mapped correctly.

- Data Formats: Make sure that your data formats are compatible between your CRM and QuickBooks.

- User Permissions: Verify that the integration app has the necessary permissions to access your data.

- App Limits: Check if you are hitting any limits set by your integration app.

2. Duplicate Records

If you’re seeing duplicate records, check the following:

- Trigger Conditions: Review your trigger conditions to ensure that they are not creating duplicate entries.

- Data Duplication: Ensure that your CRM and QuickBooks data are clean and free of duplicates before integration.

3. Slow Syncing

If the data sync is slow, consider these factors:

- Data Volume: A large amount of data can slow down the syncing process.

- Integration App Limits: Your integration app might have limitations on the number of data transfers.

- Network Issues: Check your internet connection.

4. Errors in Financial Data

If you notice errors in your financial data, check the following:

- Field Mapping: Double-check your field mapping for financial data.

- Data Entry: Review your data entry in both systems.

- Sync Frequency: Adjust the sync frequency to ensure data is updated regularly.

Conclusion: Empowering Your Business with Seamless Integration

CRM integration with QuickBooks is more than just a technical setup; it’s a strategic move that can transform your business operations. By connecting these two powerful platforms, you can streamline workflows, improve data accuracy, enhance collaboration, and gain valuable insights into your sales and finances. The benefits extend beyond efficiency gains; they contribute to improved customer relationships, better decision-making, and ultimately, a stronger bottom line.

By following the best practices outlined in this article, you can ensure a smooth and successful integration process. Remember to plan your integration, choose the right method, clean up your data, map your fields carefully, test thoroughly, and monitor your integration regularly. Don’t hesitate to seek professional help if needed. Embrace the power of CRM integration with QuickBooks and watch your business thrive.

In the ever-evolving business landscape, staying ahead of the curve is crucial. CRM integration with QuickBooks is a powerful tool that can help you do just that, paving the way for sustainable growth and success. Take the first step today, and experience the transformative power of seamless integration.