Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s dynamic business landscape, efficiency and customer satisfaction are paramount. Businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost revenue. One powerful combination that achieves these goals is the integration of a Customer Relationship Management (CRM) system with PayPal. This article delves into the intricacies of CRM integration with PayPal, exploring the benefits, implementation strategies, and best practices that can propel your business to new heights.

Understanding CRM and PayPal: The Power Couple

Before we dive into the integration, let’s establish a clear understanding of each component. CRM systems are the backbone of modern businesses, designed to manage and analyze customer interactions and data throughout the customer lifecycle. They help businesses build stronger relationships, personalize interactions, and improve customer retention. PayPal, on the other hand, is a globally recognized online payment platform that simplifies the process of sending and receiving money. It offers a secure and convenient way for businesses to accept payments from customers worldwide.

What is CRM?

CRM is more than just a contact list; it’s a comprehensive system that encompasses all aspects of customer interaction. Key features of a CRM include:

- Contact Management: Storing and organizing customer information, including contact details, purchase history, and communication logs.

- Sales Automation: Automating sales processes, such as lead management, opportunity tracking, and quote generation.

- Marketing Automation: Automating marketing campaigns, such as email marketing, social media posting, and lead nurturing.

- Customer Service: Managing customer inquiries, resolving issues, and providing support through various channels.

- Analytics and Reporting: Providing insights into customer behavior, sales performance, and marketing effectiveness.

What is PayPal?

PayPal’s widespread adoption makes it an attractive payment option for businesses of all sizes. Key benefits of PayPal include:

- Global Reach: Accepting payments from customers worldwide.

- Security: Providing secure payment processing with fraud protection.

- Convenience: Offering a user-friendly payment experience for customers.

- Integration: Seamless integration with various e-commerce platforms and business tools.

- Brand Recognition: Leveraging the trusted PayPal brand to build customer confidence.

The Synergy of CRM and PayPal Integration

Integrating CRM with PayPal creates a powerful synergy that benefits businesses in numerous ways. It bridges the gap between customer data and payment processing, providing a holistic view of the customer journey. Here are some of the key advantages:

Improved Customer Experience

By integrating CRM with PayPal, businesses can personalize the customer experience. CRM systems can store customer payment history, allowing businesses to tailor their interactions and offer relevant products or services. This personalization leads to increased customer satisfaction and loyalty.

Streamlined Sales Processes

Integration automates sales processes by linking payment information to customer records. Sales representatives can easily track payments, manage invoices, and reconcile transactions within the CRM. This reduces manual data entry, minimizes errors, and accelerates the sales cycle.

Enhanced Reporting and Analytics

CRM integration with PayPal provides a comprehensive view of sales performance. Businesses can track payment trends, analyze customer spending habits, and identify opportunities for growth. This data-driven approach enables better decision-making and improved business outcomes.

Reduced Manual Errors

Automating payment processing eliminates the need for manual data entry, reducing the risk of errors. This saves time, improves accuracy, and frees up employees to focus on more strategic tasks.

Faster Payment Processing

Integration speeds up payment processing by automating the payment workflow. Customers can pay invoices directly from their CRM accounts, and businesses can receive payments faster. This improves cash flow and reduces the time it takes to close sales.

