Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost profitability. One of the most effective strategies for achieving these goals is through the seamless integration of Customer Relationship Management (CRM) systems with payment gateways like PayPal. This article delves into the intricacies of CRM integration with PayPal, exploring the benefits, implementation strategies, and best practices to help businesses of all sizes optimize their financial workflows and foster sustainable growth.

Understanding the Power of CRM and PayPal Integration

Before diving into the specifics, it’s crucial to understand the individual strengths of CRM systems and PayPal, and how their synergy can revolutionize business processes.

What is CRM?

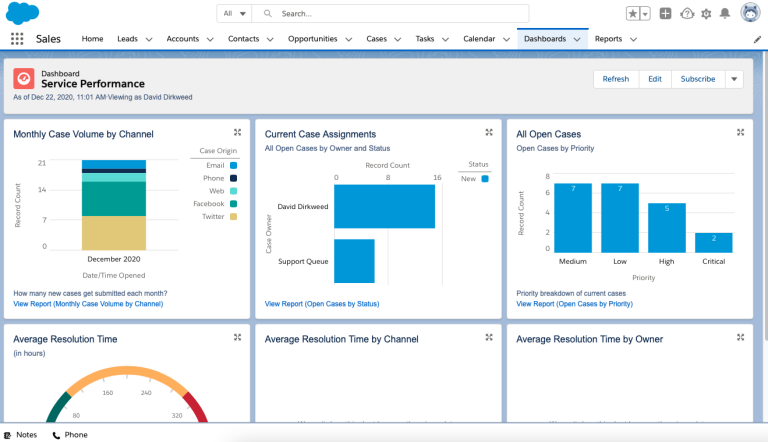

CRM, or Customer Relationship Management, is a system designed to manage and analyze customer interactions and data throughout the customer lifecycle. It acts as a central hub for all customer-related information, enabling businesses to:

- Centralize Customer Data: Store and organize all customer information, including contact details, purchase history, communication logs, and preferences.

- Improve Customer Service: Provide personalized and efficient customer support by having readily available access to customer data.

- Enhance Sales Processes: Streamline sales workflows, track leads, and manage opportunities to convert prospects into paying customers.

- Boost Marketing Efforts: Segment customers, personalize marketing campaigns, and track campaign performance to maximize ROI.

- Gain Actionable Insights: Analyze customer data to identify trends, understand customer behavior, and make data-driven business decisions.

What is PayPal?

PayPal is a widely recognized online payment platform that allows businesses to securely receive payments from customers worldwide. It offers a convenient and reliable way to:

- Accept Online Payments: Enable customers to pay for goods and services using various payment methods, including credit cards, debit cards, and bank transfers.

- Process Transactions Securely: Provide a secure payment gateway that protects sensitive financial information from fraud and cyber threats.

- Facilitate International Transactions: Support multiple currencies and facilitate transactions with customers around the globe.

- Offer Payment Flexibility: Provide customers with various payment options, including one-time payments, recurring subscriptions, and installment plans.

- Simplify Financial Management: Provide tools for tracking payments, generating reports, and managing financial transactions.

The Synergy: CRM and PayPal Integration

The integration of CRM and PayPal creates a powerful synergy that can transform the way businesses manage their financial transactions and customer relationships. By connecting these two systems, businesses can:

- Automate Payment Processes: Automatically process payments for invoices, subscriptions, and other transactions, reducing manual effort and minimizing errors.

- Track Payment History: Automatically record payment information in the CRM system, providing a complete view of customer transactions.

- Reconcile Payments: Automatically reconcile payments with invoices and customer records, ensuring accurate financial reporting.

- Improve Customer Experience: Provide customers with a seamless and convenient payment experience, reducing friction and increasing satisfaction.

- Gain Real-time Insights: Access real-time payment data within the CRM system, enabling businesses to track sales, monitor revenue, and make informed business decisions.

