Seamless Transactions: Mastering CRM Integration with PayPal for Enhanced Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost overall profitability. One of the most effective strategies involves integrating Customer Relationship Management (CRM) systems with payment gateways like PayPal. This powerful combination allows businesses to manage customer interactions, process transactions efficiently, and gain valuable insights into customer behavior. This article delves deep into the world of CRM integration with PayPal, exploring its benefits, implementation strategies, and the best practices to ensure a seamless and successful integration.

Understanding CRM and PayPal: The Dynamic Duo

Before we dive into the specifics of integration, let’s establish a clear understanding of each component. CRM systems are designed to manage and analyze customer interactions and data throughout the customer lifecycle, with the goal of improving business relationships and driving sales growth. They act as a central hub for all customer-related information, including contact details, purchase history, communication logs, and more. Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

PayPal, on the other hand, is a widely recognized online payment platform that enables businesses and individuals to send and receive money securely. It offers a convenient and user-friendly way to process payments, accept online orders, and manage financial transactions. PayPal’s global reach and ease of use make it a popular choice for businesses of all sizes.

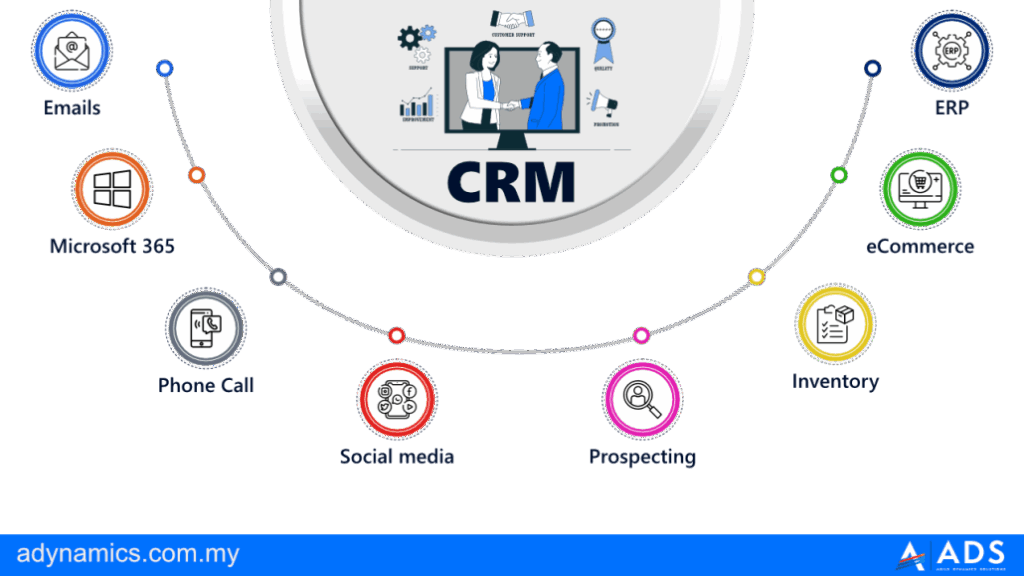

The integration of CRM and PayPal creates a synergistic relationship, allowing businesses to leverage the strengths of both platforms. By connecting these two systems, businesses can automate payment processing, track customer transactions, and gain a 360-degree view of their customers’ financial interactions. This enhanced visibility empowers businesses to make data-driven decisions, personalize customer experiences, and optimize their sales and marketing efforts.

The Compelling Benefits of CRM Integration with PayPal

The benefits of integrating CRM with PayPal are numerous and far-reaching. Here are some of the key advantages:

- Automated Payment Processing: Eliminate manual payment processing tasks by automating the transfer of payment information between your CRM and PayPal. This saves time, reduces errors, and improves efficiency.

- Enhanced Customer Data: Capture and store valuable payment data within your CRM, providing a comprehensive view of customer transactions, purchase history, and financial behavior.

- Improved Sales Tracking: Track sales in real-time, monitor revenue generation, and gain insights into sales performance. This allows you to identify trends, optimize sales strategies, and forecast future revenue.

- Streamlined Order Management: Simplify order management by automatically updating order status, sending payment confirmations, and managing refunds directly within your CRM.

- Personalized Customer Experiences: Leverage payment data to personalize customer interactions, offer targeted promotions, and provide tailored customer service.

- Reduced Manual Errors: Automate data entry and reduce the risk of human error associated with manual payment processing.

- Increased Efficiency: Automate workflows and eliminate repetitive tasks, freeing up your team to focus on more strategic initiatives.

