Seamlessly Connecting Your Business: Mastering CRM Integration with QuickBooks

Seamlessly Connecting Your Business: Mastering CRM Integration with QuickBooks

In today’s fast-paced business environment, efficiency and organization are paramount. Businesses are constantly seeking ways to streamline operations, improve customer relationships, and boost profitability. One of the most effective strategies for achieving these goals is the integration of Customer Relationship Management (CRM) systems with accounting software. This article delves deep into the benefits, processes, and best practices of CRM integration with QuickBooks, a leading accounting solution. We’ll explore how this powerful combination can transform your business, making it more agile, customer-centric, and ultimately, more successful.

Understanding the Power of CRM and QuickBooks Integration

Before diving into the specifics, it’s crucial to understand the individual strengths of CRM and QuickBooks and how their integration creates a synergy that’s greater than the sum of its parts.

What is CRM?

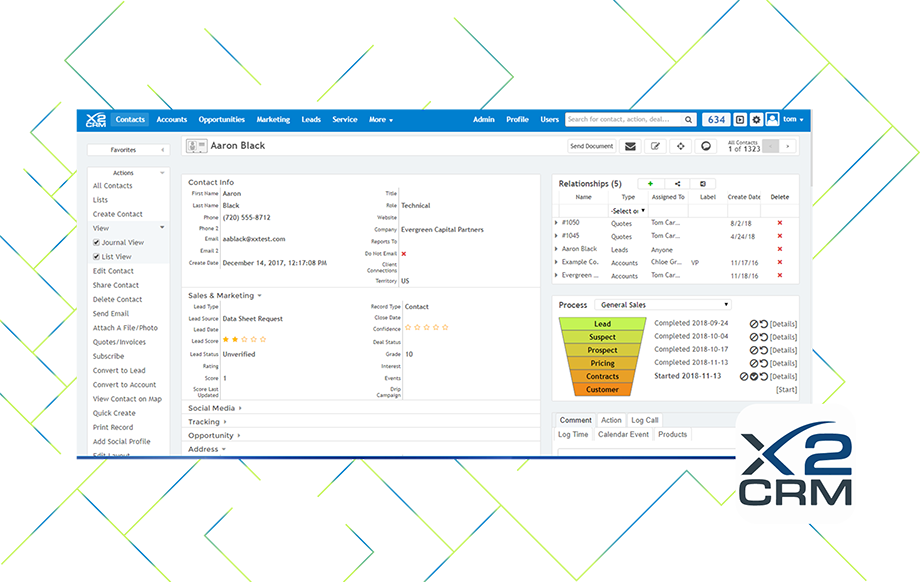

Customer Relationship Management (CRM) is a technology for managing all your company’s relationships and interactions with customers and potential customers. The goal is simple: improve business relationships. A CRM system helps companies stay connected to customers, streamline processes, and improve profitability. When people talk about CRM, they are usually referring to a CRM system – a tool that helps with contact management, sales management, productivity, and more. CRM software centralizes customer data, providing a 360-degree view of each customer interaction. This allows businesses to:

- Improve Customer Service: Accessing customer history, preferences, and past interactions enables you to provide personalized and proactive support.

- Enhance Sales Performance: CRM automates sales processes, tracks leads, and provides insights into sales performance, leading to increased conversion rates.

- Boost Marketing Effectiveness: CRM helps in segmenting customers, targeting marketing campaigns, and measuring their ROI.

- Gain Data-Driven Insights: CRM provides valuable data on customer behavior, sales trends, and marketing effectiveness, empowering businesses to make informed decisions.

What is QuickBooks?

QuickBooks is a popular accounting software solution designed for small and medium-sized businesses. It simplifies financial management by automating tasks such as:

- Invoice Creation and Management: Creating, sending, and tracking invoices.

- Expense Tracking: Recording and categorizing business expenses.

- Financial Reporting: Generating financial statements like profit and loss statements and balance sheets.

- Bank Reconciliation: Matching transactions with bank statements.

- Payroll Management: Managing employee salaries and taxes (in some versions).

The Synergy of Integration

Integrating CRM with QuickBooks brings together the customer-focused capabilities of CRM with the financial management strength of QuickBooks. This integration offers a multitude of benefits, including:

- Automated Data Synchronization: Eliminates manual data entry and reduces the risk of errors by automatically syncing customer data, invoices, payments, and other financial information between the two systems.

- Improved Accuracy: Reduces the chances of discrepancies and ensures that financial data is up-to-date and accurate.

- Enhanced Efficiency: Saves time and resources by automating tasks, allowing employees to focus on core business activities.

