Seamlessly Sync: Mastering CRM Integration with QuickBooks for Business Growth

Introduction: The Power of Integration

In today’s fast-paced business environment, efficiency and organization are paramount. Businesses are constantly seeking ways to streamline their operations, reduce manual errors, and gain a comprehensive view of their customer relationships and financial data. This is where the integration of Customer Relationship Management (CRM) software with accounting platforms like QuickBooks becomes incredibly valuable. By connecting these two powerful tools, businesses can unlock a wealth of benefits, leading to improved productivity, enhanced customer satisfaction, and ultimately, sustainable growth.

This article will delve deep into the world of CRM integration with QuickBooks, exploring the ‘why,’ the ‘how,’ and the ‘what’ of this crucial business practice. We’ll examine the advantages of seamless data synchronization, the different integration methods available, and the best practices for ensuring a smooth and successful implementation. Whether you’re a small business owner, a seasoned entrepreneur, or a finance professional, this guide will provide you with the knowledge and insights you need to leverage the power of integrated CRM and QuickBooks.

Understanding CRM and QuickBooks: A Primer

What is CRM?

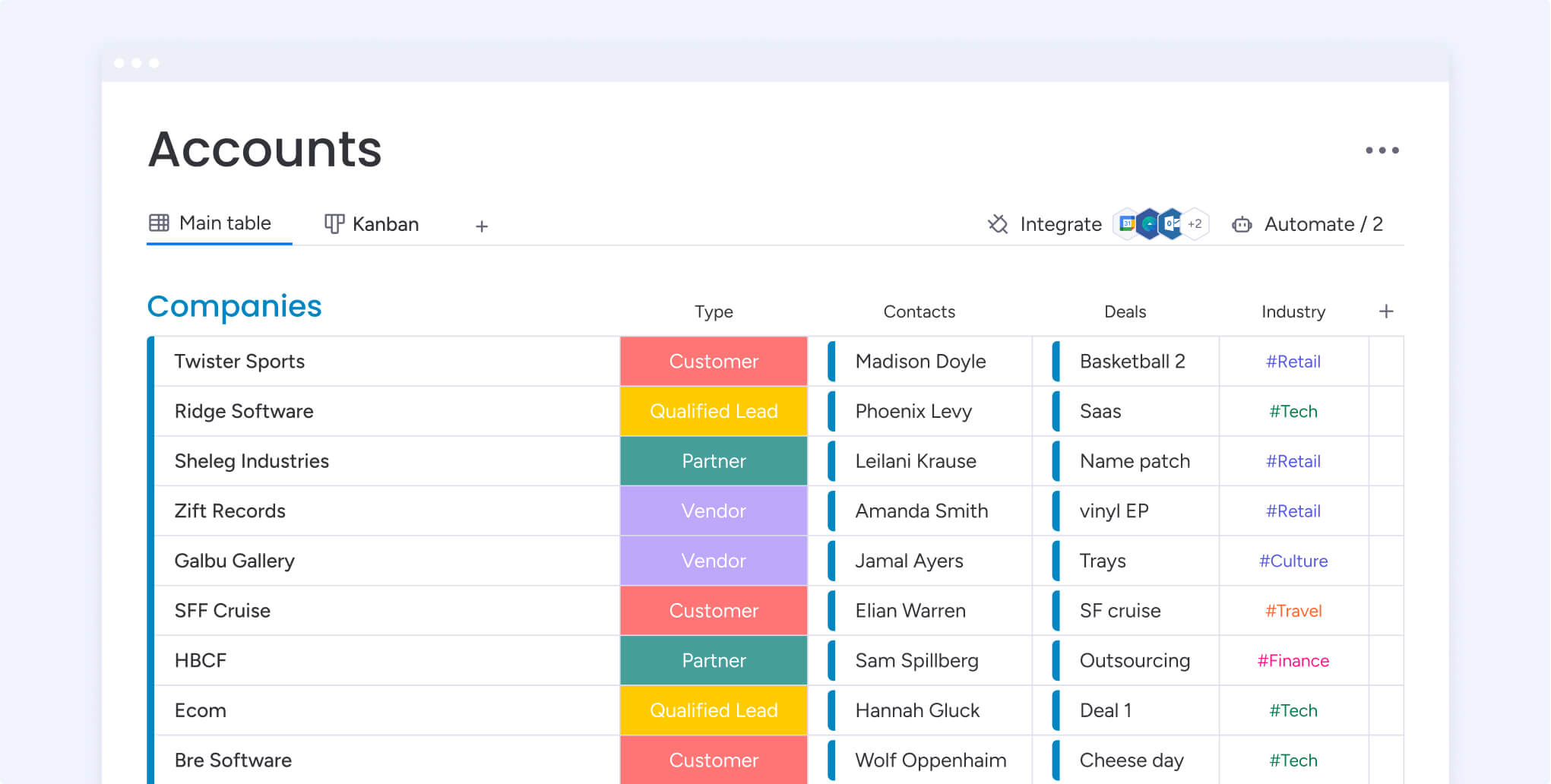

CRM, or Customer Relationship Management, is a technology that helps businesses manage and analyze customer interactions and data throughout the customer lifecycle. It’s more than just a software; it’s a strategic approach to building and nurturing customer relationships. CRM systems typically include features for contact management, sales automation, marketing automation, and customer service. They provide a centralized hub for all customer-related information, enabling businesses to personalize interactions, improve customer satisfaction, and drive sales growth.

Key benefits of CRM include:

- Improved customer relationships

- Increased sales and revenue

- Enhanced customer service

- Better marketing ROI

- Improved data analysis and reporting

What is QuickBooks?

QuickBooks is a leading accounting software solution designed to simplify financial management for small and medium-sized businesses. It offers a comprehensive suite of features, including accounting, invoicing, expense tracking, and financial reporting. QuickBooks helps businesses manage their finances efficiently, ensuring accuracy and compliance with accounting regulations. It provides real-time visibility into financial performance, enabling informed decision-making.

