Unlocking Efficiency: The Power of CRM and QuickBooks Integration

In the bustling world of business, efficiency is the name of the game. Every entrepreneur, small business owner, and seasoned executive is constantly seeking ways to streamline operations, reduce errors, and ultimately, boost the bottom line. One of the most potent strategies for achieving this is the integration of Customer Relationship Management (CRM) systems with accounting software. And when it comes to accounting software, QuickBooks reigns supreme for many businesses. This article delves deep into the world of CRM integration with QuickBooks, exploring its benefits, implementation strategies, and the key considerations for a successful setup. We’ll uncover how this powerful combination can transform your business, making it more agile, customer-centric, and profitable.

Why Integrate CRM and QuickBooks? The Core Benefits

The synergy between a CRM system and QuickBooks is remarkable. It’s like having two essential tools that, when combined, become exponentially more effective. Here’s why this integration is a game-changer:

- Enhanced Data Accuracy: Manual data entry is a breeding ground for errors. Integrating CRM and QuickBooks automates the flow of information, eliminating the need for repetitive data entry. This reduces the risk of human error, ensuring that your financial and customer data is accurate and consistent.

- Time Savings: Imagine the hours you spend manually transferring data between your CRM and QuickBooks. Integration automates this process, freeing up your team to focus on more strategic tasks like sales, customer service, and business development. This boost in productivity is a significant advantage.

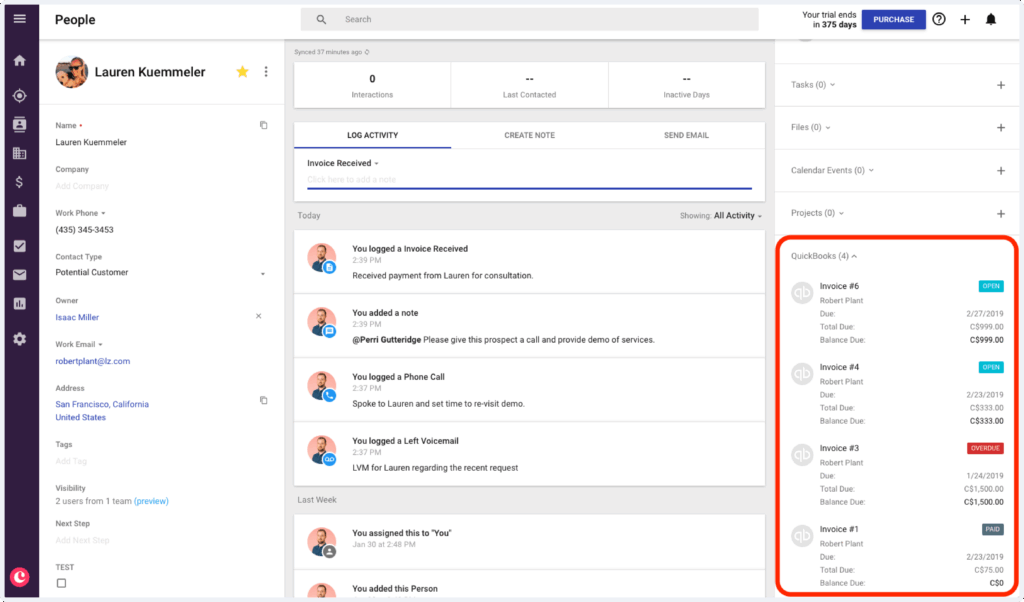

- Improved Sales and Marketing Effectiveness: With integrated systems, your sales and marketing teams gain access to real-time financial data. They can see customer payment history, outstanding invoices, and other crucial information, allowing them to tailor their approach and close deals more effectively.

- Streamlined Financial Management: Integration provides a holistic view of your business’s financial health. You can track sales, expenses, and profitability in real-time, making it easier to make informed decisions and manage cash flow. This also simplifies financial reporting and compliance.

- Better Customer Service: When your customer service team has access to both CRM and QuickBooks data, they can provide more personalized and efficient support. They can quickly access a customer’s purchase history, payment status, and other relevant information, allowing them to resolve issues faster and build stronger customer relationships.

