Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

The Power of Integration: CRM and PayPal in Harmony

In the ever-evolving landscape of e-commerce and customer relationship management, the ability to streamline processes and enhance customer experiences is paramount. One powerful combination that businesses are increasingly leveraging is the integration of Customer Relationship Management (CRM) systems with PayPal. This pairing offers a multitude of benefits, from simplified payment processing to enriched customer data analysis, ultimately driving business growth. This article delves into the intricacies of CRM integration with PayPal, exploring the advantages, implementation strategies, and real-world applications that can transform your business operations.

Understanding the Fundamentals: CRM and PayPal Explained

What is a CRM?

A CRM system is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. CRM helps businesses improve customer relationships, retain customers, and drive sales growth. Key features of a CRM include contact management, sales automation, marketing automation, and customer service support. Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365, each offering a range of features to suit different business needs and sizes.

The Role of PayPal

PayPal is a global online payment system that facilitates money transfers between parties through the internet. It serves as a secure and convenient payment gateway, allowing businesses to accept payments from customers worldwide. PayPal’s widespread acceptance, ease of use, and robust security features make it a popular choice for both consumers and businesses. PayPal provides various payment solutions, including online payment processing, invoicing, and point-of-sale (POS) systems, catering to diverse business models.

The Synergy: Why Integrate CRM with PayPal?

The integration of CRM with PayPal creates a powerful synergy, enabling businesses to optimize their payment processes, improve customer management, and gain valuable insights. Let’s explore the key benefits of this integration:

Streamlined Payment Processing

One of the most immediate benefits is the streamlining of payment processing. CRM systems can be integrated with PayPal to automate the payment collection process. This means that when a customer makes a purchase, the payment information is automatically captured and recorded in the CRM system. This eliminates the need for manual data entry, reduces errors, and saves valuable time. Furthermore, it allows businesses to easily track payment statuses, generate invoices, and manage refunds directly from the CRM interface.

Enhanced Customer Data Management

CRM integration with PayPal enriches customer data. When a customer makes a payment through PayPal, the CRM system can automatically capture and store payment details, such as transaction amounts, dates, and payment methods. This data is then linked to the customer’s profile in the CRM, providing a more complete view of the customer’s purchase history and behavior. This comprehensive data allows businesses to personalize customer interactions, tailor marketing campaigns, and provide better customer service.

