Seamlessly Connecting Your Business: Mastering CRM Integration with QuickBooks

The Power of Integration: CRM and QuickBooks Working Together

Running a business is a complex dance. You’re juggling customer relationships, financial management, sales pipelines, and a whole host of other critical tasks. It’s a constant balancing act, and the tools you use can either make it easier or add to the chaos. This is where the power of integration comes in, specifically, the integration of Customer Relationship Management (CRM) software with QuickBooks. It’s a game-changer.

Think of it this way: your CRM is the brain of your customer interactions, storing everything from contact information and communication history to sales opportunities and support tickets. QuickBooks, on the other hand, is the financial heart of your business, meticulously tracking income, expenses, and everything in between. When these two systems work in isolation, you’re forced to manually transfer data, leading to wasted time, potential errors, and a fragmented view of your business. Integration bridges this gap, creating a unified, streamlined workflow that boosts efficiency and profitability.

This article dives deep into the world of CRM integration with QuickBooks. We’ll explore the ‘why’ and ‘how’ of this powerful combination, examining the benefits, the different integration methods, and the key considerations for a successful implementation. Whether you’re a small business owner, a seasoned entrepreneur, or a financial professional, this guide will provide you with the knowledge and insights you need to harness the full potential of CRM and QuickBooks working in harmony.

Understanding the Fundamentals: CRM and QuickBooks Explained

What is CRM?

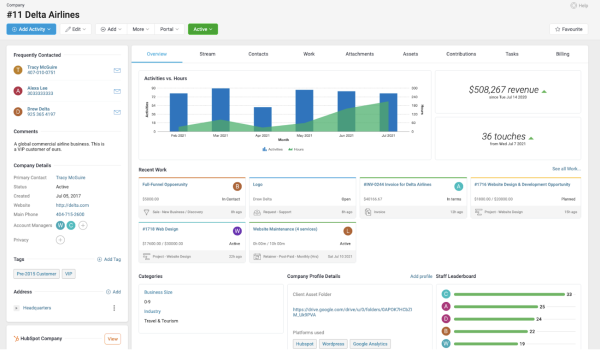

Customer Relationship Management (CRM) software is more than just a contact database; it’s a strategic approach to managing and analyzing customer interactions and data throughout the customer lifecycle. It’s the backbone of building lasting relationships, fostering customer loyalty, and driving sustainable growth. Think of it as your central hub for all things customer-related.

Key features of CRM systems typically include:

- Contact Management: Storing and organizing customer information, including contact details, communication history, and demographics.

- Sales Automation: Managing sales pipelines, tracking leads, and automating sales processes.

- Marketing Automation: Automating marketing campaigns, tracking leads, and personalizing customer interactions.

- Customer Service and Support: Managing support tickets, providing self-service options, and improving customer satisfaction.

- Reporting and Analytics: Providing insights into customer behavior, sales performance, and marketing effectiveness.

