Seamless Transactions: Mastering CRM Integration with PayPal for Enhanced Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Enhanced Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to optimize their operations, enhance customer experiences, and drive revenue growth. One powerful strategy that achieves all these goals is the integration of a Customer Relationship Management (CRM) system with payment gateways like PayPal. This article delves deep into the world of CRM integration with PayPal, exploring its benefits, implementation strategies, and best practices to help you create a seamless and efficient business process. We’ll cover everything from the fundamental concepts to advanced techniques, ensuring you have the knowledge and tools to transform your business.

Understanding the Power of CRM and PayPal

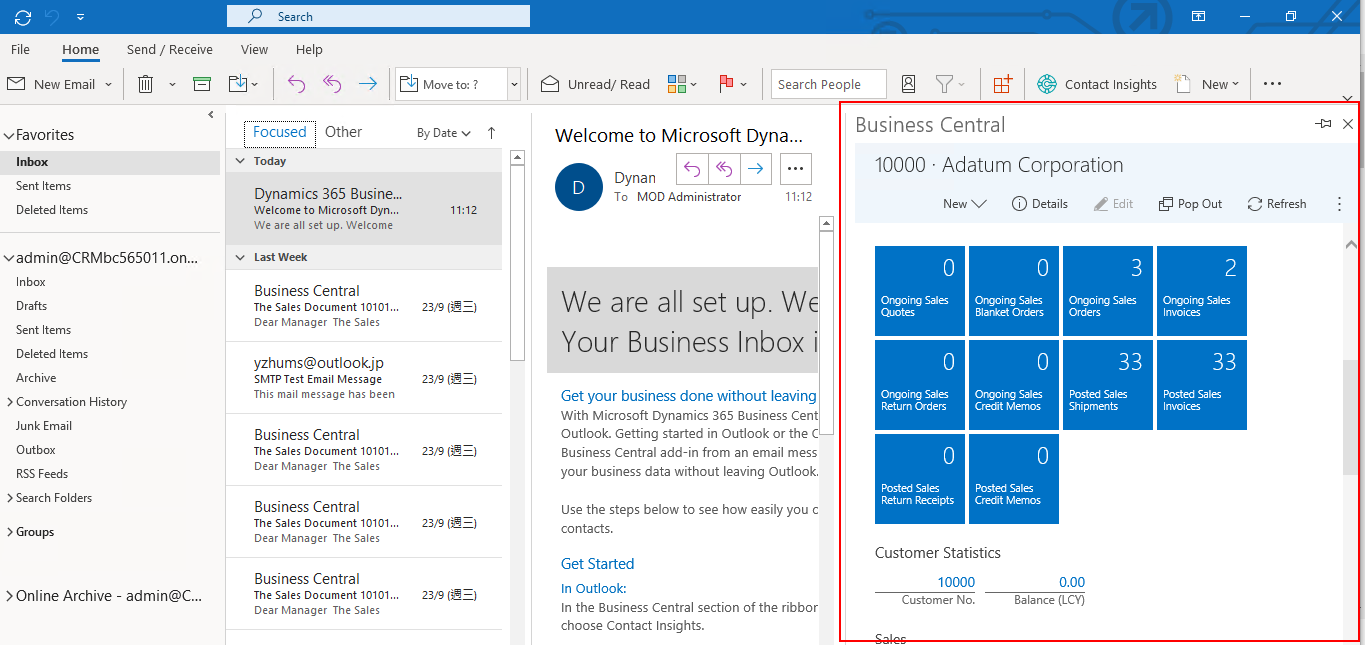

Before diving into the integration process, let’s establish a clear understanding of the core components: CRM and PayPal. CRM systems are the backbone of modern customer management. They’re designed to centralize customer data, track interactions, and automate workflows, providing valuable insights into customer behavior and preferences. PayPal, on the other hand, is a globally recognized online payment processing service, enabling businesses to accept payments securely and efficiently.

What is CRM?

CRM, or Customer Relationship Management, is more than just a software; it’s a strategic approach to managing and analyzing customer interactions and data throughout the customer lifecycle. A robust CRM system allows businesses to:

- Centralize Customer Data: Store all customer information, including contact details, purchase history, and communication logs, in one accessible location.

- Improve Customer Service: Provide personalized and efficient customer support by having a complete view of the customer’s history and preferences.

- Automate Sales and Marketing: Streamline sales processes, automate marketing campaigns, and track lead generation efforts.

- Enhance Sales Forecasting: Analyze sales data to predict future trends and make informed business decisions.

- Boost Customer Loyalty: Build stronger customer relationships through personalized interactions and proactive support.