Key Benefits of CRM Integration with PayPal

Integrating your CRM system with PayPal offers a multitude of benefits that can significantly impact your business’s bottom line and overall efficiency. Here are some of the most significant advantages:

Enhanced Efficiency and Automation

One of the primary benefits of CRM and PayPal integration is the automation of payment-related tasks. This includes:

- Automated Invoice Generation and Sending: CRM systems can automatically generate invoices based on sales orders or service agreements and send them directly to customers.

- Automated Payment Reminders: The system can send automated reminders to customers regarding upcoming payments, reducing late payments and improving cash flow.

- Automated Payment Processing: When a customer pays via PayPal, the CRM system automatically processes the payment, updates the invoice status, and records the transaction details.

- Reduced Manual Data Entry: Automation eliminates the need for manual data entry, saving time and reducing the risk of errors.

By automating these tasks, businesses can free up valuable time and resources, allowing employees to focus on more strategic initiatives.

Improved Customer Experience

A seamless payment experience is crucial for customer satisfaction and loyalty. CRM and PayPal integration can significantly improve the customer experience in several ways:

- Simplified Payment Process: Customers can easily pay for goods and services directly from invoices or within the CRM system, without having to navigate to a separate payment gateway.

- Multiple Payment Options: PayPal offers a variety of payment options, giving customers the flexibility to choose the method that suits them best.

- Secure and Reliable Transactions: PayPal’s robust security measures ensure that customer payment information is protected from fraud and cyber threats.

- Personalized Communication: CRM systems can be used to personalize payment-related communication, such as sending payment confirmations and providing updates on order status.

A positive payment experience can increase customer satisfaction, build trust, and encourage repeat business.

Better Financial Management

CRM and PayPal integration provides businesses with better control over their finances and facilitates accurate financial reporting:

- Real-time Payment Tracking: The CRM system provides real-time visibility into payment status, allowing businesses to track outstanding invoices, monitor revenue, and identify potential payment issues.

- Automated Reconciliation: The system automatically reconciles payments with invoices and customer records, ensuring accurate financial reporting and reducing the risk of errors.

- Detailed Reporting: CRM systems can generate detailed reports on sales, revenue, and payment trends, providing valuable insights for financial planning and decision-making.

- Improved Cash Flow Management: By automating payment processes and tracking payment status, businesses can improve cash flow management and ensure timely payments from customers.

Accurate financial management is crucial for the long-term success and sustainability of any business.

Enhanced Sales and Marketing Effectiveness

CRM and PayPal integration can also enhance sales and marketing effectiveness:

- Faster Order Processing: Integrated systems allow for faster order processing, as payments are automatically processed upon order placement.

- Improved Lead Conversion: By providing a seamless payment experience, businesses can improve lead conversion rates.

- Targeted Marketing Campaigns: CRM data, combined with payment information, can be used to segment customers and personalize marketing campaigns, increasing their effectiveness.

- Personalized Offers and Promotions: Businesses can create personalized offers and promotions based on customer purchase history and payment behavior.

By leveraging these capabilities, businesses can optimize their sales and marketing efforts, increase revenue, and improve customer acquisition and retention rates.

Choosing the Right CRM and PayPal Integration Method

There are several methods for integrating CRM systems with PayPal, each with its own advantages and disadvantages. The best approach depends on the specific CRM system you use, the complexity of your business processes, and your technical expertise.

Native Integrations

Many CRM systems offer native integrations with PayPal. This means that the integration is built directly into the CRM platform and can be easily set up with minimal technical knowledge. Native integrations typically offer the following advantages:

- Ease of Setup: Native integrations are usually straightforward to set up and require minimal technical expertise.

- Seamless User Experience: The integration is designed to work seamlessly within the CRM system, providing a smooth user experience.

- Regular Updates: Native integrations are typically maintained and updated by the CRM vendor, ensuring compatibility and security.

- Limited Customization: Native integrations may offer limited customization options, which may not be suitable for businesses with complex requirements.

This option is generally the easiest and most convenient for businesses that are looking for a quick and simple integration solution.

Third-Party Integrations

Third-party integration platforms offer a more flexible and customizable approach to integrating CRM systems with PayPal. These platforms provide a central hub for connecting various applications and services, allowing businesses to create custom workflows and integrations. Third-party integrations typically offer the following advantages:

- Flexibility and Customization: Third-party platforms offer a wide range of customization options, allowing businesses to tailor the integration to their specific needs.