Key benefits of QuickBooks include:

- Simplified accounting processes

- Accurate financial reporting

- Improved cash flow management

- Automated invoicing and payments

- Compliance with accounting standards

The Benefits of Integrating CRM with QuickBooks

The integration of CRM and QuickBooks creates a powerful synergy, allowing businesses to leverage the strengths of both systems. This integration eliminates data silos, reduces manual data entry, and provides a unified view of customer and financial information. The benefits are far-reaching, impacting various aspects of the business, from sales and marketing to finance and customer service.

Enhanced Data Accuracy and Consistency

One of the most significant advantages of integrating CRM with QuickBooks is the improved data accuracy and consistency. When data is manually entered into both systems, there’s a high risk of errors, inconsistencies, and data duplication. Integration automates the data transfer process, ensuring that information is synchronized accurately and consistently across both platforms. This reduces the likelihood of errors, saves time, and improves the reliability of the data.

Reduced Manual Data Entry and Time Savings

Manual data entry is a time-consuming and error-prone process. Integrating CRM with QuickBooks automates the transfer of data between the two systems, eliminating the need for manual data entry. This frees up valuable time for employees, allowing them to focus on more strategic tasks, such as building customer relationships and driving sales. Time savings translate into increased productivity and reduced operational costs.

Improved Sales and Revenue Generation

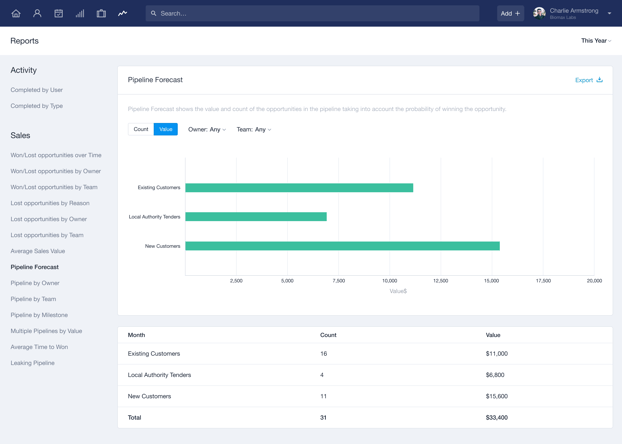

CRM integration with QuickBooks can significantly improve sales and revenue generation. By synchronizing customer data, sales teams have access to real-time financial information, such as payment history, outstanding invoices, and credit limits. This information enables them to make informed decisions, personalize sales interactions, and close deals more effectively. Sales teams can also track the impact of sales activities on revenue, providing valuable insights for sales forecasting and performance analysis.