What is PayPal?

PayPal is a leading online payment platform that facilitates secure and convenient transactions for both businesses and consumers. It enables businesses to:

- Accept Payments Online: Allow customers to pay via credit cards, debit cards, and PayPal balance.

- Process Transactions Globally: Reach a global customer base by supporting multiple currencies and languages.

- Ensure Secure Transactions: Protect sensitive financial information with advanced security measures.

- Simplify Payment Processing: Automate payment processing and reduce manual effort.

- Offer Flexible Payment Options: Provide various payment options to cater to customer preferences.

The Benefits of Integrating CRM with PayPal

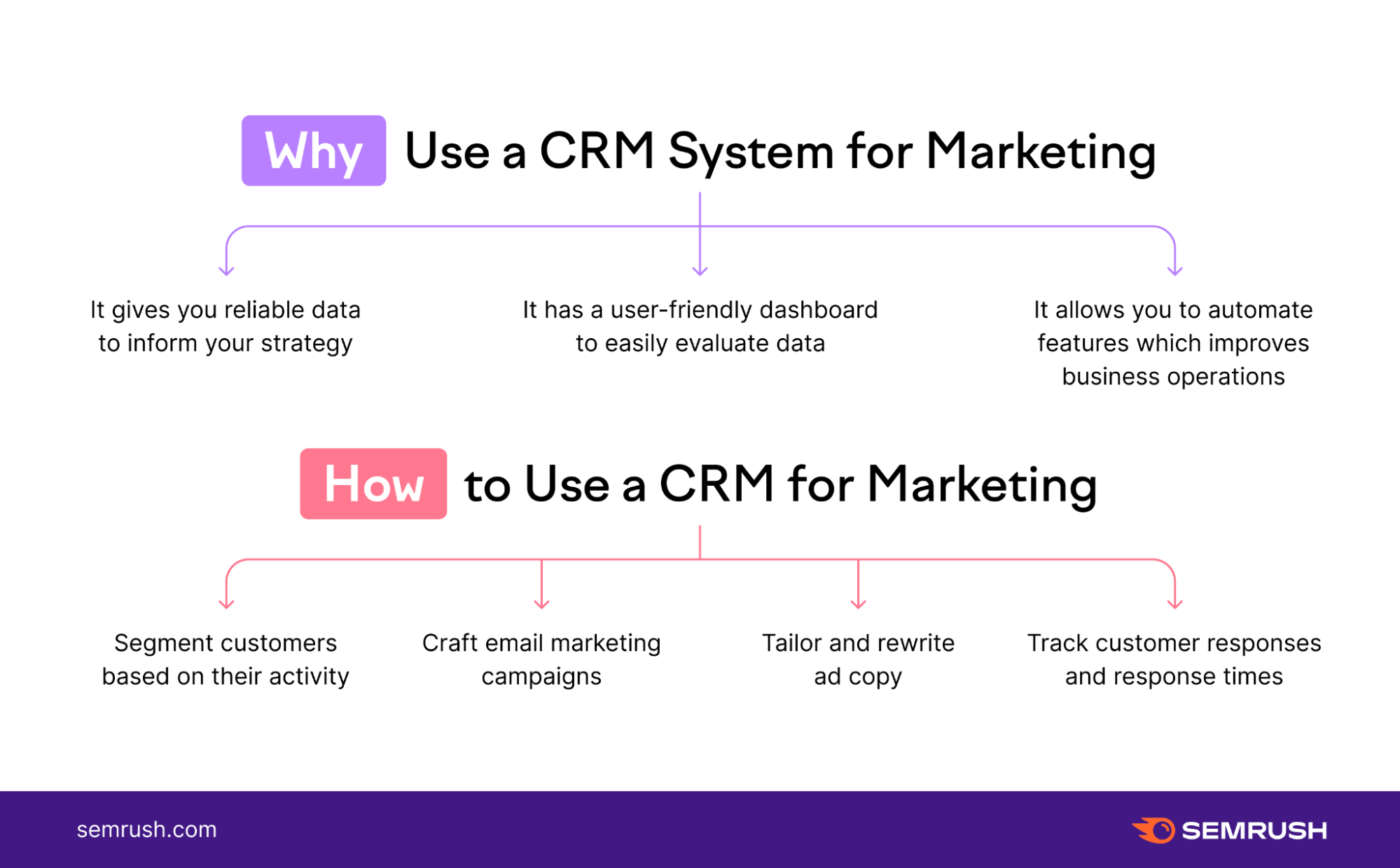

Integrating your CRM system with PayPal unlocks a wealth of benefits that can significantly impact your business’s efficiency, customer satisfaction, and bottom line. Here are some of the key advantages:

Streamlined Payment Processing

One of the most significant benefits is the streamlining of payment processing. By integrating PayPal with your CRM, you can automate the payment process, reducing manual effort and human error. This includes automatically generating invoices, sending payment reminders, and updating payment statuses within your CRM. This automation saves time, reduces administrative overhead, and ensures that payments are processed efficiently.