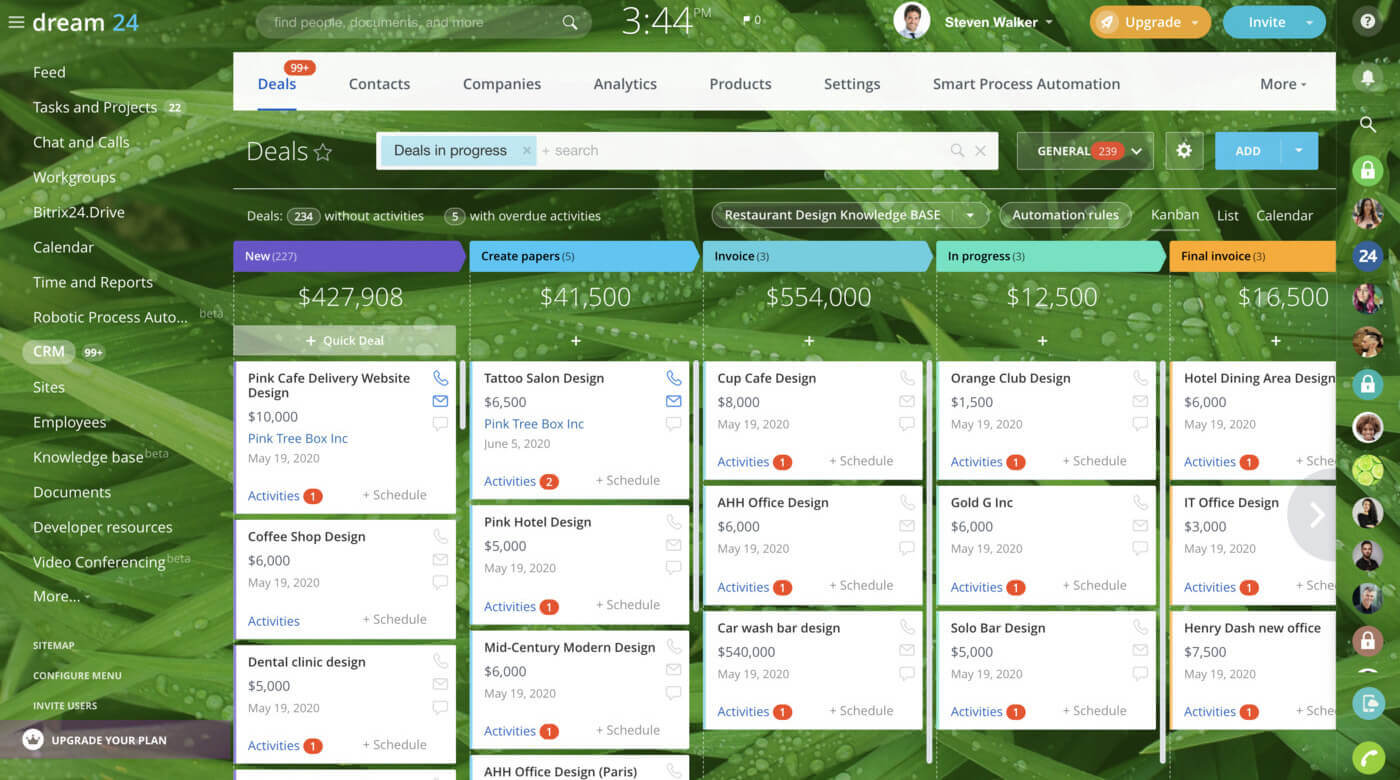

Improved Sales Automation

The integration facilitates improved sales automation. By connecting PayPal transactions to the CRM, businesses can automate various sales processes. For example, when a payment is received, the CRM can automatically update the sales pipeline, trigger follow-up emails, and assign tasks to sales representatives. This automation streamlines the sales process, reduces manual effort, and improves sales efficiency. Additionally, it enables businesses to track sales performance more accurately and identify areas for improvement.