Streamlined Financial Management

Integration simplifies financial management by providing a consolidated view of customer and financial data. Finance teams can easily track customer payments, manage outstanding invoices, and reconcile transactions between CRM and QuickBooks. This streamlines the accounting process, reduces the risk of errors, and improves cash flow management. The ability to quickly access financial information also enables better decision-making and more effective financial planning.

Enhanced Customer Service

Integration enhances customer service by providing customer service representatives with a complete view of customer interactions and financial information. They can quickly access customer history, purchase history, and payment information, enabling them to provide personalized and responsive service. This leads to improved customer satisfaction, increased customer loyalty, and positive word-of-mouth referrals.

Better Reporting and Analytics

Integration provides a more comprehensive view of business performance, enabling better reporting and analytics. Businesses can generate reports that combine customer data from CRM with financial data from QuickBooks, providing valuable insights into sales trends, customer profitability, and marketing effectiveness. This data-driven approach enables businesses to make informed decisions, optimize their strategies, and improve their overall performance.

Methods for Integrating CRM with QuickBooks

There are several methods for integrating CRM with QuickBooks, each with its own advantages and disadvantages. The best approach depends on the specific needs and technical capabilities of the business. Here are the most common integration methods:

Native Integrations

Some CRM and QuickBooks systems offer native integrations, meaning that they are designed to work seamlessly together. These integrations are typically easy to set up and use, and they provide a high level of data synchronization. Native integrations are often the preferred choice for businesses that want a simple and reliable integration solution.

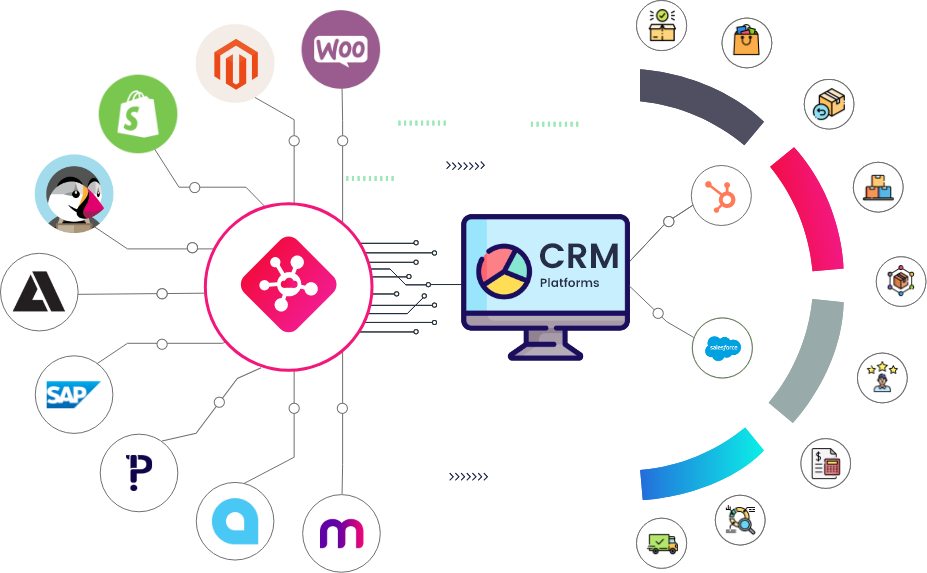

Third-Party Integration Platforms

Third-party integration platforms, such as Zapier, Make (formerly Integromat), and Workato, offer a flexible and customizable approach to CRM and QuickBooks integration. These platforms allow businesses to connect a wide range of applications, including CRM, QuickBooks, and other business tools. They offer a user-friendly interface and a variety of pre-built integrations, making it easy to set up and manage data synchronization. Third-party integration platforms are a good option for businesses that need to integrate multiple systems or require a high level of customization.

