Seamlessly Connect: Mastering CRM Integration with QuickBooks for Business Growth

Seamlessly Connect: Mastering CRM Integration with QuickBooks for Business Growth

Running a business is a whirlwind of moving parts. You’re juggling customer relationships, sales pipelines, invoices, payments, and a whole host of other crucial tasks. In this chaotic dance, efficiency is king. That’s where the powerful duo of Customer Relationship Management (CRM) systems and QuickBooks accounting software comes into play. Specifically, we’re diving deep into CRM integration with QuickBooks, a game-changer for businesses seeking streamlined operations and enhanced growth.

This article will serve as your comprehensive guide to understanding, implementing, and maximizing the benefits of CRM integration with QuickBooks. We’ll explore the ‘why’ behind this integration, the ‘how’ of setting it up, and the ‘what’ of the tangible advantages you can expect. Get ready to transform your business processes and unlock a new level of operational efficiency.

Why CRM Integration with QuickBooks Matters

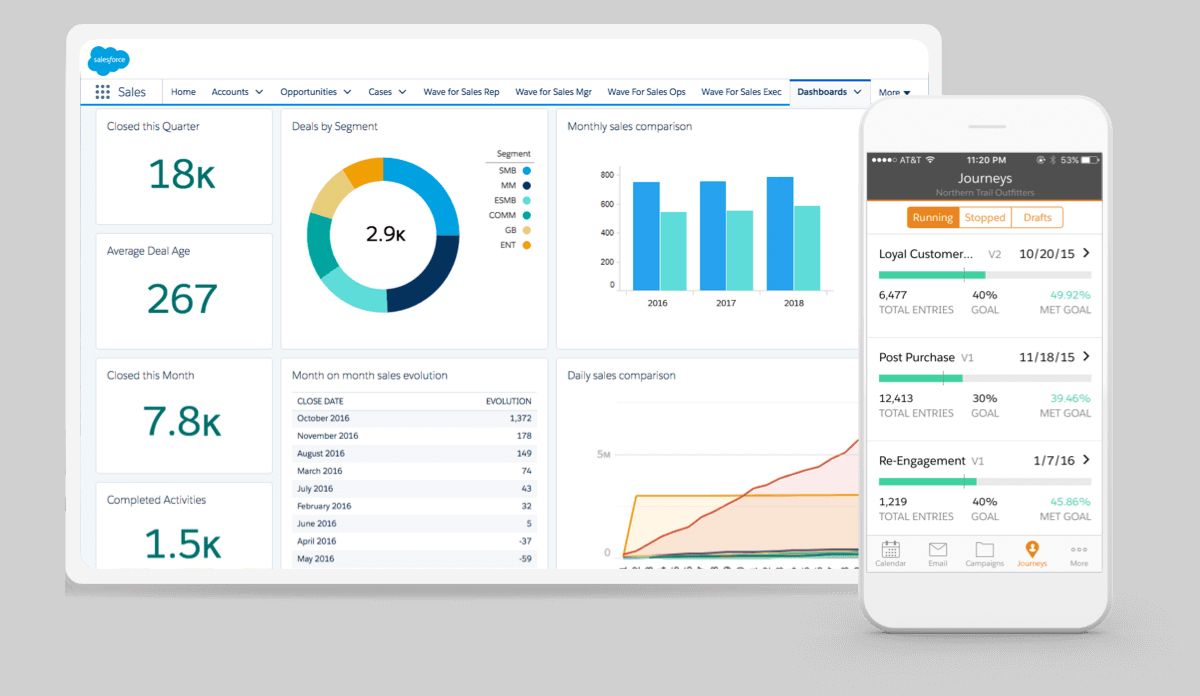

Before we get into the nitty-gritty, let’s understand why this integration is so vital. Think of your CRM as the central hub for all things customer-related. It houses contact information, tracks interactions, manages sales opportunities, and provides insights into customer behavior. QuickBooks, on the other hand, is your financial command center, handling invoices, payments, expenses, and financial reporting. When these two systems work in isolation, you’re essentially forcing your team to manually transfer data, a process that’s prone to errors, time-consuming, and ultimately, inefficient.