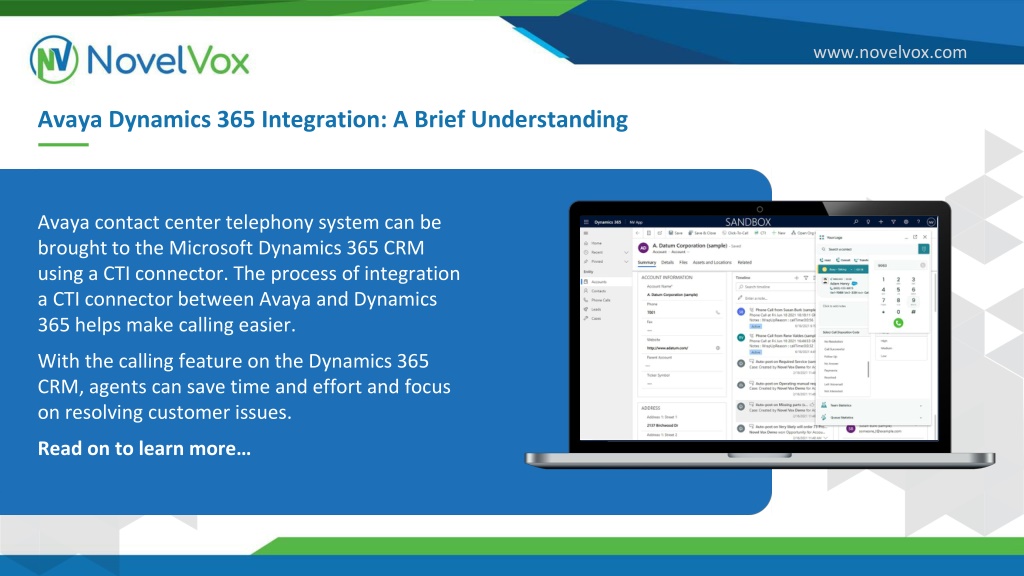

Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365, each offering a range of features and pricing options to suit different business needs.

What is QuickBooks?

QuickBooks is a widely used accounting software designed to simplify financial management for small and medium-sized businesses. It’s the go-to solution for many entrepreneurs and business owners, providing a comprehensive suite of tools to manage finances effectively.

Key features of QuickBooks include:

- Invoice Management: Creating and sending invoices, tracking payments, and managing accounts receivable.

- Expense Tracking: Recording and categorizing expenses, tracking vendor payments, and managing accounts payable.

- Bank Reconciliation: Connecting to bank accounts to automatically import transactions and reconcile accounts.

- Financial Reporting: Generating financial statements, such as income statements, balance sheets, and cash flow statements.

- Payroll Management: Processing payroll, managing employee wages, and filing payroll taxes (in some versions).

QuickBooks offers different versions, including QuickBooks Online (cloud-based) and QuickBooks Desktop (installed software), each with its own features and pricing plans.

Why Integrate CRM with QuickBooks? The Benefits Unveiled

The benefits of integrating your CRM with QuickBooks are numerous and far-reaching, impacting nearly every aspect of your business. Here are some of the key advantages:

Improved Efficiency and Productivity

One of the most significant benefits is the dramatic increase in efficiency. By eliminating manual data entry, you free up valuable time that your team can dedicate to more strategic tasks, such as closing deals, providing excellent customer service, or developing innovative products. Imagine the time saved by not having to manually transfer customer data, sales figures, and payment information between your CRM and QuickBooks. This time savings translates directly into increased productivity and a more streamlined workflow.

Reduced Errors and Data Accuracy

Manual data entry is prone to errors. Typos, incorrect formatting, and misinterpretations are all too common when data is transferred manually. Integration automates this process, ensuring that data is accurately and consistently transferred between your CRM and QuickBooks. This reduces the risk of errors in your financial records, leading to more reliable financial reporting and better decision-making.

Enhanced Financial Visibility and Reporting

Integration provides a holistic view of your business finances. By connecting your CRM and QuickBooks, you gain access to real-time financial data directly within your CRM. This allows you to track key metrics, such as customer lifetime value, sales revenue, and profitability, with greater accuracy and ease. You can generate reports that combine sales data from your CRM with financial data from QuickBooks, providing a comprehensive understanding of your business performance.

Better Customer Relationship Management

Integration improves your ability to manage customer relationships. By having access to financial data within your CRM, you can gain a deeper understanding of your customers’ purchasing behavior, payment history, and overall value. This information can be used to personalize customer interactions, tailor marketing campaigns, and provide more effective customer service. For example, you can quickly see if a customer has outstanding invoices before offering them a new service or product, preventing awkward situations and maintaining a professional image.

Streamlined Sales Processes

Integration streamlines your sales processes by automating tasks such as invoice generation, payment tracking, and revenue recognition. When a sale is closed in your CRM, the invoice can be automatically created and sent to the customer in QuickBooks. Payments can be automatically recorded, and revenue can be recognized based on the terms of the sale. This saves time, reduces errors, and allows your sales team to focus on closing deals.

Improved Cash Flow Management

Integration provides better visibility into your cash flow. By tracking invoices, payments, and outstanding balances in both your CRM and QuickBooks, you can monitor your cash flow more effectively. This allows you to identify potential cash flow problems early on and take proactive steps to address them, such as sending payment reminders or adjusting your payment terms.

Enhanced Collaboration Between Teams

Integration fosters better collaboration between your sales, marketing, and finance teams. By providing all teams with access to the same data, you break down silos and improve communication. Sales can see customer payment history, marketing can analyze customer spending patterns, and finance can track sales performance. This shared understanding can lead to better decision-making and improved overall business performance.