- Better Decision-Making: Provides a holistic view of the customer journey, from initial contact to purchase and beyond, enabling better business decisions.

- Streamlined Workflows: Simplifies business processes, from sales to finance, creating a more cohesive and efficient workflow.

Benefits of CRM Integration with QuickBooks

The advantages of integrating CRM with QuickBooks are numerous and can significantly impact various aspects of your business. Let’s explore the key benefits in detail:

Enhanced Sales Performance

Integration empowers sales teams with real-time access to financial information. Sales representatives can easily see a customer’s payment history, outstanding invoices, and credit limits directly within the CRM system. This allows them to:

- Close Deals Faster: Quickly address financial concerns and move deals through the sales pipeline more efficiently.

- Improve Customer Relationships: Provide more informed and personalized service based on a comprehensive understanding of the customer’s financial standing.

- Reduce Delays: Avoid delays caused by waiting for financial information.

Streamlined Accounting Processes

Integration automates the flow of financial data between CRM and QuickBooks, dramatically reducing manual data entry and errors. Benefits include:

- Automated Invoice Creation: Generate invoices automatically from within the CRM system once a sale is closed, eliminating the need to manually create them in QuickBooks.

- Automated Payment Tracking: Automatically record payments received in the CRM system, updating the customer’s financial record in QuickBooks.

- Simplified Reporting: Generate accurate financial reports with real-time data, providing a clear picture of sales, revenue, and expenses.

- Reduced Errors: Minimize the risk of human error associated with manual data entry.

Improved Customer Service

By having access to financial information within the CRM system, customer service representatives can provide better and more informed support. This includes:

- Faster Response Times: Quickly access customer payment history, outstanding invoices, and other financial information to address customer inquiries efficiently.

- Personalized Service: Provide tailored support based on a comprehensive understanding of the customer’s financial relationship with your business.

- Proactive Support: Identify potential issues, such as overdue invoices, and proactively reach out to customers to resolve them.

Better Data Visibility and Reporting

Integration provides a comprehensive view of your business, connecting customer interactions with financial data. This enables you to:

- Gain a 360-Degree View of Customers: Understand the complete customer journey, from initial contact to purchase and beyond.

- Improve Forecasting: Use sales and financial data to make more accurate revenue forecasts.

- Track Key Performance Indicators (KPIs): Monitor important metrics, such as customer lifetime value, sales cycle length, and customer acquisition cost.

- Make Data-Driven Decisions: Leverage real-time data to make informed decisions about sales, marketing, and customer service strategies.

Increased Efficiency and Productivity

Automation and streamlined workflows free up valuable time and resources, allowing your team to focus on more strategic tasks. This translates to:

- Reduced Manual Data Entry: Automate the transfer of data between systems, saving time and reducing the risk of errors.

- Faster Processes: Streamline sales, accounting, and customer service processes, leading to faster turnaround times.

- Improved Employee Productivity: Empower employees with the tools and information they need to work more efficiently and effectively.

- Cost Savings: Reduce labor costs and eliminate the need for redundant data entry.

How to Integrate CRM with QuickBooks: A Step-by-Step Guide

The process of integrating CRM with QuickBooks can vary depending on the specific CRM and QuickBooks versions you are using. However, the general steps involved are as follows:

1. Choose Your Integration Method

There are several methods for integrating CRM with QuickBooks:

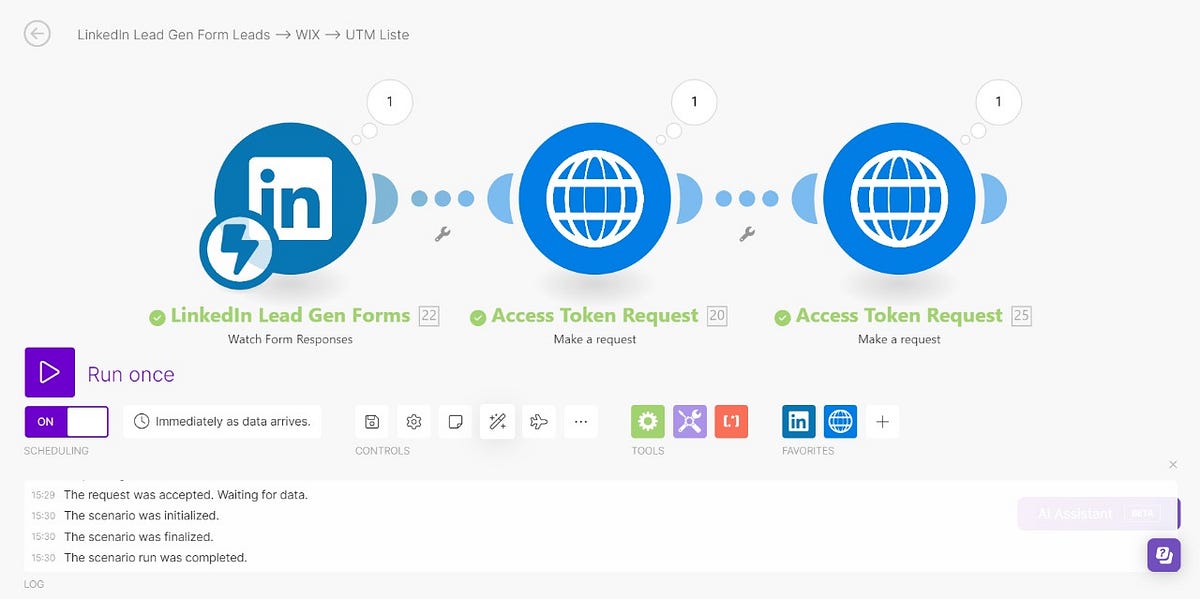

- Native Integrations: Some CRM systems offer native integrations with QuickBooks. These integrations are pre-built and often provide the most seamless experience.

- Third-Party Integrations: Several third-party integration platforms specialize in connecting CRM and QuickBooks. These platforms offer a wide range of features and customization options.

- Custom Integrations: For more complex requirements, you can develop a custom integration using APIs (Application Programming Interfaces) provided by both CRM and QuickBooks.

Consider your business needs, budget, and technical expertise when choosing an integration method.

2. Select an Integration Solution

If you choose a third-party integration platform, research and compare different options. Key factors to consider include:

- Compatibility: Ensure the platform is compatible with your specific CRM and QuickBooks versions.

- Features: Determine which features are essential for your business, such as automated data synchronization, invoice creation, and payment tracking.

- Ease of Use: Look for a user-friendly platform with an intuitive interface.

- Support: Check the provider’s support options, including documentation, tutorials, and customer support.

- Pricing: Compare pricing plans and choose the one that best fits your budget.

3. Set Up Your Accounts

Once you’ve chosen an integration solution, you’ll need to set up your accounts and configure the integration. This typically involves:

- Connecting Your CRM and QuickBooks Accounts: Provide the necessary credentials to connect your CRM and QuickBooks accounts to the integration platform.

- Mapping Fields: Map the fields in your CRM system to the corresponding fields in QuickBooks. This ensures that data is accurately transferred between the two systems.

- Configuring Data Synchronization: Set up how and when data will be synchronized between the two systems. You can choose to synchronize data in real-time, on a schedule, or manually.

4. Test the Integration

Before going live, thoroughly test the integration to ensure that data is being synchronized correctly. This includes:

- Creating Test Data: Create test customer records, invoices, and payments in both systems.

- Verifying Data Synchronization: Confirm that the data is being synchronized accurately between the two systems.

- Addressing Errors: Identify and resolve any errors or issues that arise during testing.

5. Go Live and Monitor the Integration

Once you’re satisfied with the testing results, you can go live with the integration. Monitor the integration regularly to ensure that it’s working correctly and to identify any potential issues. This may involve:

- Checking Data Synchronization Logs: Review the logs to identify any errors or synchronization issues.

- Monitoring Performance: Monitor the performance of the integration to ensure that it’s not causing any performance issues.

- Updating the Integration: Keep the integration up-to-date with the latest versions of your CRM and QuickBooks software.

Popular CRM Systems Compatible with QuickBooks

Many CRM systems offer integration with QuickBooks. Here are some of the most popular options:

- Salesforce: A leading CRM platform with robust integration capabilities. Salesforce offers native and third-party integrations with QuickBooks.

- Zoho CRM: A comprehensive CRM solution with a user-friendly interface and affordable pricing. Zoho CRM offers native integrations with QuickBooks.

- HubSpot CRM: A free CRM platform with a focus on inbound marketing and sales. HubSpot CRM offers a native integration with QuickBooks.

- Pipedrive: A sales-focused CRM platform designed to help sales teams manage their deals and pipeline. Pipedrive offers third-party integrations with QuickBooks.

- Microsoft Dynamics 365: A comprehensive CRM and ERP (Enterprise Resource Planning) platform that offers robust integration options. Microsoft Dynamics 365 offers both native and third-party integrations with QuickBooks.

