Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In the dynamic landscape of modern business, efficiency and customer satisfaction are paramount. One of the most impactful strategies to achieve these goals is the seamless integration of Customer Relationship Management (CRM) systems with payment gateways like PayPal. This article delves deep into the intricacies of CRM integration with PayPal, exploring its benefits, implementation strategies, and the transformative impact it can have on your business’s bottom line. We’ll cover everything from the core functionalities to advanced techniques, empowering you to optimize your operations and elevate your customer experience.

Understanding the Power of CRM and PayPal Integration

Before diving into the specifics, let’s establish a clear understanding of the core components. CRM systems are the backbone of customer relationship management, providing a centralized platform for managing customer interactions, data, and communication. PayPal, on the other hand, is a global leader in online payment processing, offering secure and convenient payment solutions for businesses of all sizes. The integration of these two powerful tools creates a synergy that streamlines operations, enhances customer experience, and drives business growth.

The Core Benefits: Why Integrate?

- Streamlined Payment Processing: Automate payment tracking, reconciliation, and reporting. Reduce manual data entry and human error.

- Enhanced Customer Experience: Offer seamless and secure payment options, leading to increased customer satisfaction and loyalty.

- Improved Sales Insights: Gain a comprehensive view of customer purchasing behavior, enabling targeted marketing campaigns and personalized offers.

- Reduced Administrative Overhead: Automate tasks such as invoice generation, payment reminders, and order fulfillment, freeing up valuable time and resources.

- Data-Driven Decision Making: Access real-time financial data and customer insights to make informed business decisions.

Key Features and Functionalities of CRM-PayPal Integration

The specific features and functionalities of the integration will vary depending on the CRM and PayPal integration method you choose. However, some common features include:

- Automated Payment Tracking: Automatically record and track payments made through PayPal within your CRM system.

- Invoice Generation and Management: Generate and send invoices directly from your CRM, with integrated PayPal payment links.

- Payment Reminders: Automate payment reminders to customers, reducing late payments and improving cash flow.

- Customer Data Synchronization: Automatically synchronize customer data between your CRM and PayPal accounts, ensuring data consistency.

- Reporting and Analytics: Generate detailed reports on sales, revenue, and payment trends, providing valuable insights into your business performance.

- Order Fulfillment Automation: Trigger order fulfillment processes automatically upon successful payment confirmation.

- Refund Management: Process refunds directly from your CRM, streamlining the refund process.

Popular CRM Systems and Their PayPal Integration Capabilities

Several CRM systems offer robust integration capabilities with PayPal. Here are some of the most popular options:

Salesforce

Salesforce is a leading CRM platform known for its comprehensive features and scalability. Salesforce offers various integration options with PayPal, including custom integrations through APIs and pre-built integrations available on the AppExchange. This allows businesses to seamlessly manage payments, track transactions, and gain valuable insights into their sales performance.