- Improved Reporting and Analytics: Generate comprehensive reports on sales, revenue, and customer behavior, providing valuable insights for decision-making.

- Fraud Prevention: Leverage PayPal’s fraud protection features to minimize the risk of fraudulent transactions.

- Scalability: Easily scale your payment processing capabilities as your business grows.

Step-by-Step Guide to Integrating CRM with PayPal

The process of integrating CRM with PayPal varies depending on the specific CRM platform and the integration method you choose. However, the general steps involved are as follows:

- Choose Your CRM and PayPal Account: Select the CRM platform that best suits your business needs and ensure you have an active PayPal business account.

- Assess Integration Options: Research the available integration options for your chosen CRM. These may include native integrations, third-party apps, or custom API integrations.

- Select an Integration Method: Choose the integration method that aligns with your technical expertise and budget. Native integrations are often the easiest to implement, while custom API integrations offer the most flexibility.

- Configure the Integration: Follow the instructions provided by your CRM platform or integration provider to configure the integration. This typically involves connecting your PayPal account to your CRM and mapping data fields.

- Test the Integration: Thoroughly test the integration to ensure that data is being transferred correctly and that payment processing is functioning as expected.

- Deploy and Monitor: Once you’re satisfied with the testing results, deploy the integration and monitor its performance regularly.

Let’s look at some common integration methods in more detail:

Native Integrations

Many CRM platforms offer native integrations with PayPal, which means that the integration is built directly into the CRM platform. Native integrations are typically the easiest to implement and require minimal technical expertise. They often provide a seamless user experience and automatically sync data between your CRM and PayPal account.

Third-Party Apps

If your CRM platform doesn’t offer a native integration with PayPal, you can often find third-party apps or plugins that provide the necessary functionality. These apps are often developed by third-party vendors and offer a range of features and customization options. When choosing a third-party app, be sure to research the vendor’s reputation and read reviews to ensure that the app is reliable and secure.

Custom API Integrations

For businesses with more complex integration requirements, custom API integrations may be the best option. This approach involves using the PayPal API to build a custom integration that meets your specific needs. Custom API integrations offer the most flexibility and control but require more technical expertise and development effort. You’ll likely need a developer or a team of developers to implement this type of integration.

Best Practices for Successful CRM and PayPal Integration

To ensure a smooth and successful CRM and PayPal integration, consider the following best practices:

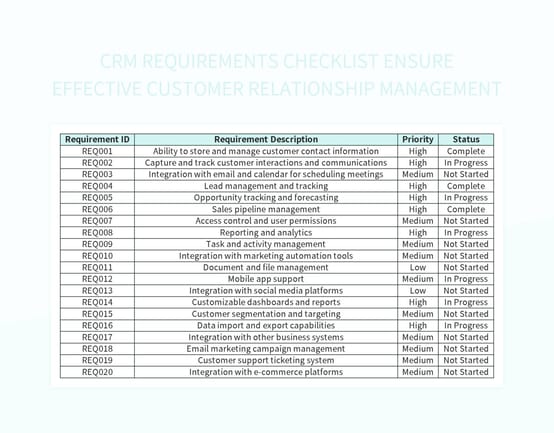

- Plan Your Integration Strategy: Before you begin, carefully plan your integration strategy. Define your goals, identify your key requirements, and choose the integration method that best suits your needs.

- Map Data Fields: Carefully map data fields between your CRM and PayPal account to ensure that data is transferred correctly. Pay close attention to data formats and ensure that they are compatible.

- Test Thoroughly: Thoroughly test the integration before deploying it to your live environment. Test various scenarios, including successful payments, failed payments, refunds, and order updates.

- Monitor Performance: Regularly monitor the performance of the integration to ensure that it is functioning correctly. Check for errors, data discrepancies, and performance issues.

- Provide Training: Provide training to your team on how to use the integrated system. Ensure that they understand how to process payments, manage orders, and access customer data within the CRM.

- Keep Your Systems Updated: Regularly update your CRM platform, PayPal account, and any third-party apps or plugins to ensure that you have the latest features and security patches.

- Secure Your Data: Implement security measures to protect your customer data. Use strong passwords, enable two-factor authentication, and regularly review your security settings.

- Document Your Integration: Document your integration process, including the steps involved, the data fields mapped, and any customizations you have made. This documentation will be invaluable for troubleshooting and future maintenance.

- Seek Professional Help: If you’re not comfortable with the technical aspects of integration, consider seeking professional help from a CRM consultant or a software developer.

