Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost revenue. One powerful combination that achieves these goals is the integration of Customer Relationship Management (CRM) systems with payment gateways like PayPal. This article dives deep into the benefits, implementation strategies, and best practices for integrating your CRM with PayPal, empowering your business to thrive.

Understanding the Power of CRM and PayPal Integration

Before we delve into the specifics, let’s establish a clear understanding of what CRM and PayPal are and why their integration is so crucial. CRM systems are the backbone of modern businesses, providing a centralized platform to manage customer interactions, track leads, and analyze sales data. PayPal, on the other hand, is a globally recognized online payment system, offering a secure and convenient way for customers to make transactions.

What is CRM?

Customer Relationship Management (CRM) is a technology and strategy for managing all your company’s relationships and interactions with current and potential customers. The goal is simple: Improve business relationships. A CRM system helps businesses stay connected to customers, streamline processes, and improve profitability. When people talk about CRM, they are typically referring to a CRM system, a tool that helps with contact management, sales management, productivity, and more.

What is PayPal?

PayPal is an online payment system that makes it easier to send and receive money online. It’s a global e-commerce business allowing payments and money transfers to be made through the Internet. Online money transfers serve as electronic alternatives to paying with traditional paper methods, such as checks and money orders. PayPal is a payment processor that is widely accepted by online retailers around the world. It provides a secure and convenient way for customers to make online purchases and for businesses to receive payments.

The Synergy: Why Integration Matters

Integrating CRM with PayPal creates a powerful synergy, unlocking numerous benefits for your business. This integration allows you to:

- Automate payment processing: Automatically process payments directly within your CRM, eliminating manual data entry and reducing errors.

- Gain a 360-degree view of customers: Track payment history, subscriptions, and transaction details within your CRM, providing a complete view of each customer’s interaction with your business.

- Improve sales and marketing efficiency: Segment customers based on their payment behavior, personalize marketing campaigns, and tailor sales efforts for maximum impact.

- Enhance customer experience: Offer seamless payment options, provide instant access to payment history, and resolve payment-related issues quickly.

- Reduce manual work: Eliminate manual reconciliation of payments, saving time and resources.

In essence, integrating CRM with PayPal streamlines your business processes, enhances customer relationships, and ultimately drives revenue growth. It’s a smart move for any business looking to stay ahead of the curve.

Benefits of CRM Integration with PayPal

The advantages of integrating your CRM with PayPal are multifaceted, touching various aspects of your business operations. Here’s a closer look at the key benefits:

Streamlined Payment Processing

One of the primary benefits is the automation of payment processing. Instead of manually entering payment details, your CRM can automatically handle transactions, reducing the risk of errors and saving valuable time. This automation is especially beneficial for businesses that handle a high volume of transactions.

Enhanced Customer Data Management

Integration allows you to capture and store payment-related data directly within your CRM. This includes transaction amounts, dates, and payment methods. This comprehensive data provides a 360-degree view of each customer, enabling you to understand their purchase history and preferences better. This data is invaluable for personalizing customer interactions and tailoring marketing campaigns.

Improved Sales and Marketing Effectiveness

With integrated data, you can segment customers based on their payment behavior. For example, you can identify high-value customers, churned customers, or those who have yet to make a purchase. This segmentation allows you to create targeted marketing campaigns and tailor sales efforts to specific customer segments. This focused approach significantly increases the effectiveness of your sales and marketing initiatives.

Better Customer Experience

Integrating CRM with PayPal provides a superior customer experience. Customers can easily access their payment history, view invoices, and manage subscriptions directly from their customer portal. This self-service approach reduces the need for customer support and increases customer satisfaction. Furthermore, by addressing payment-related issues promptly, you can build stronger customer relationships.

Reduced Operational Costs

Automation reduces the need for manual data entry and reconciliation, significantly reducing operational costs. Time saved on these tasks can be reallocated to more strategic activities, such as customer engagement and business development. Also, by reducing errors, you minimize the need for costly corrections.

Improved Reporting and Analytics

Integrated data provides more comprehensive reporting and analytics capabilities. You can track sales performance, analyze customer behavior, and identify trends to make data-driven decisions. This deeper understanding of your business performance enables you to optimize your strategies and drive growth.