Improved Customer Experience

A seamless payment experience is crucial for customer satisfaction. When you integrate PayPal with your CRM, you create a smoother, more convenient payment process for your customers. Customers can make payments directly from within their CRM profiles, eliminating the need to navigate to external payment gateways. This integrated experience enhances customer satisfaction and fosters loyalty.

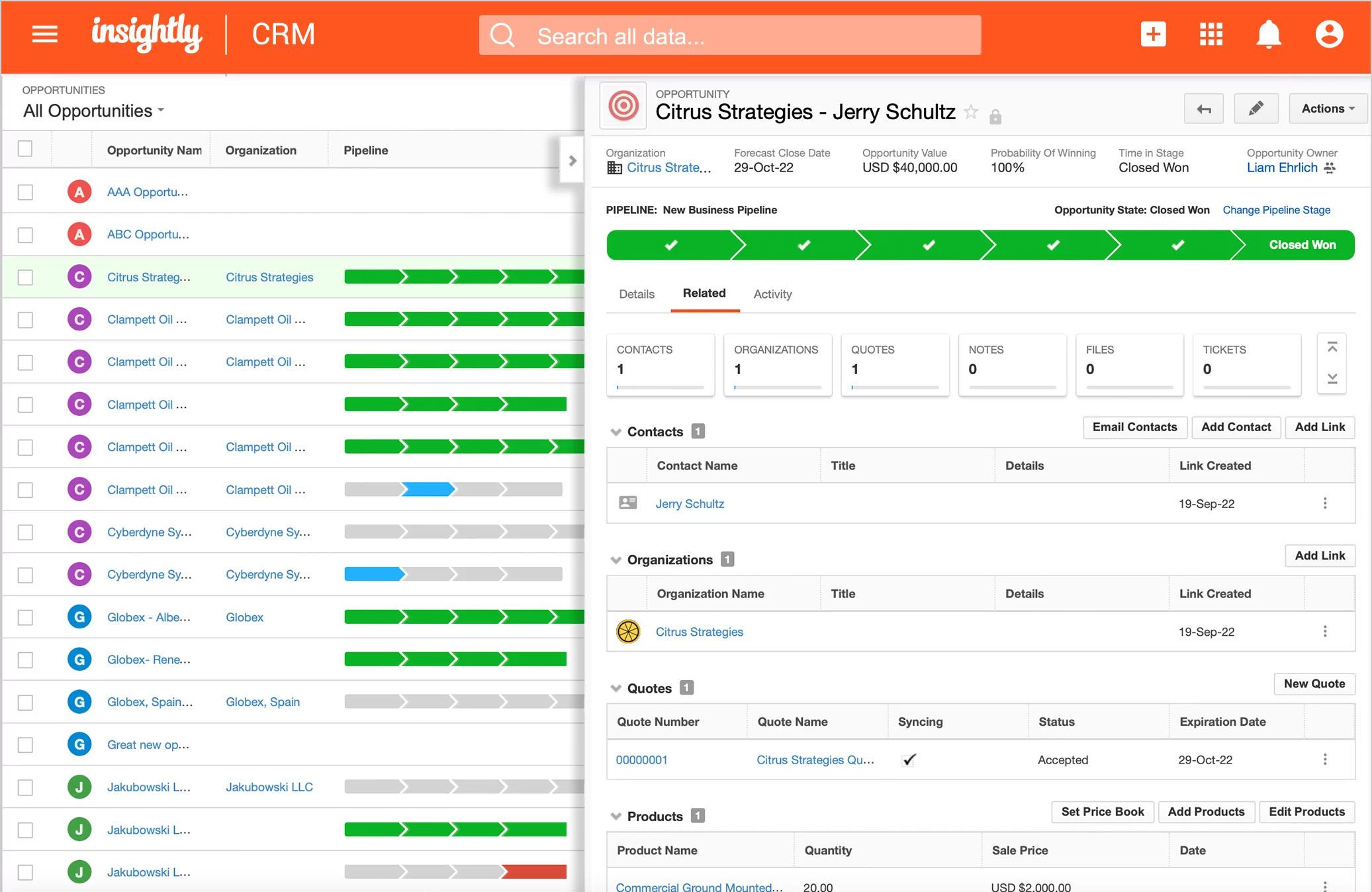

Enhanced Sales Cycle Management

CRM integration with PayPal provides valuable insights into the sales cycle. You can track payment statuses, identify potential payment issues, and gain a comprehensive view of customer transactions within your CRM. This visibility helps you manage your sales pipeline more effectively, identify opportunities to upsell or cross-sell, and improve overall sales performance.