When choosing a CRM, consider your business needs, budget, and the availability of integrations with QuickBooks.

Choosing the Right QuickBooks Version for Integration

QuickBooks offers various versions, each designed for different business needs. When considering CRM integration, it’s crucial to choose the right QuickBooks version. Here’s a general overview:

- QuickBooks Online: A cloud-based version of QuickBooks, offering flexibility and accessibility from anywhere with an internet connection. It generally has good integration capabilities.

- QuickBooks Desktop: A desktop-based version, offering more features and customization options. Integration capabilities may vary depending on the specific desktop version.

- QuickBooks Enterprise: A more advanced version designed for larger businesses with complex needs. It typically offers the most robust integration options.

Check with your chosen CRM integration solution to ensure compatibility with your QuickBooks version.

Tips for Successful CRM and QuickBooks Integration

To maximize the benefits of CRM and QuickBooks integration, keep these tips in mind:

- Plan Your Integration Strategy: Before starting the integration, clearly define your goals and objectives. Identify which data you want to synchronize and how it should be mapped.

- Clean Your Data: Ensure that your customer and financial data are accurate and up-to-date before integrating the two systems. This will help avoid data inconsistencies and errors.

- Choose the Right Integration Partner: If you’re using a third-party integration platform, choose a reputable provider with a proven track record.

- Train Your Team: Provide adequate training to your employees on how to use the integrated systems.

- Monitor and Maintain the Integration: Regularly monitor the integration to ensure that it’s working correctly and to identify any potential issues.

- Start Small and Scale: Begin with a pilot project to test the integration before implementing it across your entire business.

- Document Everything: Keep detailed records of your integration process, including the steps taken, the settings used, and any issues encountered.

- Seek Professional Help: Consider seeking assistance from a consultant or integration specialist if you need help with the integration process.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some issues during the integration process. Here are some common problems and how to address them:

- Data Synchronization Errors: These can occur if there are discrepancies between the data formats in your CRM and QuickBooks. Ensure that you’ve correctly mapped the fields and that the data types are compatible.

- Duplicate Data: Duplicate customer records or transactions can occur if the integration is not set up correctly. Implement deduplication rules within your CRM and QuickBooks, or the integration platform, to avoid this.

- Performance Issues: If the integration is synchronizing a large amount of data, it can slow down the performance of both systems. Consider optimizing the data synchronization frequency or excluding unnecessary data from the synchronization.

- Connectivity Problems: Ensure that your CRM and QuickBooks systems are connected to the internet and that your firewall or security settings are not blocking the integration.

- Authorization Issues: Make sure that the integration platform has the necessary permissions to access your CRM and QuickBooks accounts.

- Version Compatibility: Confirm that your CRM and QuickBooks versions are compatible with the integration solution.

- Data Loss: Always back up your data before making any significant changes to your CRM or QuickBooks systems.

If you encounter any persistent issues, consult the documentation for your integration solution, contact the vendor’s support team, or seek help from a qualified consultant.

The Future of CRM and QuickBooks Integration

The integration between CRM and QuickBooks is constantly evolving. As technology advances, we can expect to see:

- More Advanced Automation: AI-powered automation will further streamline processes, such as automatically creating invoices, sending payment reminders, and generating financial reports.

- Improved Data Analytics: Integration will provide deeper insights into customer behavior, sales trends, and financial performance, enabling businesses to make more informed decisions.

- Enhanced Customization: Businesses will have more flexibility to customize the integration to meet their specific needs.

- Greater Integration with Other Business Systems: CRM and QuickBooks will integrate with other business systems, such as e-commerce platforms and marketing automation tools, creating a more cohesive and efficient business ecosystem.

- Increased Focus on Mobile: Mobile accessibility will become even more critical, enabling businesses to manage their CRM and financial data from anywhere.

The future of CRM and QuickBooks integration looks bright, with the potential to transform how businesses operate and succeed.

Conclusion: Embracing Integration for Business Success

Integrating CRM with QuickBooks is a strategic move that can significantly improve your business operations. By streamlining processes, enhancing sales performance, improving customer service, and gaining better data visibility, you can create a more efficient, customer-centric, and profitable business. Whether you are a small business or a large enterprise, the benefits of this integration are undeniable. Take the time to plan your integration strategy, choose the right solution, and train your team, and you’ll be well on your way to achieving your business goals. In today’s competitive landscape, embracing integration isn’t just an option; it’s a necessity for sustainable success. Don’t delay – start exploring the possibilities of CRM integration with QuickBooks today and unlock the full potential of your business.