- Integration with Multiple Systems: These platforms can integrate with a variety of CRM systems, payment gateways, and other applications.

- Advanced Features: Third-party integrations often offer advanced features, such as data transformation, workflow automation, and error handling.

- Technical Expertise Required: Setting up and managing third-party integrations may require more technical expertise than native integrations.

This option is suitable for businesses that have complex integration requirements or need a high degree of customization.

Custom Development

For businesses with highly specific requirements or unique business processes, custom development may be the best option. This involves creating a custom integration solution that is tailored to the business’s exact needs. Custom development typically offers the following advantages:

- Complete Customization: Custom integrations can be fully customized to meet the specific needs of the business.

- Integration with Legacy Systems: Custom integrations can be used to integrate CRM systems with legacy systems or other specialized applications.

- Technical Expertise Required: Custom development requires significant technical expertise and may be more expensive than other integration methods.

- Time-Consuming: Developing a custom integration can be a time-consuming process.

This option is ideal for businesses with very specific needs or complex workflows that cannot be met by native or third-party integrations.

Step-by-Step Guide to Integrating CRM with PayPal

While the specific steps for integrating CRM with PayPal will vary depending on the chosen method (native, third-party, or custom), the general process typically involves the following steps:

1. Choose Your Integration Method

As discussed above, carefully consider your business needs and technical capabilities to determine the best integration method for your situation. Research the options available for your specific CRM system and PayPal account.

2. Create a PayPal Business Account (If You Don’t Have One)

If you don’t already have a PayPal Business account, create one. This account is required to accept payments through PayPal. Ensure your account is verified and that you have set up your payment preferences.

3. Set Up Your CRM System

Configure your CRM system to support payment processing. This may involve setting up payment gateways, configuring payment methods, and defining payment-related workflows.

4. Connect Your CRM and PayPal Accounts

Follow the instructions provided by your chosen integration method to connect your CRM and PayPal accounts. This typically involves providing API keys, account credentials, and other relevant information.

5. Configure Payment Workflows

Define the payment workflows that will be automated by the integration. This may include invoice generation, payment reminders, payment processing, and transaction recording.

6. Test the Integration

Thoroughly test the integration to ensure that it is working correctly. This involves simulating transactions, verifying payment status, and checking data accuracy.

7. Monitor and Optimize

Once the integration is live, monitor its performance and make any necessary adjustments to optimize the workflows and ensure smooth operation. Regularly review the integration’s performance and make adjustments as needed.

Best Practices for Successful CRM and PayPal Integration

To ensure a successful CRM and PayPal integration, consider these best practices:

1. Plan and Define Requirements

Before starting the integration process, clearly define your business goals, requirements, and desired outcomes. This will help you choose the right integration method and ensure that the integration meets your needs.

2. Choose the Right Tools

Select the CRM system, PayPal account, and integration method that best suit your business needs and technical capabilities. Research the options available and compare features, pricing, and support.

3. Prioritize Data Security

Implement strong security measures to protect customer data and financial information. Use secure connections, encrypt sensitive data, and comply with relevant data privacy regulations.

4. Automate Where Possible

Take advantage of automation features to streamline payment processes and reduce manual effort. Automate invoice generation, payment reminders, payment processing, and transaction recording.

5. Provide Clear Communication

Communicate clearly with customers about payment procedures, payment deadlines, and any issues that may arise. Provide payment confirmations and transaction updates.

6. Train Your Team

Train your team on how to use the integrated system and payment workflows. Ensure that they understand the processes, security protocols, and troubleshooting procedures.

7. Monitor and Analyze Performance

Regularly monitor the performance of the integration and analyze key metrics, such as sales, revenue, and payment trends. Use these insights to optimize the integration and improve business outcomes.

8. Stay Updated

Keep your CRM system, PayPal account, and integration methods up-to-date with the latest security patches and software updates. This will help ensure compatibility and security.

