Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

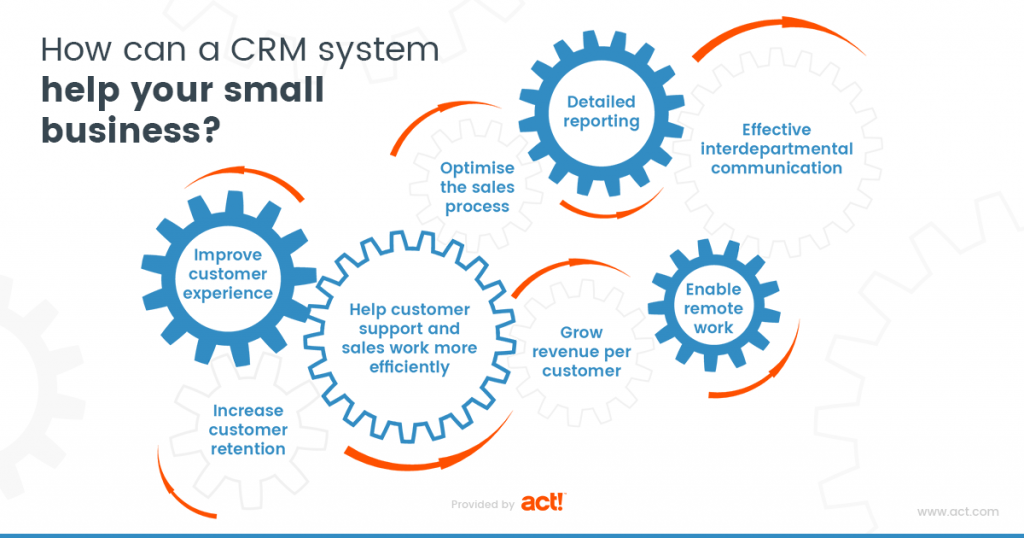

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline their operations, enhance customer experiences, and boost their bottom lines. One of the most effective strategies for achieving these goals is the integration of Customer Relationship Management (CRM) systems with payment gateways like PayPal. This powerful combination allows businesses to manage customer interactions, track sales, and process payments all in one centralized platform. This article delves deep into the world of CRM integration with PayPal, exploring its benefits, implementation strategies, and best practices to help you unlock the full potential of this dynamic duo.

Understanding the Power of CRM and PayPal Integration

Before we dive into the specifics, let’s clarify why integrating CRM with PayPal is such a game-changer. CRM systems are designed to manage and analyze customer interactions throughout the customer lifecycle, from initial contact to post-purchase support. PayPal, on the other hand, is a globally recognized online payment platform that facilitates secure and convenient transactions. When these two systems are integrated, you gain a holistic view of your customer’s journey, making it easier to personalize experiences, improve sales processes, and optimize financial management.

The Core Benefits of CRM Integration with PayPal

The advantages of integrating CRM with PayPal are numerous and far-reaching. Here are some of the key benefits:

- Enhanced Customer Relationship Management: By linking payment data with customer profiles, you gain a 360-degree view of your customers. You can track their purchase history, identify their preferences, and tailor your interactions accordingly.

- Streamlined Sales Processes: Integrated systems automate many manual tasks, such as order processing and payment reconciliation, freeing up your sales team to focus on building relationships and closing deals.

- Improved Financial Management: Real-time access to payment data allows for more accurate financial tracking and reporting. You can easily monitor revenue, identify trends, and make informed decisions.

- Reduced Errors and Manual Data Entry: Automation minimizes the risk of human error associated with manual data entry, ensuring data accuracy and integrity.

- Faster Payment Processing: PayPal’s seamless payment processing capabilities, combined with CRM’s automated workflows, result in faster payment cycles and improved cash flow.

- Personalized Customer Experiences: Armed with a comprehensive understanding of your customers, you can personalize your interactions, offer targeted promotions, and provide exceptional customer service.

- Increased Sales and Revenue: By optimizing sales processes, improving customer relationships, and providing a seamless payment experience, you can drive sales and increase revenue.

- Data-Driven Decision Making: The integration provides valuable insights into customer behavior, sales performance, and financial trends, enabling data-driven decision-making.