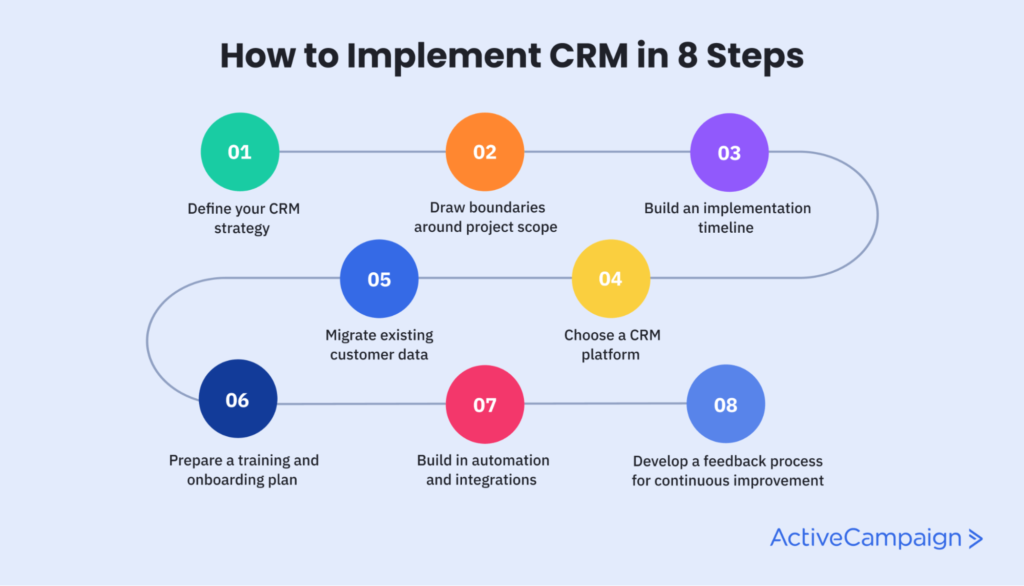

Implementing CRM Integration with PayPal: A Step-by-Step Guide

The process of integrating CRM with PayPal can vary depending on the specific CRM system and the desired level of integration. However, the general steps involved include:

1. Choose the Right CRM and PayPal Integration Method

The first step is to choose a CRM system that supports PayPal integration. Popular CRM platforms like Salesforce, HubSpot, and Zoho CRM offer native or third-party integrations with PayPal. Research the available integration options and select the one that best suits your business needs. There are a few ways to go about the integration:

- Native Integration: Some CRM systems offer built-in integration with PayPal, which is often the easiest and most seamless option.

- Third-Party Integration: If your CRM doesn’t have native PayPal integration, you can use a third-party integration tool to connect the two systems.

- Custom Integration: For more complex requirements, you can develop a custom integration using the PayPal API and your CRM’s API.

2. Create a PayPal Business Account

If you don’t already have one, create a PayPal business account. This account will allow you to accept payments from customers and manage your transactions.

3. Configure PayPal Settings

In your PayPal account, configure the necessary settings for integration with your CRM. This may involve setting up API credentials, configuring payment notifications, and specifying the currencies you accept.

4. Connect PayPal to Your CRM

Follow the instructions provided by your CRM platform or integration tool to connect your PayPal account. This typically involves entering your PayPal API credentials and authorizing the integration.

5. Configure Payment Options

Within your CRM, configure the payment options you want to offer to your customers. This may include setting up payment gateways, creating invoices, and specifying payment terms.

6. Test the Integration

Before going live, test the integration to ensure that payments are processing correctly and that data is being synchronized between your CRM and PayPal accounts. Make a test transaction to confirm that everything is working as expected.

7. Train Your Team

Provide training to your team on how to use the integrated system. This will ensure that everyone understands how to process payments, manage customer data, and leverage the benefits of the integration.

Best Practices for CRM Integration with PayPal

To maximize the benefits of CRM integration with PayPal, follow these best practices:

1. Choose the Right CRM

Select a CRM system that offers robust PayPal integration capabilities, including features like automated payment processing, invoice generation, and payment tracking.

2. Plan Your Integration Strategy

Define clear goals and objectives for your CRM integration with PayPal. Identify the specific processes you want to automate and the data you want to synchronize.

3. Secure Your Data

Implement security measures to protect your customer data and payment information. Use strong passwords, encrypt sensitive data, and follow industry best practices for data security.

4. Automate Payment Notifications

Set up automated payment notifications to keep your customers informed about the status of their payments. This includes sending confirmation emails, payment reminders, and invoices.

5. Customize Your Integration

Tailor the integration to meet your specific business needs. Customize payment forms, workflows, and reporting to optimize your processes.

6. Monitor and Optimize

Regularly monitor the performance of your CRM integration with PayPal. Track key metrics, such as payment processing times, customer satisfaction, and sales conversion rates. Make adjustments as needed to optimize your processes.

7. Keep Software Updated

Keep your CRM system, PayPal account, and any integration tools updated with the latest software versions and security patches to ensure optimal performance and security.

Advanced Integration Techniques: Taking It to the Next Level

Once you’ve established a basic CRM and PayPal integration, consider exploring advanced techniques to further enhance your capabilities:

1. Advanced Reporting and Analytics

Leverage the data from your integrated systems to generate advanced reports and analytics. Track key performance indicators (KPIs) such as customer lifetime value, sales cycle length, and conversion rates. Use these insights to make data-driven decisions and optimize your business strategies.