- Reduced Administrative Overhead: By automating data transfer and eliminating manual processes, integration reduces administrative overhead. This translates to lower costs and more efficient operations.

Understanding CRM and QuickBooks: A Brief Overview

Before diving into the integration process, let’s briefly define CRM and QuickBooks and highlight their individual strengths.

What is a CRM System?

A Customer Relationship Management (CRM) system is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. It helps businesses build stronger customer relationships, improve customer retention, and drive sales growth. Key features of a CRM system include:

- Contact Management: Storing and organizing customer contact information, including names, addresses, phone numbers, and email addresses.

- Lead Management: Tracking and nurturing potential customers (leads) through the sales pipeline.

- Sales Automation: Automating sales tasks, such as creating quotes, generating invoices, and managing sales opportunities.

- Marketing Automation: Automating marketing campaigns, such as email marketing, social media marketing, and lead nurturing.

- Customer Service: Managing customer inquiries, support tickets, and feedback.

- Reporting and Analytics: Providing insights into sales performance, customer behavior, and marketing effectiveness.

Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

What is QuickBooks?

QuickBooks is a leading accounting software solution designed for small and medium-sized businesses. It helps businesses manage their finances, track income and expenses, and generate financial reports. Key features of QuickBooks include:

- Invoice Management: Creating and sending invoices, tracking payments, and managing accounts receivable.

- Expense Tracking: Tracking and categorizing expenses, including vendor bills and employee expenses.

- Bank Reconciliation: Reconciling bank statements with QuickBooks transactions.

- Financial Reporting: Generating financial reports, such as profit and loss statements, balance sheets, and cash flow statements.

- Payroll: Managing employee payroll, including calculating wages, withholding taxes, and generating pay stubs.

- Inventory Management: Tracking inventory levels, managing stock, and generating inventory reports.

QuickBooks offers different versions, including QuickBooks Online and QuickBooks Desktop, each with its own features and pricing.

The Integration Process: Step-by-Step Guide

Integrating CRM and QuickBooks can seem daunting, but with the right approach, it’s a manageable process. Here’s a step-by-step guide to help you get started:

- Choose the Right Integration Method: There are several ways to integrate CRM and QuickBooks. The most common methods include:

- Native Integrations: Some CRM systems offer native integrations with QuickBooks, meaning they have built-in connectors that allow for seamless data transfer. This is often the easiest and most reliable method.

- Third-Party Integration Platforms: These platforms, like Zapier, PieSync, and Workato, act as intermediaries, connecting your CRM and QuickBooks. They offer a wide range of pre-built integrations and customizable workflows.

- Custom Integrations: If you have specific integration requirements that aren’t met by native or third-party integrations, you can hire a developer to build a custom integration. This offers the most flexibility but can be more expensive and time-consuming.

- Assess Your Needs: Before you begin, determine which data you want to synchronize between your CRM and QuickBooks. Common data points to integrate include:

- Customer Data: Customer names, addresses, contact information, and other relevant details.

- Invoice Data: Invoice numbers, dates, amounts, and payment status.

- Product/Service Data: Product names, descriptions, and prices.

- Payment Data: Payment amounts, dates, and methods.

- Select Your Integration Tool: Based on your needs, choose the integration method that best suits your business. Consider factors like ease of use, cost, features, and customer support. Research different integration platforms and compare their features and pricing.

- Set Up Your Accounts: If you’re using a third-party integration platform, you’ll need to connect your CRM and QuickBooks accounts to the platform. This typically involves entering your login credentials and authorizing the platform to access your data.

- Configure Data Mapping: Data mapping is the process of defining how data fields in your CRM are mapped to corresponding fields in QuickBooks. For example, you’ll need to map the “Customer Name” field in your CRM to the “Customer Name” field in QuickBooks. Carefully review the data mapping settings to ensure that data is transferred correctly.