Implementing CRM Integration with PayPal: A Step-by-Step Guide

The process of integrating CRM with PayPal can vary depending on the specific CRM system and the level of integration desired. However, the general steps involved are typically as follows:

1. Choose the Right CRM and PayPal Integration Method

The first step is to choose a CRM system that meets your business needs and offers integration capabilities with PayPal. Some popular CRM systems that offer robust PayPal integration include:

- Salesforce: A leading CRM platform with extensive customization options and a wide range of third-party integrations, including PayPal.

- Zoho CRM: A user-friendly CRM system that offers a comprehensive suite of features and seamless integration with PayPal.

- HubSpot CRM: A free and powerful CRM platform with marketing, sales, and customer service tools, including PayPal integration.

- Pipedrive: A sales-focused CRM designed to help sales teams manage leads and close deals efficiently, with PayPal integration options.

- Microsoft Dynamics 365: A versatile CRM platform that integrates with various Microsoft products and offers PayPal integration.

Once you’ve selected your CRM, you’ll need to determine the best integration method. There are several options available:

- Native Integration: Some CRM systems offer native integration with PayPal, providing a seamless and pre-built connection.

- Third-Party Integrations: Many third-party apps and services specialize in integrating CRM systems with PayPal. These can offer more advanced features and customization options.

- API Integration: For more complex integrations, you can leverage the PayPal API to create a custom integration that meets your specific needs.

2. Set Up Your PayPal Business Account

If you don’t already have one, create a PayPal Business account. This will allow you to accept payments and manage your transactions through PayPal. Make sure to verify your account and configure your business settings, such as currency and payment preferences.

3. Connect Your CRM to PayPal

The specific steps for connecting your CRM to PayPal will vary depending on the integration method you choose. Generally, this involves:

- Installing the Integration: If you’re using a third-party integration, install the app or service within your CRM.

- Connecting Your Accounts: Enter your PayPal credentials into the CRM integration settings to authorize the connection.

- Configuring Settings: Customize the integration settings to match your business needs. This may include mapping data fields, setting up automated workflows, and configuring payment notifications.

4. Test the Integration

Before going live, thoroughly test the integration to ensure that it’s working correctly. Create test transactions, track data flow, and verify that all features are functioning as expected. This will help you identify and resolve any issues before they impact your customers.

5. Train Your Team

Once the integration is set up and tested, train your team on how to use the new system. Provide them with clear instructions, documentation, and support to ensure a smooth transition and maximize the benefits of the integration.

Maximizing the Benefits: Best Practices for CRM and PayPal Integration

To get the most out of your CRM and PayPal integration, consider these best practices:

1. Define Clear Goals and Objectives

Before implementing the integration, define your goals and objectives. What do you hope to achieve by integrating CRM with PayPal? Identifying your goals will help you choose the right integration method, configure the system effectively, and measure your success.

2. Map Data Fields Carefully

When setting up the integration, carefully map the data fields between your CRM and PayPal. Ensure that all relevant data, such as customer information, order details, and payment amounts, is accurately transferred between the two systems. This will ensure data consistency and accuracy.

3. Automate Workflows

Take advantage of automation features to streamline your sales processes and reduce manual tasks. Set up automated workflows for tasks such as order creation, payment processing, and customer notifications. This will save you time, reduce errors, and improve efficiency.

4. Customize Reporting and Analytics

Customize your reporting and analytics dashboards to track key metrics, such as sales revenue, customer lifetime value, and payment processing costs. This will provide valuable insights into your business performance and help you make data-driven decisions.

5. Prioritize Security

Security should be a top priority when integrating CRM with PayPal. Ensure that your integration is secure and compliant with industry standards. Use strong passwords, enable two-factor authentication, and regularly monitor your systems for any suspicious activity.

6. Provide Excellent Customer Support

Offer excellent customer support to your customers. Respond promptly to inquiries, resolve issues quickly, and provide a seamless payment experience. This will enhance customer satisfaction and build loyalty.

7. Regularly Monitor and Optimize

Regularly monitor the performance of your integration and make adjustments as needed. Track key metrics, identify areas for improvement, and optimize your workflows to maximize efficiency and effectiveness.

Troubleshooting Common CRM and PayPal Integration Issues

Even with careful planning and implementation, you may encounter some common issues when integrating CRM with PayPal. Here’s how to troubleshoot them:

1. Data Synchronization Errors

If you’re experiencing data synchronization errors, such as missing or incorrect data, check the following:

- Data Field Mapping: Verify that the data fields are mapped correctly between your CRM and PayPal.