Custom Integrations

Custom integrations involve developing a custom solution to connect CRM and QuickBooks. This approach offers the greatest flexibility and control over the integration process. However, it also requires technical expertise and can be more complex and expensive to implement. Custom integrations are typically used by businesses with unique requirements or complex IT infrastructure.

Direct API Integration

Both CRM and QuickBooks offer APIs (Application Programming Interfaces) that allow developers to directly access and exchange data between the two systems. This method provides a high degree of control and customization but requires technical expertise in programming and API management. API integration is suitable for businesses with in-house development teams or those seeking highly specific data synchronization requirements.

Choosing the Right Integration Method

Selecting the right integration method depends on several factors, including:

- The CRM and QuickBooks systems you are using: Some CRM and QuickBooks systems offer native integrations, which are often the easiest to set up.

- Your technical expertise: If you don’t have in-house technical expertise, a third-party integration platform or a native integration might be the best option.

- Your budget: Custom integrations can be more expensive than other options.

- Your specific integration requirements: Consider the data you need to synchronize and the level of customization you require.

Before making a decision, it’s essential to evaluate your needs and compare the different integration methods. Consider the cost, ease of use, level of customization, and data synchronization capabilities. Choose the method that best aligns with your business requirements and technical capabilities.

Step-by-Step Guide to CRM and QuickBooks Integration

The specific steps for integrating CRM with QuickBooks will vary depending on the chosen integration method. However, the general process typically involves the following steps:

- Assess Your Needs: Identify the specific data you need to synchronize between CRM and QuickBooks. Determine the direction of data flow (e.g., from CRM to QuickBooks, from QuickBooks to CRM, or bidirectional).

- Choose an Integration Method: Select the integration method that best suits your needs and technical capabilities (native integration, third-party platform, custom integration, or API integration).

- Select the Right Tools: Determine which CRM and QuickBooks versions are compatible with your integration method.

- Set Up Your Accounts: Ensure you have active accounts for both your CRM and QuickBooks systems.

- Configure the Integration: Follow the instructions provided by your chosen integration method to configure the connection between CRM and QuickBooks. This may involve entering API keys, mapping fields, and setting up data synchronization rules.

- Test the Integration: Thoroughly test the integration to ensure that data is synchronizing correctly. Verify that data is flowing in the correct direction and that all fields are mapped correctly.

- Monitor and Maintain the Integration: Regularly monitor the integration to ensure that it continues to function correctly. Address any issues promptly and update the integration as needed.

Data Synchronization: What to Expect

The data that can be synchronized between CRM and QuickBooks varies depending on the integration method and the specific features of your CRM and QuickBooks systems. However, common data synchronization scenarios include:

- Customer Data: Synchronize customer information, such as contact details, addresses, and company information, between CRM and QuickBooks.

- Sales Data: Transfer sales data, such as sales orders, invoices, and payments, from CRM to QuickBooks.

- Product and Service Data: Synchronize product and service information, such as product names, prices, and descriptions, between CRM and QuickBooks.

- Financial Data: Exchange financial data, such as accounts receivable, accounts payable, and general ledger entries, between CRM and QuickBooks.

- Opportunity Data: Transfer opportunity data, such as sales stages, estimated revenue, and close dates, from CRM to QuickBooks.

It’s essential to carefully map the data fields between CRM and QuickBooks to ensure that data is synchronized accurately. Consider the data types, formats, and validation rules to avoid data errors and inconsistencies.

Best Practices for Successful CRM and QuickBooks Integration

Implementing CRM and QuickBooks integration successfully requires careful planning and execution. Here are some best practices to ensure a smooth and successful implementation:

- Plan Ahead: Develop a clear integration plan that outlines your goals, requirements, and timeline.

- Choose the Right Integration Method: Select the integration method that best suits your needs and technical capabilities.

- Map Data Fields Carefully: Ensure that data fields are mapped correctly between CRM and QuickBooks to avoid data errors.

- Test the Integration Thoroughly: Thoroughly test the integration to ensure that data is synchronizing correctly.

- Provide Training and Support: Train your employees on how to use the integrated systems and provide ongoing support.

- Monitor and Maintain the Integration: Regularly monitor the integration to ensure that it continues to function correctly.

- Back Up Your Data: Always back up your data before making any changes to your systems.