Implementing CRM Integration with PayPal: A Step-by-Step Guide

Implementing CRM integration with PayPal can seem daunting, but with the right approach, it’s a manageable process. Here’s a step-by-step guide to help you through the process:

Step 1: Choose the Right CRM and PayPal Integration Method

The first step is to select the right CRM system and PayPal integration method. Several CRM systems offer native integrations with PayPal, making the setup process relatively straightforward. Alternatively, you can use third-party integration tools or custom development to connect your CRM and PayPal. Choosing the right method depends on your specific needs and technical expertise.

Step 2: Set Up Your PayPal Account

Ensure your PayPal account is set up correctly. You’ll need a business account to process payments and access the necessary APIs. Verify your account and configure the settings to match your business requirements.

Step 3: Connect Your CRM and PayPal

Follow the instructions provided by your CRM system or integration tool to connect your CRM and PayPal accounts. This typically involves providing your PayPal API credentials, such as your API username, password, and signature. The integration process will vary depending on the CRM and integration method you choose. For some platforms, it might be as simple as inputting your API keys. Other platforms may require more advanced configuration.

Step 4: Configure Payment Settings

Configure your payment settings within your CRM. This includes setting up payment methods, currency options, and tax configurations. Ensure that your settings align with your business policies and customer preferences.

Step 5: Test the Integration

Thoroughly test the integration to ensure that payments are processed correctly and that data is synced between your CRM and PayPal. Make test transactions to verify that the entire process functions as expected. This testing phase is critical to identify and resolve any issues before going live.

Step 6: Train Your Team

Train your team on how to use the integrated system. Provide instructions on how to process payments, manage customer data, and troubleshoot any issues. Proper training ensures that your team can effectively utilize the integration and maximize its benefits.

Step 7: Monitor and Optimize

Once the integration is live, continuously monitor its performance and make necessary adjustments. Review your sales data, customer interactions, and payment processing to identify areas for optimization. Regularly update your CRM and integration tools to ensure compatibility and take advantage of new features.

Popular CRM Systems with PayPal Integration

Several CRM systems offer seamless integration with PayPal. Here are some of the most popular options:

Salesforce

Salesforce is a leading CRM platform with robust integration capabilities. It offers various integration options with PayPal, including custom integrations and third-party apps. Salesforce’s integration with PayPal allows businesses to manage payments, track transactions, and gain a comprehensive view of customer data. Salesforce is known for its scalability and customization options, making it a suitable choice for businesses of all sizes.

HubSpot

HubSpot is a popular CRM platform, particularly for marketing and sales teams. It offers native integration with PayPal through its payment tools. This integration allows users to create payment links, track transactions, and manage customer payments directly within the HubSpot platform. HubSpot is known for its user-friendly interface and comprehensive marketing automation features.

Zoho CRM

Zoho CRM is a versatile CRM system that offers seamless integration with PayPal. Users can integrate PayPal to automate payment processing, track transactions, and manage customer data. Zoho CRM is known for its affordability and customization options, making it a popular choice for small and medium-sized businesses.

Microsoft Dynamics 365

Microsoft Dynamics 365 is a comprehensive CRM platform that offers robust integration capabilities. It provides several options for integration with PayPal, including custom integrations and third-party apps. Dynamics 365 is known for its integration with other Microsoft products and its powerful reporting and analytics capabilities.

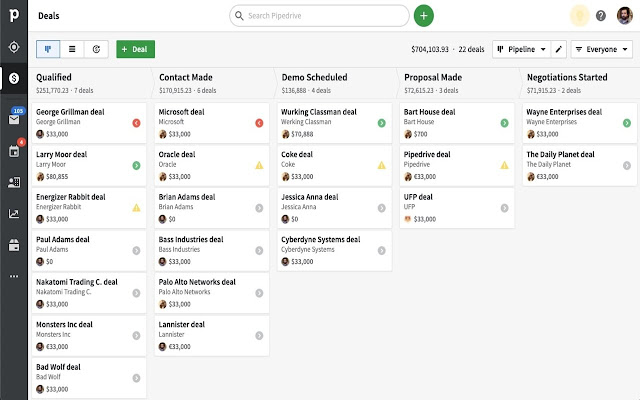

Pipedrive

Pipedrive is a sales-focused CRM that provides integration with PayPal. This integration allows users to track payments, manage invoices, and streamline sales processes. Pipedrive is known for its user-friendly interface and its focus on sales pipeline management.

The choice of CRM will depend on your specific requirements, budget, and technical expertise. Consider the features, scalability, and integration capabilities of each CRM before making a decision.