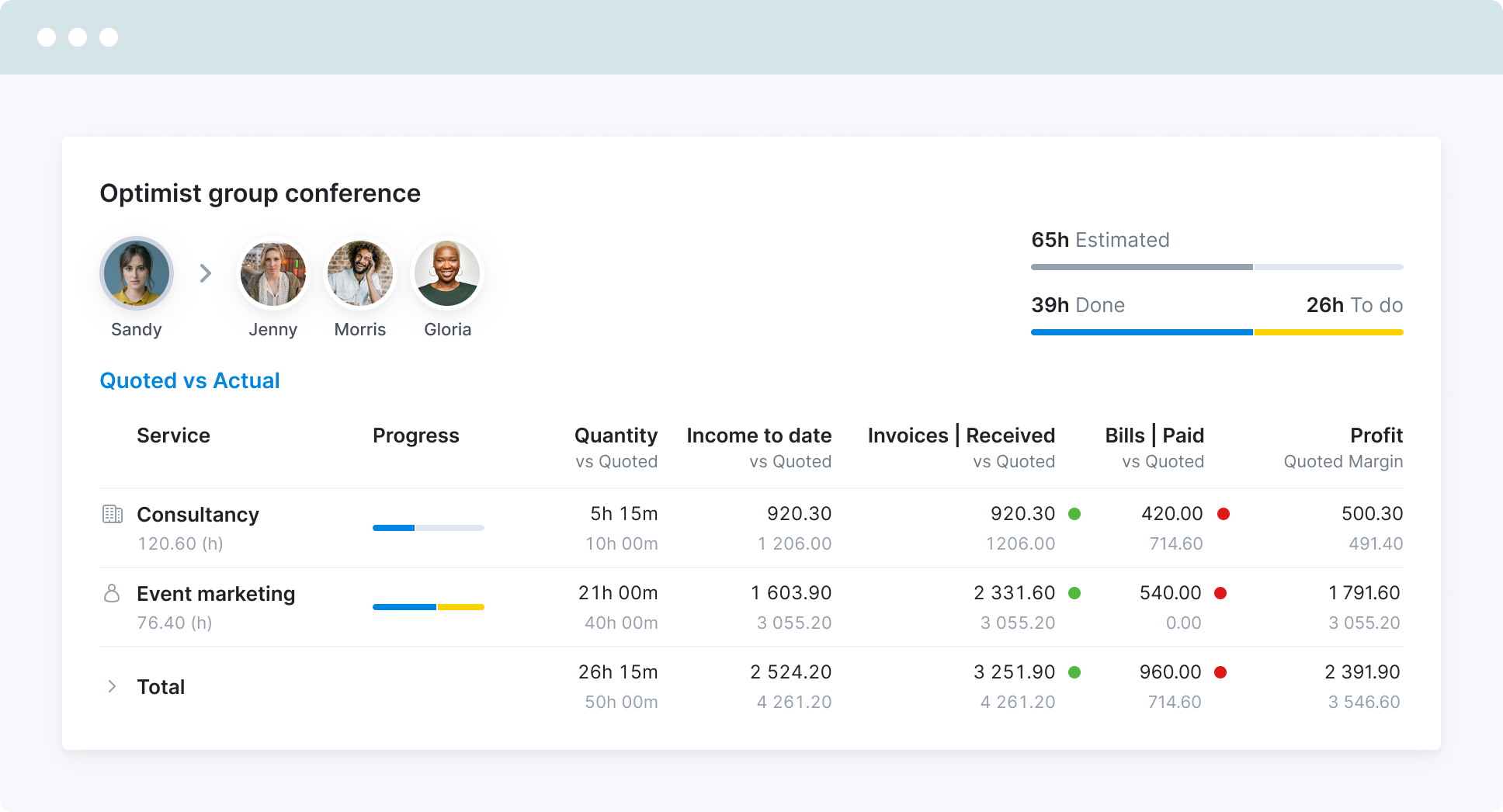

Better Reporting and Analytics

CRM integration with PayPal provides better reporting and analytics capabilities. Businesses can generate detailed reports on sales, revenue, and customer behavior, providing valuable insights into their business performance. This data can be used to identify trends, track key performance indicators (KPIs), and make data-driven decisions. For example, businesses can analyze which products or services are most popular, identify customer segments with high purchase frequency, and measure the effectiveness of marketing campaigns.

Reduced Manual Errors

Manual data entry is prone to errors, which can lead to incorrect payment records and customer dissatisfaction. CRM integration with PayPal eliminates the need for manual data entry, reducing the risk of errors. This ensures that payment information is accurate, reliable, and consistent, improving the overall efficiency of payment processing. With accurate data, businesses can avoid payment disputes and maintain a positive customer experience.

Enhanced Security

Both CRM systems and PayPal employ robust security measures to protect sensitive customer data. Integrating these two systems enhances security by providing an additional layer of protection. CRM systems can be configured to comply with industry security standards, and PayPal utilizes encryption and fraud detection technologies to secure payment transactions. This combination creates a secure environment for processing payments and managing customer data, building trust with customers.