- Document the Process: Document the integration process, including the steps taken, the settings configured, and any troubleshooting steps.

- Start Small and Scale Gradually: Begin with a limited scope and gradually expand the integration as needed.

- Seek Expert Advice: If you’re unsure about any aspect of the integration process, seek expert advice from a consultant or integration specialist.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some issues during the CRM and QuickBooks integration process. Here are some common issues and their solutions:

- Data Synchronization Errors: These errors can occur if data fields are not mapped correctly or if there are data format inconsistencies. To resolve these errors, review the field mappings, verify the data formats, and correct any inconsistencies.

- Connectivity Issues: Connectivity issues can prevent data from synchronizing between CRM and QuickBooks. Ensure that your internet connection is stable, that your CRM and QuickBooks systems are online, and that the integration is properly configured.

- User Permissions: User permissions can sometimes prevent data from synchronizing. Verify that the user accounts have the necessary permissions to access and modify data in both CRM and QuickBooks.

- API Rate Limits: Some APIs have rate limits, which can restrict the number of requests that can be made within a certain time period. If you’re exceeding the API rate limits, consider optimizing your integration to reduce the number of requests or increasing the API rate limits (if possible).

- Data Conflicts: Data conflicts can occur if the same data is modified in both CRM and QuickBooks. To resolve these conflicts, establish clear data governance rules and procedures.

- Incorrect Field Mapping: If the data isn’t syncing correctly, double-check the field mapping to ensure that each field in the CRM is connected to the proper field in QuickBooks.

If you are experiencing persistent issues, consult the documentation for your CRM and QuickBooks systems or contact the support teams for assistance.

Real-World Examples of Successful Integration

Many businesses have successfully integrated CRM with QuickBooks, reaping significant benefits. Here are a few examples:

- Example 1: A small e-commerce business integrated its CRM with QuickBooks to automate the transfer of customer data, sales orders, and payments. This reduced manual data entry, improved data accuracy, and streamlined their accounting processes.

- Example 2: A marketing agency integrated its CRM with QuickBooks to track customer interactions, manage project budgets, and generate financial reports. This provided them with a complete view of their customer relationships and financial performance, enabling them to make informed decisions.

- Example 3: A construction company integrated its CRM with QuickBooks to manage leads, track project costs, and generate invoices. This improved their sales process, reduced project costs, and streamlined their billing and invoicing.

These examples demonstrate the versatility of CRM and QuickBooks integration and its potential to transform businesses of all sizes.

Future Trends in CRM and QuickBooks Integration

The integration of CRM and QuickBooks is constantly evolving, with new technologies and trends emerging. Here are some future trends to watch out for:

- AI-Powered Integration: Artificial intelligence (AI) is being used to automate data synchronization, improve data accuracy, and provide predictive insights.

- Mobile Integration: Mobile integration is becoming increasingly important, allowing businesses to access customer and financial data on the go.

- Integration with Other Business Systems: Businesses are increasingly integrating CRM and QuickBooks with other business systems, such as e-commerce platforms, marketing automation tools, and project management software.

- Enhanced Security: Security is a top priority, with businesses implementing more robust security measures to protect their data.

- Increased Automation: Automation will continue to play a key role in CRM and QuickBooks integration, further streamlining business processes.

Conclusion: Embrace Integration for Business Success

CRM integration with QuickBooks is a powerful strategy for businesses seeking to improve their efficiency, customer relationships, and financial management. By carefully planning and implementing the integration process, businesses can unlock a wealth of benefits, including enhanced data accuracy, reduced manual data entry, improved sales and revenue generation, streamlined financial management, enhanced customer service, and better reporting and analytics.

As technology continues to evolve, the importance of integration will only increase. Businesses that embrace integration will be well-positioned to thrive in the competitive business landscape. Take the time to assess your needs, choose the right integration method, and implement the integration effectively. By doing so, you can transform your business and achieve sustainable growth.

Start your journey towards seamless integration today. Research different integration methods, explore the features of your CRM and QuickBooks systems, and develop a plan for a successful implementation. By taking these steps, you can unlock the full potential of CRM and QuickBooks and drive your business towards greater success.