Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost revenue. One of the most effective strategies involves integrating Customer Relationship Management (CRM) systems with payment gateways like PayPal. This powerful combination offers a multitude of benefits, ranging from automated payment processing to improved customer relationship management. In this comprehensive guide, we’ll delve into the intricacies of CRM integration with PayPal, exploring the advantages, implementation steps, and best practices to help your business thrive.

Understanding the Synergy: CRM and PayPal

Before diving into the specifics, let’s establish a clear understanding of the two key components: CRM and PayPal.

What is a CRM?

A Customer Relationship Management (CRM) system is a software solution designed to manage all interactions with current and potential customers. It acts as a central hub for storing customer data, tracking interactions, and automating various tasks related to sales, marketing, and customer service. CRM systems provide valuable insights into customer behavior, preferences, and purchase history, enabling businesses to personalize their interactions and build stronger relationships.

Key features of a CRM include:

- Contact management

- Lead management

- Sales force automation

- Marketing automation

- Customer service and support

- Reporting and analytics

What is PayPal?

PayPal is a widely recognized online payment platform that enables individuals and businesses to send and receive money securely. It serves as an intermediary between buyers and sellers, providing a convenient and trusted method for processing online transactions. PayPal offers various payment solutions, including:

- Online payments

- Mobile payments

- In-person payments

- Recurring billing

PayPal’s popularity stems from its ease of use, security features, and global reach, making it a preferred choice for both consumers and businesses.

The Benefits of CRM Integration with PayPal

Integrating your CRM with PayPal unlocks a wealth of benefits, significantly impacting your business’s efficiency, customer satisfaction, and bottom line. Here are some of the key advantages:

1. Streamlined Payment Processing

One of the most immediate benefits is the simplification of payment processing. Instead of manually entering payment details, CRM integration automates the process, allowing you to:

- Automatically generate invoices and send them to customers.

- Process payments directly within the CRM interface.

- Eliminate manual data entry and reduce the risk of errors.

2. Enhanced Customer Experience

CRM integration with PayPal contributes to a more seamless and positive customer experience. Customers can make payments quickly and easily, leading to:

- Faster checkout processes.

- Reduced cart abandonment rates.

- Improved customer satisfaction.

- Personalized payment options.

3. Improved Data Accuracy and Reporting

Integration ensures that payment data is automatically synced with your CRM, providing accurate and up-to-date information. This allows for:

- Real-time tracking of payments.

- Automated reconciliation of transactions.

- Comprehensive reporting on sales and revenue.

- Better insights into customer spending habits.

4. Increased Efficiency and Productivity

Automation of payment-related tasks frees up your team to focus on more strategic activities, such as:

- Lead generation.

- Customer engagement.

- Sales closing.

- Customer support.

This leads to increased productivity and a more efficient use of resources.

5. Reduced Risk of Fraud and Disputes

PayPal’s robust security features help protect your business from fraud and payment disputes. Integration with your CRM allows you to:

- Leverage PayPal’s fraud detection tools.

- Easily manage and resolve disputes.

- Reduce the risk of chargebacks.

6. Better Sales Forecasting and Decision Making

By integrating payment data with your CRM, you gain a holistic view of your sales performance. This enables you to:

- Accurately forecast future sales.

- Identify trends and patterns in customer behavior.

- Make data-driven decisions to improve sales strategies.

- Optimize pricing and promotions.

How to Integrate CRM with PayPal: A Step-by-Step Guide

The process of integrating your CRM with PayPal varies depending on the specific CRM and the integration method you choose. However, the general steps are as follows:

1. Choose the Right CRM and PayPal Integration Method

Several integration methods are available, including:

- Native Integrations: Some CRMs offer native integrations with PayPal, providing a seamless and pre-built connection.

- Third-Party Integrations: Many third-party apps and plugins facilitate the integration process.

- Custom Integrations: For more complex needs, you can develop a custom integration using APIs.

Consider your CRM’s capabilities, your technical expertise, and your budget when selecting an integration method. Research and compare different CRM systems that have direct integration capabilities with PayPal or offer easy integration with third-party tools.

2. Set Up a PayPal Business Account

If you don’t already have one, create a PayPal Business account. This account is designed for businesses and provides access to features like:

- Payment processing.

- Invoicing.

- Reporting.

Make sure your business account is verified and ready to accept payments.

3. Connect Your PayPal Account to Your CRM

The specific steps for connecting your PayPal account to your CRM depend on the integration method you’ve chosen. Generally, you’ll need to:

- Enter your PayPal API credentials (API username, password, and signature) into your CRM.

- Configure the integration settings, such as payment currencies, transaction types, and notification preferences.

- Authorize the CRM to access your PayPal account.