Best Practices for CRM and PayPal Integration

To maximize the benefits of CRM and PayPal integration, follow these best practices:

Data Synchronization

Ensure that data is synchronized accurately and consistently between your CRM and PayPal. This includes customer data, transaction details, and payment history. Regular data synchronization ensures that you have a complete and up-to-date view of your customers and their payment activity.

Security and Compliance

Prioritize the security of your customer data and ensure compliance with industry regulations, such as PCI DSS. Use secure payment gateways, encrypt sensitive data, and regularly update your security protocols. Compliance is essential to protect customer information and maintain trust.

Automation and Workflow Optimization

Leverage automation features to streamline your payment processing and other workflows. Automate tasks such as invoice generation, payment reminders, and data entry. Automation saves time, reduces errors, and improves efficiency.

Reporting and Analytics

Utilize reporting and analytics tools to track key performance indicators (KPIs) and gain insights into your sales and customer behavior. Analyze your sales data, customer interactions, and payment processing to identify trends and optimize your strategies. Reporting and analytics provide valuable insights for data-driven decision-making.

Training and Support

Provide comprehensive training and support to your team to ensure they can effectively use the integrated system. Offer ongoing support and address any issues promptly. Proper training and support ensure that your team can maximize the benefits of the integration.

Regular Updates and Maintenance

Keep your CRM and integration tools up-to-date to ensure compatibility and take advantage of new features and security enhancements. Regularly review your integration settings and make necessary adjustments to optimize performance and security. Regular maintenance is essential to keep your system running smoothly.

Troubleshooting Common Issues

Even with the best planning, you may encounter some common issues during CRM and PayPal integration. Here are some troubleshooting tips:

Connection Errors

If you encounter connection errors, verify your API credentials and ensure that your CRM and PayPal accounts are properly connected. Check your internet connection and confirm that your firewall settings allow communication between your CRM and PayPal. If problems persist, consult the documentation or contact the support team for your CRM or PayPal.

Data Synchronization Problems

If data is not synchronizing correctly, check your synchronization settings and ensure that all relevant fields are mapped correctly. Verify that your CRM and PayPal accounts have the necessary permissions to access and update data. Review your data mapping and ensure that the data formats are compatible. If issues persist, troubleshoot your data synchronization settings or contact support.

Payment Processing Errors

If you experience payment processing errors, check your payment settings and ensure that your payment methods are configured correctly. Verify that your customers have sufficient funds and that their payment information is accurate. Check your PayPal account for any restrictions or issues. If problems persist, contact PayPal support or your CRM provider.

Security Concerns

If you have security concerns, review your security settings and ensure that your data is protected. Implement strong passwords, encrypt sensitive data, and regularly update your security protocols. Monitor your system for any suspicious activity. If you identify any security breaches, take immediate action to address the issue. Consider PCI DSS compliance to ensure your data is protected.

The Future of CRM and PayPal Integration

The landscape of CRM and PayPal integration is constantly evolving, with new technologies and features emerging regularly. Here are some trends to watch:

Artificial Intelligence (AI)

AI is playing an increasingly important role in CRM and payment processing. AI-powered tools can analyze customer data, personalize payment experiences, and identify fraudulent transactions. AI can also automate customer support and provide insights into customer behavior.

Mobile Payments

Mobile payments are becoming increasingly popular, and CRM systems are adapting to support them. Mobile CRM apps can provide customers with a seamless payment experience on their mobile devices. This trend is driven by the increasing use of smartphones and the need for convenient payment options.

Blockchain Technology

Blockchain technology has the potential to revolutionize payment processing by providing a secure and transparent way to manage transactions. CRM systems are exploring the use of blockchain to enhance security and reduce transaction costs. This technology could become increasingly important in the future.

Integration with Other Payment Gateways

While PayPal is a popular choice, CRM systems are increasingly integrating with other payment gateways. This allows businesses to offer a wider range of payment options to their customers. This trend reflects the desire for flexibility and the need to cater to diverse customer preferences.

As technology advances, we can expect to see even more sophisticated CRM and PayPal integrations, offering businesses enhanced capabilities and improved customer experiences.

Conclusion

Integrating your CRM system with PayPal is a strategic move that can significantly enhance your business operations, improve customer relationships, and drive revenue growth. By automating payment processing, gaining a 360-degree view of customers, and improving sales and marketing effectiveness, you can streamline your processes and achieve greater success. The implementation process, while requiring careful planning, is manageable with the right approach. By following best practices and staying informed about the latest trends, you can maximize the benefits of this powerful combination and position your business for success in today’s competitive market.