Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost profitability. One powerful strategy involves integrating Customer Relationship Management (CRM) systems with payment gateways like PayPal. This comprehensive guide delves into the intricacies of CRM integration with PayPal, exploring its benefits, implementation strategies, and best practices to help you optimize your business processes and drive sustainable growth.

Understanding the Power of CRM and PayPal Integration

Before diving into the specifics, let’s establish a clear understanding of the core components. A CRM system serves as the central hub for managing customer interactions, tracking leads, and nurturing relationships. PayPal, on the other hand, is a widely recognized online payment platform that facilitates secure and convenient transactions. When these two systems are integrated, the synergy creates a powerful tool for businesses of all sizes.

What is a CRM?

A Customer Relationship Management (CRM) system is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. Its primary goal is to improve business relationships with customers, retain them, and drive sales growth. Key features of a CRM include contact management, lead tracking, sales automation, marketing automation, and customer service tools.

What is PayPal?

PayPal is an online payment system that allows users to send and receive money securely. It acts as a middleman between customers and businesses, handling financial transactions without requiring businesses to directly handle sensitive financial information like credit card details. PayPal offers various services, including online payments, invoicing, and payment processing for e-commerce platforms.

The Benefits of Integration

Integrating your CRM with PayPal offers a multitude of benefits, including:

- Enhanced Customer Experience: Streamlined payment processes and personalized interactions lead to higher customer satisfaction.

- Improved Efficiency: Automation of payment-related tasks reduces manual effort and frees up valuable time.

- Reduced Errors: Automated data transfer minimizes the risk of human error in data entry.

- Better Data Insights: Accurate and comprehensive data provides valuable insights into customer behavior and sales performance.

- Increased Sales: Seamless payment experiences and personalized marketing efforts can drive higher conversion rates.

- Simplified Reporting: Consolidated data from both systems makes it easier to track revenue, analyze sales trends, and generate reports.

Key Features of CRM Integration with PayPal

The specific features available with CRM and PayPal integration can vary depending on the CRM platform and the integration method. However, some common features include:

Automated Payment Processing

The most fundamental feature is the ability to automatically process payments through PayPal directly from within the CRM. This eliminates the need to manually enter payment information or switch between systems. When a customer makes a purchase or pays an invoice, the transaction details are automatically recorded in the CRM, providing a complete view of the customer’s payment history.

Invoice Management

Many integrations allow you to create and send invoices directly from your CRM and include a PayPal payment link. Customers can then easily pay their invoices online, and the payment status is automatically updated in the CRM. This streamlined invoicing process saves time and reduces the risk of late payments.

Subscription Management

For businesses that offer subscription-based services, integration can automate the management of recurring payments. The CRM can automatically handle subscription renewals, payment failures, and customer updates, reducing the administrative burden and ensuring a smooth customer experience.

Transaction Tracking

The integration allows you to track all PayPal transactions within your CRM. You can view payment amounts, dates, statuses, and other relevant details directly within the customer’s record. This comprehensive view of the customer’s financial interactions provides valuable insights for sales and customer service teams.