Methods for Integrating CRM and QuickBooks

There are several methods for integrating your CRM with QuickBooks. The best method for your business will depend on factors such as the CRM and QuickBooks versions you use, your technical expertise, and your budget. Here are some of the most common methods:

Native Integrations

Some CRM and QuickBooks platforms offer native integrations, which means they have built-in connectors that allow you to easily connect the two systems. These integrations are often the easiest to set up and use, as they are designed to work seamlessly together. Examples include the QuickBooks Online integration with Salesforce or HubSpot. These integrations typically offer a range of features, such as:

- Contact and Account Synchronization: Automatically synchronizing customer and contact information between the CRM and QuickBooks.

- Invoice and Payment Synchronization: Automatically syncing invoices and payments between the two systems.

- Sales Data Synchronization: Automatically syncing sales data, such as sales orders and revenue, between the two systems.

Native integrations are often the preferred method for businesses that want a simple and straightforward integration solution.

Third-Party Integration Platforms

Third-party integration platforms, such as Zapier, Make (formerly Integromat), and PieSync (now part of HubSpot), provide a platform for connecting different applications, including CRM and QuickBooks. These platforms offer a wide range of pre-built connectors and automation tools that allow you to create custom integrations without the need for coding. They work by triggering actions in one application based on events in another. For example, you can set up a Zap in Zapier that automatically creates a new customer record in QuickBooks when a new contact is added to your CRM. Third-party integration platforms offer flexibility and are a good option for businesses that want to connect a wider range of applications or create more complex integrations.

Custom Integrations

Custom integrations involve developing your own integration solution using APIs (Application Programming Interfaces) provided by the CRM and QuickBooks platforms. This method requires technical expertise and is typically used by businesses with in-house development teams or those that work with external developers. Custom integrations offer the greatest flexibility and control over the integration process, allowing you to tailor the integration to your specific business needs. However, they can be more time-consuming and expensive to develop and maintain.

Considerations When Choosing an Integration Method

When choosing an integration method, consider the following factors:

- CRM and QuickBooks Versions: Ensure that the integration method you choose is compatible with the versions of your CRM and QuickBooks.

- Features and Functionality: Determine the specific features and functionality you need from the integration, such as contact synchronization, invoice synchronization, and sales data synchronization.

- Technical Expertise: Assess your team’s technical expertise and choose an integration method that aligns with your skills and resources.

- Budget: Consider the cost of the integration, including the cost of the integration platform, the cost of any development services, and the ongoing maintenance costs.

- Scalability: Choose an integration method that can scale as your business grows and your integration needs evolve.

Step-by-Step Guide to CRM and QuickBooks Integration (Using a Common Method)

While the specific steps for integrating your CRM with QuickBooks will vary depending on the method you choose, here’s a general guide using a common method: using a third-party integration platform like Zapier (example).

Step 1: Choose an Integration Platform

Select a third-party integration platform that supports both your CRM and QuickBooks. Zapier, Make, and PieSync are popular choices. Consider the platform’s pricing, ease of use, and the available integrations.

Step 2: Create Accounts

If you don’t already have them, create accounts with both the integration platform and your CRM and QuickBooks. You’ll need to have valid login credentials for each.

Step 3: Connect Your Accounts

Within the integration platform, connect your CRM and QuickBooks accounts. This typically involves providing your login credentials for each application and granting the platform access to your data. The platform will then authenticate your accounts and establish the connection.

Step 4: Define the Integration Workflow (Zap, Scenario, or Sync)

This is where you set up the specific actions you want to automate. In Zapier, this is called a ‘Zap’. In Make, it’s a ‘Scenario’. In PieSync, it’s a ‘Sync’. You’ll define the trigger (the event that starts the automation) and the action (what happens in the other application). For example:

- Trigger: A new contact is created in your CRM.

- Action: A new customer is created in QuickBooks.

Or:

- Trigger: An invoice is marked as paid in QuickBooks.

- Action: The corresponding opportunity in your CRM is updated to ‘Won’ or ‘Closed Won’.

Step 5: Map the Fields

Map the fields between your CRM and QuickBooks. This tells the platform which data from your CRM should be transferred to which fields in QuickBooks, and vice-versa. For example, you’ll map the ‘First Name’, ‘Last Name’, and ‘Email’ fields from your CRM to the corresponding fields in QuickBooks.