- Test the Integration: Before going live, thoroughly test the integration to ensure that data is flowing correctly between your CRM and QuickBooks. Create test records in both systems and verify that the data is synchronized as expected.

- Monitor and Maintain: Once the integration is live, monitor its performance regularly. Check for any errors or issues and address them promptly. Also, keep your CRM and QuickBooks software updated to ensure optimal performance and security. Review and adjust your data mapping as your business needs evolve.

Choosing the Right Integration Method: A Deep Dive

As mentioned earlier, selecting the right integration method is crucial for a successful implementation. Let’s explore the different options in more detail:

Native Integrations

Pros:

- Ease of Use: Native integrations are typically the easiest to set up and use, as they’re designed specifically for the CRM and QuickBooks platforms.

- Reliability: Native integrations are usually more reliable than third-party integrations, as they’re built and maintained by the CRM and QuickBooks providers.

- Performance: Native integrations often offer better performance, as they’re optimized for the specific platforms.

- Support: You can usually get direct support from the CRM and QuickBooks providers if you have any issues with the integration.

Cons:

- Limited Features: Native integrations may offer fewer features than third-party integration platforms.

- Compatibility: Native integrations may only be available for certain CRM and QuickBooks versions.

- Cost: Native integrations may be more expensive than third-party options.

Third-Party Integration Platforms

Pros:

- Flexibility: Third-party integration platforms offer a wide range of pre-built integrations and customizable workflows, allowing you to connect a variety of apps.

- Scalability: Third-party integration platforms can scale with your business, allowing you to add or remove integrations as needed.

- Cost-Effectiveness: Third-party integration platforms are often more cost-effective than custom integrations.

- Ease of Setup: Many third-party integration platforms offer user-friendly interfaces and drag-and-drop functionality, making it easy to set up and configure integrations.

Cons:

- Complexity: Third-party integration platforms can be complex to set up and configure, especially for users who are not familiar with integration concepts.

- Performance: Third-party integrations may be slower than native integrations.

- Support: Support may be limited. You may need to rely on the integration platform’s support team or online resources.

- Security: Ensure the third-party platform has robust security measures to protect your data.

Custom Integrations

Pros:

- Flexibility: Custom integrations offer the most flexibility, allowing you to tailor the integration to your specific needs.

- Control: You have complete control over the integration process.

- Performance: Custom integrations can be optimized for performance.

Cons:

- Cost: Custom integrations are the most expensive option.

- Time-Consuming: Custom integrations can take a significant amount of time to develop and implement.

- Maintenance: You’ll be responsible for maintaining and updating the custom integration.

- Expertise: You’ll need to hire a developer with expertise in both CRM and QuickBooks.

Key Considerations for a Successful Integration

Beyond the technical aspects of integration, several other factors can significantly impact its success:

- Data Security and Privacy: Ensure that the integration platform and your CRM and QuickBooks systems comply with data security and privacy regulations, such as GDPR and CCPA. Protect sensitive customer and financial data.

- Data Backup and Recovery: Implement data backup and recovery procedures to protect your data from loss or corruption. Regularly back up your CRM and QuickBooks data.

- User Training: Provide adequate training to your employees on how to use the integrated systems. Ensure that they understand how data is synchronized and how to troubleshoot any issues.

- Ongoing Support and Maintenance: Choose an integration platform or provider that offers ongoing support and maintenance. This is essential to ensure that the integration continues to function correctly and that you receive assistance when needed.

- Scalability: Choose an integration solution that can scale with your business. As your business grows, you may need to integrate additional data or features.

- Data Governance: Establish clear data governance policies to ensure data quality and consistency. This includes defining data fields, data validation rules, and data access permissions.

- Testing and Iteration: Don’t be afraid to test and refine your integration. The first setup might not be perfect. Be prepared to make adjustments based on your business’s needs and feedback from users.

Choosing the Right CRM for QuickBooks Integration

The choice of CRM is critical for a smooth integration. Consider these factors when selecting a CRM system:

- Integration Capabilities: Does the CRM offer a native integration with QuickBooks, or does it integrate through a third-party platform? Does the integration support the data synchronization you need?