Implementing CRM Integration with PayPal: A Step-by-Step Guide

Implementing CRM integration with PayPal involves several steps. The process can vary depending on the CRM platform and the specific business requirements. However, the general steps are as follows:

Choose a CRM Platform

The first step is to choose a CRM platform that meets your business needs. Consider factors such as features, scalability, ease of use, and pricing. Popular CRM platforms that offer PayPal integration include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365. Research and compare different platforms to determine which one is the best fit for your business. Evaluate the CRM’s capabilities, integration options, and support services to make an informed decision.

Set Up a PayPal Business Account

If you don’t already have one, create a PayPal business account. This account is required to accept payments through PayPal. The setup process involves providing business information, verifying your identity, and linking your bank account. Ensure that your PayPal account is properly configured to receive payments and that you understand the associated fees and transaction limits. Familiarize yourself with PayPal’s terms of service and security policies.

Choose an Integration Method

There are several integration methods available, including:

- Native Integration: Some CRM platforms offer native integration with PayPal, providing a seamless and pre-built connection. This is often the easiest and most straightforward method.

- Third-Party Integration: Third-party integration tools and plugins can connect your CRM and PayPal accounts. These tools often offer more customization options and advanced features.

- Custom Integration: For more complex requirements, you can develop a custom integration using APIs (Application Programming Interfaces) provided by both the CRM and PayPal. This method requires technical expertise.

Evaluate the available methods and choose the one that best suits your technical capabilities and business needs.

Configure the Integration

Once you have chosen an integration method, configure the integration settings. This involves connecting your CRM and PayPal accounts, mapping data fields, and setting up automation rules. Follow the instructions provided by the CRM platform or the integration tool. Test the integration thoroughly to ensure that data is being transferred correctly and that payment processing is functioning as expected. Configure the integration settings according to your specific business requirements, such as payment notifications, invoice templates, and currency settings.

Test the Integration

Before going live, test the integration thoroughly. Conduct test transactions to verify that payments are being processed correctly and that data is being captured and stored in the CRM. Review the customer data in the CRM to ensure that it is accurate and complete. Identify and resolve any issues or errors that may arise during testing. Testing is crucial to ensure that the integration works as expected and that you provide a seamless payment experience for your customers.

Train Your Team

Train your team on how to use the integrated system. Provide training on how to process payments, manage customer data, and generate reports. Ensure that your team understands the benefits of the integration and how it can help them improve their work. Offer ongoing support and training to address any questions or issues that may arise. A well-trained team will ensure the successful adoption and utilization of the integrated system.

Monitor and Optimize

Monitor the performance of the integration regularly. Track key performance indicators (KPIs) such as sales, revenue, and customer satisfaction. Identify areas for improvement and make adjustments to the integration as needed. Stay updated on any changes to the CRM platform or PayPal’s features and policies. Continuously optimize the integration to maximize its benefits and ensure its long-term effectiveness. Regularly review the performance of the integration and make adjustments to optimize its functionality.

Real-World Applications: CRM Integration with PayPal in Action

Let’s explore how businesses are leveraging CRM integration with PayPal to achieve tangible results:

E-commerce Businesses

E-commerce businesses can use CRM integration with PayPal to automate payment processing, track customer orders, and manage customer data. When a customer makes a purchase on an e-commerce website, the payment information is automatically captured and stored in the CRM. This allows businesses to track order statuses, send shipping notifications, and provide personalized customer service. They can also analyze customer purchase history to tailor marketing campaigns and offer targeted promotions.

Subscription-Based Services

Subscription-based services can streamline billing and subscription management with CRM integration. The CRM can automatically handle recurring payments, send invoices, and manage customer subscriptions. This reduces manual effort and improves the accuracy of billing. Businesses can also track subscription cancellations and renewals, and identify customers at risk of churning. This integration helps to improve customer retention and revenue generation.

Nonprofit Organizations

Nonprofit organizations can use CRM integration with PayPal to manage donations and track donor information. The CRM can automatically record donation amounts, dates, and donor contact information. This allows nonprofits to send thank-you notes, track donor engagement, and generate reports on fundraising activities. They can also segment donors based on their giving history and tailor communication to maximize donations.