Here’s a breakdown of the key benefits:

- Eliminate Data Entry Duplication: Say goodbye to the tedious task of manually entering customer data and financial information into both systems. Integration automates this process, saving your team valuable time and reducing the risk of errors.

- Improve Data Accuracy: Manual data entry is a breeding ground for typos and inconsistencies. Integration ensures that data is synchronized between systems, maintaining accuracy and reliability.

- Gain a 360-Degree Customer View: Integration provides a holistic view of your customers. You can see their interactions with your sales team in the CRM and their payment history in QuickBooks, all in one place.

- Enhance Sales and Marketing Effectiveness: With integrated data, your sales and marketing teams can make more informed decisions. They can identify high-value customers, track sales performance, and tailor marketing campaigns based on real-time financial data.

- Streamline Accounting Processes: Integration simplifies accounting tasks like invoicing, payment tracking, and financial reporting. You can automate these processes, freeing up your accounting team to focus on more strategic activities.

- Boost Productivity: By automating data transfer and streamlining workflows, integration boosts overall productivity across your organization.

- Make Data-Driven Decisions: Access to real-time, integrated data empowers you to make informed decisions about your business. You can track key performance indicators (KPIs), identify trends, and optimize your strategies for growth.

Understanding the Key Components of Integration

To successfully integrate your CRM with QuickBooks, it’s crucial to understand the key components involved. These components work together to facilitate the seamless exchange of data between the two systems.

- The CRM System: This is the central hub for managing customer relationships. Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Pipedrive.

- QuickBooks: This is the accounting software that manages your finances. QuickBooks offers various versions, including QuickBooks Online and QuickBooks Desktop.

- The Integration Tool: This is the software or platform that facilitates the data exchange between the CRM and QuickBooks. There are several integration tools available, ranging from native integrations offered by some CRM providers to third-party integration platforms.

- The Data Mapping Process: This involves mapping the fields in your CRM to the corresponding fields in QuickBooks. This ensures that data is transferred accurately and consistently between the two systems.

- The Synchronization Process: This is the process of transferring data between the CRM and QuickBooks. Synchronization can be manual or automated, depending on the integration tool and your specific needs.

Choosing the Right CRM and QuickBooks Integration Tool

The market offers a variety of CRM and QuickBooks integration tools. The best choice for your business will depend on your specific needs, budget, and technical expertise. Here’s a look at some popular options:

Native Integrations

Some CRM providers offer native integrations with QuickBooks. These integrations are often easy to set up and use, as they are specifically designed to work with QuickBooks. However, they may have limited features compared to third-party integration platforms.

Pros:

- Easy to set up and use

- Often offer a seamless user experience

- May be more affordable than third-party platforms

Cons:

- Limited features compared to third-party platforms

- May only integrate with specific versions of QuickBooks

- Less flexibility in customization

Third-Party Integration Platforms

Third-party integration platforms offer more flexibility and features than native integrations. These platforms typically support a wider range of CRM systems and QuickBooks versions. They also offer advanced features such as data transformation, workflow automation, and custom field mapping.

Pros:

- Support a wide range of CRM systems and QuickBooks versions

- Offer advanced features such as data transformation and workflow automation

- Provide more flexibility in customization

Cons:

- May be more complex to set up and use

- Can be more expensive than native integrations

- Requires more technical expertise

Examples of Third-Party Integration Platforms:

- Zapier: A popular platform that connects thousands of apps, including CRM systems and QuickBooks. It’s known for its ease of use and extensive library of pre-built integrations.

- PieSync (by HubSpot): Specializes in two-way contact sync between CRM and other apps, ideal for businesses focused on contact management.

- Workato: An enterprise-grade integration platform with advanced features for complex integrations and workflow automation.

- Automate.io: Another user-friendly platform offering pre-built integrations and automation capabilities.

When choosing an integration tool, consider the following factors:

- Your CRM system: Make sure the tool supports your chosen CRM.

- Your QuickBooks version: Ensure the tool is compatible with your QuickBooks version (Online or Desktop).

- Your budget: Integration tools range in price from free to enterprise-level.

- Your technical expertise: Some tools are easier to set up and use than others.