2. Custom Workflows and Automations

Create custom workflows and automations to streamline your processes. For example, you can set up automated email notifications to customers when their payments are received or when their subscriptions are renewed. You can also automate tasks such as invoice generation and payment reconciliation.

3. Integration with Other Systems

Extend your integration to include other business systems, such as accounting software, e-commerce platforms, and marketing automation tools. This will create a more holistic view of your business operations and enable you to automate even more processes.

4. Mobile Optimization

Ensure that your CRM and PayPal integration is optimized for mobile devices. This will allow your sales team to access customer data, process payments, and manage transactions on the go. A mobile-friendly setup is increasingly crucial in today’s world.

5. AI-Powered Insights

Explore the use of artificial intelligence (AI) to gain deeper insights into your customer data and payment transactions. AI-powered tools can analyze customer behavior, predict future sales trends, and identify opportunities for cross-selling and upselling.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some issues during the integration process. Here are some common problems and their solutions:

1. Connection Errors

If you encounter connection errors, double-check your API credentials and ensure that your PayPal account is properly configured. Verify that your firewall is not blocking the connection and that your internet connection is stable.

2. Data Synchronization Problems

If data is not synchronizing properly between your CRM and PayPal accounts, check your integration settings and ensure that the data fields are mapped correctly. Review your logs for any error messages that may provide clues to the problem.

3. Payment Processing Errors

If you experience payment processing errors, verify that your PayPal account is in good standing and that your payment gateway is configured correctly. Check for any restrictions on the types of payments you are accepting or the countries you are serving.

4. Security Concerns

If you have security concerns, review your security settings and ensure that your data is encrypted. Follow industry best practices for data security and consider using a secure payment gateway.

5. Technical Support

If you are unable to resolve the issue on your own, contact the technical support teams for your CRM system, PayPal, and any third-party integration tools you are using. They can provide assistance and guidance to help you troubleshoot the problem.

Real-World Applications: Success Stories

Many businesses have successfully integrated their CRM with PayPal to achieve significant results. Here are a few examples:

E-commerce Businesses

E-commerce businesses use CRM integration with PayPal to streamline the checkout process, track customer orders, and manage payment transactions. This leads to increased sales, improved customer satisfaction, and enhanced operational efficiency.

Subscription-Based Businesses

Subscription-based businesses leverage CRM integration with PayPal to automate subscription billing, manage customer renewals, and track payment history. This reduces manual effort, minimizes errors, and improves customer retention.

Service-Based Businesses

Service-based businesses use CRM integration with PayPal to generate invoices, track payments, and manage customer accounts. This simplifies the billing process, improves cash flow, and enhances customer relationships.

Future Trends: The Evolution of CRM and PayPal Integration

As technology continues to evolve, so will the integration of CRM and PayPal. Here are some future trends to watch out for:

1. AI-Powered Payment Processing

AI will play an increasingly important role in payment processing, automating fraud detection, optimizing payment workflows, and personalizing the customer experience.

2. Blockchain Integration

Blockchain technology may be used to enhance the security and transparency of payment transactions, providing greater trust and efficiency.

3. Integration with Emerging Payment Methods

CRM systems will integrate with emerging payment methods, such as mobile wallets and cryptocurrencies, to provide customers with more payment options.

4. Enhanced Personalization

Businesses will leverage CRM data to personalize the payment experience, offering customized payment plans, discounts, and incentives.

5. Seamless Cross-Platform Integration

CRM and PayPal integrations will become more seamless across various platforms, including mobile devices, e-commerce platforms, and social media channels.

Conclusion: Embracing the Power of Integration

CRM integration with PayPal is a strategic move that can significantly benefit businesses of all sizes. By streamlining sales processes, improving customer experiences, and enhancing reporting capabilities, this integration empowers businesses to achieve greater efficiency, boost revenue, and foster stronger customer relationships. By following the steps outlined in this guide and adopting best practices, businesses can successfully integrate their CRM with PayPal and unlock the full potential of this powerful combination. Embrace the power of integration and propel your business towards sustained growth and success.