Follow the instructions provided by your CRM and PayPal to ensure a successful connection. Consult the documentation or support resources for both platforms if needed.

4. Configure Payment Options and Settings

Once the connection is established, configure the payment options and settings within your CRM. This may include:

- Setting up payment gateways.

- Defining payment terms.

- Customizing invoice templates.

- Enabling recurring billing (if applicable).

Configure the settings according to your business requirements and customer preferences.

5. Test the Integration

Before going live, thoroughly test the integration to ensure that payments are processed correctly and that data is synced accurately. This includes:

- Making test payments.

- Verifying that payment information is recorded in the CRM.

- Checking that notifications and reports are generated as expected.

Address any issues or errors that arise during testing before launching the integration.

6. Train Your Team

Provide adequate training to your team on how to use the integrated system. This includes:

- How to generate invoices.

- How to process payments.

- How to access payment data.

- How to troubleshoot common issues.

Ensure that your team understands the benefits of the integration and can effectively utilize the new system.

7. Monitor and Optimize

After the integration is live, continuously monitor its performance and make adjustments as needed. This includes:

- Tracking payment processing times.

- Analyzing customer feedback.

- Reviewing reports and analytics.

- Making improvements to optimize the integration for efficiency and customer satisfaction.

Choosing the Right CRM for PayPal Integration

Selecting the right CRM is crucial for a successful PayPal integration. Consider the following factors when evaluating CRM options:

1. Native Integration Capabilities

Look for CRMs that offer native integrations with PayPal. These integrations typically provide a seamless and user-friendly experience. Research and compare different CRM systems that have direct integration capabilities with PayPal or offer easy integration with third-party tools.

2. Integration with Other Payment Gateways

Consider CRMs that also integrate with other payment gateways, such as Stripe, Authorize.net, or Square. This provides flexibility and allows you to offer customers a wider range of payment options.

3. Features and Functionality

Evaluate the CRM’s overall features and functionality to ensure it meets your business needs. Consider features such as:

- Contact management.

- Lead management.

- Sales force automation.

- Marketing automation.

- Customer service and support.

4. User-Friendliness and Ease of Use

Choose a CRM that is easy to use and navigate. This will ensure that your team can quickly adopt and utilize the system effectively.