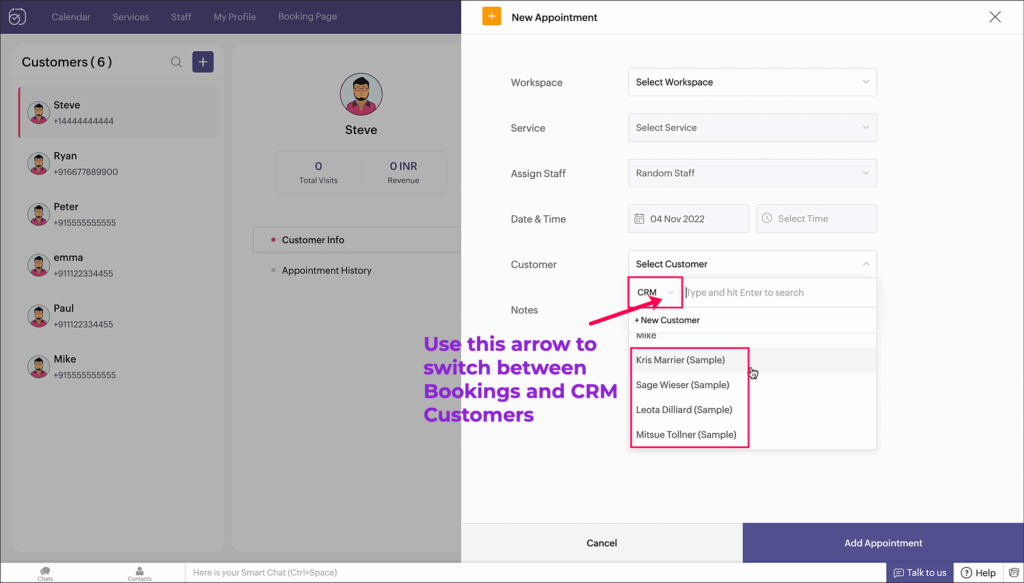

Customer Data Synchronization

Some integrations synchronize customer data between the CRM and PayPal. This ensures that customer information, such as contact details and billing addresses, is consistent across both systems. This synchronization eliminates the need to manually update customer data in multiple locations and reduces the risk of data errors.

Reporting and Analytics

Integrated systems often provide reporting and analytics capabilities. You can generate reports on sales performance, revenue trends, and customer behavior, all based on data from both your CRM and PayPal. These insights can help you make data-driven decisions to improve your business performance.

Choosing the Right CRM for PayPal Integration

The choice of CRM is crucial for successful integration with PayPal. Several CRM platforms offer robust integration capabilities. Consider the following factors when selecting a CRM:

Integration Capabilities

Ensure that the CRM platform offers native or third-party integrations with PayPal. Check the specific features supported by the integration, such as automated payment processing, invoice management, and subscription management. Research whether the CRM supports the specific PayPal features you need, such as PayPal Payments Pro or PayPal Checkout.

Scalability

Choose a CRM that can scale with your business. As your business grows, you’ll need a CRM that can handle increased data volumes, user numbers, and transaction volumes. Consider the CRM’s pricing structure and whether it aligns with your budget and growth plans.

User-Friendliness

The CRM should be easy to use and navigate. A user-friendly interface will reduce the learning curve for your team and improve adoption rates. Look for a CRM with a clean, intuitive design and helpful documentation.

Customization Options

Consider the CRM’s customization options. You may need to customize the CRM to meet your specific business needs. Look for a CRM that allows you to customize fields, workflows, and reports. Ensure that the CRM supports integrations with other business systems you use.

Pricing and Support

Evaluate the CRM’s pricing structure and support options. Consider the cost of the CRM, including any setup fees, ongoing subscription costs, and training costs. Ensure that the CRM provider offers adequate support, such as online documentation, email support, and phone support.

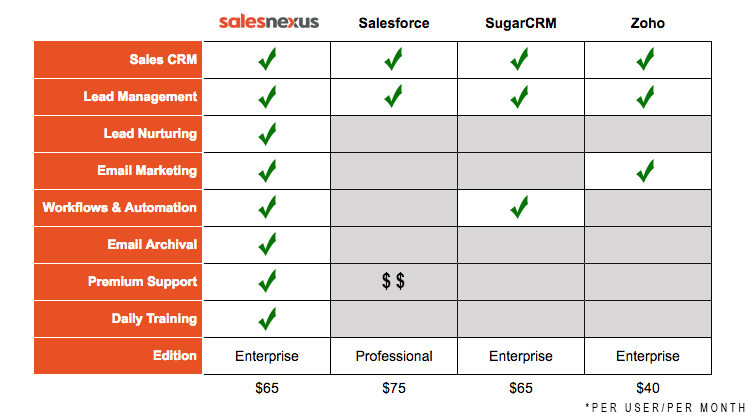

Popular CRM Platforms with PayPal Integration

Several CRM platforms seamlessly integrate with PayPal. Here are some of the most popular options:

Salesforce

Salesforce is a leading CRM platform that offers robust integration capabilities with PayPal. Its features include automated payment processing, invoice management, and subscription management. Salesforce is a highly scalable and customizable platform suitable for businesses of all sizes. It has a dedicated AppExchange with pre-built PayPal integrations.

Zoho CRM

Zoho CRM is a popular and affordable CRM platform with excellent integration with PayPal. It offers features such as automated payment processing, invoice management, and transaction tracking. Zoho CRM is known for its user-friendly interface and strong automation capabilities. Zoho offers a native integration with PayPal.

HubSpot CRM

HubSpot CRM is a free CRM platform that offers basic integration with PayPal. It allows businesses to track payment information and manage customer interactions. HubSpot CRM is known for its ease of use and comprehensive marketing automation features. While the free version has limited PayPal integration, paid versions offer more advanced capabilities through integrations.