- Your specific needs: Consider the features you need, such as data transformation, workflow automation, and custom field mapping.

Step-by-Step Guide to CRM and QuickBooks Integration

The specific steps for integrating your CRM with QuickBooks will vary depending on the integration tool you choose. However, the general process typically involves the following steps:

- Choose an Integration Tool: Select the integration tool that best meets your needs, considering the factors discussed above.

- Connect Your Accounts: Connect your CRM and QuickBooks accounts to the integration tool. You’ll typically need to provide your login credentials for both systems.

- Map Your Data: Map the fields in your CRM to the corresponding fields in QuickBooks. This ensures that data is transferred accurately and consistently. Common fields to map include customer names, addresses, email addresses, and phone numbers.

- Configure Your Settings: Configure your settings, such as the direction of data sync (one-way or two-way), the frequency of sync, and any filters you want to apply.

- Test Your Integration: Test your integration to ensure that data is being transferred correctly. You can do this by creating a new customer in your CRM and checking if it’s automatically created in QuickBooks.

- Monitor Your Integration: Regularly monitor your integration to ensure that it’s working as expected. Check for any errors or issues and troubleshoot them promptly.

Data Synchronization: One-Way vs. Two-Way

One of the critical decisions you’ll make during the integration process is whether to implement one-way or two-way data synchronization. Understanding the differences between these two approaches is crucial for making the right choice for your business.

One-Way Synchronization

In one-way synchronization, data flows in a single direction, typically from your CRM to QuickBooks. This means that when you create or update a customer record in your CRM, the information is automatically transferred to QuickBooks. However, changes made in QuickBooks are not reflected in your CRM.

Best for:

- Businesses that primarily use their CRM for customer management and QuickBooks for accounting.

- Situations where you want to ensure that customer data in QuickBooks is always up-to-date with the information in your CRM.

- Businesses that prioritize data accuracy in their financial records.

Pros:

- Simpler to set up and manage.

- Reduces the risk of data conflicts.

- Ensures data consistency in QuickBooks.

Cons:

- Changes made in QuickBooks are not reflected in your CRM.

- May require manual updates in your CRM if changes are made in QuickBooks.

Two-Way Synchronization

Two-way synchronization allows data to flow in both directions between your CRM and QuickBooks. This means that when you create or update a customer record in either system, the changes are automatically reflected in the other system. This approach provides a more comprehensive and integrated view of your customer data.

Best for:

- Businesses that want a fully integrated view of their customer data across both systems.

- Situations where both the CRM and QuickBooks are used extensively for customer management and accounting.

- Businesses that want to eliminate the need for manual data entry and ensure data consistency across both systems.

Pros:

- Provides a fully integrated view of your customer data.

- Eliminates the need for manual data entry.

- Ensures data consistency across both systems.

Cons:

- More complex to set up and manage.

- Requires careful consideration of data mapping and conflict resolution.

- May require more technical expertise.

Common Data to Synchronize

The specific data fields you choose to synchronize will depend on your business needs and the functionality of your CRM and QuickBooks systems. However, here are some common data fields that are typically synchronized:

- Customer Information: Customer name, address, phone number, email address, and other contact details.

- Invoice Information: Invoice number, date, amount, and line items.

- Payment Information: Payment date, amount, and method.

- Sales Transactions: Sales orders, quotes, and other sales-related data.

- Products and Services: Product names, descriptions, and prices.

- Accounts: Chart of accounts information for financial reporting.

Best Practices for Successful CRM and QuickBooks Integration

Implementing CRM and QuickBooks integration is a significant step towards streamlining your business processes. To ensure a smooth and successful integration, follow these best practices:

- Plan Your Integration: Before you begin, take the time to plan your integration. Define your goals, identify the data you want to synchronize, and choose the right integration tool.

- Clean Up Your Data: Ensure that your data is clean and accurate before you start the integration process. This will help prevent errors and ensure that data is synchronized correctly.

- Map Your Fields Carefully: Pay close attention to the data mapping process. Ensure that the fields in your CRM are mapped to the correct fields in QuickBooks.