Step 6: Test the Integration

Before you go live, thoroughly test your integration. Create a test contact in your CRM and ensure that it’s correctly synced to QuickBooks. Verify that invoices and payments are being synced as expected. This will help you identify and resolve any issues before they impact your live data.

Step 7: Activate the Integration

Once you’re satisfied with the testing, activate your integration. The platform will then start automatically syncing data between your CRM and QuickBooks, according to the workflows you’ve defined.

Step 8: Monitor and Maintain

Regularly monitor your integration to ensure that it’s functioning correctly. Review the logs provided by the integration platform to identify any errors or issues. Make sure to update your integration if you make changes to your CRM or QuickBooks settings or if the platform updates its features.

Choosing the Right CRM and QuickBooks Integration: Key Considerations

Selecting the right CRM and QuickBooks integration is a crucial decision. Consider these key factors to ensure a successful implementation:

Assess Your Business Needs

Before you start, clearly define your business needs and goals. What specific problems are you trying to solve with the integration? What are your key priorities? Do you need to synchronize contacts, invoices, sales data, or all of the above? The answers to these questions will help you narrow down your options and choose the best integration method.

Compatibility

Ensure that the integration method you choose is compatible with the versions of your CRM and QuickBooks. Check the integration platform’s website or documentation to confirm that it supports your specific software versions. Consider the compatibility of any add-ons or extensions you may be using within either platform. Ensure that these are also compatible with the integration.

Data Mapping

Carefully plan how your data will be mapped between your CRM and QuickBooks. Understand which fields need to be synchronized and how the data will be transferred. Inaccurate data mapping can lead to errors and inefficiencies, so take the time to plan this step thoroughly. Consider the following:

- Field Mapping: Ensure that the fields in your CRM and QuickBooks are mapped correctly. For example, map the ‘Customer Name’ field in your CRM to the ‘Customer Name’ field in QuickBooks.

- Data Formatting: Consider data formatting issues. For example, ensure that dates are formatted consistently across both systems.

- Data Integrity: Think about how data will be handled if a field is missing in one system or the other.

Security

Prioritize security when choosing an integration method. Ensure that the platform you use has robust security measures in place to protect your data. Look for platforms that offer features such as:

- Data Encryption: Encrypting data in transit and at rest to protect it from unauthorized access.

- Two-Factor Authentication: Requiring two-factor authentication to protect your accounts.

- Compliance: Adhering to industry-standard security regulations.

Scalability

Choose an integration method that can scale as your business grows. As your business expands, you’ll likely need to add more users, manage more data, and integrate with other applications. Ensure that the integration platform can handle the increased load and can adapt to your evolving needs. Consider the platform’s pricing plans and whether they align with your long-term growth plans.

Cost

Carefully evaluate the cost of the integration, including the cost of the integration platform, any development services, and the ongoing maintenance costs. Compare the pricing plans of different platforms and choose the one that offers the best value for your business needs. Don’t forget to factor in the cost of your time and the time of your team members who will be involved in the implementation and maintenance of the integration.

Support and Documentation

Choose a platform that offers excellent support and documentation. Look for platforms that provide:

- Comprehensive Documentation: Detailed documentation that explains how to set up and use the integration.

- Responsive Support: A responsive support team that can assist you with any issues you may encounter.

- Community Forums: Community forums where you can connect with other users and share tips and advice.

Testing and Training

Thoroughly test the integration before you go live. Create test data and ensure that it’s correctly synced between your CRM and QuickBooks. Provide training to your team members on how to use the integrated system. This will help to ensure a smooth transition and maximize the benefits of the integration.

Troubleshooting Common CRM and QuickBooks Integration Issues

Even with careful planning, you might encounter some issues during the integration process. Here are some common problems and how to troubleshoot them:

Data Synchronization Errors

Data synchronization errors are one of the most common issues. These errors can occur for various reasons, such as incorrect data mapping, formatting issues, or conflicts between data in your CRM and QuickBooks. To troubleshoot data synchronization errors:

- Check the Logs: Review the logs provided by your integration platform to identify the source of the error.