Automated Data Synchronization

Data synchronization is a key advantage of integrating CRM with PayPal. When a customer makes a payment through PayPal, the payment information is automatically updated in your CRM. This eliminates the need for manual data entry, reduces the risk of errors, and ensures that your CRM data is always up-to-date. This automated data synchronization saves time, improves data accuracy, and provides a complete view of your customer’s payment history.

Reduced Manual Work and Errors

By automating payment processes and synchronizing data, CRM integration with PayPal significantly reduces manual work and the potential for human error. This frees up your team to focus on more strategic tasks, such as customer relationship management, sales, and marketing. The reduced manual effort also minimizes the risk of payment-related errors, ensuring accurate financial records.

Improved Reporting and Analytics

Integration provides you with a more complete picture of your business’s financial performance. You can generate detailed reports on sales, revenue, and customer payments directly from your CRM. This data-driven approach enables you to make informed business decisions, identify areas for improvement, and track your progress toward your business goals.

Better Financial Visibility

Gain better financial visibility by having all your payment data in one centralized location. This allows you to monitor cash flow, track revenue, and reconcile payments more efficiently. This increased financial visibility helps you make more informed financial decisions and manage your business’s finances more effectively.

How to Integrate CRM with PayPal

The process of integrating your CRM with PayPal can vary depending on your specific CRM system and the integration methods available. Here’s a general overview of the steps involved:

1. Choose the Right CRM and PayPal Integration Method

The first step is to choose the appropriate CRM system and PayPal integration method. Consider factors such as your business needs, budget, and technical expertise when selecting a CRM. Also, research the integration options available for your chosen CRM, such as:

- Native Integrations: Some CRM systems offer native integrations with PayPal, providing a seamless and straightforward connection.

- Third-Party Integrations: There are third-party tools and platforms that facilitate the integration between your CRM and PayPal.

- Custom Integrations: You can develop a custom integration using APIs (Application Programming Interfaces) to connect your CRM and PayPal.

2. Set Up Your PayPal Account

If you don’t already have one, create a PayPal business account. This account will allow you to accept payments online. Ensure your PayPal account is set up correctly with the appropriate business information and payment preferences.

3. Configure the Integration

Follow the specific instructions provided by your CRM or the third-party integration platform to configure the integration. This typically involves connecting your PayPal account to your CRM, mapping data fields, and setting up payment workflows. You may need to provide your PayPal API credentials (e.g., API username, API password, and signature) to establish the connection.

4. Test the Integration

Before going live, thoroughly test the integration to ensure that payments are processed correctly and data is synchronized accurately. Make test transactions to verify that the payment process works as expected and that payment information is updated in your CRM.

5. Customize and Optimize the Integration

Once the integration is set up, customize it to meet your specific business needs. This might involve setting up automated workflows, creating custom reports, or integrating with other business systems. Continuously monitor and optimize the integration to ensure it’s performing efficiently and meeting your evolving business requirements.

Popular CRM Systems and Their PayPal Integration Capabilities

Several CRM systems offer robust integration capabilities with PayPal. Here are some of the most popular ones:

Salesforce

Salesforce is a leading CRM platform that offers various integration options with PayPal. You can integrate Salesforce with PayPal using native integrations, third-party apps from the AppExchange, or custom integrations using APIs. The integration allows you to track payments, automate payment processing, and manage customer transactions within Salesforce.

HubSpot

HubSpot is a popular CRM platform that offers a user-friendly interface and a range of marketing, sales, and customer service tools. HubSpot integrates with PayPal through third-party apps and custom integrations, allowing you to track payments, automate payment notifications, and manage customer transactions within HubSpot.

Zoho CRM

Zoho CRM is a comprehensive CRM platform that offers a wide range of features and integrations. Zoho CRM integrates with PayPal through native integrations and third-party apps. The integration enables you to track payments, generate invoices, and manage customer transactions within Zoho CRM.

Pipedrive

Pipedrive is a sales-focused CRM platform that offers a simple and intuitive interface. Pipedrive integrates with PayPal through third-party apps, enabling you to track payments, automate payment reminders, and manage customer transactions within Pipedrive.