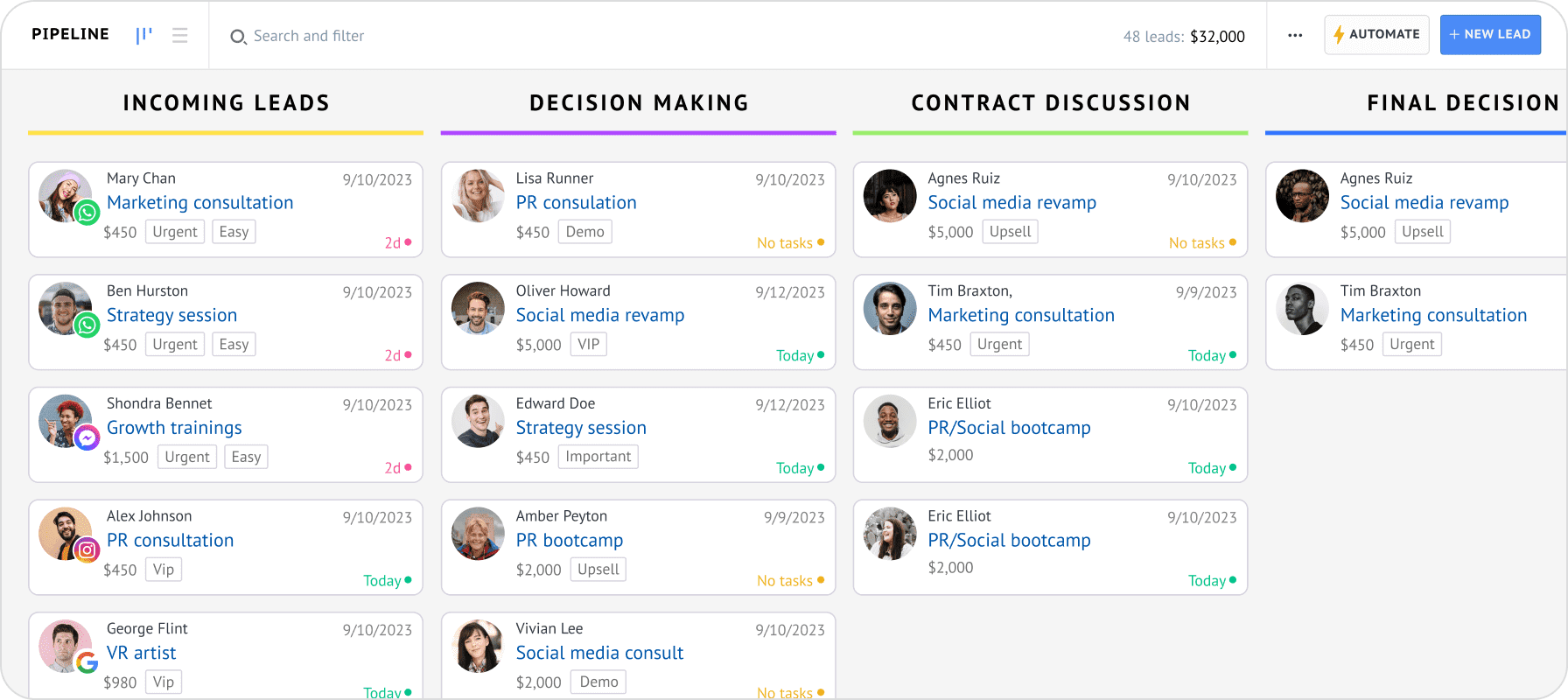

Pipedrive

Pipedrive is a sales-focused CRM that integrates with PayPal to streamline payment processing and invoicing. It’s known for its visual pipeline management and ease of use. Pipedrive offers direct integration with PayPal for payment processing and invoice creation.

SugarCRM

SugarCRM is an open-source CRM platform with a highly customizable interface and robust integration options. It integrates with PayPal for payment processing and transaction tracking. SugarCRM offers a flexible and customizable environment suitable for businesses with complex requirements.

Implementing CRM and PayPal Integration: A Step-by-Step Guide

Implementing CRM and PayPal integration involves several steps. Here’s a general guide to help you get started:

1. Choose Your CRM and Integration Method

Select the CRM platform that best fits your business needs and budget. Research the available integration options with PayPal. You can choose between native integrations, third-party integrations, or custom integrations.

2. Set Up Your PayPal Account

Ensure you have an active PayPal business account. If you haven’t already, sign up for a PayPal business account and configure your account settings.