Service-Based Businesses

Service-based businesses can use CRM integration with PayPal to manage invoices, track payments, and automate payment reminders. When a service is rendered, the CRM can automatically generate and send invoices to clients. The CRM also tracks payment statuses and sends payment reminders to overdue invoices. This streamlines billing processes, improves cash flow, and reduces administrative overhead. Service-based businesses can also track project costs and revenue to improve profitability.

Overcoming Challenges: Common Issues and Solutions

While CRM integration with PayPal offers numerous benefits, there may be some challenges to consider:

Data Synchronization Issues

Ensuring accurate data synchronization between the CRM and PayPal can be a challenge. Inconsistencies or delays in data transfer can lead to errors and frustration. To address this, regularly monitor data synchronization, implement error handling mechanisms, and choose integration methods that offer robust data transfer capabilities. Verify that data fields are properly mapped and that data is synchronized in real-time.

Security Concerns

Protecting sensitive customer data is crucial. Businesses must ensure that the integration adheres to industry security standards and that data is encrypted during transfer. Choose integration methods that offer secure data transfer protocols and consider implementing additional security measures such as two-factor authentication. Regularly review security protocols and update them as needed to protect customer data.

Technical Complexity

Implementing CRM integration with PayPal can be technically complex, especially for custom integrations. Businesses may need to hire a developer or seek the help of a third-party integration specialist. Before starting integration, assess your technical capabilities, and choose an integration method that aligns with your technical resources. Consider using pre-built integrations or third-party tools to simplify the process.

Compatibility Issues

Ensure that the CRM platform and PayPal are compatible. Some CRM platforms may not fully support PayPal integration or may have limited features. Before choosing a CRM platform, verify its compatibility with PayPal and the integration methods available. Review user reviews and documentation to ensure that the CRM and PayPal can seamlessly work together. Consider the long-term compatibility and support when making your selection.

The Future of CRM and PayPal Integration

The integration of CRM with PayPal is constantly evolving. As technology advances, we can expect to see even more sophisticated integrations that offer enhanced features and benefits. Some emerging trends include:

AI-Powered Automation

Artificial intelligence (AI) is playing an increasingly important role in CRM and payment processing. AI-powered automation can streamline payment processes, detect fraudulent transactions, and provide personalized customer experiences. AI can analyze customer data to predict future purchases, recommend products, and optimize marketing campaigns. This integration will enhance the efficiency of payment processing and customer management.

Mobile Payment Integration

With the increasing use of mobile devices, mobile payment integration is becoming more important. CRM systems can be integrated with mobile payment platforms such as Apple Pay and Google Pay, allowing businesses to accept payments on the go. This enhances the customer experience and provides flexibility in payment options. Mobile payment integration will be essential for businesses that are expanding their mobile presence.

Blockchain Technology

Blockchain technology offers secure and transparent payment processing. CRM integration with blockchain can improve the security of payment transactions and reduce the risk of fraud. Blockchain technology can also enable new payment models, such as cryptocurrency payments and decentralized finance. This integration will enhance the security and transparency of payment processing.

Enhanced Analytics

Advanced analytics tools are providing businesses with deeper insights into customer behavior and sales performance. CRM integration with PayPal can provide more detailed data on customer purchase history, payment methods, and transaction patterns. Businesses can use this data to make more informed decisions, optimize marketing campaigns, and improve customer service. Enhanced analytics will drive business growth.

Conclusion: Embrace the Power of Integration

CRM integration with PayPal is a strategic move that can significantly benefit businesses of all sizes. By streamlining payment processing, enhancing customer data management, and improving sales automation, this integration empowers businesses to optimize their operations and drive growth. By taking the time to understand the fundamentals, implement the integration effectively, and address any challenges, businesses can unlock the full potential of this powerful combination. Embrace the power of integration and watch your business thrive.