Freshsales

Freshsales is a CRM platform that provides a comprehensive suite of sales tools and features. Freshsales integrates with PayPal through third-party apps, allowing you to track payments, manage invoices, and manage customer transactions within Freshsales.

Best Practices for CRM Integration with PayPal

To maximize the benefits of CRM integration with PayPal, follow these best practices:

1. Plan Your Integration Strategy

Before you begin the integration process, carefully plan your strategy. Define your goals, identify the specific features you want to integrate, and determine the best integration method for your business needs.

2. Choose the Right Integration Method

Select the integration method that best suits your needs. Consider factors such as your budget, technical expertise, and the features you require. Native integrations are often the easiest to set up, while custom integrations offer more flexibility.

3. Map Data Fields Correctly

When setting up the integration, carefully map the data fields between your CRM and PayPal. Ensure that the data fields are mapped correctly to avoid errors and ensure that data is synchronized accurately.

4. Test Thoroughly

Before going live, thoroughly test the integration to ensure that payments are processed correctly and data is synchronized accurately. Make test transactions and review the results to identify and resolve any issues.

5. Monitor and Optimize the Integration

Once the integration is live, continuously monitor its performance. Track key metrics, such as payment processing times and data synchronization accuracy. Optimize the integration as needed to ensure that it’s performing efficiently and meeting your evolving business requirements.

6. Secure Your Data

Implement security measures to protect your customer data and financial information. Use secure connections, encrypt sensitive data, and follow industry best practices for data security.

7. Train Your Team

Train your team on how to use the integrated system. Provide them with the necessary knowledge and skills to process payments, manage customer transactions, and troubleshoot any issues that may arise.

8. Stay Updated

Keep your CRM and PayPal software up-to-date to ensure compatibility and security. Regularly check for updates and apply them promptly to avoid any integration issues.

Troubleshooting Common Integration Issues

During the integration process, you may encounter some common issues. Here are some tips for troubleshooting them:

1. Connection Issues

If you’re having trouble connecting your CRM to PayPal, check your internet connection and verify that your PayPal API credentials are correct. Ensure that your firewall is not blocking the connection.

2. Data Synchronization Issues

If data is not synchronizing correctly, check the data field mapping and ensure that the data fields are mapped correctly. Verify that the data types are compatible and that there are no data validation errors. Review your logs and error messages for more information.

3. Payment Processing Issues

If you’re experiencing payment processing issues, check your PayPal account and ensure that it’s set up correctly. Verify that the payment information is accurate and that the customer has sufficient funds. Review your payment gateway settings and ensure that they are configured correctly.

4. Error Messages

Pay close attention to any error messages that appear during the integration process. These messages often provide valuable clues about the problem. Use the error messages to troubleshoot the issue and find a solution.

5. Seek Support

If you’re unable to resolve an issue on your own, don’t hesitate to seek support from your CRM provider, PayPal, or the integration platform. They can provide expert assistance and help you resolve the issue quickly.

The Future of CRM and Payment Integration

The integration of CRM systems with payment gateways like PayPal is an evolving field, with exciting developments on the horizon. Here are some trends to watch:

AI-Powered Automation

Artificial intelligence (AI) is poised to play a significant role in automating payment processes and enhancing customer experiences. AI-powered chatbots can handle payment inquiries, process refunds, and provide personalized support. AI can also analyze payment data to identify trends, predict customer behavior, and optimize payment workflows.

Advanced Analytics

Advanced analytics tools will provide deeper insights into payment data, enabling businesses to identify opportunities to improve sales, enhance customer loyalty, and reduce fraud. These tools will help businesses make data-driven decisions and optimize their payment strategies.

Mobile Payment Integration

With the increasing popularity of mobile payments, CRM systems will continue to integrate with mobile payment platforms. This will allow businesses to accept payments on mobile devices, provide a seamless mobile payment experience, and enhance customer convenience.

Increased Security

Security will remain a top priority, with businesses implementing advanced security measures to protect customer data and financial information. This includes using encryption, multi-factor authentication, and fraud detection tools to prevent data breaches and fraud.

Blockchain Technology

Blockchain technology has the potential to revolutionize payment processing by providing a secure and transparent platform for transactions. CRM systems may integrate with blockchain-based payment solutions to offer enhanced security, transparency, and efficiency.

Conclusion

CRM integration with PayPal is a powerful strategy for businesses looking to streamline their operations, enhance customer experiences, and drive revenue growth. By following the best practices outlined in this article, you can successfully integrate your CRM with PayPal and unlock the numerous benefits it offers. Embrace the power of integrated systems and position your business for success in today’s competitive market.