3. Connect Your CRM to PayPal

Follow the instructions provided by your CRM provider or the integration provider to connect your CRM to your PayPal account. This typically involves entering your PayPal API credentials or authorizing the integration through your PayPal account.

4. Configure Integration Settings

Configure the integration settings to match your business requirements. This may involve mapping fields between your CRM and PayPal, setting up payment notifications, and configuring automated workflows.

5. Test the Integration

Thoroughly test the integration to ensure that it’s functioning correctly. Send test invoices, process test payments, and verify that data is being synchronized between your CRM and PayPal.

6. Train Your Team

Train your team on how to use the integrated system. Provide them with documentation and support to ensure they can effectively manage customer interactions and payment processes.

7. Monitor and Optimize

Monitor the integration’s performance and make adjustments as needed. Review your reports, analyze your data, and identify opportunities to optimize your processes and improve your results.

Best Practices for Successful Integration

Following these best practices will help you maximize the benefits of CRM and PayPal integration:

Data Mapping

Carefully map the data fields between your CRM and PayPal to ensure that information is transferred correctly. This includes mapping customer information, product details, and payment amounts. Thorough data mapping reduces the risk of errors and ensures data consistency.

Security

Prioritize security by using secure connections and protecting sensitive data. Ensure that your CRM and PayPal accounts are protected with strong passwords and multi-factor authentication. Regularly review your security settings and update them as needed.

Automation

Leverage automation features to streamline your processes and save time. Automate tasks such as invoice generation, payment reminders, and customer notifications. Automation reduces manual effort and improves efficiency.

Reporting and Analytics

Use the reporting and analytics capabilities of your integrated system to track your sales performance and customer behavior. Analyze your data to identify trends, measure your results, and make data-driven decisions to improve your business performance.

Regular Updates

Keep your CRM, PayPal, and integration software up to date. Regularly update your software to ensure that you have the latest features, security patches, and bug fixes. Staying up to date ensures optimal performance and security.

Customer Communication

Communicate clearly with your customers about payment processes and expectations. Provide clear instructions on how to pay invoices and make purchases. Respond promptly to customer inquiries and provide excellent customer service.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some common integration issues. Here are some troubleshooting tips:

Connection Errors

If you experience connection errors, double-check your API credentials and ensure that your internet connection is stable. Verify that your firewall or security settings are not blocking the connection between your CRM and PayPal.

Data Synchronization Issues

If data is not synchronizing correctly, verify your data mapping settings and ensure that the fields are mapped correctly between your CRM and PayPal. Check your integration settings for any errors or misconfigurations. Also, check for any API limitations or rate limits that may be affecting data synchronization.

Payment Processing Errors

If you encounter payment processing errors, verify that your PayPal account is active and in good standing. Check your payment gateway settings and ensure that they are configured correctly. Investigate any error messages and consult the PayPal documentation for troubleshooting tips.

Invoice Issues

If you experience invoice issues, verify that your invoice settings are configured correctly, including invoice templates and payment terms. Check your CRM documentation for tips on invoice management and troubleshooting.

The Future of CRM and Payment Integration

The integration of CRM and payment gateways is an evolving landscape. As technology advances, we can anticipate further developments in this area:

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML will play an increasing role in automating and optimizing payment processes. AI-powered systems can analyze customer behavior, predict payment patterns, and personalize payment experiences. Machine learning can identify fraudulent transactions and improve security.

Blockchain Technology

Blockchain technology could potentially revolutionize payment processing by providing secure and transparent transactions. Blockchain-based payment systems could offer greater security and reduce transaction fees.

Mobile Payment Integration

Mobile payments are becoming increasingly popular. CRM systems will continue to integrate with mobile payment platforms to provide customers with seamless payment experiences on the go.

Enhanced Security Features

Security will remain a top priority. We can expect to see more advanced security features, such as two-factor authentication, fraud detection, and encryption, to protect sensitive data and prevent fraudulent activities.

Conclusion

CRM integration with PayPal offers a powerful combination for businesses seeking to optimize their operations, enhance customer experiences, and drive sustainable growth. By understanding the benefits, choosing the right CRM, implementing the integration effectively, and following best practices, you can streamline your payment processes, improve data insights, and increase your sales. As technology continues to evolve, the future of CRM and payment integration promises even greater efficiency, security, and customer satisfaction. Embrace the possibilities and take your business to the next level with seamless transactions.