- Test Your Integration Thoroughly: Test your integration thoroughly before going live. Create new customer records, invoices, and payments to ensure that data is being synchronized correctly.

- Monitor Your Integration Regularly: Regularly monitor your integration to ensure that it’s working as expected. Check for any errors or issues and troubleshoot them promptly.

- Provide Training to Your Team: Provide training to your team on how to use the integrated systems. This will help them understand how the systems work together and how to use the data effectively.

- Back Up Your Data: Regularly back up your data in both your CRM and QuickBooks systems. This will protect your data in case of any issues or errors.

- Choose the Right Sync Frequency: Determine the optimal sync frequency. Real-time synchronization may be ideal for some businesses, while others might benefit from daily or hourly syncs.

- Document Your Processes: Keep detailed documentation of your integration setup, data mapping, and troubleshooting steps. This will be invaluable for future reference and when training new team members.

- Consider Customizations (If Needed): If your business has unique needs, explore the possibility of customizing the integration. Some platforms offer options for custom fields and workflows.

Troubleshooting Common Integration Issues

Even with careful planning and implementation, you may encounter some common integration issues. Here’s how to troubleshoot them:

- Data Synchronization Errors: If data is not synchronizing correctly, check your connection settings, data mapping, and sync frequency. Review the error logs provided by your integration tool for clues.

- Duplicate Data: If you’re seeing duplicate data, review your data mapping and sync settings. Ensure that you’re not accidentally creating duplicate records.

- Missing Data: If data is missing, check your data mapping and sync settings. Ensure that the fields you want to synchronize are mapped correctly.

- Performance Issues: If your integration is slowing down your systems, try optimizing your sync frequency or reducing the amount of data being synchronized.

- Connection Problems: If you’re experiencing connection problems, check your internet connection and ensure that your CRM and QuickBooks accounts are still active.

Real-World Examples: How Businesses Benefit from CRM and QuickBooks Integration

Let’s look at a few examples of how businesses have benefited from CRM and QuickBooks integration:

- Example 1: A Consulting Firm: A consulting firm used to spend hours each week manually entering customer data and invoice information. After integrating their CRM with QuickBooks, they automated this process, saving them valuable time and reducing the risk of errors. They were able to focus on providing better services to their clients.

- Example 2: A Retail Business: A retail business used to struggle with tracking sales and managing customer relationships. After integrating their CRM with QuickBooks, they gained a 360-degree view of their customers. They could see their purchase history, track their interactions with the sales team, and tailor marketing campaigns based on real-time financial data. This led to increased sales and improved customer satisfaction.

- Example 3: A Manufacturing Company: A manufacturing company had difficulty tracking expenses and managing their finances. After integrating their CRM with QuickBooks, they streamlined their accounting processes. They could automate invoicing, track payments, and generate financial reports more efficiently. This freed up their accounting team to focus on more strategic activities.

The Future of CRM and QuickBooks Integration

As technology continues to evolve, the future of CRM and QuickBooks integration looks promising. We can expect to see:

- More Advanced Automation: Integration platforms will continue to offer more advanced automation features, such as automated workflows and data transformation.

- Improved Artificial Intelligence (AI): AI-powered features will become more common, such as AI-driven data analysis and automated insights.

- Greater Integration with Other Systems: Integration platforms will expand their capabilities to integrate with other systems, such as e-commerce platforms, marketing automation tools, and project management software.

- Enhanced User Experience: Integration platforms will continue to improve their user experience, making it easier for businesses to set up and manage their integrations.

Conclusion: Embracing the Power of Integration

CRM integration with QuickBooks is no longer a luxury; it’s a necessity for businesses seeking to thrive in today’s competitive landscape. By eliminating data silos, streamlining workflows, and providing a 360-degree view of your customers and finances, this integration empowers you to make data-driven decisions, boost productivity, and drive sustainable growth.

Take the first step towards a more efficient and profitable future. Evaluate your current processes, choose the right integration tool, and embark on a journey of seamless connectivity. The rewards – increased efficiency, improved accuracy, and enhanced customer relationships – are well worth the effort.

Don’t let manual data entry and disconnected systems hold you back. Embrace the power of CRM integration with QuickBooks and unlock the full potential of your business.