- API Connectivity: Ensure that the API connection between the two systems is stable and functioning properly.

- Data Formatting: Check for any data formatting issues, such as incorrect date formats or special characters.

- Integration Logs: Review the integration logs for any error messages that may provide clues about the problem.

2. Payment Processing Errors

If you’re experiencing payment processing errors, such as declined payments or failed transactions, check the following:

- Account Status: Verify that your PayPal account is in good standing and that there are no restrictions on your account.

- Payment Information: Ensure that the customer’s payment information is accurate and valid.

- Transaction Limits: Check for any transaction limits that may be preventing the payment from being processed.

- PayPal’s Status: Verify that PayPal’s systems are operational and that there are no reported outages.

3. Workflow Automation Issues

If your workflow automation is not working as expected, check the following:

- Workflow Triggers: Ensure that the workflow triggers are configured correctly and that they are activated under the appropriate conditions.

- Workflow Actions: Verify that the workflow actions are configured correctly and that they are executed as intended.

- User Permissions: Check user permissions to ensure that users have the necessary access to trigger and execute workflows.

- System Limitations: Be aware of any system limitations that may be affecting workflow performance.

Real-World Examples of CRM and PayPal Integration in Action

To further illustrate the power of CRM and PayPal integration, let’s look at some real-world examples of how businesses are using this technology to drive success:

E-commerce Businesses

E-commerce businesses can leverage CRM and PayPal integration to:

- Track Customer Purchase History: Understand customer buying patterns and preferences.

- Personalize Marketing Campaigns: Target customers with relevant product recommendations and promotions.

- Automate Order Processing: Streamline order fulfillment and payment reconciliation.

- Provide Seamless Checkout Experiences: Offer a smooth and secure checkout process with PayPal.

Subscription-Based Services

Subscription-based services can use CRM and PayPal integration to:

- Manage Recurring Payments: Automate subscription billing and payment collection.

- Track Subscription Renewals: Monitor subscription lifecycles and identify opportunities for upselling and cross-selling.

- Reduce Churn: Proactively address customer issues and prevent subscription cancellations.

- Analyze Customer Lifetime Value: Understand the long-term value of each customer.

Non-Profit Organizations

Non-profit organizations can benefit from CRM and PayPal integration by:

- Manage Donations: Track donations and donors.

- Automate Thank-You Notes: Send personalized thank-you notes to donors.

- Segment Donors: Identify and target specific donor segments.

- Increase Fundraising Effectiveness: Improve fundraising campaigns and donor engagement.

The Future of CRM and PayPal Integration

As technology continues to evolve, the integration of CRM with PayPal will only become more sophisticated and powerful. We can expect to see:

- More Advanced Automation: AI-powered automation will streamline even more processes, such as personalized customer service and proactive problem-solving.

- Deeper Data Insights: More sophisticated analytics tools will provide deeper insights into customer behavior, sales performance, and financial trends.

- Enhanced Personalization: Businesses will be able to personalize customer experiences even further, offering tailored product recommendations, promotions, and customer service.

- Increased Mobile Integration: Mobile-first solutions will enable businesses to manage their CRM and PayPal integrations from anywhere, anytime.

- Improved Security: Increased focus on security will lead to more robust security measures to protect customer data and prevent fraud.

The future of CRM and PayPal integration is bright, offering businesses unprecedented opportunities to improve customer relationships, streamline operations, and drive growth.

Conclusion: Embracing the Synergy of CRM and PayPal

Integrating CRM with PayPal is a strategic move that can transform the way you do business. By combining the power of customer relationship management with the convenience and security of PayPal, you can create a seamless and efficient ecosystem that benefits both your business and your customers. From enhanced customer relationships and streamlined sales processes to improved financial management and data-driven decision-making, the advantages are undeniable.

By following the step-by-step guide and implementing the best practices outlined in this article, you can successfully integrate CRM with PayPal and unlock its full potential. Embrace the synergy of these two powerful tools and position your business for success in the ever-evolving digital landscape. The time to act is now. Start exploring the possibilities and embark on a journey to revolutionize your business with the dynamic duo of CRM and PayPal integration.