- Features and Functionality: Does the CRM have the features and functionality you need to manage your customer relationships and sales processes? Consider your current and future needs.

- Ease of Use: Is the CRM user-friendly and easy to learn? Look for a CRM with an intuitive interface and comprehensive documentation.

- Scalability: Can the CRM scale with your business? Ensure the CRM can handle your current and future data volume and user base.

- Cost: Compare the pricing of different CRM systems. Consider both the initial cost and the ongoing costs, such as subscription fees and support costs.

- Customer Support: Does the CRM provider offer good customer support? Read reviews and check the provider’s support channels.

- Reviews and Reputation: Research the CRM system and read reviews from other users. Consider the CRM’s reputation in the industry.

Some popular CRM systems that integrate well with QuickBooks include:

- Salesforce: A robust CRM platform with a wide range of features and a strong integration with QuickBooks through various platforms.

- HubSpot CRM: A user-friendly CRM that offers a free version and easy integration with QuickBooks via various integrations.

- Zoho CRM: A comprehensive CRM with a range of features and an integration option with QuickBooks.

- Microsoft Dynamics 365: A powerful CRM platform with strong integration capabilities, suitable for larger businesses.

- Pipedrive: A sales-focused CRM with a simple interface and integration options.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some issues during or after the integration. Here are some common problems and how to address them:

- Data Synchronization Errors: Data may not synchronize correctly due to incorrect data mapping, network issues, or software glitches. Check your data mapping settings, ensure your internet connection is stable, and contact the integration platform’s support team.

- Duplicate Data: Duplicate customer records or invoices can occur if the integration isn’t configured correctly. Review your data mapping settings and set up rules to prevent duplicate data entry.

- Missing Data: Data may be missing if the integration doesn’t support all the data fields you need to synchronize. Review your data mapping settings and ensure the integration supports the data fields you need.

- Slow Performance: Slow performance can occur if the integration is processing a large amount of data or if there are network issues. Optimize your data mapping settings, ensure your internet connection is stable, and consider upgrading your integration platform’s plan.

- Security Issues: Data security is paramount. Ensure the integration platform has robust security measures and that you’re using strong passwords. Monitor your integration for any suspicious activity.

- Integration Breakdowns: Changes in either QuickBooks or your CRM can sometimes break the integration. Stay informed about updates to both platforms and be prepared to make adjustments to your integration settings if necessary.

The Future of CRM and QuickBooks Integration

The integration of CRM and QuickBooks is constantly evolving. Here are some trends to watch:

- Artificial Intelligence (AI): AI is being used to automate tasks, provide insights, and improve the customer experience. Expect to see more AI-powered features in CRM and QuickBooks integrations.

- Mobile Integration: Mobile integration is becoming increasingly important, as businesses need to access data and manage their operations on the go. Expect to see more mobile-friendly CRM and QuickBooks integrations.

- Enhanced Automation: Businesses are looking for ways to automate more tasks, such as lead scoring, invoice generation, and payment processing. Expect to see more advanced automation features in CRM and QuickBooks integrations.

- Improved Data Analytics: Businesses are using data analytics to gain insights into their customers, sales, and finances. Expect to see more advanced data analytics features in CRM and QuickBooks integrations.

- Personalization: Businesses are personalizing their customer interactions to improve engagement and loyalty. Expect to see more personalization features in CRM and QuickBooks integrations.

Conclusion: Embrace the Power of Integration

Integrating CRM with QuickBooks is a smart move for any business looking to improve efficiency, boost sales, and enhance customer relationships. By automating data transfer, eliminating manual processes, and gaining a holistic view of your business, you can unlock significant benefits. While the initial setup might require some effort, the long-term rewards are well worth it. Choose the right integration method, carefully plan your implementation, and monitor your results to ensure a successful outcome. As technology continues to advance, the integration of CRM and QuickBooks will only become more seamless and powerful, empowering businesses to thrive in today’s competitive landscape. So, take the leap, integrate your systems, and watch your business soar!