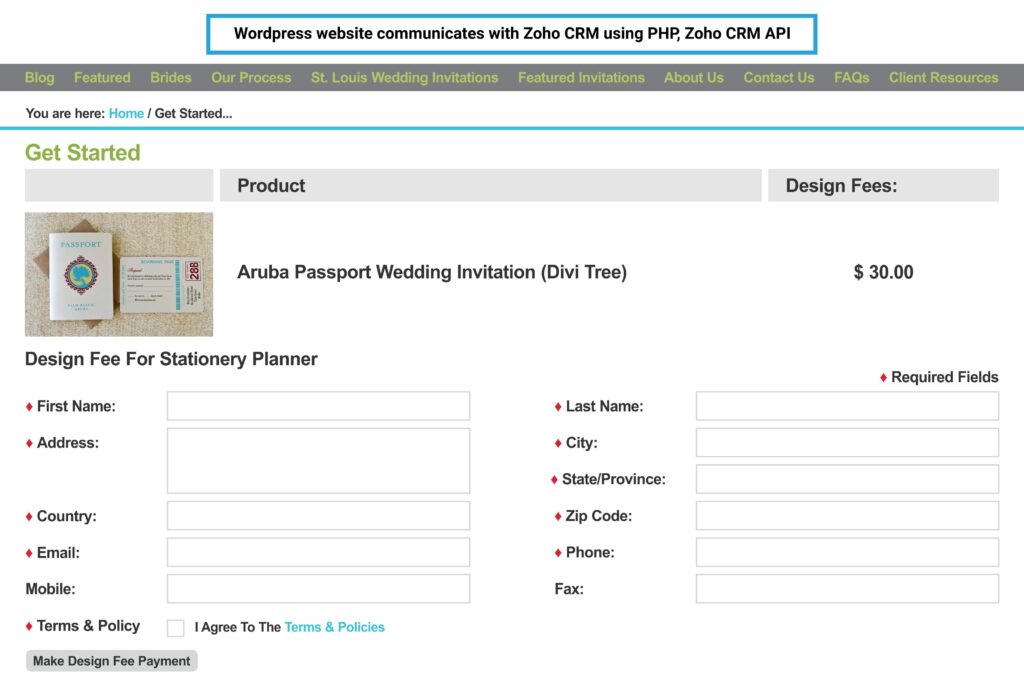

Zoho CRM

Zoho CRM is a versatile and affordable CRM solution suitable for businesses of all sizes. Zoho CRM offers native integration with PayPal, allowing users to accept payments, manage invoices, and track transactions directly within the CRM platform. This integration simplifies the payment process and provides a unified view of customer data and financial transactions.

HubSpot CRM

HubSpot CRM is a user-friendly CRM platform that offers a range of free and paid features. HubSpot CRM integrates with PayPal through third-party apps and custom integrations. This integration enables businesses to track payments, manage customer data, and automate sales processes, leading to increased efficiency and improved customer relationships.

Microsoft Dynamics 365

Microsoft Dynamics 365 is a comprehensive CRM and ERP platform designed for large enterprises. Dynamics 365 offers robust integration capabilities with PayPal, allowing businesses to manage payments, track transactions, and gain valuable insights into their financial performance. The integration supports various features, including automated payment tracking, invoice generation, and customer data synchronization.

Pipedrive

Pipedrive is a sales-focused CRM platform designed to help sales teams manage leads, track deals, and close more sales. Pipedrive offers integration with PayPal through third-party apps and custom integrations. This integration allows businesses to streamline the payment process, track transactions, and gain insights into their sales performance.

Step-by-Step Guide: Implementing CRM-PayPal Integration

The implementation process will vary depending on the CRM system you are using. However, the general steps involved are as follows:

- Choose Your Integration Method: Decide whether to use a pre-built integration, a third-party app, or a custom integration through APIs.

- Connect Your CRM and PayPal Accounts: Follow the instructions provided by your CRM and PayPal to connect your accounts. This typically involves entering your PayPal API credentials and configuring payment settings.

- Configure Payment Settings: Set up payment options, currency preferences, and other relevant settings within your CRM.

- Test the Integration: Conduct thorough testing to ensure that payments are processed correctly and that data is synchronized accurately.

- Customize the Integration: Tailor the integration to meet your specific business needs, such as customizing invoice templates or automating workflows.

- Train Your Team: Provide training to your team on how to use the integrated system and manage payments effectively.

- Monitor and Optimize: Regularly monitor the performance of the integration and make adjustments as needed to optimize its efficiency and effectiveness.

Best Practices for Successful CRM-PayPal Integration

To ensure a successful CRM-PayPal integration, consider the following best practices:

- Choose the Right CRM and Integration Method: Select a CRM system that meets your business needs and offers robust integration capabilities with PayPal. Carefully evaluate the available integration options to determine the best fit for your requirements.

- Prioritize Data Security: Implement security measures to protect sensitive customer data and payment information. Use secure payment gateways and adhere to industry best practices for data protection.

- Provide Clear and Concise Instructions: Offer clear and concise instructions for your customers on how to make payments through PayPal. Make the payment process as seamless and user-friendly as possible.

- Automate Payment Reminders: Automate payment reminders to reduce late payments and improve cash flow. Send reminders at regular intervals and offer various payment options.

- Track and Analyze Payment Data: Track and analyze your payment data to identify trends, optimize your payment processes, and gain valuable insights into your business performance.

- Integrate with Other Systems: Consider integrating your CRM and PayPal with other systems, such as accounting software and email marketing platforms, to streamline your operations and improve efficiency.

- Regularly Update and Maintain the Integration: Keep your CRM and PayPal integration up-to-date with the latest versions and security patches. Regularly review and maintain the integration to ensure its optimal performance.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some issues during the integration process. Here are some common problems and their solutions:

- Connection Errors: Verify your API credentials, ensure that your CRM and PayPal accounts are properly connected, and check for any network connectivity issues.

- Data Synchronization Issues: Check your data mapping settings to ensure that data is being synchronized correctly between your CRM and PayPal accounts. Review the data logs to identify any synchronization errors.