Real-World Examples: CRM and PayPal Integration in Action

Let’s explore some real-world examples of how businesses are leveraging CRM integration with PayPal:

- E-commerce Businesses: E-commerce businesses can use CRM integration with PayPal to automate payment processing, track order status, manage refunds, and personalize customer experiences. For example, when a customer makes a purchase on your website, the order details are automatically captured in your CRM, and the payment is processed through PayPal.

- Subscription-Based Businesses: Subscription-based businesses can use CRM integration with PayPal to automate recurring payments, manage subscriptions, and track customer churn. When a customer signs up for a subscription, their payment information is securely stored in PayPal, and recurring payments are automatically processed.

- Nonprofit Organizations: Nonprofit organizations can use CRM integration with PayPal to manage donations, track donor interactions, and send automated thank-you messages. When a donor makes a donation through PayPal, the donation details are automatically captured in your CRM.

- Service-Based Businesses: Service-based businesses, such as consultants and freelancers, can use CRM integration with PayPal to send invoices, track payments, and manage client relationships. For example, you can generate invoices within your CRM and send them to your clients via email. Once the client pays the invoice through PayPal, the payment status is automatically updated in your CRM.

Choosing the Right CRM for PayPal Integration

The choice of CRM platform is critical for a successful integration with PayPal. Here are some popular CRM platforms that offer robust PayPal integration capabilities:

- Salesforce: Salesforce offers a wide range of integration options with PayPal, including native integrations and third-party apps. It provides a comprehensive suite of features for managing sales, marketing, and customer service.

- HubSpot: HubSpot offers a user-friendly CRM platform with a strong focus on inbound marketing. It provides seamless integration with PayPal through third-party apps.

- Zoho CRM: Zoho CRM offers a cost-effective CRM solution with a variety of integration options, including native integrations and third-party apps.

- Microsoft Dynamics 365: Microsoft Dynamics 365 is a comprehensive CRM platform that offers robust integration capabilities with PayPal. It is well-suited for larger businesses with complex requirements.