9. Seek Expert Advice

If you are unsure about any aspect of the integration process, seek expert advice from a CRM consultant, IT professional, or integration specialist.

Troubleshooting Common Issues

Even with careful planning and implementation, you may encounter some common issues during the CRM and PayPal integration process. Here are some troubleshooting tips:

1. Connection Errors

If you experience connection errors, double-check your API keys, account credentials, and network settings. Ensure that your CRM system and PayPal account are properly configured and that there are no firewall restrictions blocking communication.

2. Payment Processing Errors

If payment processing fails, verify the customer’s payment information, such as the credit card number, expiration date, and billing address. Check PayPal’s transaction logs for error messages and troubleshoot the issue accordingly.

3. Data Synchronization Issues

If data is not synchronizing correctly between your CRM system and PayPal, check the integration settings and ensure that the data mapping is configured correctly. Verify that the data fields are compatible and that there are no data validation errors.

4. Reporting Inaccuracies

If you notice inaccuracies in your reports, review the data sources and ensure that the data is being captured and processed correctly. Verify that the reporting settings are configured correctly and that there are no errors in the report calculations.

5. User Access Issues

If users are unable to access the integrated system, check their user permissions and ensure that they have the necessary access rights. Verify that the user accounts are properly configured and that there are no login errors.

Real-World Examples of Successful CRM and PayPal Integration

Many businesses have successfully integrated CRM systems with PayPal to streamline their operations and improve customer experiences. Here are a few examples:

- E-commerce Businesses: E-commerce businesses use CRM and PayPal integration to automate order processing, track customer payments, and manage customer relationships. They can send automated payment reminders, process refunds, and provide a seamless payment experience for customers.

- Subscription-Based Services: Subscription-based services use CRM and PayPal integration to automate recurring billing, manage subscriptions, and track customer churn. They can automatically process payments, send invoices, and provide customers with self-service portals.

- Consulting Firms: Consulting firms use CRM and PayPal integration to manage client invoices, track project payments, and provide a professional payment experience. They can generate invoices, send payment reminders, and provide clients with secure online payment options.

- Non-profit Organizations: Non-profit organizations use CRM and PayPal integration to process donations, track donor contributions, and manage fundraising campaigns. They can automatically process donations, send donation receipts, and provide donors with online giving options.

These examples demonstrate the versatility and effectiveness of CRM and PayPal integration across various industries and business models.

The Future of CRM and PayPal Integration

As technology continues to evolve, the integration of CRM systems and PayPal is likely to become even more sophisticated and seamless. We can expect to see the following trends:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will be used to automate more payment processes, personalize customer experiences, and provide predictive analytics.

- Mobile Payment Integration: Mobile payment options, such as PayPal’s mobile SDK, will become more integrated into CRM systems, providing customers with a more convenient and secure way to pay on the go.

- Blockchain Technology: Blockchain technology may be used to enhance payment security, transparency, and efficiency.

- Enhanced Data Analytics: CRM systems will provide more advanced data analytics capabilities, enabling businesses to gain deeper insights into customer behavior and payment trends.

- Increased Automation: We can expect to see even greater automation of payment-related tasks, freeing up employees to focus on more strategic initiatives.

These trends suggest that CRM and PayPal integration will continue to play a vital role in helping businesses streamline operations, enhance customer experiences, and achieve sustainable growth in the years to come.

Conclusion: Embrace the Power of Integration

In conclusion, integrating your CRM system with PayPal is a strategic move that can significantly benefit your business. By automating payment processes, improving customer experience, enhancing financial management, and boosting sales and marketing effectiveness, you can unlock a new level of efficiency and profitability.

Whether you choose a native integration, a third-party platform, or custom development, carefully plan your integration, choose the right tools, prioritize data security, automate where possible, communicate clearly, train your team, and monitor performance. By following these best practices, you can ensure a successful integration and reap the rewards of a streamlined payment process and improved customer relationships.

Embrace the power of CRM and PayPal integration and take your business to the next level. The future of business is seamless, efficient, and customer-centric – and integration is the key to unlocking that future.