- Payment Processing Errors: Verify your payment settings, ensure that your PayPal account is properly configured to accept payments, and check for any transaction limits or restrictions.

- Invoice Generation Issues: Review your invoice templates and settings to ensure that invoices are being generated correctly. Check for any formatting errors or missing information.

- Reporting and Analytics Issues: Verify your reporting settings and ensure that you have the correct permissions to access the data. Check for any data discrepancies or errors in the reports.

If you encounter persistent issues, consult the documentation for your CRM and PayPal or contact their support teams for assistance.

Advanced Techniques and Customization Options

Once you’ve established the basic integration, you can explore advanced techniques to further optimize your setup:

- Custom Fields and Data Mapping: Tailor the integration to map specific data fields between your CRM and PayPal accounts. This is particularly useful for capturing custom information related to transactions.

- Workflow Automation: Set up automated workflows within your CRM to trigger actions based on payment events. For example, you could automatically update a deal stage upon receiving a payment.

- Advanced Reporting and Analytics: Utilize the data from your integrated systems to create custom reports and dashboards that provide in-depth insights into your sales and financial performance.

- API Integrations: For more complex needs, consider leveraging the APIs of both your CRM and PayPal to build custom integrations that perfectly match your unique business processes.

The Impact on Customer Experience

The benefits of CRM and PayPal integration extend far beyond internal efficiencies. A well-executed integration significantly enhances the customer experience:

- Seamless Checkout: Customers enjoy a streamlined checkout process with secure and familiar payment options, reducing cart abandonment.

- Personalized Interactions: Access to customer purchase history and preferences allows for more personalized communication and offers.

- Faster Issue Resolution: Integrated systems enable quick access to payment information and order details, allowing for faster and more effective customer service.

- Increased Trust and Confidence: Offering trusted payment options like PayPal builds trust with customers, increasing their confidence in your business.

Real-World Examples: Success Stories

Numerous businesses have experienced significant benefits from integrating their CRM with PayPal. Here are a couple of examples:

Example 1: E-commerce Business

An e-commerce business selling handcrafted goods integrated their CRM with PayPal. This allowed them to automate invoice generation, track payments, and personalize customer communication based on purchase history. The result was a 20% increase in sales and a significant reduction in administrative overhead.

Example 2: Service-Based Company

A consulting firm integrated their CRM with PayPal to streamline their invoicing and payment processes. By automating payment reminders and providing easy online payment options, they reduced late payments by 30% and improved their cash flow. They were also able to gain a better understanding of customer spending habits, allowing them to tailor their services to better meet customer needs.

Security Considerations

Security should be a top priority when integrating CRM and PayPal. Here are some key considerations:

- Use Secure Payment Gateways: Always use secure payment gateways like PayPal that encrypt sensitive payment information.

- Follow PCI DSS Compliance: Ensure that your business complies with the Payment Card Industry Data Security Standard (PCI DSS).

- Protect Customer Data: Implement measures to protect customer data, such as data encryption and access controls.

- Regularly Update Software: Keep your CRM and PayPal integration software up-to-date with the latest security patches.

- Monitor for Suspicious Activity: Monitor your systems for suspicious activity and promptly address any security breaches.

Future Trends in CRM and Payment Integration

The landscape of CRM and payment integration is constantly evolving. Here are some future trends to watch out for:

- Artificial Intelligence (AI): AI-powered CRM systems will be able to automate more tasks, personalize customer interactions, and provide more accurate sales forecasts.

- Mobile Payments: The increasing use of mobile devices will drive the adoption of mobile payment solutions.

- Integration with Cryptocurrency: As cryptocurrencies become more mainstream, businesses may start to integrate them into their payment systems.

- Enhanced Security Features: Security features, such as fraud detection and two-factor authentication, will continue to evolve to protect businesses and customers.

- Cross-Platform Integrations: Expect to see more seamless integrations between CRM systems, payment gateways, and other business applications.

Conclusion: Embracing the Future of Business

CRM integration with PayPal is a powerful strategy for businesses looking to streamline operations, enhance customer experience, and drive growth. By understanding the benefits, implementing the integration effectively, and staying informed about the latest trends, businesses can position themselves for success in the competitive business landscape. Embrace this transformative technology and unlock the full potential of your customer relationships and payment processes. The future of business is integrated, efficient, and customer-centric, and CRM-PayPal integration is a crucial step towards achieving that future.