- Verify Data Mapping: Ensure that your data mapping is correct and that the fields in your CRM and QuickBooks are mapped correctly.

- Check Data Formatting: Make sure that your data is formatted consistently across both systems.

- Resolve Conflicts: If there are conflicts between data in your CRM and QuickBooks, determine which data is correct and update the other system accordingly.

Connectivity Issues

Connectivity issues can prevent data from being synced between your CRM and QuickBooks. These issues can be caused by network problems, server outages, or incorrect login credentials. To troubleshoot connectivity issues:

- Check Your Internet Connection: Ensure that you have a stable internet connection.

- Verify Server Status: Check the status of the servers for your CRM, QuickBooks, and integration platform.

- Re-enter Login Credentials: Double-check your login credentials for your CRM, QuickBooks, and integration platform.

- Contact Support: If the issue persists, contact the support teams for your CRM, QuickBooks, and integration platform.

Performance Issues

Slow data synchronization can impact your productivity. Performance issues can be caused by a large volume of data, inefficient integration workflows, or limitations of the integration platform. To troubleshoot performance issues:

- Optimize Workflows: Simplify your integration workflows to reduce the number of steps involved.

- Limit Data Synchronization: Limit the amount of data that is synchronized to improve performance.

- Upgrade Your Platform: Consider upgrading to a higher-tier plan with your integration platform or CRM/QuickBooks if performance is a persistent problem.

- Contact Support: If performance issues continue, contact the support team for your integration platform.

Security Concerns

Security is paramount. If you suspect security breaches or unauthorized access, take immediate action:

- Review Permissions: Audit user permissions in your CRM and QuickBooks.

- Change Passwords: Immediately change all passwords associated with the integration.

- Contact Support: Contact the support team for your CRM, QuickBooks, and integration platform to report the issue.

The Future of CRM and QuickBooks Integration

The landscape of business technology is constantly evolving, and the integration of CRM and QuickBooks is no exception. Here’s a glimpse into the future of this powerful combination:

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are poised to revolutionize CRM and QuickBooks integration. Expect to see:

- Predictive Analytics: AI-powered insights that predict customer behavior, sales trends, and financial performance.

- Intelligent Automation: Automated workflows that learn and adapt to your business processes, optimizing efficiency.

- Personalized Recommendations: AI-driven recommendations to help your sales team close deals, and your finance team manage cash flow.

Enhanced Automation

Automation will become even more sophisticated, with the ability to handle complex tasks and workflows seamlessly. This means:

- Advanced Data Synchronization: Real-time data synchronization across multiple platforms.

- Trigger-Based Actions: Automated actions based on specific events or conditions.

- Automated Reporting: Automated generation of financial and sales reports.

Increased Customization

Businesses will have greater control over their integrations, with the ability to customize them to meet their specific needs. This means:

- Flexible Integration Options: More flexible and customizable integration options.

- API-Driven Integrations: API-driven integrations that allow for greater control and customization.

- User-Friendly Interfaces: User-friendly interfaces that make it easy to configure and manage integrations.

Focus on User Experience

Integration platforms will prioritize user experience, making it easier for businesses to set up and manage their integrations. This means:

- Simplified Setup: Simplified setup processes.

- Intuitive Interfaces: More intuitive and user-friendly interfaces.

- Improved Support: Enhanced support and documentation.

By embracing these advancements, businesses can unlock even greater value from their CRM and QuickBooks integration, driving growth, efficiency, and customer satisfaction.

Conclusion: Embrace the Power of Integration

CRM integration with QuickBooks is no longer a luxury; it’s a necessity for businesses seeking to thrive in today’s competitive landscape. By seamlessly connecting your customer relationship management and financial management systems, you can unlock a wealth of benefits, from improved efficiency and reduced errors to enhanced financial visibility and better customer relationships.

This guide has provided you with a comprehensive overview of the integration process, from understanding the fundamentals of CRM and QuickBooks to exploring the different integration methods and troubleshooting common issues. By following the steps outlined in this article and carefully considering the key factors discussed, you can successfully integrate your CRM and QuickBooks and reap the rewards of a streamlined, efficient, and data-driven business.

Don’t let your systems work in isolation. Embrace the power of integration and take your business to the next level. The future of business is connected, and the time to connect your CRM and QuickBooks is now.