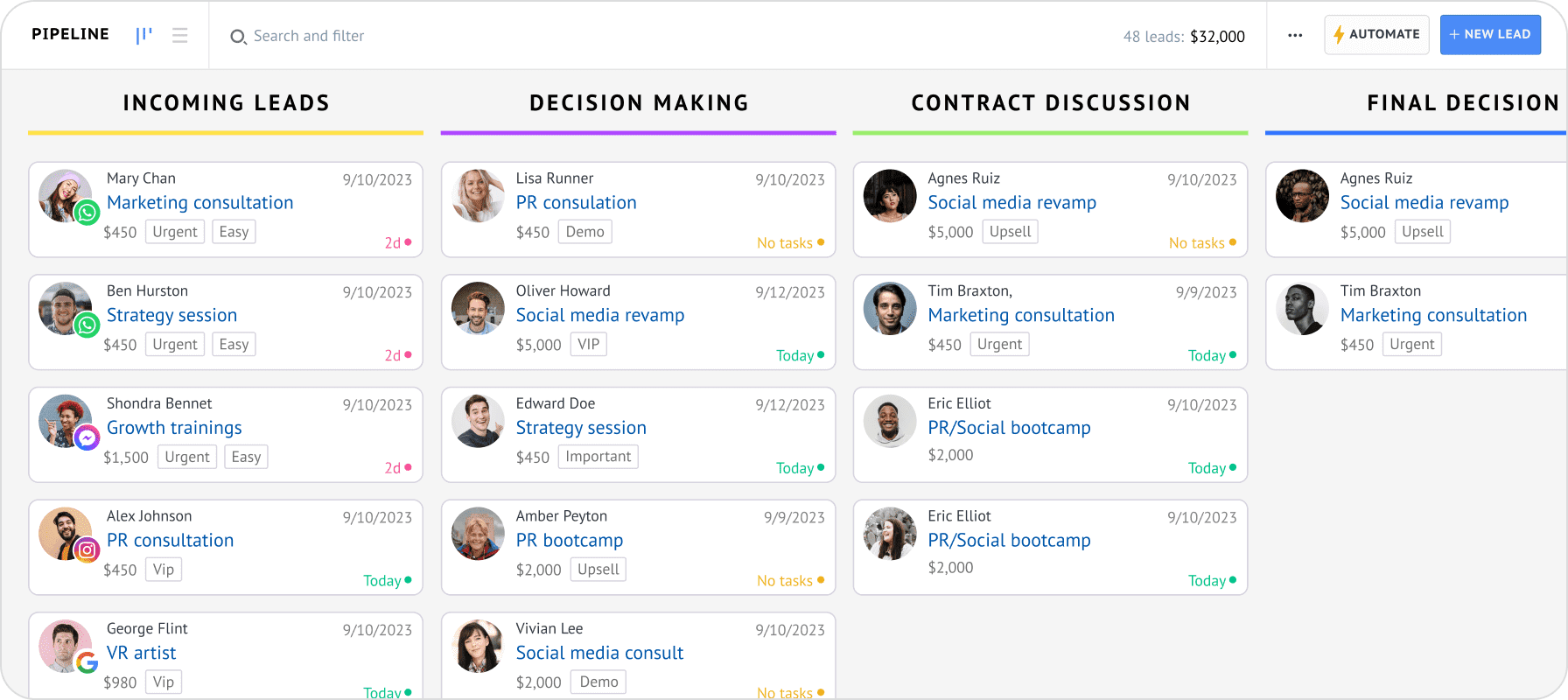

- Pipedrive: Pipedrive is a sales-focused CRM platform that offers a simple and intuitive user interface. It integrates with PayPal through third-party apps.

When choosing a CRM platform, consider the following factors:

- Integration Capabilities: Ensure that the CRM platform offers seamless integration with PayPal, either through native integrations or third-party apps.

- Features: Evaluate the CRM’s features and ensure that they meet your business needs. Consider features such as sales automation, marketing automation, and customer service.

- Scalability: Choose a CRM platform that can scale with your business.

- Pricing: Compare the pricing of different CRM platforms and choose the one that fits your budget.

- Ease of Use: Choose a CRM platform that is easy to use and has a user-friendly interface.

Troubleshooting Common CRM and PayPal Integration Issues

Even with careful planning and implementation, you may encounter some issues during your CRM and PayPal integration. Here are some common problems and how to troubleshoot them:

- Data Synchronization Errors: If data is not being synchronized correctly between your CRM and PayPal, check the following:

- Data Field Mapping: Ensure that data fields are mapped correctly between your CRM and PayPal account.

- Data Formats: Verify that data formats are compatible between your CRM and PayPal account.

- API Errors: Check for any API errors that may be preventing data synchronization.

- Payment Processing Errors: If you’re experiencing payment processing errors, check the following:

- PayPal Account Status: Ensure that your PayPal account is active and in good standing.

- Payment Settings: Verify your payment settings within your CRM and PayPal account.

- Transaction Limits: Check for any transaction limits that may be preventing payments from being processed.

- Order Management Issues: If you’re experiencing order management issues, check the following:

- Order Status Updates: Ensure that order status updates are being synchronized correctly between your CRM and PayPal account.

- Inventory Management: Verify that your inventory management system is integrated with your CRM and PayPal account.

- Connectivity Issues: If you’re experiencing connectivity issues, check the following:

- Internet Connection: Ensure that you have a stable internet connection.

- Firewall Settings: Verify that your firewall settings are not blocking communication between your CRM and PayPal account.

- API Availability: Check the availability of the PayPal API.

If you’re unable to resolve these issues on your own, consider seeking help from your CRM provider or a PayPal integration specialist.

The Future of CRM and PayPal Integration

The integration of CRM and PayPal is constantly evolving, with new features and capabilities being added regularly. Here are some trends to watch for:

- AI-Powered Integrations: AI-powered integrations are becoming more sophisticated, enabling businesses to automate tasks, gain deeper insights into customer behavior, and personalize customer experiences.

- Mobile Payments: With the increasing popularity of mobile payments, expect to see more integrations that support mobile transactions.

- Enhanced Security: Security will continue to be a top priority, with integrations incorporating advanced security features to protect customer data.

- Cross-Platform Integrations: Businesses are increasingly using multiple platforms, so expect to see more integrations that connect CRM and PayPal with other business applications.

- Focus on Customer Experience: Future integrations will prioritize the customer experience, providing seamless and personalized interactions.

Conclusion: Embrace the Power of Integration

Integrating CRM with PayPal is a strategic move that can significantly benefit businesses of all sizes. By automating payment processing, gaining valuable customer insights, and streamlining operations, businesses can enhance customer experiences, drive sales growth, and improve overall profitability. By following the best practices outlined in this article, you can successfully integrate your CRM with PayPal and unlock the full potential of these powerful platforms. Embrace the power of integration and take your business to the next level!