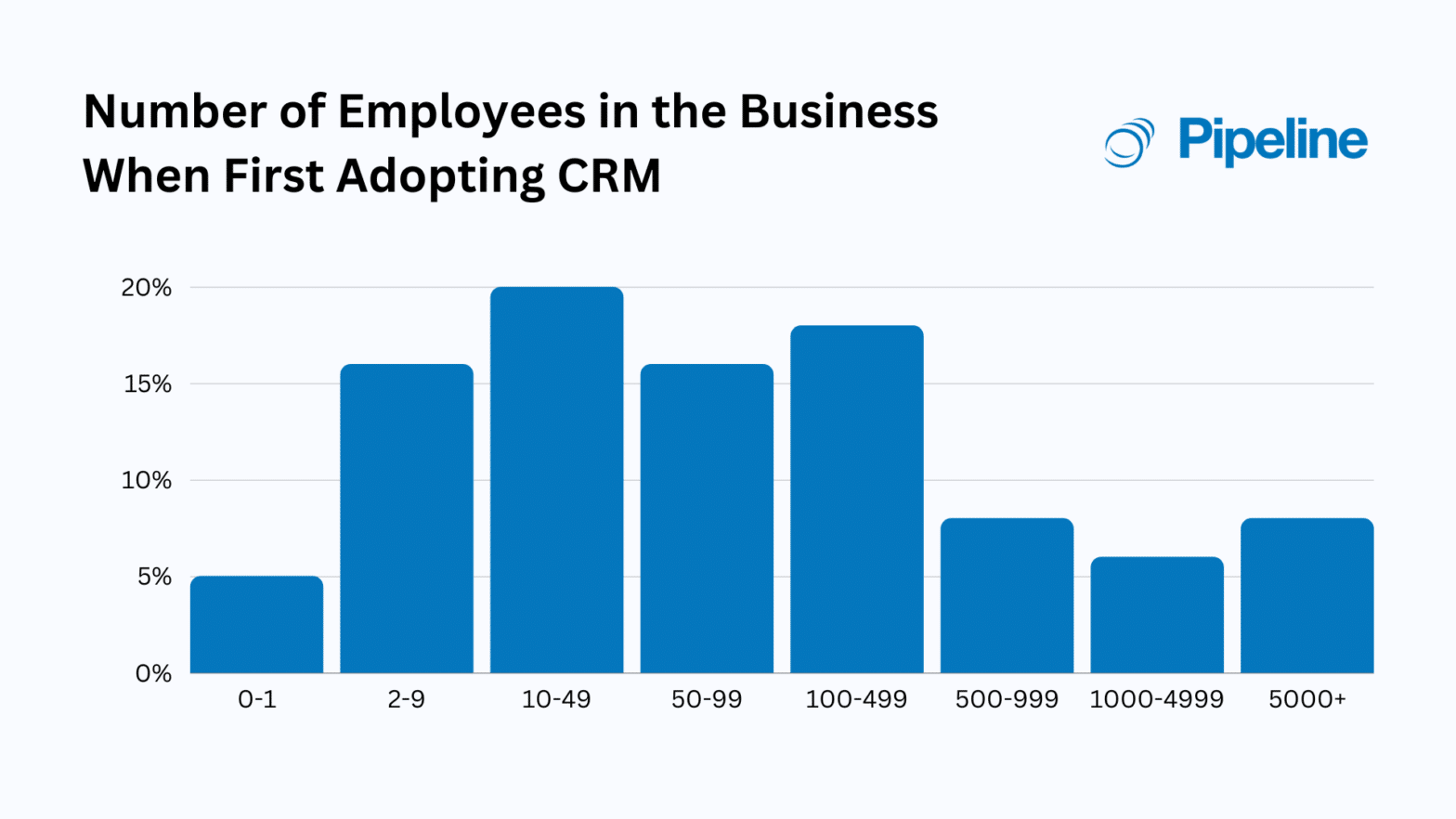

5. Scalability

Select a CRM that can scale with your business as it grows. Ensure that the system can handle increasing volumes of data and transactions.

6. Pricing and Cost

Consider the pricing and cost of the CRM. Evaluate the subscription fees, implementation costs, and any additional fees associated with the PayPal integration.

7. Customer Support and Documentation

Ensure that the CRM provider offers reliable customer support and comprehensive documentation. This will help you troubleshoot any issues and get the most out of the system.

Popular CRM Systems with PayPal Integration

Several CRM systems offer robust PayPal integration capabilities. Here are some popular choices:

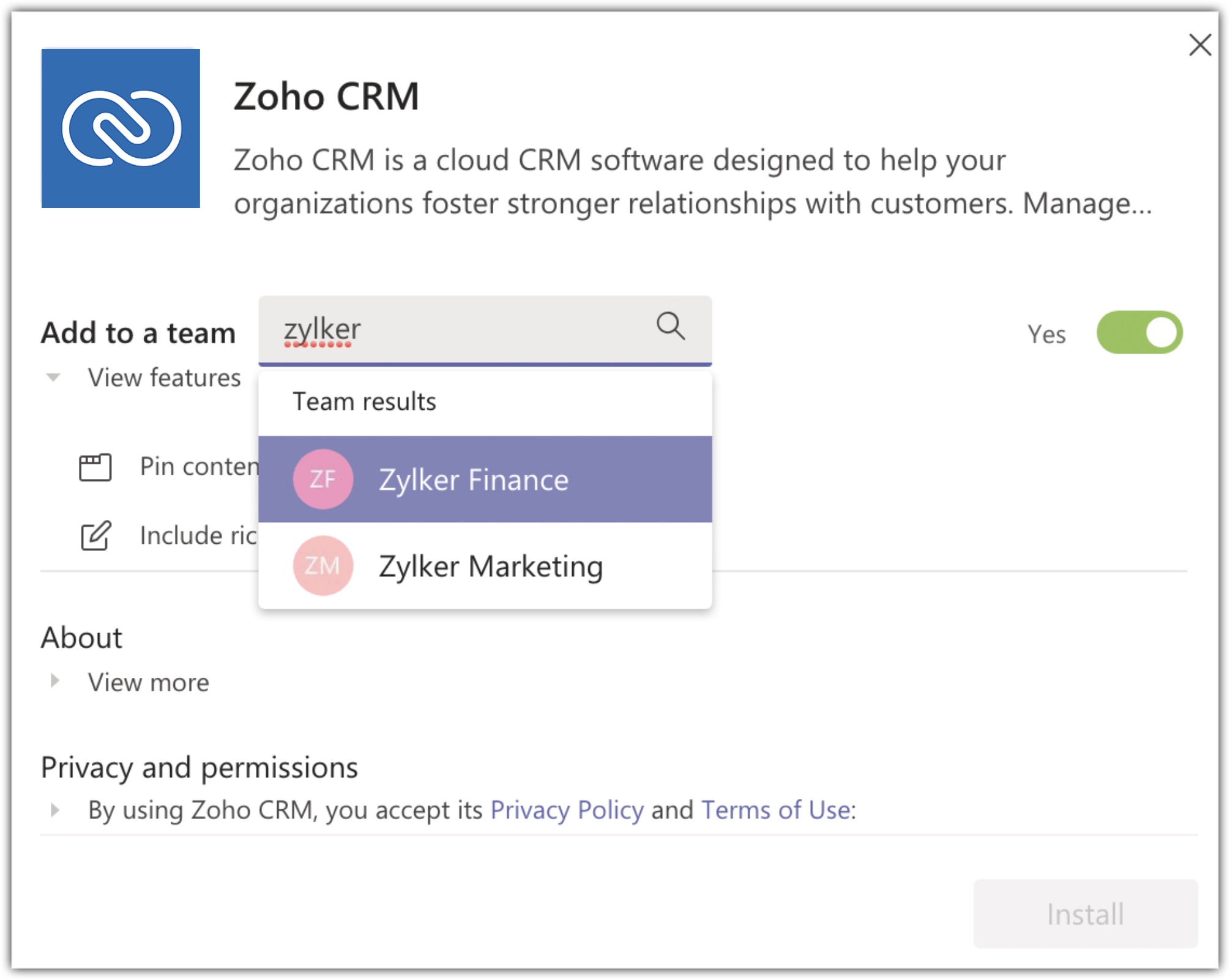

- Zoho CRM: Offers a native integration with PayPal, allowing users to create invoices, process payments, and manage transactions directly within the CRM.

- HubSpot CRM: Provides integrations with PayPal through third-party apps and plugins.

- Salesforce: Offers various integration options with PayPal through its AppExchange marketplace.

- Pipedrive: Integrates with PayPal through third-party apps and plugins, streamlining payment processing.

- Freshsales: Provides integration with PayPal for seamless payment processing and customer relationship management.

Best Practices for CRM Integration with PayPal

To maximize the benefits of CRM integration with PayPal, follow these best practices:

1. Plan Your Integration Strategy

Before you begin, define your goals and objectives for the integration. Determine which features and functionalities are most important to your business. Plan the integration process carefully to ensure a smooth transition.

2. Data Migration

If you’re migrating data from another system, plan the data migration process carefully. Ensure that all relevant data is transferred accurately and securely.

3. Security Measures

Prioritize security when integrating your CRM with PayPal. Use strong passwords, enable two-factor authentication, and regularly monitor your accounts for suspicious activity.

4. Regular Backups

Regularly back up your CRM data to prevent data loss in case of system failures or other issues.

5. Training and Support

Provide comprehensive training to your team on how to use the integrated system. Offer ongoing support to address any questions or issues.

6. Compliance with Regulations

Ensure that your CRM and PayPal integration complies with all relevant regulations, such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

7. Monitor and Evaluate

Continuously monitor the performance of the integration and evaluate its effectiveness. Make adjustments as needed to optimize its performance and ensure that it meets your business needs.

Troubleshooting Common Issues

Even with careful planning, you may encounter issues during the integration process or after it’s live. Here are some common problems and how to address them:

1. Connection Errors

If you’re experiencing connection errors, double-check your API credentials and ensure that your CRM and PayPal accounts are properly connected. Verify your internet connection and try again.

2. Payment Processing Errors

If payments are not processing correctly, verify that your payment settings are configured correctly. Check for any error messages and consult the documentation or support resources for both platforms.

3. Data Synchronization Issues

If data is not syncing correctly between your CRM and PayPal, check the integration settings and ensure that the data fields are mapped correctly. Contact the support team for both platforms if needed.

4. Reporting Issues

If you’re having trouble generating accurate reports, verify that the reporting settings are configured correctly. Ensure that all relevant data is being captured and processed.

5. Security Concerns

If you have any security concerns, review your security settings and implement additional security measures. Contact the support team for both platforms if needed.

The Future of CRM and PayPal Integration

The integration of CRM systems with PayPal is constantly evolving, with new features and functionalities being added regularly. Here are some trends to watch:

- AI-Powered Automation: AI and machine learning are being used to automate more tasks, such as fraud detection and customer service.

- Personalized Payment Experiences: Businesses are using data to personalize the payment experience for each customer.

- Mobile Payments: Mobile payments are becoming increasingly popular, and CRM systems are adapting to support them.

- Integration with Cryptocurrency: Some businesses are beginning to integrate with cryptocurrency payment systems.

As technology continues to advance, the integration of CRM and PayPal will become even more seamless and powerful, providing businesses with new opportunities to grow and succeed.

Conclusion

CRM integration with PayPal is a strategic move that can significantly benefit your business. By automating payment processing, enhancing customer experiences, and improving data accuracy, you can streamline your operations, boost sales, and build stronger customer relationships. By following the steps outlined in this guide and adhering to best practices, you can successfully integrate your CRM with PayPal and unlock the full potential of this powerful combination. Embrace the future of seamless transactions and propel your business towards greater success.